Cheapest Connecticut Car Insurance Rates in 2025 (10 Most Affordable Companies)

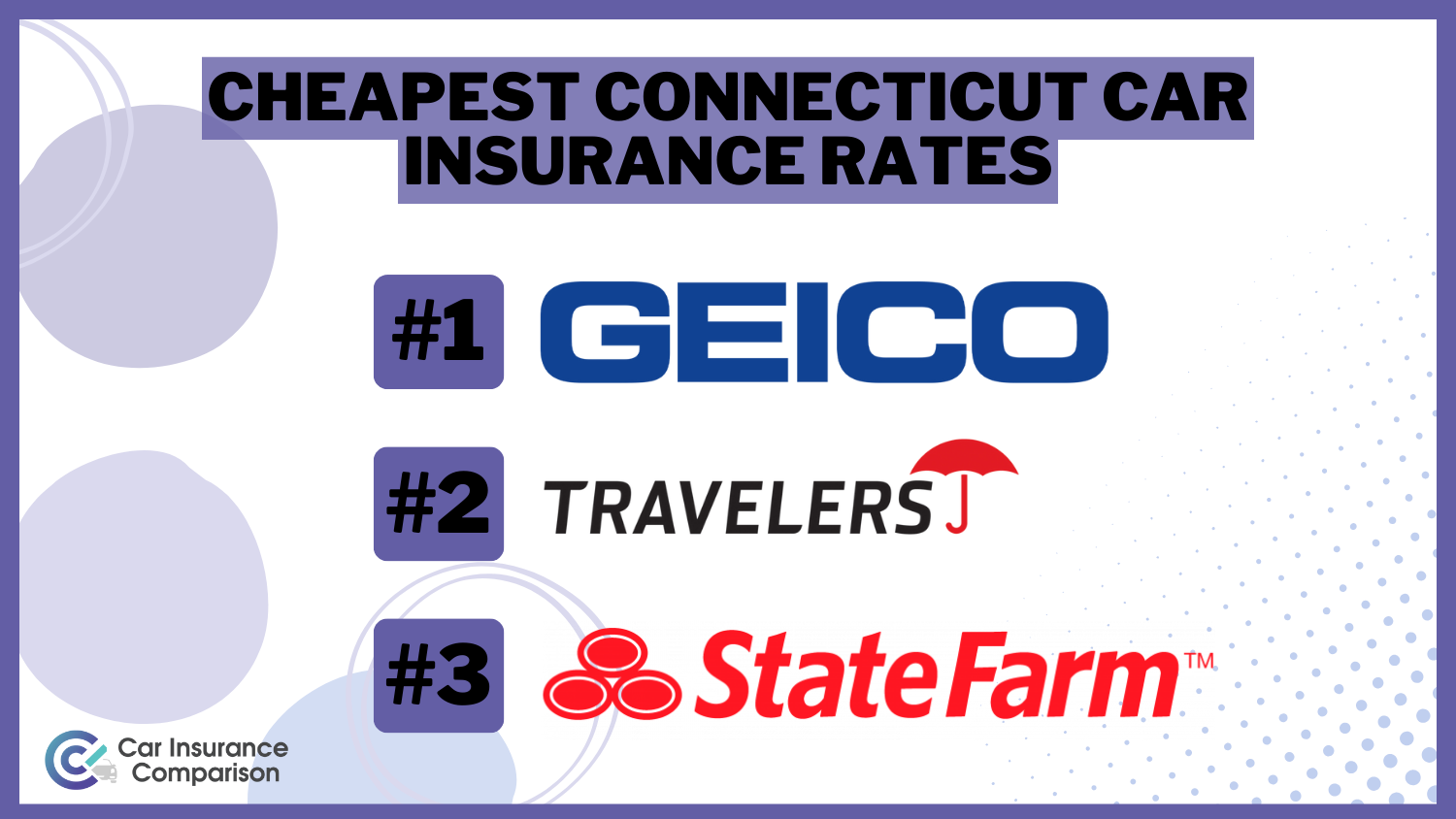

The cheapest Connecticut car insurance rates start at $32 per month with Geico, followed by Travelers at $43 per month, and State Farm at $47 per month. These companies offer competitive prices and reliable coverage, making them the top choices for affordable insurance in Connecticut. Compare rates now.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Connecticut

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Connecticut

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Connecticut

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

The cheapest Connecticut car insurance rates are offered by Geico, Travelers, and State Farm, with Geico being the top pick overall. With rates starting at $32 for monthly car insurance rate, Geico provides the most affordable option without sacrificing coverage quality. Travelers and State Farm follow with competitive rates at $43 and $47 per month, respectively.

The article explores why these companies lead in cost-effectiveness and reliability. Learn how to find the best car insurance policy for your needs by comparing these top providers. Discover how you can save on your car insurance without compromising on quality.

Our Top 10 Company Picks: Cheapest Connecticut Car Insurance Rates

Company Rank Monthly Rates A.M. Best Rating Best For Jump to Pros/Cons

#1 $32 A++ Low Rates Geico

#2 $43 A++ Safe Driver Travelers

#3 $47 B Broad Discounts State Farm

#4 $58 A+ Vanishing Deductible Nationwide

#5 $69 A+ Snapshot Program Progressive

#6 $78 A Discount Selection Farmers

#7 $85 A+ Customer Service Amica

#8 $88 A+ AARP Discounts The Hartford

#9 $101 A+ Multiple Policies Allstate

#10 $104 A Custom Coverage Liberty Mutual

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Get the cheapest Connecticut car insurance rates starting at $32 per month

- Compare top providers to find the best coverage and savings for your needs

- Geico offers the best rates without compromising quality and coverage

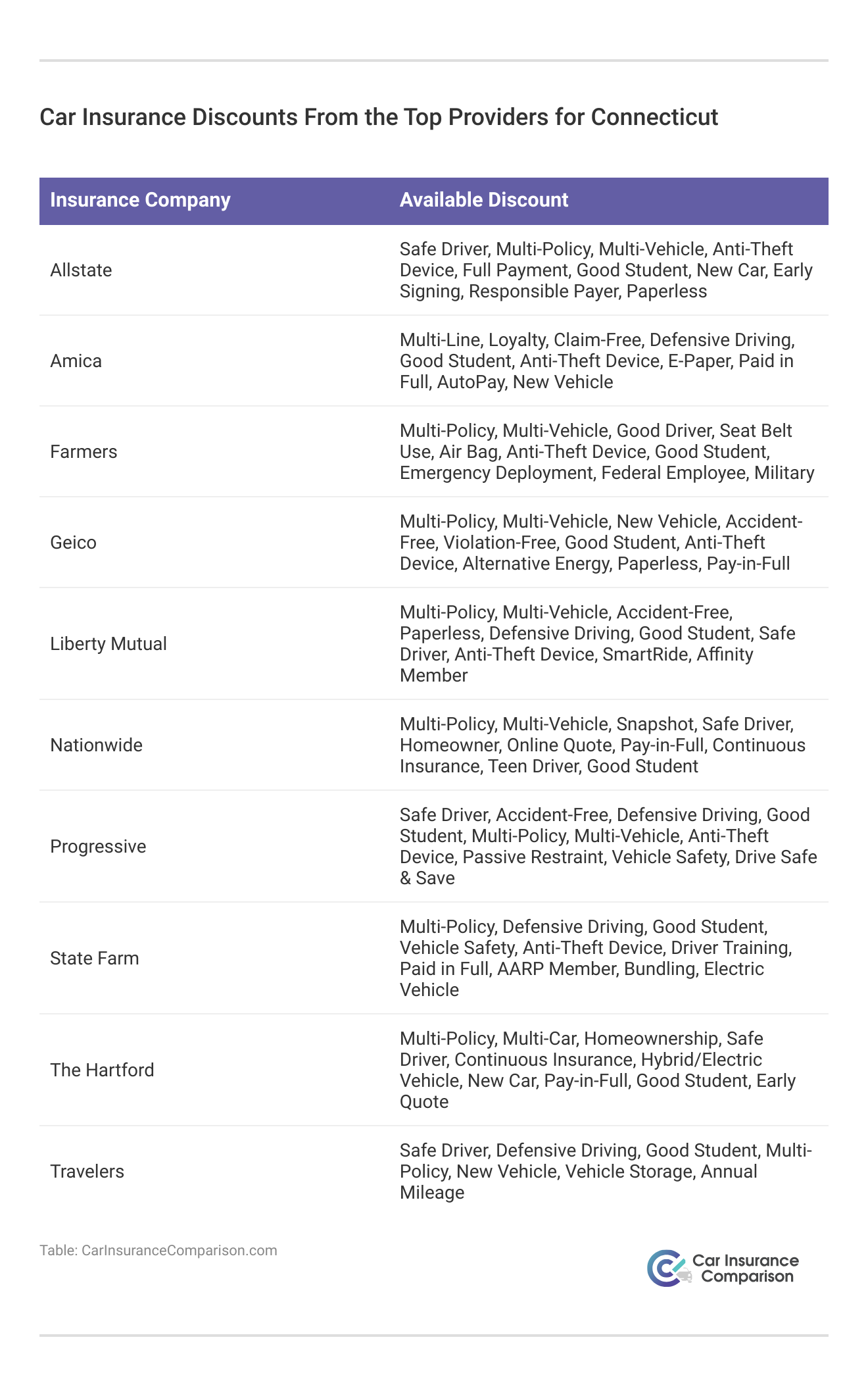

#1 – Geico: Top Overall Pick

Pros

- Low Rates: Geico offers some of the lowest rates in Connecticut, making it affordable for a wide range of customers.

