Cheapest Nevada Car Insurance Rates in 2025 (Find Savings With These 10 Companies!)

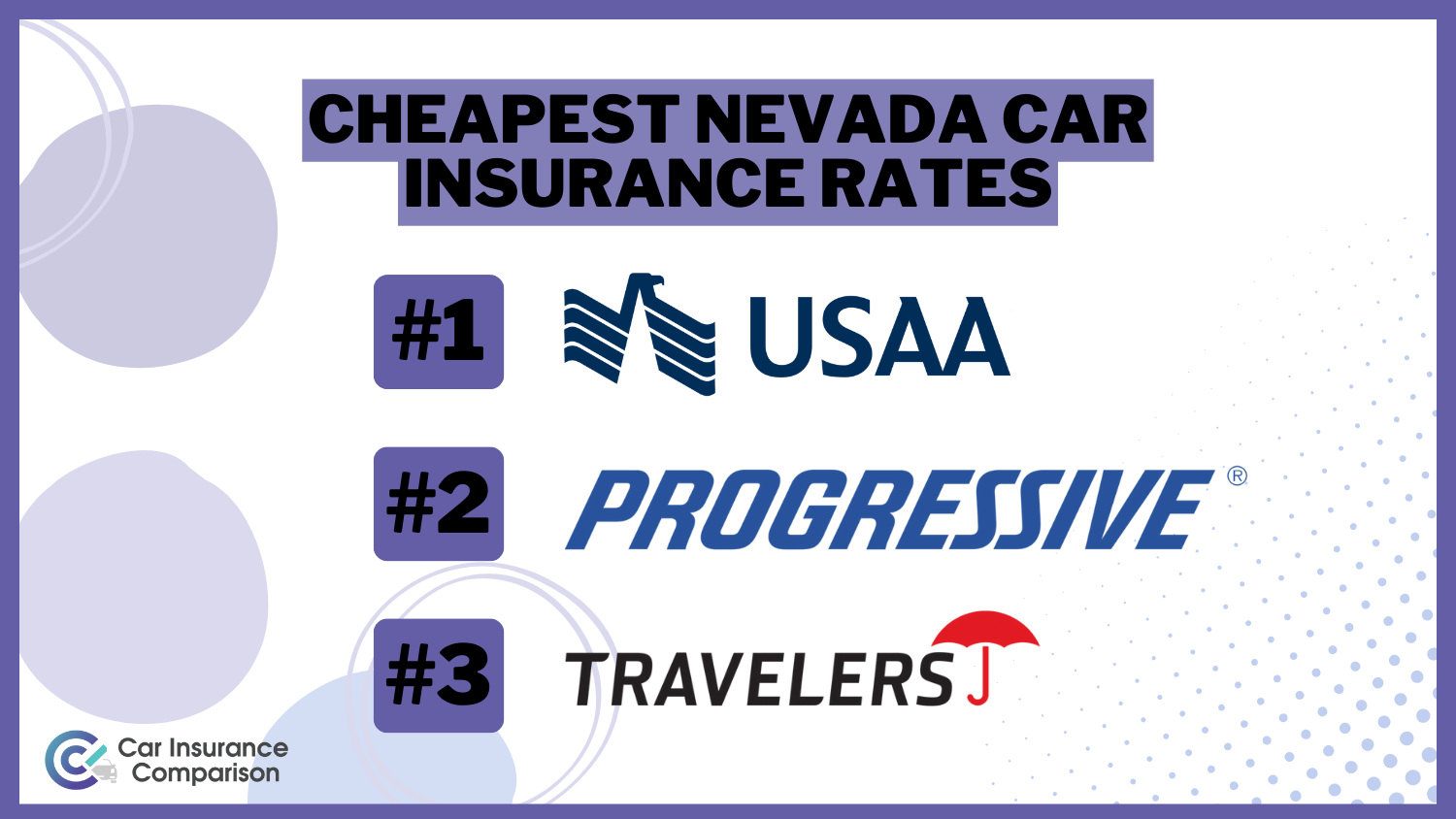

The top picks for the cheapest Nevada car insurance rates can be found with USAA, Progressive, and Travelers, offers the lowest rates at 29/month. These companies provide competitive rates and reliable coverage options, ensuring Nevada drivers receive comprehensive protection without overspending.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Nevada

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

The top picks for the cheapest Nevada car insurance rates are USAA, Progressive, and Travelers, with the lowest rates at $29/month for minimum coverage.

These companies also offer competitive rates and robust coverage options, ensuring that Nevada drivers get great value.

