Cheapest Utah Car Insurance Rates in 2025 (Find Savings With These 10 Companies)

The top picks for the cheapest Utah car insurance rates are Geico, Travelers, and Nationwide, with rates starting at $33 per month. These providers stand out for their affordability, reliable customer service, and comprehensive coverage options tailored to Utah drivers' needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Utah

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Utah

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Utah

A.M. Best Rating

Complaint Level

3,071 reviews

3,071 reviews

The cheapest Utah car insurance rates are offered by Geico, Travelers, and Nationwide, with Geico as the top pick overall at $33/month for minimum coverage.

This article explores why these providers stand out, considering affordability, customer service, and comprehensive car insurance by coverage options tailored to Utah drivers.

Our Top 10 Company Picks: Cheapest Utah Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $33 A++ Online Tools Geico

#2 $39 A++ Hybrid Vehicles Travelers

#3 $42 A+ SmartRide Program Nationwide

#4 $43 A+ Snapshot Program Progressive

#5 $45 A++ Customer Loyalty Auto-Owners

#6 $46 B Customer Service State Farm

#7 $47 A Teen Driver American Family

#8 $50 A+ AARP Benefits The Hartford

#9 $51 A Policy Bundling Farmers

#10 $53 A Safe Driver Liberty Mutual

Learn about the state’s insurance requirements, penalties for lack of coverage, and factors influencing rates. Discover how to find the best car insurance policy to meet your needs in Utah.

- Compare Utah Car Insurance Rates

Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

- Geico offers the cheapest Utah car insurance at $33/mo for minimum coverage

- Explore factors affecting Utah insurance rates, coverage options, and penalties

- Insurer provides affordable rates with comprehensive coverage options

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico car insurance review highlights the lowest car insurance rates in Utah, with prices starting at only $33 per month for minimum coverage.

- Discounts: Geico provides a variety of discounts, including good student, military, and multi-policy discounts, which can significantly lower premiums.

- Comprehensive Coverage Options: Geico offers extensive coverage options including liability, collision, comprehensive, and uninsured/underinsured motorist coverage, tailored to Utah drivers’ needs.

Cons

- Limited Local Agents: Geico primarily operates online and by phone, which may not be ideal for those preferring face-to-face interactions.

- High Rates for High-Risk Drivers: Drivers with a history of accidents or traffic violations may find Geico’s rates less competitive compared to other insurers.

#2 – Travelers: Best for Hybrid Vehicles

Pros

- Competitive Rates for Hybrid Vehicles: Travelers car insurance review highlights some of the best rates for hybrid vehicle insurance in Utah, promoting eco-friendly driving.

- Good Range of Discounts: Travelers provides discounts for safe driving, multiple policies, and hybrid vehicles, helping policyholders save more.

- Flexible Coverage Options: Travelers offers a wide range of coverage options, including liability, collision, comprehensive, and gap insurance, catering to various driver needs in Utah.

Cons

- Higher Base Rates: Travelers’ base rates can be higher than some other insurers, especially for minimum coverage, starting at $39 per month.

- Limited Online Tools: While functional, Travelers’ online tools and mobile app are not as advanced or user-friendly as some competitors.

#3 – Nationwide: Best for SmartRide Program

Pros

- Diverse Discount Options: Nationwide car insurance discounts highlights various discounts including multi-policy, good student, anti-theft, and accident-free discounts.

- Affordable Rates: Nationwide offers competitive pricing, making it one of the cheapest options for car insurance in Utah.

- Comprehensive Coverage Options: Offers a wide range of coverage options, allowing customers to tailor policies to their specific needs.

Cons

- Limited Availability of Discounts: While there are several discounts, they may not be as extensive as those offered by competitors.

- Mobile App Limitations: The Nationwide mobile app has fewer features compared to other leading insurers, which can be a drawback for tech-savvy users.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program offers discounts based on driving behavior, potentially lowering rates significantly for safe drivers.

- Competitive Pricing: Progressive car insurance review highlights that Progressive offers some of the most affordable car insurance rates in Utah, making it a budget-friendly choice.

- Strong Online Presence: Progressive’s online tools and mobile app are highly rated, making it easy for customers to manage their policies and claims.

Cons

- Higher Premiums for Certain Drivers: Drivers with poor credit scores or a history of accidents may face higher premiums.

- Customer Service Variability: While many customers report positive experiences, some have noted inconsistencies in customer service quality.

#5 – Auto-Owners: Best for Customer Loyalty

Pros

- Affordable Rates: Auto-Owners car insurance review highlights some of the most affordable car insurance rates in Utah, starting at $45/month for minimum coverage.

- Wide Range of Discounts: Auto-Owners provides various discounts including multi-policy, safe driver, and green vehicle discounts, making it easier to save.

- Comprehensive Coverage Options: Offers extensive coverage options tailored to individual needs, including optional coverages like rental car reimbursement and gap insurance.

Cons

- Limited Online Features: Their online services are less comprehensive compared to other providers, which can be inconvenient for tech-savvy users.

- Regional Availability: Auto-Owners insurance is not available nationwide, which could be a drawback if you move out of Utah.

#6 – State Farm: Best for Customer Service

Pros

- Customer Service Excellence: State Farm is renowned for its exceptional customer service and claims handling, providing peace of mind for Utah drivers.

- Competitive Rates: State Farm car insurance review showcases competitive rates for both minimum and full coverage, highlighting it as an affordable option for many drivers in Utah.

