Compare Arkansas Car Insurance Rates [2025]

The average Arkansas car insurance rates are $75 per month, but comparing Arkansas car insurance quotes from multiple providers will help you get even lower premium rates. Arkansas car insurance minimum liability requirements are 25/50/25 for bodily injury and property coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Feb 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The average car insurance in Arkansas costs $75 per month

- The state of Arkansas requires you to buy a minimum liability coverage of 25/50/25

- Arkansas is an at-fault state for car insurance

Isn’t shopping around for auto insurance coverage exhausting to start with?

Unlike other shopping experiences, buying insurance coverage requires thorough research of various facets that impact your Arkansas car insurance rates in the long run. It’s easy to get a cheap quote these days, however buying from the right insurance carrier involves a detailed analysis. Before buying, you must be able to answer some basic questions such as – what’s the minimum liability coverage required for your state, what happens if the at-fault party in an accident is uninsured, how much coverage is sufficient for your car or will your insurer pay if your car gets damaged in a storm?

To make the process less daunting for you, we have created this thorough guide that would help you to buy car insurance in Arkansas.

How to Get Arkansas Car Insurance Coverage and Rates

The minimum car insurance requirements vary from state to state, and that’s why it’s important to know the specific coverage that you must buy to drive a car in your state. If you’re looking for an insurance provider, make sure to compare car insurance quotes that combine affordable rates with great customer service. You also need to ensure that your insurance coverage meets the minimum state requirements

In Arkansas, it’s illegal to drive without the minimum coverage or proof of financial responsibility. Also, you must maintain coverage throughout the period you own a motor vehicle.

- Compare Arkansas Car Insurance Rates

- Best Trumann, AR Car Insurance in 2025

- Best Stuttgart, AR Car Insurance in 2025

- Best Russellville, AR Car Insurance in 2025

- Best Little Rock, AR Car Insurance in 2025

- Best Hot Springs, AR Car Insurance in 2025

- Best Harrison, AR Car Insurance in 2025

- Best Des Arc, AR Car Insurance in 2025

- Best Batesville, AR Car Insurance in 2025

Now that we have established that you need to buy car insurance if you wish to drive in Arkansas, let’s help you understand the basics of car insurance. In this guide, we would touch on each and every point that would ease the process of buying car insurance for you. In case you want to compare average premium rates in your state, you can use our FREE comparison tool.

Compare Car Insurance Rates in Arkansas

Unlock the best car insurance rates tailored to your location across various cities in Arkansas. Quickly compare and find the most competitive rates for Batesville, Little Rock, Des Arc, Russellville, Harrison, Stuttgart, Hot Springs, and Trumann.

Compare Car Insurance Rates in Your City

| Compare Car Insurance Rates in Your City |

|---|

| Little Rock, AR |

| Russellville, AR |

| Stuttgart, AR |

| Trumann, AR |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are Arkansas minimum car insurance requirements?

To drive a motor vehicle in Arkansas, your car insurance must include bodily injury and property damage coverage.

- Bodily Injury: If you’re involved in an accident, the bodily injury liability car insurance coverage would cover the cost of medical expenses to the third-party who was injured in the accident. The minimum coverage law in Arkansas requires you to buy insurance that would pay medical expenses up to $25,000 for each injured person with a maximum limit of $50,000 per accident.

- Property Damage: When you’re involved in an accident, you also end up damaging the third-party’s car for which Arkansas’ minimum coverage law requires you to buy insurance that can pay $25,000 to cover the loss.

Arkansas Minimum Insurance Coverage

| Type of Coverage | Minimum Coverage |

|---|---|

| Bodily Injury | $25,000 per person /$50,000 per accident |

| Property Damage | $25,000 per accident |

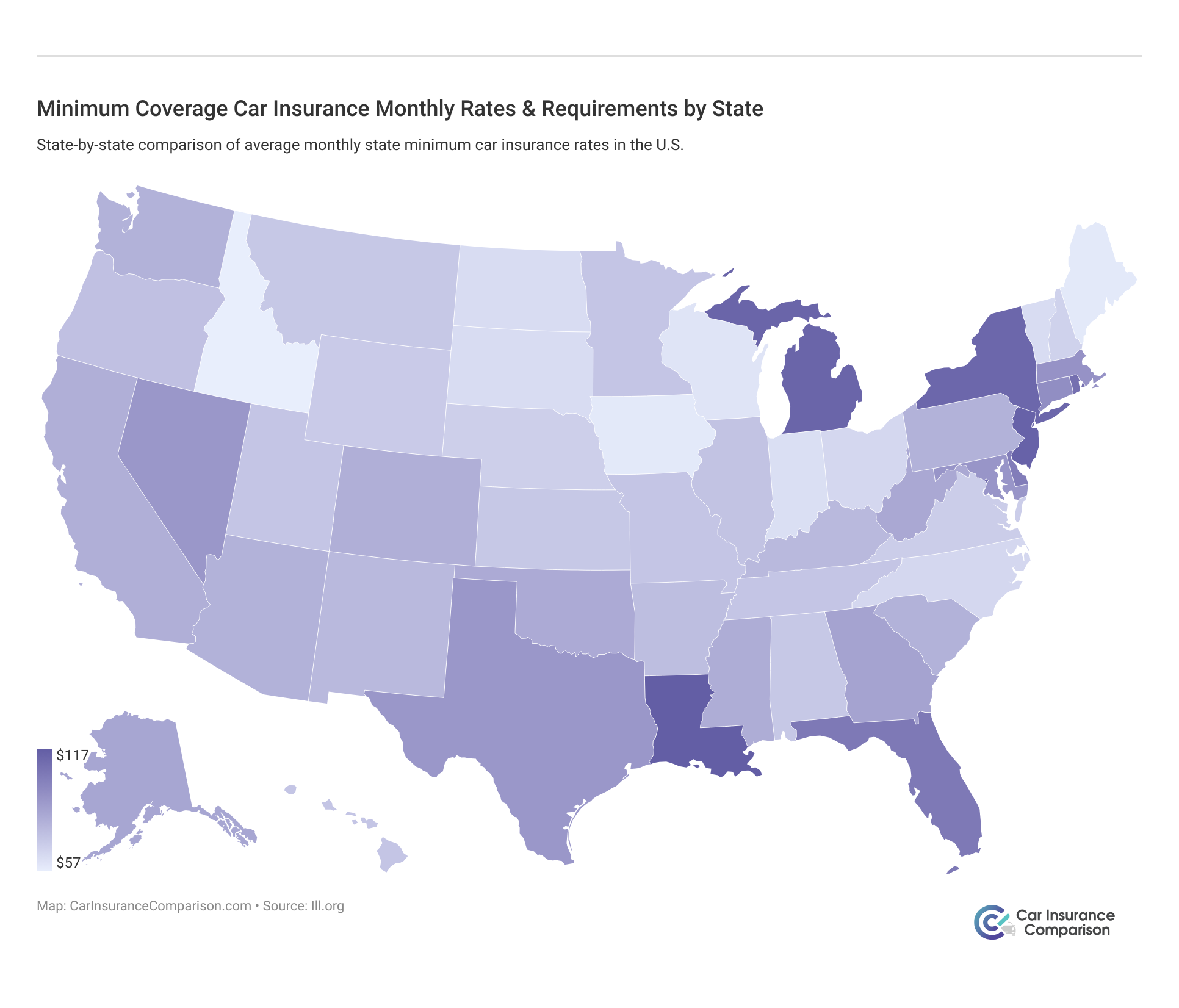

Liability coverage also pays for the legal defense cost if the third-party decides to file a lawsuit against you.Minimum coverage costs vary from state to state.

Though there are minimum coverage laws in your state, it’s recommended that you buy additional coverage to pay-off the damages in case you’re involved in a major accident.What are the required forms of financial responsibility?

The laws of every state require a motorist to carry proof of financial responsibility which shall be presented as per need. In the auto insurance industry, the financial cost a motorist is liable to pay when he/she causes an accident that leads to injury or damage is known as financial responsibility.Here are the acceptable forms of financial responsibility in Arkansas:

- Proof of insurance coverage from an insurer who’s authorized to conduct operations in the state

- Certificate of self-insurance

What percentage of income are car insurance rates in Arkansas?

In 2014, the annual per capita disposable income for households in Arkansas was $33,929. And, the average annual premiums for full coverage was around $900 which means the cost of premiums is approximately 2.65% of the income.Though you’re required to pay only $75 per month for full coverage, the ratio of premium cost to income is a bit on the higher side as the national average is around 2.37%.

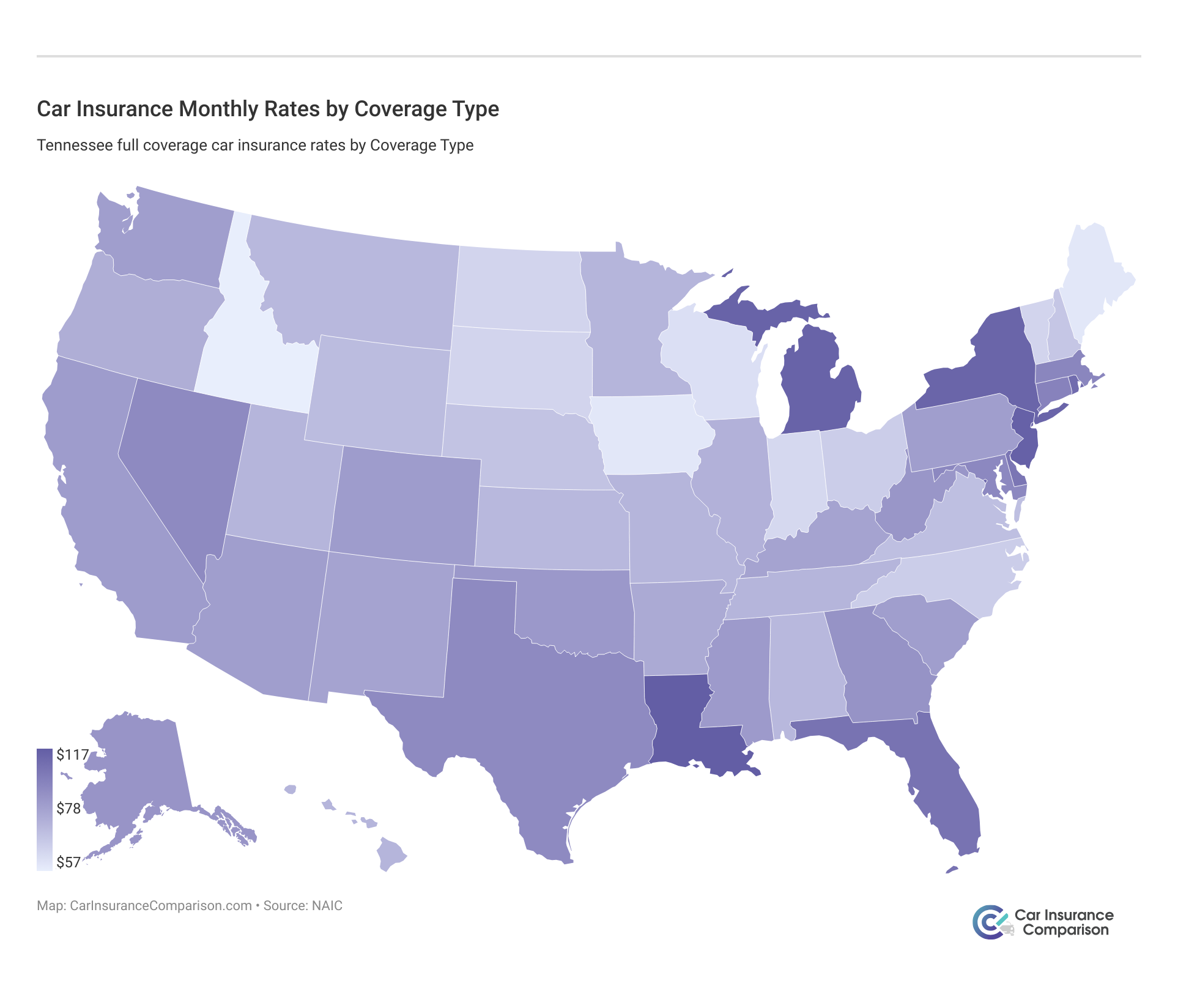

What are the average monthly car insurance rates in AR (liability, collision, comprehensive)?

Core Coverage Premiums - Arkansas

| Coverage Type | Annual Average Premiums (2015) |

|---|---|

| Liability | $394.13 |

| Collision | $321.80 |

| Comprehensive | $190.41 |

| Combined | $906.34 |

The table shows the average premiums paid by residents of Arkansas in the year 2015, that includes liability, collision and comprehensive car insurance coverage. The amount of premium varies from person to person depending on what kind of coverage one chooses.

Note that the state requires you to buy a minimum liability coverage of 25/50/25 which might cost much lower than the average premiums. However, it’s recommended to buy additional coverage to pay-off damages in case you’re involved in a severe accident.

In the Auto Insurance Database Report 2016, published by NAIC, the combined annual car insurance premium in Arkansas was $950 making it the 24th cheapest state in combined auto premiums. The national average for combined auto premiums was $1,062 in that year.

In its border states, Arkansas ranks third in combined auto premium quotes with better rates than Mississippi, Oklahoma, Texas, and Louisiana.The premiums charged/insurance discounts awarded by insurance carriers vary from case to case. At times, you might be surprised by the low auto premiums your neighbor is paying, however, there are many factors that determine the cost of your coverage:

- Driving record

- Age

- Gender

- Geographic location

- Marital Status

- Number of years you have been driving

- Daily usage

- Type of car

Till now, we have looked mainly at three types of auto coverage – liability, collision, and comprehensive insurance. But, there are other coverage options recommended to cover a few unforeseen circumstances. Let’s take a look at those options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are there additional coverage options in Arkansas?

When buying coverage, you should know whether your state is – an at-fault state or no-fault state?

Arkansas is an at-fault state which means that the person responsible for causing the accident would have to pay the cost of personal injury and property damage.

In Arkansas, if you’re involved in an accident, you would have three options to claim damages:

- You can ask the at-fault party to file a third-party claim that would pay damages incurred in the accident

- You can also ask your own insurer to pay for the damages (your policy should have coverage to pay for your damages)

- You can also file a lawsuit against the at-fault party in a civil court

In no-fault states, motorists can only turn to their own insurer to pay-off damages irrespective of who was at fault. The personal injury protection coverage is required in these states to cover for any injury or damages arising from accidents.Drivers in Arkansas needn’t worry about reaching out to their own insurer, because the at-fault party is liable to pay damages.

Arkansas is considered an add-on state when it comes to no-fault laws. This means that drivers in Arkansas have a choice in buying the personal injury protection coverage – they can either refuse it or add it.

Loss Ratio Table - Arkansas

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection | 28.65% | - | 94.17% |

| Medical Payments | 89.94% | 83.09% | 80.99% |

| Uninsured/Underinsured Motorist | 70.23% | 68.12% | 83.37% |

Optional coverage, such as Medical Payment, Personal Injury Protection, Uninsured Motorist Insurance, aren’t mandatory in Arkansas. These options, however, help you in circumstances that are completely unpredictable.For instance, how would you feel if you get hit by a motorist who’s uninsured and your policy doesn’t have coverage to pay for your loss? These additional coverage options help you when the at-fault party is unable to claim third-party damages.

As per estimates, Arkansas ranked ninth among states with the highest percentage of uninsured drivers in 2015. Around 16.6% of the motorists are uninsured on the roads you’re driving on!

That’s not a small percentage of people driving without a insurance in Arkansas, and that should be a cause of worry to you.You can also watch this interesting video on why additional coverage matters for drivers in Arkansas.

Are there any add-ons, endorsements, and riders in Arkansas?

Getting the right coverage at the cheapest rate is something that everyone aims for. While that approach makes us happy, you should also know about the add-ons and riders that you can add to your policy.It’s always wise to be aware of what is available in the market. Do browse through the following coverage options that might save you from an unexpected cost in the future.

