Does car insurance cover car doors dinging another car? (2025)

If your car door hits another car, contact your own insurance company to process it. The other vehicle's damages will be covered by your liability insurance. You may need collision and comprehensive to be covered for your own damages, depending on the situation.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Accidents happen occasionally, and you may have inadvertently hit another car with your door when getting in or out. You’ll want to know how to rectify the damage and may be thinking about contacting your insurance company in this case.

If you’re wondering, “My car door hit another car parked. Will insurance cover it?” the answer is yes. Liability insurance will pay for the damages in this case.

So, what do you do if your car door hits another car and damages it? You may also be wondering what to do if someone opens their car door into yours. Keep reading to find out these answers and more. You can also enter your ZIP code into our free quote tool above to shop for cheap door dings insurance near you.

- You need to contact your own insurance company if you want to file a claim for damage to another vehicle caused by your car door

- No-fault insurance rules do not cover this situation as they only apply to bodily injury

- Depending upon your deductible, you may find it cheaper to pay for this type of damage out of your pocket and also avoid paying higher rates in the future

Liability Insurance Covers Car Door Hitting Another Car

Does car insurance cover door dings? Liability insurance pays for damages if your car door scratched another car. For instance, if your car door hit another car due to wind, the vehicle owner can file a claim on your insurance. The coverage would also apply if you accidentally opened your car door into another car.

A search for “What happens if I accidentally hit someone’s car with my door?” on Reddit finds most users say you should leave a note with personal information, such as your name and phone number, to ensure your liability insurance pays for their damages.

You must file a claim under your property damage liability coverage if you want to involve your car insurance company. This type of coverage will pay for any damage you cause to another vehicle or property.

Some people think the situation can vary based on whether you live in a no-fault state or an at-fault state. However, this difference only applies to a claim for bodily injury, where each insurance company will cover the claim on behalf of the client. When it comes to property damage, auto insurance companies handle these claims the traditional way, no matter which state you live in.

You might be wondering, “If my car was hit while parked, will my insurance go up?” If you end up filing a claim, your insurance will likely increase. However, your rates won’t go up if you don’t file a claim.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What to Do if Your Car Door Hits Another Car

You may be thinking, “I accidentally hit someone’s car with my door. What do I do?” If you are responsible for damage to another vehicle, you should always try to contact the owner. Many of these incidents happen in shopping mall parking lots where cars are lined up very close to each other.

In this case, you should go into the shopping mall and ask the staff to try and locate the owner of the vehicle for you. If this proves impossible, leave a note on the other car’s windshield with your contact details.

If you decide to file a claim with your insurer for the damages caused to the other car, gather as much information as you can first. You will want the contact details of the other party, together with information about the vehicle. It would help if you also took photographs of the damage and the general location.

Next, call your insurance company and talk to an agent. They will provide you with the relevant forms to fill out so they can process the claim for you.

What to Do if Someone Hits Your Car With Their Door

You may be wondering, “What do I do if someone hit my car with their door and left?” Sometimes, you may be the victim of a parking lot hit-and-run. In this case, you need to assess the extent of the damage and decide whether you want to file a claim against your insurance.