- Extensive Coverage Options: Provides a wide range of coverage options, including unique add-ons like rideshare insurance and emergency roadside assistance.

Cons

- Higher Rates for High-Risk Drivers: Premiums can be higher for drivers with a less favorable driving history or those considered high-risk.

- Limited Local Agents: While State Farm has a broad network, some areas may have limited access to local agents, affecting personalized service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Teen Driver

Pros

- Competitive Rates for Teen Drivers: American Family offers some of the most affordable rates for teen drivers in Utah, making it a top pick for families looking to insure their young drivers without breaking the bank.

- Excellent Customer Service: American Family car insurance review highlights the company’s responsive and helpful customer service, making the insurance process smoother and more pleasant for Utah drivers.

- Comprehensive Coverage Options: The company offers a wide range of coverage options, allowing customers to tailor their policies to fit their specific needs and budget.

Cons

- Higher Rates for High-Risk Drivers: Drivers with poor records may find American Family’s rates less competitive compared to other insurers.

- Fewer Digital Tools: The company’s online and mobile tools are less robust compared to some competitors, potentially making policy management less convenient for tech-savvy customers.

#8 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits: The Hartford offers special benefits and discounts for AARP members, making it a great choice for senior drivers looking for affordable coverage in Utah.

- Customer Loyalty Rewards: The company provides incentives for long-term customers, such as accident forgiveness and disappearing deductibles, helping to keep rates low over time.

- Wide Range of Discounts: The Hartford car insurance discounts showcases various discounts for Utah drivers, from multi-policy savings to safe driver rewards, helping them reduce their premiums.

Cons

- Higher Base Rates: Compared to some other companies on the “cheapest Utah car insurance rates” list, The Hartford’s base rates may be higher, especially for younger drivers.

- Fewer Local Agents: The Hartford has fewer local agents in Utah, which might be a drawback for customers who prefer in-person service.

#9 – Farmers: Best for Policy Bundling

Pros

- Competitive Discounts: Farmers offers a variety of discounts including multi-policy, safe driver, and good student discounts, helping to lower overall costs for Utah drivers.

- Customer Service: Known for excellent customer service, Farmers provides responsive and helpful support, making it easier for policyholders to manage their insurance needs.

- Educational Resources: Farmers car insurance review highlights the extensive educational resources and tools provided by Farmers, helping Utah drivers make informed decisions about their insurance coverage.

Cons

- Higher Premiums: Farmers’ premiums can be higher compared to some competitors, which might make it less attractive for those specifically seeking the cheapest Utah car insurance rates.

- Complex Policy Structures: Some customers may find Farmers’ policy structures and options complex, requiring more effort to understand and choose the right coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Safe Driver

Pros

- Variety of Discounts: Liberty Mutual offers numerous discounts such as multi-policy, military, and good student discounts, which can significantly reduce insurance costs for Utah drivers.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program ensures that your rates won’t increase after your first accident, which can be a significant benefit for Utah drivers.

- User-Friendly Digital Tools: Liberty Mutual car insurance review highlights the user-friendly digital tools and mobile apps that simplify policy management and claims filing for Utah drivers.

Cons

- Higher Rates for Young Drivers: Liberty Mutual tends to have higher rates for young drivers, which might make it less appealing for families with teen drivers looking for the cheapest Utah car insurance rates.

- Mixed Customer Reviews: While many customers are satisfied, there are mixed reviews regarding claims processing times and customer service experiences.