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental car reimbursement coverage

- Emergency Roadside Assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-drive insurance

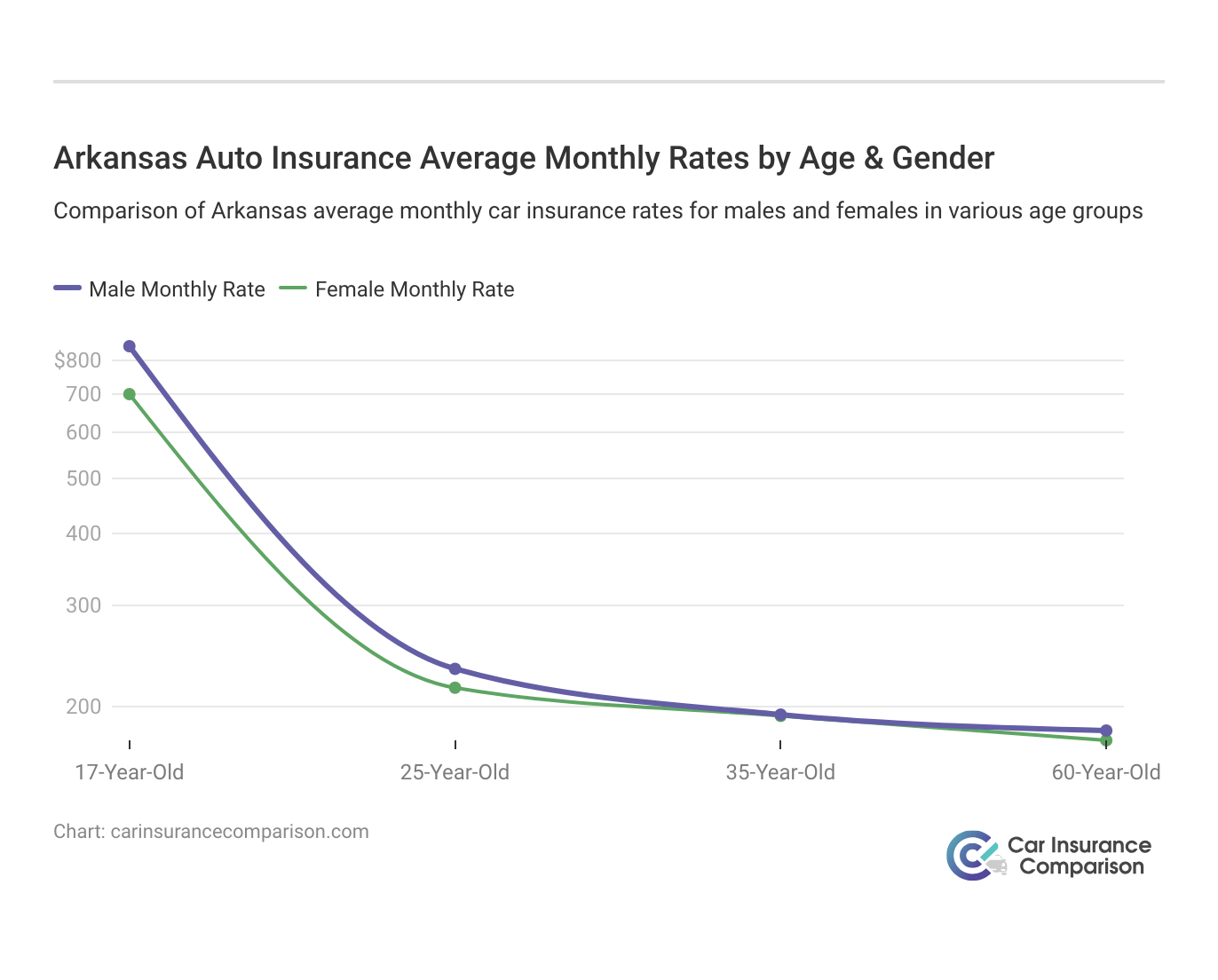

What are the average car insurance rates by age & gender in AR?

Male vs Female Annual Car Insurance Rates in Arkansas

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| $2,908.00 | $2,928.74 | $2,593.49 | $2,774.39 | $10,596.85 | $12,699.62 | $3,211.86 | $3,487.30 | |

| $2,316.82 | $2,306.44 | $2,070.77 | $2,176.91 | $9,693.38 | $10,046.95 | $2,654.22 | $2,797.50 | |

| $2,536.43 | $2,508.78 | $2,340.15 | $2,274.76 | $6,588.67 | $6,607.80 | $2,492.72 | $2,527.69 | |

| $2,324.12 | $2,488.44 | $2,220.47 | $2,477.39 | $8,280.70 | $9,115.49 | $2,511.18 | $2,626.04 | |

| $2,629.04 | $2,679.98 | $2,359.97 | $2,495.08 | $6,363.21 | $8,114.04 | $3,008.14 | $3,244.81 |

| $2,820.71 | $2,675.07 | $2,318.03 | $2,422.91 | $11,868.05 | $13,373.52 | $3,372.76 | $3,645.70 | |

| $1,757.39 | $1,757.39 | $1,571.32 | $1,571.32 | $5,051.46 | $6,355.63 | $1,979.45 | $2,268.23 | |

| $2,222.90 | $2,265.25 | $2,194.96 | $2,201.72 | $12,955.34 | $20,822.43 | $2,377.54 | $2,746.50 | |

| $1,336.55 | $1,349.38 | $1,240.31 | $1,248.11 | $4,210.03 | $4,407.45 | $1,721.30 | $1,855.30 |

Across the country, its widely believed that men and women are charged different rates even if they have the same profile and driving history.As per the table above, the rates for males and females are almost similar in the 35-60-year-old age group. However, auto premiums are significantly higher for males in the 17-25-year-old categories.

There are many factors involved in calculating rates which take into account the demographics. However, almost 48% of people in America think that insurers charge higher premiums from men than women.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

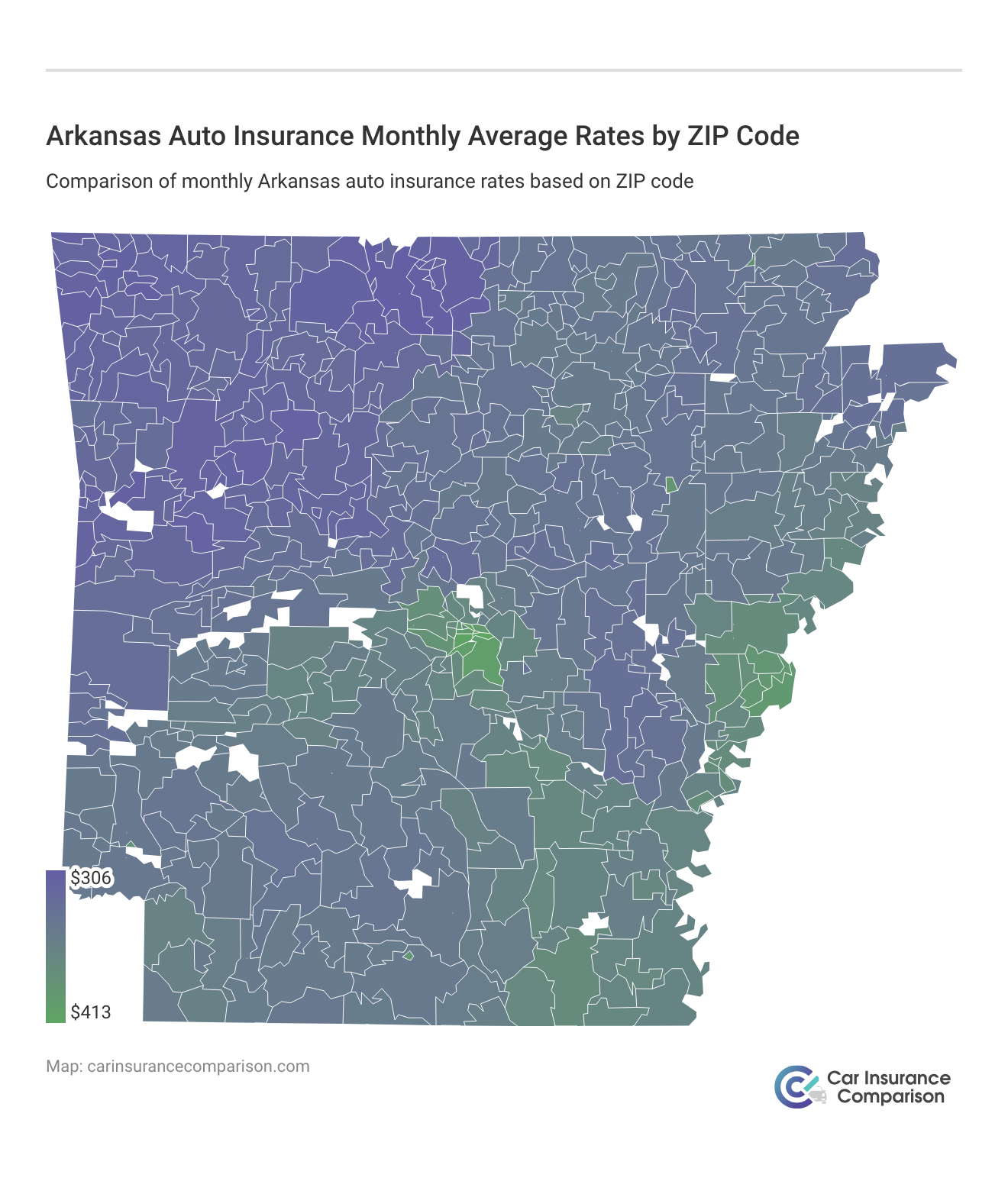

What are the most expensive/least expensive rates by ZIP code in Arkansas?

Most/Least Expensive Rates by Zip Code - Arkansas| Zipcode | Most Expensive Annual Rate | Rank | Compared to Average Annual Rate | City |

