How do you get car insurance for a car you Don’t own?

How do you get insurance on a car not registered to you? Do you need insurance if you don’t have a car? Car insurance for a car you don't own is offered in three ways. You can get car insurance for a car you don't own by adding it to your policy, buying non-owner coverage, or buying a separate policy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Car Insurance Coverage | Details | Source |

|---|---|---|

| 2015 Countrywide Rates for a Basic Policy | Liability: $538.73 Collision: $322.61 Comprehensive: $148.04 Total Cost: $1,009.38 | NAIC |

| Cheapest Insurer for High Level Coverage | USAA and Geico | Quadrant Data |

How do you get insurance on a car not registered to you? Figuring out how to get car insurance on a car not in your name is often a tricky situation. While everyone who owns a vehicle cannot drive legally without car insurance, some people question whether you can get insurance on a car not registered in your name. If you don’t own the vehicle outright, non-owner car insurance is one option. Luckily, in this guide, we will go over three simple ways to insure a vehicle not in your name. Read on to learn which option is best for you, and then be sure to enter your ZIP code to start comparing free quotes for non-owner car insurance today.

Can you insure a car you don’t own?

Getting insurance on a car not registered to you is no small feat.Read below for a quick explanation of why or why not drivers may need insurance to drive someone else’s car.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Can I insure a car that’s not registered to me?

If you find yourself driving a particular vehicle frequently that doesn’t belong to you, you’ll want to get an insurance policy to make sure you’re covered.The short answer here is: you need car insurance to drive someone else’s car.There are three ways you can insure a car not in your name:

- Adding the vehicle to your existing policy

- Purchasing non-owner/ non-driver coverage

- Buying a separate policy

Not every way will be right for you, so it’s important to read through each method to find the one that works best.If you want to learn more about how to protect yourself with a vehicle you don’t own, keep reading.

Read More:

- Buying Car Insurance for Your New Car

- Can I drive my mom’s car without my own insurance?

- Can you drive your parents’ car without insurance?

- Can I get an insurance quote without a car?

#1 — Adding a Vehicle to an Existing Insurance Policy

When you already have an auto policy for a car that you own, you may be able to add another vehicle to your existing policy. There are some things that you need to prepare for, however, that prevent total strangers from insuring a vehicle for nefarious reasons.

| Documentation Need to Apply for Non-Owner Car Insurance | Reasons for Required Documentation |

|---|---|

| Your Insurance Company's Agreement | Your insurance company has to agree with adding the vehicle to your existing policy. Not every company will, so you may need to find a new insurance company that can better meet your needs. |

| VIN (Vehicle Identification Number) | This information will not necessarily affect your rate, but it will ensure that you actually have access to the vehicle and know the person who owns the vehicle. |

| List of Drivers | Adding the vehicle to your policy does not cover the person who owns the vehicle, only you. While you can add that person to your policy (take for instance if it is one of your children or your spouse), keep in mind that your rates will increase if they have poor driving records or fall into the under-27 age category for drivers (the younger they are the more they will cost). |

If you want to insure the vehicle for your driving purposes only, then you will not need to add other drivers to your policy. When you insure the vehicle under your existing policy, you’ll need to either give the insurer the make and model or the National Highway Traffic Safety Administration vehicle identification number (VIN). Both of these identification methods allow insurers to determine the following:

- Vehicle safety features

- Vehicle crash rating

- Vehicle repair costs

Insurers use these vehicle factors to determine the risk of claim payouts. For example, if a vehicle performs poorly in a crash, insurers can expect to pay more for hospital bills and severe vehicle damage. Costs are then based partially on the insurer’s analysis of the vehicle.

#2 — Getting Non-Owner Car Insurance Without a Car

There is also a policy option for people who want to have the option of driving someone else’s vehicle from time to time when that person’s insurance does not cover other drivers.This option is called non-owner car insurance. This type of coverage is a very limited policy offered by most major car insurance providers that allow you to drive someone else’s vehicle.

It provides liability coverage, but generally no protection for the vehicle you’re driving. If you cause an accident or drive into a tree or the vehicle is hit by a deer or other animal while you are driving, non-driver insurance will not cover those situations. (For more information, read our “Will my car insurance go up if I hit a deer with my car?“).

