Cheapest Ohio Car Insurance Rates in 2025 (Big Savings With These 10 Companies!)

The top providers for the cheapest Ohio car insurance rates are offered by USAA, Geico, and American Family, with rates as low as $16 per month. These companies offers affordable options with excellent customer service and comprehensive coverage options, ensuring Ohio drivers get the best value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Min. Coverage for Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the cheapest Ohio car insurance rates are found with USAA, Geico, and American Family, making them the top picks for drivers in the state.

This article explores Ohio’s car insurance laws, detailing both mandatory and optional coverages to help you understand your requirements and options.

Our Top 10 Company Picks: Cheapest Ohio Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $16 A++ Military Savings USAA

#2 $23 A++ Cheap Rates Geico

#3 $24 A Many Discounts American Family

#4 $25 A++ Usage Discount Travelers

#5 $27 B Accident Forgiveness State Farm

#6 $33 A+ Local Agents Progressive

#7 $37 A Online Convenience Farmers

#8 $41 A Add-on Coverages Liberty Mutual

#9 $44 A+ Student Savings Nationwide

#10 $46 A+ Customizable Polices Allstate

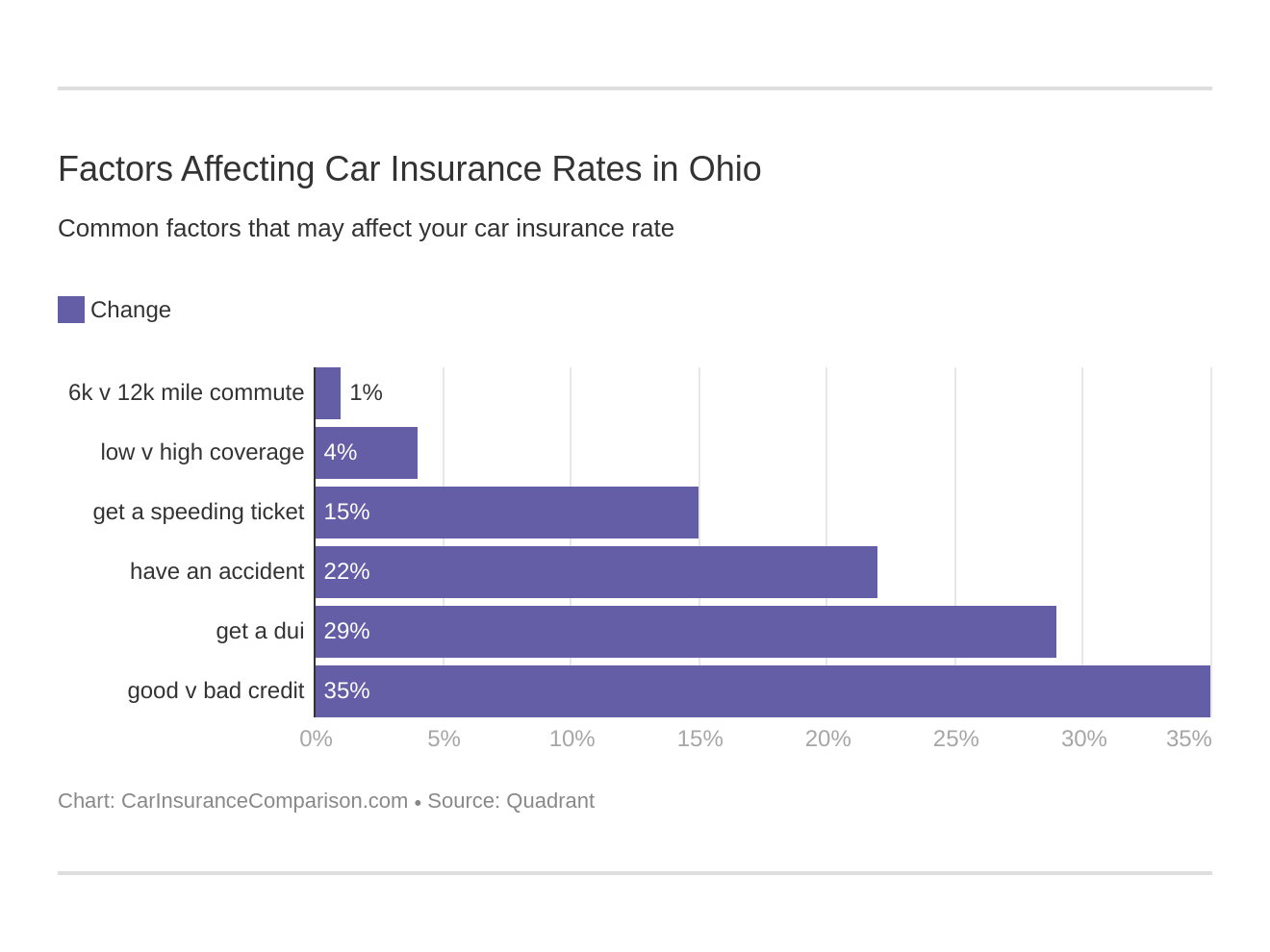

It also examines how various factors such as age, gender, and driving record influence insurance rates, providing you with insights to make informed decisions. To gain further insights, consult our comprehensive guide titled “Average Car Insurance Rates by Age and Gender.”

Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

#1 – USAA: Top Overall Pick

Pros

- Exclusive Membership Benefits: USAA is exclusively available to military members and their families, offering specialized services and discounts tailored to their unique needs.

- Comprehensive Coverage Options: USAA provides a wide range of coverage options, including specialized military-related coverages like deployment discounts and overseas insurance.

- Strong Financial Stability: USAA car insurance review highlights the company’s outstanding financial ratings, showcasing their reliability and efficient claims payout ability.

Cons

- Limited Availability: USAA is only available to military members, veterans, and their families, excluding the general public.

- Digital Focus: While their online and mobile services are robust, some customers may prefer more in-person interactions, which can be limited.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico car insurance review showcases some of the most competitive and affordable insurance rates available in the market.