Our Top 10 Company Picks: Cheapest Nevada Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $29 A++ Military Benefits USAA

#2 $35 A+ Loyalty Rewards Progressive

#3 $38 A++ Industry Experience Travelers

#4 $43 B Teen Discounts State Farm

#5 $46 A++ Online Convenience Geico

#6 $47 A+ Accident Forgiveness Nationwide

#7 $54 A High-Risk Coverage The General

#8 $59 A Claims Service American Family

#9 $65 A Safe Drivers Farmers

#10 $69 A+ Customized Policies Allstate

This article explores these top providers, comparing their rates, coverage options, and customer satisfaction to help you make an informed decision.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- USAA offers the lowest rates at $29/month, making it the top pick for coverage

- Insurers offers low rates and excellent customer satisfaction in Nevada

- Compare competitive rates for comprehensive protection in Nevada

#1 – USAA: Top Overall Pick

Pros

- Competitive Rates: USAA offers some of the lowest car insurance rates in Nevada, starting at $29/month for minimum coverage, making it highly affordable for many drivers.

- Strong Financial Stability: USAA car insurance review showcases an A++ (Superior) rating from A.M. Best, highlighting exceptional financial stability and claims payout capability.

- Exclusive Membership Benefits: Membership is restricted to military personnel and their families, offering exclusive benefits tailored to their unique needs.

Cons

- Restricted Eligibility: USAA is only available to military members, veterans, and their families, limiting access for the general public.

- Limited Physical Locations: USAA has fewer physical branches compared to other insurers, which might be inconvenient for those who prefer in-person service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Loyalty Rewards

Pros

- Diverse Coverage Options: Progressive offers a comprehensive range of coverage options, including liability, collision, comprehensive, rental reimbursement, and roadside assistance.

- Strong Online Tools: Progressive provides robust online tools and mobile app features, making it easy to manage policies, file claims, and get quotes.

- Multi-Policy Discounts: Progressive’s car insurance review highlights significant savings when bundling auto insurance with other policies such as home or renters insurance.

Cons

- Higher Rates for Specific Demographics: Progressive’s rates for certain demographics, such as young male drivers, can be higher compared to some other insurers.

- Discount Limitations: Some discounts, such as the multi-policy discount, may not be as significant as those offered by other insurers, depending on the coverage and policies combined.

#3 – Travelers: Best for Industry Experience

Pros

- Competitive Rates: Travelers offers some of the lowest rates for car insurance in Nevada, making it a cost-effective option for many drivers.

- Customer Service: Travelers car insurance review showcases commendable customer service, with notably fewer complaints compared to its competitors.

- Discount Opportunities: Offers various discounts, such as for safe drivers, multi-policy holders, and those with safety features in their vehicles.

Cons

- Higher Rates for High-Risk Drivers: Travelers tends to charge significantly higher premiums for drivers with poor driving records or DUIs.

- Limited Availability for High-Risk Insurance: May not be the best option for drivers requiring high-risk insurance, as the rates can be prohibitive.

#4 – State Farm: Best for Teen Discounts

Pros

- Wide Network of Agents: State Farm car insurance review showcases its extensive network of local agents, emphasizing enhanced accessibility for personalized service and support.

- Flexible Coverage Options: Provides a range of coverage options, from basic liability to comprehensive and collision coverage, catering to different needs and budgets.

- User-Friendly Online Tools: State Farm has robust online tools and a mobile app that allow customers to manage their policies, file claims, and get quotes easily.

Cons

- Higher Base Rates: Generally has higher base rates compared to some competitors, which might not be ideal for price-sensitive customers.

- Mixed Customer Reviews: While many customers are satisfied, there are mixed reviews regarding claims processing times and customer service experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Geico: Best for Online Convenience

Pros

- Competitive Pricing: Geico is known for offering some of the lowest insurance rates in the industry, making it an attractive option for budget-conscious drivers.

- Wide Range of Discounts: Offers a variety of discounts, including for good drivers, multi-policy holders, federal employees, and military personnel.

- User-Friendly Online Tools: Geico car insurance review showcases a superb online platform and mobile app for policy management, claim filing, and quote acquisition.

Cons

- Limited Local Agents: Primarily operates online and over the phone, which may not be ideal for those who prefer in-person interactions with their insurance agent.

- Mixed Customer Service Reviews: While many customers report positive experiences, there are instances of dissatisfaction, particularly concerning claims handling.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Comprehensive Coverage Options: Offers a wide range of coverage options, including standard auto insurance, gap insurance, and accident forgiveness.

- Discount Opportunities: Nationwide car insurance showcases a variety of discounts, including those for safe drivers, good students, multi-policy holders, and members of specific organizations.

- Robust Financial Ratings: Solid financial stability with high ratings from A.M. Best and other agencies, indicating reliability in claims payout.

Cons

- Higher Premiums: Often charges higher premiums compared to some competitors, which may not be ideal for budget-conscious consumers.

- Mixed Online Experience: Some customers report that Nationwide’s online tools and mobile app are less user-friendly compared to those of other major insurers.

#7 – The General: Best for High-Risk Coverage

Pros

- Affordable Rates: The General car insurance review showcases competitive rates, highlighting its appeal to budget-conscious drivers seeking affordable insurance.

- High-Risk Driver Acceptance: They specialize in providing coverage for high-risk drivers, including those with previous accidents or traffic violations.

