Best Cadillac Car Insurance Rates in 2025 (Compare the Top 10 Companies)

Geico, USAA, and State Farm have the best Cadillac car insurance rates. At Geico, minimum Cadillac coverage is an average of $30/mo. However, Cadillac insurance rates will vary slightly depending on the Cadillac model. For example, insurance for a Cadillac XLS will cost more than Cadillac CTS insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Cadillac

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Cadillac

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Cadillac

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGeico, USAA, and State Farm have the best Cadillac car insurance rates.

If you drive a Cadillac, you must buy insurance that meets your state’s minimum coverage requirements.

Our Top 10 Company Picks: Best Cadillac Car Insurance Rates

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 23% | A++ | Comprehensive Coverage | Geico | |

| #2 | 19% | A++ | Military Focus | USAA | |

| #3 | 14% | B | Competitive Pricing | State Farm | |

| #4 | 15% | A+ | Usage-Based Options | Progressive | |

| #5 | 16% | A+ | Specialized Plans | Allstate | |

| #6 | 10% | A | New Replacement | Liberty Mutual |

| #7 | 19% | A | Customized Policies | Farmers | |

| #8 | 22% | A+ | Deductible Benefits | Nationwide |

| #9 | 25% | A+ | Excellent Service | Amica | |

| #10 | 24% | A++ | Safety Focus | Travelers |

Cadillac car insurance rates vary for many reasons, but you may be able to find affordable rates for coverage in your area.

You should also compare multiple car insurance quotes online as you shop. Comparing quotes from several companies helps you determine which offers the type of car insurance you want at a reasonable rate. Compare rates now with our free quote tool to find cheap Cadillac car insurance.

#1 – Geico: Top Pick Overall

Pros

- Comprehensive Coverage: Fully protect your Cadillac with comprehensive coverage from Geico. See what else you can buy in our Geico review.

- Financial Rating: Cadillac owners will be purchasing insurance from a very highly rated company.

- User-Friendly Online Tools: Geico is rated well for its online convenience.

Cons

- Agent Interaction: Geico doesn’t provide local agents in most areas, so interactions are mostly virtual.

- Gap Insurance: This coverage isn’t sold at Geico, which could be a problem for new Cadillac owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Focus

Pros

- Military Focus: USAA sells exclusively to military and veterans, allowing it to provide specialized services and keep rates affordable.

- SafePilot: Participating drivers can save on Cadillac auto insurance if they are safe drivers.

- Customer Service: There are high ratings for USAA’s customer service.

Cons

- Eligibility is Exclusive: USAA is military-focused, so only Cadillac owners who are veterans or military can buy coverage.

- Add-On Coverages: USAA doesn’t have as many extras for sale. Learn what coverages are available in our USAA car insurance review.

#3 – State Farm: Best for Competitive Pricing

Pros

- Competitive Pricing: State Farm offers competitive pricing to most types of Cadillac drivers. Our State Farm review provides more rate information.

- Extensive Network: Cadillac owners should be able to easily find an agent near them, thanks to State Farm’s extensive network.

- Coverage Options: State Farm has all the basics plus specialized add-on coverages.

Cons

- Online Functions: State Farm relies less on online functions due to local agents.

- Discount Availability: Some discounts may be limited to certain states.

#4 – Progressive: Best for Usage-Based Options

Pros

- Usage-Based Options: Progressive offers discounts based on Cadillac owners’ usage and driving skills.

- Online Convenience: Most policy tasks can be done online. Find out more in our Progressive review.

- Budget Shopping: A free Name Your Price tool can assist Cadillac owners on budgets.

Cons

- UBI Rate Increases: Poor drivers who participate in the UBI program could end up with higher rates.

- Customer Reviews: Progressive could still improve its customer service ratings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Specialized Plans

Pros

- Specialized Plans: Allstate’s options make it easy to create a specialized plan for your Cadillac.

- Pay-Per-Mile Rates: Low-mileage Cadillac drivers could save with Milewise. Learn more in our Allstate Milewise review.

- Online Convenience: Cadillac policyholders can add drivers, change cars, file claims, and much more online.

Cons

- Customer Reviews: There is a higher-than-normal complaint number.

- High-Risk Rates: Safe drivers will have the most competitive Cadillac auto insurance rates.

#6 – Liberty Mutual: Best for New Replacement

Pros

- New Replacement: Liberty Mutual offers new car replacement coverage, which new Cadillac owners may wish to purchase. Find more coverage options in our Liberty Mutual review.

- Accident Forgiveness: Accident forgiveness offers an incentive to be a safe driver.