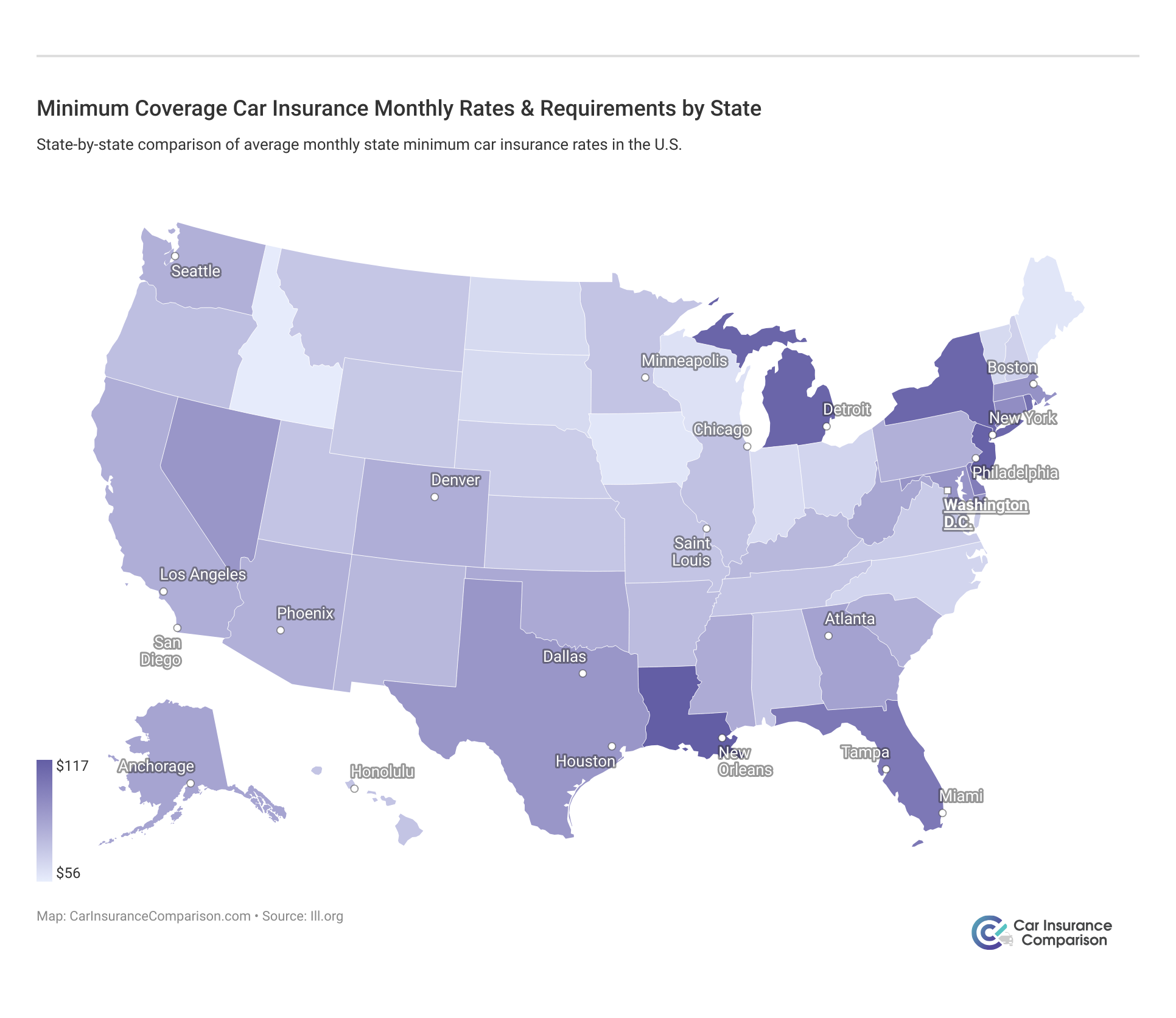

Compare Utah Car Insurance Rates and Coverage Requirements

Finding the best car insurance fit can be confusing due to varying state coverage requirements and company rates. In Utah, car insurance is mandatory, and driving without it is illegal. Drivers must have bodily injury and property damage liability coverage, along with personal injury protection (PIP), which covers medical, rehabilitation, earning loss, and funeral costs.

Geico offers the best car insurance rates in Utah at just $33 per month for minimum coverage, combining affordability with excellent service.

Brad Larson Licensed Insurance Agent

The minimum coverage amounts are $25,000 for injury or death per person, $65,000 per accident, $15,000 for property damage, and $3,000 PIP per person. Alternatively, a combined single limit policy of $80,000 is available, though PIP coverage remains necessary. To gain further insights, consult our comprehensive guide titled “Best Personal Injury Protection (PIP) Car Insurance.”

Not meeting these requirements leads to penalties such as license and registration suspension, a minimum $400 fine for the first offense, and $1,000 for subsequent offenses. Ensure you have the required insurance to avoid these consequences and retain your driving privileges, as minimum insurance costs vary by state.

Utah Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $47 $105

Auto-Owners $45 $115

Farmers $51 $115

Geico $33 $73

Liberty Mutual $53 $119

Nationwide $42 $93

Progressive $43 $95

State Farm $46 $103

The Hartford $50 $120

Travelers $39 $88

Utah car insurance rates vary by coverage level and provider. For minimum coverage, Geico offers the lowest monthly rate at $33, followed by Auto-Owners at $45. Liberty Mutual and Farmers have higher rates at $53 and $51, respectively.

For full coverage, Geico again offers the most affordable rate at $73, with American Family and State Farm offering competitive rates at $105 and $103, respectively. The Hartford has the highest full coverage rate at $120. Travelers provides balanced rates with $39 for minimum coverage and $88 for full coverage.

Car insurance discounts from top providers in Utah can help you save significantly on your premiums. Discounts vary by company and can include options like good student, multi-policy, defensive driver, and more. For example, American Family offers discounts for good students and low mileage, while Auto-Owners provides discounts for safe drivers and green vehicles.

Farmers, Geico, and Liberty Mutual offer a range of discounts such as bundling, military, and accident-free incentives. Nationwide, Progressive, and State Farm provide discounts for usage-based programs, anti-theft devices, and continuous insurance.

The Hartford and Travelers also offer discounts for multi-vehicle policies, defensive driving, and early quotes. Each company has its unique set of available discounts, ensuring that you can find a policy tailored to your needs and budget.

Utah Driving & Vehicle Statistics Summary

| Summary | Details |

|---|---|

| Annual Road Miles | Total in State: 46,299 Vehicle Miles Driven: 27.6 billion |

| Vehicles | Registered in State: 2,150,360 Total Stolen: 8,707 |

| State Population | 3,161,105 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 8.20% State Rank: 39th |

| Total Driving Fatalities | 2008-2017 Speeding: 851 Drunk Driving: 468 |

| Average Monthly Rates | Liability: $471 Collision: $254 Comprehensive: $106 |

| Cheapest Providers | USAA and Geico |

Home to the Great Salt Lake and majestic canyons, Utah has attracted a population of over three million people. With over two million vehicles registered in Utah, drivers have many different options when it comes to buying Utah car insurance.

Who has the cheapest car insurance in Utah? How much is car insurance in Utah? What car insurance is required? We’ve put together a comprehensive guide that covers everything you need to know, from Utah car insurance requirements to state driving laws.