- Online Convenience: Customers can easily get quotes, purchase policies, and manage their accounts online, making the process quick and efficient.

Cons

- Limited Coverage Options: The General primarily offers basic coverage, which may not meet the needs of drivers looking for more comprehensive policies.

- Mixed Customer Service Reviews: Some customers have reported dissatisfaction with the customer service experience, citing long wait times and difficulty resolving issues.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Claims Service

Pros

- Discounts and Rewards: They provide numerous discounts, such as multi-policy, good driver, and loyalty discounts, which can significantly lower premiums.

- Exceptional Customer Service: American Family is known for its high customer satisfaction ratings and responsive customer service.

- Local Agents: American Family car insurance review highlights its network of local agents who showcase personalized service and tailored advice to meet individual customer needs.

Cons

- Higher Premiums: Some customers may find American Family’s premiums to be higher compared to other insurers, particularly for basic coverage.

- Availability: American Family insurance is not available in all states, limiting access for some potential customers.

#9 – Farmers: Best for Safe Drivers

Pros

- Discount Opportunities: Farmers offers numerous discounts, such as safe driver discounts, multi-policy discounts, and good student discounts, helping policyholders save on premiums.

- Claims Process: Farmers car insurance review highlights the straightforward and efficient claims process, showcasing a mobile app that simplifies filing and tracking claims.

- Educational Resources: Farmers provides a wealth of educational resources and tools on its website to help customers make informed decisions about their insurance needs.

Cons

- Higher Premiums: Farmers’ premiums can be higher compared to some competitors, which might make it less appealing for budget-conscious customers.

- Mixed Reviews: While many customers praise Farmers for its service, there are also reports of inconsistent experiences depending on the local agent and region.

#10 – Allstate: Best for Customized Policies

Pros

- Strong Financial Stability: Allstate car insurance review highlights a robust financial position, showcasing reliability and the capability to settle claims effectively.

- Customer Service: Allstate is known for its solid customer service, with a large network of local agents providing personalized assistance.

- Discount Opportunities: The company offers a variety of discounts, including those for safe drivers, new cars, and multiple policies, helping customers reduce their premiums.

Cons

- Mixed Claim Satisfaction: Some customers have reported dissatisfaction with the claims process, citing delays and difficulties in getting claims approved.

- Policy Complexity: Allstate’s policies and discount structures can be complex, making it harder for customers to understand their coverage and how to maximize savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Nevada Car Insurance Coverage and Rates

Understanding Nevada’s car insurance requirements is essential. The state mandates minimum coverage of $25,000 per person for bodily injury or death, $50,000 per accident for total bodily injury or death, and $20,000 per accident for property damage. Liability coverage helps with expenses if you’re at fault in an accident, but consider higher coverage.

Nevada follows a “fault system,” making the at-fault driver responsible for damages. Liability coverage applies to family members driving your car but doesn’t cover your damages if someone else causes the accident. To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

USAA stands out as the top choice for Nevada drivers seeking the lowest rates and comprehensive coverage options.

Dani Best Licensed Insurance Producer

Additional options like MedPay, PIP, and collision are beneficial. Nevada strictly enforces penalties for lapses in coverage, with no grace period. Even a one-day lapse can result in registration suspension and a $251 reinstatement fee.

Nevada Car Insurance Monthly Rates by Coverage Level & Providers

Insurance Company Minimum Coverage Full Coverage

Allstate $69 $165

American Family $59 $140

Farmers $65 $155

Geico $46 $110

Nationwide $47 $112

Progressive $35 $82

State Farm $43 $103

The General $54 $232

Travelers $38 $91

USAA $29 $69

In Nevada, car insurance rates vary by provider and coverage level. For minimum coverage, USAA offers the lowest rate at $29 per month, while The General is the highest at $54. For full coverage, USAA remains the cheapest at $69, and The General is the most expensive at $232.

Other providers like Geico, State Farm, and Progressive offer competitive rates, with Geico’s minimum coverage at $46 and full coverage at $110, State Farm’s at $43 and $103, and Progressive’s at $35 and $82 respectively. This comparison highlights the varying costs between minimum and full coverage among different insurers.