The only bills this type of insurance will cover is the other driver’s medical bills and property damage bills if you run into them. It won’t cover your bills if you have to go to the hospital or if your friends’ insurance doesn’t cover all of the repair costs. To qualify, you need to meet at least one of the following requirements:

- You frequently drive rental cars.

- You frequently borrow other drivers’ cars.

- You sold your car.

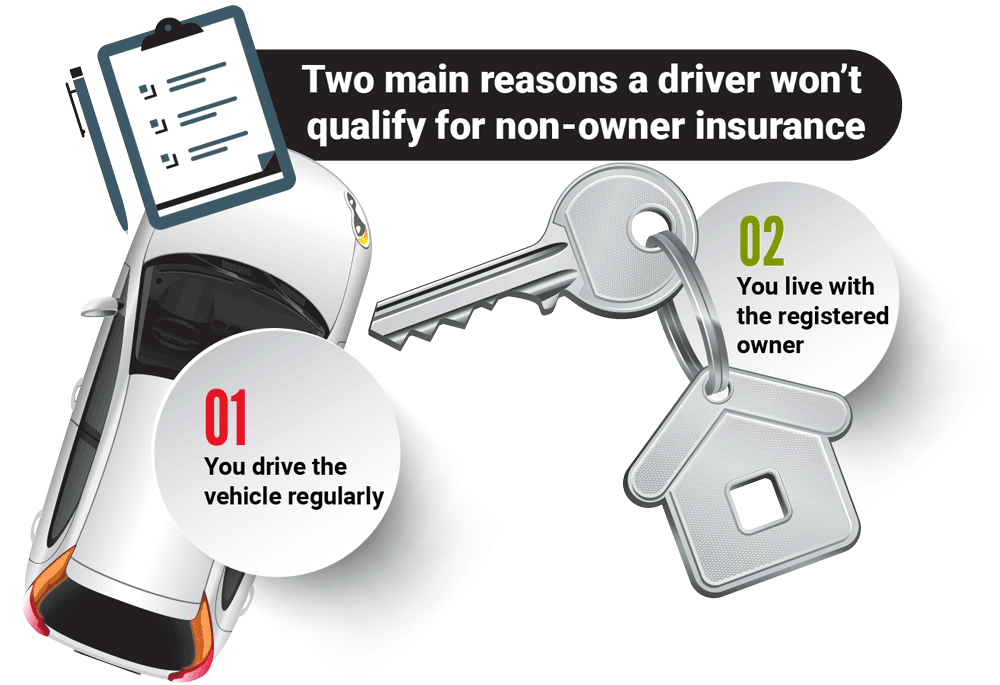

You will not qualify for this insurance if the following is true:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2a — What is SR-22 non-owner insurance?

