Cheapest Pennsylvania Car Insurance Rates in 2025 (Unlock Savings From These 10 Companies!)

Get the cheapest Pennsylvania car insurance rates from Geico, Travelers, and State Farm, with rates as low as $23 monthly. These car insurance companies offer Pennsylvania drivers affordable rates, discounts, reliable coverage, and unique programs. Compare these top companies to find the best savings for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Pennsylvania

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

The cheapest Pennsylvania car insurance rates come from Geico, Travelers, and State Farm with rates as low as $23 monthly. Geico stands out for providing robust digital tools and nationwide availability. Compare these top companies to find the best savings.

To compare Pennsylvania car insurance rates and find the best deal, first decide on your coverage level. Minimum coverage offers cheap car insurance, but isn’t as comprehensive as full coverage.

Our Top 10 Company Picks: Cheapest Pennsylvania Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $23 A++ Digital Tools Geico

#2 $25 A++ Policy Discounts Travelers

#3 $26 B Reliable Coverage State Farm

#4 $27 A+ Local Support Erie

#5 $28 A++ Customer Satisfaction Auto-Owners

#6 $29 A+ Vanishing Deductible Nationwide

#7 $31 A+ AARP Benefits The Hartford

#8 $36 A Personalized Service American Family

#9 $44 A Customizable Policies Farmers

#10 $49 A+ Snapshot Program Progressive

We cover everything you need to know, from necessary coverages to insurance laws. Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

- Geico known for affordability and digital tools

- Use multi-policy and safe driver discounts for more savings

- Compare cheapest Pennsylvania car insurance rates

- Compare Pennsylvania Car Insurance Rates

- Best York, PA Car Insurance in 2025

- Best Westmoreland City, PA Car Insurance in 2025

- Best Sharon Hill, PA Car Insurance in 2025

- Best Paupack, PA Car Insurance in 2025

- Best New Bethlehem, PA Car Insurance in 2025

- Best Mayport, PA Car Insurance in 2025

- Best Matamoras, PA Car Insurance in 2025

- Best Latrobe, PA Car Insurance in 2025

- Best Lancaster, PA Car Insurance in 2025

- Best Lake Ariel, PA Car Insurance in 2025

- Best Johnstown, PA Car Insurance in 2025

- Best Horsham, PA Car Insurance in 2025

- Best Hatboro, PA Car Insurance in 2025

- Best Hamburg, PA Car Insurance in 2025

- Best Gap, PA Car Insurance in 2025

- Best Easton, PA Car Insurance in 2025

- Best Canonsburg, PA Car Insurance in 2025

- Best Bristol, PA Car Insurance in 2025

- Best Bridgeport, PA Car Insurance in 2025

- Best Bala Cynwyd, PA Car Insurance in 2025

- Best Philadelphia, PA Car Insurance in 2025

#1 – Geico: Top Pick Overall

Pros

- Competitive Rates: Geico offers the cheapest Pennsylvania car insurance rates at an average of $23 per month, making it an ideal choice for cost-conscious drivers looking to save on premiums.

- User-Friendly Online Tools: Geico’s robust online platform and mobile app make managing car insurance policies easy for Pennsylvania drivers, offering convenient features like online quotes, bill payments, and claims tracking.