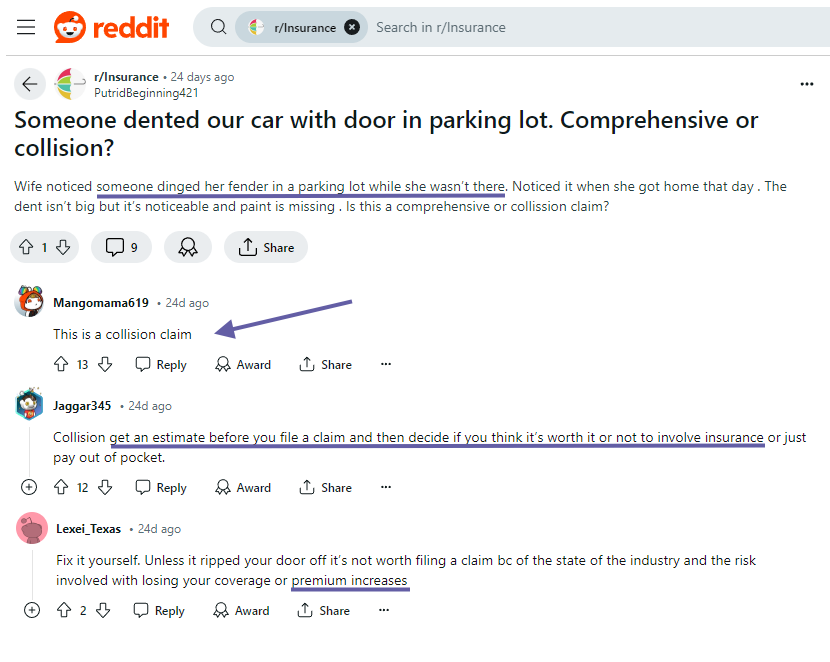

One Reddit user asked the r/Insurance subreddit what type of insurance would pay for their damages after being the victims of car door damage in a parking lot. According to use responses, if someone dings your car with their car door and you can’t find who did it, you’ll file the claim under your collision coverage.

However, as another user on Reddit notes, you should get an estimate to see if it’s worth filing a claim, as it might make more sense to pay out of pocket. After all, you may have to pay increased rates in the future following such a claim.

Unless you must have a pristine car, it is probably not worth the effort to pursue an insurance claim. Often, most incidents where a driver opened a car door into another car, no damage was sustained and it is perhaps not worth the hassle or expense of involving your insurance company.

Now that you know what happens if someone hits your car with their door, we’ll overview some real-life case studies that explains how coverage works if a door dinged someone car.

Exploring Real Cases: Car Insurance Coverage for Car Doors Dinging Another Car

Check out the case studies below for a list of real-life scenarios where you may need coverage.

- Case Study 1: Liability Coverage: John accidentally hit a car door in a parking lot. The owner of the damaged car files a claim with John’s insurance company. Since John is at fault, his liability insurance kicks in. The insurance company covers the cost of repairs to the other vehicle. John’s liability insurance protects him from paying out of pocket.

- Case Study 2: Collision Coverage: Sarah is parked on a busy street when another driver swings their car door open and hits Sarah’s car. Sarah contacts her insurance company to file a claim. She has collision coverage, which covers damages, regardless of who is at fault. The insurer assesses the damage, determines the cost, and covers the expenses minus the deductible. (For more information, read our “How do I assess car damage for insurance purposes?“).

- Case Study 3: Comprehensive Coverage: Mark’s car is parked in a parking lot when a strong wind causes a shopping cart to slam into his car door, causing a dent and paint damage. Mark has comprehensive coverage. He contacts his insurance company and files a claim. The comprehensive coverage covers damages to Mark’s vehicle that are not caused by a collision, such as theft, vandalism, or weather-related incidents.

- Case Study 4: No Coverage: Emily parks her car on the street and returns to find her car was hit by another car door. Unfortunately, Emily doesn’t have any collision or comprehensive coverage. In this case, Emily is responsible for repair costs herself. She must pay out of pocket or negotiate with the other driver’s insurance company if they’re willing to accept liability.

Read More:

- Compare Ding & Dent Car Insurance: Rates, Discounts, & Requirements

- Is it worth claiming a scratch on your car insurance?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What You Should Do if Your Car Door Hits Another Car

What happens if you hit a car with your door? If you accidentally hit a car with your door, you’re responsible for the damage if you or your passenger opened a door into a car. If the other driver is there, you can discuss the issue with them and decide whether you will pay for the damage out of pocket or file a claim with your insurer.

If the other driver is absent, you should take steps to try to locate them or leave your details on a note attached to the windshield. It may be better for you to settle out of pocket rather than pay your deductible and risk higher insurance rates in the future.

If you’re wondering, “Someone hit my car with their door and drove off, but I don’t have coverage. What do I do?” enter your ZIP code into our free quote tool below to compare prices from the top providers and ensure you have full protection in all scenarios.

Frequently Asked Questions

Does car insurance cover car doors dinging another car?