Ensuring Compliance and Financial Responsibility for Car Insurance in Utah

In Utah, where car insurance is mandatory, forms of financial responsibility are crucial to verify compliance with the law. These forms, such as an insurance ID card, insurance binder, or insurance declaration, prove that you have the required coverage. You must provide proof of insurance during traffic stops, car registration, or accidents.

Failure to do so can result in license suspension. Additionally, law enforcement monitors insurance status electronically through Insure-Rite, to which your insurer reports. Ignoring Insure-Rite notifications can lead to multiple penalties. For additional details, explore our comprehensive resource titled “Driving Without Insurance: Avoid Lapses in Coverage for Lower Rates.”

To understand the financial impact, examining premiums as a percentage of per capita disposable income reveals how much car insurance costs affect the average salary in Utah. Utah’s percentage of income going to insurance coverage is actually fairly high (the highest state percentage is almost four percent).

Utah Car Insurance Cost as a Percentage of Income

| Year | Disposable Income | Full Coverage | Monthly Rates |

|---|---|---|---|

| 2022 | $31,991 | $805 | 2.52% |

| 2023 | $32,176 | $820 | 2.55% |

| 2024 | $33,566 | $852 | 2.54% |

However, Utah’s percentage has remained fairly consistent, which is good news. The yearly disposable income, however, took a dip in 2013 and hasn’t quite made it back up to the yearly disposable income in 2014. Unfortunately, despite the small dip in income, car insurance coverage costs went up slightly over the years.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

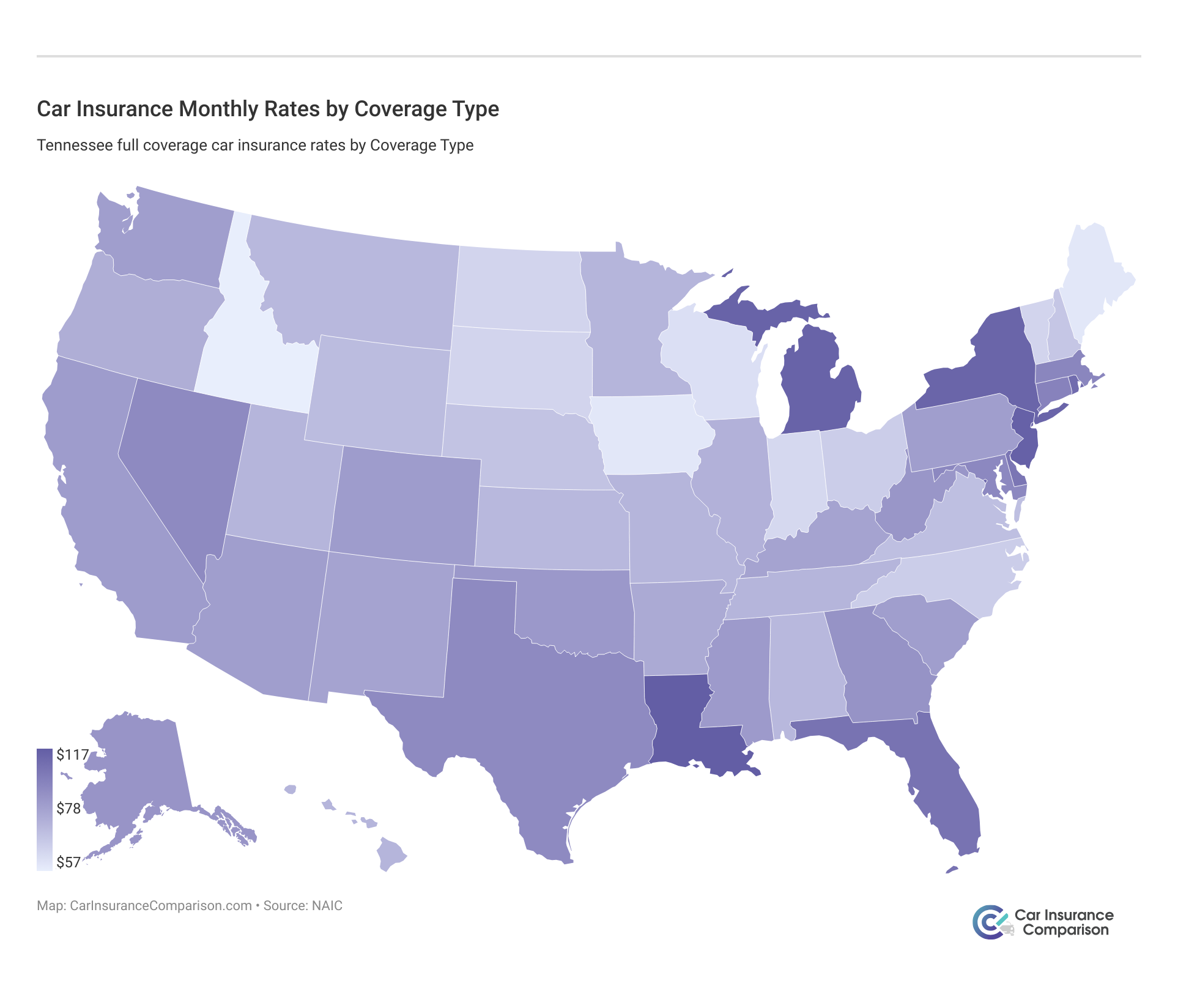

Average Monthly Car Insurance Rates in Utah (Liability, Collision, Comprehensive)

Core coverage includes all the basics: liability insurance, collision insurance, and comprehensive insurance. The good news is that Utah’s average premiums are all under the countrywide averages.