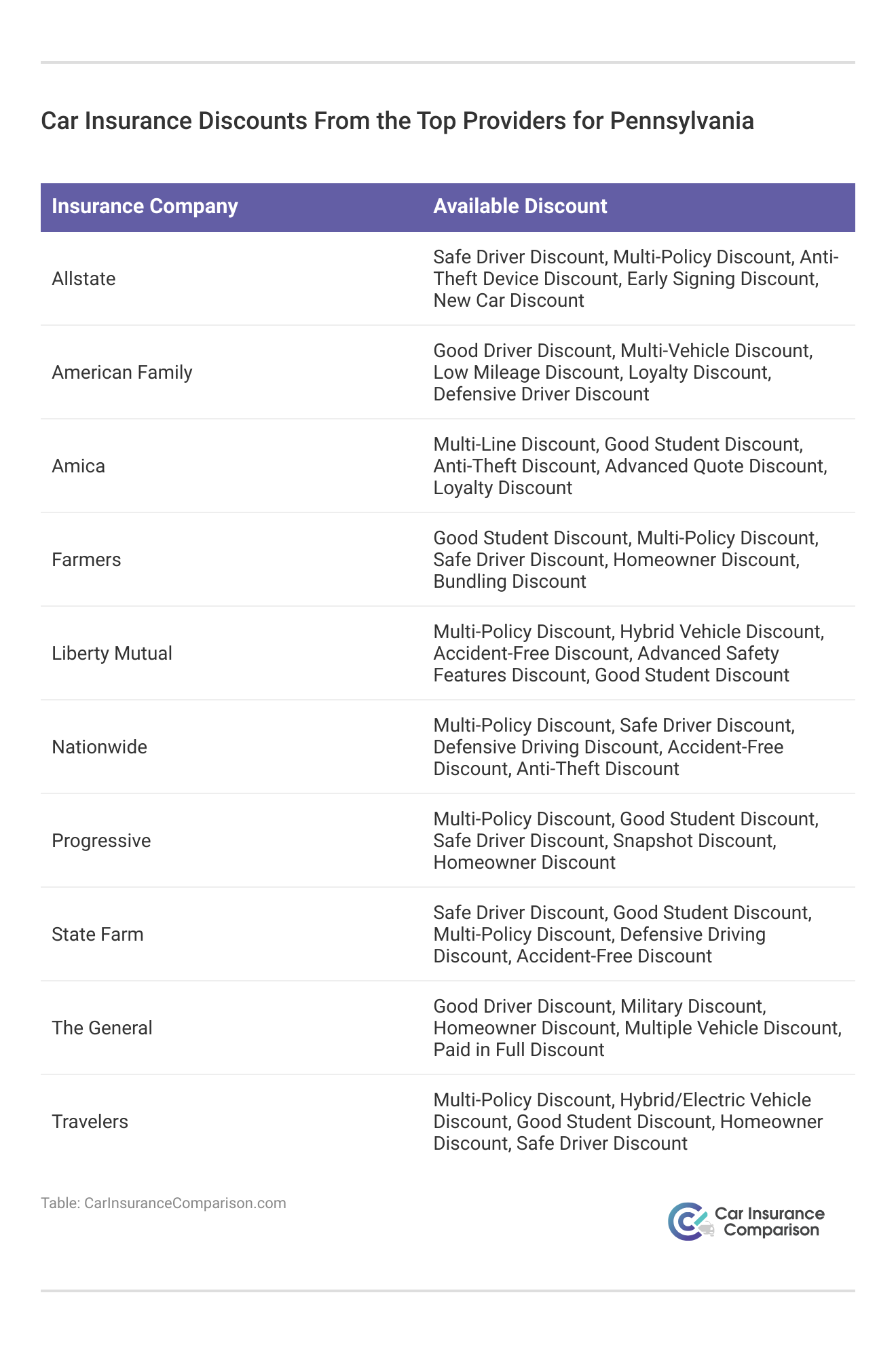

- Discount Opportunities: Pennsylvania drivers can benefit from Geico’s numerous discount opportunities, including safe driver discounts, multi-vehicle discounts, and military discounts, allowing for significant savings on car insurance. Learn more in our Geico car insurance review.

Cons

- Limited Local Agent Interaction: Geico primarily operates online and via phone, which may not appeal to Pennsylvania drivers who prefer face-to-face interactions with local agents for personalized service.

- Potential Higher Rates for Specific Demographics: Some Pennsylvania drivers, such as those with poor credit or a history of accidents, may experience higher premiums with Geico compared to other insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Travelers: Best For Policy Discounts

Pros

- Affordable Premiums: Travelers offers one of the cheapest Pennsylvania car insurance rates, with an average monthly premium of $25, providing substantial savings for budget-conscious drivers in the state.

- Extensive Coverage Options: Travelers provides a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage, allowing Pennsylvania drivers to customize their policies to fit their needs while keeping costs low.

- Discounts for Safe Drivers: Travelers offers discounts for safe driving, multi-policy holders, and good students, helping Pennsylvania drivers reduce their insurance costs even further. See more details on our Travelers car insurance review.

Cons

- Mixed Customer Service Reviews: While many customers are satisfied, some Pennsylvania drivers have reported mixed experiences with Travelers’ customer service, potentially impacting their overall satisfaction with the insurer.

- Limited Availability of Local Agents: In certain rural areas of Pennsylvania, drivers may find fewer local Travelers agents, which could affect the availability of personalized, in-person service.

#3 – State Farm: Best For Reliable Coverage

Pros

- Affordable Premiums: State Farm offers competitive Pennsylvania car insurance rates, with an average monthly premium of $26, making it a cost-effective choice for budget-conscious drivers in the state. Unlock details in our State Farm car insurance review.

- Comprehensive Coverage Options: With extensive coverage options, including liability, collision, and comprehensive insurance, State Farm ensures Pennsylvania drivers can customize their policies to fit their needs while maintaining affordability.

- Discount Programs: State Farm provides a range of discount programs for Pennsylvania drivers, such as safe driver discounts, multi-policy discounts, and student discounts, helping to further reduce the overall cost of car insurance.

Cons

- Limited Availability of Local Agents: While State Farm has a large network of agents nationwide, some rural areas in Pennsylvania may experience limited access to local agents, potentially impacting personalized service.

- Higher Premiums for High-Risk Drivers: State Farm’s affordable rates may not extend to high-risk drivers in Pennsylvania, who may face higher premiums due to factors like driving history or credit score.

#4 – Erie: Best For Local Support

Pros

- Competitive Rates: As mentioned in our Erie car insurance review, Erie offers some of the cheapest Pennsylvania car insurance rates at an average of $27 per month, making it a great option for drivers looking for affordable premiums.

- High Customer Satisfaction: Erie is known for its excellent customer service, consistently receiving high marks for customer satisfaction from Pennsylvania drivers, ensuring a positive insurance experience.

- Comprehensive Coverage Options: Erie provides a wide range of coverage options, including liability, collision, and comprehensive coverage, allowing Pennsylvania drivers to tailor their policies to their specific needs.

Cons

- Limited Availability: Erie is only available in 12 states, including Pennsylvania, which may limit its accessibility for drivers who relocate outside these regions and wish to retain their insurance provider.

- Potentially Higher Rates for Young Drivers: Younger drivers in Pennsylvania may find Erie’s rates less competitive compared to other insurers, potentially facing higher premiums based on their age and driving experience.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best For Customer Satisfaction

Pros

- Affordable Premiums: Auto-Owners offers competitive Pennsylvania car insurance rates, with an average monthly premium of $28, providing budget-friendly options for drivers in the state. Check out our page titled Auto-Owners car insurance review to know more details.

- Wide Range of Discounts: Auto-Owners provides various discounts for Pennsylvania drivers, including multi-policy, safe driver, and good student discounts, helping to reduce overall insurance costs.