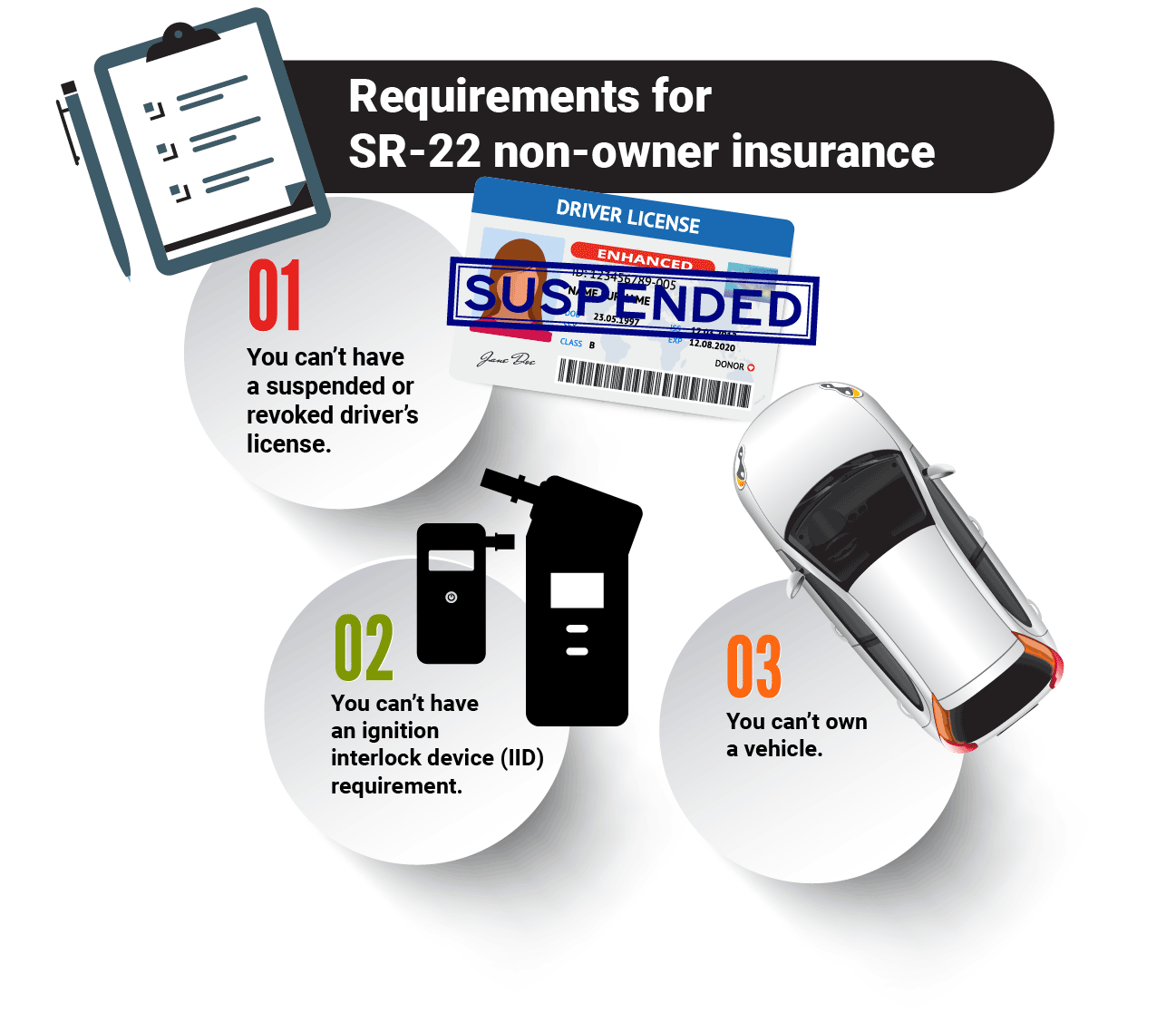

The expectation is that if you are a regular driver of a vehicle, the vehicle owner will add your name to their policy, thereby providing you with complete coverage that their policy has to offer, but SR-22 non-driver car insurance is much cheaper because it’s for irregular use of a car.Like regular non-owner insurance, SR-22 non-driver insurance just covers the basic liability needs of a vehicle, protecting you from high bills if you hit someone else. However, you have to meet more rigid standards to qualify for an SR-22 non-owner insurance policy:

#3 — How to Get Insurance on a Car

If you don’t meet the criteria for kind of insurance, and the owner of the car you want to drive doesn’t want to add you to their policy, you can purchase a separate car insurance policy for that vehicle. This option provides you with the same car insurance coverage that you would expect from any other policy that you would buy if you owned the car for yourself.

If you drive a vehicle regularly, then it is up to you to be responsible for getting the proper car insurance coverage necessary for when you drive it.

To purchase this kind of car insurance coverage from your provider, you’ll need to prove insurable interest. Basically, you’ll have to prove that you’d suffer a financial loss should the vehicle you’re insuring be damaged. To do this, you need to prove a direct relationship between you, the vehicle, and the driver.For example, you may want to insure a vehicle that you bought your 80-year-old mother, or insure a vehicle your son owns but that you are paying the lease on.Whether you are insuring a significant other’s car, family’s car, or a friend’s car, you need to prove that you have a direct interest in the vehicle due to financial repercussions should the owner of the vehicle crash it.In these situations, you can purchase any amount of car insurance coverage that you want for the vehicle, including comprehensive coverage for those odd things that might happen when the vehicle is in your care.

Read more: How do I purchase car insurance without a membership?

How do I choose the best auto policy?

