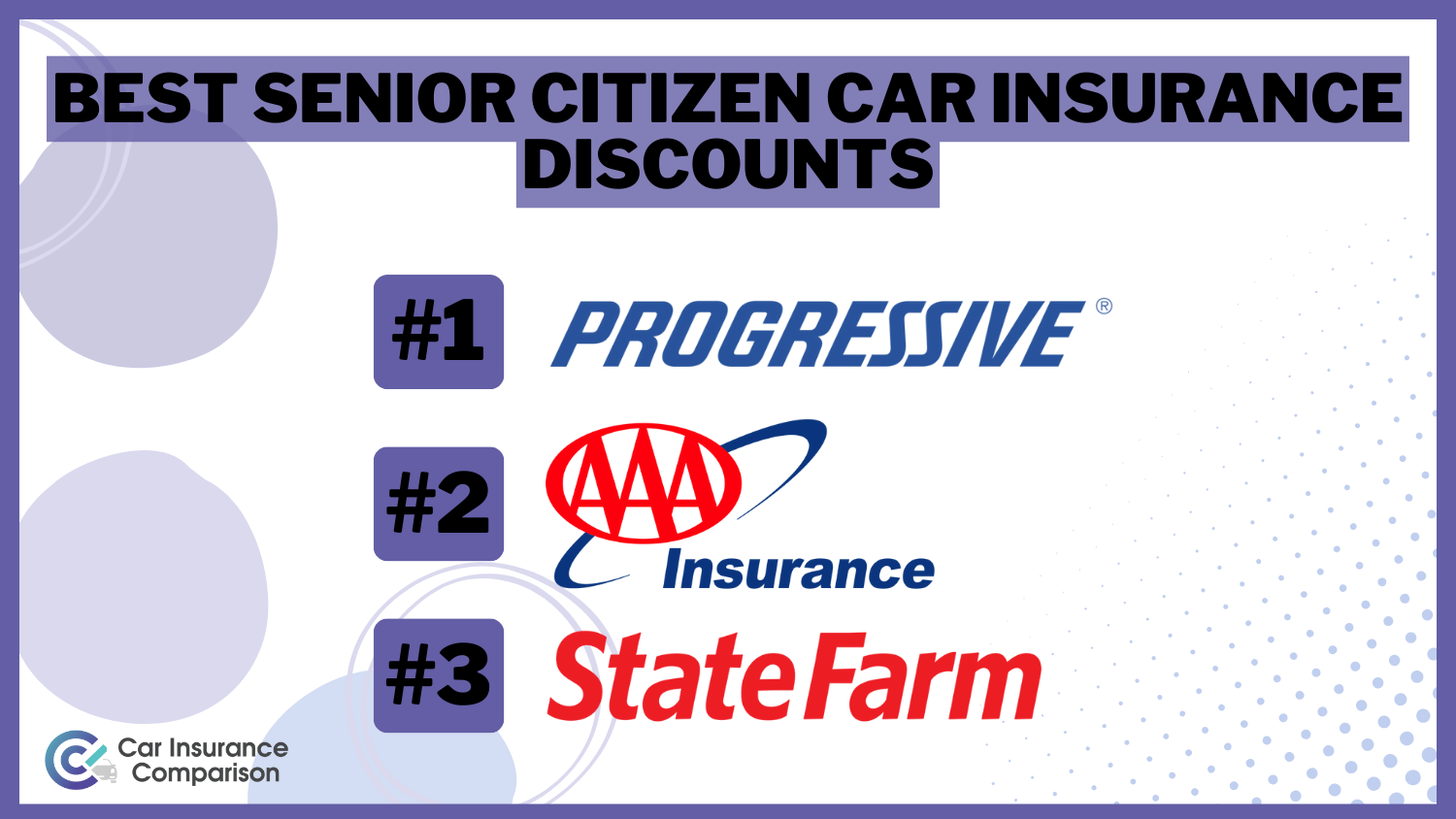

Best Senior Citizen Car Insurance Discounts in 2024 (Top 10 Companies Ranked)

Progressive, AAA, and State Farm offer the best senior citizen car insurance discounts, with rates starting as low as $30/month. Tailored for senior citizens, these companies stand out for their multiple discounts, loyalty rewards, and customizable coverage, making them the prime choices for savvy seniors.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Avg. Monthly Rate for Senior Citizen

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rate for Senior Citizen

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rate for Senior Citizen

A.M. Best Rating

Complaint Level

Pros & Cons

Progressive was the top pick for the best senior citizen car insurance discount provider, combining competitive pricing with superior customer service and comprehensive coverage.

