Compare Washington, D.C. Car Insurance Rates [2025]

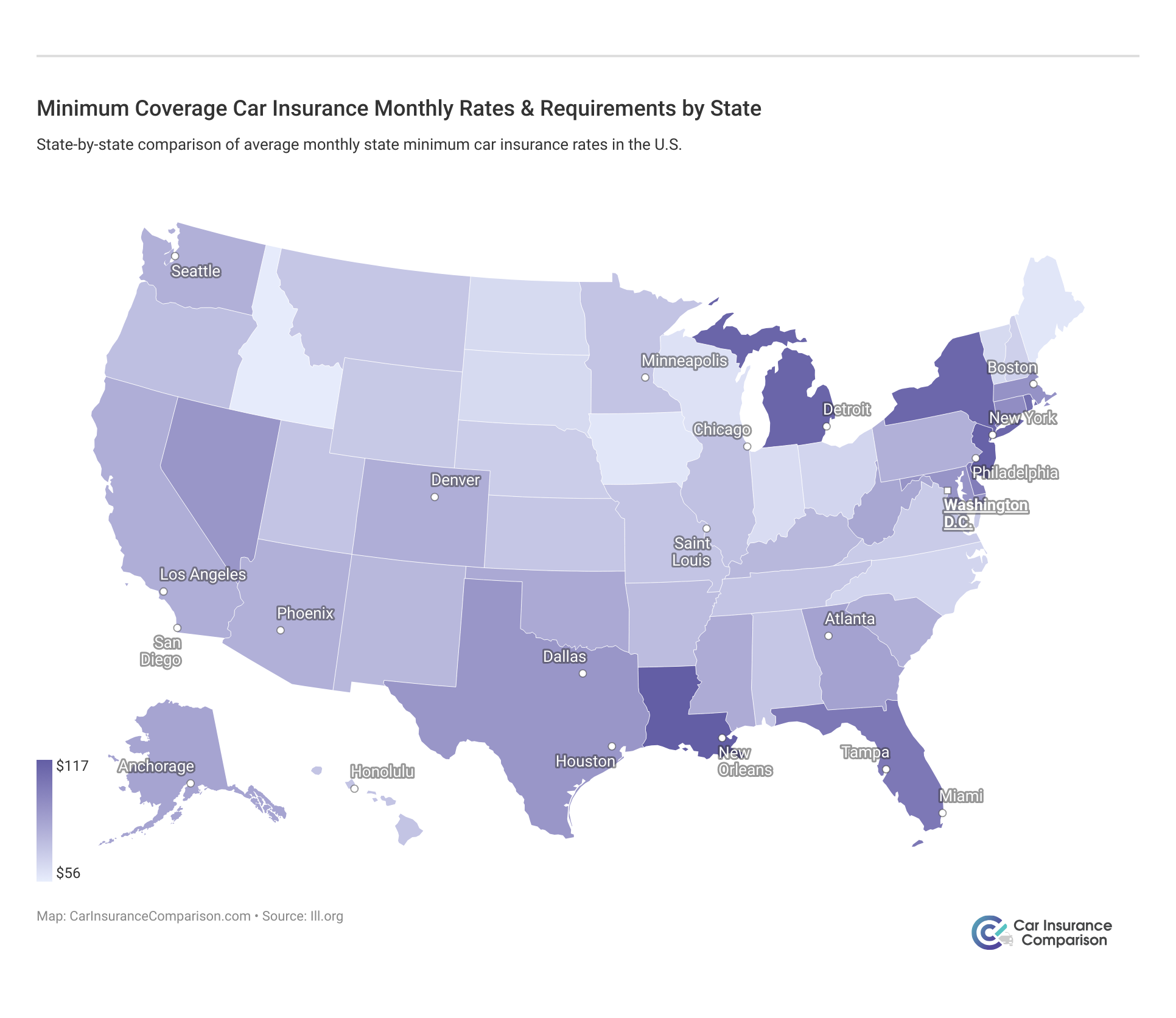

Compare Washington, D.C. car insurance rates to get the lowest price. Monthly rates average $111, but Pharmacists Mutual and Geico offer affordable car insurance rates as low as $25/mo. Washington, D.C. auto laws require a minimum of 25/50/10 for bodily injury, property damage, and uninsured motorist coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