- Excellent Financial Strength: Our examination of Geico car insurance review shows A++ A.M. Best Rating indicating Geico’s financial stability and reliability.

- Multiple Discounts: Geico provides a variety of discounts, including for good drivers, multi-policy holders, and military personnel.

Cons

- Limited Local Agents: Geico operates primarily online, which might not appeal to customers preferring in-person service.

- Accident Forgiveness Cost: Geico’s accident forgiveness feature may require an additional cost or be limited to certain policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Travelers: Best for Safe Driver

Pros

- Safe Driver Discounts: According to our Travelers car insurance review, Travelers offers substantial discounts for safe driving habits, rewarding good drivers.

- Superior Financial Stability: With an A++ A.M. Best Rating, Travelers is a secure choice for insurance.

- Innovative Technology: Travelers provides advanced tools for policy management and claims processing through their mobile app and website.

Cons

- Higher Base Rates: Travelers’ base rates may be higher compared to some competitors, particularly for high-risk drivers.

- Customer Service Variability: Customer service experiences can vary significantly based on location and individual agents.

#3 – State Farm: Best for Broad Discounts

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: The results of our State Farm car insurance review suggests State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a unique program that reduces your deductible over time with safe driving.

- Strong Financial Rating: With an A+ A.M. Best Rating, Nationwide is financially secure.

- Diverse Discounts: Nationwide provides a range of discounts, including multi-policy and safe driver discounts. Check out further information on Nationwide car insurance discounts for savings.

Cons

- Higher Rates: Nationwide’s premiums can be higher, particularly for drivers without multiple policies.

- Complex Policy Options: Some customers may find Nationwide’s extensive policy options confusing.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe driving with potential premium reductions.

- Broad Coverage Options: Our Progressive car insurance review highlights Progressive’s extensive coverage options and add-ons.

- Strong Financial Health: With an A+ A.M. Best Rating, Progressive is a reliable insurer.

Cons

- Snapshot Program Privacy: Some customers may have concerns about the privacy implications of the Snapshot program.

- Higher Rates Post-Claim: Progressive’s rates can increase significantly after a claim.

#6 – Farmers: Best for Discount Selection

Pros

- Extensive Discount Options: Farmers offers a wide array of discounts for different driver profiles.

- Financial Stability: According to our Farmers car insurance review, Farmers has an A A.M. Best Rating making it a reliable and stable insurer.

- Personalized Service: Farmers provides personalized service through local agents.

Cons

- Higher Premiums: Farmers’ premiums can be higher compared to other insurers.

- Customer Service Variability: Experiences with customer service can vary based on the agent and location.

#7 – Amica: Best for Customer Service

Pros

- Exceptional Customer Service: Amica is renowned for its high customer satisfaction and responsive service.

- Dividend Policies: Amica offers dividend policies that return a portion of the premium to policyholders.

- Comprehensive Coverage Options: Amica provides a wide range of coverage options to meet diverse needs. Learn more information on our “How do you get an amica mutual car insurance quote online?“

Cons

- Higher Premiums: Amica’s premiums tend to be higher than some competitors, reflecting their superior service.

- Limited Online Tools: Compared to larger insurers, Amica’s online tools and mobile app are less advanced.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for AARP Discounts

Pros

- AARP Discounts: The Hartford car insurance discounts have specialized ones for AARP members, making it a great choice for older drivers.

- Financial Strength: With an A+ A.M. Best Rating, The Hartford is financially sound.

- Comprehensive Coverage: The Hartford provides extensive coverage options, including unique benefits for seniors.

Cons

- Higher Rates: The Hartford’s premiums can be higher, particularly for non-AARP members.

- Limited Availability: Some coverage options and discounts are only available to AARP members.

#9 – Allstate: Best for Multiple Policies

Pros

- Multi-Policy Discounts: Allstate offers significant discounts for customers who bundle multiple policies.

- Strong Financial Rating: With an A+ A.M. Best Rating, Allstate is financially stable.

- Wide Range of Coverage: Insights from our Allstate car insurance review shows Allstate provides a broad range of coverage options and add-ons.

Cons

- Higher Premiums: Allstate’s premiums tend to be higher than some competitors, even with discounts.

- Mixed Customer Service Reviews: Customer service experiences can vary significantly.

#10 – Liberty Mutual: Best for Custom Coverage

Pros

- Customizable Coverage: Our Liberty Mutual car insurance review highlights Liberty Mutual’s offers highly customizable coverage options to fit individual needs.

- Financial Stability: With an A A.M. Best Rating, Liberty Mutual is a stable and reliable insurer.

- Discounts: Liberty Mutual provides a variety of discounts, including for good students and safe drivers.

Cons

- Higher Rates: Liberty Mutual’s premiums can be higher compared to other insurers.

- Complex Pricing: The pricing structure can be complex, making it hard to understand the final premium.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparing Connecticut Car Insurance Rates

Despite being a legal requirement, car insurance also offers essential financial protection for unexpected incidents. Accidents can cause a financial burden, so having a car insurance policy can help pay for injuries, repairs, or even transportation expenses. Finding the time to research all there is to know about car insurance companies in Connecticut and their rates and practices can seem like an impossible task.

The good news is we’ve paved the way for you to get the information you want and need to make an informed decision about your car insurance and rates. We will help you discover the key indicators that insurance companies consider risks and how you can mitigate those risks.