Senior citizen can absolutely get car insurance discounts. As a result, the majority of car insurance providers offer the best car insurance for senior citizen.

Company Rank Multi-Vehicle Discounts A.M. Best Best For Jump to Pros/Cons

#1 24% A+ Customized Coverage Progressive

#2 16% A+ Accident Forgiveness AAA

#3 15% A++ Loyalty Rewards State Farm

#4 12% A+ Driving Rewards Allstate

#5 18% A Multi-Policy Discount Liberty Mutual

#6 10% A Bundle Discounts Farmers

#7 11% A Generational Discounts American Family

#8 7% A Roadside Assistance Nationwide

#9 13% A+ Personalized Service Erie

#10 10% A++ Coverage Options Travelers

This makes them the go-to option for seniors seeking the perfect balance of affordability and quality protection. Enter your ZIP code below to compare car insurance rates right now.

- Progressive leads with up to 10% senior discounts

- Seniors aged 55 and above can qualify for discounts due to reduced driving

- Compare Progressive with AAA and State Farm for savings

#1 – Progressive: Customized Coverage Expert

Pros

- Cost Savings: Significantly reduce insurance premiums.

- Rewarding Loyalty: Loyalty discounts are extended to long-standing customers. Here’s our Progressive car insurance review for your guide.

- Enhanced Coverage Options: Specialized coverage options created for senior drivers.

Cons

- Limited Eligibility: Driving history, vehicle type, and location are the qualifications based on eligibility criteria.

- Potential Rate Increases: Premiums may increase over time due to factors like changes in driving habits.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – AAA: Accident Forgiveness Leader

Pros

- Tailored Coverage: AAA offers specialized options like medical expense coverage or roadside assistance.

- Loyalty Rewards: Long-time customers reaching senior age may benefit from discounts, making them loyal.

- Cost Savings: AAA’s senior citizen discounts can lower insurance premiums.

Cons

- Rate Fluctuations: While discounts reduce costs initially, premiums may rise over time.

- Coverage Restrictions: Discounts may entail coverage restrictions. Find out more with our AAA car insurance review.

#3 – State Farm: Loyalty Reward Specialist

Pros

- Multiple Discounts: State Farm offers various discounts tailored for seniors.

- Customizable Coverage: Seniors can personalize their policies.

- Financial Stability: In our State Farm car insurance review, it’s evident that their strong financial standing guarantees reliable claims processing.

Cons

- Claim Handling: Few customers have raised complaints with claim processing, potentially causing delays or disputes over settlements.

- Potential Higher Premiums: While discounts are available, premiums may be comparatively higher for some seniors.

#4 – Allstate: Driving Rewards Expert

Pros

- Discount Variety: Allstate offers various discounts tailored for seniors.

- Tailored Insurance: Seniors have the flexibility to tailor their policies with features such as medical expense coverage.

- Economic Security: Allstate’s robust financial position guarantees dependable claims payment.

Cons

- Customer Service Challenges: There are reported instances of customer service and claim processing issues with Allstate.

- Higher Premiums Potential: Despite discounts, some seniors may experience increased costs. Check out more with our Allstate car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Multi-Policy Discount Leader

Pros

- Diverse Discount Offerings: Liberty Mutual provides a variety of discounts for seniors.

- Personalized Policy Options: In our Liberty Mutual car insurance review, some seniors may face elevated insurance rates.

- Financial Security: Liberty Mutual robust financial position ensures the dependability in handling claims.

Cons

- Varied Eligibility Requirements: Not every senior may meet the criteria for Liberty Mutual discounts.

- Potential for Elevated Premiums: Despite the availability of discounts, premiums offered by Liberty Mutual may be comparatively higher for certain seniors.

#6 – Farmers: Bundles Discount Specialist

Pros

- Reputation: Farmers is well-established with a stellar standing. Find out more details of Farmers in our Farmers car insurance review.

- Flexible Protection: Seniors can customize their coverage.

- Discount Options: Offers various discounts tailored for seniors, such as safe driver discounts, multi-policy discounts, and discounts for safety features.

Cons

- Eligibility Criteria: Not every senior may be eligible for Farmers Insurance’s discounts.

- Customer Service Concern: Some customers have reported issues with Farmers Insurance’s customer service and claims processing.

#7 – American Family: Generational Discounts Provider

Pros

- Discount Diversity: American Family provides a wide range of discounts designed for seniors.