- Discounts and Savings: Geico offers a variety of discounts, including those for good drivers, multiple policies, and vehicle safety features.

- Efficient Claims Process: Geico has a streamlined claims process with good customer service, ensuring quick and hassle-free claim settlements.

Cons

- Mixed Customer Service Reviews: While many customers report positive experiences, there are also reports of inconsistent customer service quality.

- Higher Rates for High-Risk Drivers: Geico may not offer the most competitive rates for drivers with poor driving records or those considered high-risk.

#3 – American Family: Best for Many Discounts

Pros

- Affordable Rates: American Family car insurance review highlights their competitive rates, frequently positioning them as one of the more affordable options for drivers in Ohio.

- Comprehensive Coverage Options: They provide a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments.

- Discounts: Offers numerous discounts such as multi-policy, good student, safe driver, and loyalty discounts, helping policyholders save more.

Cons

- Limited Availability: American Family insurance is not available in all states, which may limit options for those who move out of their coverage area.

- Average Digital Experience: While their mobile app and website are functional, they might not be as advanced or user-friendly as some competitors.

#4 – Travelers: Best for Usage Discount

Pros

- Extensive Coverage Options: Travelers offers a comprehensive range of coverage options, including optional add-ons like roadside assistance and gap insurance.

- Strong Financial Ratings: Travelers car insurance review highlights its strong financial stability, as evidenced by high ratings from A.M. Best, showcasing its capability to manage large-scale claims.

- Discounts and Savings: Provides numerous discounts, including multi-policy, hybrid/electric vehicle, good student, and safe driver discounts.

Cons

- Price Variability: While they offer competitive rates, prices can vary significantly based on location and personal factors, sometimes leading to higher premiums.

- Mixed Customer Service Reviews: Customer service experiences can be inconsistent, with some policyholders reporting less satisfactory interactions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – State Farm: Best for Accident Forgiveness

Pros

- Wide Range of Coverage Options: State Farm offers a variety of insurance products including auto, home, renters, life, and health insurance, allowing for bundling and potential discounts.

- Extensive Agent Network: State Farm car insurance review highlights the personalized customer service and claims support offered through their extensive network of local agents.