Connecticut Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $101 $196

Amica $85 $160

Farmers $78 $151

Geico $32 $62

Liberty Mutual $104 $201

Nationwide $58 $112

Progressive $69 $133

State Farm $47 $91

The Hartford $88 $165

Travelers $43 $83

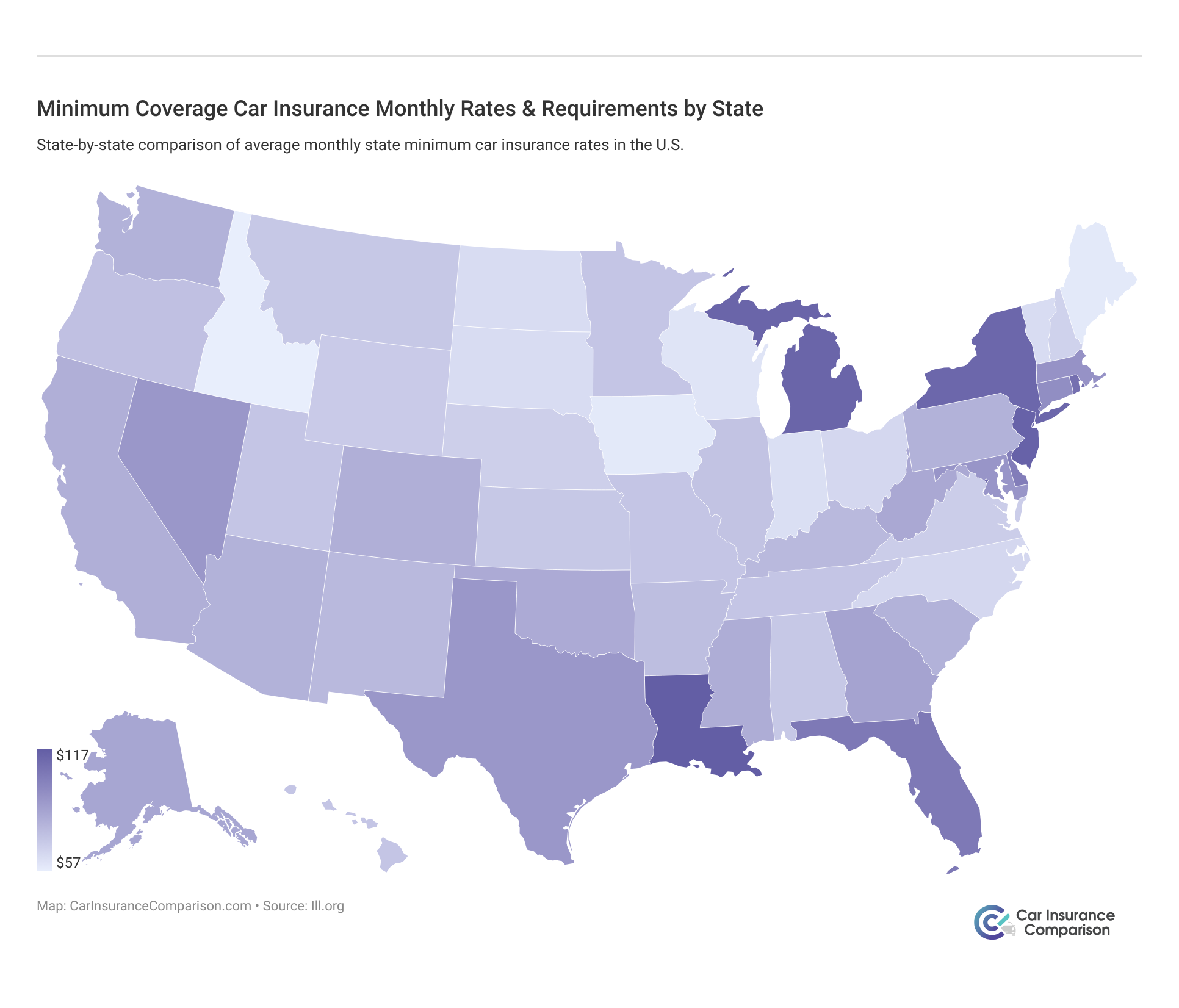

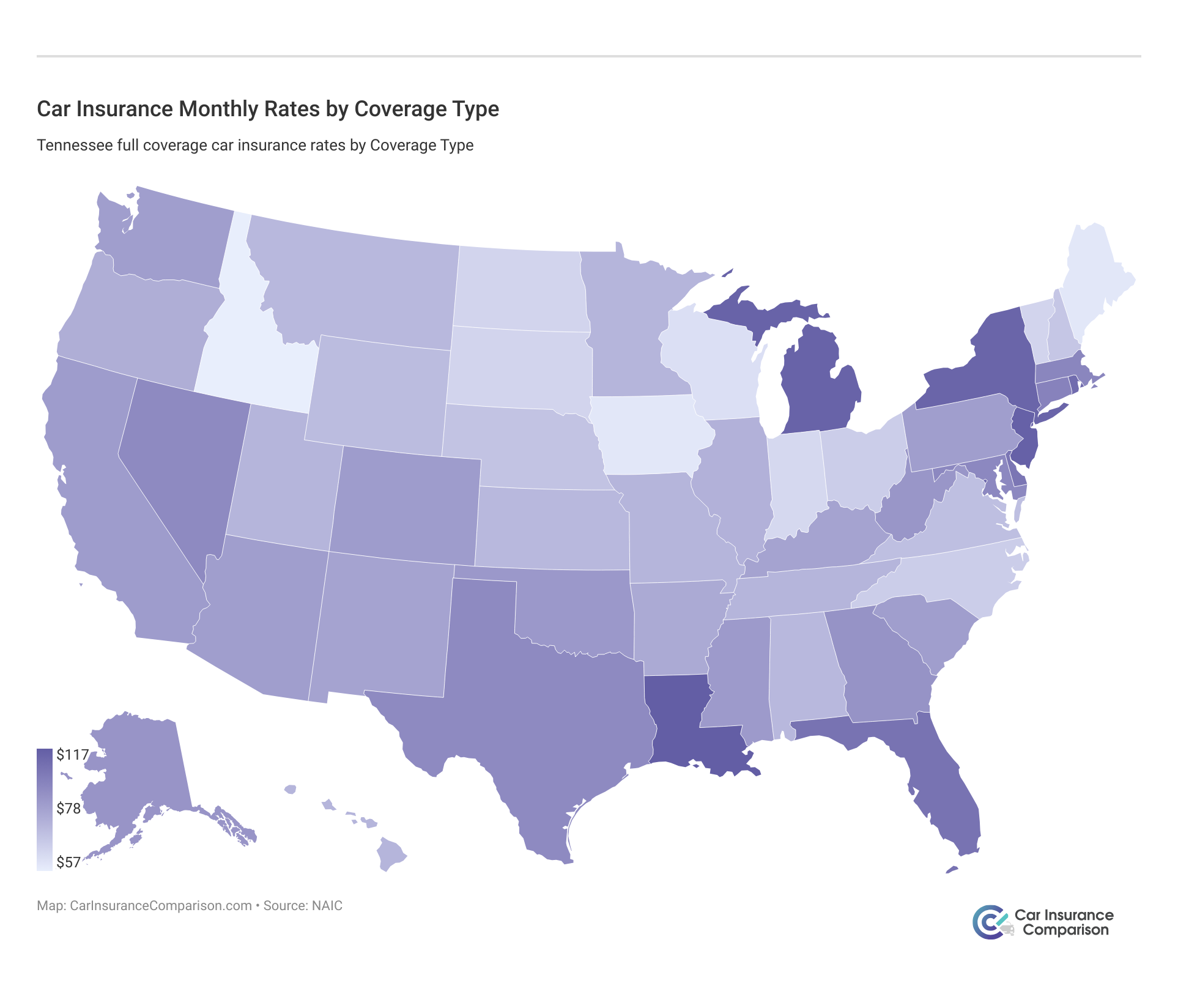

We’ll help you to know what the minimum car insurance required in your state is, what you may want or need, and where you can get it at the best price. See how Connecticut compares with other states in terms of rates.

Connecticut Car Insurance Requirements

Connecticut is a fault state, meaning that the person who was at fault for causing the car accident is responsible to compensate anyone who suffered harm as a result of the crash.

The required minimum coverage limits for basic coverage in Connecticut is to 25/50/25 for all motorists. This means that car owners must carry the following minimum liability car insurance coverage requirements.

Geico offers the cheapest Connecticut car insurance rates starting at $32 per month, coupled with excellent financial stability and a variety of discounts, making it the top choice for cost-conscious drivers.

Scott W. Johnson Licensed Insurance Agent

$25,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle, $50,000 for total bodily injury or death in an accident caused by the owner of the insured vehicle, and $25,000 for property damage liability per accident caused by the owner of the insured vehicle.

Connecticut does require you to carry uninsured/underinsured motorist coverage so that you can protect yourself and your passengers and pay for any medical bills if the at-fault driver has no insurance or if you are the victim of a hit-and-run.

How much risk are you assuming by only carrying the minimum amount of liability insurance? It depends on your monthly budget and on how exposed you want to be to potential litigation, and it can also vary from state to state.

If you have assets or future assets that you wish to protect, you want to consider increasing your liability coverage. The experts at the Wall Street Journal recommend liability limits of 100/300/50 and offer the following advice for choosing your coverage limits: Make sure you’re covered for an amount equal to the total value of your assets (Add up the dollar values of your house, your car, savings, and investments).

If you are looking to repair or replace your car after an accident, then collision insurance and comprehensive insurance coverage are worth the investment. These policies come with a deductible, and they pay out based on the current value of your car, not necessarily the price you might have paid for it.

Self-insurance is available in Connecticut to individuals who receive approval from the state insurance commissioner by providing evidence of their ability to meet financial obligations.

Next, we will take a look at how much motorists in Connecticut pay on average for car insurance. The amount you actually will pay may be slightly lower or higher than these figures, but this data will provide you with some context from which you can project your own situation with reasonable accuracy.

Compare Connecticut Car Insurance Rates as a Percentage of Income

Comedienne Paula Poundstone once quipped, “The wages of sin are death, but by the time taxes are taken out, it’s just sort of a tired feeling.”

That funny one-liner illustrates how taxes can affect one’s Disposable Personal Income (DPI), which is the money you are allowed to keep after the government takes its portion.

Connecticut Full Coverage Car Insurance Cost as a Percentage of Income

| Monthly Rates | Average Annual Income | Percentage of Income |

|---|---|---|

| $94 | $56,186 | 2.02% |

You are mandated by law to carry at least the basic coverage. A full coverage car insurance policy includes liability, comprehensive, and collision insurance. Here is a peek at the average cost of each: Now that we have examined facts about car insurance costs to individual consumers, let’s take a look at some important statistics about the insurance companies themselves. First, let us examine the concept of loss ratio.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Loss Ratio and Connecticut Car Insurance Rates

What exactly is a loss ratio? And what is its effect on your premiums?

The insurance loss ratio is the loss to the insurance company for claims that were paid out, divided by the premiums collected. A high loss ratio means that an insurance company has too many customers filing claims, which will subsequently lead to a rise in future premiums for all consumers.

Geico car insurance has a loss ratio of 75.82 %. A standard loss ratio is between 40 to 60%. Higher ratios indicate the company is paying out too many claims and may struggle to remain solvent. However, if a company’s loss ratio is well under 40%, that means the company is pocketing much more money in premiums than paying out in claims or insurance discounts to its customers.

Obtain more information with our guide titled “Car Insurance Claim Investigation.”

