Cheap Car Insurance for Pickup Trucks in 2025

The top picks for cheap car insurance for pickup trucks are Geico, Dairyland, and Mercury. At Geico, the average pickup truck rate is $50/mo for minimum coverage. The average insurance cost for pickup trucks is higher than for cars, as pickup trucks are more prone to rolling over and theft.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Pickup Truck

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 175 reviews

175 reviewsCompany Facts

Min. Coverage for Pickup Truck

A.M. Best Rating

Complaint Level

Pros & Cons

175 reviews

175 reviews 675 reviews

675 reviewsCompany Facts

Min. Coverage for Pickup Truck

A.M. Best Rating

Complaint Level

Pros & Cons

675 reviews

675 reviewsThe top companies with cheap car insurance for pickup trucks are Gecio, Dairyland, and Mercury.

Do you have a pickup truck and need car insurance rates? Because pickup trucks cost more to insure, it is important to compare pickup truck insurance rates with a car insurance calculator to find the best rates.

Our Top 8 Company Picks: Cheap Car Insurance for Pickup Trucks

| Company | Rank | Monthly Rates | Good Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $50 | 26% | Online Convenience | Geico | |

| #2 | $52 | 10-15% | High-Risk Drivers | Dairyland | |

| #3 | $55 | 20% | Multiple Discounts | Mercury | |

| #4 | $60 | 15-20% | Low Mileage | Mile Auto | |

| #5 | $65 | 5-10% | Farm Trucks | Farm Bureau | |

| #8 | $89 | 40% | Safe Drivers | Nationwide | |

| #6 | $90 | 23% | Technology Users | Travelers | |

| #7 | $98 | 25% | Local Agents | State Farm |

Read on to learn about pickup truck car insurance. Use our simple tool above and enter your ZIP code to get car insurance quotes in your area today.

- Geico has the cheapest auto insurance for pickup trucks

- Pickup truck insurance rates are higher than insurance rates on standard cars

- Insurance rates depend on factors like the pickup model and safety features

#1 – Geico: Top Pick Overall

Pros

- Online Convenience: Manage your pickup truck insurance from your phone or laptop.

- Coverage Options: You can choose extras like rental reimbursement for your pickup.

- Military Discount: Geico offers a discount to service members. Learn about more ways to save in our Geico review.

Cons

- In-Person Assistance Limited: Most areas won’t have a local Geico agent.

- Discount Availability: Some of Geico’s discounts will be limited to certain states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Dairyland: Best for High-Risk Drivers

Pros

- High-Risk Drivers: Dairyland offers SR-22 insurance filings and accepts drivers with poor driving records. Learn more in our Dairyland review.

- Online Quotes: Quickly get a pickup truck insurance online quote to see how much it will cost to insure your pickup.

- Anti-Theft Discount: Installing an anti-theft device in your pickup will result in lower rates.

Cons

- Availability: You won’t be able to buy Dairyland insurance in some states.

- Poor Credit Rates: Dairyland insurance may cost more for drivers without good credit scores.

#3 – Mercury: Best for Multiple Discounts

Pros

- Multiple Discounts: Save with car insurance discounts like good student discounts, anti-theft discounts, and more.

- Roadside Assistance: Add 24/7 roadside assistance to your pickup insurance.

- Mobile App: Easily make changes to your pickup policy from your phone.

Cons

- Availability: You may not have Mercury auto insurance available in your state.

- Customer Reviews: A few reviews state issues reaching a representative.

#4 – Mile Auto: Best for Low Mileage

Pros

- Low Mileage: Mile Auto is pay-per-mile insurance, so it is best for truck drivers who drive less than the average driver (learn more: Best Low-Mileage Car Insurance).

- Mobile App: The app makes it easy to submit mileage and check your rates.

- No Telematics Tracking: Mile Auto doesn’t track driving data like some pay-per-mile companies.

Cons

- Not for High-Mileage: Truck drivers with high mileage won’t save on their pickup truck insurance rates.