We’ve talked about liability coverage before, which Utah requires all drivers to have. Collision insurance coverage is optional but is useful in an accident. It will help pay for the costs of repairing or replacing your car if you are in an accident with another car or an object like a mailbox.

Utah Car Insurance Monthly Rates vs. U.S. Average by Coverage Type

| Coverage Type | Utah Average | U.S. Average |

|---|---|---|

| Liability | $43 | $39 |

| Collision | $25 | $21 |

| Comprehensive | $12 | $9 |

| Full Coverage | $80 | $69 |

Comprehensive car insurance coverage is also optional, and it covers a wide range of mishaps other than an accident. It will help pay for the costs if your car is damaged by natural disasters (fire, etc.), theft, vandalism, or hitting an animal.

Evaluating Additional Liability Coverage and Financial Health in Utah

Additional liability insurance includes personal injury protection (PIP), medical payments (Medpay), and uninsured/underinsured motorist coverage. Utah mandates PIP but not Medpay or uninsured/underinsured coverage. Assessing these coverages’ performance involves examining their loss ratios, which indicate financial health.

Geico stands out as the top choice for car insurance in Utah, offering unmatched affordability and excellent service.

Michelle Robbins Licensed Insurance Agent

A low loss ratio risks customer loss due to insufficient claims payouts, while a high ratio over 100% suggests financial instability. Utah’s PIP loss ratios are stable, but Medpay and uninsured/underinsured payments exceed 100%. Therefore, reviewing your insurer’s loss ratios for these coverages is crucial.

Despite high numbers, these coverages are vital as they protect against uninsured drivers, who make up 8.20% of Utah’s motorists, ensuring bills are paid when at-fault drivers can’t cover costs. Medpay covers medical expenses for you and your passengers. Also, consider affordable add-ons like gap insurance, rental car reimbursement, and emergency roadside assistance to customize your plan.

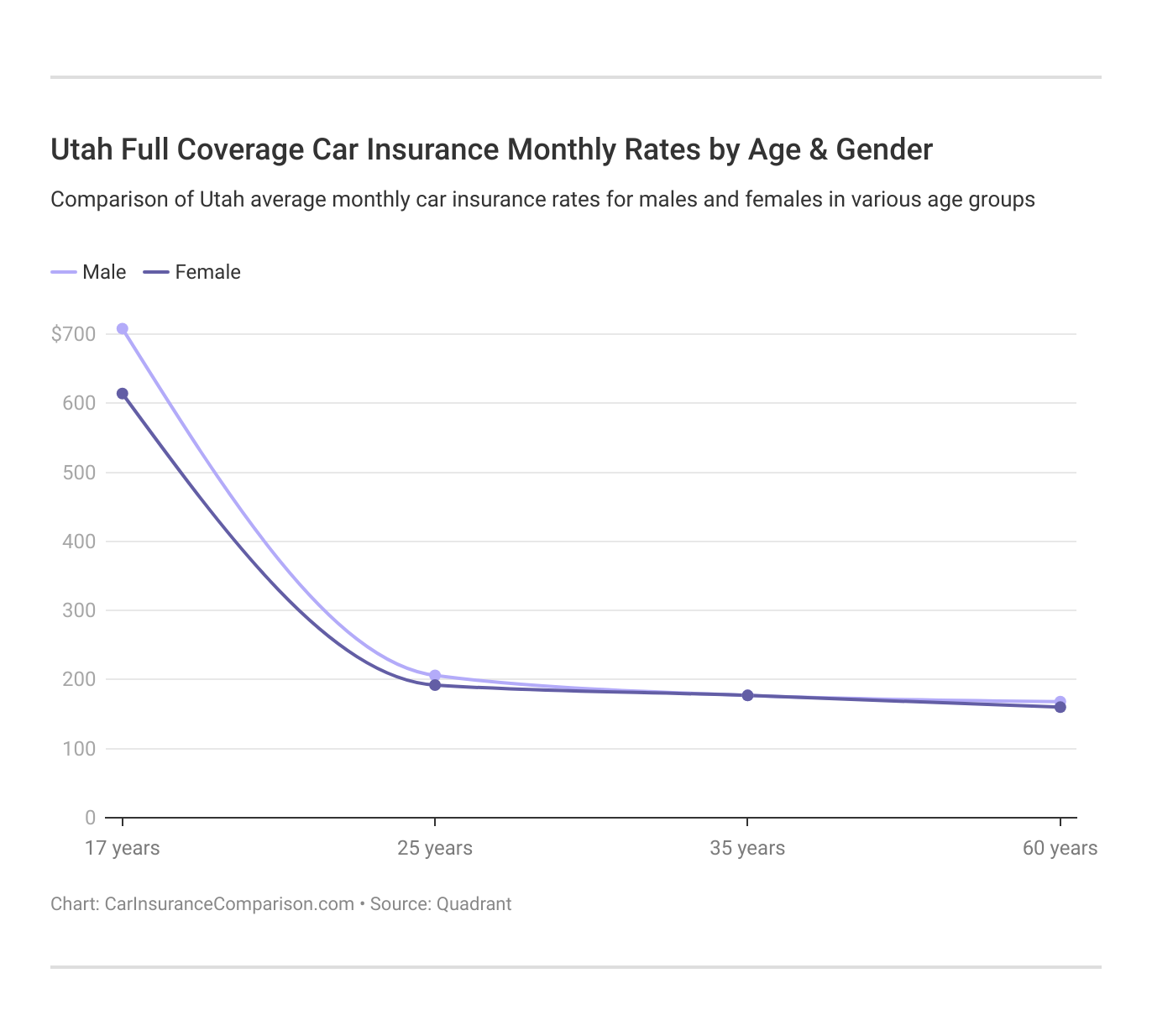

Average Monthly Car Insurance Rates by Age & Gender in UT

Demographics actually play a significant role in determining rates. Car insurance rates by age and gender can be vastly different. Let’s take a look at how gender and age impact insurers’ rates.