Popular Car Insurance Add-ons in Connecticut

According to the Insurance Information Institute, a little over 9% of drivers in Connecticut (9.4% to be exact) don’t have insurance, which ranks as the 36th highest percentage in the country. As protection against those who drive without any insurance coverage, you may consider opting for additional coverage options to protect.

One such option in the Constitution State is medical payments coverage. medical payments coverage, or MedPay, is an optional coverage in all motor vehicle insurance policies in the State of Connecticut. You can purchase this coverage in the following amounts: $1,000, $5,000, $10,000, $25,000, or even $50,000.

Check out more details on our “Best Usage-Based Car Insurance Companies.”

Med Pay insurance applies regardless of whether the insured or another driver was at fault. It even applies when the insured driver or the insured’s family are pedestrians on the street and are struck by another motorist. Despite the increasing popularity of pay-per-mile car insurance plans offered by companies like MetroMile, they are currently not being offered in Connecticut.

Other usage-based car insurance programs (UBI) are active and available to drivers in Connecticut. Programs like Allstate’s Drivewise or Snapshot from Progressive, or Drive Safe & Save from State Farm offer discounts to drivers based on how well and how often they drive.

In addition to these add-ons, there are several more optional enhancements that you can explore to decide which ones may be right for you:

- Gap insurance

- Personal umbrella policy (PUP)

- Rental car reimbursement

- Emergency roadside assistance

- Mechanical breakdown coverage

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

In conclusion, while the basic car insurance coverage provides essential protection, these additional options offer further security and peace of mind tailored to your specific needs. Whether you’re looking for extra protection in case of accidents, comprehensive coverage for a classic car, or emergency support when you need it most, these enhancements can make a significant difference.

Take the time to review each option and consult with your insurance provider to ensure you have the best possible coverage for your unique situation.

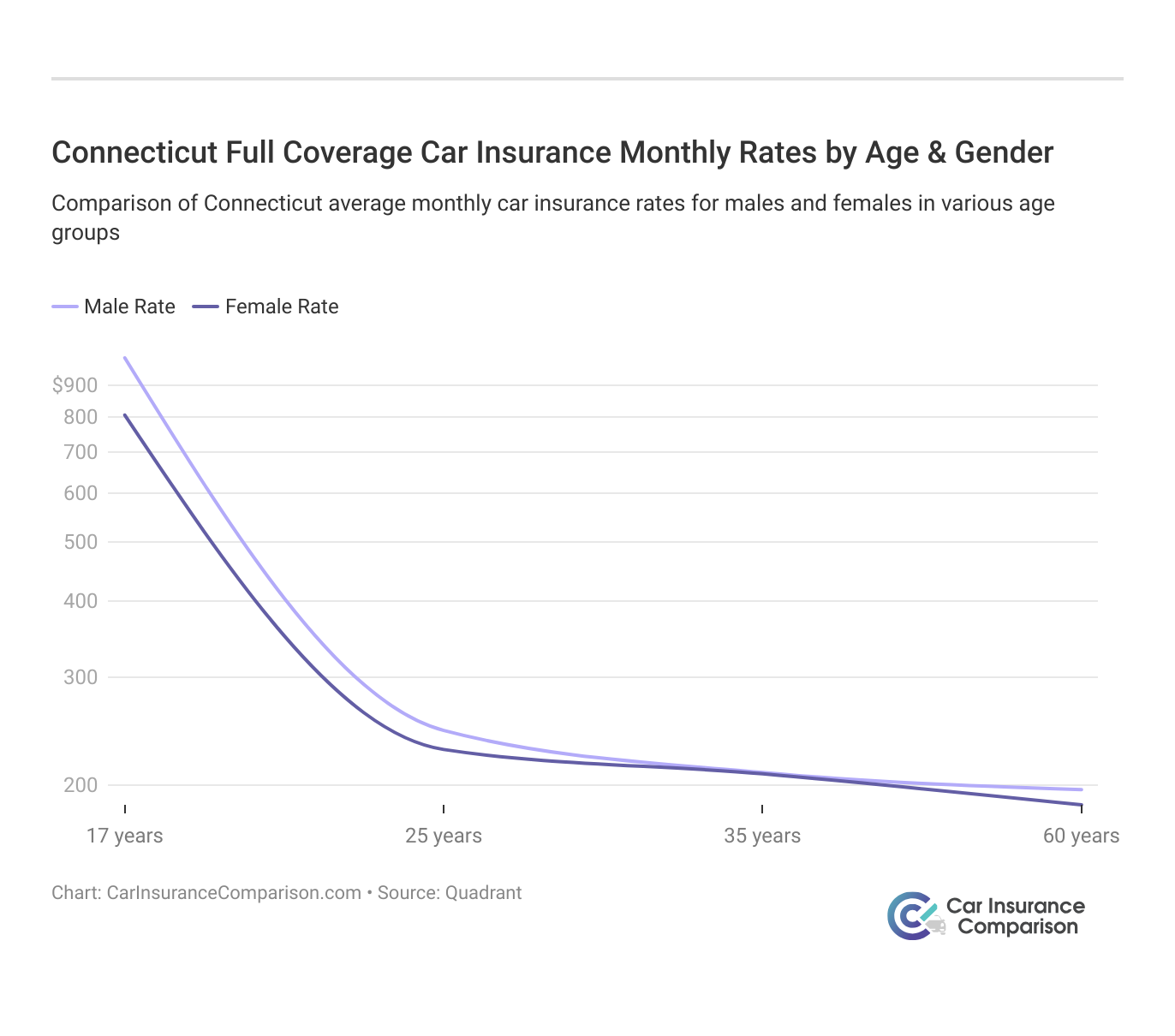

Compare Connecticut Car Insurance Rates by Gender

Cyndi Lauper once reminded us: “When the working day is done, girls just want to have fun.” And there are few things more fun in Connecticut than saving money on car insurance quotes. In that context, let’s see whether or not girls are having more fun than boys when it comes to their insurance premiums. Take a look at the following chart and table to compare and contrast.

In Connecticut, 17-year-olds face the highest car insurance rates due to their inexperience, while rates decrease significantly by age 25 and remain relatively stable for 35-year-olds. At 60, rates may vary but generally stay consistent, with gender differences influenced by statistical risk profiles.

Connecticut Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $78 | $92 | $27 | $28 | $26 | $25 | $24 | $25 |

| Geico | $37 | $43 | $15 | $15 | $16 | $16 | $15 | $15 |

| Nationwide | $45 | $57 | $19 | $20 | $16 | $17 | $15 | $15 |

| Progressive | $77 | $85 | $21 | $24 | $18 | $17 | $16 | $16 |

| Safeco | $122 | $138 | $25 | $27 | $24 | $27 | $19 | $23 |

| State Farm | $38 | $48 | $14 | $16 | $13 | $13 | $12 | $12 |

| Travelers | $97 | $157 | $14 | $15 | $13 | $13 | $13 | $13 |

| USAA | $43 | $45 | $18 | $19 | $14 | $13 | $13 | $13 |

Here’s a look at the most expensive demographic rates in Connecticut. Where do you fit in the equation? Are you on the higher end or lower end of the ledger? Do you now have a better idea of what car insurance cost you and your family in the Nutmeg State? Learn more information on our guide titled “Average Car Insurance Rates by Age and Gender.”

Connecticut Most Expensive Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Safeco | $1,466 | $1,653 | $297 | $324 | $293 | $319 | $226 | $278 |

| Travelers | $1,166 | $1,884 | $164 | $185 | $151 | $153 | $220 | $225 |

| Allstate | $935 | $1,104 | $320 | $337 | $306 | $303 | $282 | $302 |

| Progressive | $919 | $1,019 | $251 | $282 | $220 | $205 | $188 | $196 |

| Nationwide | $540 | $686 | $226 | $243 | $195 | $198 | $175 | $184 |

| State Farm | $460 | $578 | $170 | $195 | $151 | $151 | $162 | $162 |

| USAA | $515 | $540 | $219 | $226 | $163 | $161 | $152 | $152 |

| Geico | $439 | $519 | $189 | $190 | $183 | $177 | $176 | $177 |

Take a look at Travelers, if you are a 35-year-old married man, you’ll pay $151 on average for your monthly premium, which would be among the lowest rate possible statewide. However, if you are a 17-year-old single man looking to get insured by that same company, your average monthly premium would be $1,884, the absolute highest in the state. That is a difference of $1,732 per year.

