Best Farm Bureau Car Insurance Discounts in 2025 (Save 25% With These Offers)

The best Farm Bureau car insurance discounts feature offers like the multi-policy discount, allowing drivers to save up to 25% by bundling auto with other policies. Additional savings are available for safe driving and good students. These Farm Bureau car insurance discounts reduce premiums for eligible drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Discover the best Farm Bureau car insurance discounts to maximize your savings. Farm Bureau offers a variety of discounts, including up to 25% off with the multi-policy discount.

These discounts significantly help drivers reduce their monthly premiums, with competitive rates tailored to different age groups and locations. Explore further with our article entitled “Multiple Policy Car Insurance Discounts.”

Our Top 10 Picks: Best Farm Bureau Car Insurance Discounts

Discount Rank Savings Potential Description

Multi-Policy #1 25% Bundle auto with another policy for savings.

Safe Driver #2 20% Maintain a clean driving record.

Good Student #3 15% Students with good grades qualify.

Multi-Vehicle #4 15% Insure more than one vehicle.

Anti-Theft #5 10% Equip your vehicle with anti-theft devices.

Driver Training #6 10% Complete a safety course for savings.

New Vehicle #7 10% Insure a new or recent vehicle.

Low Mileage #8 10% Drive fewer miles per year.

Paid-in-Full #9 5% Pay your policy in full upfront.

Paperless Billing #10 5% Switch to paperless billing for savings.

Whether you’re bundling policies or maintaining a clean driving record, Farm Bureau’s diverse range of discounts makes it a top choice for affordable car insurance options. See if you’re getting the best deal on car insurance by entering your ZIP code.

- The best Farm Bureau car insurance discounts offer savings for safe drivers

- The multi-policy discount provides up to 25% savings when bundling insurance

- Drivers can lower their monthly premiums by taking advantage of multiple discounts