The huge price of teen auto insurance means that many parents choose to add their teen drivers to their parents’ insurance plans, which results in a much smaller price increase.

Utah Full Coverage Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Female (Age 16) | Male (Age 16) | Female (Age 25) | Male (Age 25) | Female (Age 30) | Male (Age 30) | Female (Age 60) | Male (Age 60) |

|---|---|---|---|---|---|---|---|---|

| American Family | $527 | $605 | $172 | $195 | $150 | $175 | $120 | $125 |

| Auto-Owners | $525 | $580 | $160 | $185 | $145 | $165 | $115 | $120 |

| Farmers | $572 | $654 | $189 | $215 | $160 | $185 | $125 | $130 |

| Geico | $445 | $490 | $140 | $160 | $125 | $140 | $95 | $100 |

| Liberty Mutual | $580 | $660 | $180 | $210 | $155 | $180 | $130 | $135 |

| Nationwide | $508 | $595 | $170 | $190 | $150 | $170 | $120 | $125 |

| Progressive | $505 | $590 | $160 | $185 | $140 | $160 | $110 | $115 |

| State Farm | $530 | $615 | $175 | $200 | $150 | $170 | $120 | $125 |

| The Hartford | $545 | $620 | $185 | $210 | $160 | $180 | $125 | $130 |

| Travelers | $515 | $590 | $165 | $190 | $145 | $165 | $115 | $120 |

Let’s take a closer look at the ranking of demographic rates. The below table will give you an idea of how much different demographics are paying, and what the worst demographic to be is. Statistically, 60 and 35-year-olds enjoy the most favorable rates due to their experience and lower risk profiles.

These age groups are seen as more responsible and less likely to engage in risky driving behaviors, leading to fewer claims and lower costs for insurers. On the other hand, 17-year-olds face much higher premiums, often charged thousands more than their older counterparts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