D.C. Summary Stats

| Washington D.C. Summary Statistics | Details |

|---|---|

| Road Miles | Total in the District: 1,503 Vehicle Miles Driven: 3.5 Billion |

| Driving Deaths | Speeding: 17 - 55% Drunk Driving: 16 - 52% |

| Vehicles | Registered: 329,881 Total Stolen: 3,783 - 11% |

| Most Popular Vehicle | Honda Civic |

| Average Premiums (Annual) | Liability: $629 Collision: $469 Comprehensive: $233 Combined Premiums: $1,331 |

| Uninsured Motorists | 15.6% State Rank: 10th |

| Cheapest Provider | Pharmacists Mutual |

- The cost of D.C. car insurance depends on your age, gender, and driving record

- Pharmacists Mutual has the cheapest liability rates at $25 monthly

- Geico is the next-cheapest D.C. car insurance company with monthly liability rates of $35

Pharmacists Mutual and Geico have the cheapest car insurance in Washington, D.C. You can pay less than $40 monthly for liability coverage with either company.

Keep reading to compare Washington, D.C. car insurance rates from the cheapest and most expensive companies in the district. We break down the no-fault car insurance policy options you have, explain why particular types of coverage are essential, and compare rates from the best insurance companies in Washington, D.C.

Average Car Insurance Rates in Washington, D.C.

There are other coverage options you can add to your insurance package at minimal costs that can make a huge difference when it comes to protecting your investments (and saving you money) in the unfortunate event of a crash.

Premiums as Percentage of Income in Washington, D.C.

Annual car insurance in the District of Columbia costs about $1,324, which is over two percent of the average disposable personal income.

D.C. Coverage as % of Income

| Rates vs Income | Cost/Percent |

|---|---|

| Annual Full Coverage Average Premiums | $1,324 |

| Monthly Full Coverage Average Premiums | $110 |

| Annual Per Capita Disposable Personal Income | $59,936 |

| Monthly Per Capita Disposable Personal Income | $4,995 |

| Percent of Income | 2.21% |

The above data was collected from the NAIC (National Association for Insurance Commissioners) December 2017 auto insurance report. Disposable Personal Income (DPI) is the total amount of money you have left to spend (or save) after you pay your taxes.