- Strong Financial Stability: Auto-Owners is known for its financial stability and reliability, giving Pennsylvania drivers confidence in the company’s ability to pay out claims promptly and fairly.

Cons

- Limited Online Tools: Auto-Owners’ online tools and digital resources are less advanced compared to some competitors, which may be a drawback for tech-savvy Pennsylvania drivers who prefer managing their policies online.

- Availability of Local Agents: In some rural areas of Pennsylvania, drivers might find fewer Auto-Owners agents, potentially impacting the availability of personalized, in-person service.

#6 – Nationwide: Best For Vanishing Deductible

Pros

- Affordable Premiums: Nationwide offers competitive Pennsylvania car insurance rates, with an average monthly premium of $29, making it a budget-friendly option for drivers in the state.

- Strong Coverage Options: Nationwide provides a variety of coverage options, including liability, collision, and comprehensive insurance, allowing Pennsylvania drivers to customize their policies to fit their needs while keeping costs low.

- Vanishing Deductible: Nationwide offers a vanishing deductible program, which rewards safe driving by reducing the deductible over time, providing additional savings for Pennsylvania drivers. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Mixed Customer Service Reviews: While many customers are satisfied, some Pennsylvania drivers have reported mixed experiences with Nationwide’s customer service, potentially impacting their overall satisfaction with the insurer.

- Higher Premiums for High-Risk Drivers: Nationwide’s affordable rates may not extend to high-risk drivers in Pennsylvania, who may face higher premiums due to factors like driving history or credit score.

#7 – The Hartford: Best For AARP Benefits

Pros

- Competitive Rates: The Hartford offers affordable Pennsylvania car insurance rates, with an average monthly premium of $31, providing cost-effective options for budget-conscious drivers.

- AARP Discounts: The Hartford is known for its partnership with AARP, offering exclusive discounts and benefits to Pennsylvania drivers aged 50 and older, making it an attractive option for senior drivers. Learn more in our page AARP auto insurance program from The Hartford review.

- Comprehensive Coverage Options: The Hartford provides a variety of coverage options, including liability, collision, and comprehensive insurance, allowing Pennsylvania drivers to tailor their policies to their specific needs.

Cons

- Higher Premiums for Younger Drivers: Younger drivers in Pennsylvania may find The Hartford’s rates less competitive compared to other insurers, potentially facing higher premiums based on their age and driving experience.

- Limited Availability: The Hartford primarily focuses on serving older drivers and may have limited availability for younger Pennsylvania drivers or those without an AARP membership.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best For Personalized Service

Pros

- Competitive Rates: As mentioned in our American Family car insurance review, American Family offers Pennsylvania car insurance rates at an average of $36 per month, making it a cost-effective choice for many drivers in the state.

- Comprehensive Coverage Options: American Family provides a variety of coverage options, including liability, collision, and comprehensive insurance, allowing Pennsylvania drivers to customize their policies to fit their needs while keeping costs low.

- Generous Discounts: Pennsylvania drivers can benefit from American Family’s wide range of discounts, including multi-policy, safe driver, and good student discounts, helping to reduce overall insurance costs.

Cons

- Limited Availability of Local Agents: In some rural areas of Pennsylvania, drivers might find fewer American Family agents, potentially impacting the availability of personalized, in-person service.

- Mixed Customer Service Reviews: While many customers are satisfied, some Pennsylvania drivers have reported mixed experiences with American Family’s customer service, potentially impacting their overall satisfaction with the insurer.

#9 – Farmers: Best For Customizable Policies

Pros

- Affordable Premiums: Farmers offers competitive Pennsylvania car insurance rates, with an average monthly premium of $44, providing budget-friendly options for drivers in the state. Learn more in our Farmers car insurance review.

- Strong Coverage Options: Farmers provides a variety of coverage options, including liability, collision, and comprehensive insurance, allowing Pennsylvania drivers to customize their policies to fit their needs while keeping costs low.

- Discount Programs: Farmers offers numerous discount programs for Pennsylvania drivers, such as safe driver discounts, multi-policy discounts, and good student discounts, helping to reduce overall insurance costs.

Cons

- Limited Availability of Local Agents: In some rural areas of Pennsylvania, drivers might find fewer Farmers agents, potentially impacting the availability of personalized, in-person service.

- Higher Premiums for High-Risk Drivers: Farmers’ affordable rates may not extend to high-risk drivers in Pennsylvania, who may face higher premiums due to factors like driving history or credit score.

#10 – Progressive: Best For Snapshot Program

Pros

- Competitive Rates: Progressive offers Pennsylvania car insurance rates at an average of $49 per month, making it a viable option for drivers seeking affordable premiums in the state. Delve into our evaluation of Progressive car insurance review.

- Innovative Technology: Progressive’s Snapshot program uses telematics to track driving behavior, allowing Pennsylvania drivers to potentially lower their premiums based on safe driving habits, providing additional savings.

- Comprehensive Coverage Options: Progressive provides a wide range of coverage options, including liability, collision, and comprehensive coverage, allowing Pennsylvania drivers to tailor their policies to their specific needs.

Cons

- Mixed Customer Service Reviews: While many customers are satisfied, some Pennsylvania drivers have reported mixed experiences with Progressive’s customer service, potentially impacting their overall satisfaction with the insurer.

