Allstate Car Insurance Review for 2026 [See Rates & Discounts Here]

Allstate car insurance offers essential coverages starting at $59/month, with options like accident forgiveness and deductible rewards. Our Allstate car insurance review covers everything you need to know about Allstate’s claims process, average rates, coverage options, and available discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

Our Allstate car insurance review provides an in-depth look at the company’s offerings, highlighting affordable premiums starting at $59/month.

The company provides a wide array of coverage choices, including liability, collision, and comprehensive coverage. You can compare comprehensive car insurance options, alongside discounts like accident forgiveness and safe driving bonuses.

Allstate Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 4.0 |

| Claims Processing | 3.0 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.2 |

| Plan Personalization | 4.5 |

| Policy Options | 3.4 |

| Savings Potential | 3.8 |

While Allstate’s premiums may be higher than some competitors, its financial stability and customizable plans make it a strong option. This review helps you decide if it’s right for you.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

- Allstate offers customizable plans with rates starting at $59/month

- Customer reviews highlight strong financial stability but mixed claims experiences

- Young drivers benefit from competitive rates compared to other insurers

Key Information About Allstate Insurance

Allstate is a top U.S. insurer offering customizable coverage and discounts, with premiums starting at $59/month, though rates vary by location and driving history. Compare car insurance by coverage type to find the best option for your needs. Allstate features such as accident forgiveness and safe driving bonus can assist you in tailoring your policy while saving big without compromising on coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Age, Gender, and Coverage Affect Premiums

Allstate insurance rates are influenced by various factors such as coverage level, age, and gender. Younger drivers typically face higher premiums, while older drivers can enjoy significantly lower rates. Here’s a breakdown of Allstate’s monthly car insurance rates based on these key factors.

Allstate Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $237 | $608 |

| Age: 16 Male | $260 | $638 |

| Age: 18 Female | $193 | $448 |

| Age: 18 Male | $223 | $519 |

| Age: 25 Female | $69 | $181 |

| Age: 25 Male | $72 | $190 |

| Age: 30 Female | $64 | $168 |

| Age: 30 Male | $67 | $177 |

| Age: 45 Female | $62 | $162 |

| Age: 45 Male | $61 | $160 |

| Age: 60 Female | $59 | $150 |

| Age: 60 Male | $60 | $154 |

| Age: 65 Female | $61 | $158 |

| Age: 65 Male | $60 | $157 |

Allstate car insurance rates vary by coverage, age, and gender. Young drivers pay higher premiums, with 16-year-old males at $260 and females at $237. Rates decrease significantly with age, reaching $59 for females and $60 for males at age 60. The best car insurance rates for young drivers with points may be higher due to driving violations.

Full coverage rates follow a similar trend, with younger drivers paying more, while older drivers experience lower premiums, such as $608 for a 16-year-old female and $150 for a 60-year-old female.

Allstate is a solid option for drivers looking for complete coverage and the assurance that their financial rivals can meet state requirements.

Michelle Robbins Licensed Insurance Agent

Whether you’re a young driver or more experienced, understanding how age and coverage level affect your premium is crucial when choosing Allstate car insurance. This allows you to see the plan that fits within your budget, taking a look at age brackets and coverage levels.