- Availability: Mile Auto isn’t available in many states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Farm Bureau: Best for Farm Trucks

Pros

- Farm Trucks: Farm Bureau specializes in coverage for farm vehicles.

- Local Agents: Agents can provide personalized assistance when you compare truck insurance rates and coverages at the company.

- Discount Variety: Most Farm Bureau states offer plenty of discounts. Learn more in our article on Farm Bureau car insurance discounts.

Cons

- Availability: A few states don’t carry insurance from Farm Bureau.

- Location Changes: Some states may not have as many coverages or discounts as others.

#6 – Nationwide: Best for Safe Drivers

Pros

- Safe Drivers: Nationwide offers affordable rates for safe drivers and discount opportunities. Learn more in our article on Nationwide discounts.

- Multi-Policy Discount: You can insure your truck and your home at Nationwide for a discount.

- Vanishing Deductible: Stay claims-free to see a drop in your deductible.

Cons

- Availability: Some truck owners may not have Nationwide in their state.

- High-Risk Rates: It may be harder to get cheap truck insurance if you’re a high-risk driver.

#7 – Travelers: Best for Technology Users

Pros

- Technology Users: Travelers is great for truck drivers who want to manage their policies online.

- Roadside Assistance: If your truck has broken down before, adding roadside assistance may be beneficial.

- Gap Coverage: If you have a brand new truck, consider this coverage from Travelers. Learn about Travelers’ other coverages in our Travelers review.

Cons

- High-Risk Rates: Your pickup truck insurance rates will be higher if you’re a high-risk driver.

- IntelliDrive Program: You may have a rate increase if you perform poorly in the program.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – State Farm: Best for Local Agents

Pros

- Local Agents: Find a local agent for help picking the best insurance for pickup trucks.

- Multi-Policy Discount: Purchase truck insurance and another insurance type for a discount.

- Student Discount: Good students can save on their truck insurance.

Cons

- High-Risk Rates: State Farm is the most affordable for safe drivers. Learn more in our State Farm car insurance review.

- Coverage Availability: Some states may offer fewer add-on coverages.

Average Car Insurance Rates for Trucks

How much is insurance for a truck? At the companies with the cheapest pickup truck insurance, you can expect your average pickup truck insurance cost per month to be similar to the rates displayed below.

Pickup Truck Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Dairyland | $52 | $120 |

| Farm Bureau | $65 | $190 |

| Geico | $50 | $115 |

| Mercury | $55 | $155 |

| Mile Auto | $60 | $180 |

| Nationwide | $89 | $150 |

| State Farm | $98 | $124 |

| Travelers | $90 | $215 |

Shopping at the cheapest companies and comparing quotes should help most drivers reduce their average pickup truck insurance cost.

Read More: How do you compare multiple car insurance quotes online?