|---|---|---|---|---|

| 72202 | $5,258.22 | 1 | $947.87 | LITTLE ROCK |

| 72204 | $5,217.13 | 2 | $906.78 | LITTLE ROCK |

| 72201 | $5,204.57 | 3 | $894.22 | LITTLE ROCK |

| 72209 | $5,126.92 | 4 | $816.57 | LITTLE ROCK |

| 72206 | $5,108.30 | 5 | $797.95 | LITTLE ROCK |

| 72332 | $5,062.51 | 6 | $752.16 | EDMONDSON |

| 72114 | $5,032.25 | 7 | $721.90 | NORTH LITTLE ROCK |

| 72205 | $5,026.06 | 8 | $715.71 | LITTLE ROCK |

| 72342 | $4,977.37 | 9 | $667.02 | HELENA |

| 72169 | $4,975.29 | 10 | $664.94 | TUPELO |

| 72390 | $4,952.76 | 11 | $642.41 | WEST HELENA |

| 72227 | $4,927.27 | 12 | $616.92 | LITTLE ROCK |

| 72355 | $4,905.12 | 13 | $594.77 | LEXA |

| 71759 | $4,903.48 | 14 | $593.13 | NORPHLET |

| 72322 | $4,884.85 | 15 | $574.50 | CALDWELL |

| 72210 | $4,881.65 | 16 | $571.30 | LITTLE ROCK |

| 71823 | $4,870.73 | 17 | $560.38 | BEN LOMOND |

| 72037 | $4,854.09 | 18 | $543.74 | COY |

| 72462 | $4,847.20 | 19 | $536.85 | REYNO |

| 72369 | $4,839.90 | 20 | $529.55 | ONEIDA |

| 72211 | $4,837.05 | 21 | $526.70 | LITTLE ROCK |

| 72312 | $4,825.91 | 22 | $515.56 | BARTON |

| 72374 | $4,818.73 | 23 | $508.38 | POPLAR GROVE |

| 72135 | $4,810.70 | 24 | $500.35 | ROLAND |

| 72366 | $4,805.06 | 25 | $494.71 | MARVELL |

| 72383 | $4,803.95 | 26 | $493.60 | TURNER |

| 72207 | $4,781.63 | 27 | $471.28 | LITTLE ROCK |

| 72223 | $4,775.21 | 28 | $464.86 | LITTLE ROCK |

| 72212 | $4,764.95 | 29 | $454.60 | LITTLE ROCK |

| 72328 | $4,743.08 | 30 | $432.73 | CRUMROD |

| 71601 | $4,737.62 | 31 | $427.27 | PINE BLUFF |

| 72065 | $4,722.97 | 32 | $412.62 | HENSLEY |

| 72360 | $4,720.81 | 33 | $410.46 | MARIANNA |

| 72103 | $4,720.70 | 34 | $410.35 | MABELVALE |

| 72367 | $4,719.49 | 35 | $409.14 | MELLWOOD |

| 72333 | $4,698.82 | 36 | $388.47 | ELAINE |

| 71603 | $4,696.54 | 37 | $386.19 | PINE BLUFF |

| 72118 | $4,696.00 | 38 | $385.65 | NORTH LITTLE ROCK |

| 72113 | $4,687.58 | 39 | $377.23 | MAUMELLE |

| 71646 | $4,685.74 | 40 | $375.39 | HAMBURG |

| 72132 | $4,665.55 | 41 | $355.20 | REDFIELD |

| 72180 | $4,664.75 | 42 | $354.40 | WOODSON |

| 72376 | $4,662.68 | 43 | $352.33 | PROCTOR |

| 72142 | $4,659.05 | 44 | $348.70 | SCOTT |

| 72389 | $4,658.61 | 45 | $348.26 | WABASH |

| 72183 | $4,652.34 | 46 | $341.99 | WRIGHTSVILLE |

| 71675 | $4,640.35 | 47 | $330.00 | WILMAR |

| 71654 | $4,640.07 | 48 | $329.72 | MC GEHEE |

| 71635 | $4,639.80 | 49 | $329.45 | CROSSETT |

| 72348 | $4,639.62 | 50 | $329.27 | HUGHES |

| 71663 | $4,636.18 | 51 | $325.83 | PORTLAND |

| 72341 | $4,632.43 | 52 | $322.08 | HAYNES |

| 72320 | $4,626.62 | 53 | $316.27 | BRICKEYS |

| 72311 | $4,625.88 | 54 | $315.53 | AUBREY |

| 71659 | $4,623.92 | 55 | $313.57 | MOSCOW |

| 71666 | $4,623.23 | 56 | $312.88 | MC GEHEE |

| 71667 | $4,623.08 | 57 | $312.73 | STAR CITY |

| 71676 | $4,608.11 | 58 | $297.76 | WILMOT |

| 71956 | $4,607.65 | 59 | $297.30 | MOUNTAIN PINE |

| 71678 | $4,606.47 | 60 | $296.12 | YORKTOWN |

| 72133 | $4,605.47 | 61 | $295.12 | REYDELL |

| 72164 | $4,605.03 | 62 | $294.68 | SWEET HOME |

| 72117 | $4,600.20 | 63 | $289.85 | NORTH LITTLE ROCK |

| 71968 | $4,594.88 | 64 | $284.53 | ROYAL |

| 71674 | $4,594.04 | 65 | $283.69 | WATSON |

| 72368 | $4,591.96 | 66 | $281.61 | MORO |

| 72011 | $4,589.19 | 67 | $278.84 | BAUXITE |

| 71964 | $4,584.69 | 68 | $274.34 | PEARCY |

| 72022 | $4,580.77 | 69 | $270.42 | BRYANT |

| 71630 | $4,580.02 | 70 | $269.67 | ARKANSAS CITY |

| 71658 | $4,577.12 | 71 | $266.77 | MONTROSE |

| 71602 | $4,574.95 | 72 | $264.60 | WHITE HALL |

| 71901 | $4,572.52 | 73 | $262.17 | HOT SPRINGS NATIONAL PARK |

| 71913 | $4,572.28 | 74 | $261.93 | HOT SPRINGS NATIONAL PARK |

| 71661 | $4,571.98 | 75 | $261.63 | PARKDALE |

| 72120 | $4,567.48 | 76 | $257.13 | SHERWOOD |

| 72339 | $4,566.91 | 77 | $256.56 | GILMORE |

| 71677 | $4,564.61 | 78 | $254.26 | WINCHESTER |

| 71639 | $4,562.62 | 79 | $252.27 | DUMAS |

| 72122 | $4,561.67 | 80 | $251.32 | PARON |

| 72002 | $4,561.06 | 81 | $250.71 | ALEXANDER |

| 72129 | $4,560.68 | 82 | $250.33 | PRATTSVILLE |

| 71640 | $4,552.16 | 83 | $241.81 | EUDORA |

| 72379 | $4,548.54 | 84 | $238.19 | SNOW LAKE |

| 71653 | $4,548.12 | 85 | $237.77 | LAKE VILLAGE |

| 71655 | $4,545.26 | 86 | $234.91 | MONTICELLO |

| 72384 | $4,545.16 | 87 | $234.81 | TURRELL |

| 71643 | $4,543.26 | 88 | $232.91 | GOULD |

| 71929 | $4,537.95 | 89 | $227.60 | BISMARCK |

| 72128 | $4,537.66 | 90 | $227.31 | POYEN |

| 72364 | $4,536.38 | 91 | $226.03 | MARION |

| 71949 | $4,534.25 | 92 | $223.90 | JESSIEVILLE |

| 72087 | $4,530.70 | 93 | $220.35 | LONSDALE |

| 71662 | $4,529.47 | 94 | $219.12 | PICKENS |

| 72327 | $4,529.04 | 95 | $218.69 | CRAWFORDSVILLE |

| 71642 | $4,525.47 | 96 | $215.12 | FOUNTAIN HILL |

| 72116 | $4,519.61 | 97 | $209.26 | NORTH LITTLE ROCK |

| 72079 | $4,516.94 | 98 | $206.59 | JEFFERSON |

| 72152 | $4,516.10 | 99 | $205.75 | SHERRILL |

| 72340 | $4,515.88 | 100 | $205.53 | GOODWIN |

| 71854 | $4,513.94 | 101 | $203.59 | TEXARKANA |

| 72550 | $4,512.58 | 102 | $202.23 | LOCUST GROVE |

| 71671 | $4,508.56 | 103 | $198.21 | WARREN |

| 71837 | $4,507.34 | 104 | $196.99 | FOUKE |

| 72168 | $4,507.24 | 105 | $196.89 | TUCKER |

| 72301 | $4,505.95 | 106 | $195.60 | WEST MEMPHIS |

| 72373 | $4,501.51 | 107 | $191.16 | PARKIN |

| 72015 | $4,500.61 | 108 | $190.26 | BENTON |

| 71644 | $4,500.41 | 109 | $190.06 | GRADY |

| 72046 | $4,498.76 | 110 | $188.41 | ENGLAND |

| 72076 | $4,496.83 | 111 | $186.48 | JACKSONVILLE |

| 71652 | $4,496.55 | 112 | $186.20 | KINGSLAND |

| 72072 | $4,494.92 | 113 | $184.57 | HUMNOKE |

| 72019 | $4,492.40 | 114 | $182.05 | BENTON |

| 71670 | $4,491.50 | 115 | $181.15 | TILLAR |

| 72353 | $4,489.32 | 116 | $178.97 | LAMBROOK |

| 72331 | $4,487.73 | 117 | $177.38 | EARLE |

| 71826 | $4,485.15 | 118 | $174.80 | BRADLEY |

| 72677 | $4,483.05 | 119 | $172.70 | SUMMIT |

| 71748 | $4,481.25 | 120 | $170.90 | IVAN |

| 72352 | $4,481.15 | 121 | $170.80 | LA GRANGE |

| 72329 | $4,478.44 | 122 | $168.09 | DRIVER |

| 72377 | $4,478.24 | 123 | $167.89 | RIVERVALE |

| 72472 | $4,477.35 | 124 | $167.00 | TRUMANN |

| 72105 | $4,475.74 | 125 | $165.39 | JONES MILL |

| 71909 | $4,473.76 | 126 | $163.41 | HOT SPRINGS VILLAGE |

| 71933 | $4,472.41 | 127 | $162.06 | BONNERDALE |

| 72150 | $4,471.59 | 128 | $161.24 | SHERIDAN |

| 72396 | $4,471.18 | 129 | $160.83 | WYNNE |

| 72346 | $4,470.09 | 130 | $159.74 | HETH |

| 72175 | $4,466.41 | 131 | $156.06 | WABBASEKA |

| 71660 | $4,464.60 | 132 | $154.25 | NEW EDINBURG |

| 72527 | $4,462.88 | 133 | $152.53 | DESHA |

| 71638 | $4,459.82 | 134 | $149.47 | DERMOTT |

| 72004 | $4,458.72 | 135 | $148.37 | ALTHEIMER |

| 71747 | $4,454.98 | 136 | $144.63 | HUTTIG |

| 72568 | $4,454.88 | 137 | $144.53 | PLEASANT PLAINS |

| 71943 | $4,454.59 | 138 | $144.24 | GLENWOOD |

| 72391 | $4,445.11 | 139 | $134.76 | WEST RIDGE |

| 72167 | $4,442.94 | 140 | $132.59 | TRASKWOOD |

| 71935 | $4,441.21 | 141 | $130.86 | CADDO GAP |

| 72099 | $4,438.82 | 142 | $128.47 | LITTLE ROCK AIR FORCE BASE |

| 71952 | $4,436.58 | 143 | $126.23 | LANGLEY |

| 71647 | $4,434.94 | 144 | $124.59 | HERMITAGE |

| 71845 | $4,433.17 | 145 | $122.82 | LEWISVILLE |

| 71631 | $4,432.41 | 146 | $122.06 | BANKS |

| 71651 | $4,432.18 | 147 | $121.83 | JERSEY |

| 72084 | $4,426.56 | 148 | $116.21 | LEOLA |

| 71921 | $4,423.61 | 149 | $113.26 | AMITY |

| 72529 | $4,420.89 | 150 | $110.54 | CHEROKEE VILLAGE |

| 72386 | $4,420.76 | 151 | $110.41 | TYRONZA |

| 72387 | $4,420.36 | 152 | $110.01 | VANNDALE |

| 71665 | $4,418.71 | 153 | $108.36 | RISON |

| 72350 | $4,418.22 | 154 | $107.87 | JOINER |

| 72566 | $4,416.53 | 155 | $106.18 | PINEVILLE |

| 71765 | $4,415.74 | 156 | $105.39 | STRONG |

| 71861 | $4,414.24 | 157 | $103.89 | TAYLOR |

| 72467 | $4,413.74 | 158 | $103.39 | STATE UNIVERSITY |

| 72534 | $4,412.63 | 159 | $102.28 | FLORAL |

| 71950 | $4,408.57 | 160 | $98.22 | KIRBY |

| 72069 | $4,408.36 | 161 | $98.01 | HOLLY GROVE |

| 71840 | $4,407.42 | 162 | $97.07 | GENOA |

| 72313 | $4,407.30 | 163 | $96.95 | BASSETT |

| 71834 | $4,406.66 | 164 | $96.31 | DODDRIDGE |

| 72338 | $4,406.40 | 165 | $96.05 | FRENCHMANS BAYOU |

| 72395 | $4,400.92 | 166 | $90.57 | WILSON |

| 71750 | $4,400.43 | 167 | $90.08 | LAWSON |

| 72166 | $4,399.91 | 168 | $89.56 | TICHNOR |

| 72432 | $4,399.73 | 169 | $89.38 | HARRISBURG |

| 71749 | $4,398.46 | 170 | $88.11 | JUNCTION CITY |

| 72556 | $4,397.19 | 171 | $86.84 | MELBOURNE |

| 72016 | $4,397.16 | 172 | $86.81 | BIGELOW |

| 72470 | $4,395.24 | 173 | $84.89 | SUCCESS |

| 72513 | $4,394.06 | 174 | $83.71 | ASH FLAT |

| 71762 | $4,393.43 | 175 | $83.08 | SMACKOVER |

| 72365 | $4,393.07 | 176 | $82.72 | MARKED TREE |

| 72123 | $4,391.95 | 177 | $81.60 | PATTERSON |

| 71853 | $4,391.76 | 178 | $81.41 | OGDEN |

| 72325 | $4,391.01 | 179 | $80.66 | CLARKEDALE |

| 72057 | $4,390.64 | 180 | $80.29 | GRAPEVINE |

| 72392 | $4,389.38 | 181 | $79.03 | WHEATLEY |

| 72140 | $4,389.02 | 182 | $78.67 | SAINT CHARLES |

| 72104 | $4,388.93 | 183 | $78.58 | MALVERN |

| 71940 | $4,387.93 | 184 | $77.58 | DELIGHT |

| 71839 | $4,387.13 | 185 | $76.78 | GARLAND CITY |

| 72394 | $4,386.82 | 186 | $76.47 | WIDENER |

| 72567 | $4,386.06 | 187 | $75.71 | PLEASANT GROVE |

| 72321 | $4,385.93 | 188 | $75.58 | BURDETTE |

| 72501 | $4,384.83 | 189 | $74.48 | BATESVILLE |

| 71959 | $4,383.76 | 190 | $73.41 | NEWHOPE |

| 71770 | $4,383.55 | 191 | $73.20 | WALDO |

| 72561 | $4,383.38 | 192 | $73.03 | MOUNT PLEASANT |

| 71971 | $4,382.90 | 193 | $72.55 | UMPIRE |

| 72023 | $4,381.62 | 194 | $71.27 | CABOT |

| 72039 | $4,380.78 | 195 | $70.43 | DAMASCUS |

| 72530 | $4,380.43 | 196 | $70.08 | DRASCO |

| 72577 | $4,380.29 | 197 | $69.94 | SIDNEY |

| 71965 | $4,379.91 | 198 | $69.56 | PENCIL BLUFF |

| 72335 | $4,378.81 | 199 | $68.46 | FORREST CITY |

| 72521 | $4,378.31 | 200 | $67.96 | CAVE CITY |

| 72523 | $4,378.10 | 201 | $67.75 | CONCORD |

| 71725 | $4,376.51 | 202 | $66.16 | CARTHAGE |

| 72569 | $4,374.32 | 203 | $63.97 | POUGHKEEPSIE |

| 72422 | $4,374.23 | 204 | $63.88 | CORNING |

| 71831 | $4,372.11 | 205 | $61.76 | COLUMBUS |

| 71724 | $4,371.60 | 206 | $61.25 | CALION |

| 71860 | $4,370.98 | 207 | $60.63 | STAMPS |

| 72126 | $4,370.71 | 208 | $60.36 | PERRYVILLE |