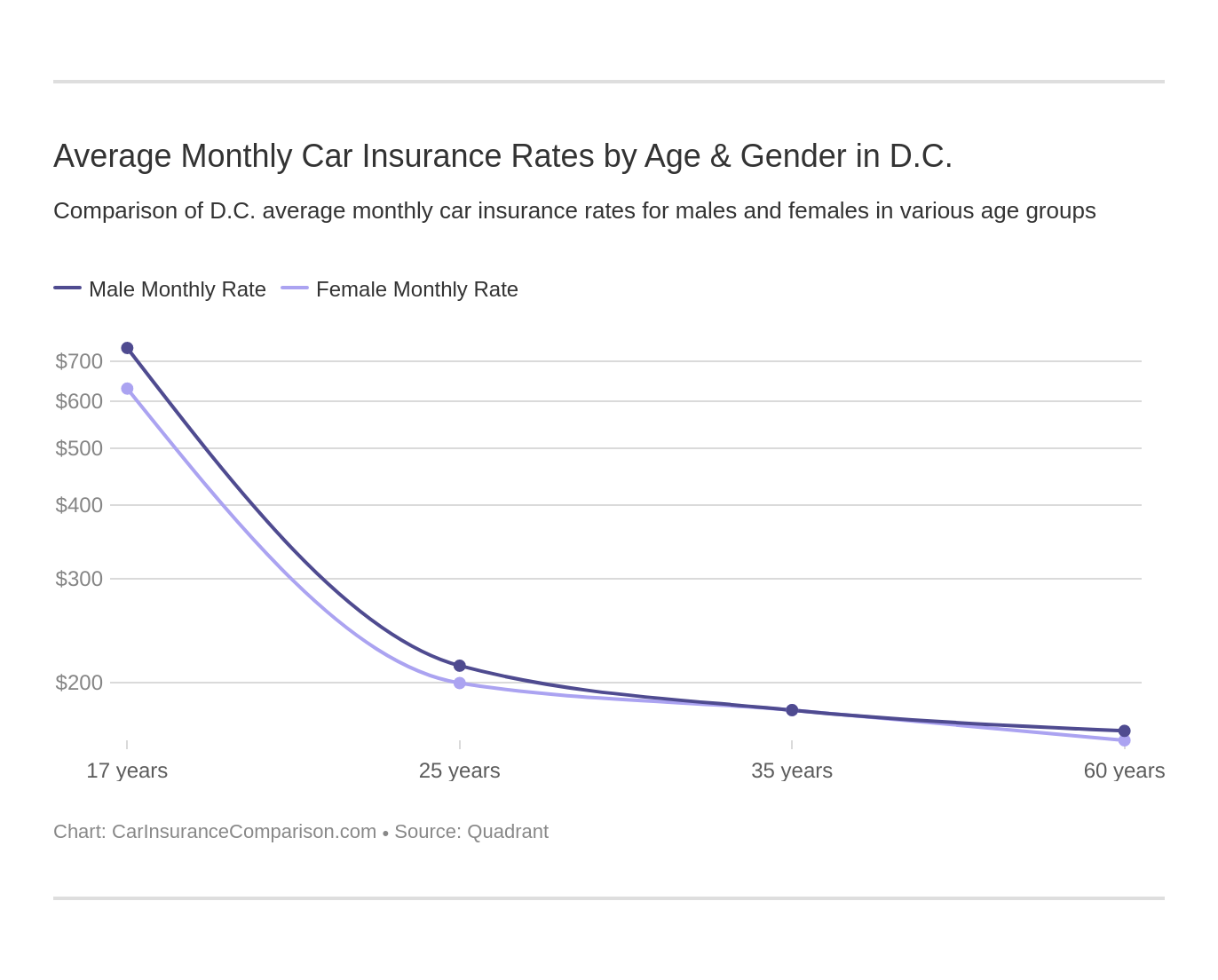

Compare Washington, D.C. Car Insurance Rates by Age And Gender

Click here for the driving record and personal profile used to obtain the above quotes. A handful of states have taken measures to legally prevent males and females from paying different rates for their car insurance, however, this is not the case in Washington, D.C.

Males pay more than females, especially in the younger demographic. Check out this chart showing D.C. auto insurance rates by age and gender:

How much more? Our researchers retrieved specific rate quotes for female drivers in D.C. that were $240 a year more than those given for males who were the same age and had identical profiles and driving records.