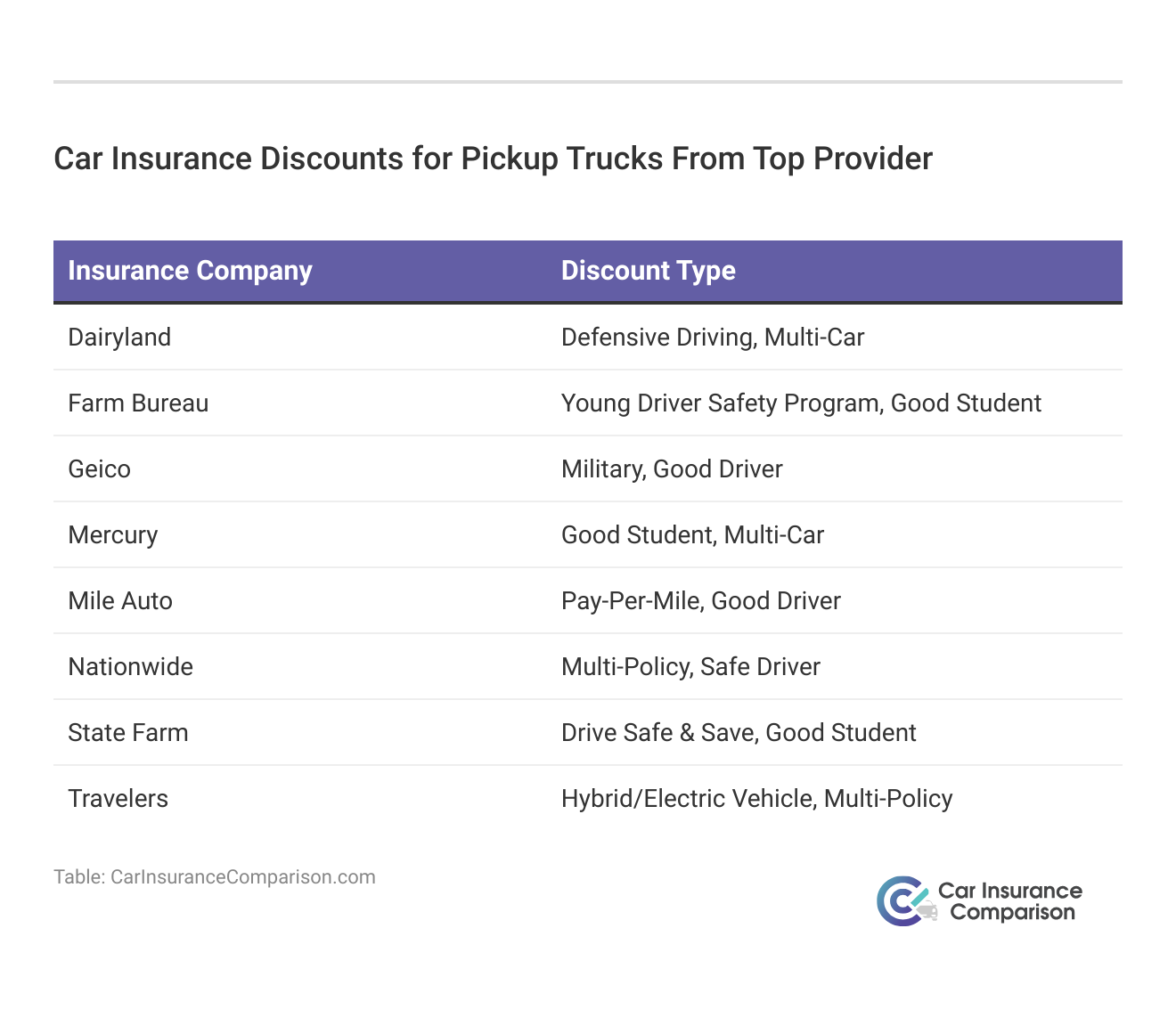

How to Save on Pickup Truck Car Insurance

If you’ve already shopped at the cheapest companies and still need to reduce your pickup truck insurance cost, make sure you apply for discounts at your company. Some discounts, such as a good student discount, aren’t applied until you provide proof of good grades.

Some other ways you can try to reduce your truck insurance rates include:

- Raise your insurance deductible. Raising your deductible will reduce your monthly rates. Just make sure that you can afford your deductible still, as it is the portion you have to pay when there is a claim.

- Carry only minimum insurance on old trucks. If the cost of full coverage every month would soon equal the value of your truck in a year, it may be worth it to carry just minimum coverage.

Buying a well-rated, affordable truck will also go a long way to keeping rates low, as an expensive truck will cost more to insure.

Pickup Truck Car Insurance Coverages

Are there specific types of coverage for my pickup truck? Having comprehensive and collision insurance coverage will protect you against any type of physical damage to your pickup truck, including damage from another car, damage from an animal, fire, theft, and vandalism.

Another type of insurance that is important to carry is underinsured/uninsured motorist coverage. This type of insurance covers you if you get into an accident with someone who does not carry car insurance.