- Mobile App and Online Tools: State Farm’s mobile app and online portal provide convenient access to policy information, claims filing, and payment options.

Cons

- Higher Premiums: State Farm’s premiums can be higher compared to other insurers, particularly for younger drivers or those with less-than-perfect driving records.

- Limited Availability of Discounts: Some discounts and features may not be available in all states, potentially limiting savings for some customers.

#6 – Progressive: Best for Local Agents

Pros

- Competitive Pricing: Progressive car insurance review highlights its competitive rates, especially for drivers with good records or those who utilize its Snapshot program.

- Comprehensive Coverage Options: Offers a wide array of coverages, including unique options like pet injury coverage and custom parts and equipment value.

- Strong Online Presence: Progressive’s website and mobile app are highly rated for ease of use, providing convenient access to policy management and claims filing.

Cons

- Mixed Customer Service Reviews: Progressive has received mixed reviews for customer service, with some customers experiencing issues with claim handling and responsiveness.

- Potential Rate Increases: Some customers report significant rate increases upon policy renewal, even without claims or changes in driving habits.

#7 – Farmers: Best for Online Convenience

Pros

- Wide Range of Coverage Options: Farmers offers extensive coverage options, including unique policies such as rideshare insurance and pet injury coverage.

- Discount Opportunities: Farmers car insurance review highlights several discounts, including multi-policy, safe driver, and good student discounts, which help lower premiums.

- Personalized Service: Farmers is known for its personalized customer service, with agents available to assist with policy selection and claims processes.

Cons

- Higher Premiums: Farmers tends to have higher premiums compared to some competitors, making it less attractive for budget-conscious consumers.

- Mixed Customer Reviews: While some customers appreciate the personalized service, others report dissatisfaction with claims processing and customer service experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Add-on Coverages

Pros

- Wide Range of Coverage: Liberty Mutual offers a broad spectrum of coverage options, including liability, collision, comprehensive, personal injury protection, and additional coverages like rental car reimbursement and roadside assistance.

- Customizable Policies: They provide customizable policies that allow policyholders to tailor their insurance to meet their specific needs, ensuring they only pay for what they require.

- 24/7 Customer Support: Liberty Mutual car insurance review highlights their 24/7 customer support and user-friendly mobile app, ensuring help is always available when needed.

Cons

- Price Variability: Premium rates with Liberty Mutual can vary significantly based on location and individual circumstances, which may lead to higher costs for some customers.

- Potential for Rate Increases: There are reports of unexpected rate increases upon policy renewal, which can be a concern for long-term policyholders.

#9 – Nationwide: Best for Student Savings

Pros

- Strong Financial Stability: Nationwide car insurance discounts highlight the company’s financial stability and reliability in paying claims, as evidenced by high ratings from agencies like A.M. Best.

- Customer Service: Nationwide is known for its good customer service, with numerous positive reviews highlighting its responsiveness and helpfulness.

- User-Friendly Digital Tools: The Nationwide mobile app and online portal are user-friendly, allowing customers to easily manage their policies, file claims, and get quotes.

Cons

- Limited Availability: Some of Nationwide’s specialized insurance products and discounts may not be available in all states.

- Mixed Claims Satisfaction: While many customers praise Nationwide’s customer service, some reviews indicate occasional dissatisfaction with the claims process, particularly regarding delays and settlement amounts.

#10 – Allstate: Best for Customizable Polices

Pros

- Extensive Coverage Options: Allstate offers a broad range of coverage options, including unique add-ons like new car replacement, sound system insurance, and rideshare coverage.

- Comprehensive Discount Programs: Allstate car insurance review showcases numerous discounts, such as those for safe driving, good students, early signing, and multi-policy bundling.

- Innovative Technology: Allstate’s mobile app, Drivewise, and Milewise programs use telematics to help customers save money based on their driving habits.

Cons

- Higher Rates for High-Risk Drivers: Allstate tends to charge higher premiums for drivers with poor credit or those considered high-risk due to past violations or accidents.