- Higher Rates for High-Risk Drivers: Progressive’s competitive rates may not extend to high-risk drivers in Pennsylvania, who may face higher premiums due to factors like driving history or credit score.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Pennsylvania Insurance Coverage and Rates

Pennsylvania requires all drivers to be insured, and looking through the many options available can make you feel overwhelmed. For the money that you must pay, you want to understand the coverage you get.

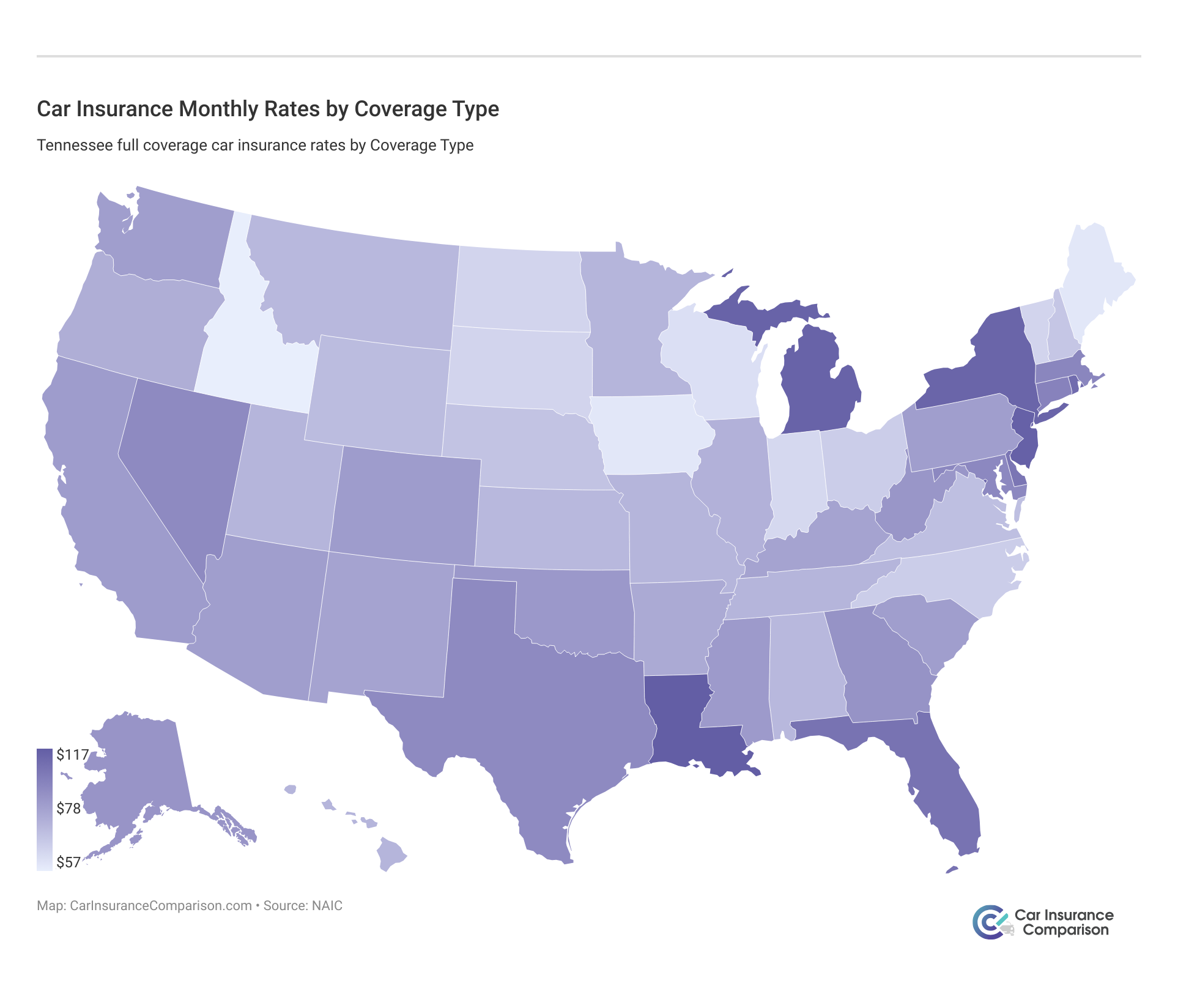

Pennsylvania Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $36 $108

Auto-Owners $28 $78

Erie $27 $77

Farmers $44 $131

Geico $23 $68

Nationwide $29 $86

Progressive $49 $148

State Farm $26 $76

The Hartford $31 $88

Travelers $25 $75

Our guide will help you get to know what you’re paying for; we’ll explain the major coverage types, insurers, average rates in Pennsylvania and other states, and much more.

So, buckle up and keep reading to learn more.