| 71758 | $4,370.34 | 209 | $59.99 | MOUNT HOLLY |

| 72048 | $4,369.83 | 210 | $59.48 | ETHEL |

| 71832 | $4,369.45 | 211 | $59.10 | DE QUEEN |

| 72417 | $4,366.37 | 212 | $56.02 | BROOKLAND |

| 72475 | $4,365.95 | 213 | $55.60 | WALDENBURG |

| 71842 | $4,365.64 | 214 | $55.29 | HORATIO |

| 72137 | $4,364.56 | 215 | $54.21 | ROSE BUD |

| 72101 | $4,364.10 | 216 | $53.75 | MC CRORY |

| 72526 | $4,363.87 | 217 | $53.52 | CUSHMAN |

| 71753 | $4,363.78 | 218 | $53.43 | MAGNOLIA |

| 71957 | $4,363.52 | 219 | $53.17 | MOUNT IDA |

| 72579 | $4,363.51 | 220 | $53.16 | SULPHUR ROCK |

| 72522 | $4,362.74 | 221 | $52.39 | CHARLOTTE |

| 72007 | $4,361.83 | 222 | $51.48 | AUSTIN |

| 71969 | $4,361.56 | 223 | $51.21 | SIMS |

| 71764 | $4,359.89 | 224 | $49.54 | STEPHENS |

| 71923 | $4,359.45 | 225 | $49.10 | ARKADELPHIA |

| 72429 | $4,359.38 | 226 | $49.03 | FISHER |

| 71742 | $4,359.07 | 227 | $48.72 | FORDYCE |

| 72066 | $4,358.09 | 228 | $47.74 | HICKORY PLAINS |

| 72542 | $4,357.30 | 229 | $46.95 | HARDY |

| 72411 | $4,356.13 | 230 | $45.78 | BAY |

| 71958 | $4,355.75 | 231 | $45.40 | MURFREESBORO |

| 72517 | $4,354.93 | 232 | $44.58 | BROCKWELL |

| 72179 | $4,354.12 | 233 | $43.77 | WILBURN |

| 71730 | $4,354.09 | 234 | $43.74 | EL DORADO |

| 72540 | $4,352.91 | 235 | $42.56 | GUION |

| 72131 | $4,352.90 | 236 | $42.55 | QUITMAN |

| 71970 | $4,352.86 | 237 | $42.51 | STORY |

| 72401 | $4,352.85 | 238 | $42.50 | JONESBORO |

| 71836 | $4,352.65 | 239 | $42.30 | FOREMAN |

| 72372 | $4,352.49 | 240 | $42.14 | PALESTINE |

| 72572 | $4,351.39 | 241 | $41.04 | SAFFELL |

| 72052 | $4,351.33 | 242 | $40.98 | GARNER |

| 72024 | $4,350.95 | 243 | $40.60 | CARLISLE |

| 72441 | $4,349.96 | 244 | $39.61 | MC DOUGAL |

| 71961 | $4,349.58 | 245 | $39.23 | ODEN |

| 71941 | $4,348.71 | 246 | $38.36 | DONALDSON |

| 72421 | $4,348.12 | 247 | $37.77 | CASH |

| 71960 | $4,347.73 | 248 | $37.38 | NORMAN |

| 72326 | $4,346.01 | 249 | $35.66 | COLT |

| 71922 | $4,343.99 | 250 | $33.64 | ANTOINE |

| 72324 | $4,343.15 | 251 | $32.80 | CHERRY VALLEY |

| 72182 | $4,342.75 | 252 | $32.40 | WRIGHT |

| 72478 | $4,341.24 | 253 | $30.89 | WARM SPRINGS |

| 72424 | $4,340.45 | 254 | $30.10 | DATTO |

| 72086 | $4,340.18 | 255 | $29.83 | LONOKE |

| 72021 | $4,340.03 | 256 | $29.68 | BRINKLEY |

| 72562 | $4,339.82 | 257 | $29.47 | NEWARK |

| 72074 | $4,339.20 | 258 | $28.85 | HUNTER |

| 72136 | $4,339.09 | 259 | $28.74 | ROMANCE |

| 72571 | $4,338.89 | 260 | $28.54 | ROSIE |

| 71833 | $4,338.75 | 261 | $28.40 | DIERKS |

| 71820 | $4,337.63 | 262 | $27.28 | ALLEENE |

| 72425 | $4,337.46 | 263 | $27.11 | DELAPLAINE |

| 72106 | $4,337.22 | 264 | $26.87 | MAYFLOWER |

| 71801 | $4,336.42 | 265 | $26.07 | HOPE |

| 72165 | $4,335.90 | 266 | $25.55 | THIDA |

| 71847 | $4,333.67 | 267 | $23.32 | MC CASKILL |

| 72584 | $4,333.25 | 268 | $22.90 | VIOLET HILL |

| 72347 | $4,332.54 | 269 | $22.19 | HICKORY RIDGE |

| 72435 | $4,330.24 | 270 | $19.89 | KNOBEL |

| 72469 | $4,329.82 | 271 | $19.47 | STRAWBERRY |

| 72173 | $4,328.41 | 272 | $18.06 | VILONIA |

| 72443 | $4,326.39 | 273 | $16.04 | MARMADUKE |

| 72479 | $4,326.17 | 274 | $15.82 | WEINER |

| 72139 | $4,325.99 | 275 | $15.64 | RUSSELL |

| 71744 | $4,325.90 | 276 | $15.55 | HAMPTON |

| 71862 | $4,323.06 | 277 | $12.71 | WASHINGTON |

| 72085 | $4,321.75 | 278 | $11.40 | LETONA |

| 71751 | $4,321.58 | 279 | $11.23 | LOUANN |

| 72051 | $4,320.63 | 280 | $10.28 | FOX |

| 71962 | $4,319.40 | 281 | $9.05 | OKOLONA |

| 71825 | $4,319.21 | 282 | $8.86 | BLEVINS |

| 71932 | $4,318.53 | 283 | $8.18 | BOARD CAMP |

| 72450 | $4,317.69 | 284 | $7.34 | PARAGOULD |

| 72464 | $4,317.36 | 285 | $7.01 | SAINT FRANCIS |

| 72573 | $4,317.27 | 286 | $6.92 | SAGE |

| 71859 | $4,316.40 | 287 | $6.05 | SARATOGA |

| 71942 | $4,316.30 | 288 | $5.95 | FRIENDSHIP |

| 71999 | $4,315.86 | 289 | $5.51 | ARKADELPHIA |

| 72404 | $4,313.33 | 290 | $2.98 | JONESBORO |

| 72456 | $4,312.53 | 291 | $2.18 | POLLARD |

| 71822 | $4,312.26 | 292 | $1.91 | ASHDOWN |

| 72416 | $4,311.60 | 293 | $1.25 | BONO |

| 71841 | $4,309.61 | 295 | -$0.74 | GILLHAM |

| 72532 | $4,309.49 | 296 | -$0.86 | EVENING SHADE |

| 72585 | $4,308.81 | 297 | -$1.54 | WIDEMAN |

| 71740 | $4,308.40 | 298 | -$1.95 | EMERSON |

| 71745 | $4,308.35 | 299 | -$2.00 | HARRELL |

| 72005 | $4,307.61 | 300 | -$2.74 | AMAGON |

| 71835 | $4,307.22 | 301 | -$3.13 | EMMET |

| 72528 | $4,307.16 | 302 | -$3.19 | DOLPH |

| 72111 | $4,306.81 | 303 | -$3.54 | MOUNT VERNON |

| 72067 | $4,306.44 | 304 | -$3.91 | HIGDEN |

| 71838 | $4,306.03 | 305 | -$4.32 | FULTON |

| 72014 | $4,304.05 | 306 | -$6.30 | BEEDEVILLE |

| 72143 | $4,302.94 | 307 | -$7.41 | SEARCY |

| 72453 | $4,302.64 | 308 | -$7.71 | PEACH ORCHARD |

| 72564 | $4,302.61 | 309 | -$7.74 | OIL TROUGH |

| 72176 | $4,302.33 | 310 | -$8.02 | WARD |

| 72457 | $4,301.58 | 311 | -$8.77 | PORTIA |

| 72449 | $4,301.16 | 312 | -$9.19 | O KEAN |

| 72466 | $4,300.43 | 313 | -$9.92 | SMITHVILLE |

| 72860 | $4,300.43 | 313 | -$9.92 | ROVER |

| 72412 | $4,300.15 | 315 | -$10.20 | BEECH GROVE |

| 72414 | $4,300.06 | 316 | -$10.29 | BLACK OAK |

| 72436 | $4,299.71 | 317 | -$10.64 | LAFE |

| 72036 | $4,299.57 | 318 | -$10.78 | COTTON PLANT |

| 72354 | $4,299.49 | 319 | -$10.86 | LEPANTO |

| 72038 | $4,298.59 | 320 | -$11.76 | CROCKETTS BLUFF |

| 72459 | $4,298.37 | 321 | -$11.98 | RAVENDEN |

| 72515 | $4,297.89 | 322 | -$12.46 | BEXAR |

| 71846 | $4,297.73 | 323 | -$12.62 | LOCKESBURG |

| 72081 | $4,297.50 | 324 | -$12.85 | JUDSONIA |

| 71763 | $4,297.44 | 325 | -$12.91 | SPARKMAN |

| 72482 | $4,296.92 | 326 | -$13.43 | WILLIFORD |

| 72430 | $4,296.38 | 327 | -$13.97 | GREENWAY |

| 72444 | $4,296.17 | 328 | -$14.18 | MAYNARD |

| 72073 | $4,295.21 | 329 | -$15.14 | HUMPHREY |

| 71920 | $4,294.85 | 330 | -$15.50 | ALPINE |

| 71866 | $4,294.16 | 331 | -$16.19 | WINTHROP |

| 71726 | $4,293.61 | 332 | -$16.74 | CHIDESTER |

| 71766 | $4,293.44 | 333 | -$16.91 | THORNTON |

| 72554 | $4,292.78 | 334 | -$17.57 | MAMMOTH SPRING |

| 72474 | $4,292.01 | 335 | -$18.34 | WALCOTT |

| 72645 | $4,291.49 | 336 | -$18.86 | LESLIE |

| 71828 | $4,290.30 | 337 | -$20.05 | CALE |

| 71827 | $4,290.04 | 338 | -$20.31 | BUCKNER |

| 72040 | $4,289.31 | 339 | -$21.04 | DES ARC |

| 72555 | $4,289.12 | 340 | -$21.23 | MARCELLA |

| 72030 | $4,288.71 | 341 | -$21.64 | CLEVELAND |

| 71752 | $4,288.19 | 342 | -$22.16 | MC NEIL |

| 72828 | $4,287.99 | 343 | -$22.36 | BRIGGSVILLE |

| 72047 | $4,287.50 | 344 | -$22.85 | ENOLA |

| 72127 | $4,287.25 | 345 | -$23.10 | PLUMERVILLE |

| 72539 | $4,287.25 | 345 | -$23.10 | GLENCOE |

| 71998 | $4,287.01 | 347 | -$23.34 | ARKADELPHIA |

| 72583 | $4,286.94 | 348 | -$23.41 | VIOLA |

| 72533 | $4,286.54 | 349 | -$23.81 | FIFTY SIX |

| 72055 | $4,286.47 | 350 | -$23.88 | GILLETT |

| 72440 | $4,284.84 | 351 | -$25.51 | LYNN |

| 71864 | $4,283.36 | 352 | -$26.99 | WILLISVILLE |

| 71865 | $4,281.85 | 353 | -$28.50 | WILTON |

| 71728 | $4,281.00 | 354 | -$29.35 | CURTIS |

| 72428 | $4,279.58 | 355 | -$30.77 | ETOWAH |

| 72447 | $4,279.47 | 356 | -$30.88 | MONETTE |

| 71855 | $4,279.31 | 357 | -$31.04 | OZAN |

| 72310 | $4,276.96 | 358 | -$33.39 | ARMOREL |

| 72178 | $4,276.22 | 359 | -$34.13 | WEST POINT |

| 72351 | $4,275.97 | 360 | -$34.38 | KEISER |

| 72536 | $4,275.78 | 361 | -$34.57 | FRANKLIN |

| 72512 | $4,274.75 | 362 | -$35.60 | HORSESHOE BEND |

| 72587 | $4,274.56 | 363 | -$35.79 | WISEMAN |

| 71701 | $4,274.00 | 364 | -$36.35 | CAMDEN |

| 72581 | $4,273.67 | 365 | -$36.68 | TUMBLING SHOALS |

| 72025 | $4,272.04 | 366 | -$38.31 | CASA |

| 72663 | $4,272.04 | 366 | -$38.31 | ONIA |

| 71852 | $4,271.28 | 368 | -$39.07 | NASHVILLE |

| 72112 | $4,270.58 | 369 | -$39.77 | NEWPORT |

| 72006 | $4,270.50 | 370 | -$39.85 | AUGUSTA |

| 71772 | $4,270.26 | 371 | -$40.09 | WHELEN SPRINGS |

| 72543 | $4,269.73 | 372 | -$40.62 | HEBER SPRINGS |

| 71743 | $4,269.02 | 373 | -$41.33 | GURDON |

| 72010 | $4,267.46 | 374 | -$42.89 | BALD KNOB |

| 72576 | $4,267.17 | 375 | -$43.18 | SALEM |

| 72026 | $4,266.55 | 376 | -$43.80 | CASSCOE |

| 72465 | $4,266.14 | 377 | -$44.21 | SEDGWICK |

| 71858 | $4,265.53 | 378 | -$44.82 | ROSSTON |

| 72061 | $4,265.36 | 379 | -$44.99 | GUY |

| 71851 | $4,264.91 | 380 | -$45.44 | MINERAL SPRINGS |

| 72107 | $4,264.21 | 381 | -$46.14 | MENIFEE |

| 71720 | $4,264.13 | 382 | -$46.22 | BEARDEN |

| 72058 | $4,263.55 | 383 | -$46.80 | GREENBRIER |

| 72413 | $4,262.90 | 384 | -$47.45 | BIGGERS |

| 72358 | $4,261.87 | 385 | -$48.48 | LUXORA |

| 72013 | $4,260.89 | 386 | -$49.46 | BEE BRANCH |

| 72020 | $4,260.78 | 387 | -$49.57 | BRADFORD |

| 72075 | $4,260.78 | 387 | -$49.57 | JACKSONPORT |

| 72680 | $4,260.18 | 389 | -$50.17 | TIMBO |

| 72431 | $4,253.84 | 390 | -$56.51 | GRUBBS |

| 72560 | $4,252.72 | 391 | -$57.63 | MOUNTAIN VIEW |

| 72538 | $4,252.67 | 392 | -$57.68 | GEPP |

| 72520 | $4,252.39 | 393 | -$57.96 | CAMP |

| 72031 | $4,252.08 | 394 | -$58.27 | CLINTON |

| 72082 | $4,252.08 | 394 | -$58.27 | KENSETT |

| 72410 | $4,252.02 | 396 | -$58.33 | ALICIA |

| 72330 | $4,251.26 | 397 | -$59.09 | DYESS |

| 72044 | $4,250.62 | 398 | -$59.73 | EDGEMONT |

| 71721 | $4,249.70 | 399 | -$60.65 | BEIRNE |

| 72455 | $4,249.67 | 400 | -$60.68 | POCAHONTAS |

| 72546 | $4,249.43 | 401 | -$60.92 | IDA |

| 72102 | $4,248.61 | 402 | -$61.74 | MC RAE |

| 72437 | $4,248.21 | 403 | -$62.14 | LAKE CITY |

| 72857 | $4,244.81 | 404 | -$65.54 | PLAINVIEW |

| 72083 | $4,243.64 | 405 | -$66.71 | KEO |

| 72565 | $4,242.75 | 406 | -$67.60 | OXFORD |

| 72524 | $4,241.46 | 407 | -$68.89 | CORD |

| 71722 | $4,239.50 | 408 | -$70.85 | BLUFF CITY |

| 72419 | $4,237.32 | 409 | -$73.03 | CARAWAY |

| 71972 | $4,236.43 | 410 | -$73.92 | VANDERVOORT |

| 72519 | $4,235.40 | 411 | -$74.95 | CALICO ROCK |

| 72064 | $4,234.06 | 412 | -$76.29 | HAZEN |

| 71857 | $4,232.80 | 413 | -$77.55 | PRESCOTT |

| 72473 | $4,232.43 | 414 | -$77.92 | TUCKERMAN |

| 72130 | $4,232.35 | 415 | -$78.00 | PRIM |

| 72134 | $4,231.73 | 416 | -$78.62 | ROE |

| 72029 | $4,230.90 | 417 | -$79.45 | CLARENDON |

| 72041 | $4,230.20 | 418 | -$80.15 | DE VALLS BLUFF |

| 72442 | $4,228.40 | 419 | -$81.95 | MANILA |

| 72461 | $4,227.87 | 420 | -$82.48 | RECTOR |