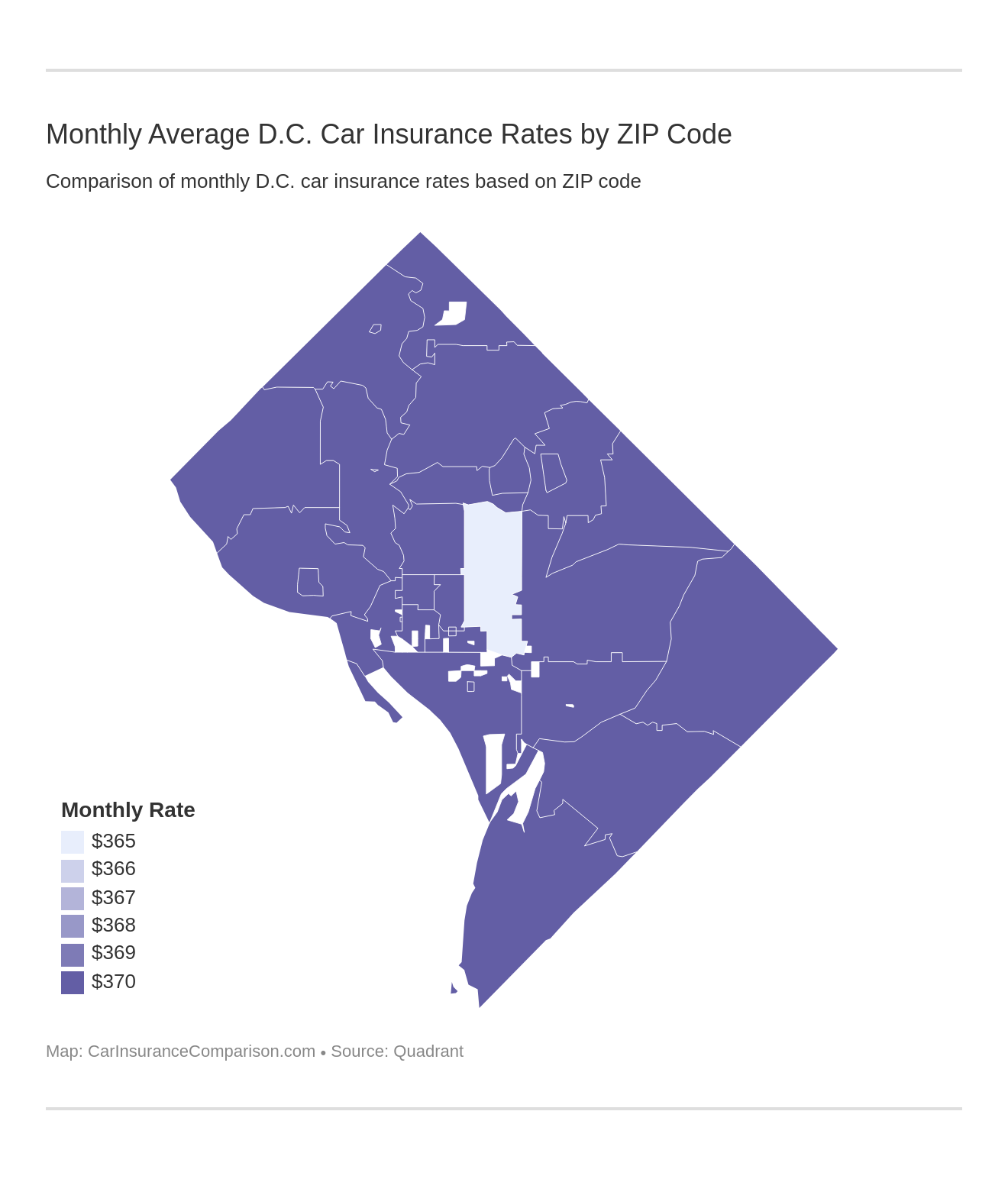

Compare Washington, D.C. Car Insurance Rates by City

In most states proper, your ZIP code has a tremendous impact on your rates, simply due to different driving conditions and risk factors. In the District, this is not the case, and most ZIP codes pay a very similar rate on average.

Compare Washington, D.C. Car Insurance Rates by Provider

DC's 20 Cheapest & Most Expensive Car Insurance Companies

| 10 Cheapest Providers | Annual Rates | 10 Most Expensive Providers | Annual Rates |

|---|---|---|---|

| Pharmacists Mutual | $280 | State Farm | $1,200 |

| Geico Advantage | $422 | Geico Choice | 1,264 |

| Horace Mann | $448 | LM General | $1,340 |

| USAA Casualty | $484 | Erie | $1,448 |

| IDS Property Casualty | $528 | Nationwide | $1,638 |

| USAA | $566 | California Casualty | $1,874 |

| Progressive Casualty | $580 | Great Northern | $2,154 |

| Amica | $614 | Allstate Property | $2,424 |

| Progressive Direct | $662 | LM Insurance | $2,824 |

| AIG Property Casualty | $702 | Allstate Indemnity | $5,774 |

Now that you know the District’s insurance requirements and rates, let’s find out which providers in D.C. have the best (and worst!) ratings and reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Compare Washington, D.C. Car Insurance Companies

You can start by conducting a best car insurance companies comparison with our free tools. Keep reading to get the inside scoop on who the best providers are (and why) across the District of Columbia.

The 10 Largest Washington, D.C. Car Insurance Companies

A.M. Best Ratings of Car Insurance Companies in D.C.

| Insurance Company | A.M. Best Rating |

|---|---|

| A++ | |

| B | |

| A++ | |

| A++ |

| A+ | |

| A+ |

| A+ |

| A+ |

| A+ | |

| A |

Read More: Erie Car Insurance Review

Washington, D.C. Car Insurance Company Reviews

Here are the ten auto insurance companies in Washington, D.C. that had the most complaints. This data proves that a company can have a high volume of complaints, but still deliver exceptional customer service. It’s what the company does with those complaints that really matters.