Pennsylvania Minimum Insurance Coverage

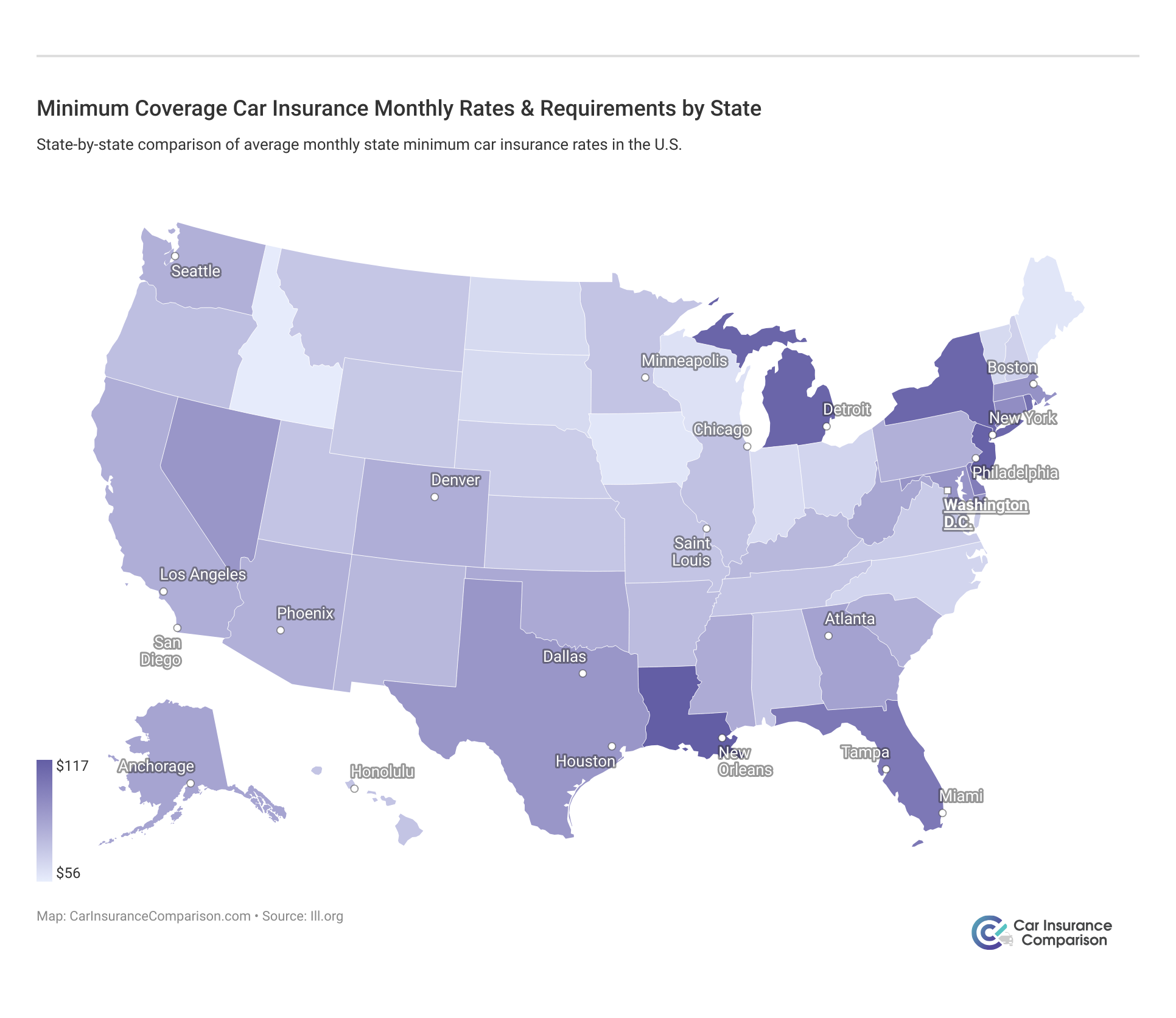

Most states require minimum coverage to ensure the financial responsibility of drivers on the road. Pennsylvania is no different, but minimum costs vary from state to state, as we can see below.

Pennsylvania is a no-fault insurance state, which means that you submit your claim to your insurance company. Your basic personal injury protection (PIP) or medical benefits coverage will pay for your medical bills and certain other out-of-pocket losses regardless of who caused the crash.

Unlike other “no-fault” states, Pennsylvania lets vehicle owners “opt out” of the no-fault system when they buy a car insurance policy. Insurance companies must inform customers of these coverage options: full tort or limited tort coverage.

Limited Tort Coverage: you can seek recovery for all medical and other out-of-pocket losses from an accident, and limited pain and suffering or other non-monetary losses unless your injuries qualify as “serious.” Recent Pennsylvania court decisions show that a “serious” injury often requires critical impairment of a bodily function or permanent and severe disfigurement.

Full Tort Coverage: it costs more, but gives you unlimited rights to sue for medical treatment, pain and suffering, and other out-of-pocket losses when another driver causes a car crash, even if the law doesn’t define your injuries as “serious.”

Read More: Compare Full Tort Car Insurance: Rates, Discounts, & Requirements

Note that Pennsylvania’s no-fault car insurance system doesn’t apply to vehicle damage claims. Someone injured in an accident can file a claim for vehicle damage against the at-fault driver without limits.

All Pennsylvania drivers must have car insurance. State minimum car insurance requirements are:

- $5,000 of Medical Benefits coverage (also known as First-Party Benefits), a form of personal injury protection, to cover medical expenses for yourself or others, regardless of fault

- $15,000 in liability insurance to cover medical costs for injuries to one person, capped at $30,000 per accident

- $5,000 to cover property damage if you’re at fault

- Limited or full tort coverage

Liability insurance pays everyone owed money for property damage and/or injuries from a car accident that you or anyone under your policy has caused – drivers, passengers, pedestrians, bicyclists, etc.

The Keystone State also recognizes certain all-purpose car insurance policies as long as there is a minimum of $35,000 in total coverage.

Remember that if you’re found at fault for a car accident and the injured drivers’ and/or passengers’ losses exceed the limits of your car insurance policy – even if you’ve met the state minimum coverage requirements – you could be responsible for the difference.

So, to protect yourself in case this happens, it makes sense to buy more than the minimum coverage required.

Forms of Financial Responsibility

Liability insurance or self-insurance, or other reliable monetary arrangements, deposits, resources, or commitments filed with PennDOT can provide proof of financial responsibility. If a law enforcement offer pulls you over, you’ll need to provide this proof.

