Cheap Car Insurance for Minivans in 2025 (Save Money With These 8 Companies)

State Farm, Geico, and Erie are the top choices for cheap car insurance for minivans. At State Farm, minimum minivan auto insurance rates average just $39/mo. Thanks to minivan safety features and driver demographics, car insurance for minivans is some of the least expensive insurance to purchase.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Minivans

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Minivans

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Minivans

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsState Farm, Geico, and Erie are the top providers of cheap car insurance for minivans.

Overall, auto insurance for minivans is cheap compared to other vehicles. However, many variables are involved in determining insurance rates for minivans, including what make and model you drive, where you live, and your unique demographics, so some drivers may have higher rates than others. This makes it important to still compare minivan insurance rates with a car insurance calculator.

Our Top 8 Company Picks: Cheap Car Insurance for Minivans

| Company | Rank | Monthly Rates | Good Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $39 | 25% | Highly Reliable | State Farm | |

| #2 | $41 | 26% | Broad Coverage | Geico | |

| #4 | $46 | 18% | Regional Best | Erie |

| #3 | $55 | 15% | Cost Effective | Farm Bureau | |

| #5 | $65 | 20% | Standard Service | Nationwide |

| #6 | $66 | 31% | Custom Plans | Progressive | |

| #7 | $68 | 22% | User-Friendly | Allstate | |

| #8 | $70 | 23% | Flexible Choices | Travelers |

Read on to learn about car insurance for minivans, and get the best minivan insurance rates by entering your ZIP code into our free quote comparison tool above.

- State Farm has the cheapest minivan insurance

- Minivans are among the cheapest vehicles to insure

- Your driving history will make a big impact on your minivan insurance rates

#1 – State Farm: Top Pick Overall

Pros

- Reliability: State Farm has strong financial ratings, so it is a reliable company. Read our State Farm insurance review to learn more.

- Local Agents: Minivan owners should be able to find a representative to meet in person.

- Multi-Policy Discount: Purchase minivan insurance along with home or renters insurance for a discount.

Cons

- Best for Good Drivers: Rates are best for minivan owners with good driving records, as bad drivers are charged much more.

- Accident Forgiveness: Most minivan owners won’t be able to qualify for accident forgiveness at State Farm.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Broad Coverage

Pros

- Broad Coverage: Purchase a broad full coverage policy for your minivan at Geico. Learn more by reading our Geico review.

- Military Discount: Service members can save on minivan insurance at Geico.

- App Ratings: Geico’s app has great ratings from customers.

Cons

- In-Person Assistance: Assistance for your minivan policy will be mostly virtual, as Geico has few local agents.

- Good Driver Discount Availability: A few states don’t offer Geico’s UBI discount, so you may not be able to get this discount for your minivan.

#3 – Erie: Best for Customer Service

Pros

- Customer Service: Customers are mostly happy with Erie’s customer service and highly rated it. Learn more in our Erie review.

- Full Coverage Perks: A full coverage minivan policy will come with extras like coverage for pet injuries.

- Flexible Deductibles: You can increase or decrease your minivan deductibles.

Cons

- Availability: Erie coverage is not available nationwide, so minivan owners may not have it in their state.

- Claim Filing: You will need to contact an Erie agent for help filing a claim.

#4 – Farm Bureau: Best for Young Drivers

Pros

- Young Drivers: Farm Bureau has a young driver safety program and discount for drivers under 25.

- Local Agents: You can talk about your minivan policy in person.

- Roadside Assistance: Get help from Farm Bureau with simple fixes or a tow if your minivan breaks down.

Cons

- Availability: Minivan owners may not have Farm Bureau coverage in their state.

- Discount Availability: You may not have all discounts offered in your state. Read more in our article on Farm Bureau insurance discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Minivan owners who don’t file claims can qualify for a vanishing deductible. Learn more in our article on Nationwide discounts.

- Pay-Per-Mile Rates: This coverage is great for minivan owners who drive 10,000 miles or less a year.

- Online Convenience: Get quotes online, file a claim, or make policy changes.

Cons

- Rideshare Insurance: Nationwide doesn’t offer rideshare coverage.

- High-Risk: Minivan coverage is not as cheap for drivers deemed high-risk.