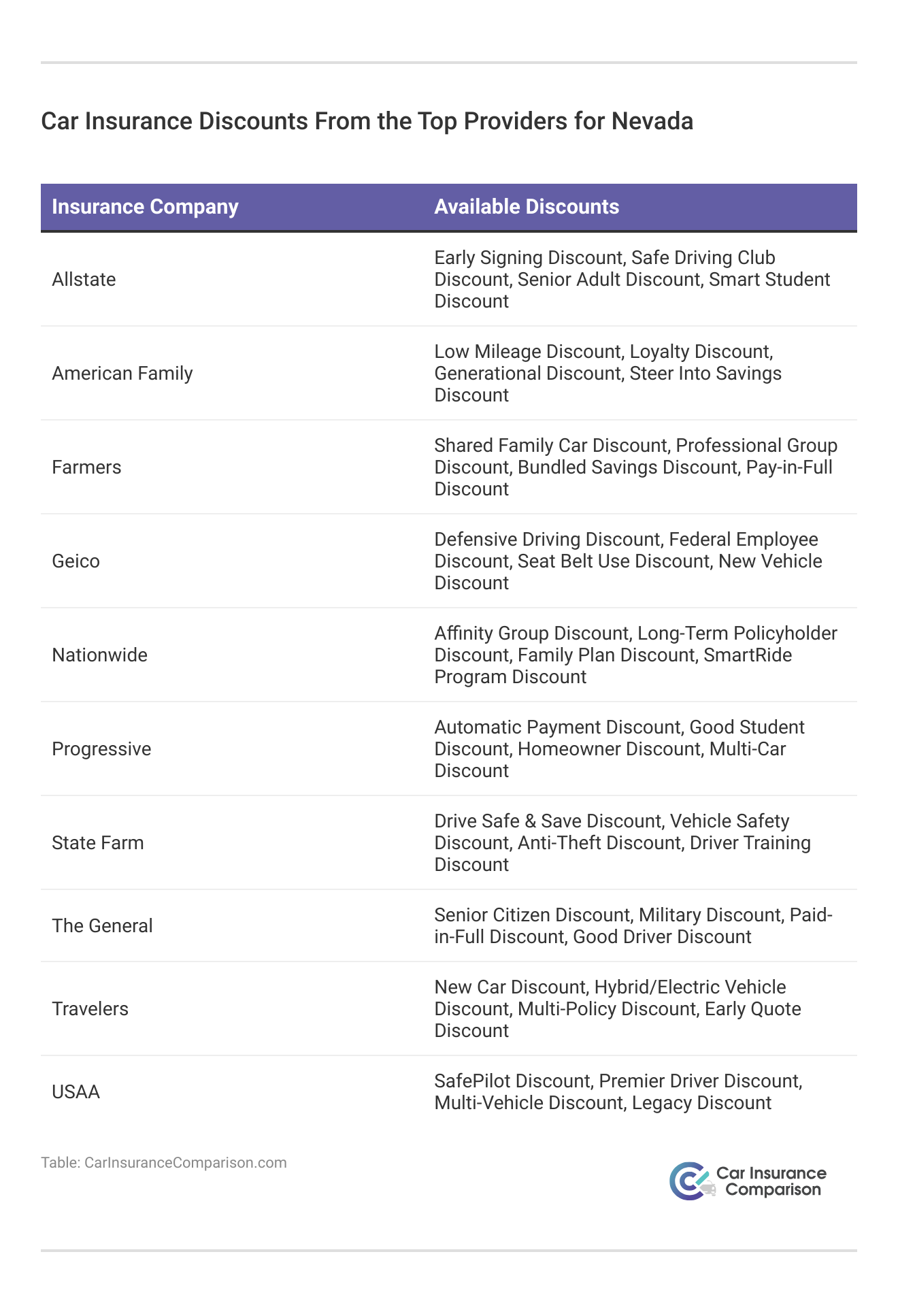

Top car insurance providers in Nevada offer various discounts. Allstate offers early signing and safe driving club discounts. American Family provides low mileage and loyalty discounts. Farmers features bundled savings and pay-in-full discounts. Geico includes defensive driving and federal employee discounts. Nationwide has affinity group and family plan discounts.

Progressive offers automatic payment and good student discounts. State Farm provides drive safe & save and anti-theft discounts. The General features senior citizen and military discounts. Travelers includes new car and multi-policy discounts. USAA offers SafePilot and legacy discounts. These can help reduce your premiums.

Mandatory Forms of Financial Responsibility in Nevada

Nevada has a unique system they use for insurance verification purposes known as the LIVE program. The LIVE program allows the Nevada DMV to verify a driver’s current coverage in real time. However, you are still required to carry proof of financial responsibility or proof of insurance with you in your car at all times. For a comprehensive analysis, refer to our detailed guide titled “Compare Car Insurance by Coverage Type.”

If you are ever pulled over by an officer in Nevada and cannot offer proof of insurance, you will be cited. Your insurer-issued proof of coverage card, showing your name, policy number, policy expiration date, and National Association of Insurance Commissioner’s (NAIC) license number is one easy option.

You are also allowed to show digital proof of insurance to a responding offer by keeping the information on your phone. It just needs to be clear, easy to read, and include all the details your hard copy card would.