- RightTrack: The UBI program RightTrack offers discounts to Cadillac drivers who participate in the program.

Cons

- Claims Satisfaction: Some customer ratings aren’t positive, expressing dissatisfaction with claims processing.

- Telematics Tracking: RightTrack tracks the driving data of Cadillac drivers.

#7 – Farmers: Best for Customized Policies

Pros

- Customized Policies: Cadillac owners can easily customize Farmers’ policies. Learn what policy options are available in our Farmers review.

- Discount Variety: Cadillac policyholders can save with good driver discounts, paperless discounts, etc.

- Agent Availability: Farmers has a decent amount of agents stationed locally.

Cons

- Online Functions: Farmers’ representatives will need to be contacted for some policy actions.

- Customer Satisfaction: Farmers’ customer service does have mixed ratings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Deductible Benefits

Pros

- Deductible Benefits: Nationwide reduces deductibles annually if Cadillac drivers stay accident-free.

- Pay-Per-Mile Rates: SmartMiles by Nationwide offers cheap rates to Cadillac owners with low mileage.

- Discount Variety: Cadillac owners should be able to qualify for several Nationwide car insurance discounts.

Cons

- DUI Rates: DUI drivers will find Cadillac insurance rates less competitive.

- Limited Local Agents: Nationwide’s agents aren’t stationed as widely as at other companies.

#9 – Amica: Best for Excellent Service

Pros

- Excellent Service: Amica has decent customer service ratings.

- Rideshare Insurance: This is offered in some states and is great for Cadillac drivers who work as rideshare drivers on the side.

- Discount Variety: Amcia offers plenty of car insurance discounts to Cadillac drivers.

Cons

- Hawaii Coverage: Amica is not sold in Hawaii.

- Local Agents: Amica doesn’t offer local assistance through stationed agents.

#10 – Travelers: Best for Safety Focus

Pros

- Safety Focus: Travelers offers discounts for safety features, safe driving, and more. Read more in our Travelers review.

- Availability: Cadillac owners can buy coverage in any state.

- IntelliDrive Program: Reduce your Cadillac insurance costs by participating in this UBI program.

Cons

- Limited Local Agents: Cadillac owners will receive most assistance virtually.

- IntelliDrive Rates: You may have rate increases after a poor driving performance in the program.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Choosing the Right Cadillac Car Insurance

There are different minimum car insurance requirements by state for driving legally. To meet your state’s requirements, you’ll need liability insurance, which includes:

- Property Damage Liability: Property damage liability insurance covers you if you cause an accident and damage someone’s vehicle or other personal property.

- Bodily Injury Liability: Bodily injury liability covers you if you cause an accident and one or more people are injured.

In addition to a minimum coverage or liability car insurance policy, your state may require that you carry one or more of the following car insurance coverages:

- Personal Injury Protection (PIP): PIP coverage helps with medical bills, lost wages, and funeral costs associated with a covered accident.

- Medical Payments (MedPay): MedPay helps with medical bills like visits to the doctor and hospital stays.

- Uninsured/Underinsured Motorist Coverage: If another driver causes an accident but does not carry proper insurance, uninsured/underinsured motorist coverage allows your insurance company to pay for the damage someone else caused to your vehicle.

If you live in a state that only requires property damage and bodily injury liability, your monthly or annual car insurance rates may be much lower than states that require PIP, MedPay, and uninsured/underinsured motorist insurance.

Determining the Need for Full Coverage on Your Cadillac

You can purchase additional car insurance coverage for your Cadillac if you want added protection. With liability, you still have to pay out of pocket if you cause an accident and your vehicle is damaged. However, if you get full coverage, you don’t have to worry about damage to your car. Below, you can see how costs vary between the two coverage types.

Cadillac Car Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| Amica | $22 | $59 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $46 | $151 |

Full coverage helps cover the cost of repairs to your vehicle if something happens. To have a full coverage policy, you need the following insurance:

- Collision Insurance: Collision insurance pays for damage to your vehicle if you cause an accident. Collision will cover your Cadillac up to its actual cash value (ACV).

- Comprehensive Insurance: Comprehensive car insurance pays if theft, vandalism, wild animals, or inclement weather damage your Cadillac.

With full coverage, you’re protected if something happens to your car or if you cause an accident and damage your car as a result.

Understanding Cadillac Car Insurance Rates: Expense Factors and Considerations

Car insurance for a Cadillac typically costs around $2,194 annually or $183 per month. Still, your Cadillac car insurance rates will vary based on different factors. As a result, the model is one of the most important variables to impact Cadillac car insurance quotes.