#6 – Progressive: Best for Budgeting Tools

Pros

- Budgeting Tools: Progressive’s free tool is great for minivan owners with budget constraints.

- Add-On Coverages: Find less common coverages at Progressive, like rideshare coverage.

- Good Driver Discount: Good drivers will save more at Progressive. Learn more in our Progressive review.

Cons

- Claim Reviews: Progressive has some complaints about its claim service.

- Young Driver Rates: Teen rates are high at Progressive.

#7 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Minivan owners can save with Allstate’s Drivewise program.

- Claim Satisfaction Guarantee: Allstate works with customers to guarantee satisfaction on claims.

- Pay-Per-Mile Rates: Great for minivan drivers who don’t regularly drive.

Cons

- Customer Complaint: Allstate has a slightly high complaint ratio. Learn more in our Allstate insurance review.

- High-Risk Rates: Allstate is pricey for drivers with poor driving records.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Bundling Policies

Pros

- Bundling Policies: Travelers can meet all your insurance needs and offers a bundling discount.

- Gap Coverage: Great for new minivans. Learn what else Travelers has in our review of Travelers.

- Availability: Purchase minivan insurance in any state.

Cons

- Customer Reviews: Not all reviews are positive from customers.

- IntelliDrive Program: Minivan owners who drive poorly may have their rates increased after the program.

Average Minivan Car Insurance Rates

The average cost of minivan insurance changes depending on the make and model you purchase. However, even if you buy the cheapest minivan to insure, other individual factors will still impact your rates.

If you’re looking at your rates and wondering why minivan insurance is expensive, it probably has more to do with your driving record or credit history than the vehicle itself.

Your location, age, driving record, and even credit history also impact your car insurance rates.

To help you estimate how much you might pay for coverage, check out the table below to see how much insurance is for a minivan based on make and model.

Minivan Car Insurance Rates by Make, Model, & Coverage Level

| Make & Model | Monthly Rates |

|---|---|

| Chrysler Pacifica | $111 |

| Dodge Grand Caravan | $97 |

| Honda Odyssey | $112 |

| Kia Sedona | $100 |

| Saturn Relay | $119 |

| Toyota Sienna | $113 |

If you’re wondering what is the cheapest car to insure on the market, minivans like the Kia Sedona are often the answer. The Dodge Grand Caravan, in particular, has the lowest insurance rates of any minivan.

Read more: Compare Kia Car Insurance Rates

The data also shows that brand matters. For example, how much would car insurance costs for a Saturn Relay, a minivan that was discontinued in 2007? As you can see from the above table, it is much higher than models still being manufactured today. Of course, your choice of company and coverage will also impact what you pay.

Minivan Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $68 | $173 |

| Erie | $46 | $161 |

| Farm Bureau | $55 | $140 |

| Geico | $41 | $134 |

| Nationwide | $65 | $148 |

| Progressive | $66 | $169 |

| State Farm | $39 | $125 |

| Travelers | $70 | $172 |

It’s important to do a minivan cost comparison to ensure you’re getting the best rates. If you want the best bang for your buck, invest in a newer, more popular model that has not been discontinued.

Factors That Affect Minivan Insurance Rates

Besides your vehicle’s make and model, a major factor that determines your insurance quote is your driving record. You may drive one of the cheapest cars to insure in 2020, but your rates will still be higher if you have a rocky driving history. Driving experience also comes into play when determining rates. In many states, this is directly related to the age of the driver.

A 16-year-old driver is almost guaranteed to pay more for car insurance than someone who is 26. The best way to get affordable rates for teen drivers is to have them join a parent's policy.

Kristen Gryglik Licensed Insurance Agent

However, because rates change for car insurance by vehicle, teenagers driving the cheapest minivan to insure might save on insurance costs. Your location also impacts coverage rates. States like Maine have lower average car insurance premiums than Florida or Louisiana, where insurance is the highest in the country.

All of these factors make it tricky to generalize car insurance rates. For these reasons, we always recommend comparison shopping at the best minivan insurance companies like State Farm before purchasing coverage.