Understanding Car Insurance Costs and Coverage Options for Nevada Residents

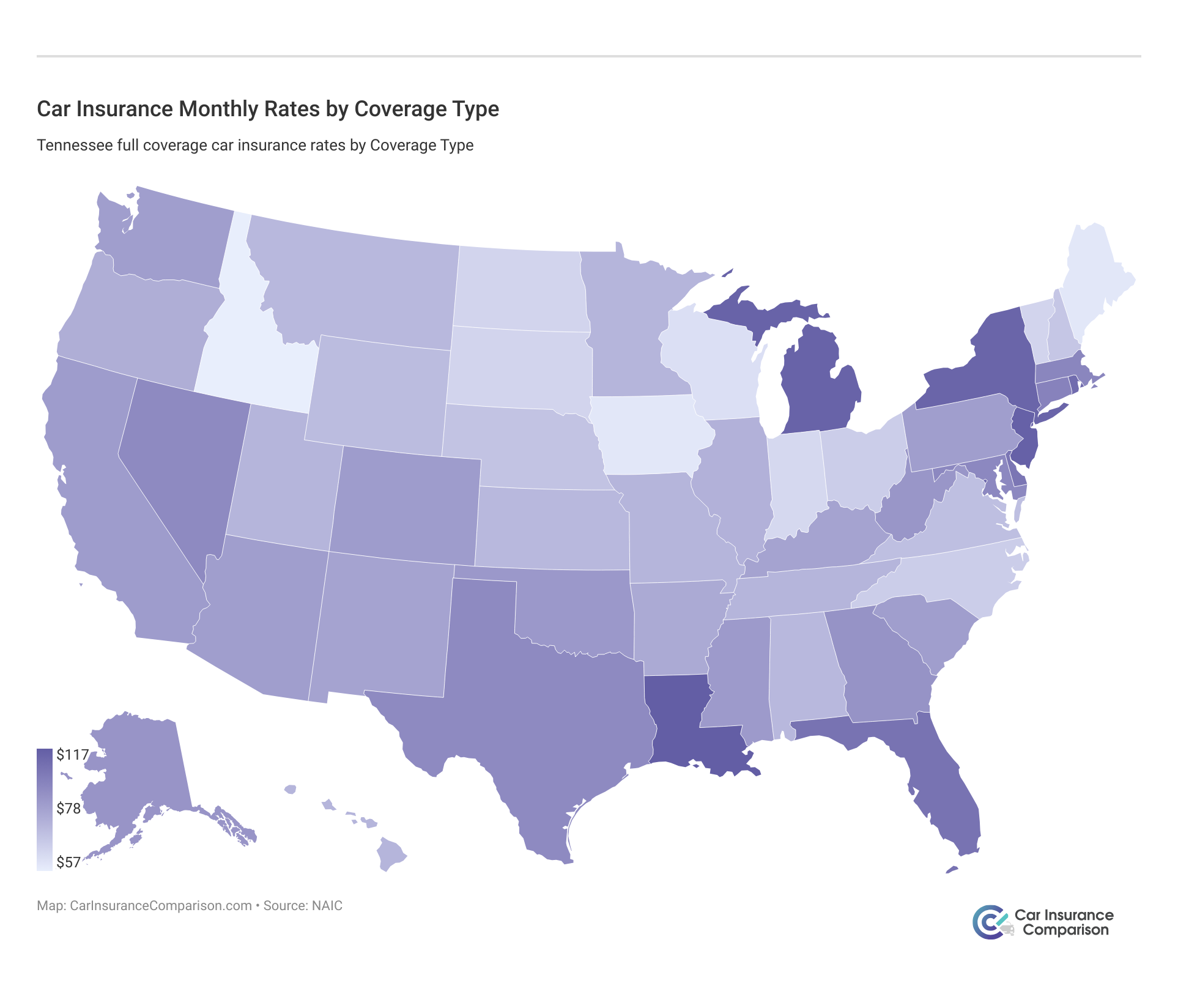

Nevada resident brings home about $3,850 a month, with $92 going towards car insurance. While this might seem small, factors like driving history and coverage lapses can increase rates significantly. Keeping at least the minimum liability coverages current can help save on costs and avoid unnecessary complications.

While not mandatory under current Nevada car insurance laws, collision coverage offers you protection for damage to your car, no matter who the at-fault party is. Collision coverage covers the cost of repairs or provides you with a stipend in the event of a loss.

Comprehensive car insurance insures you in case of theft or damage to your vehicle from outside elements, such as falling objects, a flood, or fire. Another type of car insurance you might want to consider if you have multiple drivers and vehicles in your family is combined coverage. Combined car insurance allows you to list all your vehicles on a single policy for a cost-effective plan.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