As you can see, it pays to do your due diligence when shopping around for car insurance, and even something as simple as your gender can affect your car insurance. There is no one size fits all insurer. A company offering the best rates for one customer may end up being the most expensive option for another.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

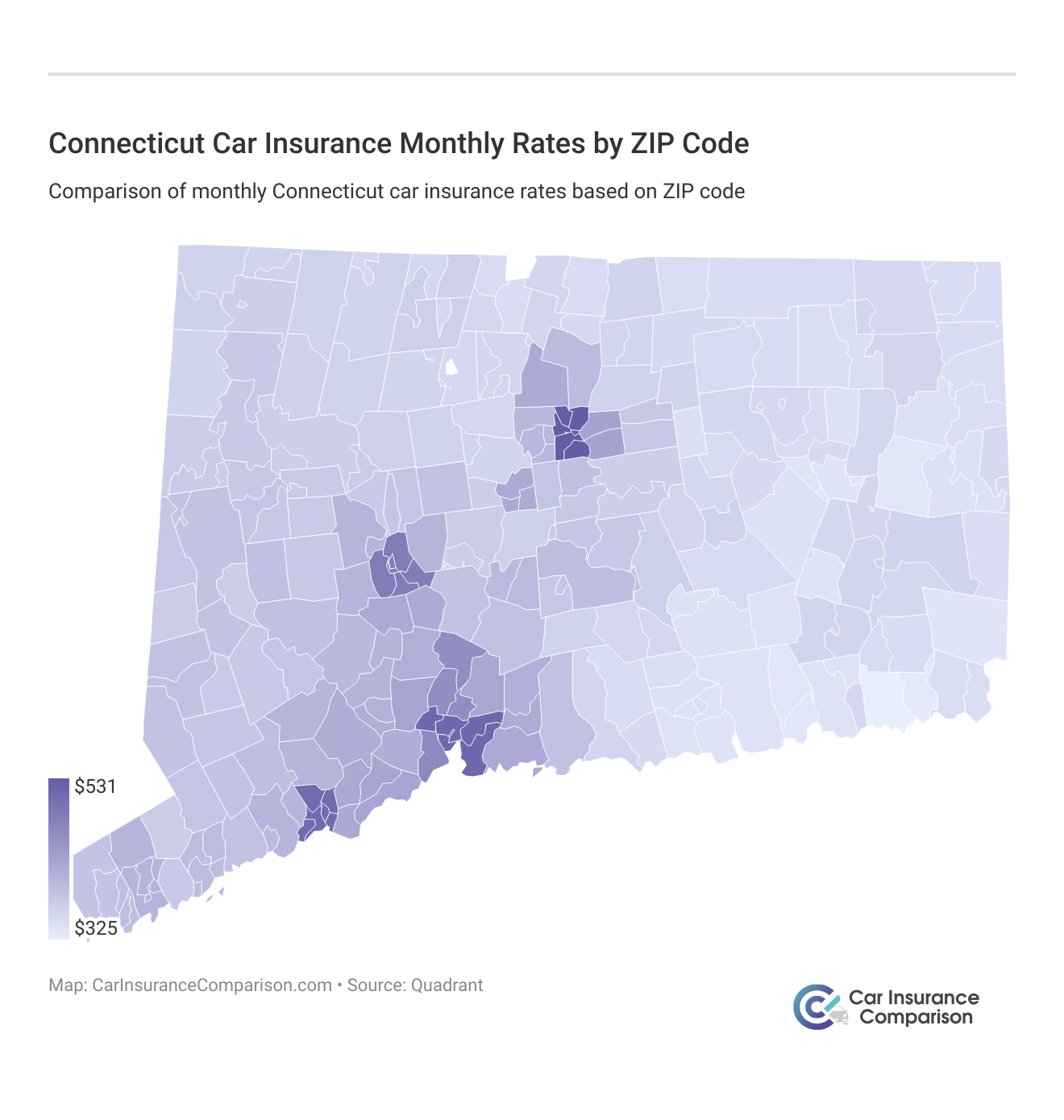

Compare Connecticut Car Insurance Rates by Location

So that you can find where your city and neighborhood rank statewide, here are the average monthly premiums by ZIP code in Connecticut:

Connecticut Car Insurance Monthly Rates in the Most Expensive ZIP Codes by Provider

| ZIP Code | City | Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|---|

| 06103 | Hartford | $531 | Travelers | $829 | Geico | $303 |

| 06105 | Hartford | $531 | Travelers | $829 | USAA | $306 |

| 06106 | Hartford | $531 | Travelers | $829 | USAA | $306 |

| 06112 | Hartford | $531 | Travelers | $829 | USAA | $306 |

| 06114 | Hartford | $531 | Travelers | $829 | State Farm | $328 |

| 06120 | Hartford | $531 | Travelers | $829 | State Farm | $328 |

| 06160 | Hartford | $531 | Travelers | $829 | State Farm | $328 |

| 06510 | New Haven | $514 | Travelers | $771 | State Farm | $328 |

| 06511 | New Haven | $514 | Travelers | $771 | State Farm | $328 |

| 06512 | East Haven | $514 | Travelers | $771 | State Farm | $328 |

| 06513 | New Haven | $514 | Travelers | $771 | State Farm | $342 |

| 06515 | New Haven | $514 | Travelers | $771 | State Farm | $342 |

| 06519 | New Haven | $514 | Travelers | $771 | State Farm | $342 |

| 06101 | Hartford | $512 | Travelers | $829 | State Farm | $342 |

| 06152 | Hartford | $512 | Travelers | $829 | State Farm | $342 |

| 06604 | Bridgeport | $509 | Liberty Mutual | $795 | State Farm | $342 |

| 06605 | Bridgeport | $509 | Liberty Mutual | $795 | Geico | $350 |

| 06606 | Bridgeport | $509 | Liberty Mutual | $795 | Geico | $350 |

| 06607 | Bridgeport | $509 | Liberty Mutual | $795 | Geico | $350 |

| 06608 | Bridgeport | $509 | Liberty Mutual | $795 | Geico | $350 |

| 06610 | Bridgeport | $509 | Liberty Mutual | $795 | Geico | $350 |

| 06650 | Bridgeport | $483 | Liberty Mutual | $795 | Geico | $350 |

| 06702 | Waterbury | $483 | Travelers | $696 | Geico | $350 |

| 06704 | Waterbury | $483 | Travelers | $696 | Geico | $350 |

| 06705 | Waterbury | $483 | Travelers | $696 | Geico | $350 |

This table shows monthly insurance rates in various Connecticut cities. Hartford has a consistent rate of $531, with Travelers being the most expensive at $829 and Geico the cheapest at $350. New Haven, East Haven, and Bridgeport have rates of $514 and $509 respectively, with Travelers and Liberty Mutual being the most expensive and State Farm the cheapest.

Connecticut Car Insurance Monthly Rates in the Cheapest ZIP Codes by Provider

| ZIP Code | City | Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|---|

| 06340 | Groton | $325 | Liberty Mutual | $586 | Geico | $205 |

| 06355 | Mystic | $332 | Liberty Mutual | $576 | Geico | $205 |

| 06331 | Canterbury | $336 | Liberty Mutual | $576 | Geico | $207 |

| 06333 | East Lyme | $337 | Liberty Mutual | $576 | Geico | $207 |

| 06357 | Niantic | $337 | Liberty Mutual | $568 | Geico | $207 |

| 06359 | North Stonington | $339 | Liberty Mutual | $565 | Geico | $207 |

| 06226 | Willimantic | $339 | Liberty Mutual | $561 | Geico | $207 |

| 06266 | South Windham | $339 | Liberty Mutual | $559 | Geico | $212 |

| 06280 | Windham | $339 | Liberty Mutual | $558 | Geico | $212 |

| 06475 | Old Saybrook | $340 | Liberty Mutual | $558 | Geico | $212 |

| 06264 | Scotland | $340 | Liberty Mutual | $554 | Geico | $212 |

| 06334 | Bozrah | $340 | Liberty Mutual | $554 | Geico | $214 |

| 06371 | Old Lyme | $341 | Liberty Mutual | $553 | Geico | $214 |

| 06426 | Essex | $341 | Liberty Mutual | $548 | Geico | $214 |

| 06442 | Ivoryton | $341 | Liberty Mutual | $548 | Geico | $220 |

| 06420 | Salem | $341 | Liberty Mutual | $548 | Geico | $220 |

| 06498 | Westbrook | $341 | Liberty Mutual | $545 | Geico | $220 |

| 06375 | Quaker Hill | $341 | Liberty Mutual | $542 | State Farm | $221 |

| 06385 | Waterford | $341 | Liberty Mutual | $542 | State Farm | $221 |

| 06249 | Lebanon | $342 | Liberty Mutual | $536 | State Farm | $222 |

| 06417 | Deep River | $342 | Liberty Mutual | $535 | State Farm | $224 |

| 06332 | Central Village | $342 | Liberty Mutual | $535 | State Farm | $224 |

| 06354 | Moosup | $342 | Liberty Mutual | $532 | State Farm | $224 |

| 06374 | Plainfield | $342 | Liberty Mutual | $531 | State Farm | $224 |

| 06423 | East Haddam | $343 | Liberty Mutual | $527 | State Farm | $224 |

All three of these cities are among the most populated cities in the state.