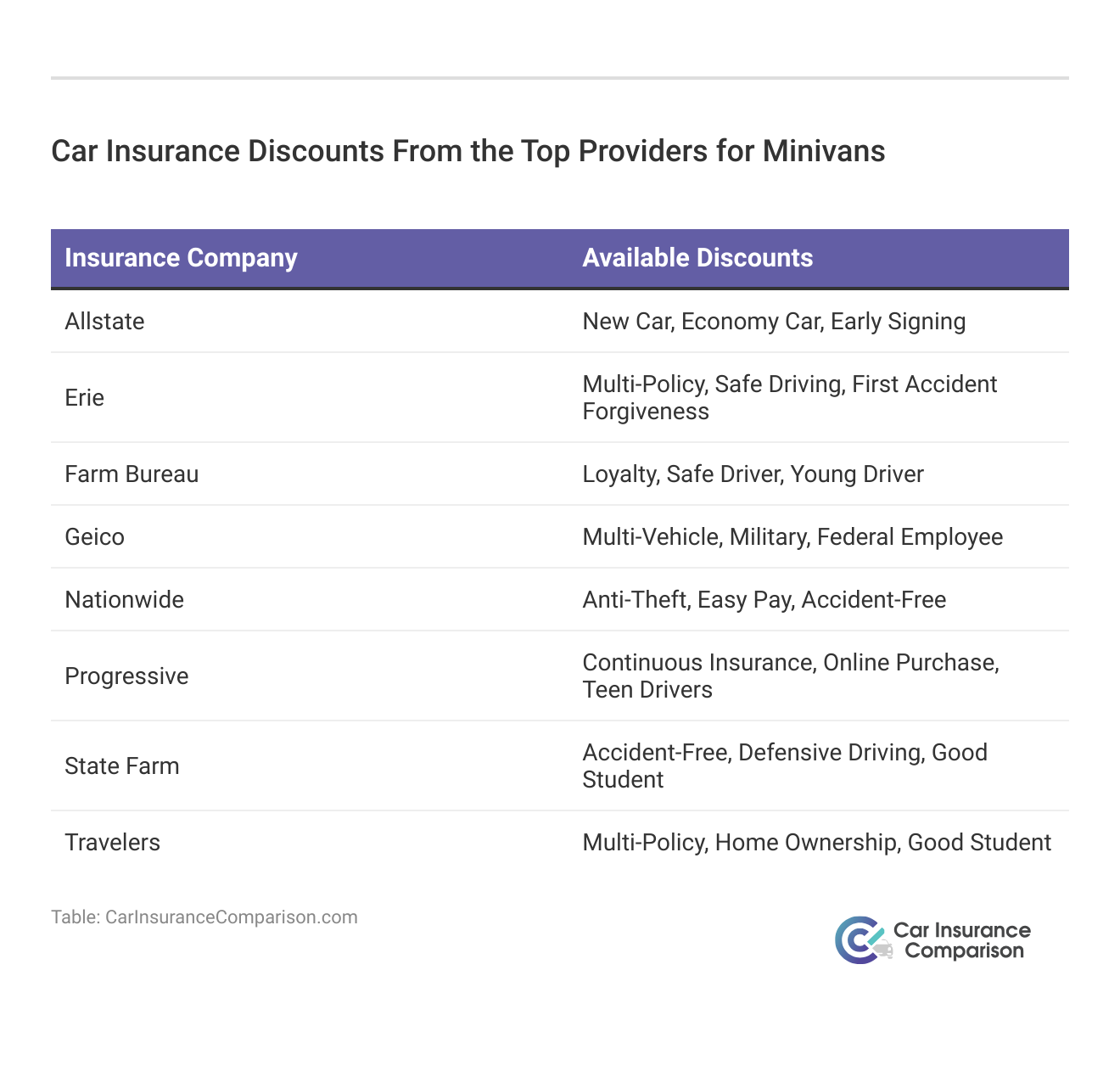

How to Save on Minivan Insurance

If your minivan rates are high, make sure you are shopping for discounts.

You can also save on your minivan auto insurance by shopping for quotes at cheap minivan insurance companies.

Minivan Safety Ratings

As we said before, minivans are often the answer if you’re wondering, “What are the least expensive cars to buy car insurance for?” Now that we’ve looked at the average cost of minivan insurance, let’s discuss why those rates are so low.