Now that you understand what your options are as a non-driver, it’s time for you to pick the right car insurance for your situation. This part of the process can become quite overwhelming if you have never bought car insurance before.Luckily, we’ve compiled a list of coverage options and prices to help save you time. Stick with us to make sure that you and the vehicle are protected.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the basic car insurance coverage options?

Whether you are buying your own policy, a non-drivers insurance policy, or want to make sure the owner of the car has proper insurance, there are basic car insurance coverages that every driver should have.

- Liability insurance is a legal requirement. It includes bodily injury liability and property damage liability. Both of these coverages protect you if you cause an accident by paying the other driver’s bills.

- Collision coverage isn’t a legal requirement, but it protects you if you get into an accident. It will pay for repairs to the car if you collide with another vehicle or object.

- Comprehensive car insurance isn’t a legal requirement but like collision coverage, it is designed to protect you. It pays for repairs if you run into an animal, criminals steal your car or vandalize it, or a natural disaster ruins your car.

- Uninsured/underinsured motorist coverage is sometimes a legal requirement, depending on the state. It will protect you if the driver who caused the accident doesn’t have insurance or has poor insurance.

If you are using someone else’s car insurance, it’s vital that they have these coverages. Why? As the driver, you may be liable for any bills the car owner’s insurance doesn’t cover.So before you get behind the wheel of someone else’s vehicle, make sure that they have proper proof of insurance.Take picking out car insurance coverage seriously. You’ll be glad you considered coverages carefully after an accident. Use our free rate tool below to compare costs of coverages between insurers.

Readmore: What if an uninsured friend wrecks my car? (Three Types of Borrowers)

What are car insurance add-ons?

If you’re buying your own car insurance policy, there are some add-ons that can further protect you in an accident.

- Classic car coverage. Are you driving your friend’s vintage car? If so, classic car insurance is a cheaper alternative to regular car insurance.

- Gap insurance or loan/lease coverage. If you are driving a car that’s less than two years old, you should get gap coverage. This coverage will make sure you don’t lose any money on a totaled car and can still pay off a loan. (For more information, read our “Can you transfer GAP insurance from one car to another?“).

- MedPay coverage or PIP coverage. Both of these coverages pay for medical bills after an accident, although PIP (personal injury protection) also pays for lost wages.

- Roadside assistance coverage. This coverage will help if you are locked out of the car, run out of gas, or encounter other common situations.

If you’re added to someone else’s policy, see what add-on coverages they have.

Read more:

How can I save money on car insurance?

Now that you know what kind of car insurance coverage is available, and how to insure a car you don’t own, it’s time to start going through car insurance prices.We know car insurance can be expensive, but there are some ways you can save money on your own car insurance policy.Even if you are added to someone else’s policy, they may appreciate if you help them save on car insurance. After all, you’re driving their vehicle, so any way you can help out is a nice gesture.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Where can I find car insurance quote tools?

The easiest method for you to try is to use a free car insurance quote tool like the one that’s available at the top of this page. Quote tools are quite valuable for people who are looking for a deal when it comes to their car insurance purchase. Here are some ways quote tools are beneficial:

- While it’s easy enough for you to get a quote from individual websites, you can’t get quotes from every company that provides insurance in the state that you live in unless you have a great deal of time.

- Filling out the same forms over and over can get quite tiring.

- They don’t require you to put in your Social Security number or give them your other personal information to get a quote as insurance sites do.

Your information is yours to keep until you make your final decision about your insurance company.

Read more: Is it a bad idea to give your Social Security number when shopping for car insurance?

What is the cost of basic car insurance coverage?

A basic policy includes liability, comprehensive, and collision coverage. To bring you data on the countrywide averages for each coverage type, we pulled data from the National Association of Insurance Commissioners (NAIC).Take a look at NAIC’s data on countrywide averages.

| Countrywide Average Rates | Liability Coverage | Collision Coverage | Comprehensive Coverage | Average Total Rates |

|---|---|---|---|---|

| 2011 | $492.03 | $284.60 | $131.80 | $908.43 |

| 2012 | $503.28 | $287.87 | $133.30 | $924.45 |

| 2013 | $517.88 | $295.27 | $137.77 | $950.92 |

| 2014 | $530.01 | $308.32 | $143.45 | $981.77 |

| 2015 | $538.73 | $322.61 | $148.04 | $1,009.38 |

| Average | $516.39 | $299.73 | $138.87 | $954.99 |

This may not seem like much, but the rates in the above table are for the bare minimum coverage. If you chose to increase the coverage level of your policy (which we always recommend), you will end up paying more than a mere hundred dollars. To show you what we’re talking about, we partnered with Quadrant data to bring you rates by company and coverage level.