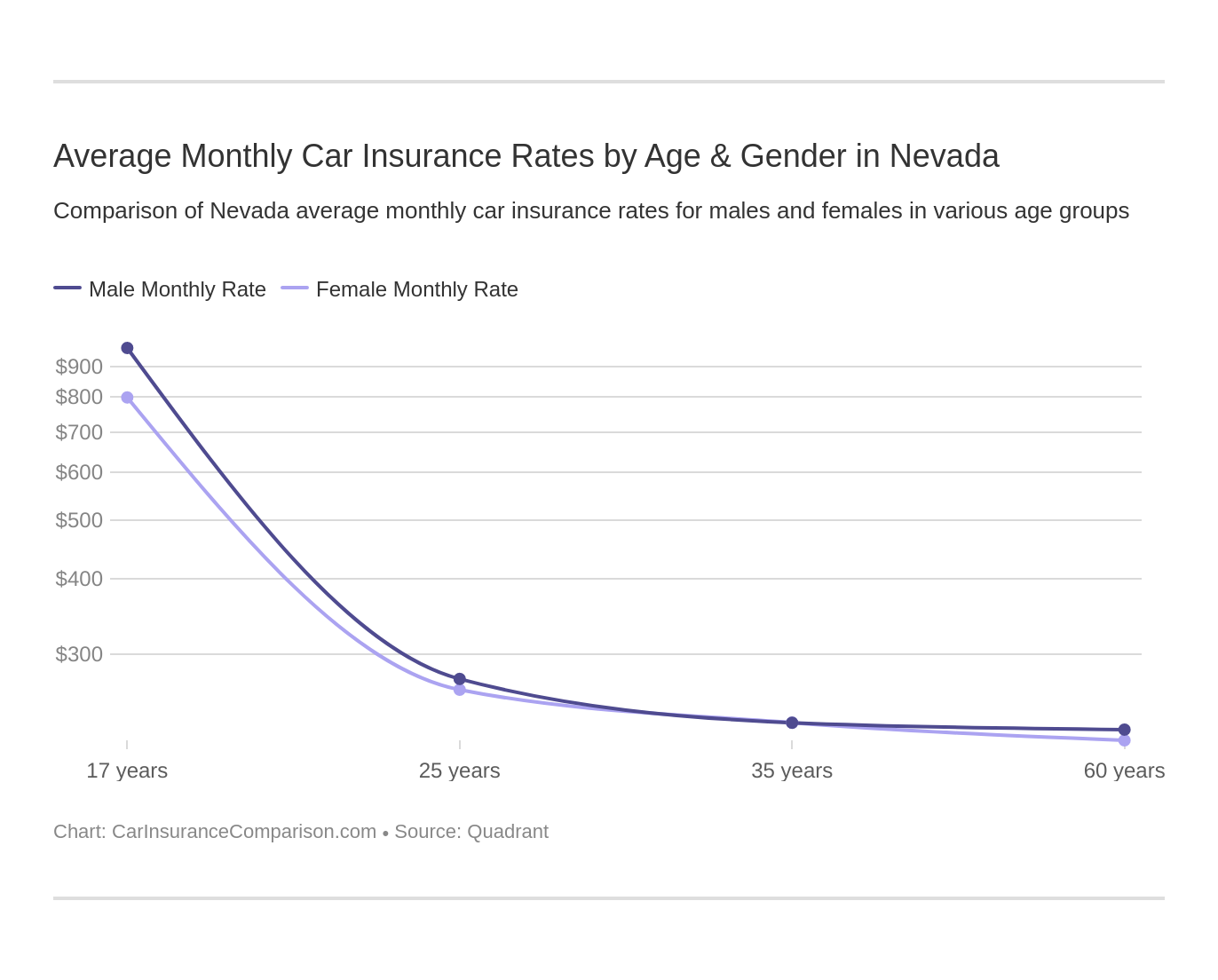

Average Monthly Car Insurance Rates by Age & Gender in Nevada

You will find data our researchers gathered from Nevada car insurance providers statewide to see car insurance rates by age and gender. Men are often charged higher for car insurance rates than women, with teen drivers usually having the highest rates of all.

For instance, Allstate charges 17-year-old male drivers nearly $13,000 in premiums, while they only charge 25-year-old male drivers approximately $4,000. That’s a nearly $9,000 premium difference. For other companies, the rate difference isn’t quite so extreme.

Take USAA, for example. Teen driver rates are still the highest, but only a few thousand dollars more than other demographics in most cases. Teen drivers aside, the rate difference between other age groups and genders isn’t typically too wide.

For instance, carriers like Mid-Century Insurance Company only charge 35-year-old male drivers about $90 more in premiums than female drivers of the same age. On the other hand, Nevada car insurance companies like American Family Mutual charge 35 and 60-year-old drivers the exact same rates, regardless of gender.

