USAA Car Insurance Review for 2025 [Rates, Discounts, & Options]

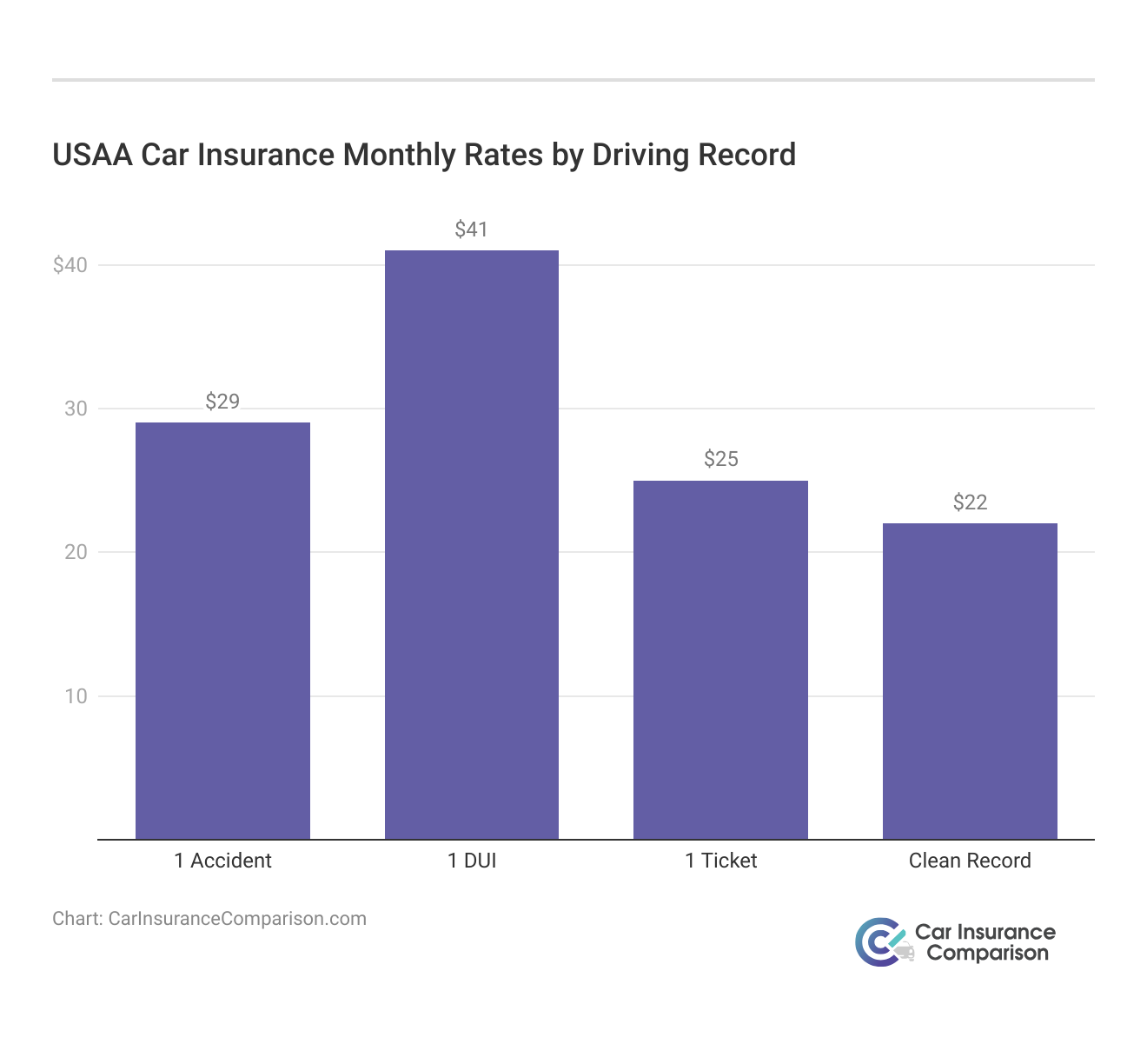

Our USAA car insurance review found rates starting at $22 per month. Military families should look no further when searching for affordable car insurance. USAA offers flexible coverage and exclusive discounts, making it a top provider with the highest customer satisfaction.