| Companies | Low Coverage Level | Medium Coverage Level | High Coverage Level |

|---|---|---|---|

| Liberty Mutual | $5,805.75 | $6,058.57 | $6,356.04 |

| Allstate | $4,628.03 | $4,896.81 | $5,139.02 |

| Travelers | $4,223.63 | $4,462.02 | $4,619.07 |

| Farmers | $3,922.47 | $4,166.22 | $4,494.13 |

| Progressive | $3,737.13 | $4,018.46 | $4,350.96 |

| Nationwide | $3,394.83 | $3,449.80 | $3,505.37 |

| State Farm | $3,055.40 | $3,269.80 | $3,454.80 |

| American Family | $3,368.49 | $3,544.37 | $3,416.40 |

| Geico | $3,001.91 | $3,213.97 | $3,429.14 |

| USAA | $2,404.11 | $2,539.87 | $2,667.92 |

It’s important for us to note at this point that if you are driving someone else’s vehicle, you need to be considerate of their needs and desires regarding coverage levels. If their vehicle is still being paid for, you must purchase a comprehensive car insurance plan to satisfy their agreement with their lender. If you don’t, you could risk them losing their vehicle or facing a fine from the lending company.While getting car insurance isn’t as cheap as most people would like it to be, it is a necessity if you’re going to drive someone else’s car or truck. Get the coverage that you need to ensure that your friend’s vehicle has the coverage necessary to protect them from financial trouble if you should get into an accident while driving their vehicle.

Frequently Asked Questions

Before we finish up this guide, we want to answer this question in depth: Can you get insurance on a car not registered to you? Stick with us to learn about a few more important factors of car insurance for vehicles not under your name.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What happens if I get into a car accident in someone else’s car?

Let’s say you’re driving down the road when you swerve to avoid a squirrel. You crash into another vehicle and ruin the front bumpers of both vehicles. Who’s paying for the other driver’s repair costs?The law requires that whoever is liable for the accident pays, but this can get tricky if you don’t own the vehicle. Luckily, we have a few tips to sort it out.

- If you have your own non-driver insurance, your insurance will pay for the repairs to the other driver’s vehicle. However, the car owner’s insurance will have to pay for the repairs to the vehicle you were driving.

- If you have your own policy, your insurance will pay for all bills(both yours and the other driver’s) as long as you have a complete coverage plan.

- If you have no insurance at all, the car owner’s insurance will have to cover your bills. However, it may not cover any medical bills you may have.

Bottom line? Your insurance will kick in first, followed by the car owner’s insurance.

Can two people insure the same car?

Most insurers will not allow two policies on a vehicle, and in most places this is illegal. Why? Some people may try to get two policies on a car to reap twice the reward after a crash.If an insurer finds out that you filed a claim at a different insurer after you filed with them, you could be prosecuted. The exception is if you have non-owner insurance, as insurers permit two policies on a vehicle if non-owners are involved.

What if I own a car, but someone else drives my car?

If the primary driver is someone other than you, they can insure the car. For example, a teen may purchase their own insurance policy even though they are driving their parents’ car.So, another good question might be: Can I insure a car that doesn’t belong to me?In some situations, yes. You should always contact your insurer first, mainly because they will want the primary policyholder to also own the car.Generally, it is easiest if the insurer is related to you or lives at the same address. Otherwise, the other driver may need non-driver car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Do you have to be the registered owner of a vehicle to insure it?

One question many folks have is: Does a car have to be registered to you to insure it?Typically, yes. Certain exceptions may apply, such as if you inherit a vehicle or buy a car for someone else.

But, can you get car insurance if the car is in someone else’s name?

Merely being named as the owner on the vehicle title is not enough for insurance companies. It may be difficult to insure a vehicle unless you are named as the driver of the car.However, if you can prove insurable interest, this may be an option. If you’re the parent of a teenage driver, simply adding them to your policy is enough.