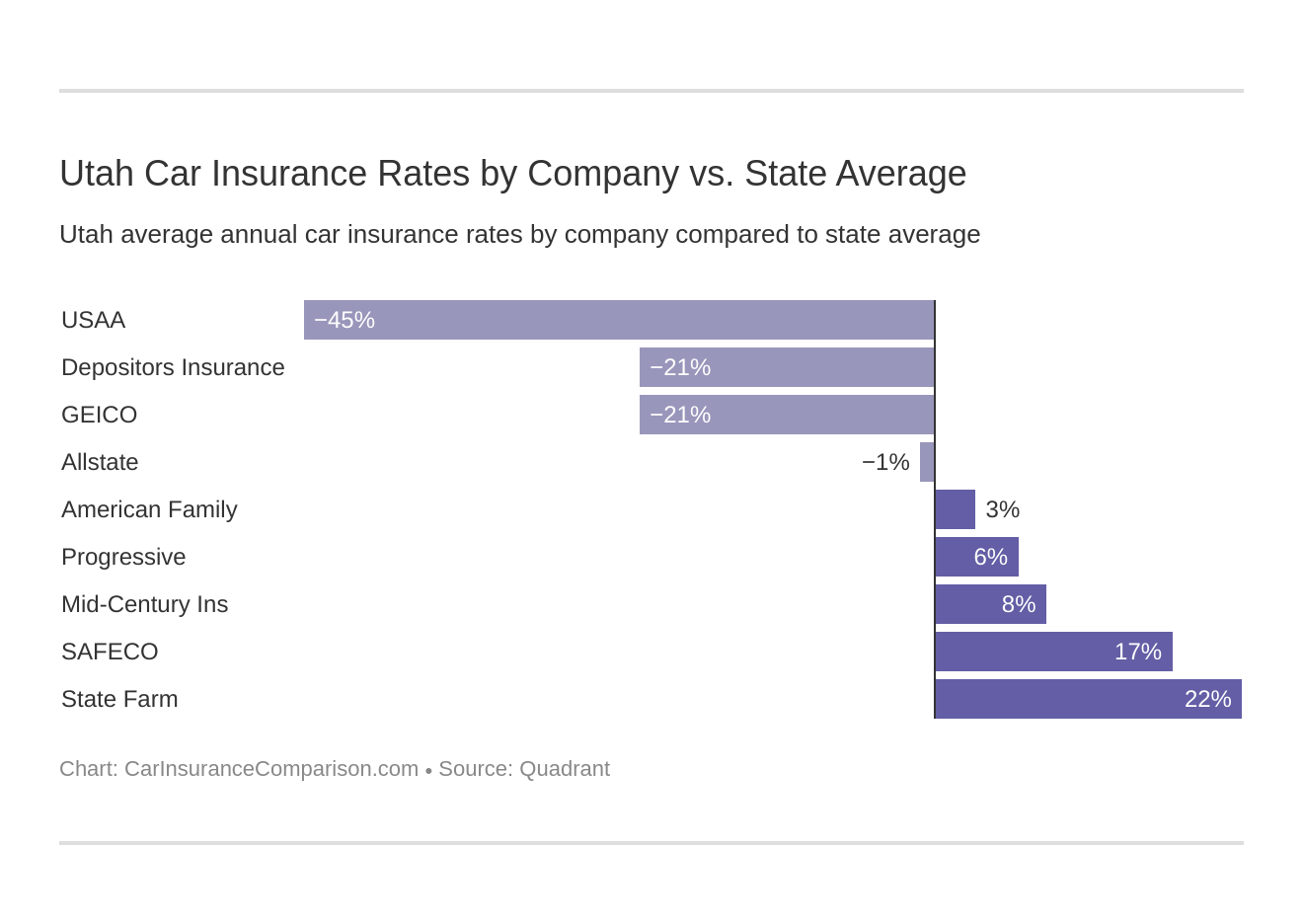

Cheapest Companies in Utah

Price is usually forefront of our minds when shopping, and nothing is more exciting than getting a great deal. This attitude also applies to car insurance companies, as we want to pay the least possible for great protection. So if you want to know the cheapest providers in Utah, check out the table and chart below.

Clearly, shopping around for car insurance pays off. Our Geico car insurance review and USAA car insurance review show that Utah auto insurance rates are significantly below the state average, meaning you will save a few hundred or even a few thousand by picking a cheaper company. To learn more, explore our comprehensive resource on insurance titled “Compare the Cheapest Car Insurance Companies.”

Navigating Utah’s Car Insurance Laws and Driving Regulations

Understanding Utah’s driving and insurance laws is crucial for avoiding tickets and penalties, helping you keep your savings intact. From mandatory insurance requirements to specific rules on windshield repairs and high-risk driver protocols, Utah’s regulations can be complex. Check out our ranking of the top providers: Best Car Insurance for High-Risk Drivers

Insurance rates must be filed with the Utah Insurance Department, and while windshield coverage isn’t mandated, comprehensive plans usually include it. High-risk drivers, such as those with DUIs or poor records, might need SR-22 insurance, but finding coverage can be challenging. Utah offers various insurance discounts but no low-income assistance programs.

Automobile insurance fraud is strictly prohibited, with severe penalties for violations. Additionally, Utah’s statute of limitations for filing claims is four years for personal injury and three for property damage. The state also enforces an unfair claim settlement law to protect consumers. Knowing these laws helps ensure compliance and optimal insurance benefits.

Understanding Utah’s Vehicle Licensing and Insurance Laws

In Utah, it’s mandatory for all drivers to have insurance, and driving without it leads to significant penalties. For a first offense, there’s a $400 fine and a license suspension until proof of insurance is provided for three years, plus a $100 reinstatement fee. A second offense incurs a $1000 fine, the same license suspension requirements, and another $100 reinstatement fee.

Acceptable proof of insurance includes an insurance ID card, binder, or declaration. Proof of insurance is required during traffic stops, car registration, or accidents, and law enforcement can verify insurance electronically. To delve deeper, refer to our in-depth report titled “How Traffic Infractions Affect Car Insurance.”

Utah Teen Driving Restrictions

| Summary | Details |

|---|---|

| Mandatory Holding Period of Learner's License | 6 months |

| Minimum Supervised Driving Time | 40 hours (10 of which must be at night) |

| Minimum Age | 16 |

Violating insurance laws may result in car registration suspension, necessitating the surrender of the license plate and registration until reinstated. Additionally, teens can obtain a learner’s permit at 15, but must meet specific requirements to advance to a full or restricted license.

If a teen has a restricted license, they must follow the rules below. These rules help keep teens distraction-free in the car, which is necessary for preventing accidents. Up next, we will cover another age group with special requirements — older drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding Utah’s Road Rules and Safety Laws

Navigating Utah’s roads requires a solid understanding of the state’s unique traffic and safety laws. As a no-fault state, Utah mandates that your own car insurance provider covers accident costs, necessitating personal injury protection coverage. For a thorough understanding, refer to our detailed analysis titled “Understanding Car Accidents.”

Critical regulations include seat belt and car seat laws, prohibiting riding in cargo areas except for specific exemptions, and strict DUI penalties with a lower BAC limit of 0.05. The “keep right” and “move over” laws are designed to enhance safety by minimizing lane obstructions and protecting roadside workers.

Speed limits are enforced to maintain safe travel speeds, while ridesharing regulations ensure drivers meet safety and vehicle standards. Automation on the road is currently under testing with no restrictions, reflecting the state’s evolving transportation landscape.

Distracted driving laws, particularly against texting, aim to reduce accidents caused by inattention. Lastly, understanding vehicle theft trends and the primary causes of traffic fatalities, such as speeding and impaired driving, can help Utah drivers remain vigilant and safe.

Case Studies: Innovative Strategies for Affordable Car Insurance in Utah

From families with new teen drivers to seniors adjusting their policies post-retirement, these stories offer practical insights and strategies that can help you drive towards better savings. To expand your knowledge, refer to our comprehensive handbook titled “Compare Teen Driver Car Insurance Rates.”

- Case Study #1 – Driving Down Costs: The Jensen family in Salt Lake City sought to lower car insurance premiums after their teenage son got his license. They used good student and multi-policy discounts, opted for usage-based insurance, and added defensive driving courses, reducing premiums by 30%.