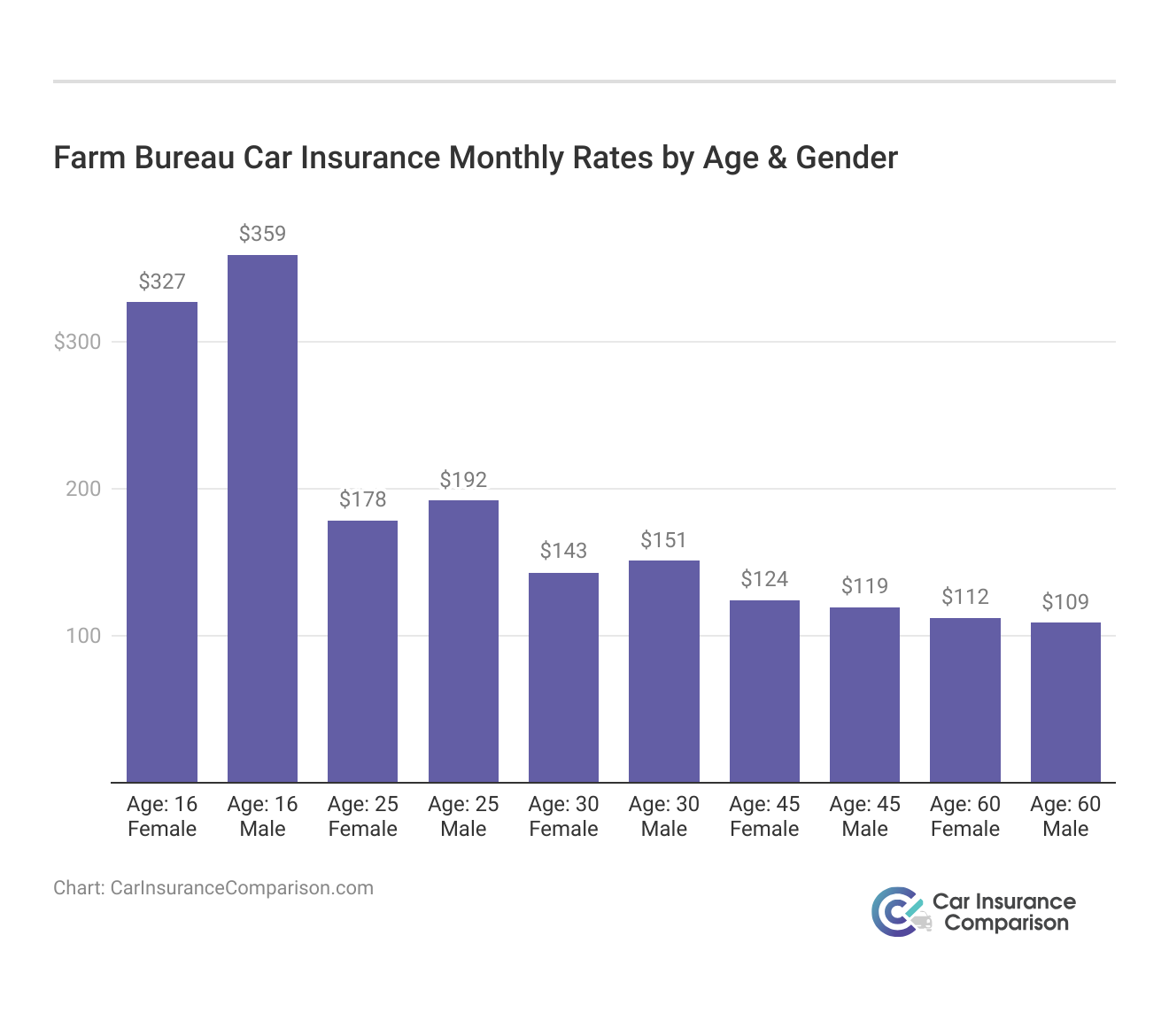

Farm Bureau Car Insurance Monthly Rates by Age & Gender

When evaluating car insurance options, understanding how age and gender influence monthly rates is essential. Farm Bureau Car Insurance provides competitive rates that vary based on these factors. This analysis highlights the monthly premium differences for various age groups and genders, helping you make informed decisions for your coverage needs.

In conclusion, Farm Bureau Car Insurance offers tailored monthly rates that reflect the influence of age and gender on premium costs. By analyzing these variations, drivers can gain valuable insights into how their unique profiles affect their insurance expenses.

Understanding these factors will empower you to choose the best coverage while optimizing your savings. Dive into the details with our article, “Company Discounts on Car Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding Farm Bureau Car Insurance Discounts

Farm Bureau offers discounts to help customers save on auto insurance premiums. These discounts vary by state and individual circumstances but typically include savings for safe driving, bundling policies, and multi-vehicle coverage.

In addition, the Farm Bureau provides discounts for good students, loyal customers, and members who meet specific criteria. The availability of these discounts ensures that both rural and urban drivers can enjoy affordable rates with tailored coverage options. Explore further in our article titled “Occupation Car Insurance Discounts.”

Farm Bureau Car Insurance Discounts

Farm Bureau offers a variety of car insurance discounts to its members, helping drivers save on premiums. Common Farm Bureau discounts include the good student discount, which rewards students who maintain a high GPA, and the safe driver discount, which benefits drivers with clean driving.

Additionally, members can take advantage of the low mileage discount, reducing rates for those who drive fewer miles annually. These Farm Bureau auto discounts are designed to promote responsible driving and support members in saving money on their insurance. Delve into the specifics in our article “Safety Features Car Insurance Discounts.”

Farm Bureau State-Specific Discounts

Farm Bureau also provides discounts specific to certain states. For example, Illinois Farm Bureau discounts and Missouri Farm Bureau discounts cater to members in those regions, offering exceptional savings based on state guidelines.

Similarly, Texas Farm Bureau membership discounts allow Texas drivers to save on premiums, with additional savings available for Farm Bureau member car rental discounts and accident forgiveness Farm Bureau options.

Becoming a member can unlock various Farm Bureau member discounts that make car insurance more affordable and accessible. For a comprehensive understanding, consult our article “Best Disabled Veterans Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Famous Farm Bureau Car Insurance Discounts

Farm Bureau offers a wide range of auto insurance discounts to eligible policyholders, including:

- Safe Driver Discount: Save money by maintaining a clean driving record with no accidents or traffic violations.

- Multi-Policy Discount: Bundle your auto insurance with other policies like home or renters insurance for additional savings.

- Multi-Vehicle Discount: Insure more than one car under the same policy to receive a lower rate.

- Good Student Discount: Students with a GPA of 3.0 or higher may qualify for a discount on their auto insurance.

- Loyalty Discount: Long-term Farm Bureau members may receive discounts for remaining with the company for a set period.

Each of these discounts can lower your overall insurance premium, helping to make Farm Bureau a competitive option for auto coverage. Enhance your knowledge by reading our “Safe Driver Car Insurance Discounts.”