- Complex Discount Eligibility: Some customers find the eligibility criteria for certain discounts to be complex or challenging to understand, potentially making it difficult to maximize savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ohio Car Insurance Coverage and Rates

Ohio law mandates that you have to carry a minimum amount of car insurance to be on the road legally. The good news for Ohioans is that rates fall below the national average, but that doesn’t make shopping for car insurance any more enjoyable. You want to make sure you’re adequately covered, but you don’t want to overpay or buy coverage you don’t need.

A clear, concise understanding of your options would make it easier. Everything you need to know is right here in a straightforward and uncomplicated format. We have gathered the details on mandatory coverage and options and provided rate comparisons between states and companies to give you an idea of what to expect.

USAA stands out as the top choice for Ohio car insurance with its unmatched affordability and comprehensive coverage options.

Brad Larson Licensed Insurance Agent

In Ohio, car insurance rates differ by coverage level and provider. For minimum coverage, USAA offers the lowest rate at $16 per month, followed by Geico at $23, and American Family at $24. The highest rates are from Nationwide and Allstate, at $44 and $46 respectively.

Ohio Car Insurance Monthly Rates by Coverage Level & Providers

Insurance Company Minimum Coverage Full Coverage

Allstate $46 $120

American Family $24 $62

Farmers $37 $96

Geico $23 $59

Liberty Mutual $41 $106

Nationwide $44 $114

Progressive $33 $85

State Farm $27 $70

Travelers $25 $63

USAA $16 $41

For full coverage, USAA remains the cheapest at $41 per month. Geico and American Family follow with rates of $59 and $62. The most expensive full coverage is from Allstate at $120, with Nationwide also high at $114. This variation underscores the importance of comparing rates to find the best deal.

Ohio residents can find car insurance discounts from top providers. Allstate offers 18% off for safe drivers, new car owners, and anti-theft devices. American Family gives 12% for loyal customers and multi-vehicle policies. Farmers and Geico both offer 15% for bundling, safe driving, and good students.

Liberty Mutual provides 10% for military personnel, new graduates, and multi-car policies. Nationwide has a 15% discount for multi-policy, safe drivers, and paperless billing. Progressive offers 16% for multi-policy holders, homeowners, and continuous insurance. State Farm also gives 15% for good drivers and multi-policy holders.

Travelers provides 10% for multi-policy, safe drivers, and early quotes. USAA offers 10% for military members, safe drivers, and online quotes. These discounts help Ohio residents save on car insurance by matching their needs with the right provider.

Minimum Car Insurance Requirements in Ohio

Insurance in Ohio is required to make sure that everyone can handle the financial responsibility of a car accident. Liability car insurance coverage exists to do just that, and it’s what you need to buy to form the legally required basis of your policy. Minimum coverage costs vary from state to state.