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

USAA

Average Monthly Rate For Good Drivers

$22A.M. Best Rating:

A++Complaint Level:

LowPros

- Low rates

- Excellent customer Service

- Specialty military coverage

- Easy-to-use mobile app

- Nationwide coverage

Cons

- No gap insurance

- Membership eligibility

- DUIs drastically increase rates

Our USAA car insurance review includes economical, strong coverage, which is best for marital families. USAA consistently shines, with rates starting at $22 per month.

Outside of price, USAA has some of the highest ratings in customer satisfaction, an easy claims process, and very flexible coverage, which makes it an excellent option for those looking for reliable and affordable insurance. Check out our best USAA car insurance discounts to learn more.

USAA Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.8 |

| Business Reviews | 4.5 |

| Claim Processing | 5.0 |

| Company Reputation | 5.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.7 |

| Customer Satisfaction | 4.7 |

| Digital Experience | 5.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.6 |

| Plan Personalization | 5.0 |

| Policy Options | 4.7 |

| Savings Potential | 4.7 |

From liability to comprehensive and collision coverage, USAA provides competitive rates and military-friendly service for its members. See if you’re getting the best deal on car insurance by entering your ZIP code.

- USAA offers military families exclusive coverage tailored to their needs

- Competitive rates start at $22, making USAA a top pick for affordable insurance

- Flexible coverage options and high customer satisfaction boost USAA’s appeal

USAA Car Insurance Coverage Cost

USAA is considered one of the best value providers of car insurance, with rates based on the needs of active and veteran military professionals and their enablers. USAA offers some of the cheapest insurance rates in the nation — around $59 a month on average for a full-coverage policy and about $22 a month for minimum coverage.

USAA Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $96 | $245 |

| Age: 16 Male | $102 | $249 |

| Age: 18 Female | $78 | $180 |

| Age: 18 Male | $88 | $203 |

| Age: 25 Female | $31 | $80 |

| Age: 25 Male | $32 | $85 |

| Age: 30 Female | $28 | $74 |

| Age: 30 Male | $30 | $79 |

| Age: 45 Female | $41 | $108 |

| Age: 45 Male | $22 | $59 |

| Age: 60 Female | $23 | $53 |

| Age: 60 Male | $24 | $55 |

| Age: 65 Female | $26 | $58 |

| Age: 65 Male | $25 | $57 |

USAA Car insurance pricing advantage offers high-quality coverage at a price that caters to the military community, which the company is proud to support. Explore our USAA car insurance quotes online for more details.