Read more: Can I buy car insurance without a title?

What factors affect car insurance rates?

The main factors that will influence how much you pay for car insurance are:

- Your driving record. Accidents, DUIs, and speeding tickets raise rates, especially if you are placed into the SR22 high-risk category.

- Your age and gender. Younger drivers and male drivers pay the most for car insurance.

- Your address. Where you live matters, as you may at an increased risk for crime, natural disasters, or crashes in your area.

- The vehicle you are insuring. If you’re borrowing your friend’s luxury sports car, you’ll pay more for non-owner car insurance than if you borrow an SUV.

Read more: Can I insure my friend’s car?

The best ways to reduce car insurance premiums are keeping a clean record and shopping around for car insurance.

Do all insurance companies have non-owner car insurance?

You likely still have some questions:

- Will Geico or Progressive insure a car not in my name?

- Can I get car insurance with two names on the title?

- Does your car insurance and registration have to be under the same name?

- Does your car insurance and registration have to be under the same address?

The best advice is to check with your insurance provider. It’s best to play it safe so that your claim won’t be denied if you’re in an accident.Not all insurers offer non-driver coverage. While the majority of major insurers do offer coverage for non-drivers, you may not meet the insurer’s criteria. Remember, it has to be a car you frequently borrow but don’t own, and you need to be an active driver.If you don’t meet these criteria, you may qualify for a vested interest in the vehicle if you would suffer a financial loss due to an accident. Make sure to talk in-depth to your insurer to see if you qualify for any of the three insurance coverage options we outlined in this guide.

If you want free quotes for non-owner car insurance, just click on the tool at the bottom of the page to enter your ZIP code below and find the best insurance you can at the best premiums possible for FREE.

Do I need insurance if I don’t have a car?

There are many topics that come to mind when asking if you can get insurance on a car not registered in your name.Another is: Can I still buy auto insurance if I don’t own a car?The answer is yes. The following options will help you protect yourself, even if you don’t own a vehicle.

- If you are a frequent borrower of another’s vehicle, you should consider buying a non-owner car insurance policy

- These policies add coverage to help cover any damages you may incur in an accident while driving

- Even if you do not own your own car, you may need to file for a non-driver SR-22 which shows you can be financially responsible for any auto accidents. (For more information, read our “How do I get SR-22 insurance without a car?”).

Is it possible to purchase auto insurance without owning a car? Well, in order to drive a vehicle you need car insurance.Typically, people insure their cars and the insurance automatically transfers to any driver using it, as long as you have permission to use the car. However, there are many situations in which you may want to have your own car insurance policy, even though you don’t actually own a car.Read the rest of this common auto insurance FAQ and make sure to enter your ZIP code above to start comparing car insurance today!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Why should I get auto insurance if I don’t own a car?

If you frequently borrow a car from a family member or friend, you may want to invest in this type of car insurance policy. Such a policy is not specific to any one vehicle; therefore, it can be used when you are driving any car.Non-owner insurance provides you coverage that goes above and beyond the coverage carried by the car owner so that if you are involved in an at-fault car accident, your assets are protected.

If you are concerned about the amount of liability coverage carried by the owners of the cars you are driving, having your own non-driver insurance policy can alleviate such concerns.

Many car owners opt to carry only the minimum required liability insurance limits as mandated by their state in order to save money.However, if you are driving a borrowed vehicle and are at fault in an accident, the other party can sue you personally for any losses not covered by the insurer of the vehicle you were driving. If you have personal assets that you want to protect, this kind of policy may be a good choice for you.

Can someone else insure my financed car?

If you are financing a car and wondering if insurance can be in someone else’s name, think again. Whether you own a vehicle or not, the insurer will want to see that you have taken full financial responsibility for the car, including insurance.

How does this type of auto insurance work?

A non-owner auto insurance policy works like supplemental insurance. If an accident occurs, the car owner’s policy kicks in first. If the limits are insufficient to cover the damages and/or injuries involved in the accident, your non-owner car insurance policy takes care of the rest up to the limit of your own policy.This type of coverage can provide you with peace of mind regarding your own liability in regards to being at fault in an accident. These types of policies do not, however, cover the costs of damage to the vehicle you are driving. Before taking out any insurance policy, be sure you understand exactly what you are getting and what is excluded.There is really no point in having liability insurance without owning a car.Check with your car insurance company and see if you can buy car insurance without owning a vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What is the importance of non-owner SR-22 coverage?