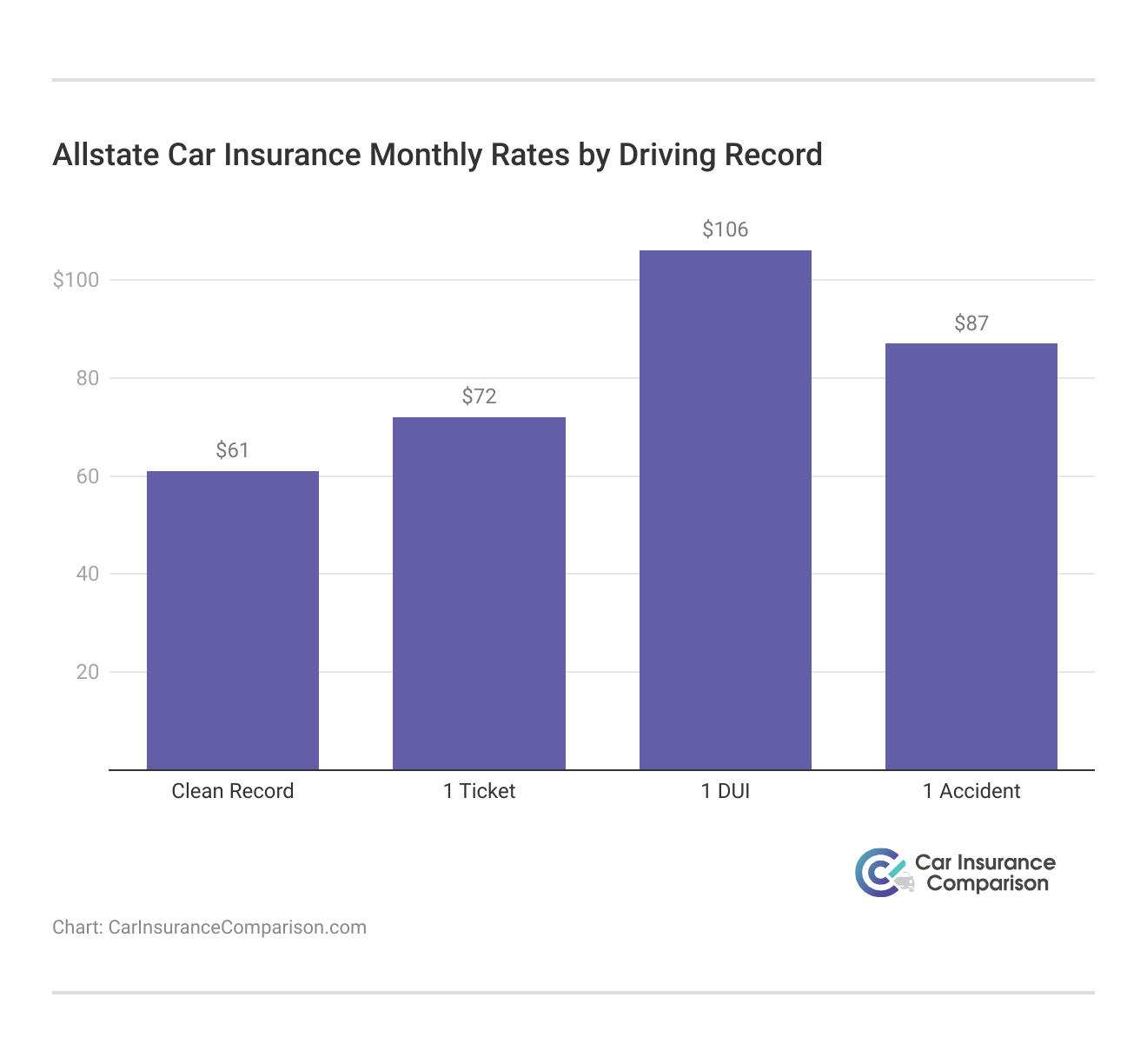

Impact of Your Driving Record on Allstate Car Insurance Rates: Clean Record vs. Violations

Your driving record plays a significant role in determining your car insurance rates. Whether you have a clean record or past violations, understanding how they affect your car insurance premiums is crucial when selecting coverage.

The rates that you pay for car insurance depend on your driving record. For minimum coverage, clean record rates are $61/month, but a DUI can jump the cost to $106/month. Driving history is another factor in premiums, with a ticket or accident also raising rates.

If you know the way tickets, accidents, and DUIs affect your insurance, it will help you make informed choices that may keep rates lower as you minimize your driving record damage.

Comparing Allstate Car Insurance Rates for Young Drivers: A Price Breakdown by Age & Gender

Allstate stands apart in the other direction, offering some of the most competitive pricing for young drivers. Parents and young drivers should consider Allstate, which has lower rates than many of its top competitors for 16- and 18-year-old drivers.

Allstate car insurance rates for 16- and 18-year-old drivers are competitively priced compared to top competitors, with several factors that affect car insurance rates. For example, Allstate charges $210 for a 16-year-old female and $215 for a 16-year-old male, while companies like American Family and Farmers have significantly higher rates.