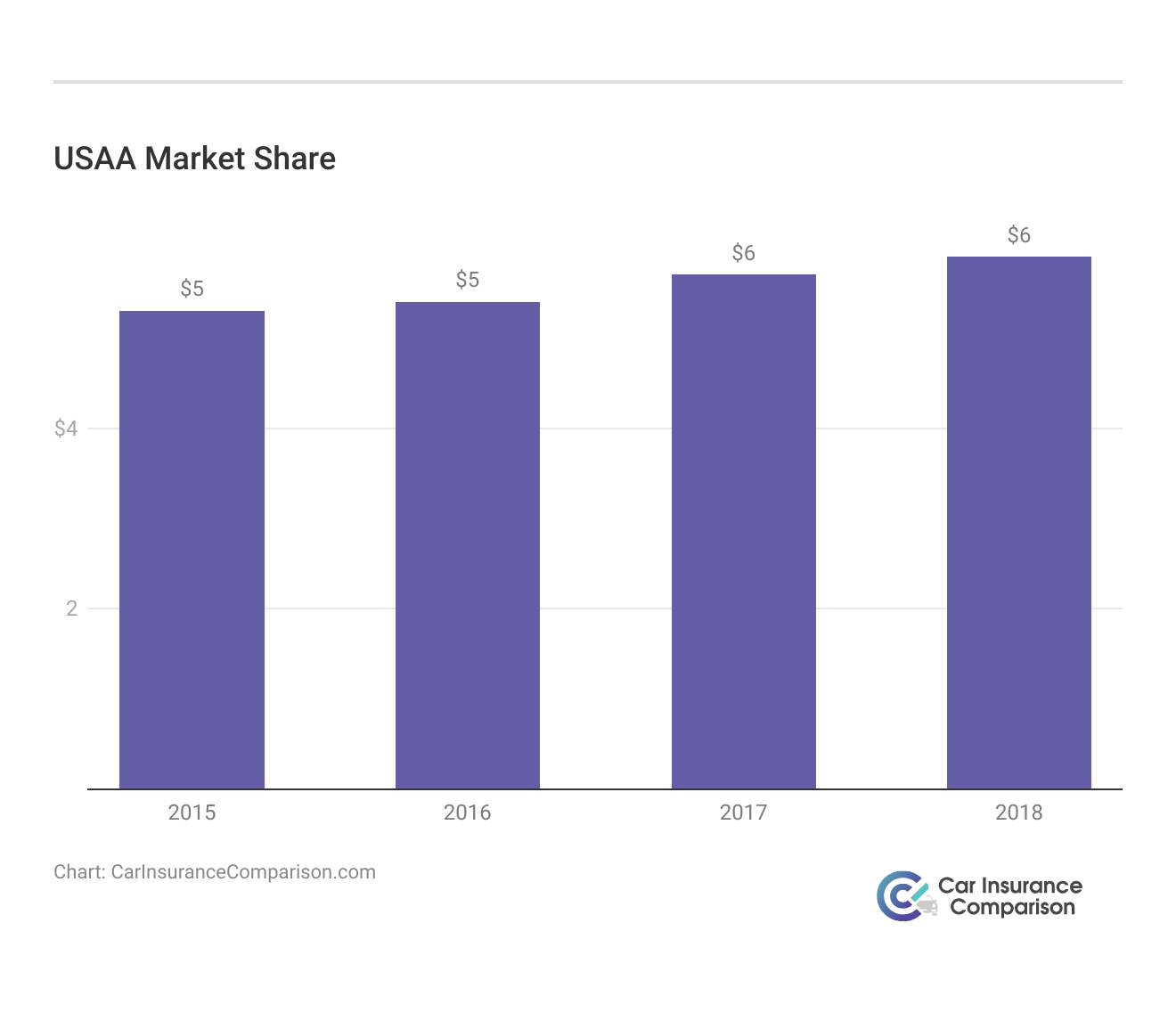

USAA Average Cost vs. Competitors

USAA Auto insurance is consistently one of the cheapest options with major insurers for qualified members, giving military families a break. Although companies like Geico and State Farm are typically considered competitive annual premium rates, USAA auto insurance coverage is often lower.

USAA customers can benefit from this affordability and a more comprehensive range of coverage options, making it an excellent pick for balancing cost and protection.

In addition, USAA serves military members and families who may need more tailored policies to fit their unique scenarios. This adds complexity and value that simple price discounts cannot replicate, making USAA one of the better options for service members who want affordable and quality auto insurance coverage.

Discover our Ameriprise vs. USAA car insurance comparison for further insights.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

USAA Customer Reviews

USAA is known for responsive customer service, swift claims turnaround, and the digital tools offered to members, including a well-reviewed mobile app.

Many USAA insurance customers compliment the company on its knowledge of military-specific needs and its representatives for going the extra mile to resolve issues.

Opinions on USAA Pay As You Drive?

byu/ComfortableChair4518 inUSAA

USAA auto coverage patrons will also be faithful at eleven instances of the countrywide typical, proving the insurer’s dedication to service and support. Visit our Progressive vs. USAA car insurance comparison to get the full scoop.

Business Reviews of USAA Insurance

USAA has a financial strength rating of “A++” from BBB. This rating confirms that USAA is a stable and reliable insurance provider with solid finances and a track record of meeting policyholder obligations.