SR-22 car insurance coverage is a liability insurance policy that is certified by the insurance company. It provides proof to the department of motor vehicles in your state that you do indeed have liability car insurance coverage.Those who have received certain types of citations, such as a DUI, or have not complied with certain contracts like paying insurance premiums on time, are required to have SR-22 insurance for a certain period of time.

Non-driver SR-22 coverage is even available for those with a driver’s license who do not own a vehicle.

This coverage allows you to maintain insurance coverage so that you can prove to the DMV that you have had uninterrupted coverage for the period you are required to have it.Even if you cannot afford to have a car right now, having the non-driver SR-22 coverage will allow you to maintain your ability to be insured so that when you can afford a car again, your rates will be more reasonable.

In addition, if you are to borrow or rent a car, a non-owner SR-22 insurance policy might be the only way for you to be covered, especially if you are named as an excluded driver on a policy.

Read More: Does car insurance cover excluded drivers?

How can I find the right non-owner auto insurance carrier?

When you are ready to invest in your non-driver auto insurance, you should expect to spend some time doing a little research. There are different guidelines in different states about this type of insurance.You should know the laws in the state where you reside and will drive.In addition, you need to shop around for coverage. Not all insurance companies provide non-owner car insurance so it may take some time to locate the ones that do.

How can I get free non-owner car insurance quotes online?

In order to quickly find non-owner auto insurance company quotes, put our online quote tool to work for you.Simply answer questions about yourself and your driving record, as well as the limits you desire and the quote tool will submit your information to a variety of insurers offering coverage where you live.Enter your ZIP code into the box at the bottom of this page to get started now!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How do I get car insurance without a car?

Can you get car insurance if the car is in someone else’s name?

- If you own a vehicle, you will not need to purchase a non-owner policy for a vehicle that you use but don’t own

- If you don’t own a vehicle but rent cars often, you may wish to purchase a non-owner policy as it will be cheaper than continually purchasing rental car policies

- In some cases, the insurance carried by the owner of the car you’re borrowing will cover the car if you cause an accident, but you should make sure of this, and consider purchasing a non-owner policy as backup

If you don’t own a car, you can still purchase car insurance from a car insurance company simply by purchasing what is called a non-owner policy.A non-owner policy is a policy that covers you no matter what vehicle you drive. This type of coverage is useful for a couple of reasons..

Keep in mind: If you own your own vehicle, then you won’t need to purchase a non-owner policy for vehicles that you don’t own.

You can purchase a non-owner policy from any insurance company. Even if you travel a lot, you will want to purchase the policy in your state of residence.It will be applicable in any state that you travel. You will be required to purchase your state’s minimums but, like with any insurance policy, you will want to consider your assets and what you can afford to pay out of pocket if an accident occurs.Read on to see the circumstances under which a non-owner policy might be valuable to you and then enter your zip above for free online car insurance rates!

You Might Need a Non-Owner Policy if You Travel a Lot

If you are a frequent traveler who rents vehicles wherever you go then you may want to purchase a non-owner policy rather than buying a rental insurance policy from the car rental company. If you only rent every once in a while, then you may not want to pay for a regular policy.

When you own your own vehicle, your existing insurance will cover you when you use a rental vehicle, but if you don’t own your own vehicle, you have to have insurance coverage to legally drive in any state.Every car rental company offers rental car coverage; however, this coverage is nearly twice as much as purchasing coverage from an insurance company. Buying insurance coverage from a rental car company can become cost-prohibitive very quickly.

You will find that purchasing a non-owner policy directly from an insurance company is very affordable and will be comparable in price to a regular car insurance plan.

It will be a little more expensive simply because you will be driving different vehicle types under the policy, but it won’t be too much more.