Monthly Rates with Farm Bureau Car Insurance Discounts

Monthly rates for Farm Bureau auto insurance vary depending on location, driving history, vehicle type, and discount eligibility. These premiums can be significantly reduced by taking advantage of the available discounts.

For instance, policyholders who qualify for multiple discounts, such as the multi-vehicle and safe driver discounts, can substantially lower their monthly payments. Students and long-term members may also benefit from further savings through additional discount opportunities. Uncover more by delving into our article entitled “Good Credit Car Insurance Discounts.”

Best Companies for Farm Bureau Car Insurance Discounts

Farm Bureau offers insurance through various state-based organizations but faces competition from other top companies providing substantial discounts. Some of the best alternatives include:

- State Farm: Known for its safe driver discounts and multi-policy savings, State Farm competes with the Farm Bureau in offering affordable premiums.

- Progressive: Offers a variety of discounts, including multi-policy and safe driver savings, making it an excellent alternative to Farm Bureau for budget-conscious drivers.

- Geico: With discounts for federal employees, military members, and good drivers, Geico often matches Farm Bureau’s discounted rates in several states.

By comparing these companies’ discounts and rates, drivers can determine whether Farm Bureau is the best choice or if switching to another provider might yield more incredible savings. Get a better grasp of this by checking out our article “Student Away at School Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Maximize Farm Bureau Car Insurance Discounts

Maximizing your Farm Bureau car insurance discounts requires a proactive approach. Here are some tips to ensure you’re getting the best possible rate:

- Review All Available Discounts: Make sure you know all the discounts Farm Bureau offers, including those that may apply to your unique situation, such as safe driving or membership loyalty.

- Bundle Policies: Consider bundling your auto insurance with home or renters insurance to qualify for a multi-policy discount.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your eligibility for the safe driver discount.

- Ask About Membership Discounts: Check if your Farm Bureau membership qualifies you for exclusive discounts in your state.

These steps can significantly reduce your auto insurance premium and maximize Farm Bureau’s savings opportunities. Expand your understanding with our article called “Multiple Line Car Insurance Discounts.”

Unlock Savings with Farm Bureau Car Insurance Discounts

Farm Bureau offers a variety of car insurance discounts to help policyholders save significantly on their premiums. Drivers can benefit from discounts like safe driving, bundling policies, multi-vehicle coverage, and good student and loyalty savings.

With the Multi-Policy Discount, customers can save up to 25% by combining their auto insurance with other policies, such as home or renters insurance. Farm Bureau’s discounts are available in various states, allowing drivers to find affordable and customized coverage.

Farm Bureau offers some of the best car insurance discounts available, making it a top choice for budget-conscious drivers.

Michelle Robbins Licensed Insurance Agent

This article explores the top discounts offered, provides insights into monthly rates, and compares Farm Bureau with top competitors such as State Farm, Progressive, and Geico, ensuring you can choose the best option to meet your insurance needs while maximizing savings.

For additional insights, refer to our “Electronic Stability Control Car Insurance Discounts.” Our free online comparison tool allows you to compare cheap car insurance instantly quotes — enter your ZIP code to get started.

Frequently Asked Questions

What are the best Farm Bureau car insurance discounts?

The best discounts include safe driving, good student, and multi-policy discounts. Gain a deeper understanding through our article entitled “Best Senior Citizen Car Insurance Discounts.”

How can I qualify for discounts with Farm Bureau?

Discounts are available based on safe driving records, student grades, and bundled policies.

Is the multi-policy discount worth it?

Yes, it can save you up to 25% when you bundle auto and home insurance.

Do Farm Bureau discounts vary by state?

Yes, available discounts may differ based on state guidelines. Gain insights by reading our article titled “Recent Retirees Car Insurance Discounts.”

What is the safe driver discount?

This discount rewards policyholders with clean driving records. By entering your ZIP code, you can get instant car insurance quotes from top providers.

How much can I save with Farm Bureau car insurance?

Savings can reach up to 25% through various discounts.

Are there discounts for good students?

Yes, students with high GPAs can receive a good student discount. Find out more by reading our article titled “Best Professional Group Car Insurance Discounts.“

Can I combine multiple discounts?

Yes, many discounts can be combined to maximize savings.

How do I apply for Farm Bureau discounts?

You can apply by contacting your local Farm Bureau agent or online. Find cheap car insurance quotes by entering your ZIP code.

Is there a low mileage discount available?

Yes, drivers who log fewer miles annually may qualify for this discount. Broaden your knowledge with our article named “Low-Risk Jobs Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.