Best USAA Car Insurance Discounts in 2025 [Save 60% With These Offers!]

The best USAA car insurance discounts can help you save up to 60% on your policy. From the USAA defensive driving discount to savings for students, USAA offers plenty of ways to lower your bill. USAA also offers special discounts designed to help military members save even more on their insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Nov 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best USAA car insurance discounts can help you save up to 60%, but not everyone qualifies for USAA membership.

Whether you need the best car insurance for veterans or cheap coverage for active members, USAA offers a variety of discounts to help you save.

It doesn’t offer the most extensive list of discounts on the market, but USAA’s low rates and stellar service make it a good choice for any member of the military.

Our Top 10 Picks: Best USAA Car Insurance Discounts

| Discount Name | Rank | Savings Potential | Who Qualifies? |

|---|---|---|---|

| Vehicle Storage | #1 | 60% | Active duty service members leaving their vehicles in storage |

| SafePilot Program | #2 | 30% | Safe drivers enrolled in the SafePilot program |

| Bundling | #3 | 25% | Customers who bundle auto with renters or home insurance |

| Military Installation | #4 | 15% | Drivers who keep their cars parked in a military base |

| New Vehicle | #5 | 15% | Car owners with new vehicles |

| Annual Mileage | #6 | 12% | Low-mileage drivers |

| Family | #7 | 10% | Policies with multiple drivers covered |

| Defensive Driving | #8 | 10% | Drivers who have completed a defensive driving course |

| Accident-Free | #9 | 10% | Accident-free drivers |

| Vehicle Recovery | #10 | 5% | Vehicle owners with a recovery system installed |

Read on to learn more about USAA auto insurance discounts, including which ones you might qualify for. Then, compare USAA rates with other companies by entering your ZIP code into our free comparison tool above.

- USAA offers 14 discounts to help drivers save

- Some USAA discounts are catered specifically for military members

- Discounts help make USAA car insurance rates some of the lowest on the market

USAA Car Insurance Discounts

USAA offers 14 car insurance discounts to help its drivers save as much as possible. While availability may vary by state, USAA member discounts can be split into three categories: driver history, vehicle, and policy choices.

To start, USAA discounts based on your driving history include:

- Defensive Driver Discount: Pass a USAA defensive driving course to earn a discount on your insurance.

- Safe Driver Discount: Maintain a clean driving record for at least five years to earn this discount.

- Good Student Discount: Students under 25 can earn the USAA good student discount by maintaining a GPA of 3.0 or better.

- Driver Education Discount: Get the USAA driver’s ed discount by completing a driving course. This discount is only available to younger drivers.

Aside from being a safe driver, you can also earn discounts based on what type of vehicle you own. Take a look below to see USAA vehicle discounts:

- New Car Discount: USAA offers special savings for cars within three years of the latest model year.

- Multi-Car Discount: If you have more than one vehicle in your household, you can save by adding them to the same policy with the USAA multi-car discount.

- Annual Mileage: Drivers who add fewer than 12,000 miles to their vehicle in a single year may qualify for USAA auto insurance with low-mileage discounts.

- Vehicle Storage: USAA offers a significant discount if you plan on storing your vehicle during a deployment.

There are also discounts for your policy choices, including paying for your entire premium at once, being a loyal customer, and bundling policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

USAA Usage-Based Insurance Program

Aside from the standard USAA car insurance discount list, you can also save by signing up for the usage-based insurance (UBI) program SafePilot.

SafePilot rewards safe driving habits with a potential discount of up to 30%. The program utilizes a mobile app to monitor and assess driving behaviors. It also provides feedback to encourage safer driving.

While some UBI programs at other companies will increase your rates if you don’t drive well enough, USAA guarantees that SafePilot won’t raise your premiums.

Scott W. Johnson Licensed Insurance Agent

Although SafePilot offers one of the largest USAA insurance discounts, it’s not the best option for everyone. SafePilot tracks the following driving behaviors:

- Time of Day: SafePilot tracks when and where you drive, with late-night driving considered risky behavior.

- Phone Use: USAA is one of the few companies that have a UBI program that tracks phone use while you drive.

- Braking: To get the premier driver level discount with SafePilot, make sure to avoid sudden braking.

- Speeding: To maximize USAA discount codes for SafePilot, make sure you obey the speed limit.

If you regularly engage in the driving behaviors listed above, SafePilot probably isn’t the best option for you. However, SafePilot earns USAA a spot as one of the best usage-based car insurance companies by offering substantial savings to drivers who can meet the safe driving criteria.