You Might Need a Non-Owner Policy if You Borrow Other Vehicles

Some people don’t own a vehicle of their own and they will borrow other people’s vehicles to run errands, get around, etc. If this applies to you, the responsible thing to do would be to purchase a non-owner policy to cover you if you have an accident.In many cases, the owner of the vehicle whose car you borrow will have insurance that will cover any accident that occurs no matter who is driving.Not all policies offer this coverage, however, and many require the car owner to add any people who drive their vehicles to the policy. Having a non-owner policy protects your friend if an accident occurs.If the policy covers any drivers on the vehicle and you have an accident, the car owner’s policy will offer the primary coverage for the accident. The non-owner policy kicks in if the bills from the accident exceed the owner’s coverage amount.If, however, the owner’s policy doesn’t cover additional drivers then the non-owner policy will become the primary policy and cover the accident. That is why it is important to ensure that you have enough coverage for a serious accident in case it should occur.If you are driving someone else’s vehicle, you should:

- drive responsibly

- pay any deductibles that they have if you cause an accident

- pay the difference in premium for the duration of time it is increased

It is simply the right thing to do.So what do you do the next time you or a friend asks, Can I put insurance on a car that is not in my name?Refer to our free guide, which includes knowledge that can help protect you if you don’t own a vehicle, drive someone else’s, and more!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How do I buy a non-owner policy?

Buying a non-owner policy is easy. All you have to do is purchase one from any car insurance company. Like any policy, you want to get the best insurance rate that you can on your non-owner policy. To do this, you need to get car insurance quotes.

Insurance quotes can be found at individual car insurance company sites, through an insurance agent, or you can save time by using a free quote tool. The comparison quote tool above offers you the opportunity to view rates between several reputable companies in one place.You can see what you can expect to pay for your non-owner policy and get started on the process of purchasing the insurance that you need. Give the free rate tool a try today!

- https://www.irmi.com/online/insurance-glossary/terms/i/insurable-interest.aspx

- https://content.naic.org/

Case Studies: Getting Car Insurance for a Car You Don’t Own

Case Study 1: Borrowed Vehicle

John frequently borrows his friend’s car and wants to ensure he has insurance coverage while driving it. He contacts his insurance company to inquire about coverage options for borrowed vehicles. John discovers that his existing policy provides coverage for borrowed cars, so he notifies his insurance company about the specific vehicle and duration of usage.

Case Study 2: Rental Car

Sarah is renting a car for a short period and needs insurance coverage for the rental vehicle. She contacts her insurance company to inquire about coverage options for rental cars. Sarah discovers that her policy includes rental car coverage, so she simply verifies the coverage with her insurance provider and receives an insurance document via email, allowing her to rent the car without needing additional insurance.

Case Study 3: Non-Owned Vehicle

Mike occasionally drives a company car provided by his employer. He needs insurance coverage for this non-owned vehicle. Mike contacts his insurance company to check if his policy offers coverage for non-owned vehicles. Upon confirmation, he notifies his insurance company about the specific details of the company car and ensures he has adequate coverage while driving it.

Case Study 4: Temporary Vehicle Use

Samantha needs insurance coverage for a temporary situation where she will be driving a car that doesn’t belong to her. She contacts insurance providers and explains her situation, seeking short-term insurance coverage options. Samantha finds an insurance company that offers temporary coverage and provides the necessary information to obtain insurance for the specific duration and vehicle use.

Frequently Asked Questions

How do you get car insurance for a car you don’t own?

Car insurance for a car you don’t own is offered in three ways. You can get car insurance for a car you don’t own by adding it to your policy, buying non-owner coverage, or buying a separate policy.

How do you get insurance on a car not registered to you?

To get insurance on a car not registered to you, you have three options: adding the vehicle to your existing insurance policy, purchasing non-owner car insurance, or buying a separate policy for the car.

Do you need insurance if you don’t have a car?

If you don’t own a car but drive someone else’s vehicle, you can consider getting non-owner car insurance. This type of coverage provides liability protection while driving a vehicle that you don’t own.

Can you insure a car you don’t own?

Yes, you can insure a car you don’t own. There are three ways to do it: adding the vehicle to your existing policy, purchasing non-owner car insurance, or buying a separate policy for the car.

Can I insure a car that’s not registered to me?

Yes, you can insure a car that is not registered to you. By adding the vehicle to your existing policy, purchasing non-owner car insurance, or buying a separate policy, you can ensure coverage for a car you don’t own.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.