| 72471 | $4,226.92 | 421 | -$83.43 | SWIFTON |

| 72838 | $4,223.51 | 422 | -$86.84 | GRAVELLY |

| 72042 | $4,220.47 | 423 | -$89.88 | DE WITT |

| 72438 | $4,219.63 | 424 | -$90.72 | LEACHVILLE |

| 72121 | $4,219.61 | 425 | -$90.74 | PANGBURN |

| 72027 | $4,219.54 | 426 | -$90.81 | CENTER RIDGE |

| 72458 | $4,218.84 | 427 | -$91.51 | POWHATAN |

| 72476 | $4,218.14 | 428 | -$92.21 | WALNUT RIDGE |

| 72068 | $4,216.60 | 429 | -$93.75 | HIGGINSON |

| 72149 | $4,215.47 | 430 | -$94.88 | SEARCY |

| 72012 | $4,213.67 | 431 | -$96.68 | BEEBE |

| 72059 | $4,212.98 | 432 | -$97.37 | GREGORY |

| 71944 | $4,211.68 | 433 | -$98.67 | GRANNIS |

| 72827 | $4,211.68 | 433 | -$98.67 | BLUFFTON |

| 72578 | $4,210.70 | 435 | -$99.65 | STURKIE |

| 72017 | $4,209.07 | 436 | -$101.28 | BISCOE |

| 72445 | $4,208.69 | 437 | -$101.66 | MINTURN |

| 72181 | $4,205.64 | 438 | -$104.71 | WOOSTER |

| 72153 | $4,203.90 | 439 | -$106.45 | SHIRLEY |

| 72639 | $4,203.86 | 440 | -$106.49 | HARRIET |

| 72531 | $4,202.56 | 441 | -$107.79 | ELIZABETH |

| 72157 | $4,201.58 | 442 | -$108.77 | SPRINGFIELD |

| 72170 | $4,200.16 | 443 | -$110.19 | ULM |

| 72657 | $4,199.75 | 444 | -$110.60 | TIMBO |

| 72926 | $4,198.80 | 445 | -$111.55 | BOLES |

| 72156 | $4,197.90 | 446 | -$112.45 | SOLGOHACHIA |

| 72426 | $4,197.17 | 447 | -$113.18 | DELL |

| 72370 | $4,196.67 | 448 | -$113.68 | OSCEOLA |

| 72841 | $4,195.98 | 449 | -$114.37 | HARVEY |

| 72315 | $4,195.93 | 450 | -$114.42 | BLYTHEVILLE |

| 72950 | $4,195.17 | 451 | -$115.18 | PARKS |

| 72035 | $4,189.97 | 452 | -$120.38 | CONWAY |

| 72433 | $4,189.84 | 453 | -$120.51 | HOXIE |

| 72003 | $4,189.17 | 454 | -$121.18 | ALMYRA |

| 72629 | $4,189.05 | 455 | -$121.30 | DENNARD |

| 72853 | $4,185.56 | 456 | -$124.79 | OLA |

| 72948 | $4,184.77 | 457 | -$125.58 | NATURAL DAM |

| 72824 | $4,183.92 | 458 | -$126.43 | BELLEVILLE |

| 72060 | $4,182.50 | 459 | -$127.85 | GRIFFITHVILLE |

| 72088 | $4,182.28 | 460 | -$128.07 | FAIRFIELD BAY |

| 72160 | $4,180.15 | 461 | -$130.20 | STUTTGART |

| 72460 | $4,179.30 | 462 | -$131.05 | RAVENDEN SPRINGS |

| 72045 | $4,173.50 | 463 | -$136.85 | EL PASO |

| 71973 | $4,172.26 | 464 | -$138.09 | WICKES |

| 72955 | $4,168.22 | 465 | -$142.13 | UNIONTOWN |

| 72833 | $4,167.00 | 466 | -$143.35 | DANVILLE |

| 72670 | $4,165.51 | 467 | -$144.84 | PONCA |

| 72032 | $4,164.98 | 468 | -$145.37 | CONWAY |

| 72141 | $4,164.37 | 469 | -$145.98 | SCOTLAND |

| 72454 | $4,163.33 | 470 | -$147.02 | PIGGOTT |

| 72125 | $4,163.32 | 471 | -$147.03 | PERRY |

| 72434 | $4,162.22 | 472 | -$148.13 | IMBODEN |

| 72063 | $4,159.89 | 473 | -$150.46 | HATTIEVILLE |

| 72944 | $4,157.56 | 474 | -$152.79 | MANSFIELD |

| 72415 | $4,154.89 | 475 | -$155.46 | BLACK ROCK |

| 72952 | $4,153.70 | 476 | -$156.65 | RUDY |

| 71937 | $4,149.70 | 477 | -$160.65 | COVE |

| 72080 | $4,147.51 | 478 | -$162.84 | JERUSALEM |

| 72001 | $4,144.29 | 479 | -$166.06 | ADONA |

| 72834 | $4,143.98 | 480 | -$166.37 | DARDANELLE |

| 72034 | $4,141.28 | 481 | -$169.07 | CONWAY |

| 72070 | $4,139.51 | 482 | -$170.84 | HOUSTON |

| 72110 | $4,129.02 | 483 | -$181.33 | MORRILTON |

| 72947 | $4,125.55 | 484 | -$184.80 | MULBERRY |

| 71953 | $4,125.41 | 485 | -$184.94 | MENA |

| 72760 | $4,124.55 | 486 | -$185.80 | SAINT PAUL |

| 71945 | $4,121.33 | 487 | -$189.02 | HATFIELD |

| 72958 | $4,119.59 | 488 | -$190.76 | WALDRON |

| 72946 | $4,117.05 | 489 | -$193.30 | MOUNTAINBURG |

| 72945 | $4,111.32 | 490 | -$199.03 | MIDLAND |

| 72934 | $4,109.80 | 491 | -$200.55 | CHESTER |

| 72851 | $4,106.36 | 492 | -$203.99 | NEW BLAINE |

| 72776 | $4,096.92 | 493 | -$213.43 | WITTER |

| 72623 | $4,094.09 | 494 | -$216.26 | CLARKRIDGE |

| 72648 | $4,093.30 | 495 | -$217.05 | MARBLE FALLS |

| 72638 | $4,091.69 | 496 | -$218.66 | GREEN FOREST |

| 72655 | $4,084.91 | 497 | -$225.44 | MOUNT JUDEA |

| 72730 | $4,082.17 | 498 | -$228.18 | FARMINGTON |

| 72921 | $4,082.14 | 499 | -$228.21 | ALMA |

| 72641 | $4,076.90 | 500 | -$233.45 | JASPER |

| 72940 | $4,075.82 | 501 | -$234.53 | HUNTINGTON |

| 72611 | $4,074.69 | 502 | -$235.66 | ALPENA |

| 72701 | $4,073.71 | 503 | -$236.64 | FAYETTEVILLE |

| 72956 | $4,073.61 | 504 | -$236.74 | VAN BUREN |

| 72650 | $4,073.49 | 505 | -$236.86 | MARSHALL |

| 72703 | $4,069.50 | 506 | -$240.85 | FAYETTEVILLE |

| 72686 | $4,069.39 | 507 | -$240.96 | WITTS SPRINGS |

| 72740 | $4,069.22 | 508 | -$241.13 | HUNTSVILLE |

| 72679 | $4,069.00 | 509 | -$241.35 | TILLY |

| 72846 | $4,068.62 | 510 | -$241.73 | LAMAR |

| 72632 | $4,068.20 | 511 | -$242.15 | EUREKA SPRINGS |

| 72683 | $4,066.30 | 512 | -$244.05 | VENDOR |

| 72721 | $4,062.33 | 513 | -$248.02 | COMBS |

| 72932 | $4,061.79 | 514 | -$248.56 | CEDARVILLE |

| 72842 | $4,058.48 | 515 | -$251.87 | HAVANA |

| 72669 | $4,055.96 | 516 | -$254.39 | PINDALL |

| 72738 | $4,049.14 | 517 | -$261.21 | HINDSVILLE |

| 72901 | $4,044.87 | 518 | -$265.48 | FORT SMITH |

| 72904 | $4,044.84 | 519 | -$265.51 | FORT SMITH |

| 72928 | $4,043.76 | 520 | -$266.59 | BRANCH |

| 72640 | $4,042.48 | 521 | -$267.87 | HASTY |

| 72662 | $4,035.80 | 522 | -$274.55 | OMAHA |

| 72938 | $4,033.74 | 523 | -$276.61 | HARTFORD |

| 72668 | $4,032.18 | 524 | -$278.17 | PEEL |

| 72660 | $4,030.61 | 525 | -$279.74 | OAK GROVE |

| 72717 | $4,029.83 | 526 | -$280.52 | CANEHILL |

| 72544 | $4,028.79 | 527 | -$281.56 | HENDERSON |

| 72718 | $4,028.39 | 528 | -$281.96 | CAVE SPRINGS |

| 72856 | $4,027.89 | 529 | -$282.46 | PELSOR |

| 72727 | $4,027.29 | 530 | -$283.06 | ELKINS |

| 72843 | $4,026.28 | 531 | -$284.07 | HECTOR |

| 72737 | $4,024.93 | 532 | -$285.42 | GREENLAND |

| 72916 | $4,021.77 | 533 | -$288.58 | FORT SMITH |

| 72774 | $4,021.49 | 534 | -$288.86 | WEST FORK |

| 72802 | $4,021.12 | 535 | -$289.23 | RUSSELLVILLE |

| 72762 | $4,018.82 | 536 | -$291.53 | SPRINGDALE |

| 72704 | $4,018.66 | 537 | -$291.69 | FAYETTEVILLE |

| 72858 | $4,018.63 | 538 | -$291.72 | POTTSVILLE |

| 72927 | $4,017.37 | 539 | -$292.98 | BOONEVILLE |

| 72933 | $4,015.50 | 540 | -$294.85 | CHARLESTON |

| 72616 | $4,014.47 | 541 | -$295.88 | BERRYVILLE |

| 72863 | $4,013.74 | 542 | -$296.61 | SCRANTON |

| 72764 | $4,013.67 | 543 | -$296.68 | SPRINGDALE |

| 72845 | $4,012.64 | 544 | -$297.71 | KNOXVILLE |

| 72930 | $4,012.59 | 545 | -$297.76 | CECIL |

| 72628 | $4,011.57 | 546 | -$298.78 | DEER |

| 72736 | $4,011.25 | 547 | -$299.10 | GRAVETTE |

| 72837 | $4,011.25 | 547 | -$299.10 | DOVER |

| 72835 | $4,010.14 | 549 | -$300.21 | DELAWARE |

| 72659 | $4,009.98 | 550 | -$300.37 | NORFORK |

| 72739 | $4,008.74 | 551 | -$301.61 | HIWASSE |

| 72624 | $4,008.26 | 552 | -$302.09 | COMPTON |

| 72852 | $4,007.37 | 553 | -$302.98 | OARK |

| 72751 | $4,003.33 | 554 | -$307.02 | PEA RIDGE |

| 72617 | $4,003.29 | 555 | -$307.06 | BIG FLAT |

| 72753 | $4,002.89 | 556 | -$307.46 | PRAIRIE GROVE |

| 72756 | $4,001.09 | 557 | -$309.26 | ROGERS |

| 72666 | $4,000.84 | 558 | -$309.51 | PARTHENON |

| 72823 | $4,000.46 | 559 | -$309.89 | ATKINS |

| 72773 | $4,000.18 | 560 | -$310.17 | WESLEY |

| 72854 | $3,999.19 | 561 | -$311.16 | OZONE |

| 72923 | $3,997.34 | 562 | -$313.01 | BARLING |

| 72749 | $3,997.10 | 563 | -$313.25 | MORROW |

| 72744 | $3,996.66 | 564 | -$313.69 | LINCOLN |

| 72908 | $3,993.42 | 565 | -$316.93 | FORT SMITH |

| 72631 | $3,991.15 | 566 | -$319.20 | EUREKA SPRINGS |

| 72685 | $3,990.73 | 567 | -$319.62 | WESTERN GROVE |

| 72865 | $3,989.62 | 568 | -$320.73 | SUBIACO |

| 72769 | $3,989.32 | 569 | -$321.03 | SUMMERS |

| 72752 | $3,988.29 | 570 | -$322.06 | PETTIGREW |

| 72672 | $3,988.20 | 571 | -$322.15 | PYATT |

| 72732 | $3,986.79 | 572 | -$323.56 | GARFIELD |

| 72537 | $3,986.11 | 573 | -$324.24 | GAMALIEL |

| 72959 | $3,986.03 | 574 | -$324.32 | WINSLOW |

| 72936 | $3,984.76 | 575 | -$325.59 | GREENWOOD |

| 72714 | $3,984.36 | 576 | -$325.99 | BELLA VISTA |

| 72675 | $3,983.75 | 577 | -$326.60 | SAINT JOE |

| 72722 | $3,982.71 | 578 | -$327.64 | DECATUR |

| 72715 | $3,980.31 | 579 | -$330.04 | BELLA VISTA |

| 72903 | $3,978.88 | 580 | -$331.47 | FORT SMITH |

| 72729 | $3,977.95 | 581 | -$332.40 | EVANSVILLE |

| 72855 | $3,976.22 | 582 | -$334.13 | PARIS |

| 72615 | $3,972.77 | 583 | -$337.58 | BERGMAN |

| 72734 | $3,970.07 | 584 | -$340.28 | GENTRY |

| 72742 | $3,966.97 | 585 | -$343.38 | KINGSTON |

| 72651 | $3,966.71 | 586 | -$343.64 | MIDWAY |

| 72937 | $3,966.18 | 587 | -$344.17 | HACKETT |

| 72735 | $3,964.76 | 588 | -$345.59 | GOSHEN |

| 72733 | $3,961.68 | 589 | -$348.67 | GATEWAY |

| 72847 | $3,956.64 | 590 | -$353.71 | LONDON |

| 72682 | $3,955.26 | 591 | -$355.09 | VALLEY SPRINGS |

| 72801 | $3,950.72 | 592 | -$359.63 | RUSSELLVILLE |

| 72758 | $3,948.67 | 593 | -$361.68 | ROGERS |

| 72949 | $3,948.34 | 594 | -$362.01 | OZARK |

| 72821 | $3,947.99 | 595 | -$362.36 | ALTUS |

| 72636 | $3,947.30 | 596 | -$363.05 | GILBERT |

| 72712 | $3,946.77 | 597 | -$363.58 | BENTONVILLE |

| 72747 | $3,945.68 | 598 | -$364.67 | MAYSVILLE |

| 72943 | $3,942.79 | 599 | -$367.56 | MAGAZINE |

| 72820 | $3,938.24 | 600 | -$372.11 | ALIX |

| 72839 | $3,937.26 | 601 | -$373.09 | HAGARVILLE |

| 72601 | $3,932.87 | 602 | -$377.48 | HARRISON |

| 72642 | $3,931.86 | 603 | -$378.49 | LAKEVIEW |

| 72644 | $3,931.50 | 604 | -$378.85 | LEAD HILL |

| 72830 | $3,930.46 | 605 | -$379.89 | CLARKSVILLE |

| 72661 | $3,930.02 | 606 | -$380.33 | OAKLAND |

| 72719 | $3,929.68 | 607 | -$380.67 | CENTERTON |

| 72832 | $3,929.25 | 608 | -$381.10 | COAL HILL |

| 72745 | $3,921.21 | 609 | -$389.14 | LOWELL |

| 72840 | $3,918.96 | 610 | -$391.39 | HARTMAN |

| 72941 | $3,917.45 | 611 | -$392.90 | LAVACA |

| 72951 | $3,916.23 | 612 | -$394.12 | RATCLIFF |

| 72658 | $3,915.02 | 613 | -$395.33 | NORFORK |

| 72768 | $3,911.90 | 614 | -$398.45 | SULPHUR SPRINGS |

| 72633 | $3,909.12 | 615 | -$401.23 | EVERTON |

| 72653 | $3,908.72 | 616 | -$401.63 | MOUNTAIN HOME |

| 72635 | $3,906.40 | 617 | -$403.95 | GASSVILLE |

| 72761 | $3,899.87 | 618 | -$410.48 | SILOAM SPRINGS |

| 72619 | $3,887.16 | 619 | -$423.19 | BULL SHOALS |

| 72634 | $3,873.45 | 620 | -$436.90 | FLIPPIN |

| 72687 | $3,866.44 | 621 | -$443.91 | YELLVILLE |

| 72626 | $3,838.69 | 622 | -$471.66 | COTTER |

What are the most expensive/least expensive rates by city in Arkansas?