USAA Car Insurance Business Ratings and Consumer Reviews

| Agency |  |

|---|---|

| Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: A++ Excellent Business Practices |

|

| Score: 96/100 High Customer Satisfaction |

|

| Score: 1.74 More Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength |

This extreme level of trust makes USAA insurance a trustworthy option for U.S. Army associates who need safety and quality. Consult our USAA gap insurance review to learn more.

USAA Company History

USAA proudly boasts that it has been there for its members for nearly 100 years, and its founding took some teamwork. In 1922, 25 military members met in San Antonio, Texas, and decided to insure each other’s vehicles.

For military families and veterans who value affordability, quality, and reliable service, USAA is undoubtedly the best choice for car insurance coverage.

Eric Stauffer Licensed Insurance Agent

That was the start of what would eventually become one of the largest insurers in the United States., as it expanded into other types of policies (home, business, life, and health) and financial services (banking, investing). In 2009, the company made all active members of the military and veterans who have honorably served in the U.S. military eligible for membership.

With over 12 million members, the company continues to grow and focus on the latest technological changes to serve its customers better. Read our AAA vs. USAA car insurance comparison to find out more.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Coverages With USAA

USAA auto coverage includes more customization Than is typical for insurance, or members can choose among just a few capabilities. USAA car insurance provider has some of the most necessary features, including:

- Roadside Assistance: Towing, fuel delivery, flat tire changes, and lock-out service.

- Rental Reimbursement: This covers the costs of a rental car while your vehicle is being repaired after an accident.

- Accident Forgiveness: If you qualify, this feature helps keep your premium from rising after you are at fault for your first accident.

- Rideshare insurance: Coverage for drivers who use their vehicles to provide rideshare services.

This wide array of unique options gives USAA auto insurance members great flexibility to tailor protection confidently to their lifestyles. See the canceled USAA car insurance page for additional details.

USAA Available Discounts

To help you afford coverage further, USAA insurance offers many discounts. These include:

- Safe Driver Discount: It benefits drivers by providing them with a clean record.

- Excellent Student: Full-time students who qualify based on GPA.

- Multi-Vehicle Discount: Discount for having more than one vehicle insured with USAA.

- Low Mileage Discount: For those who drive fewer miles than a certain amount each year.

You can also save more when bundling USAA auto insurance with other USAA products, such as home or renters insurance. This type of discount exemplifies USAA’s commitment to providing members with value-oriented products. Refer to our 21st Century vs. USAA car Insurance comparison for additional details.

Pros and Cons of USAA Insurance

USAA auto insurance is widely regarded as a top choice for military members and their families, thanks to its combination of affordability, flexible coverage options, and dedicated customer service.

With substantial financial backing and exclusive benefits tailored for the military community, USAA stands out as a reliable option in the auto insurance market.

However, eligibility is restricted to military personnel and their families, which limits access to this otherwise highly-rated provider. Below, we examine the main pros and cons of USAA auto insurance to help you decide if it’s the right fit.

Pros

- Affordable Rates: USAA offers highly competitive premiums for military members and their families.

- Extensive Coverage Options: USAA auto insurance provides flexible add-ons from roadside assistance to accident forgiveness.

- Exceptional Customer Service: Consistently high customer satisfaction ratings.

- Financial strength: Top ratings from BBB.

Cons

- Eligibility Restrictions: Only available to military personnel and their families.

- Limited Physical Locations: Most interactions occur online or over the phone, with limited in-person service.

USAA auto insurance offers affordable rates, flexible coverage options, and top-notch service for military members. While it excels in customer satisfaction and financial stability, eligibility is limited to military personnel and families, and in-person service is less available. Here’s a quick look at the pros and cons.

Dive into our Liberty Mutual vs. USAA car insurance comparison for more insights.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

USAA Types of Car Insurance

USAA offers customers many primary types of car insurance coverage. These are among their different coverage options.

Basic car insurance coverage:

- Bodily Injury Liability: If you cause an accident, this helps cover another driver’s medical bills.

- Collision: This will cover you if you hit an object or another vehicle.