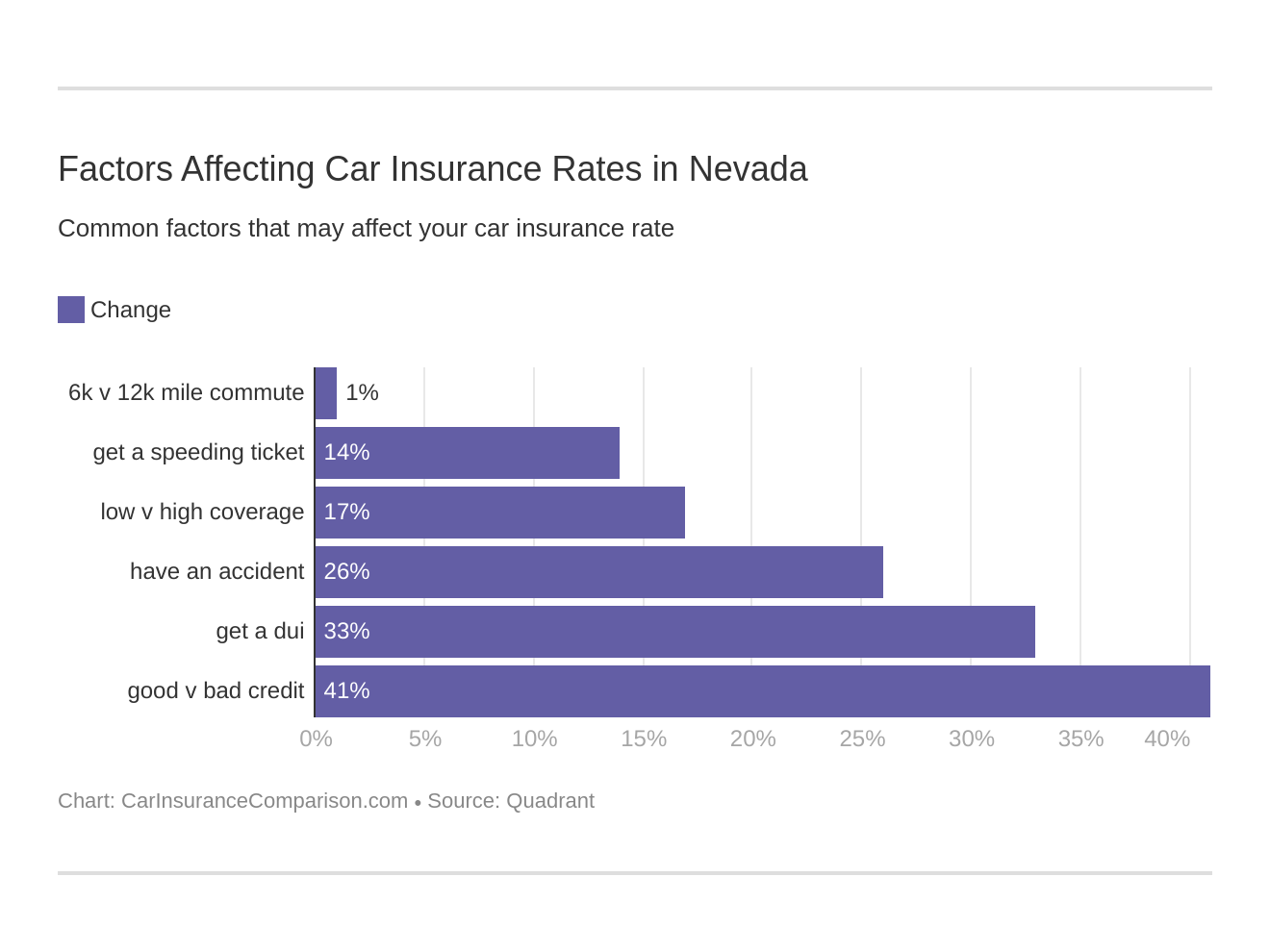

Nevada Car Insurance Rates by Company

Rates are probably the first thing you think of when determining whether a car insurance carrier is right for you. The table above shows 10 of the top Nevada car insurance companies, including their average rates against the state average. For a comprehensive overview, explore our detailed resource titled “Factors That Affect Car Insurance Rates.”

Our researchers discovered that Safeco charges the highest premiums and USAA the lowest. If you pay close attention, you’ll notice there’s an over $3,000 rate difference between the two. For instance, companies like Farmers and Liberty Mutual charged insureds with both 10 and 25-mile commutes the exact same rates.

However, carriers like State Farm show an over $300 rate differences for insured individuals with 10 vs. 25-mile commutes. Pretty interesting, right? Take a look at some of the other factors that are taken into consideration when determining your rates.

Driving Laws in Nevada

Nevada drivers must have minimum liability coverage and cannot use handheld devices or text while driving. High-risk drivers may need special insurance, and there’s no low-cost insurance for welfare recipients. Insurance fraud is a felony with severe penalties. The statute of limitations is two years for injury claims and three years for property damage.

Nevada’s modified comparative negligence rule allows damage recovery if less than 50% at fault. Driving without insurance results in fines and license suspension. Teen drivers have specific requirements, and older drivers need vision tests for renewal after age 71. Reckless driving carries fines and jail time.

USAA offers the most competitive rates and robust coverage options for Nevada drivers, making it the top choice for affordability and reliability.

Justin Wright Licensed Insurance Agent

Nevada follows a “fault” system for accidents. Seat belts and child safety seats are mandatory, and there are restrictions on riding in pickup truck cargo areas. Rideshare drivers need higher insurance, and autonomous vehicles are regulated. DUI and marijuana-impaired driving laws are strict, and handheld device use while driving is banned.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Nevada Fascinating Facts You Need to Know

Nevada drivers should know key facts about vehicle theft and driving behaviors. Las Vegas had 6,635 motor vehicle thefts. Risky driving behaviors contribute to traffic fatalities, with statistics available for cities, crash types, and trends. Speeding and alcohol-impaired driving are major issues in the top 10 counties.