Most Expensive/Least Expensive Rates by City - Arkansas

| City | Average Annual Rate |

|---|---|

| COTTER | $3,675.93 |

| YELLVILLE | $3,701.73 |

| FLIPPIN | $3,706.66 |

| SILOAM SPRINGS | $3,714.85 |

| BULL SHOALS | $3,719.26 |

| LAVACA | $3,727.89 |

| SULPHUR SPRINGS | $3,730.83 |

| LOWELL | $3,732.84 |

| MOUNTAIN HOME | $3,733.81 |

| GASSVILLE | $3,737.78 |

| EVERTON | $3,740.11 |

| CENTERTON | $3,740.12 |

| RATCLIFF | $3,746.65 |

| LAKEVIEW | $3,750.39 |

| HARTMAN | $3,752.32 |

| BENTONVILLE | $3,756.99 |

| MAYSVILLE | $3,760.25 |

| HARRISON | $3,760.28 |

| OAKLAND | $3,760.68 |

| COAL HILL | $3,761.40 |

| ALIX | $3,763.31 |

| LEAD HILL | $3,764.03 |

| CLARKSVILLE | $3,764.38 |

| HAGARVILLE | $3,766.14 |

| MAGAZINE | $3,766.31 |

| GATEWAY | $3,768.92 |

| GOSHEN | $3,773.59 |

| HACKETT | $3,775.02 |

| OZARK | $3,775.81 |

| GENTRY | $3,777.59 |

| ALTUS | $3,778.37 |

| GILBERT | $3,778.47 |

| ROGERS | $3,779.69 |

| MIDWAY | $3,786.15 |

| GREENWOOD | $3,788.31 |

| VALLEY SPRINGS | $3,788.34 |

| LONDON | $3,788.68 |

| NORFORK | $3,789.77 |

| DECATUR | $3,792.36 |

| BELLA VISTA | $3,792.51 |

| EVANSVILLE | $3,792.99 |

| GARFIELD | $3,793.96 |

| KINGSTON | $3,794.09 |

| BERGMAN | $3,794.88 |

| BARLING | $3,798.08 |

| WINSLOW | $3,803.91 |

| SUMMERS | $3,804.01 |

| LINCOLN | $3,805.26 |

| PARIS | $3,805.98 |

| PEA RIDGE | $3,810.74 |

| MORROW | $3,811.51 |

| RUSSELLVILLE | $3,812.21 |

| GAMALIEL | $3,813.14 |

| FORT SMITH | $3,813.54 |

| PYATT | $3,815.53 |

| SAINT JOE | $3,815.59 |

| PRAIRIE GROVE | $3,816.07 |

| PETTIGREW | $3,817.02 |

| HIWASSE | $3,820.14 |

| SUBIACO | $3,820.19 |

| WESTERN GROVE | $3,820.75 |

| WESLEY | $3,821.96 |

| GRAVETTE | $3,825.09 |

| SPRINGDALE | $3,826.46 |

| CHARLESTON | $3,828.13 |

| WEST FORK | $3,828.56 |

| OZONE | $3,828.88 |

| ATKINS | $3,828.94 |

| BIG FLAT | $3,829.04 |

| BERRYVILLE | $3,829.31 |

| PARTHENON | $3,829.81 |

| CAVE SPRINGS | $3,833.38 |

| CECIL | $3,835.65 |

| BOONEVILLE | $3,837.27 |

| OARK | $3,838.35 |

| GREENLAND | $3,838.46 |

| DOVER | $3,838.64 |

| DELAWARE | $3,840.29 |

| COMPTON | $3,840.63 |

| DEER | $3,842.72 |

| SCRANTON | $3,842.80 |

| ELKINS | $3,843.47 |

| CANEHILL | $3,844.04 |

| KNOXVILLE | $3,844.41 |

| EUREKA SPRINGS | $3,844.52 |

| POTTSVILLE | $3,847.38 |

| HARTFORD | $3,850.24 |

| PEEL | $3,850.55 |

| HENDERSON | $3,855.55 |

| HECTOR | $3,855.81 |

| OAK GROVE | $3,856.90 |

| PELSOR | $3,858.60 |

| FAYETTEVILLE | $3,861.27 |

| OMAHA | $3,861.27 |

| BRANCH | $3,861.77 |

| CEDARVILLE | $3,862.21 |

| HINDSVILLE | $3,863.57 |

| HASTY | $3,870.90 |

| VAN BUREN | $3,876.27 |

| COMBS | $3,879.99 |

| ALMA | $3,882.75 |

| HUNTINGTON | $3,884.38 |

| PINDALL | $3,885.12 |

| HUNTSVILLE | $3,886.97 |

| HAVANA | $3,889.58 |

| FARMINGTON | $3,890.26 |

| TILLY | $3,890.86 |

| LAMAR | $3,893.18 |

| ALPENA | $3,893.59 |

| VENDOR | $3,895.67 |

| WITTS SPRINGS | $3,896.04 |

| MOUNT JUDEA | $3,903.55 |

| JASPER | $3,905.27 |

| MARSHALL | $3,905.47 |

| CLARKRIDGE | $3,909.73 |

| GREEN FOREST | $3,912.51 |

| WITTER | $3,918.25 |

| MIDLAND | $3,918.96 |

| MARBLE FALLS | $3,921.34 |

| CHESTER | $3,925.17 |

| NEW BLAINE | $3,926.14 |

| MOUNTAINBURG | $3,929.74 |

| MULBERRY | $3,931.69 |

| MORRILTON | $3,940.34 |

| WALDRON | $3,943.41 |

| SAINT PAUL | $3,946.03 |

| HATFIELD | $3,947.54 |

| MENA | $3,955.98 |

| HOUSTON | $3,956.09 |

| RUDY | $3,956.39 |

| CONWAY | $3,956.96 |

| ADONA | $3,957.08 |

| PIGGOTT | $3,962.19 |

| JERUSALEM | $3,964.22 |

| EL PASO | $3,968.00 |

| BLACK ROCK | $3,968.65 |

| DARDANELLE | $3,969.59 |

| UNIONTOWN | $3,970.21 |

| HATTIEVILLE | $3,974.36 |

| MANSFIELD | $3,975.03 |

| COVE | $3,975.95 |

| IMBODEN | $3,976.25 |

| PERRY | $3,980.21 |

| STUTTGART | $3,981.55 |

| SCOTLAND | $3,982.05 |

| GRIFFITHVILLE | $3,983.23 |

| PONCA | $3,983.66 |

| RAVENDEN SPRINGS | $3,985.96 |

| ALMYRA | $3,989.59 |

| BLYTHEVILLE | $3,991.65 |

| NATURAL DAM | $3,992.81 |

| DANVILLE | $3,993.79 |

| WOOSTER | $3,994.77 |

| ULM | $3,996.48 |

| OSCEOLA | $3,996.61 |

| DELL | $3,997.00 |

| WICKES | $3,998.59 |

| HOXIE | $4,000.00 |

| FAIRFIELD BAY | $4,002.60 |

| SOLGOHACHIA | $4,005.88 |

| BEEBE | $4,006.27 |

| BELLEVILLE | $4,007.32 |

| LEACHVILLE | $4,008.50 |

| DENNARD | $4,009.96 |

| CARAWAY | $4,010.65 |

| BISCOE | $4,011.75 |

| SPRINGFIELD | $4,012.83 |

| MANILA | $4,013.01 |

| OLA | $4,015.16 |

| HIGGINSON | $4,016.31 |

| DE WITT | $4,018.57 |

| RECTOR | $4,018.76 |

| MINTURN | $4,019.14 |

| PARKS | $4,019.82 |

| HARVEY | $4,020.76 |

| SHIRLEY | $4,021.57 |

| GREGORY | $4,021.90 |

| ELIZABETH | $4,023.62 |

| WALNUT RIDGE | $4,024.13 |

| DE VALLS BLUFF | $4,024.90 |

| PANGBURN | $4,024.93 |

| BOLES | $4,026.54 |

| HAZEN | $4,026.55 |

| HARRIET | $4,027.03 |

| STURKIE | $4,027.33 |

| CLARENDON | $4,029.70 |

| LAKE CITY | $4,029.70 |

| POWHATAN | $4,030.37 |

| KEO | $4,030.58 |

| BLUFFTON | $4,032.91 |

| CENTER RIDGE | $4,033.28 |

| GRANNIS | $4,033.79 |

| SWIFTON | $4,034.86 |

| TUCKERMAN | $4,037.03 |

| ROE | $4,037.85 |

| MC RAE | $4,040.32 |

| TIMBO | $4,044.17 |

| GRAVELLY | $4,044.67 |

| DYESS | $4,047.96 |

| CORD | $4,048.63 |

| PRIM | $4,049.19 |

| POCAHONTAS | $4,051.89 |

| VANDERVOORT | $4,051.95 |

| KENSETT | $4,053.36 |

| GUY | $4,053.83 |

| SEARCY | $4,054.58 |

| PRESCOTT | $4,055.81 |

| GREENBRIER | $4,057.14 |

| LUXORA | $4,057.43 |

| MONETTE | $4,058.13 |

| ALICIA | $4,058.32 |

| GRUBBS | $4,059.56 |

| ETOWAH | $4,061.12 |

| JACKSONPORT | $4,061.31 |

| OXFORD | $4,061.67 |

| IDA | $4,062.03 |

| CALICO ROCK | $4,062.32 |

| CASSCOE | $4,062.53 |

| EDGEMONT | $4,063.60 |

| BEE BRANCH | $4,064.16 |

| WEST POINT | $4,064.71 |

| CLINTON | $4,064.91 |

| MENIFEE | $4,065.41 |

| KEISER | $4,066.53 |

| PLAINVIEW | $4,066.85 |

| BLUFF CITY | $4,067.73 |

| BRADFORD | $4,067.74 |

| GEPP | $4,068.32 |

| CAMP | $4,069.16 |

| ENOLA | $4,069.47 |

| SEDGWICK | $4,070.35 |

| BIGGERS | $4,070.60 |

| ARMOREL | $4,070.80 |

| MOUNTAIN VIEW | $4,071.01 |

| BLACK OAK | $4,073.09 |

| WALCOTT | $4,074.34 |

| NEWPORT | $4,074.50 |

| BALD KNOB | $4,077.27 |

| HEBER SPRINGS | $4,078.00 |

| AUGUSTA | $4,078.23 |

| WARD | $4,079.23 |

| GILLETT | $4,079.64 |

| BEIRNE | $4,082.83 |

| TUMBLING SHOALS | $4,083.46 |

| SALEM | $4,085.37 |

| DES ARC | $4,086.07 |

| PLUMERVILLE | $4,087.64 |

| ROSSTON | $4,088.10 |

| ONIA | $4,088.11 |

| FRANKLIN | $4,088.67 |

| HUMPHREY | $4,088.75 |

| HORSESHOE BEND | $4,089.98 |

| WISEMAN | $4,090.11 |

| WHELEN SPRINGS | $4,091.54 |

| CASA | $4,091.83 |

| MOUNT VERNON | $4,092.60 |

| LYNN | $4,093.60 |

| LEPANTO | $4,094.01 |

| LAFE | $4,094.57 |

| MINERAL SPRINGS | $4,096.05 |

| GREENWAY | $4,096.77 |

| MARCELLA | $4,097.05 |

| BEARDEN | $4,097.81 |

| PARAGOULD | $4,098.11 |

| GURDON | $4,098.90 |

| PORTIA | $4,099.55 |

| COTTON PLANT | $4,099.70 |

| CROCKETTS BLUFF | $4,099.73 |

| CLEVELAND | $4,099.78 |

| BEECH GROVE | $4,100.53 |

| NASHVILLE | $4,101.58 |

| GLENCOE | $4,101.73 |

| FIFTY SIX | $4,102.16 |

| O KEAN | $4,102.24 |

| CAMDEN | $4,102.55 |

| PEACH ORCHARD | $4,102.70 |

| LONOKE | $4,103.61 |

| BONO | $4,103.63 |

| MAYNARD | $4,103.75 |

| VILONIA | $4,103.85 |

| JUDSONIA | $4,103.88 |

| WILLIFORD | $4,104.47 |

| RAVENDEN | $4,105.16 |

| AMAGON | $4,105.59 |

| JONESBORO | $4,107.14 |

| BRIGGSVILLE | $4,107.19 |

| OZAN | $4,107.57 |

| POLLARD | $4,108.16 |

| VIOLA | $4,108.27 |

| MAMMOTH SPRING | $4,108.73 |

| MARMADUKE | $4,110.26 |

| SMITHVILLE | $4,110.68 |

| WILLISVILLE | $4,110.98 |

| EVENING SHADE | $4,111.44 |

| WILTON | $4,111.53 |

| MAYFLOWER | $4,111.71 |

| CURTIS | $4,112.91 |

| OIL TROUGH | $4,113.19 |

| LESLIE | $4,113.80 |

| MC NEIL | $4,115.33 |

| BEXAR | $4,115.38 |

| BEEDEVILLE | $4,116.08 |

| BUCKNER | $4,117.06 |

| CALE | $4,117.52 |

| LETONA | $4,117.72 |

| HIGDEN | $4,117.82 |

| ALPINE | $4,118.45 |

| SAINT FRANCIS | $4,120.15 |

| BAY | $4,121.23 |

| BOARD CAMP | $4,121.32 |

| WRIGHT | $4,121.61 |

| WEINER | $4,122.16 |

| ROVER | $4,122.46 |

| DOLPH | $4,122.63 |

| CHIDESTER | $4,123.73 |

| WINTHROP | $4,124.16 |

| SPARKMAN | $4,124.98 |

| THORNTON | $4,124.99 |

| RUSSELL | $4,125.07 |

| LOCKESBURG | $4,125.34 |

| WIDEMAN | $4,125.45 |

| ROMANCE | $4,125.54 |

| BRINKLEY | $4,125.66 |

| FRIENDSHIP | $4,127.16 |

| GILLHAM | $4,127.77 |

| KNOBEL | $4,128.07 |

| ASHDOWN | $4,128.50 |

| EMMET | $4,129.66 |

| SAGE | $4,130.20 |

| FULTON | $4,131.06 |

| COLT | $4,132.16 |

| EMERSON | $4,132.35 |

| CARLISLE | $4,133.63 |

| AUSTIN | $4,134.10 |

| HICKORY RIDGE | $4,134.89 |

| FOX | $4,135.83 |

| WARM SPRINGS | $4,136.39 |

| ARKADELPHIA | $4,137.41 |

| DELAPLAINE | $4,138.24 |

| HARRELL | $4,138.26 |

| GARNER | $4,138.36 |

| CHERRY VALLEY | $4,138.82 |

| PALESTINE | $4,138.89 |

| SARATOGA | $4,139.39 |

| HUNTER | $4,139.52 |

| BROOKLAND | $4,139.64 |

| STRAWBERRY | $4,139.72 |

| DATTO | $4,139.98 |

| CASH | $4,140.09 |

| HICKORY PLAINS | $4,142.02 |