- Comprehensive coverage: Protect you from damage that a vehicle didn’t cause, such as theft, hitting a deer, hail damage, etc.

Other options:

- Classic Car Insurance: For vintage vehicles of value.

- Extended Benefits Coverage: This will give you more protection if you also have medical payment coverage; it varies by location.

- Personal Injury Protection: This will help with medical bills from an accident and other costs.

- Property Damage Liability: If you damage another driver’s property, this will pay for it.

- Umbrella: This coverage will protect your assets from lawsuits.

- Uninsured and Underinsured Motorist Coverage: If another driver lacks adequate coverage or isn’t insured, this coverage will kick in to cover the bills from a hit-and-run or other type of accident.

Add-ons and more services:

- Car Buying Service: USAA has partnered with TruCar to provide low loan rates, savings off manufacturers’ suggested retail prices (MSRPs), and “bonus cash” military incentives.

- Commercial: For vehicles used for business.

- Ridesharing Gap Coverage: This will fill your personal and ride-sharing insurance gaps.

- Roadside Assistance: This coverage will help if your battery dies, you run out of gas, or you encounter other car-related calamities.

- Usage-Based Insurance: USAA’s SafePilot program gives discounts for safe driving habits.

USAA provides all of this and more. It has a decent variety of car insurance for different needs and budgets at a lower cost than many other insurers.

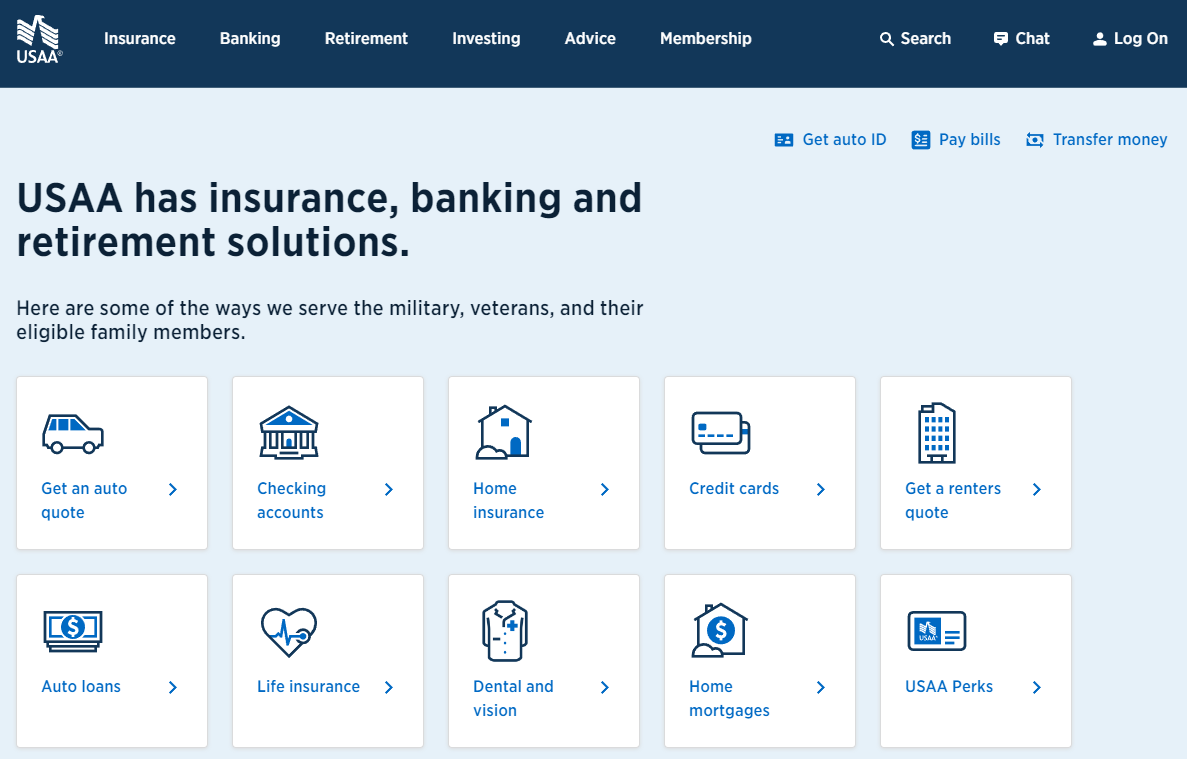

USAA Membership Services

The United Services Automobile Association offers more than auto insurance. Members can enjoy services like banking, investments, home and renters insurance, and even retirement planning tools.