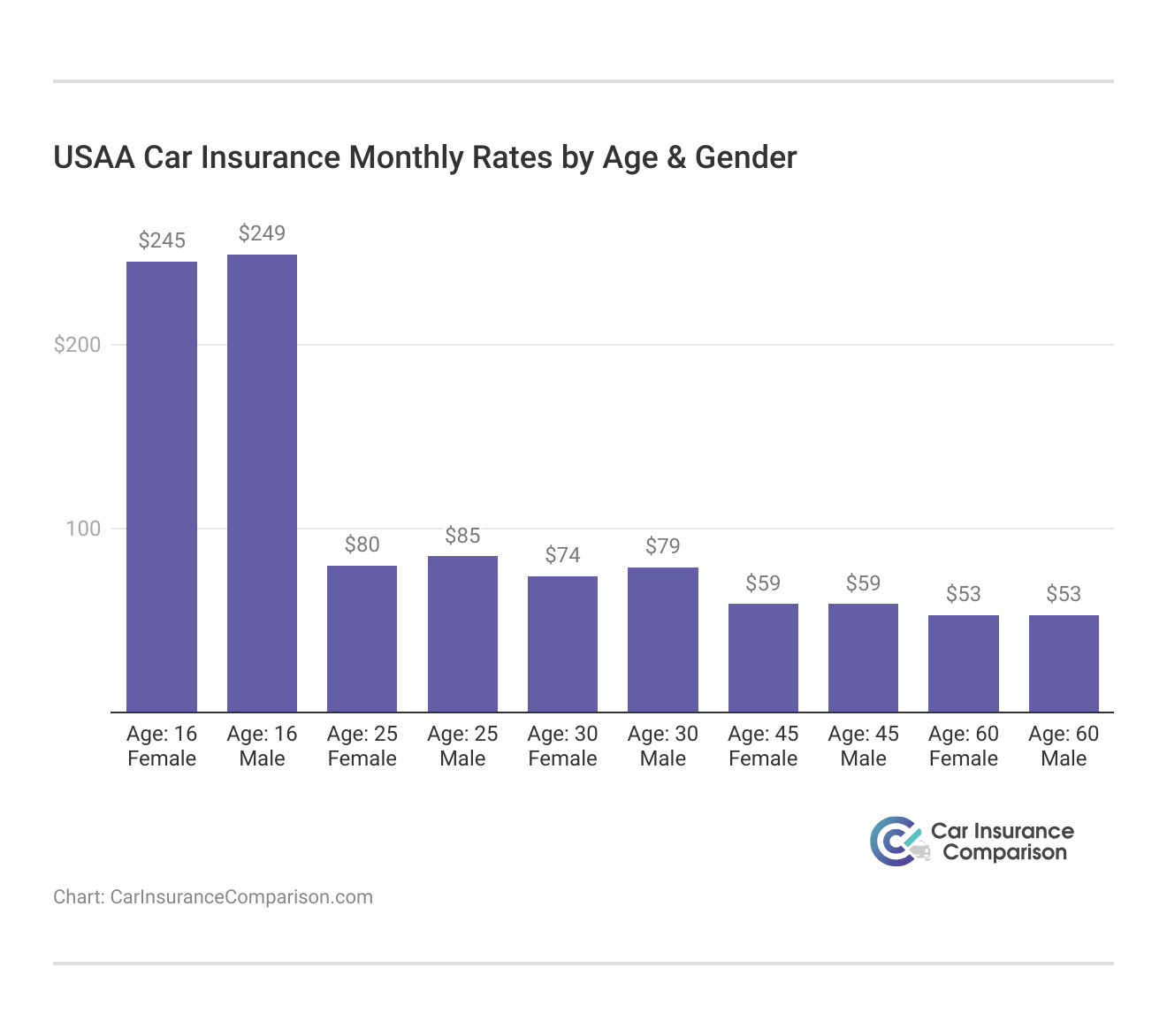

USAA Car Insurance Rates

USAA is frequently one of the cheapest options on the market, and its discounts play a crucial role in those low prices. Whether you need USAA auto insurance discounts for seniors or ways to save for young drivers, USAA is generally affordable.

To see how much you might pay for USAA car insurance, check the rates below.

As you can see, USAA is usually a great place to get cheap car insurance, no matter how old you are. However, not everyone can purchase USAA car insurance. Only active and retired military members and their direct families qualify for USAA membership.

Wondering how to get a USAA car insurance quote online? Simply visit the USAA website and use the quote-generating tool to get a personalized rate.

Once you have a quote from USAA, simply repeat the process at other providers to compare rates. Alternatively, you can use an online quote comparison tool to see rates from multiple companies at once.

USAA Extended Vehicle Protection

It may offer some of the best cheap car insurance in America, but does USAA offer an extended car warranty?