Take a look at our interactive chart above to know how some other ZIP codes stack up.

Another is, where does your city rank statewide?

Connecticut Car Insurance Monthly Rates in the Most Expensive Cities by Provider

| City | Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|

| Hartford | $527 | Travelers | $829 | Geico | $350 |

| East Haven | $514 | Travelers | $771 | State Farm | $328 |

| New Haven | $514 | Travelers | $771 | State Farm | $328 |

| Bridgeport | $506 | Liberty Mutual | $795 | State Farm | $342 |

| Waterbury | $483 | Travelers | $696 | USAA | $306 |

| West Haven | $465 | Liberty Mutual | $691 | State Farm | $305 |

| Hamden | $458 | Liberty Mutual | $703 | State Farm | $275 |

| South Britain | $430 | Travelers | $771 | Geico | $260 |

| East Hartford | $428 | Liberty Mutual | $644 | USAA | $279 |

| Woodbridge | $427 | Liberty Mutual | $669 | Geico | $261 |

| Milford | $425 | Liberty Mutual | $662 | State Farm | $241 |

| East Glastonbury | $425 | Travelers | $829 | USAA | $238 |

| North Haven | $423 | Liberty Mutual | $682 | State Farm | $269 |

| Stratford | $420 | Liberty Mutual | $690 | State Farm | $277 |

| Milldale | $419 | Travelers | $829 | USAA | $238 |

| Naugatuck | $418 | Liberty Mutual | $683 | State Farm | $260 |

| Branford | $418 | Liberty Mutual | $678 | Geico | $255 |

| Prospect | $417 | Liberty Mutual | $678 | State Farm | $260 |

| New Britain | $417 | Liberty Mutual | $638 | USAA | $290 |

| Bloomfield | $417 | Liberty Mutual | $609 | State Farm | $270 |

| North Branford | $416 | Liberty Mutual | $652 | State Farm | $269 |

| Shelton | $414 | Liberty Mutual | $643 | USAA | $272 |

| Poquonock | $413 | Travelers | $829 | State Farm | $217 |

| Orange | $413 | Liberty Mutual | $627 | State Farm | $241 |

| Derby | $412 | Liberty Mutual | $626 | State Farm | $275 |

Hartford once again makes the top of the list for the worst insurance rates in the state.

Connecticut Car Insurance Monthly Rates in the Cheapest Cities by Provider

| City | Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|

| Conning Towers Nautilus Park | $325 | Liberty Mutual | $535 | Geico | $205 |

| Mystic | $332 | Liberty Mutual | $535 | Geico | $205 |

| Canterbury | $336 | Liberty Mutual | $532 | Geico | $220 |

| East Lyme | $337 | Liberty Mutual | $542 | Geico | $214 |

| Niantic | $337 | Liberty Mutual | $542 | Geico | $214 |

| North Stonington | $339 | Liberty Mutual | $527 | Geico | $212 |

| South Windham | $339 | Liberty Mutual | $576 | State Farm | $224 |

| Windham | $339 | Liberty Mutual | $576 | State Farm | $224 |

| Old Saybrook | $340 | Liberty Mutual | $553 | Geico | $207 |

| Scotland | $340 | Liberty Mutual | $545 | Geico | $220 |

| Bozrah | $340 | Liberty Mutual | $568 | Geico | $220 |

| Old Lyme | $341 | Liberty Mutual | $536 | Geico | $214 |

| Essex Village | $341 | Liberty Mutual | $558 | Geico | $207 |

| Ivoryton | $341 | Liberty Mutual | $558 | Geico | $207 |

| Salem | $341 | Liberty Mutual | $565 | State Farm | $224 |

| Westbrook | $341 | Liberty Mutual | $561 | State Farm | $222 |

| Quaker Hill | $341 | Liberty Mutual | $554 | State Farm | $221 |

| Waterford | $341 | Liberty Mutual | $554 | State Farm | $221 |

| Lebanon | $342 | Liberty Mutual | $531 | State Farm | $224 |

| Deep River | $342 | Liberty Mutual | $586 | Geico | $207 |

| Central Village | $342 | Liberty Mutual | $548 | Geico | $212 |

| Moosup | $342 | Liberty Mutual | $548 | Geico | $212 |

| Plainfield | $342 | Liberty Mutual | $548 | Geico | $212 |

| East Haddam | $343 | Liberty Mutual | $559 | Geico | $207 |

| Moodus | $343 | Liberty Mutual | $559 | Geico | $207 |

Compare car insurance rates across various cities in Connecticut including Cheshire, Danbury, Farmington, Guilford, Newtown, Old Greenwich, Somers, Stamford, and Waterbury.

Connecticut Car Insurance Cost by City

Start now to find the best deal for you. Delve more insights with our “Compare Car Insurance Rates by City.”

The Best Connecticut Car Insurance Companies

Making sense of all the information while trying to decide on the car insurance company that is the right fit for you can be stressful. Who’s going to give you the best rates? Who has the best customer service? Do you qualify for any discounts or upgrades? What special features and customer benefits, if any, can you earn?

With so much data to consider and so many options from which to choose, making a sound decision can be a bit mystifying. Every driver is different because they have a different budget, age, and driving history.

Geico stands out as the top choice in Connecticut for offering the lowest rates combined with strong financial stability and extensive discount options.

Brad Larson Licensed Insurance Agent

Therefore, the best car insurance company will depend on the personal qualities of each person. Researching the average rate in your area can help you find which providers offer the cheapest car insurance. You don’t have to worry. We have gathered and sorted through all the relevant information you need to make sure your decision is, in a word: superb.

When deciding on a car insurance company, it is important to make a thorough examination of its public reputation. A company’s public reputation can often be a telling indicator of its business practices and the kinds of prices it offers to the buying public. We’ll show how the largest companies rate in the areas of financial stability and customer satisfaction.

Connecticut Car Insurance Companies by Financial Rating

AM Best is a credit rating agency. It evaluates insurance companies and grades them based on their financial stability.

Top 10 Connecticut Car Insurance Companies by Premiums Written & Financial Strength

| Rank | Insurance Company | Premiums Written | A.M. Best |

|---|---|---|---|

| #1 | Geico | $528,907 | A++ |

| #2 | Allstate | $304,028 | A+ |

| #3 | Liberty Mutual | $297,602 | A- |

| #4 | Progressive | $268,001 | A+ |

| #5 | Travelers | $195,421 | A+ |

| #6 | State Farm | $192,401 | A++ |

| #7 | USAA | $137,617 | A++ |

| #8 | Nationwide | $123,130 | A+ |

| #9 | Amica | $111,152 | A+ |

| #10 | Metropolitan | $105,129 | A |

The table above shows the ten best car insurance companies in Connecticut as measured by direct premiums written with their AM Best rating.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Connecticut Car Insurance Rates by Other Factors

The table shows the monthly car insurance rates in Connecticut for various providers based on two annual mileage categories: 6000 miles and 12000 miles. Allstate, Liberty Mutual, Nationwide, Progressive, Travelers, and USAA maintain consistent rates regardless of mileage, indicating they may not heavily factor mileage into their pricing models.

Connecticut Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $486 | $486 |

| Geico | $252 | $260 |

| Liberty Mutual | $607 | $607 |

| Nationwide | $306 | $306 |

| Progressive | $410 | $410 |

| State Farm | $242 | $254 |

| Travelers | $500 | $500 |

| USAA | $263 | $269 |

Geico and State Farm show minor increases in rates when annual mileage doubles, suggesting a slight consideration of increased risk with higher mileage. Among all providers, State Farm offers the lowest rates for both mileage categories, making it the most affordable option.

Curious about how your credit history impacts the quotes you receive from car insurance companies? Consumer Reports conducted a study for Connecticut analyzing the effect of credit history on premiums.

Connecticut Car Insurance Monthly Rates by Credit Score Rating & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $31 | $39 | $52 |

| Geico | $14 | $19 | $31 |

| Liberty Mutual | $35 | $45 | $72 |

| Nationwide | $20 | $23 | $34 |

| Progressive | $32 | $33 | $37 |

| State Farm | $15 | $18 | $29 |

| Travelers | $38 | $39 | $47 |

| USAA | $17 | $20 | $29 |

If you have good credit, you may qualify for a good credit discount.

When it comes to having a less-than-perfect driving record, your reputation can be detrimental to your premiums. Each car insurance company has its own criteria for underwriting and each assesses certain violations differently.

Connecticut Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $414 | $414 | $511 | $606 |

| Geico | $162 | $199 | $212 | $452 |

| Liberty Mutual | $531 | $572 | $665 | $659 |

| Nationwide | $249 | $278 | $325 | $372 |

| Progressive | $350 | $415 | $508 | $368 |

| State Farm | $231 | $254 | $254 | $254 |

| Travelers | $403 | $527 | $436 | $635 |

| USAA | $206 | $206 | $259 | $393 |

Above was a quick look at how different car insurers in Connecticut price their monthly rates for various driving violations. Choose the company that will provide the best rates and services for your present circumstance, not anybody else’s. The best way to ensure that you’re getting the best possible car insurance coverage at the best possible rates for your specific circumstance is to compare rates from multiple carriers.