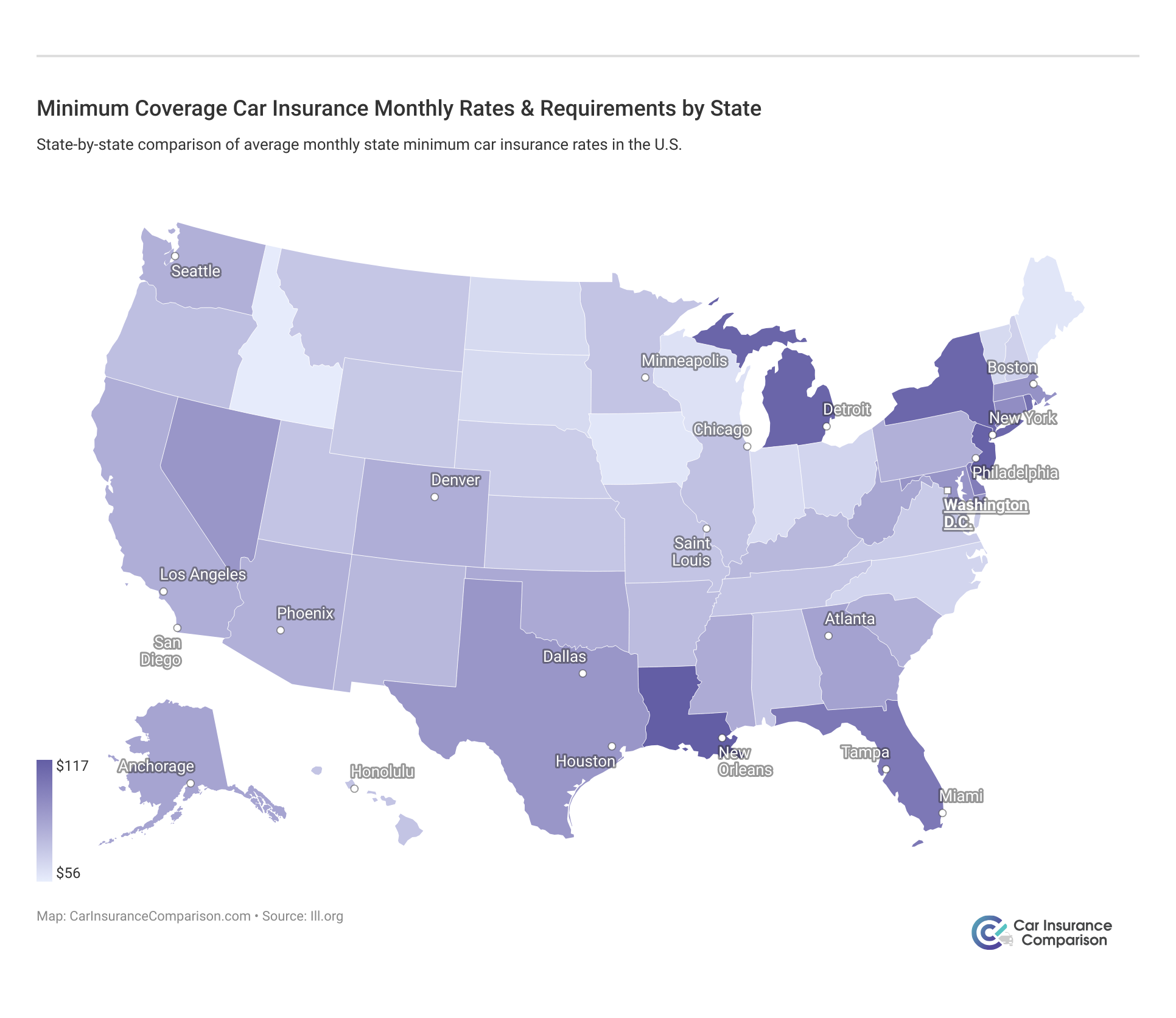

Here are Ohio’s state minimum car insurance requirements, according to Ohio State Law. A state-by-state comparison reveals the average monthly rates for state minimum car insurance across major U.S. cities.

For instance, Washington D.C. has an average rate of $117.11, while Los Angeles averages $56.66. This information, sourced from CarInsuranceComparison.com and Ill.org, provides insights into how car insurance costs vary depending on location and coverage type.

Financial Responsibility and Car Insurance Costs in Ohio

In Ohio, liability insurance is the most popular form of financial responsibility among drivers, although there are a few other options available. Self-insurance is an alternative but only applies to individuals who own 25 or more vehicles. For additional details, explore our comprehensive resource titled “Compare Car Insurance Rates by Vehicle Make and Model.”

Another option is obtaining a certificate of financial responsibility, which can be achieved by depositing cash or government bonds with the Treasurer of the State of Ohio, signing a certificate of bond with equity of at least $60,000 in real estate, or providing evidence of a bond issued by an authorized surety or insurance company.

Regardless of the choice, proof of financial responsibility must be carried while driving, often shown through a car insurance certificate. Ohio drivers spend about 1.98 percent of their average disposable income on car insurance, which is significantly lower than the national average.

Despite rising premiums, the average disposable income has also increased, maintaining affordability. A full-coverage policy in Ohio includes liability, collision, and comprehensive insurance, with average rates in all categories being lower than the national average.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Best Ohio Car Insurance Companies

Choosing a car insurance company feels a little like throwing a dart at a list of company names and hoping for the best. Everyone promises excellent rates, great coverage, and the best customer service, but how can you be sure they’re keeping those promises? There has to be a better way to choose the company that’s protecting you on the road.