For example, the average cost of Cadillac DTS Pro car insurance is $1,344 annually or $112 each month. However, Cadillac XLS car insurance costs around $1,778 annually or $148 each month.

Discover the Perfect Policy: Compare Cadillac Car Insurance Rates by Model

Easily compare car insurance rates for various Cadillac models including CTS, STS, DTS, XLR, SRX, and XLR-V. Start now to find the best rates for your Cadillac.

Compare Cadillac Car Insurance Rates by Model

As you shop for car insurance for a Cadillac, you can compare rates for your model with different companies to see which offers the most affordable coverage option. Drivers can get quotes directly from Geico, USAA, and other companies.

However, getting quotes individually from each company can be time-consuming, so you may want to use a quote comparison tool instead.

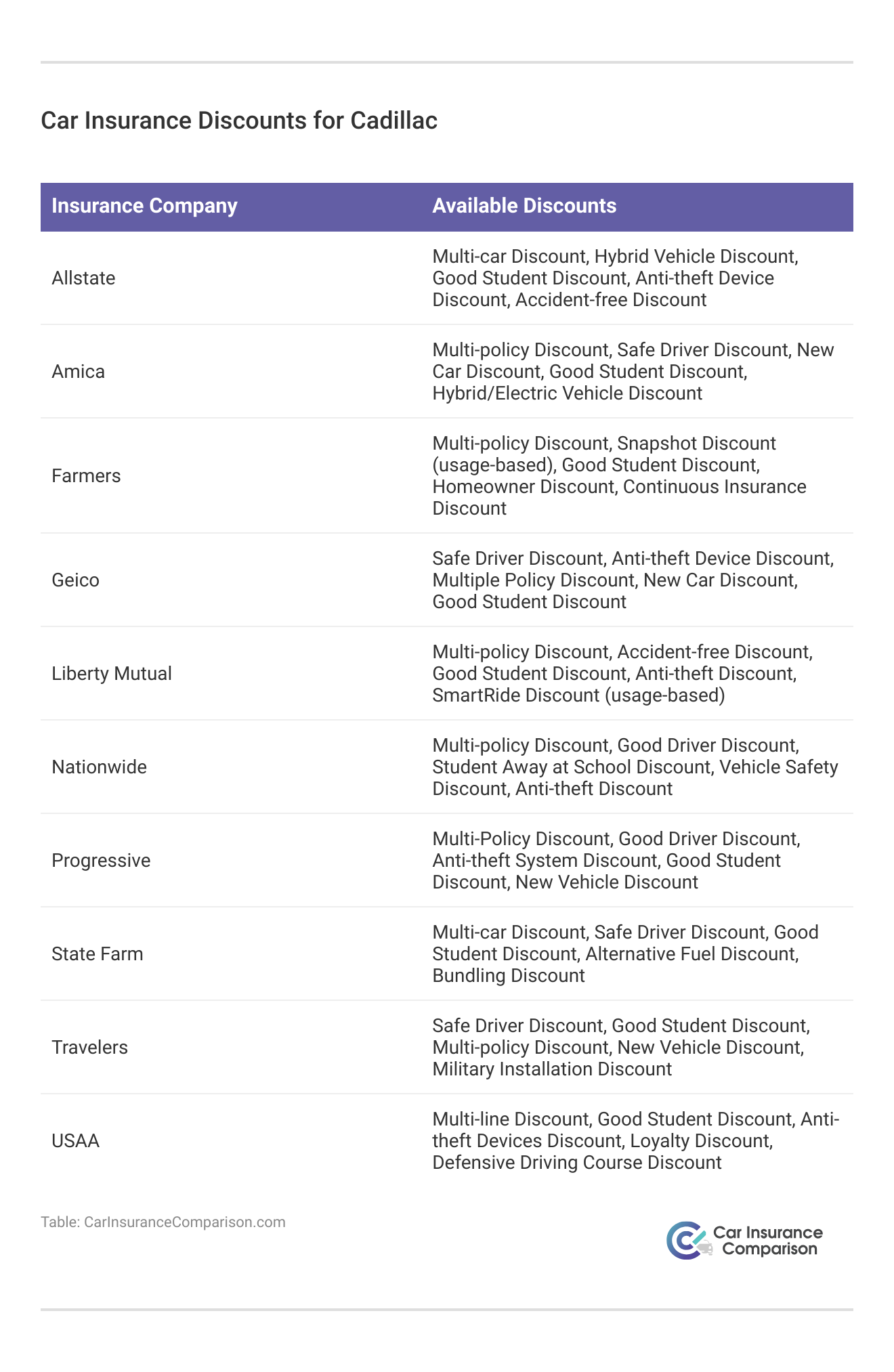

Maximizing Savings: Discounts Available for Cadillac Car Insurance

You may be able to lower your Cadillac car insurance costs by taking advantage of different insurance discounts. For example, you can save up to 25% on car insurance discounts, which could significantly lower your monthly or annual Cadillac car insurance rates.