Another surefire way to make sure your rates stay as low as possible is to be a good driver. And being a good driver entails knowing the rules of the road and adhering to them. We’ll go over the laws of the land to keep you informed and how to maintain a clean driving record.

How to Get High-Risk Insurance in Connecticut

The SR-22 car insurance form must be filed by drivers who have committed violations or have multiple infractions, as well as uninsured drivers and others. If your license has been revoked or suspended, you may need to file an SR-22 to have it reinstated. The SR-22 form is available from your insurance company, but it is not an car insurance policy.

If you do require the SR-22 insurance proof in CT, that means your license is or will be suspended or revoked and you cannot legally drive in Connecticut. Filing the correct documentation and meeting other requirements per the DMV can help you toward eventually reinstating your driving privileges.

Unveil more insights on our “How do you file for SR-22 insurance?”

In Connecticut, having the correct address on your driver’s license is crucial to receive important notices regarding violations. Certain offenses result in points being added to your license, potentially leading to suspension:

Negligent homicide with a motor vehicle earns 5 points. Operating a school bus at excessive speed also results in 5 points. Passing a stopped school bus incurs 4 points, and passing in a no-passing zone adds 3 points. Driving while impaired results in 3 points, while failing to obey a stop sign or red light adds 2 points.

Check more information on our “How Traffic Infractions Affect Car Insurance” to be aware of the effects on your premium.

Speeding adds 1 point to your license. Adhering to traffic laws is essential to avoid accumulating points that could jeopardize your driving privileges. Your license may be canceled for an incorrect or fraudulent license application, or it may be canceled if a check written to pay driver’s license fees is returned for insufficient funds.

How to Get Windshield Coverage in Connecticut

Connecticut has no specific laws requiring insurance companies to offer special broken windshield car insurance or no-deductible windshield replacement. The Constitutions State does allow for a Full Glass Coverage option that covers broken safety glass, including windshields, with no deductible.

You may have your car repaired at a repair shop to your liking, but you may be required to pay the difference. Connecticut allows insurers to use aftermarket parts, as well as used recycled parts, but they must inform you in writing. Check if your car insurance provider cover broken car windows.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Fraud in Connecticut

Insurance fraud is the second-largest economic crime in America. Insurance fraud impacts premium rates and the prices consumers pay for goods and services. The department’s insurance fraud prevention division plays an important role in investigating suspected fraud.

And if those fraud numbers continue to escalate it is more likely that the insurance will pass on some of that cost to you as the consumer in the form of increased premiums. If companies didn’t have to waste their premium dollars on false claims, you could see a reduction in the rates you pay. There are two classifications of fraud and these undergo car insurance claim investigation:

- Hard Fraud: A purposefully fabricated claim or accident

- Soft Fraud: A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40% of consumers admitted to lying to their insurer about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime, no matter how you slice it. Even the little, white lie you tell to get a lower rate can lead to harmful consequences. That kind of willful misrepresentation of facts is called known as “rate evasion” and is a $16 billion annual expense to car insurers.

Insurance fraud is a Class D felony in Connecticut. And according to a report by the Connecticut Insurance Department’s Insurance Fraud Unit, insurance fraud costs consumers in Connecticut nearly $2 billion annually.

Vehicle Licensing Laws in Connecticut

Don’t make the mistake of driving in the state of Connecticut without proper registration and insurance. It would be unwise and potentially costly to do so.

Penalties for Driving Without Car Insurance in Connecticut

Connecticut’s DMV has an online portal where residents can perform tasks such as renewing their registrations and driver’s licenses, updating or changing their addresses, and retrieving their driving history. Vehicle registration and insurance information can be easily accessed through the state database.

The penalty for driving without insurance in Connecticut is as follows: A fine between $100 and $1,000 and a license suspension for one month for the first offense with a $175 reinstatement fee. A second offense will result in a fine between $100 and $1,000 and license suspension for six months with a $175 reinstatement fee.

Teen Driver Laws in Connecticut

Connecticut employs a Graduated Driver’s Licensing program for young drivers, designed to reduce the high accident and fatality rate among teen motorists. In addition to that, the state of Connecticut has partnered with AAA to provide valuable safety tips and training for teen drivers and their parents/guardians.

Connecticut Teen Driver Laws and Restrictions

| Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 16 years | First 6 months: Only parents or a driving instructor allowed as passengers. Second 6 months: Only parents, a driving instructor, or immediate family members allowed as passengers. | 11 P.M. - 5 A.M. |

| Provisional License | 12 months or until age 18, whichever comes first (minimum age: 17 years, 4 months) | First 6 months: Only parents or a driving instructor may accompany the driver. Second 6 months: Only parents, a driving instructor, or immediate family members are allowed as passengers. | Nighttime restrictions will be lifted at age 18 |

| Full License | 16 years and 4 months old; mandatory 6-month holding period (4 months with driver education); minimum of 40 hours supervised driving time. | NA | NA |

Furthermore, the Connecticut DMV has the Center for Teen Safe Driving which provides additional resources such as safe driving videos and sample content knowledge tests for drivers seeking extra training and support. Once a teenager has completed the requirements for getting a driver’s license, the next step is finding teen car insurance. Expand your knowledge with our guide “Compare Teen Driver Car Insurance Rates.”

License Renewal for Older Drivers in Connecticut

Elderly drivers, ages 65 and older, have the option in Connecticut to renew their licenses every two years or every six years.

All other drivers are required to renew every six years. Just like the rest of the general population, senior drivers do not have to show proof of adequate vision at every renewal. And just like the rest of the general population, elderly motorists are prohibited from renewing online or by mail; all drivers in Connecticut must renew in person.

Getting Your License as a New Resident in Connecticut

If you are about to make the move to Connecticut, here’s what you need to know:

- Once you have established residency in Connecticut, you have 30 days to transfer your out-of-state license to Connecticut.

- The State of Connecticut Department of Motor Vehicles handles all matters related to vehicle licensing.

-

With your current driver’s license, the completion of a form, acceptable forms of identification, and payment for two fees, you will be licensed to drive in CT.

Make sure to visit the State of Connecticut Department of Motor Vehicles website for the latest requirements and forms needed for your license transfer.

Renewing Your License in Connecticut

Driver licenses must be renewed every six years. Renewals must be done in person. You should not wait until your license expires.

Driving Laws in Connecticut

Let’s take a look at some of Connecticut’s traffic laws and your car insurance.

Keep Right and Move Over Laws in Connecticut

Connecticut law requires that you keep right if driving slower than the average speed of traffic around you. Connecticut employs “Move Over” legislation, requiring drivers to move over for emergency vehicles while simultaneously lowering speed as they pass. The law bars drivers from driving in the lane next to shoulders where emergency and nonemergency workers are present.

Maximum Speed Limit in Connecticut

Understanding speed limits for different types of roadways is crucial for safe driving. Below is a table outlining the speed limits for various road types.

Connecticut Speed Limits

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 65 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 55 mph |

Remember, adhering to these speed limits helps ensure your safety and the safety of others on the road. Drive safely and always follow traffic regulations.

Seat Belt Laws in Connecticut

Seat belt laws typically impact your car insurance, so it’s important to know what they are. In Connecticut, all drivers and front-seat passengers eight years and older are required to wear a seat belt. A violation is not a primary offense.

Obtain more insights with our “Do seat belt laws impact my car insurance?”

Passengers in the back seat ages 8-15 years old (or weighing 60 pounds or more) are permitted to use an adult safety belt. Not wearing a seat belt by itself cannot be a cause for your getting pulled over but should you be stopped for some other traffic violation, you can be ticketed for failure to wear a seat belt. The minimum fine is $50.

Connecticut law permits passengers to ride in the cargo area of a vehicle for people 16 and older. Passengers 15 and younger are permitted if belted. Exceptions are allowed for farming operations, parades, and hayrides from August through December.

Car Seat Laws in Connecticut

All children 2 years old or younger (or weighing less than 30 pounds) are required to be seated in a rear-facing child safety seat. Children 2-4 years old and weighing between 30-40 pounds can be seated in a rear-or-forward-facing child safety seat.

Children 5-7 years old weighing between 40-60 pounds may sit in a forward-or-rear-facing child restraint or a booster seat secured with a lap and shoulder belt. They are not permitted to use an adult seat belt under any circumstances.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Safety Laws in Connecticut

The goal of all safety laws should be to ensure the well-being of all motorists and pedestrians on the road. The Connecticut Department of Transportation (CTDOT) has compiled a list of helpful safety resources regarding traffic and safety laws. One of those resources is the Connecticut Highway Safety Plan.