- Tailored Coverage: Seniors can personalize their insurance plans. Check out how this works in our American Family car insurance review.

- Reputable Provider: American Family is well-regarded in the insurance industry.

Cons

- Service Issues: Some customers have expressed concerns regarding American Family’s customer support and claim management.

- Potential for Increased Premiums: Despite available discounts, premiums offered by American Family may be relatively higher.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Roadside Assistance Processor

Pros

- Discount Range: Nationwide encompasses safe driving records, policy bundling, and safety enhancements.

- Flexible Coverage: Seniors have the freedom to customize their policies. Use our Nationwide car insurance review as your customization guide.

- Brand Trust: Nationwide is a respected and reputable insurance provider.

Cons

- Service Concerns: Some customers have expressed dissatisfaction with Nationwide’s customer service.

- Potential for Elevated Premiums: Despite available discounts, premiums from Nationwide may be negatively higher for certain seniors.

#9 – Erie: Personalized Service Specialist

Pros

- Discount Opportunities: Erie offers various discounts made for seniors.

- Customized Policies: Seniors can tailor their policies to their specific needs.

- Reputation: Erie is a well-regarded insurance provider known for its customer service.

Cons

- Limited Availability: Erie may not be available in all areas, limiting options for seniors seeking insurance coverage.

- Eligibility Criteria: Not all seniors may be registered for Erie’s discounts. Qualifications can be viewed in our Erie car insurance review.

#10 – Travelers: Coverage Options Leader

Pros

- Discount Options: Travelers offers various discounts specifically created for seniors.

- Flexible Coverage: Seniors can customize their auto insurance coverage. Read how senior drivers can pick the coverages they need in our Travelers car insurance review.

- Reputation: Travelers is a well-established insurance provider with a strong reputation.

Cons

- Limited Coverage Options: Travelers may not offer as many specialized coverage options.

- Eligibility Criteria: Not all seniors may be secured for Travelers’ discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Factors Influencing Car Insurance Rates for Senior Citizens

Outside of offering lower rates to senior citizens, everything else with the insurance company stays the same. You will not get lower rates if you have a terrible driving record, bad credit, or any DUIs on your record.

The senior citizen discount applies to drivers in good standing with their insurance companies.

In fact, in addition to your senior citizen discount, you can still qualify for:

- Good driver discounts

- Loyalty discounts

- Multiple policy discounts

- Multiple car discounts

- Safe car discounts

When a car insurance company considers your application, they will review your:

- Age

- Gender

- Marital status

- Education

- Credit score

- Type of car

- Driving record

- Location

Senior citizens may enjoy lower car insurance rates, but factors like driving record and credit score still matter. Other discounts, like for safe driving or loyalty, may also apply based on your profile.

Understanding Automatic Changes in Car Insurance Rates at Age 55

In most cases, your insurance rate will change automatically when something major changes in your life. Of course, there are a few things that the insurance company has no way of knowing unless you tell them, such as if you get married or have a child.

However, because they require you to provide your birthday when you apply for car insurance, they will know when you hit any major age milestones that will affect your rates.

If your insurer offers a discount for completing a defensive driving course, you’ll need to provide course details to qualify. This discount often reflects improved driving skills, and there are various other discounts available to help secure affordable rates. To learn more, read our guide on Over Age 55 Car Insurance Discounts 2023.

Lower Rate Guarantees at Other Ages

There is no way to say absolutely yes. At the age of 55, you may be driving a $60,000 car; while you were 25, you might have been driving a $7,000 car. Driving abilities, type of vehicle, age range, safety features, and driving habits are just some of the things that can determine your auto insurance rates.

If you live in an area that has higher crime rates than you did in previous years, then your rates will be higher as well.

There is just no sure way to say that you will pay less once you turn 55.

If, however, from the age of 54 to the age of 55 nothing has changed regarding where you live and what kind of car you drive, you could be paying less money for your car insurance.

However, while rates will be lower for you between the ages of 55 and 70, according to the Insurance Information Institute, the risk that you will have an accident increases significantly after you turn 70. At that point you will probably have to pay more for your senior car insurance rates, despite additional driving experience.

With all of the varying factors that can affect the cost of auto insurance, comparison shopping is essential. Driving discount options for seniors will depend on if they meet the eligibility requirements. Get full coverage auto insurance for the lowest price by comparing rates from the top companies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Eligibility Criteria for Senior Car Insurance Discounts

While the official age a person is considered a senior citizen in the United States is 65, most car insurance providers offer senior discounts to people in their 50’s. This is often referred to as a mature driver discount.