| THIDA | $4,142.87 |

| ROSIE | $4,143.83 |

| NEWARK | $4,145.68 |

| VIOLET HILL | $4,146.15 |

| OKOLONA | $4,146.61 |

| LOUANN | $4,146.62 |

| BLEVINS | $4,147.12 |

| QUITMAN | $4,147.92 |

| MC DOUGAL | $4,148.51 |

| WALDENBURG | $4,149.91 |

| WASHINGTON | $4,149.92 |

| SAFFELL | $4,151.60 |

| ROSE BUD | $4,151.71 |

| HOPE | $4,152.39 |

| HAMPTON | $4,153.21 |

| FORREST CITY | $4,153.88 |

| FISHER | $4,154.86 |

| CABOT | $4,157.53 |

| WILBURN | $4,158.20 |

| MC CASKILL | $4,158.32 |

| DAMASCUS | $4,160.26 |

| ALLEENE | $4,160.96 |

| DONALDSON | $4,162.71 |

| NORMAN | $4,164.49 |

| GUION | $4,165.28 |

| HARDY | $4,165.37 |

| CHARLOTTE | $4,166.31 |

| ANTOINE | $4,167.39 |

| STORY | $4,167.51 |

| ETHEL | $4,167.60 |

| WIDENER | $4,168.23 |

| WHEATLEY | $4,168.40 |

| BROCKWELL | $4,168.43 |

| DIERKS | $4,169.43 |

| FOREMAN | $4,170.57 |

| SULPHUR ROCK | $4,171.11 |

| ODEN | $4,171.13 |

| CUSHMAN | $4,171.17 |

| MC CRORY | $4,171.31 |

| BURDETTE | $4,171.84 |

| CLARKEDALE | $4,172.64 |

| CORNING | $4,173.80 |

| SIMS | $4,176.06 |

| MOUNT IDA | $4,176.62 |

| GRAPEVINE | $4,176.87 |

| CAVE CITY | $4,177.61 |

| PERRYVILLE | $4,177.89 |

| EL DORADO | $4,178.47 |

| FORDYCE | $4,178.48 |

| SAINT CHARLES | $4,180.87 |

| MAGNOLIA | $4,182.60 |

| MALVERN | $4,183.46 |

| TICHNOR | $4,183.96 |

| POUGHKEEPSIE | $4,184.46 |

| MARKED TREE | $4,184.60 |

| MURFREESBORO | $4,184.60 |

| HORATIO | $4,185.35 |

| CONCORD | $4,185.60 |

| BATESVILLE | $4,185.68 |

| DE QUEEN | $4,185.68 |

| MOUNT HOLLY | $4,185.88 |

| CARTHAGE | $4,186.21 |

| HARRISBURG | $4,186.68 |

| GARLAND CITY | $4,187.38 |

| SIDNEY | $4,188.22 |

| STAMPS | $4,189.06 |

| DRASCO | $4,189.94 |

| STATE UNIVERSITY | $4,190.43 |

| CALION | $4,190.51 |

| STEPHENS | $4,190.66 |

| PLEASANT GROVE | $4,192.76 |

| COLUMBUS | $4,192.85 |

| WILSON | $4,193.07 |

| SUCCESS | $4,193.83 |

| MOUNT PLEASANT | $4,194.19 |

| PATTERSON | $4,194.77 |

| PENCIL BLUFF | $4,195.59 |

| ASH FLAT | $4,198.05 |

| BASSETT | $4,199.15 |

| FRENCHMANS BAYOU | $4,199.15 |

| WALDO | $4,199.99 |

| BIGELOW | $4,201.32 |

| OGDEN | $4,203.87 |

| HOLLY GROVE | $4,205.59 |

| GENOA | $4,206.98 |

| UMPIRE | $4,207.15 |

| NEWHOPE | $4,208.24 |

| FLORAL | $4,209.82 |

| SMACKOVER | $4,210.09 |

| MELBOURNE | $4,210.37 |

| JOINER | $4,211.04 |

| DELIGHT | $4,211.90 |

| LITTLE ROCK AIR FORCE BASE | $4,212.41 |

| DODDRIDGE | $4,212.74 |

| TYRONZA | $4,214.88 |

| LEOLA | $4,218.27 |

| SUMMIT | $4,219.69 |

| VANNDALE | $4,220.12 |

| PINEVILLE | $4,221.41 |

| JUNCTION CITY | $4,221.91 |

| KIRBY | $4,224.18 |

| LAWSON | $4,224.30 |

| RISON | $4,224.73 |

| CHEROKEE VILLAGE | $4,226.68 |

| TAYLOR | $4,229.17 |

| TRASKWOOD | $4,230.06 |

| WEST RIDGE | $4,230.92 |

| STRONG | $4,235.27 |

| ALTHEIMER | $4,235.40 |

| HUMNOKE | $4,236.09 |

| SHERIDAN | $4,240.41 |

| AMITY | $4,240.74 |

| WABBASEKA | $4,241.28 |

| LEWISVILLE | $4,247.19 |

| CADDO GAP | $4,250.88 |

| LANGLEY | $4,252.86 |

| TRUMANN | $4,254.21 |

| JERSEY | $4,254.78 |

| JACKSONVILLE | $4,255.86 |

| ENGLAND | $4,256.42 |

| HERMITAGE | $4,257.02 |

| HETH | $4,257.43 |

| BANKS | $4,258.47 |

| WYNNE | $4,258.84 |

| DESHA | $4,260.33 |

| JONES MILL | $4,260.57 |

| PLEASANT PLAINS | $4,260.62 |

| DRIVER | $4,261.40 |

| HOT SPRINGS VILLAGE | $4,262.17 |

| LA GRANGE | $4,263.41 |

| EARLE | $4,264.95 |

| RIVERVALE | $4,266.81 |

| DERMOTT | $4,269.21 |

| LAMBROOK | $4,270.99 |

| GLENWOOD | $4,271.16 |

| BONNERDALE | $4,271.32 |

| BENTON | $4,272.20 |

| HUTTIG | $4,276.65 |

| NEW EDINBURG | $4,276.86 |

| TUCKER | $4,279.80 |

| WEST MEMPHIS | $4,284.61 |

| GOODWIN | $4,285.59 |

| PARKIN | $4,286.72 |

| TILLAR | $4,289.53 |

| GRADY | $4,289.86 |

| JEFFERSON | $4,290.20 |

| SHERRILL | $4,290.97 |

| IVAN | $4,295.79 |

| BRADLEY | $4,297.97 |

| FOUKE | $4,299.14 |

| LONSDALE | $4,300.42 |

| TEXARKANA | $4,302.64 |

| CRAWFORDSVILLE | $4,303.32 |

| LOCUST GROVE | $4,308.99 |

| MARION | $4,310.91 |

| POYEN | $4,311.68 |

| KINGSLAND | $4,311.87 |

| PICKENS | $4,316.95 |

| SHERWOOD | $4,318.37 |

| JESSIEVILLE | $4,319.67 |

| TURRELL | $4,323.47 |

| ALEXANDER | $4,324.68 |

| BISMARCK | $4,324.82 |

| SNOW LAKE | $4,326.46 |

| GILMORE | $4,329.53 |

| FOUNTAIN HILL | $4,330.49 |

| WARREN | $4,330.68 |

| PRATTSVILLE | $4,332.53 |

| WHITE HALL | $4,333.70 |

| BRYANT | $4,335.55 |

| PARON | $4,338.14 |

| GOULD | $4,340.30 |

| HOT SPRINGS NATIONAL PARK | $4,342.75 |

| MONTICELLO | $4,344.26 |

| DUMAS | $4,351.53 |

| LAKE VILLAGE | $4,352.05 |

| EUDORA | $4,358.38 |

| WINCHESTER | $4,360.04 |

| PEARCY | $4,362.07 |

| BAUXITE | $4,362.21 |

| MORO | $4,369.60 |

| REYDELL | $4,371.05 |

| ROYAL | $4,371.56 |

| MOSCOW | $4,374.66 |

| SWEET HOME | $4,376.40 |

| PARKDALE | $4,376.79 |

| WATSON | $4,381.23 |

| ARKANSAS CITY | $4,382.04 |

| MONTROSE | $4,383.44 |

| MOUNTAIN PINE | $4,383.58 |

| YORKTOWN | $4,397.30 |

| HAYNES | $4,400.52 |

| BRICKEYS | $4,401.91 |

| AUBREY | $4,402.16 |

| HUGHES | $4,406.93 |

| WRIGHTSVILLE | $4,409.46 |

| WILMOT | $4,412.43 |

| SCOTT | $4,416.88 |

| MC GEHEE | $4,423.92 |

| STAR CITY | $4,425.08 |

| PROCTOR | $4,431.21 |

| MAUMELLE | $4,433.50 |

| REDFIELD | $4,435.04 |

| PORTLAND | $4,437.39 |

| WABASH | $4,440.61 |

| CROSSETT | $4,441.80 |

| WILMAR | $4,442.85 |

| WOODSON | $4,442.86 |

| NORTH LITTLE ROCK | $4,456.07 |

| PINE BLUFF | $4,457.35 |

| MABELVALE | $4,467.04 |

| HENSLEY | $4,472.74 |

| ELAINE | $4,478.23 |

| MELLWOOD | $4,492.81 |

| HAMBURG | $4,493.87 |

| MARIANNA | $4,494.46 |

| CRUMROD | $4,508.83 |

| COY | $4,554.52 |

| TURNER | $4,554.58 |

| REYNO | $4,558.66 |

| ROLAND | $4,559.09 |

| MARVELL | $4,559.19 |

| POPLAR GROVE | $4,570.51 |

| CALDWELL | $4,591.51 |

| BARTON | $4,594.10 |

| BEN LOMOND | $4,602.55 |

| ONEIDA | $4,603.82 |

| NORPHLET | $4,632.65 |

| LEXA | $4,660.25 |

| TUPELO | $4,681.81 |

| WEST HELENA | $4,698.75 |

| LITTLE ROCK | $4,715.90 |

| HELENA | $4,725.99 |

| EDMONDSON | $4,759.29 |

Read more: Gateway Car Insurance Review

What are the best Arkansas car insurance companies?

Usually, we choose a car insurance carrier on the basis of auto insurance quotes, without much thought to the insurers’ reputation in the market. Factors, such as financial ratings, consumer complaints, claims satisfaction history, are rarely considered by consumers before buying insurance.

Do remember that in the event of an unfortunate accident, how well your insurer handles the insurance claims settlement process from the first notice of loss (FNOL) to the final settlement depends on these above-mentioned factors.

So who are the best Arkansas auto insurance companies? Don’t worry, we have done the necessary research for you!In the next few sections, we would talk about these factors and provide facts about each insurance carrier in your state to help you make an informed decision.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the financial ratings of leading insurance carriers in Arkansas?

The financial strength of your insurance provider determines whether they would be able to settle a claim in case you’re involved in an accident. On the macro level, rating organizations assess the balance sheet of insurers to ensure the long-term financial viability of their operations.

Arkansas Top Insurance Providers and Their A.M. Best Ratings

| Leading Insurance Providers | A.M. Best Rating |

|---|---|

| A+ | |

| A | |

| A | |

| A++ | |

| A |

| A+ |

| A+ | |

| B | |

| A++ | |

| A++ |

Before buying an insurance policy, checking the A.M. Best Rating would give you some peace of mind for later. A.M. ratings of A+ to B mean superior to fair financial strength and anything below B isn’t financially viable, ranging from marginal to poor.

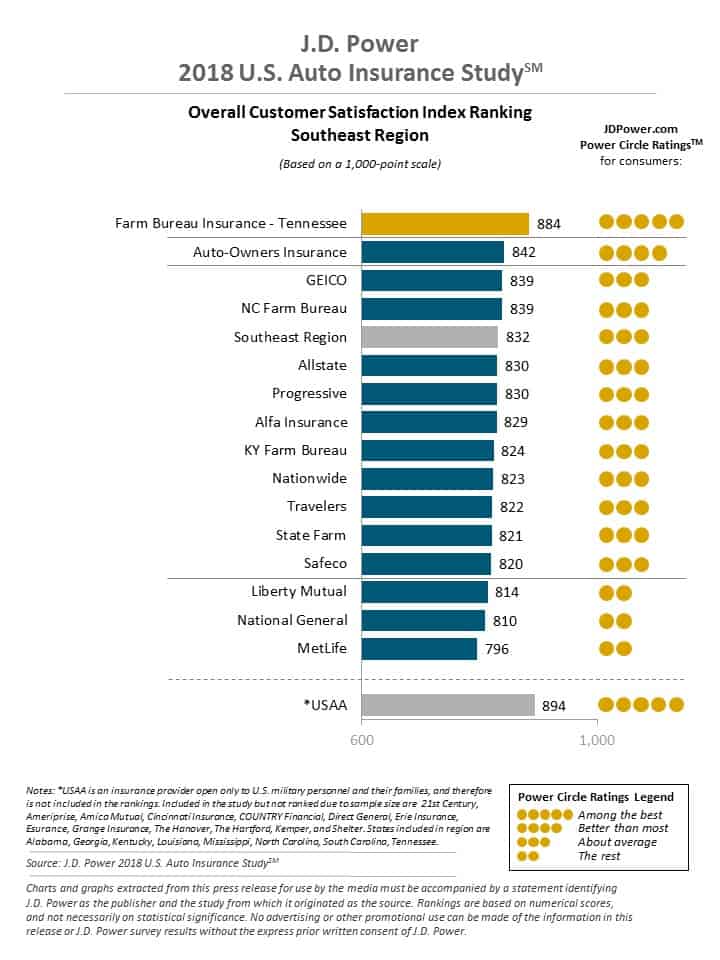

What are the customer satisfaction ratings of insurance providers in Arkansas?

Customer satisfaction surveys are the true indicator of a company’s services. Financial ratings might not always be accurate, but customer ratings would tell you if an insurer acknowledges its obligations when a claim is filed.

Insurance in the digital era – Customers these days rate insurers on the basis of their digital interaction, omnichannel presence, transparency in premium hikes, usage-based insurance adoption etc. It’s not about just cost anymore.

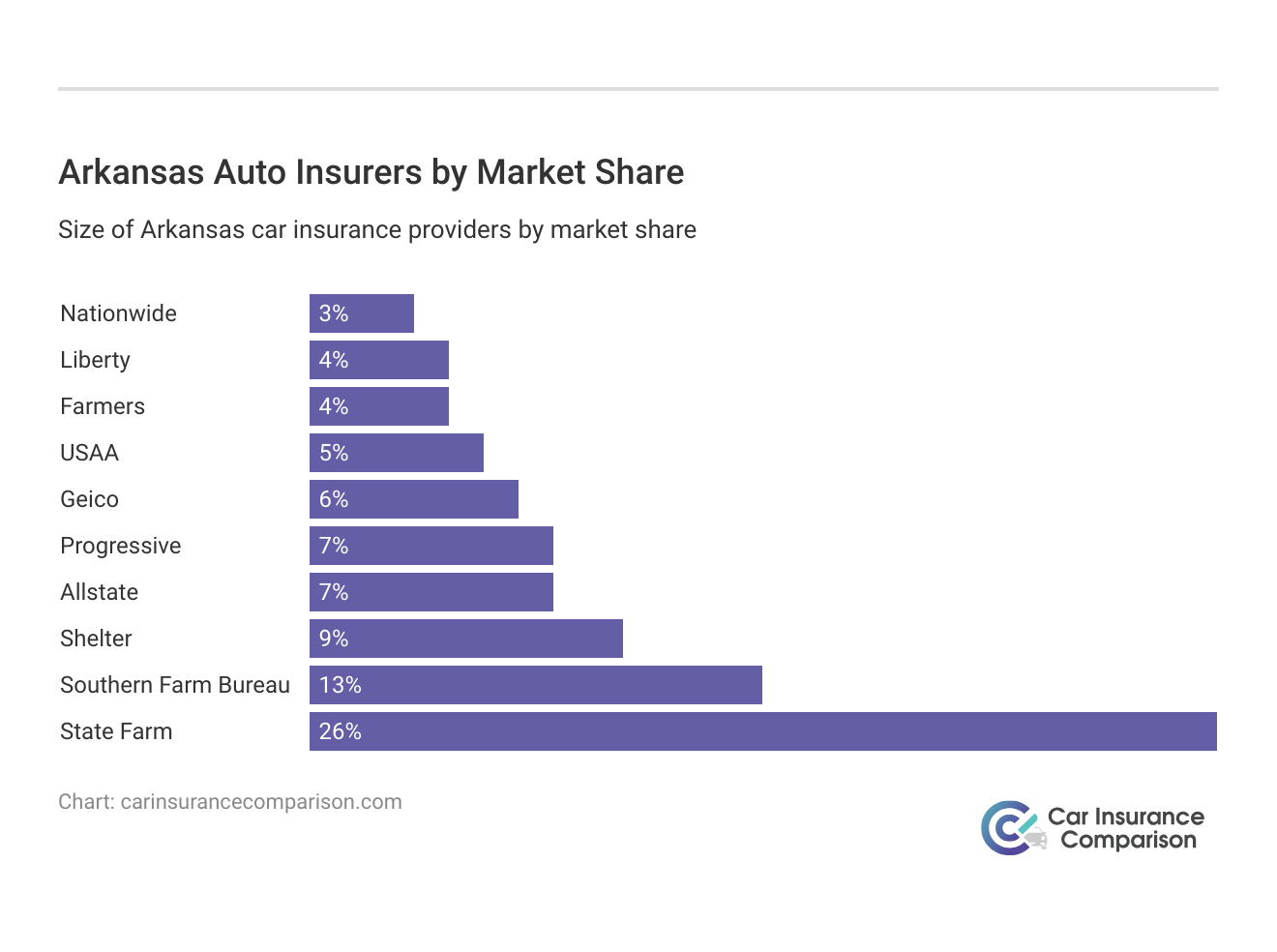

What are the leading car insurance companies in Arkansas (by market share)?

Leading Car Insurers in Arkansas

| Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| $141,053 | 47.21% | 7.24% | |

| $79,776 | 52.42% | 4.10% | |

| $248,792 | 69.46% | 12.78% |

| $109,940 | 70.69% | 5.65% | |

| $80,245 | 61.30% | 4.12% |

| $57,506 | 51.80% | 2.95% |

| $139,855 | 58.71% | 7.18% | |

| $167,424 | 67.43% | 8.60% |

| $500,195 | 66.99% | 25.69% | |

| $92,071 | 73.14% | 4.73% |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

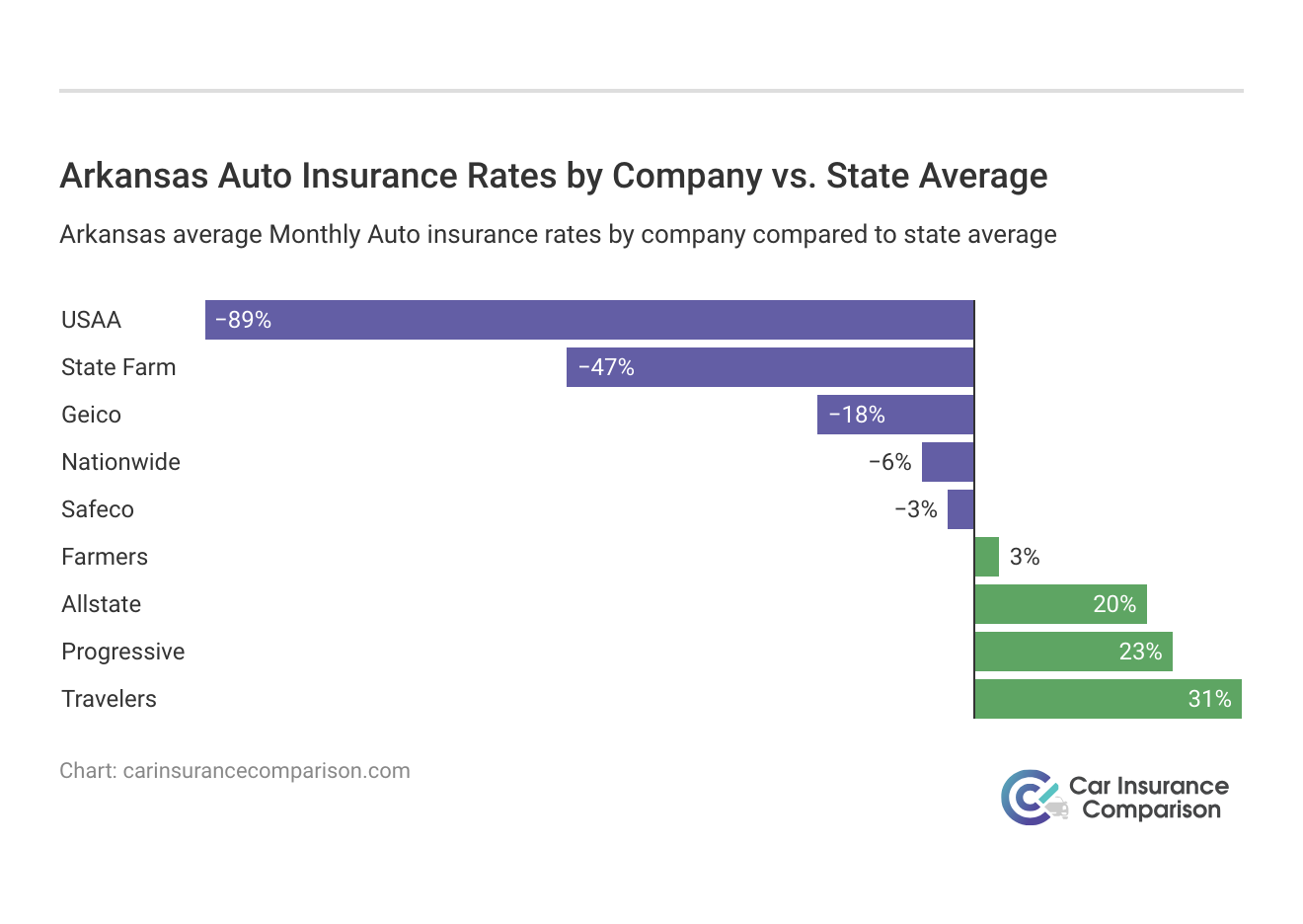

What are the cheapest Arkansas car insurance coverage rates by company?