According to PennDOT, drivers must provide proof of insurance in one of the following ways:

- An insurance identification card from an insurer or self-insurance.

- A copy of the insurance declaration page listing the claim holder and insured cars and drivers

- An insurance binder a licensed broker has signed

- A copy of an application for the Pennsylvania Assigned Risk Plan

- A signed letter from the insurance provider on company letterhead

Carrying the proper proof of financial responsibility is crucial for Pennsylvania drivers to avoid penalties. Ensuring you have documentation like an insurance identification card or declaration page can help you stay compliant and drive with confidence.

Self-Insurance

According to PennDOT, Pennsylvania drivers can opt for self-insurance instead of traditional insurance companies, provided they obtain approval from the Department. The requirements for a self-insurance proposal include submitting a self-insurance application, a security agreement, an income statement, and a completed balance sheet reflecting the individual’s or group’s financial standing from the previous year.

Additionally, a minimum collateral of $50,000 is required for one vehicle, and $10,000 for each additional vehicle, which can be in the form of U.S. currency, Treasury bills, loans, escrow deposits, or bonds. Next, we’ll examine the average amount Pennsylvanians spend on car insurance to help you assess affordability.

Premiums as a Percentage of Income

In 2014, the annual per capita disposable personal income (DPI) in Pennsylvania, after taxes were paid, was $42,414.

The average annual cost of car insurance in Pennsylvania is $950, which is two percent of the average DPI and about the same as nearby states; this number remained steady from 2012 to 2014.

The average Pennsylvanian has $3,535 each month to buy food, pay bills, etc. Car insurance will take about $79 out of that, and possibly more if your driving record isn’t entirely spotless.

Frequently Asked Questions

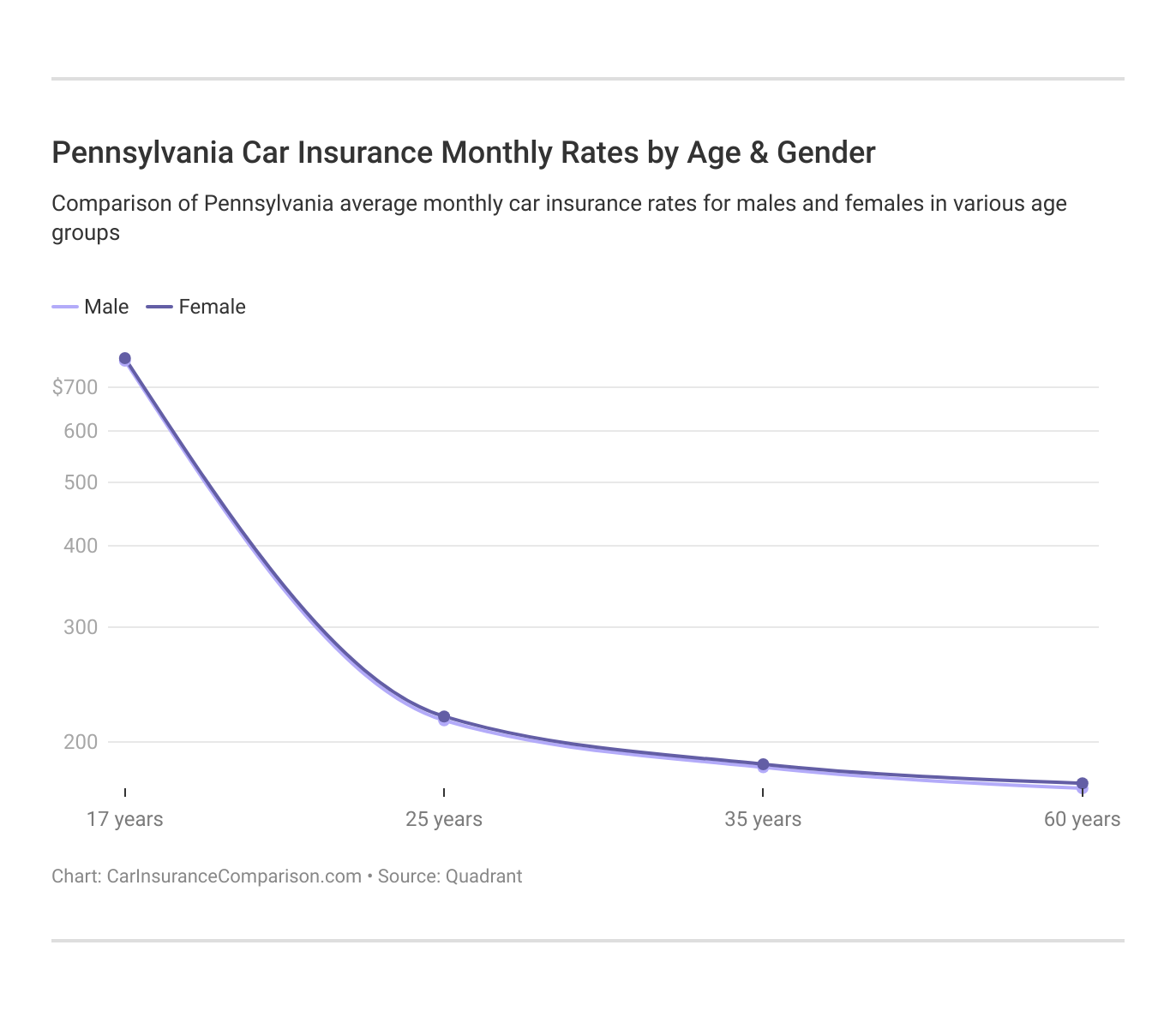

How are car insurance rates determined in Pennsylvania?