Customer Complaints: DC

| Insurance Company | Complaint Ratio | Total Complaints |

|---|---|---|

| 0.5 | 163 | |

| 0.8 | 73 | |

| 0.5 | 52 | |

| 0.7 | 333 | |

| J. Whited | 7.4 | 253 |

| 6.1 | 222 |

| Metropolitan | 1.3 | 70 |

| 0.8 | 120 | |

| 0.4 | 1482 | |

| 0.7 | 296 |

In addition, what says more about a company isn’t the number of complaints it receives (bigger companies will usually get more complaints), but rather the company’s complaint ratio. Defined: In this case, the complaint ratio is the number of complaints the auto insurance company received for every 1,000 accident claims it filed. Liberty Mutual, J. Whited, and Metropolitan have the most work to do in cutting down on customer complaints.

Washington, D.C. Car Insurance Coverage Requirements

Only 19 states and Washington, D.C. require their drivers to have uninsured or underinsured motorist coverage.

DC minimum coverage requirements

| Required Coverage | Minimum Limits (25/50/10) |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

| Uninsured Motorist Bodily Injury | $20,000 per person $50,000 per accident |

| Uninsured Motorist Property Damage | $5,000 per accident w/$200 deductible |

Now that you know the minimum coverage you are required by law to have in D.C., you can shop around to price compare what the top providers have to offer.

Add-ons, Endorsements, and Riders in Washington, D.C.

Here’s a list of useful coverage available to you in D.C.:

- Gap insurance

- Rental reimbursement

- Roadside assistance

- Car insurance for engine failures

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

Pay-As-You-Drive or Usage-Based Insurance in Washington, D.C.

There are many names for this new way of determining your car insurance rates: pay-as-you-drive, usage-based insurance (UBI), telematics, driver monitoring, etc., but they all mean the same thing.

You will install a device in your vehicle that will report back to your insurer on how many miles you drove and how safely you navigated through each of those miles on the roads.

High-Risk Car Insurance in Washington, D.C.

What makes car insurance more expensive in D.C.? Here are some examples of why D.C. drivers would be required to get this high-risk coverage:

- Driving uninsured

- DUI/DWI

- Multiple accidents

- Too many points on your record

In D.C., a high-risk driver must file SR-22 car insurance. Your insurance provider will file your SR-22 with the DMV for all vehicles that are registered under your name or driven by you. If your current company can’t file SR-22 insurance, you will need to switch to an insurer that can, which may raise your rates. (For more information, read our “What are the DUI insurance laws in Washington?“).

Washington, D.C. Driver Points System

Like much of the U.S., the District of Columbia uses a car insurance points system for moving violations and other illegal motorist activity. Here is what you will get in D.C. for the most common violations:

Washington, D.C. Car Insurance: Point System Chart

| Violation | Points Awarded |

|---|---|

| Drive with an expired license (under 90 days expired) | 2 |

| Drive a vehicle without the required class of license | 2 |

| Follow another vehicle too closely (tailgate) | 2 |

| Commit a moving violation that doesn't contribute to an accident (and isn't listed below) | 2-3 |

| Break the seatbelt laws | 3 |

| Commit moving violations that contribute to an accident | 3 |

| Fail to yield or stop for a pedestrian | 3 |

| Speed 11-15 mph over the posted speed limit | 3 |

| Speed 16-20 mph over the posted speed limit | 4 |

| Fail to stop for a school bus when lights flashing | 4 |

| Drive when in violation of your restricted license | 4 |

| Drive with a learner's permit without a licensed driver | 5 |

| Speed 21 mph over the posted speed limit | 5 |

| Commit a misdemeanor crime involving a motor vehicle | 6 |

| Fail to yield to an emergency vehicle | 6 |

| Reckless driving | 6 |

| Leave the scene of a collision (when no personal injuries occurred) | 8 |

| Turn off headlights to avoid being seen by a police officer | 8 |

The following 11 acts will instantly cost you your license if committed in Washington, D.C.:

DC: instant 12 points and lost license

| Violation | Points Awarded |

|---|---|

| Flee or attempt to elude a police officer | 12 |

| Leave the scene of an accident where personal injury occurred (hit and run) | 12 |

| Aggravated reckless driving | 12 |

| Drive with a suspended or revoked driver license | 12 |

| Drive with someone else's driver license | 12 |

| Get convicted for an assault or homicide by vehicle | 12 |

| Drive under the influence of alcohol or drugs | 12 |

| Drive under 21 with any measurable amount of alcohol | 12 |

| Commit a felony crime by vehicle | 12 |

| Make a false affidavit or statement under any law relating to driving or vehicles | 12 |

| Commit any violation while driving without the permission of the owner | 12 |

When D.C. drivers get 10 to 11 points, their license gets suspended and they lose their driving privileges for 90 days. If they get 12 or more points, their license gets revoked and they lose their driving privileges for at least six months.

Low-Cost or Low-Income Insurance in Washington, D.C.

Currently, California, Hawaii, and New Jersey are the only three states that offer government-funded car insurance programs for lower-income families and car insurance for welfare recipients. However, D.C. does have its own line of auto insurance that’s been around since 1982 to ensure that every driver is properly insured.

The District of Columbia Automobile Insurance Plan (D.C. AIP) is available to motorists who are turned down from other providers due to a bad driving record or high-risk personal factors.

Rideshare Car Insurance in Washington, D.C.

Here are the legislative regulations from D.C.’s Public Vehicle-for-Hire Innovation Act:

- Privately owned vehicles can be used as for-hire public transportation if the drivers are notified electronically

- Rideshare drivers are prohibited from picking up passengers that hail them from the street

- Rideshare drivers are prohibited from offering rides at taxi stands designated for D.C. taxis

- If illegal behavior is suspected, the driver must provide law enforcement their trip records

- Background checks and insurance are required for all drivers

- Companies must provide passengers with a photo of the driver and license plate before pickup

- Drivers must pass a criminal background check, sex offender database check, and driver history check

- App-based services must provide insurance coverage of at least $50,000 per person per accident, up to $100,000 available to all, and at least $25,000 for property damage (higher than D.C.’s minimum requirements)

- A rideshare driver may work for more than one company (unless not allowed by the company)

More rules governing the two largest rideshare companies operating across the District of Columbia include:

DC: Uber requirements

| Requirements | Lyft | Uber |

|---|---|---|

| Vehicle Year | 2006 or newer | 2007 or newer |

| Vehicle Size | 4-door with 5-8 seats | 4-door car or minivan |

| Vehicle Safety | Must pass DMV check and background check | Must pass inspection, be in good condition, & no cosmetic damage (no commercial branding allowed) |

| Driver | Must be over 21 and have a valid driver's license | Must be over 21 and have a valid driver's license |

| Insurance & Registration | Must have state/local insurance and vehicle registration | Must have state/local insurance and vehicle registration |

Allstate, Geico, and Liberty Mutual all offer car insurance in D.C. to drivers using their vehicle for rideshare, delivery, and ride hailing services.

Washington, D.C. Car Insurance Laws

Washington, D.C. is a “no-fault” district. No matter who is at fault for a car accident in D.C., those hurt can use their personal injury protection (PIP) or “no-fault” insurance to get compensation for medical bills and lost wages from their insurance company.

However, PIP or no-fault insurance is not the best option for the innocent victims in an accident or when there are major damages. In D.C., it’s best for the injured (and innocent) parties to submit a claim against the at-fault driver.

Normally you can’t file a claim against the at-fault driver and receive no-fault benefits, but in D.C. you can if both of the following criteria are met:

- Your medical bills exceed your insurance policy’s PIP coverage

- Your injuries cause permanent impairment or disfigurement, scarring, or disability lasting at least 180 days

If both the monetary and injury requirements listed above aren’t met, the charges against the driver will be dropped.

Driving Without Car Insurance in Washington, D.C.