USAA offers a digital platform and a mobile app that allow members to access their finances, check out financial information, and complete insurance-related tasks anytime and anywhere. Such a membership approach aligns with USAA’s mission of serving the broad array of needs of military families.

Please look at our best car insurance for veterans for complete information.

Comprehensive Review of USAA Car Insurance

Nationally, USAA car insurance is unique in the insurance space due to its focus on providing affordable, high-value coverage options specifically to the military community. USAA car insurance offers military members and their families significant milestones with low premiums, extensive coverage options, and a customer service-first mentality.

USAA car insurance is among the best based on its combination of low rates, quality breadth of insurance and financial services, and deep pockets for paying claims—but it is only available to the military-affiliated population. Look at our best-disabled veterans’ car insurance discounts to understand more.

Stop overpaying for car insurance. Our free quote comparison tool lets you shop for quotes from the top providers near you by entering your ZIP code.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How much does USAA car insurance cost?

USAA car insurance rates start at around $22 per month for minimum coverage, with full coverage averaging about $59 per month. View our comparison of military personnel car insurance rates to find out more.

What types of car insurance coverage does USAA offer?

USAA provides standard coverage options like liability, collision, and comprehensive, along with add-ons such as roadside assistance, rental car reimbursement, and gap insurance.

Who is eligible for USAA car insurance?

USAA car insurance is available to active, retired, and honorably discharged military members and their eligible family members.

What discounts are available with USAA car insurance?

USAA offers various discounts, including safe driver, multi-policy, multi-vehicle, and military-specific discounts, helping reduce premium costs. Learn additional insights from our understanding of your car insurance policy.

Does USAA provide good customer service?

USAA consistently ranks high for customer satisfaction, offering responsive service and straightforward claims processing, especially for military families. You can get instant car insurance quotes from top providers by entering your ZIP code.

Can I bundle other insurance policies with USAA car insurance?

USAA offers bundling discounts for combining auto insurance with home, renters, or other USAA financial products.

How do USAA car insurance rates compare to other providers?

USAA typically offers lower rates than many competitors, particularly for military families, while maintaining strong customer service and coverage options. For complete details, peruse our comprehensive car insurance guide.

Does USAA offer insurance for electric vehicles like the Tesla Model 3?

USAA provides competitive rates and specialized coverage options for electric vehicles, including the Tesla Model 3.

What makes USAA a top choice for military families?

USAA’s exclusive military focus, low rates, flexible coverage options, and military-specific benefits make it one of the best providers for service members and their families.

How do USAA car insurance claims work?

USAA offers a simple, efficient claims process. Its online platform and mobile app are easy to use and allow users to track and submit claims. For all the information, read how you find competitive car insurance rates.

Can I manage my USAA car insurance policy online?

USAA offers a robust online platform and mobile app that allows members to manage their policies, make payments, and file claims 24/7. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

How does USAA vs. Root car insurance compare?

USAA generally offers more comprehensive coverage options, while Root focuses on usage-based pricing. For a complete overview, read about how to find your car insurance deductible amount.

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Jeremy Autz

USAA review

AnTonyC

Active Duty and Veterans Beware!

Poteattony

Usaa not so great anymore

ioam

Customer service got bad

Sandy_H

Unresolved billing issue for months

davidwells

USAA: Always hire a lawyer

chanelcinq

Completely incompetent

HB23

Incompetent company

JonB36

USAA's exemplary service legacy has hit rock bottom.

Cvinny10_

Do NOT get this insurance