Whether you drive a high-end minivan or the cheapest minivan on the market, you’ll likely secure low car insurance quotes. There are two reasons why typical minivan coverage rates are so low.

Firstly, minivans offer reliable protection if you get into a car accident. Bigger vehicles are safer than SUVs, which are more likely to roll over when involved in a collision. Minivans are also more affordable to fix and easy to drive.

Minivans also often receive nearly perfect safety ratings from places like the Insurance Institute for Highway Safety. Check out how the IIHS rated leading minivan models in the following table.

Minivan Safety Ratings by Make and Model

| Minivan Make and Model | Small Overlap Front (Driver-Side) | Small Overlap Front (Passenger-Side) | Moderate Overlap Front | Side | Roof | Head Restraints and Seats |

|---|---|---|---|---|---|---|

| Dodge Grand Caravan | Poor | Not Tested | Good | Good | Good | Good |

| Kia Sedona | Good | Acceptable | Good | Good | Good | Good |

| Chrysler Pacifica | Good | Acceptable | Good | Good | Good | Good |

| Honda Odyssey | Good | Good | Good | Good | Good | Good |

| Toyota Sienna | Acceptable | Marginal | Good | Good | Good | Good |

Surprisingly, the 2019 Dodge Grand Caravan has the worst ratings in the group. The National Highway Traffic Safety Administration also gives the Dodge Grand Caravan a lower safety rating of four stars. Owners of these newer models may see an increase in insurance rates.

Learn more: Compare Dodge Car Insurance Rates

Crash test ratings for older models of minivans have also recently been updated. The risk of serious injury is usually reduced if you drive a minivan, which means less money spent on claims by insurance companies. Choosing a minivan with great ratings, like the Chrysler Pacifica or Honda Odyssey, will usually lead to lower minivan insurance rates.

View this post on Instagram

The second reason minivan insurance costs are lower than other vehicles is because of the main demographic of their drivers. Parents often drive with their children in minivans. To insurance companies, this demonstrates a level of responsibility that makes minivan drivers low-risk. They’re less likely to drive recklessly or get into an accident because they’re focused on keeping their children safe.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Final Word on Cheap Minivan Insurance

You aren’t going to find one particular car insurance company with a better overall rate for minivans than other companies. Specialty car insurance is not available for minivans because they are not specialty vehicles (learn more: Compare Specialty Car Insurance Rates). There are also car insurance companies that only sell car insurance for classic cars and for high-end vehicles, such as Porsches.

If you are wondering about particular car insurance companies and the rates that they charge overall, Weiss Ratings or J.D. Power may be good places for you to find rating information for different insurance companies. Although these ratings are more about the overall performance of a company, they can give you a good idea about what providers are reliable when it comes time to consider your insurance options.

How much is your minivan insurance? Compare cheap quotes online by entering your ZIP code into our free tool below.

Frequently Asked Questions

Why are minivans cheaper to insure than other vehicles?

Minivans are safer, more affordable to fix, and driven by responsible, low-risk demographics.

What factors affect car insurance rates for a minivan?

Factors include driving record, age, location, and credit history. Want to learn more? Read our article to learn about factors that affect car insurance rates.

What is the cheapest minivan to insure?

The Dodge Grand Caravan generally has the lowest insurance rates among minivans.

How much does minivan insurance cost?

Insurance costs vary based on the make, model, and individual factors. A new minivan costs between $25,000 and $45,000.

What is the recommended insurance for a minivan?

It is recommended that you purchase at least your state’s minimum coverage requirements. To find what your state requires, read our article on minimum car insurance requirements by state.

Are minivans cheaper on insurance than SUVs?

Yes, minivans are usually cheaper to insure than SUVs. Use our free comparison tool to find cheap auto insurance for minivans today.

Who typically has the cheapest car insurance?

State Farm typically has the cheapest minivan insurance quotes.

Who is cheaper, Geico or Progressive?

Geico has cheaper minivan insurance policy rates on average.

Is Allstate cheaper than Geico?

No, Geico has cheaper auto insurance for minivans on average (learn more: Geico vs. Allstate Car Insurance Comparison).

What is the cheapest Toyota to insure?

One of the cheapest Toyotas to insure is the Toyota RAV4 (learn more: Compare Toyota Car Insurance Rates).

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.