What is the use of having all the USAA discounts without the protection you need for your vehicle? For $299, you can protect your new car against total losses with the USAA extended car warranty. USAA’s Debt Protection Program is for hardships, and the USAA Extended Vehicle Protection Program is also for hardships.

While many insurance and finance companies would oppose having your car shipped overseas, USAA understands the PCS process.

Even with 100% financing, which USAA provides, you can ship your car or truck to your next military station without the usual hassles.

Michelle Robbins Licensed Insurance Agent

If you need to refinance your car through USAA to receive all of these benefits, this outfit will take care of everything related to paying off and transferring your loan.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Other Benefits of USAA Car Insurance

USAA has excellent third-party ratings, which means you can trust that any policy you buy will be there for you. For example, USAA has an “A++” from insurance rating expert A.M. Best for their solid financial strength and industry standing.

USAA also received accolades for its recognized customer service department. Their members do not hesitate to offer good feedback to these executives for the work they do.

USAA is not just a car insurance company for military personnel — it is also a full-service financial center. They offer other products such as:

- Life and Health Insurance

- Homeowners Insurance

- Business Insurance

- Real Estate Support and Financing

- Retirement Options

USAA offers several categories of savings and discounts under these product headings. It is extraordinary for a company to offer so many products and services and maintain an excellent reputation. However, USAA offers more than financial and insurance programs. It also strives to help service men and women throughout the country.

With so many excellent benefits, it’s no wonder USAA remains one of the most popular choices when comparing military personnel car insurance rates.

Compare USAA Car Insurance Rates Today

Although USAA is often one of the cheapest providers, you should still compare monthly car insurance rates before you decide. With 14 discounts, however, you’ll likely see the lowest rates at USAA.

Comparing car insurance quotes doesn’t have to be difficult. Simply enter your ZIP code into our free comparison tool to compare rates in your area.

Frequently Asked Questions

What car insurance discounts does USAA offer?

USAA offers some of the best car insurance discounts, including a USAA defensive driving discount, a USAA student discount, a good student discount, and a basic driver training discount. They also offer discounts for attending a basic driving school, having a vehicle less than three years old, and being a second, third, or fourth-generation member. Additionally, USAA members may be eligible for other savings such as AAA or other club savings, prepayment discounts, and security features discounts.

How much is the USAA defensive driving discount?

USAA offers a defensive driving discount to policyholders who complete an approved defensive driving course. The exact discount varies depending on the state and the specific circumstances of the policyholder, but it typically ranges from 5% to 10% off your auto insurance premium.

Does USAA offer a student away-at-college discount?

Currently, there is no USAA student away at college discount. However, you can get a good student discount at USAA to maintain a good GPA. If you want to find a student-away-at-college discount, enter your ZIP code in our free comparison tool to look at different companies.

Does USAA offer usage-based insurance?

Yes, USAA offers a usage-based insurance (UBI) program called SafePilot. SafePilot helps safe drivers save up to 30% on their car insurance.

Are USAA car insurance discounts enough to make it the cheapest option?

USAA is known for offering competitive rates and abundant discounts, which can make it a cost-effective option. However, it’s always recommended to compare car insurance rates and discounts from multiple companies to ensure you’re getting the best deal. By comparing quotes, you can evaluate the overall cost and coverage options provided by different insurers.

Does USAA offer gap insurance?

Unfortunately, USAA gap car insurance is no longer available. However, you may be able to purchase a type of gap coverage if you finance your car through USAA.

What are the payment options for USAA car insurance?

USAA offers flexible payment options that can be tailored to coincide with your pay dates. If you are paid every two weeks, for example, you can split up your payment for convenience. It’s recommended that you discuss payment options with your USAA agent to find the best arrangement for your needs and budget.

Does USAA have mobile applications for car insurance?

Yes, as a USAA member, you can download the USAA mobile application, which provides tips, tools, resources, and conveniences for managing your car insurance. The mobile app allows you to access various features without needing to make a phone call. You can even apply for a car loan using the app. However, some restrictions on mobile transactions may apply to specific regions such as Puerto Rico and Hawaii.

Does USAA offer a car warranty?

While it doesn’t offer cheap car insurance with breakdown coverage, USAA does offer an extended vehicle protection program for an additional cost. This program provides coverage beyond the standard manufacturer’s warranty and can help protect your vehicle against unexpected repairs and breakdowns.

What other offerings does USAA provide?

In addition to car insurance, USAA offers a range of financial services and products. These include home insurance, renters insurance, life insurance, banking services, investment options, and more. USAA is known for its solid financial strength and industry standing, and they have received accolades for their customer service department. Read our USAA car insurance review to learn more.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.