Car insurance rates in Pennsylvania are determined by various factors, including your driving record, age, gender, location, the type of vehicle you drive, coverage options chosen, and your credit history. Insurance companies use these factors to assess the level of risk you pose as a driver and calculate your premium accordingly.

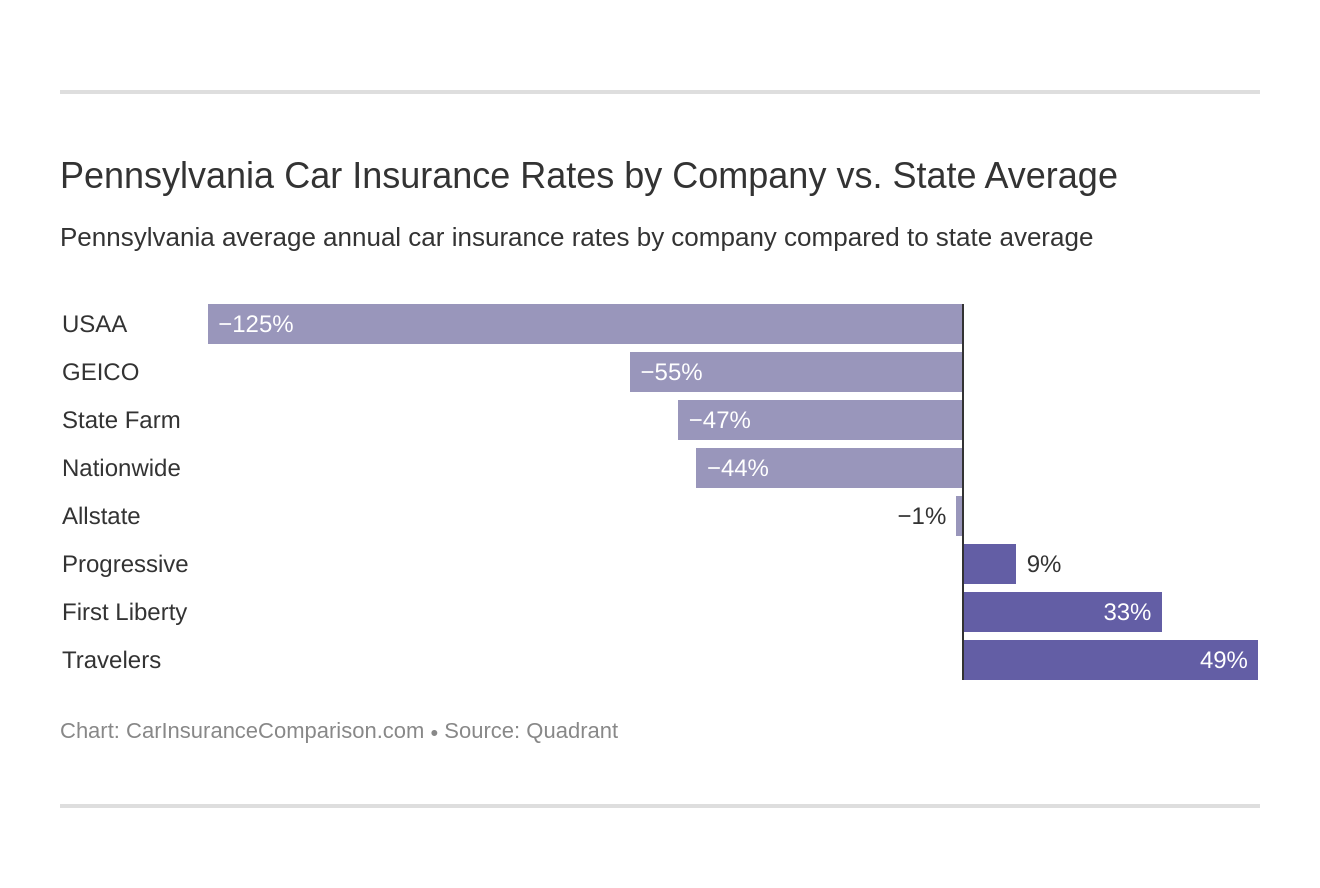

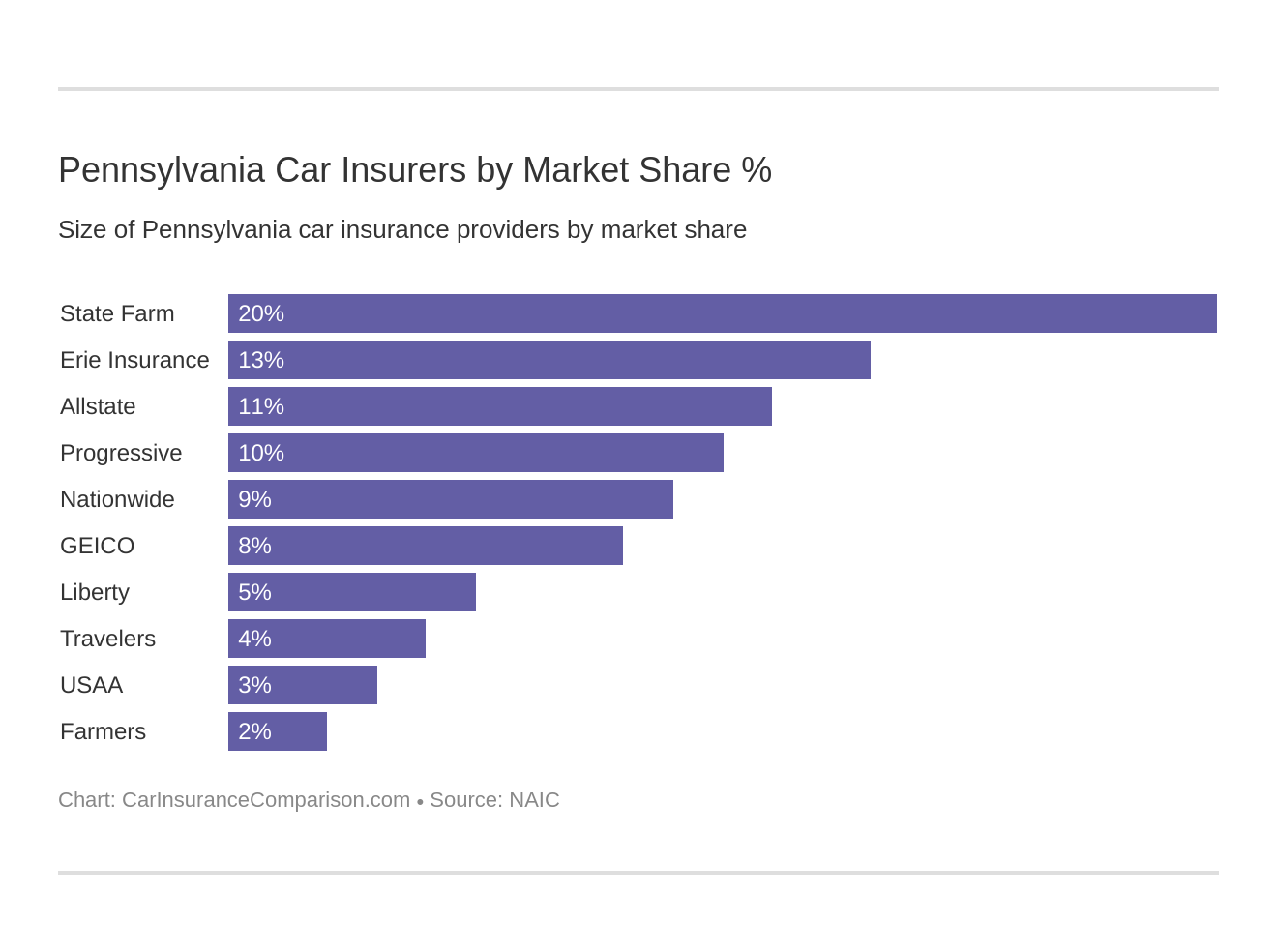

Are car insurance rates higher in Pennsylvania compared to other states?

Car insurance rates in Pennsylvania can vary compared to other states. The rates are influenced by factors such as population density, traffic congestion, weather conditions, and state-specific insurance regulations. While rates may differ, it’s important to compare quotes from multiple insurance providers to find the best rate for your specific situation.

Read More: Compare Car Insurance Rates by State

Are there any minimum car insurance requirements in Pennsylvania?

Yes, Pennsylvania requires all drivers to carry minimum liability coverage. The minimum requirements include $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage liability. These requirements ensure that drivers have a basic level of coverage to protect themselves and others in the event of an accident.

How can I find the best car insurance rates in Pennsylvania?

To find the best car insurance rates in Pennsylvania, compare quotes from multiple insurers, assess your coverage needs, and look for discounts such as safe driving or bundling policies. Check customer reviews for satisfaction levels and consider consulting an insurance agent for personalized advice.

Get fast and cheap car insurance coverage today with our quote comparison tool above.

What are some pros of comparing car insurance rates in Pennsylvania?

Comparing car insurance rates in Pennsylvania can lead to cost savings by finding more affordable premiums, allow you to customize coverage to better suit your needs, and reveal insurers offering additional benefits or unique policy features. It also helps you select a provider known for excellent customer service and reliability.