Now that you’re aware of the leading insurance providers in Arkansas, you must be curious about the average premiums charged by providers in the state.

Arkansas's Car Insurance Rates by Provider| Insurance Company | Average (Annual) | Compared to State Average (-/+) | Percentage Change (-/+) |

|---|---|---|---|

| $5,150.03 | $1,038.33 | 20.16% | |

| $4,257.88 | $146.18 | 3.43% | |

| $3,484.63 | -$627.07 | -18.00% | |

| $4,005.48 | -$106.22 | -2.65% | |

| $3,861.78 | -$249.92 | -6.47% |

| $5,312.09 | $1,200.39 | 22.60% | |

| $2,789.02 | -$1,322.68 | -47.42% | |

| $5,973.33 | $1,861.63 | 31.17% | |

| $2,171.05 | -$1,940.65 | -89.39% |

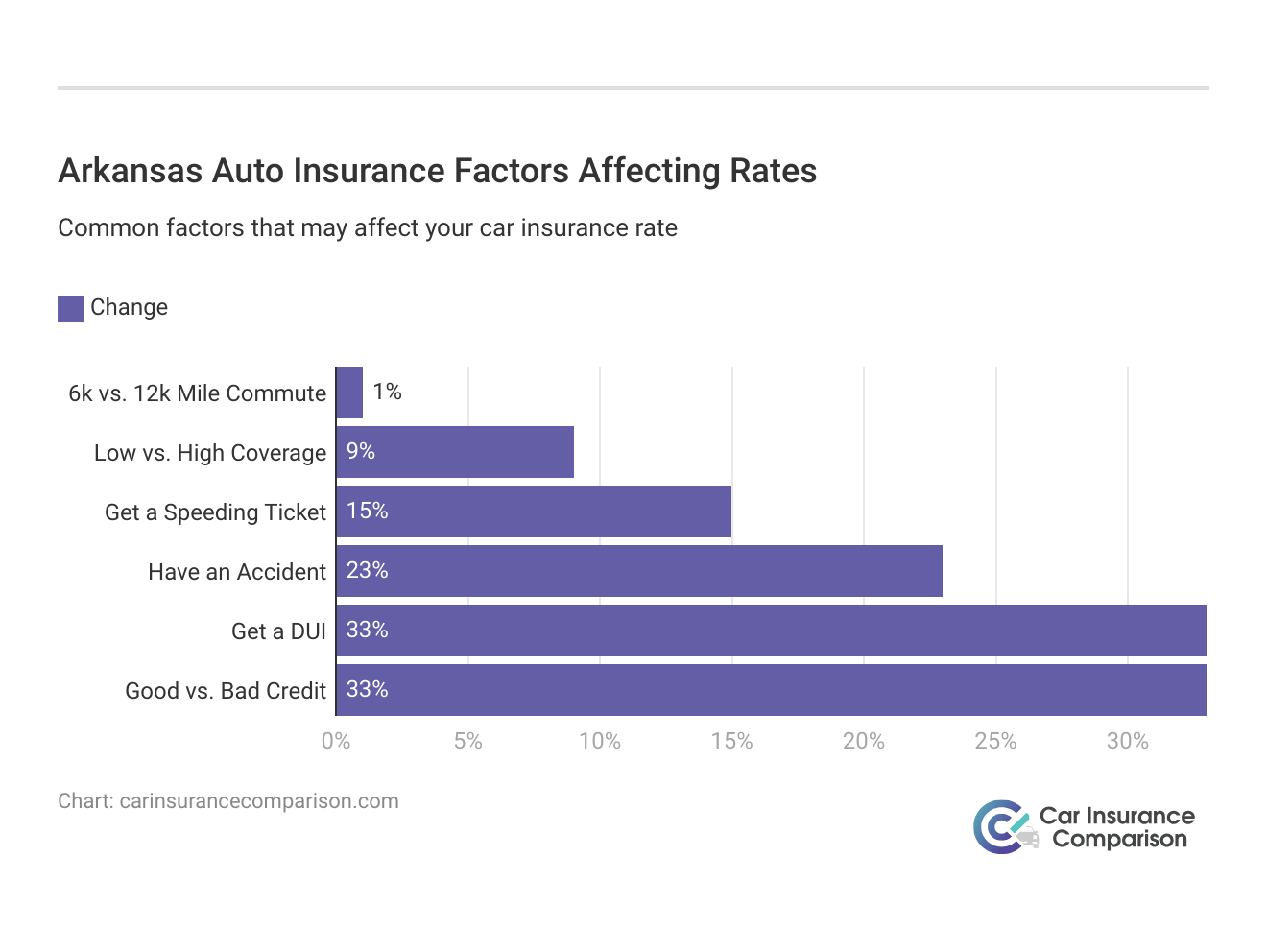

What are the best Arkansas average annual premiums by commute rate?

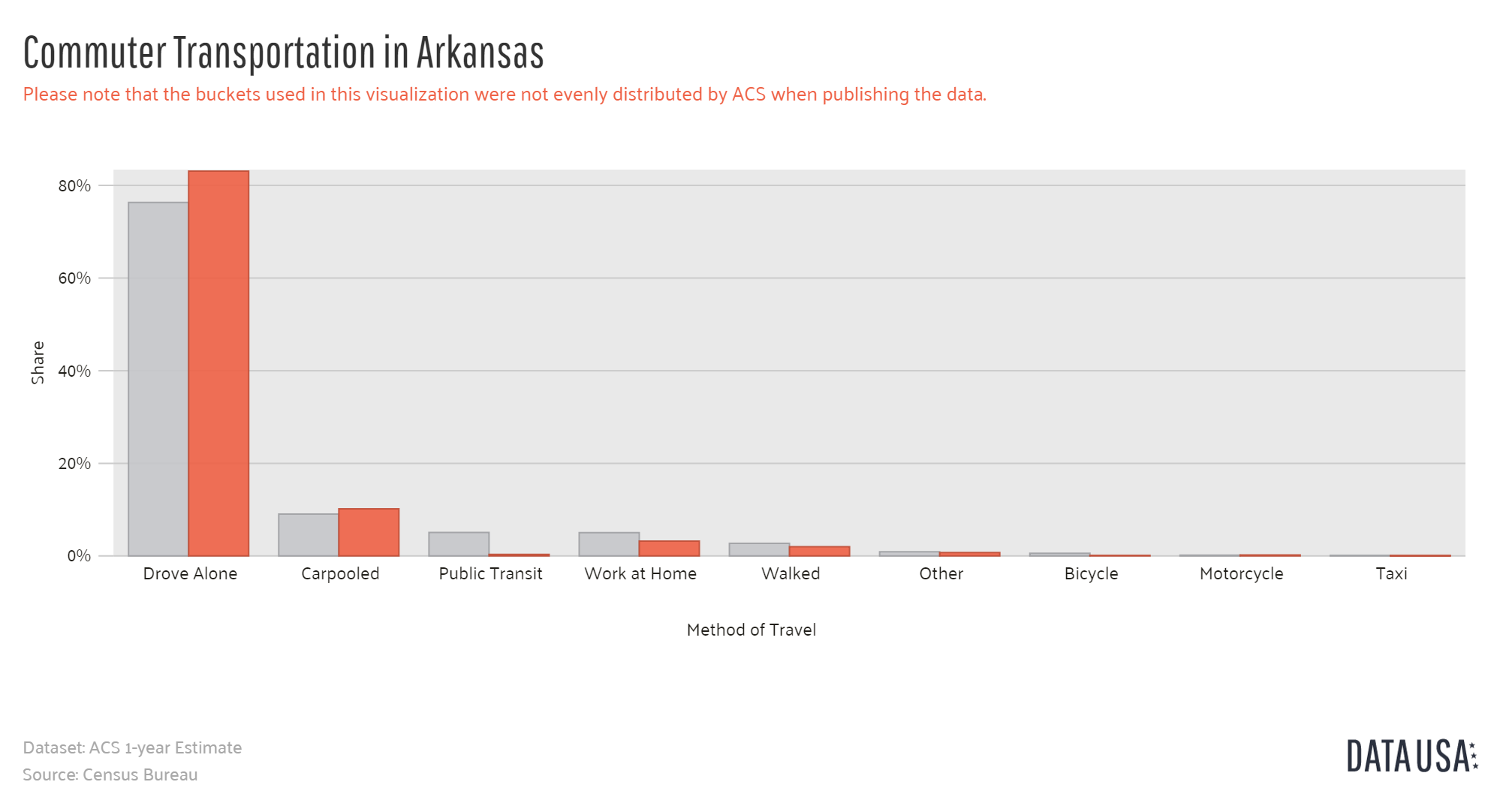

Do you know why your insurance company always asks – how many miles do you drive on an average?Since you get a slew of questions from your insurance agent, you might not know the relevance of each one. In usage-based insurance, the miles driven by you is taken into consideration to offer better rates. As you drive more every day, you’re exposed to more dangerous drivers and accidents, hence the higher quote.

Arkansas’s Average Annual Premiums by Commute Rate| Insurance Company | Commute and Annual Mileage | Annual Premiums |

|---|---|---|

| 10 miles commute. 6000 annual mileage. | $5,973.33 | |

| 25 miles commute. 12000 annual mileage. | $5,973.33 | |

| 10 miles commute. 6000 annual mileage. | $5,312.09 | |

| 25 miles commute. 12000 annual mileage. | $5,312.09 | |

| 10 miles commute. 6000 annual mileage. | $5,150.03 | |

| 25 miles commute. 12000 annual mileage. | $5,150.03 | |

| 10 miles commute. 6000 annual mileage. | $4,257.87 | |

| 25 miles commute. 12000 annual mileage. | $4,257.87 | |

| 10 miles commute. 6000 annual mileage. | $4,005.48 |

| 25 miles commute. 12000 annual mileage. | $4,005.48 |

| 10 miles commute. 6000 annual mileage. | $3,861.78 |

| 25 miles commute. 12000 annual mileage. | $3,861.78 |

| 25 miles commute. 12000 annual mileage. | $3,508.22 | |

| 10 miles commute. 6000 annual mileage. | $3,461.03 | |

| 25 miles commute. 12000 annual mileage. | $2,856.08 | |

| 10 miles commute. 6000 annual mileage. | $2,721.97 | |

| 25 miles commute. 12000 annual mileage. | $2,232.91 | |

| 10 miles commute. 6000 annual mileage. | $2,109.20 |

Apart from Geico, State Farm, and USAA, insurance providers are charging the same rate for different mileages in Arkansas. Nevertheless, you can always ask your provider to offer you discounts based on your usage.

What are the car insurance rates by coverage level in Arkansas?

Car Insurance Rates by Coverage Level in Arkansas

| Insurance Company | Coverage Level | Annual Average Premiums |

|---|---|---|

| High | $6,245.09 | |

| Medium | $5,989.75 | |

| High | $5,831.14 | |

| Low | $5,685.15 | |

| High | $5,296.98 | |

| Medium | $5,221.81 | |

| Medium | $5,146.99 | |

| Low | $5,006.12 | |

| Low | $4,883.32 | |

| High | $4,509.37 | |

| Medium | $4,214.22 | |

| High | $4,170.01 |

| Low | $4,050.03 | |

| Medium | $3,977.85 |

| High | $3,915.62 |

| Low | $3,886.60 |

| Low | $3,868.57 |

| Medium | $3,783.13 |

| High | $3,628.49 | |

| Medium | $3,483.60 | |

| Low | $3,341.79 | |

| High | $2,927.56 | |

| Medium | $2,786.42 | |

| Low | $2,653.10 | |

| High | $2,268.89 | |

| Medium | $2,163.34 | |

| Low | $2,080.93 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the car insurance rates by credit history in Arkansas?

Car Insurance Rates by Credit History in Arkansas

| Insurance Company | Credit History | Annual Premiums |

|---|---|---|

| Poor | $6,854.36 | |

| Fair | $5,719.88 | |

| Good | $5,345.75 | |

| Poor | $6,472.14 | |

| Fair | $4,957.59 | |

| Good | $4,020.37 | |

| Poor | $6,026.44 | |

| Fair | $5,135.36 | |

| Good | $4,774.48 | |

| Poor | $4,566.24 |

| Fair | $3,673.03 |

| Good | $3,346.08 |

| Poor | $4,845.12 | |

| Fair | $4,060.17 | |

| Good | $3,868.33 | |

| Poor | $5,786.43 |

| Fair | $3,493.43 |

| Good | $2,736.58 |

| Poor | $4,174.77 | |

| Fair | $3,431.81 | |

| Good | $2,847.29 | |

| Poor | $2,875.86 | |

| Fair | $1,963.67 | |

| Good | $1,673.63 | |

| Poor | $4,040.73 | |

| Fair | $2,432.50 | |

| Good | $1,893.84 |

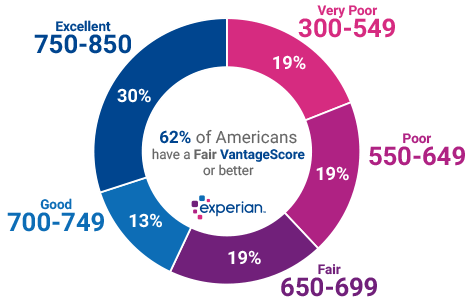

As you can see in the table, auto insurance rates vary significantly when your credit history changes from good to poor. Improving your credit score can be one of the ways to reduce your auto premiums and get a good credit car insurance discount. As per Experian’s State of Credit survey in 2017, Arkansas was among the ten states with the lowest credit ratings at a vantage score of 657.

Vantage score is calculated based on your credit payment history to determine the ability to pay-off debts on time.

What are the car insurance premiums by driving history in Arkansas?

Here’s a breakdown of Arkansas DUI insurance laws.

Car Insurance Premiums by Driving History in Arkansas

| Insurance Company | Driving Record | Annual Average Premiums |

|---|---|---|

| With 1 DUI | $7,570.08 | |

| With 1 speeding violation | $6,145.34 | |

| With 1 accident | $5,171.93 | |

| Clean record | $5,005.97 | |

| With 1 DUI | $4,812.78 | |

| With 1 speeding violation | $5,496.11 | |

| With 1 accident | $6,359.88 | |

| Clean record | $4,579.61 | |

| With 1 DUI | $5,933.45 | |

| With 1 speeding violation | $5,074.04 | |

| With 1 accident | $5,344.99 | |

| Clean record | $4,247.65 | |

| With 1 DUI | $5,408.92 | |

| With 1 speeding violation | $2,541.89 | |

| With 1 accident | $3,625.74 | |

| Clean Record | $2,361.95 | |

| With 1 DUI | $5,189.50 |

| With 1 speeding violation | $3,668.24 |

| With 1 accident | $4,435.22 |

| Clean record | $2,728.95 |

| With 1 DUI | $4,504.91 | |

| With 1 speeding violation | $4,315.87 | |

| With 1 accident | $4,611.04 | |

| Clean record | $3,599.68 | |

| With 1 DUI | $5,255.42 |

| With 1 speeding violation | $3,306.76 |

| With 1 accident | $3,881.91 |

| Clean record | $3,003.05 |

| With 1 DUI | $2,789.02 | |

| With 1 speeding violation | $2,789.02 | |

| With 1 accident | $3,016.88 | |

| Clean record | $2,561.18 | |

| With 1 DUI | $3,050.64 | |

| With 1 speeding violation | $1,850.74 | |

| With 1 accident | $2,115.02 | |

| Clean record | $1,667.81 |

A clean record can definitely get you the cheapest rate from all insurance providers, what’s worth noting from the table is the impact of driving under the influence (of alcohol/other drugs) on premiums.

One incidence of DUI can raise your rates significantly and is considered more severe than speeding violations and accidents.

What’s the number of insurers in Arkansas?

Number of Insurance Providers - Arkansas| Type of Insurer | Number |

|---|---|

| Domestic | 12 |

| Foreign | 887 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the state laws in Arkansas?