You and your vehicle don’t just have to be properly insured, you have to be able to prove it at all times while operating a vehicle on public roads.

DC: penalties for owning an uninsured vehicle

| Owning an Uninsured Vehicle | Fine | License Suspension | Reinstatement Fee |

|---|---|---|---|

| First Offense | $30 | 30 days | $98 |

| Subsequent Offenses | $30 + $150 ($7 each day after 1st 30 days up to $2,500) | 60 days | $98 |

DC: penalties for driving an uninsured vehicle

| Driving an Uninsured Vehicle | Fine | License Suspension | Reinstatement Fee |

|---|---|---|---|

| First Offense | $30 + $500 Civil Fine | 30 days | $98 |

| Subsequent Offenses | $30 + $750 (Civil Fine increases by 50% each offense) | 60 days | $98 |

Even if you’re following the law, if you’re pulled over and can’t prove you and your vehicle are insured, you face all of the same penalties.

Washington, D.C. DUI Laws

Here are some key facts on DUIs in our nation’s capital:

DC DUI laws

| Driving Impaired | Specifics |

|---|---|

| Name for Offense | Driving Under the Influence (DUI) |

| BAC Limit | .08 |

| High BAC Categories | .20-.25 .25-.30 .30+ |

| Criminal Status | Misdemeanor |

| Look Back Period | 15 years |

In regards to a DUI, the District of Columbia is one of the least forgiving areas in the U.S. with this period lasting 15 years.

Here’s the breakdown for first, second, and third DUIs in D.C.:

DC DUI: 1st Offense

| 1st Offense | Penalties |

|---|---|

| License Revoked | 6 months |

| Jail Time | BAC over .20: 10 days BAC over .25: 15 days BAC over .30: 20 days up to 180 days |

| Fine | up to $1,000 |

| Vehicle Impounded | No Law |

| DUI Program | Alcohol Diversion Program possible |

| Community Service | Determined in Court |

| Mandatory Ignition Interlock Device | Yes |

| Required to get License Reinstated | $98 min, SR22 insurance, and retake driver test |

| Probation | Determined in Court |

DC DUI: 2nd Offense

| 2nd Offense: | Penalties: |

|---|---|

| License Revoked | 1 year |

| Jail Time | BAC below .20: 5 min BAC over .20: 10 days BAC over .25: 20 days up to 1 year |

| Fine | up to $5,000 |

| Vehicle Impounded | No Law |

| DUI Program | Determined in Court |

| Community Service | 30 days possible |

| Mandatory Ignition Interlock Device | Yes |

| Required to get License Reinstated | $98 min, SR22 insurance, and retake driver test |

| Probation | Determined in Court |

DC DUI: 3rd Offense

| 3rd Offense | Penalties |

|---|---|

| License Revoked | 3 years |

| Jail Time | BAC under .20: 5 days min BAC over .20: 15 days BAC over .25: 25 days up to 1 year |

| Fine | up to $10,000 |

| Vehicle Impounded | No Law |

| DUI Program | Determined in Court |

| Community Service | 30 days possible |

| Mandatory Ignition Interlock Device | Yes |

| Required to get License Reinstated | $98 min, SR22 insurance, and retake driver test |

| Probation | Determined in Court |

The above fines and penalties all apply even if the vehicle never moves an inch. According to D.C. law, being behind the wheel with the keys in the ignition while impaired is enough to earn a DUI.

Distracted Driving Laws in Washington, D.C.

Here are the laws in D.C. regarding phone use behind the wheel:

DC: cellphone use laws

| Cellphones Laws: | Who? |

|---|---|

| Hand-held use banned | All drivers |

| All use banned | Learner's permit holders |

| Texting banned | All drivers |

| Enforcement | Primary |

Not only was D.C. first to completely ban texting while driving, but it is also known for giving the most texting tickets with nearly 90,000 written in D.C. alone in under a decade!

Washington, D.C. Windshield and Glass Repair Laws

Surprisingly, the District of Columbia does not have any laws regarding vehicle repairs or replacements. But just because D.C. doesn’t have set laws on windshield cracks doesn’t mean you can’t get pulled over and ticketed for one.