What are some cons of comparing car insurance rates in Pennsylvania?

Comparing car insurance rates in Pennsylvania can be time-consuming and may lead to information overload, making it difficult to choose the best option. Additionally, some insurance companies might not be included in comparisons, potentially missing competitive options. Frequent changes in providers for lower rates can also cause inconvenience and require adjustments to your coverage.

What factors influence car insurance rates in Pennsylvania?

Several factors that affect car insurance rates in Pennsylvania, including your driving history, vehicle type, location, and coverage level. Local factors such as crime rates and weather conditions can also impact your premiums.

Are there any state-specific regulations that affect car insurance rates in Pennsylvania?

Yes, Pennsylvania has specific regulations that impact car insurance rates, such as its choice no-fault system and mandatory coverage requirements. Understanding these regulations can help you make more informed decisions when choosing your policy.

Uncover affordable car insurance rates from the top providers by entering your ZIP code below.

How often should I review and update my car insurance policy in Pennsylvania?

It’s a good practice to review your car insurance policy annually or whenever you experience significant life changes, such as moving to a new area, buying a new vehicle, or altering your driving habits. Regular reviews ensure that your coverage remains adequate and that you are taking advantage of any available discounts.

How can my credit score affect my car insurance rates in Pennsylvania?

In Pennsylvania, your credit score can influence your car insurance rates. Insurers often use credit scores to assess risk, with lower scores potentially leading to higher premiums. Maintaining a good credit score can help you secure more favorable insurance rates.

Read More: Best Car Insurance Companies That Don’t Use Credit Scores

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.