For auto insurance discounts for senior citizens, it’s important to note that this discount may not be automatically applied. Therefore, policyholders should review their policy regularly to ensure that they maintain affordable car insurance for senior citizens.

It is not uncommon for this type of discount to save the policyholder 10 percent or more on their annual car insurance premium. Just because as a person starts receiving discounts on their car insurance as they get older does not mean they will continue to receive them.

Other Car Insurance Discounts

There are many other discounts of which a senior citizen might be able to take advantage. These discounts include low mileage discounts, good driver discounts, quick or full payment discounts, homeowner discounts, and long-time customer discounts.

Someone who is retired most likely will not drive as much as someone who has a daily commute to work.

Due to reduced driving frequency in retirement, seniors often qualify for car insurance discounts. These discounts acknowledge the lower risk associated with driving less. Additionally, discounts for safe driving, including those for seniors, are available to those with a clean driving history. Avoiding violations and accidents helps maintain eligibility for these discounts.

Progressive emerges as the most affordable and tailored choice for senior citizen car insurance, offering competitive rates and discounts based on individual factors.

Brad Larson Licensed Insurance Agent

Progressive offers competitive six-month car insurance tailored for seniors, featuring discounts like full payment incentives, which are commonly favored by this demographic. Seniors are much more likely to make this type of payment arrangement than a younger policyholder.

Seniors are also more likely to receive a discount for being member of an auto club like AAA or an organization like AARP. Seniors tend to plan ahead a bit better than their younger counterparts so are more likely to be a member of these types of organizations.

Car Insurance Offerings for Senior Citizens Across Insurance Companies

Respected car insurers serve all age groups, provided they meet driving requirements. If dissatisfied, explore other providers for competitive rates and suitable coverage, including options tailored for seniors. Research “cheapest car insurance for seniors” for the best value.

If a car insurance company turns you down, it is likely that there are other underlying reasons for the cause rather than just age.

If you are concerned about how an insurance company might treat you, use sources like J.D. Power or Weiss Ratings to see how companies are rated on customer service. These sites may help ease your mind about the insurance company you choose.

Insurance Company Minimum Coverage Full Coverage

Progressive $36 $95

AAA $30 $77

State Farm $30 $76

Allstate $60 $154

Liberty Mutual $64 $159

Farmers $50 $128

American Family $40 $105

Nationwide $30 $77

Erie $21 $55

Travelers $35 $90

Rates for senior citizen monthly car insurance vary across providers, with options such as Progressive offering full coverage at $95 and minimum coverage at $36, AAA at $77 for full coverage and $30 for minimum coverage, and State Farm at $76 for full coverage and $30 for minimum coverage, among others.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Impact on my Car Insurance Rates if I Fail the Driver’s Test

If you fail your driver’s test, your insurance rates won’t change for the time being. In some states, the DMV informs your insurance company of the change in your driving status, but not all states do.

It boils down to driving your car. If you cannot drive, you should consider dropping your car insurance.

There is no reason to pay for insurance costs you cannot benefit from, especially if you’ve added expenses like homeowners insurance or life insurance.

If you have other drivers on your vehicle, you can have your name removed from the list of insured people on the car. If you don’t have a safe driving record, this removal could lower your rates, though the chances are higher if other drivers on your policy have excellent driving records.

If you’re a mature driver aiming to browse through the best car insurance for seniors, you’ll want a company with dependable customer service, fair policy service options, a reliable claims service, and rewards for being a safe driver. An auto policy may allow for an accident-free discount or a safe driver discount, or yield another option for seniors to lower their auto insurance costs.

You can compare car insurance rates right now by entering your ZIP code below.

Case Studies: Senior Citizen Car Insurance Discounts

In today’s insurance landscape, senior citizens often benefit from tailored discounts that acknowledge their reduced driving frequency, enhanced driving skills, and commitment to safety. Let’s explore three case studies highlighting how senior citizens optimize their car insurance premiums.

- Case Study 1: Reduced Rates At 58, Mr. Johnson experienced a pleasant surprise on his birthday: a 10% reduction in his car insurance rates due to driving less frequently.

- Case Study 2: Additional Discounts Mrs. Ramirez, aged 62, not only availed herself of the senior citizen discount but also qualified for extra savings due to her impeccable driving record and vehicle safety enhancements.

- Case Study 3: Comparison Shopping 65-year-old Mr. Lee diligently compared quotes from various insurers, discovering providers offering senior citizen discounts as high as 15%.