Allstate Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age 16 Female | Age 16 Male | Age 18 Female | Age 18 Male |

|---|---|---|---|---|

| $210 | $215 | $205 | $210 | |

| $530 | $740 | $99 | $108 | |

| $530 | $740 | $99 | $108 | |

| $530 | $740 | $99 | $108 | |

| $530 | $740 | $99 | $108 |

| $530 | $740 | $99 | $108 |

| $530 | $740 | $99 | $108 | |

| $530 | $740 | $99 | $108 | |

| $530 | $740 | $99 | $108 | |

| $530 | $740 | $99 | $108 |

However, Geico and Liberty Mutual have rates in the same ballpark as Allstate for young drivers. This side-by-side price comparison with other major insurers helps you to see how Allstate prices compare to the competition based on age and gender.

Reflecting on Allstate rates next to those from other leading insurers can help you make a side by side decision, depending on your age and gender. This helps you find competitive coverage for the lowest cost possible with its comparison tools.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Car Insurance Coverage: Key Terms and What They Mean

Allstate provides the exact same level of coverages as every other company and usually at a higher rate. Here are the industry-standard insurance terms and a breakdown of what they mean.

We realize it can be a little confusing, which is why we put together a rundown of some of the most common coverages along with a simplified description. Four basic categories exist into which varying coverage types will fall:

- Liability Car Insurance: Covers the physical damage you do to another car and any injury everyone in that car suffers.

- Uninsured and Underinsured Motorist Coverage: Pays for your expenses if the other driver who causes the crash only has limited liability coverage or no coverage at all. Compare liability car insurance to ensure you’re adequately protected.

- Collision Car Insurance: This collision car insurance pays for your vehicle’s repairs or replacement in an accident.

- Comprehensive Car Insurance: Covers what most people might think of as “out of our control” — storm damage, hitting an animal, etc. So Allstate full coverage probably is liability plus collision plus comprehensive.

- Personal Injury Protection: These insurance pays any costs you incur for harm to yourself and others in the vehicle and lost wages and funeral expenses no matter who was at fault.

Allstate allows you to customize your coverage with options like personal injury protection and uninsured motorist coverage.

Allstate provides comprehensive coverage options and valuable discounts, but its rates may be higher for certain drivers, making comparison shopping essential.

Jeffrey Manola Licensed Insurance Agent

You can tailor your policy with coverage limits that provide optimal protection for yourself and others in the event of accidents, property damage, or other unexpected situations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Exploring Specialized Car Insurance Options

There are types of car insurance available, so familiarize yourself on which will suit you best. Specialty policies — insurer coverage for various driving circumstances, from classic car insurance for vintage vehicles to rideshare coverage for drivers.

- Classic Car Insurance: Policy tailored for classic or antique cars with coverage that is appropriate for their special value and use.

- Rideshare Car Insurance: Same as above but for those who drive people around through rideshare companies. Compare rideshare car insurance to find the best coverage options.

- Roadside Assistance: Covers the cost of emergency roadside services like flat tire changes, lockouts, and battery jump-starts to keep you moving.

- Property Protection: Covers costs when you damage someone else’s property, like a fence or building, during an accident.

- Milewise: A pay-per-mile insurance option where premiums are based on the number of miles driven each month, ideal for low-mileage drivers.

Whether you restore classic cars, use your vehicle for rideshare services, or only require roadside assistance, picking the right coverage to fit your lifestyle is key.

This is why you must explore options like milewise and property protection so that you can get the right insurance at the lowest rate.

Allstate Customer Ratings, Financial Strength, and What You Need to Know

With the gloves off, let us find out what several independent agencies have to say about Allstate and how it may fit your company. Allstate auto insurance earns fairly good ratings through multiple review systems. J.D Power offers an average satisfaction score of 832/1,000.

Allstate Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Strong Customer Support |

|

| Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.45 Avg. Complaints |

|

| Score: A+ Superior Financial Strength |

The BBB gives Allstate an A+ for excellent customer support, while Consumer Reports rates it 74/100 for good customer satisfaction. Despite a higher-than-average complaint ratio (1.45 according to NAIC), Allstate’s financial strength is rated A+ by A.M. Best, reflecting its stability.

A Reddit user shares their experience researching Allstate insurance, mentioning positive reviews concerning coverage options like new car replacement, roadside assistance, cheaper rates, and best car insurance discounts.