We can help you make that decision with the information you need to feel confident in your choice. We’ve gathered all the ratings and complaint data for the biggest insurance companies in Ohio right here, and broken down all the information.

USAA offers the cheapest Ohio car insurance rates starting as low as $16 per month, making it the top pick for budget-conscious drivers.

Michelle Robbins Licensed Insurance Agent

You can also compare those companies based on their average premiums for several big rating factors, so you know you’re picking both the company with the best reputation and the company that delivers the best rates for your needs. To learn more, explore our comprehensive resource on insurance titled “What Is a Car Insurance Premium?”

Commute Rates By Company

Out of the top companies, only four show an increase in rates with a longer commute. For those that do show a change, it’s minimal, with the biggest difference seen at State Farm. Even there, it’s less than $125 a year difference.

Your commute doesn’t have a significant impact on what you pay for car insurance in Ohio. People who only drive for pleasure can look into what is pleasure driving for car insurance purposes. American Family and USAA remain the cheapest companies even by commute mileage.

Important Ohio Driving and Safety Laws

Driving in Ohio requires not just skill but also a solid understanding of the state’s driving and safety laws. These regulations are designed to protect everyone on the road by penalizing dangerous driving behaviors.

- Ohio Safety Laws: These laws penalize drivers who risk the lives of others with dangerous driving habits.

- Ohio Driving Under the Influence Laws: In Ohio, driving under the influence is legally known as Operating a Vehicle Under the Influence (OVI), and depending on the offense, it may be a misdemeanor or a felony.

- Ohio Marijuana Driving Laws: The use of medical marijuana is legal in Ohio, while in neighboring Michigan, it’s legal for recreational use. But driving while impaired by marijuana can result in an OVI charge. To delve deeper, refer to our in-depth report titled “Compare Medical Student Car Insurance Rates.”

- Ohio Distracted Driving Laws: Law enforcement can use the general distracted driving law, which carries a fine of $100 for any driver whose distraction contributes to another violation.

Staying informed about Ohio’s driving and safety laws is essential for maintaining a safe driving environment and avoiding severe penalties. By following these regulations, drivers contribute to safer roads and help prevent accidents.

Remember, responsible driving is not just about following the law; it’s about ensuring the safety and well-being of everyone on the road. Stay safe and drive responsibly.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding Ohio State Laws: Insurance, Licensing, and Legal Penalties

Ohio state laws protect residents and insurance companies by regulating car insurance, driver and vehicle licensing, and legal penalties. The Ohio Department of Insurance and State Legislature oversee car insurance laws. Windshield coverage can include aftermarket parts, and high-risk drivers can use the Ohio Automobile Insurance Plan.

Ohio’s competitive market keeps insurance costs low, and the Fraud Unit investigates insurance fraud. Claims for injury or property damage must be filed within two years. Penalties for driving without insurance increase with repeat offenses.

USAA emerges as the top choice for Ohio car insurance due to its combination of competitive pricing and comprehensive coverage options.

Daniel Walker Licensed Insurance Agent

Teen drivers follow a graduated licensing program, and all drivers must renew their licenses every four years with an in-person vision test. New residents have 30 days to obtain an Ohio license and register their vehicles. Ohio’s point system tracks violations, resulting in penalties and higher insurance rates for repeated offenses.

Case Studies: Finding Affordable Car Insurance in Ohio

Navigating the car insurance landscape can be challenging, especially with the myriad of options and rates available. For Ohio residents, finding affordable and comprehensive coverage requires diligent research and comparison. In this collection of case studies, we explore the journeys of five individuals who successfully reduced their car insurance costs.

- Case Study #1 – John’s Journey to Affordable Coverage: John, a 25-year-old single male in Columbus, Ohio, found affordable car insurance with USAA at $41 per month for full coverage, benefiting from a 10% safe driver discount due to his military affiliation. This allowed him to drive confidently in his new city.

- Case Study #2 – Sarah’s Student Savings: Sarah, a 22-year-old college student in Cincinnati, Ohio, found Geico’s $59/month full coverage with a 15% good student discount using a free comparison tool, fitting her tight budget and long commutes.