- Case Study #2 – Navigating Insurance for High-Risk Drivers: John, a 45-year-old driver from Provo, faced increased premiums after multiple speeding tickets and a DUI conviction. Enrolled in a DUI education program, installed an ignition interlock device, shopped for SR-22 insurance, and secured coverage at a 20% lower rate.

- Case Study #3 – Maximizing Coverage: An Ogden delivery service with ten vehicles aimed to balance comprehensive coverage and cost efficiency. Negotiated bulk discounts, installed telematics for safer driving incentives, and utilized multi-vehicle discounts, saving 25% on premiums.

- Case Study #4 – The Road to Savings: Mary, a 70-year-old driver from St. George, sought to reduce her car insurance costs after retirement. Premiums remained high despite reduced annual mileage. Switched to a low-mileage discount plan, reviewed and adjusted coverage limits, and added a senior defensive driving course discount.

- Case Study #5 – Eco-Friendly Savings: The Smiths in Park City bought an electric vehicle and sought insurance savings. They found a provider with green vehicle discounts, applied for low mileage, and bundled home and auto policies. They saved 40% on their premiums while supporting their eco-friendly lifestyle.

These case studies demonstrate that significant savings on car insurance are achievable through informed choices and proactive measures.

Geico is the leading choice for car insurance in Utah, combining cost-effectiveness with exceptional customer service.

Daniel Walker Licensed Insurance Agent

Whether you are adding a teenage driver, dealing with a high-risk status, managing a business fleet, adjusting to retirement, or embracing eco-friendly vehicles, there are strategies that can help reduce your premiums.

Summary: Affordable Car Insurance Options and Requirements in Utah

The cheapest car insurance providers in Utah are Geico, Travelers, and Nationwide, with Geico offering the lowest rate at $33 per month for minimum coverage. These companies stand out due to their affordability, reliable customer service, and comprehensive coverage options tailored to Utah drivers.

Understanding Utah’s mandatory insurance requirements and available discounts can help residents save on their premiums. Comparing quotes from multiple providers is essential for finding the best rates and coverage.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

How much is car insurance per month in Utah?

The average car insurance rates in Utah are $539 per year for a minimum coverage policy and $1,510 for a full coverage policy. On a monthly basis, that breaks down to about $45 per month for minimum coverage and $126 per month for full coverage.

What types of auto insurance coverage does Bear River offer in Draper, Utah?

Bear River Auto Insurance in Draper, Utah, offers a range of coverage options including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). They also provide various discounts for safe drivers, multiple policies, and more.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Why is car insurance so expensive in Utah?

For full coverage that adds up to hundreds of extra dollars from Utah families per year. Experts say car repairs are getting more expensive, and the number of deadly and severe traffic accidents is also rising. The CPI puts the current U.S. inflation rate at 3.2%.

To gain profound insights, consult our extensive guide titled “Traffic Tickets that Raise Car Insurance Rates.”

How can I get a quote for auto insurance from Bear River in Herriman, UT?

You can get a quote for Bear River Auto Insurance in Herriman, UT, by visiting their website, calling their local office, or contacting a Bear River insurance agent. They will need details about your vehicle, driving history, and coverage needs to provide an accurate quote.

Are there any specific discounts available for Bear River car insurance in Herriman, UT?

Yes, Bear River offers several discounts for car insurance in Herriman, UT. These may include discounts for good drivers, multi-car policies, bundling with home insurance, and safe driving courses. Contact a local Bear River agent to learn more about available discounts.

What other types of insurance does Bear River offer in American Fork, apart from auto insurance?

In American Fork, Bear River Insurance provides a variety of insurance products including homeowners, renters, umbrella, and commercial insurance. They are known for their competitive rates and comprehensive coverage options.

For a comprehensive overview, explore our detailed resource titled “The Best Car Insurance Commercials.”

What is the minimum car insurance in Utah?

Utah law mandates that auto insurance policies provide the following: Liability – Minimum Required: $25,000 per person for bodily injury. $65,000 per accident for bodily injury.

How does Bear River Insurance in West Jordan, Utah, handle claims?

Bear River Insurance in West Jordan, Utah, offers a straightforward claims process. You can file a claim online, over the phone, or through your insurance agent. They are committed to providing prompt and efficient claims service to help you get back on the road quickly.

Is Bear River Mutual a good choice for car insurance in Saratoga Springs, UT?

Bear River Mutual is a popular choice for car insurance in Saratoga Springs, UT, due to its local expertise, personalized customer service, and competitive rates. They have a strong reputation for handling claims efficiently and offering various discounts to meet the needs of their clients.

To enhance your understanding, explore our comprehensive resource on insurance titled “Car Insurance Discounts: Compare the Best Discounts.”

Who typically has the cheapest insurance?

USAA, Nationwide, Travelers, Erie, Geico and Progressive are the cheapest car insurance companies nationwide, according to our analysis. Car insurance costs are continuing to climb this year. To help you find the lowest rates for your needs, we assessed rates for various ages and driver profiles.

Is it illegal to not have car insurance in Utah?

Failure to provide insurance or operator’s security is a Class B misdemeanor, for which the fine may not be less than $400 for a first offense; and $1,000 for a second and subsequent offense within three years of a previous conviction or bail forfeiture.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What is full coverage insurance in Utah?

Full coverage insurance in Utah is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $65,000 per accident, and $15,000 in property damage coverage.

For detailed information, refer to our comprehensive report titled “What is considered good car insurance coverage?“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.