How is Allstate as an insurance company, are the nightmare stories about them true?

byu/Jcs609 inInsurance

But after hearing about claim denials like a roof in California and car damages from the storm readers wonder if Allstate is really worse than say Liberty Mutual, Geico or Travelers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Car Insurance: Affordable Rates, Discounts, and Comprehensive Coverage

Pricing out at $60/month, Allstate is becoming affordable. This does encompass liability insurance policy, collision insurance coverage, as well as thorough protection. For drivers looking for a good mix of protection, the discounts that come with USAA make it appealing alongside extras like accident forgiveness, safe driving bonuses and car insurance deductible rewards.

data-media-max-width=”560″>

Have you heard of Drivewise? It’s located in our Allstate app. We recently found out that customers who choose to use Drivewise are 25% less likely to have a severe collision than those who don’t. https://t.co/HNMxg3hVAZ

— Allstate (@Allstate) May 13, 2024

Though Allstate might have a handful of higher premiums than its competitors, its overall financial strength and customizable coverage plans are impressive. Allstate is widely regarded, with strong ratings from the BBB and A.M. Best, but depending on your situation you may be able to find a better rate through one of many other insurers, so be sure to shop around before locking in your policy.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

What is included in an Allstate auto insurance policy?

Allstate auto insurance typically includes coverage options such as liability, collision, comprehensive, personal injury protection, and uninsured motorist coverage. And you can also add on extras like roadside assistance and rental reimbursement as needed.

How do I obtain an Allstate auto insurance quote?

To get an Allstate auto insurance quote, you can visit their website, provide your vehicle and driving information, and choose your preferred coverage options. You can also get a quote by calling Allstate or speaking with an agent.

See your local car insurance options here and learn which companies are the cheapest by entering your ZIP code.

How accurate is an Allstate car insurance quote?

Allstate car insurance quotes vary depending on your driving history, vehicle type, location, and coverage selections. With a poor driving history, Allstate may offer customized alternatives. To get the most accurate quote, provide as much information as possible when getting a quote online or via an agent. Because the best car insurance for a bad driving record can differ, it’s crucial to compare quotes.

What do Allstate insurance reviews say about their claims process?

Allstate insurance reviews indicate that while many customers praise the company for its overall service and financial stability, there are mixed opinions on the claims process. Some customers report quick and fair claim handling, while others mention challenges with delays or denials.

How does Allstate vehicle insurance compare to other insurers?

Allstate auto insurance provides a wide range of coverage options and discounts, but its rates can be above average. You should compare Allstate’s quotes with other providers to ensure you get the best rate and coverage available to you.

How much does Allstate car insurance cost on average?

Allstate car insurance premiums depend on your driving history, age, gender, and location. Rates for minimum coverage typically start at around $60 per month, though young drivers or those with a less than stellar driving record could see higher rates. To learn which factors affect your rates, check out the car insurance guide for more in-depth information.

Is Allstate a reliable car insurance provider?

Allstate is viewed as a reliable insurer, offering several types of coverage and strong financial strength. Its pricing offers competitive rates compared with other providers, with some customers enjoying discounts such as accident forgiveness; however, others have said its premiums have been higher than those at other insurers.

How can I get an Allstate auto insurance quote over the phone?

Calling the Allstate auto quote phone number makes getting an Allstate auto quote simple. All you have to do is enter information about your vehicle, driving record, and coverage needs, and an agent will help you get a tailored quote.

How do Allstate DUI insurance rates compare to other providers?

Allstate typically charges higher premiums for drivers with a DUI but offers programs like accident forgiveness to help lower rates over time. To find cheap car insurance after a DUI, compare Allstate’s rates with other insurers for the best deal.

Can I get an Allstate insurance quote online?

Yes, you can quickly get an Allstate insurance quote online by visiting their website. After entering your vehicle details, driving record, and coverage preferences, you’ll receive a personalized quote within minutes.

How does Allstate’s auto replacement protection work?

What are the pros and cons of Allstate’s Milewise program?

Is Allstate car insurance expensive compared to other providers?

What types of automotive insurance does Allstate offer?

What is the Allstate new car replacement program?

How does Allstate milewise customer service handle inquiries and support?

What is Allstate auto replacement protection and how does it work?

How can I benefit from Allstate’s deductible rewards program?

Does Allstate offer commercial vehicle insurance?

What does Allstate comprehensive coverage include?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.