If you’re wondering, “Someone dented my car with their car. Will insurance cover it?” the answer is yes, car insurance will cover you if someone’s door hits your car, or if your car door hits another car.

The other vehicle’s damages will be covered by your liability insurance. You may need collision and comprehensive to be covered for your own damages, depending on the situation.

If I hit a vehicle with my car door, will car insurance pay?

You may be wondering, “I opening my car door and hit another car. Will insurance cover it.” Yes, and you must file a claim under your property damage liability coverage if you want to involve your car insurance company. This type of coverage will pay for any damage you cause to another vehicle or property.

What if I live in a no-fault state?

Some people think the situation can vary based on whether you live in a no-fault state or an at-fault state. However, this difference only applies to a claim for bodily injury, where each insurance company will cover the claim on behalf of the client. When it comes to property damage, auto insurance companies handle these claims the traditional way, no matter which state you live in.

What should I do if my car door hit another car?

You may be wondering what to do if you ding somoene’s car door. If you are responsible for damage to another vehicle, you should always try to contact the owner. In shopping mall parking lots where incidents like these often occur, go into the mall and ask the staff to try and locate the owner of the vehicle for you. If this proves impossible, leave a note on the other car’s windshield with your contact details.

How do I process a car insurance liability claim?

If you decide that you want to process a claim through your auto insurance company for the damage that you caused to the other car, gather as much information as you can first. You will want the contact details of the other party, together with information about the vehicle. It would help if you also took photographs of the damage and the general location. Next, call your insurance company and talk to an agent. They will provide you with the relevant forms to fill out so they can process the claim for you.

What if my car door hits another, and I leave?

You may be wondering, “What happens if I dinged a car door and left?” This is illegal, and you could face a fine if the police decide you are responsible for this type of hit-and-run damage.

Always try to locate the other driver if they are not present at the incident and exchange insurance details if you choose to process a claim through your insurer. Otherwise, you can decide to pay for the damage yourself.

Is door dinging a hit-and-run? Yes, if your car door hit another car in a parking lot and you leave, it could be considered a hit-and-run depending on the damages.

Can you claim if someone hits your car door?

You might be thinking, “Can I file a claim if someone hit my car door with their door?” Yes, you can file a claim for a car door hit in a parking lot, but you’ll probably have to cover the cost of a deductible and may wonder whether it’s worth filing.

Unless you must have a pristine car, it is probably not worth the effort to pursue an insurance claim. Often, the damage caused by a swinging car door is relatively minor, and it is perhaps not worth the hassle or expense of involving your insurance company.

If you’re wondering, “What happens if your car door hits another car and I don’t have coverage?” enter your ZIP code into our free quote tool below to instantly compare costs from the top providers in your area.

Can you get in trouble for hitting a car with your door?

Will I get in trouble if my car door opened into another car? No, there is no criminal law on opening a car door in a parking lot unless you drive away after. However, you may be liable for the damages.

So, what if my car door hit another car and I left? In this situation, you could be charged with a hit-and-run if you leave without providing your personal information.

Will my insurance go up if I hit a parked car?

You might be wondering, “Will my car insurance rates go up if I hit someone’s car door with mine?” Your car insurance rates will likely go up if you file a claim after a parked car open door accident.

If the wind blew my car door into another car, am I liable for damages?

A top question readers ask is, “Am I responsible if the wind blew my car door open into another car?” Yes, you’re generally responsible for all damages caused by your car, including if you open your door and the wind blows your door into another vehicle.

What happens if my car door hit another car with no damage?

You may be wondering what to do if you opened your car door into another car with no damage. Even without visible damage, it’s still important to exchange information in case the incident causes underlying issues for the car afterwards.

What happens if I unknowingly hit a parked car and the owner isn’t around?

If you accidentally hit a parked car and the owner isn’t there, leave a note with your full name and phone number so they can contact you. Failing to do so could result in hit-and-run charges.

Is there a parking lot door ding law?

You may be wondering, “Someone’s car door hit my car. What are the laws for parking lot door dings?” While there isn’t a specific parking lot door ding law, property damage laws require the person at fault for damages be liable to pay.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.