View this post on Instagram

Some of the most common car insurance discounts for Cadillac owners include:

- Safety features discount

- Defensive driver discount

- Good student discount

- Student away at school discount

- Paid-in-full discount

- Affiliation discount

- Loyalty discount

- Multi-car discount

- Multi-policy discount

If you believe you qualify for one or more discounts with any company, speak with a company representative to learn more about your options and how much you could save.

Impact of a New Cadillac on Insurance Costs

You may find that a newer car means higher car insurance rates, but that’s not always true.

Many new Cadillacs cost more to insure because they're worth more if you're ever in an accident. Additionally, a new Cadillac may cost more to cover if that new car requires a full coverage policy.

Dani Best Licensed Insurance Producer

Newer cars may help you save money on car insurance if your vehicle has specific safety features. Certain safety features, like anti-lock brakes, help drivers save money because they allow you to stay safe on the road.

Smart Strategies for Saving on Your Cadillac Car Insurance Rates

If you want to save money on your Cadillac insurance, you should shop and compare quotes and consider taking advantage of discounts.

You may be able to save even more on coverage if you:

- Bundle your Cadillac coverage with another insurance policy.

- Increase the car insurance deductible of your Cadillac car insurance policy.

- Keep a clean driving record.

- Improve your credit score.

Comparing quotes for coverage gives you a better idea of how much you can expect to pay in monthly or annual car insurance rates.

Read more: Compare Smart Car Insurance Rates [2023]

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cadillac Car Insurance: The Bottom Line

You need car insurance if you own a Cadillac. You can purchase minimum coverage or add collision and comprehensive insurance to your policy for better protection. Many Cadillac drivers take advantage of car insurance discounts to save money on coverage. You can also bundle your insurance policies, increase your car insurance deductible, and improve your credit and driving record to get cheaper coverage for your Cadillac.

It’s important to find and compare car insurance quotes for Cadillac coverage from different insurance companies in your area. When you compare Cadillac quotes, you’ll learn which companies offer the coverage you want at a price that works best for you. Enter your ZIP code into our free quote tool to get started.

Frequently Asked Questions

What factors determine Cadillac car insurance rates?

Several factors can influence Cadillac car insurance rates, including the model and year of the Cadillac, the driver’s age and driving record, the location where the car is primarily driven, the coverage options selected, and the deductible chosen.

Are Cadillacs expensive to insure?

Insurance on a Cadillac can be expensive if you own a newer, more expensive model.

Are Cadillac car insurance rates generally higher compared to other car brands?

Cadillac car insurance rates can vary depending on the specific model and other factors. Generally, luxury vehicles like Cadillacs may have higher insurance rates due to the higher cost of repairs and replacement parts, so the best insurance for luxury cars like Cadillacs will cost more.

How can I find the best insurance rates for my Cadillac?

To find the best insurance rates for your Cadillac, it’s important to compare quotes from different insurance providers. You can do this by reaching out to insurance companies directly or by using online comparison tools that gather quotes from multiple insurers. Enter your ZIP into our free quote tool to find cheap Cadillac auto insurance today.

Are there any discounts available to lower Cadillac car insurance rates?

Yes, insurance companies often offer various discounts that can help lower Cadillac car insurance rates. Some common discounts include safe driver discounts, multi-policy discounts (if you have multiple insurance policies with the same company), anti-theft device discounts, and good student discounts (for young drivers with good academic records).

Does the age of my Cadillac affect insurance rates?

Yes, the age of your Cadillac can impact insurance rates. Generally, newer Cadillacs may have higher insurance rates due to their higher value and cost of repairs. As the vehicle ages, insurance rates may decrease as the vehicle depreciates in value (read more: Cheap Car Insurance for Older Vehicles).

What is the best car insurance for a Cadillac?

Full coverage is usually the best choice of car insurance for Cadillacs. To find affordable full coverage for a Cadillac, compare rates with our free tool to find the best Cadillac car insurance quotes.

Do Cadillacs require premium gas?

Some Cadillac models do require premium gas to run.

Which is better, Cadillac or Lexus?

Both makes have their own pros and cons, but Lexus tends to be a more popular choice than Cadillac (read more: Best Lexus Car Insurance Rates).

Is Cadillac a high-end car?

Yes, a Cadillac is considered a high-end car, which means Cadillac car insurance costs will be a little higher.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.