Learn more: Compare Uninsured/Underinsured Motorist (UM/UIM) Coverage: Rates, Discounts, & Requirements

Although it is state law to carry car insurance, many people do not. If you get into an accident with an underinsured or uninsured person, he might not have the financial resources to pay the damages. In this case, uninsured motorist insurance can cover any damages, medical bills, and more.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Commercial and Personal Truck Insurance

Do I need pickup truck insurance for my small business? If you rely on your truck for business purposes, it is vital to have the proper amount of insurance coverage. If you do not have the proper amount of insurance, your entire business could be at risk.

View this post on Instagram

At the very least, you should purchase liability insurance if you’re using your truck for business. Having liability insurance allows you and your employees to be covered in the case of an accident.

If you own a business that depends on pick-up trucks as the primary source of transportation for both individuals and equipment, it is vital to ensure you carry the best commercial auto insurance policy.

Daniel Walker Licensed Insurance Producer

Small businesses may rely exclusively on pickup trucks, so being able to afford commercial insurance is a very important part of the businesses functioning properly and efficiently.

Read more: Compare Commercial Car Insurance: Rates, Discounts, & Requirements

If you don’t use your pickup truck for your business, then you will need to purchase a personal auto insurance policy. You can quickly get quotes from companies like Geico online or use a comprehensive truck insurance comparison tool to compare rates.

The Final Word on Cheap Pickup Insurance

Even though it can be more expensive to carry insurance for your pickup truck, it is cheaper than having to pay for damages and medical bills out of your own pocket because you aren’t covered by insurance. Luckily, shopping at the cheapest truck insurance companies and taking the time to compare monthly car insurance rates at these companies can help make truck insurance affordable.

Looking for the best pickup insurance at an affordable rate? Enter your ZIP code to find free car insurance quotes for pickup truck coverage near you.

Frequently Asked Questions

Why does pickup truck insurance cost more than standard car insurance?

Wondering why is truck insurance more than a car? Pickup truck insurance costs more than standard car insurance due to the following reasons:

- Accidents involving pickup trucks potentially cause a lot more damage than accidents with a small car, due to the size of pickups.

- Trucks are often targeted by auto thieves. Researchers have found that a pickup truck is three times more likely to get stolen than any other type of vehicle.

- Pickup and full-size trucks with large frames and tires are more susceptible to rolling over which makes them a bigger accident risk.

Do I need pickup truck insurance for my small business?

If you rely on your pickup truck for business purposes, it is vital to have the proper amount of insurance coverage to protect your business.

What types of coverage are available for my pickup truck?

Comprehensive car insurance and collision car insurance coverage protect against physical damage to your pickup truck, while underinsured/uninsured motorist coverage covers accidents with individuals who lack car insurance.

If I can’t afford insurance for my truck, should I carry basic coverage?

It’s important not to risk losing your livelihood by not having the proper amount of insurance. Without your truck, you may not be able to do your job effectively and efficiently. While it may be more expensive, carrying insurance is cheaper than paying for damages out of pocket.

Do not risk losing your entire livelihood to save a couple of hundreds of dollars a year by not having the proper amount of insurance. Remember to enter your ZIP code above to get car insurance quotes for your pickup truck.

Are trucks cheaper to insure than cars?

No, when it comes to the cost of truck vs. car insurance, trucks typically cost more than cars to insure.

What are the cheapest trucks to insure?

Affordable trucks that have good safety ratings will be cheaper to insure than expensive trucks with poor safety ratings, as cars with great safety features and ratings may qualify for a discount (learn more: Safety Features Car Insurance Discounts).

How much is insurance on a truck?

Rates will vary by truck model, driver, and company, but the average pickup truck insurance cost at Geico is $50/mo for minimum coverage.

How can I save on pickup truck insurance?

Take the time to do a truck insurance comparison by getting quotes from the cheapest companies. You can compare rates now by entering your ZIP into our free tool.

Who typically has the cheapest insurance?

Geico, Dairyland, and Mercury have the cheapest rates on average for pickup trucks.

Who is cheaper, Geico or Progressive?

Geico is cheaper on average for pickup truck insurance than Progressive (read more: Progressive Car Insurance Review).

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.