Teen drinking and driving and EMS response times also affect safety. On a positive note, Nevada residents have an average commute time of 23.1 minutes, shorter than the national average, though 1.92% face commutes over 90 minutes. Las Vegas and Reno are the top cities for traffic congestion. For detailed information, refer to our comprehensive report titled “How Traffic Infractions Affect Car Insurance.”

Case Studies: Nevada Drivers Saving on Car Insurance

These case studies highlight the diverse strategies Nevada drivers can employ to find the best coverage at the most affordable rates. Whether it’s leveraging loyalty rewards, bundling policies, or utilizing online conveniences, there are numerous ways to optimize your car insurance plan.

- Case Study #1 – Maximizing Savings for a Safe Driver: Jennifer, 35, of Reno, NV, opts for Progressive’s full coverage, drawn by loyalty rewards offering discounts and comprehensive protection for her Toyota Camry. To enhance your understanding, explore our comprehensive resource on insurance titled “Car Insurance Discounts: Compare the Best Discounts.”

- Case Study #2 – Best for Teen Drivers: Mark, a 17-year-old in Las Vegas, drives a used Honda Civic. His family chooses State Farm for comprehensive coverage and savings through the Steer Clear program.

- Case Study #3 – Comprehensive Coverage for Families: The Smith family in Henderson, NV, owns three vehicles and needs comprehensive coverage. They chose Farmers Insurance for a multi-vehicle discount, saving on premiums while ensuring full protection for all their cars.

- Case Study #4 – Affordable High-Risk Coverage: Sarah, a 28-year-old driver from Carson City, NV, has a recent at-fault accident on her record and needs affordable liability and collision insurance. The General offers her a policy that meets her needs at a competitive rate, providing coverage to high-risk drivers.

- Case Study #5 – Savings for Military Families: James, a 30-year-old active-duty military member in Las Vegas, NV, drives a Ford F-150 and needs comprehensive insurance coverage. He chooses USAA for its competitive rates, flexible payment plans, and excellent customer service tailored to military members.

By comparing options and understanding the offerings of different insurers, drivers can make informed decisions that protect their vehicles and their finances.

USAA provides Nevada drivers with the best combination of affordability and comprehensive coverage, making it the top choice among insurance options.

Brandon Frady Licensed Insurance Agent

Remember, regular comparison shopping and staying informed about available discounts and programs can significantly impact your overall insurance expenses.

The Final Word: Cheapest Nevada Car Insurance Rates

For Nevada drivers seeking affordable car insurance, the top picks are USAA, Progressive, and Travelers. USAA offers the lowest rate at $29 per month for minimum coverage, while Progressive and Travelers follow closely with competitive rates and comprehensive coverage options.

Nevada mandates minimum coverage of 25/50/20 for liability insurance. Drivers can save on premiums by taking advantage of discounts, comparing quotes regularly, bundling policies, and maintaining a clean driving record. For a comprehensive overview, explore our detailed resource titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Frequently Asked Questions

How much is car insurance per month in Nevada?

On average, minimum liability insurance costs around $60 per month, while full coverage insurance averages about $159 per month in Nevada.

Who is known for the cheapest car insurance in Nevada?

USAA is often recognized for offering the cheapest car insurance rates in Nevada, with rates as low as $29 per month for minimum coverage.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

What is the lowest policy coverage amount in Nevada?

The minimum coverage required by Nevada law is 25/50/20, which includes $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $20,000 per accident for property damage.

To gain profound insights, consult our extensive guide titled “How do I assess car damage for insurance purposes?”

Why is Nevada car insurance so expensive?

Nevada car insurance can be expensive due to factors like high traffic density, a higher rate of accidents, and the state’s legal requirements for insurance coverage.

Do you need car insurance in Nevada?

Yes, all drivers in Nevada are required to have car insurance that meets the state’s minimum liability coverage requirements.

Is it illegal to drive without insurance in Nevada?

Yes, it is illegal to drive without insurance in Nevada. Drivers must have proof of insurance at all times and can face fines and penalties if caught without it.

To expand your knowledge, refer to our comprehensive handbook titled “Safe Driver Car Insurance Discounts.”

Is Nevada a no-fault state?

No, Nevada is not a no-fault state. It follows a fault-based system, meaning the at-fault driver is responsible for the damages in an accident.

What is the lowest form of car insurance?

The lowest form of car insurance is liability insurance, which covers damages and injuries you cause to others in an accident. In Nevada, this includes the minimum 25/50/20 coverage.

Can I register a car in Nevada with California insurance?

No, you cannot register a car in Nevada with California insurance. You must have a Nevada insurance policy to register your vehicle in the state.

For a thorough understanding, refer to our detailed analysis titled “Compare Car Insurance Rates by Vehicle Make and Model.”

What is the cheapest insurance for full coverage in Nevada?

USAA offers some of the cheapest full-coverage insurance rates in Nevada, with rates starting at approximately $69 per month.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.