- Case Study #3 – The Smiths’ Multi-Vehicle Savings: The Smith family from Cleveland, Ohio needed insurance for three vehicles with multi-vehicle discounts. American Family provided full coverage at $62 per vehicle per month with a 12% discount, making it affordable for the Smiths.

- Case Study #4 – Mark’s Safe Driving Discounts: Mark, a 65-year-old retiree in Toledo, Ohio, found an affordable $45/month full coverage policy with Liberty Mutual, which included a 10% safe driving discount and a 10% retiree discount. This provided him peace of mind and financial ease in retirement.

- Case Study #5 – New Driver and New Savings: Emily, an 18-year-old new driver in Dayton, Ohio, found her first car insurance policy using a comparison tool. She chose State Farm, which offered a $50/month rate with discounts for safe driving and a driver’s education course, giving her confidence in her driving journey.

These case studies highlight the importance of comparing car insurance quotes and exploring various discounts to find the best rates. Whether you’re a new driver, a parent, or someone with a less-than-perfect driving record, there are opportunities to save on car insurance. For a thorough understanding, refer to our detailed analysis titled “Car Insurance Discounts: Compare the Best Discounts.”

USAA stands out as the top choice for Ohio car insurance, offering comprehensive coverage and excellent customer service.

Kristen Gryglik Licensed Insurance Agent

By leveraging tools and resources, Ohio residents can navigate the complexities of car insurance and secure affordable coverage that meets their needs. Let these real-life examples inspire you to take control of your car insurance costs and unlock potential savings.

Summary: Secure the Cheapest Car Insurance in Ohio

This article guides Ohio residents on finding the most affordable car insurance rates in 2024. Highlighting top providers like USAA, Geico, and American Family, it showcases rates starting as low as $16 per month. The importance of comparing quotes is emphasized, as various factors such as age, gender, and driving record can influence rates.

The article also outlines Ohio’s mandatory minimum coverage requirements and offers tips on securing discounts. By utilizing a free comparison tool, drivers can make informed decisions and achieve significant savings on their car insurance. To expand your knowledge, refer to our comprehensive handbook titled “Compare Car Insurance by Coverage Type.”

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Frequently Asked Questions

What is the cheapest car insurance in Ohio?

The cheapest car insurance in Ohio is typically offered by USAA, with minimum coverage rates as low as $16 per month.

How much is car insurance per month in Ohio?

Car insurance rates in Ohio can vary, but for minimum coverage, prices start at around $16 per month with USAA. Full coverage rates begin at approximately $41 per month.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Who typically has the cheapest car insurance?

USAA, Geico, and American Family are usually among the providers with the cheapest car insurance rates in Ohio.

Check out our ranking of the top providers: Cheap Car Insurance

What is the minimum car insurance in Ohio?

The minimum car insurance requirements in Ohio include $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

What is the penalty for not having car insurance in Ohio?

Driving without car insurance in Ohio can result in penalties such as fines, suspension of your driver’s license, and vehicle registration, as well as impoundment of your vehicle.

What is full coverage insurance in Ohio?

Full coverage insurance in Ohio includes liability, collision, and comprehensive coverage. This ensures that you are protected not only against damages you cause but also against damages to your own vehicle from accidents, theft, and other incidents.

To gain profound insights, consult our extensive guide titled “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

At what age is car insurance cheapest?

Car insurance rates tend to be cheapest for drivers in their mid-30s to early 50s, as they are considered lower-risk compared to younger and older drivers.

Is Ohio a no-fault state?

No, Ohio is not a no-fault state. Ohio follows a tort system, meaning the driver found to be at fault in an accident is responsible for paying the damages.

Do I need collision insurance in Ohio?

Collision insurance is not legally required in Ohio, but it is highly recommended if you want coverage for damages to your own vehicle resulting from collisions.

For a comprehensive overview, explore our detailed resource titled “How do I assess car damage for insurance purposes?”

Does insurance follow the car or the driver in Ohio?

In Ohio, car insurance typically follows the car. This means that if someone else drives your car with your permission and gets into an accident, your insurance policy would generally cover the damages.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.