These case studies underscore the importance of exploring available discounts and engaging in informed comparison shopping for senior citizen car insurance, ensuring significant savings without compromising coverage.

Frequently Asked Questions

What is a senior citizen car insurance discount?

A senior citizen car insurance discount is a special rate or discount offered to older individuals, typically aged 55 or older, by insurance companies to help reduce their car insurance premiums. These discounts are designed to recognize the lower-risk profile often associated with senior drivers.

How much can I save with a senior citizen car insurance discount?

The amount you can save with a senior citizen car insurance discount varies depending on the insurance company and the specific discounts they offer. Typically, the discount can range from 5% to 15% off the base premium. It’s advisable to check with your insurance provider to determine the exact amount you could save. You can compare discounts as well and gain further insight now by entering your ZIP code below.

Are there any eligibility requirements to qualify for a senior citizen car insurance discount?

Yes, eligibility requirements can vary between insurance companies. Generally, you will need to be a certain age, typically 55 or older, and hold a valid driver’s license. Some companies may also consider factors such as driving record, annual mileage, and the type of vehicle you drive. It’s best to check with your insurance provider to understand their specific eligibility criteria.

Can seniors qualify for discounts through auto club or organization membership?

Yes, seniors can receive additional discounts by being members of auto clubs like AAA or organizations. For more details, check out our AARP car insurance review.

Where can I find senior-oriented driver education courses?

Consult organizations like AARP or AAA to find senior-oriented driver education courses.

Are senior-oriented driver education courses worth the cost?

Yes, attending senior-oriented driver education courses, typically costing $10 to $30, can save policyholders 10% or more on their car insurance rates.

Can I combine a senior citizen car insurance discount with other discounts?

In many cases, yes. Insurance companies often allow customers to combine multiple discounts to maximize their savings. However, the availability and specifics of combining discounts may vary between insurance providers. It’s recommended to discuss this with your insurer to determine which discounts can be combined.

Do all insurance companies offer senior citizen car insurance discounts?

Not all insurance companies offer senior citizen car insurance discounts, but many do. It’s important to shop around and compare quotes from different insurance providers to find the one that offers the best coverage and discounts for your needs.

How can I compare car insurance rates for seniors?

Use the free online search tool by entering your ZIP code to compare car insurance rates for seniors. Obtain quotes from multiple providers and consider coverage options and discounts. You can do it in the most convenient way possible now by entering your ZIP code below.

What factors affect car insurance rates for seniors?

Car insurance rates for seniors are influenced by factors such as the type of car, driving history, credit score, location, and coverage options chosen.

What types of coverage are typically included in senior citizen car insurance policies?

Senior citizen car insurance policies often include standard coverage options such as liability, collision, and comprehensive coverage. Additionally, they may offer specialized coverage for medical expenses, roadside assistance, and coverage for rental vehicles.

Are there any hidden discounts in car insurance policies for seniors?

Some car insurance policies for seniors may offer hidden discounts that are not explicitly advertised. These discounts could include loyalty rewards, bundling discounts, or discounts for specific affiliations such as professional organizations or alumni associations.

Is there affordable car insurance available specifically designed for senior citizens?

Yes, there is affordable car insurance available specifically designed for senior citizens. Many companies offer competitive car insurance rates and tailored coverage options for older drivers, ensuring they receive adequate protection at a reasonable cost.

What factors determine car insurance rates for senior citizens?

Senior citizens receive lower rates, but other factors like driving record and credit score still influence premiums. Discounts for safe driving, loyalty, and multiple policies or cars may also apply.

Why do car insurance rates change automatically at age 55?

Your insurance rate adjusts for major life changes, and age-related rate changes are tracked using your birthdate provided during application. Defensive driving course details may qualify you for a discount, alongside various others for affordable rates.

Does this guarantee me a lower rate than at any other age?

There’s no absolute guarantee; factors like driving habits, vehicle type, and location influence rates. Comparison shopping is crucial to find the best coverage at the lowest price, especially for seniors who may qualify for driving discounts.

Do all insurance companies offer car insurance to senior citizens?

Respected insurers offer coverage for all age groups; explore alternatives for competitive rates and tailored options, especially for seniors. Utilize resources like J.D. Power or Weiss Ratings to assess customer service ratings and find the best value.

What happens to my car insurance rates if I can’t pass my driver’s test?

Failing your driver’s test may not impact insurance rates immediately, as not all states notify insurers of changes. Consider dropping car insurance if you cannot drive, especially if you have other expenses like homeowners or life insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.