Drivers in D.C. are not allowed to operate a vehicle that has anything causing an obstructed view of the road. There are many companies out there eager to repair your broken windows. Don’t wait until it’s a danger to yourself or others. D.C. drivers have the option of adding a zero-deductible glass replacement benefit to their insurance policy, but this coverage is not required by law.

Read more: Zero-Deductible Car Insurance: Explained Simply

Automobile Insurance Fraud in Washington, D.C.

Leaders in D.C. define insurance fraud as when a person knowingly defrauds or fraudulently obtains property. Here are more specifics on what you can’t do according to Washington, D.C. law:

- Present false information or knowingly conceal information when applying for or renewing an insurance policy, making a claim, applying for financing, selling an insurance policy, applying for an insurance license, or writing a financial statement

- Buy or sell insurance from or to someone who has a strong likelihood of not being able to pay off the debt owed

- Remove or change records of claims, official documents, or material assets regarding the insurance

- Misuse or hide insurance funds that come from claims, business transactions, or mergers

- Sell or buy insurance to/from someone without a license or certificate of authority

- Act as an agent to falsely obtain information or insurance money

- File a fraudulent claim against an insurer or the insured customer

And if you do any of the above, here are the consequences in the District:

DC Insurance Fraud Penalties

| Crime Level | Fraud Level | Fine | Prison Time |

|---|---|---|---|

| Misdemeanor | Attempt - any value | Up to $1,000 | Up to 180 days |

| 2nd Degree | Attempt - value at $1,000 or more | 1st offense - up to $10,000 2nd offense - up to $20,000 | 1st offense - up to 5 years 2nd offense - up to 10 years |

| 1st Degree | Succeed - value at $1,000 or more | Up to $50,000 | Up to 15 years |

Unique Washington, D.C. Auto Laws

Not being its own state, D.C. doesn’t have direct representation in Congress, which means that all of the laws District leaders want to be passed must go through the city council and a congressional review period before they can become official law.

This small, but mighty area in the U.S. has its own specific laws called the District of Columbia Official Code. Within this code is Title 50 that clearly defines all the laws having to do with vehicles and driving.

Title 50 is made up of 27 chapters covering laws on commercial vehicles, government vehicles, taxicabs, environmental protection, registration, inspection, licensing, ownership, parking, and much more. The chapters are split up into 47 sections with links to navigate to each one.

The Bottom Line on How to Compare Washington, D.C. Car Insurance Rates And Get The Best Coverage

Frequently Asked Questions

How much is car insurance in D.C. per month?

Washington, D.C. car insurance costs $111 monthly for full coverage, but your rates can vary based on your age and the kind of car you drive.

Who has the most reasonable car insurance rates in Washington, D.C.?

Pharmacists Mutual and Geico have the lowest Washington, D.C. auto insurance rates in most ZIP codes.

How can I compare Washington, D.C. car insurance rates?

Gather information, research insurance providers, compare coverage options, consider customer reviews, and get free car insurance quotes online to determine the best price.

Is Allstate or Geico more expensive in Washington, D.C.?

Allstate is more expensive than Geico in most states, including Washington, D.C.

What factors influence Washington, D.C. car insurance rates?

Factors that affect car insurance rates in Washington DC include driving record, vehicle details, coverage limits, deductibles, age, gender, credit history, mileage, location, claim history, and insurance coverage history.

What car insurance is required in Washington, D.C.?

Yes, Washington, D.C. requires drivers to carry liability insurance with minimums of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

Are there discounts available to get cheap Washington, D.C. car insurance rates?

Yes, discounts in Washington, D.C. may include good driver, bundling, safety features, good student, defensive driving course, low mileage, and affiliation discounts.

Can credit score affect D.C. car insurance rates?

Yes, credit scores can impact car insurance rates when companies use them to assess risk. Not all providers check credit score, so shop around to find the best Washington, D.C. car insurance company for you.

What is the rate of uninsured drivers in D.C.?

The uninsured rate in D.C. is 15.6%.

Who is Geico’s biggest competitor in Washington, D.C.?

Pharmacists Mutual and State Farm are among Geico’s biggest competitors. Compare Washington, D.C. car insurance rates from these and more companies near you above to get the best price on your policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.