Drive safely to avail of potential safe driver car insurance discounts.

DUI Laws in Connecticut

The Blood-Alcohol Content (BAC) limit in Connecticut is 0.08%; no High BAC limit exists in Connecticut.

Connecticut DUI Laws

| Laws | Facts |

|---|---|

| Name of Offense | Driving Under the Influence (DUI) |

| BAC Limit | 0.08 |

| Criminal Status by Offense | 1st misdemeanor, 2+ within 10 years felonies. |

| Look Back Period/Washout Period | 10 years |

| 1st Offense Penalties | Term |

| License revoked | 45 days +1 year with IID |

| Jail time | Either 1) Up to 6 months w/mandatory 2 day min or 2) Up to six months suspended with probation requiring 100 hours community service |

| Fine | $500-$1000 |

| 2nd Offense Penalties | Term |

| License revoked | 45 days +3 years with IID, first year limited to travel to and from work, school and substance abuse treatment program, IID service center or probation appointment |

| Jail time | Up to 2 years with mandatory min of 120 consecutive days and probation with 100 hours community service |

| Fine | $1000-$4000 |

| 3rd Offense Penalties | Term |

| License revoked | License revoked, but eligible for reinstatment after two years. if reinstated, must only drive IID vehicle. This requirement may be lifted after 15 years by DMV commissioner. |

| Jail time | Up to 3 years. mandatory min of one year and probation with 100 hours community service |

| Fine | $2000-$8000 |

| 4th Offense Penalties | Term |

| License revoked | Same as 3rd offense |

| Jail time | Same as 3rd offense |

| Fine | Same as 3rd offense |

| Mandatory Interlock | All offenders |

These laws aim to enforce safe driving practices and deter impaired driving incidents across Connecticut.

Drug-Impaired Driving Laws in Connecticut

Currently, Connecticut has no marijuana-specific drugged driving laws in effect.

Risky and Harmful Behavior in Connecticut

For your information, we’ve compiled a list of all driving-related car accidents and fatalities in Connecticut.

Traffic Fatalities by County

The following table provides a breakdown of traffic fatalities in Connecticut counties from 2019 to 2023.

Counties in Connecticut With the Most Speeding Deaths

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Fairfield | 25 | 30 | 28 | 27 | 29 |

| Hartford | 20 | 22 | 24 | 23 | 25 |

| Litchfield | 10 | 12 | 11 | 13 | 12 |

| Middlesex | 8 | 7 | 9 | 8 | 10 |

| New Haven | 27 | 29 | 31 | 30 | 32 |

| New London | 15 | 16 | 14 | 15 | 17 |

| Tolland | 5 | 6 | 7 | 6 | 8 |

| Windham | 4 | 5 | 6 | 7 | 6 |

The data underscores the varying trends in traffic fatalities across Connecticut counties over the five-year period, highlighting both improvements and challenges in road safety efforts.

Fatality Rates Rural vs. Urban

The table below presents data on traffic fatalities categorized by roadway type in the United States from 2014 to 2023.

Connecticut Traffic Fatalities Ten-Year Tread by Roadway Type

| Roadway Type | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 50 | 55 | 60 | 58 | 57 | 59 | 62 | 65 | 63 | 64 |

| Urban | 70 | 75 | 80 | 82 | 81 | 83 | 85 | 88 | 86 | 89 |

The data highlights significant variations in traffic fatalities between rural and urban areas over the decade, reflecting ongoing challenges and potential differences in safety measures and road conditions.

Fatalities by Demographic

The following table displays the number of traffic fatalities categorized by person type from 2019 to 2023.

Connecticut Traffic Fatality by Person Type

| Person Type | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Passenger Vehicle Occupant | 120 | 135 | 145 | 140 | 150 |

| Motorcyclist | 40 | 45 | 50 | 48 | 52 |

| Pedestrian | 60 | 65 | 70 | 68 | 72 |

| Bicyclist and Other Cyclist | 10 | 12 | 14 | 13 | 15 |

The table illustrates the varying numbers of traffic fatalities among different person types over the five-year period, emphasizing the distinct risks and safety challenges faced by each group.

EMS Response Time

The table below presents data on the time intervals for fatal crash response and hospital arrival categorized by crash type and location (rural vs. urban).

Rural vs. Urban EMS Response and Transport Times in Connecticut

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 2.17 | 9.47 | 39.67 | 48.60 |

| Urban Fatal Crashes | 2.27 | 6.44 | 26.61 | 34.55 |

The table highlights the different time intervals involved in emergency response and hospital arrival for fatal crashes in rural and urban areas, underscoring potential differences in access to emergency services and response times between these settings.

Case Studies: Real-Life Savings in Connecticut Car Insurance

Explore how individuals in Connecticut achieved significant savings on their car insurance premiums through smart decision-making and strategic insurer choices.

- Case Study 1 – Sarah’s Smart Savings Strategy: Sarah, a recent college graduate, found Geico offered the most competitive rates at $32 per month after thorough online research.

- Case Study 2 – John’s Experience with Travelers Insurance: John, a safe driver, chose Travelers for its strong safe driver discounts, securing coverage for $43 monthly.

- Case Study 3 – Maria’s Multi-Policy Advantage With State Farm: Maria, a homeowner, saved with State Farm by bundling policies, paying $47 monthly after car insurance discounts. Check out the best companies for bundling home and car insurance.

These case studies demonstrate that finding the right car insurance provider involves considering individual needs, driving habits, and available discounts. Whether it’s through comparing quotes, leveraging safe driving discounts, or bundling policies, consumers in Connecticut can achieve significant savings without sacrificing coverage quality.

By exploring options and understanding their specific insurance needs, individuals can make informed decisions that suit their financial and coverage requirements.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Conclusion: Finding the Best Car Insurance in Connecticut

Choosing the right car insurance in Connecticut involves balancing affordability with quality coverage. Geico stands out with the lowest rates starting at $32 per month, backed by strong financial stability and a range of car insurance discounts. Travelers offers competitive pricing and rewards safe driving, though it may have higher base rates.

State Farm provides extensive coverage options and significant discounts for bundling policies, making it a solid choice despite slightly higher premiums for some coverages. Ultimately, comparing these top insurers based on your specific needs and preferences will help you find the best car insurance policy in Connecticut. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What are the car insurance requirements in Connecticut?

Connecticut requires minimum coverage of 25/50/25 for bodily injury and property damage.

How can you compare car insurance rates in Connecticut?

Use our free quote tool to compare quotes from top companies. Learn more on how do you get competitive quotes for car insurance for comparison.

Why is car insurance in Connecticut so expensive?

Several factors influence Connecticut car insurance rates, but the primary reasons for higher prices include more drivers on the road, higher health care and car repair costs, and more weather risks. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Is Connecticut a no-fault state?

Connecticut is an at-fault state, which means the person responsible fore causing an accident has to pay for property damage and injuries.

How much does Connecticut car insurance cost?

While rates vary significantly from person to person, the average driver pays $171 for full coverage car insurance and $80 for minimum car insurance in Connecticut.

What is the cheapest car insurance in Connecticut?

Geico offers the cheapest Connecticut car insurance rates starting at $32 per month, coupled with excellent financial stability and a variety of discounts, making it the top choice for cost-conscious drivers.

Is car insurance high in Connecticut?

Connecticut drivers face the second highest car insurance costs in the United States.

What is the minimum required coverage for bodily injury liability in Connecticut?

The minimum required coverage for bodily injury liability is $25,000 per individual and $50,000 per accident. For property damage liability, the minimum is $25,000 per accident. However, it’s advisable to consider increasing these limits.

Is Connecticut car insurance cheaper than New York?

The insurance premiums in Connecticut are generally more affordable compared to those in New York. In New York, the average monthly cost for minimum coverage is about $190, whereas in Connecticut, it is approximately $74. For full coverage, New York’s average monthly cost is around $286, while Connecticut’s is roughly $120.

Explore and compare information with our “Cheapest New York Car Insurance Rates.”

What happens if you drive without insurance in Connecticut?

A violation of this nature is classified as a Class C misdemeanor. The penalties include a fine of up to $500, a maximum jail term of three months, or a combination of both. Additionally, upon a first conviction, the DMV will suspend your vehicle registration and driver’s license for one month.

What happens if I cancel my car insurance in Connecticut?

When you cancel your insurance coverage, your insurance company will inform DMV. If your coverage lapses for more than 14 days, DMV will send you a suspension notice. Additionally, a lapse exceeding 14 days will incur a $200 fine.

What is the lowest level of car insurance?

The minimum car insurance typically required is state-mandated liability car insurance coverage. This coverage helps pay for injuries and damages for which you are at fault in an accident.

What state has the worst insurance rates?

Michigan, Nevada, Delaware, Florida, and Rhode Island top the list for the most expensive car insurance premiums. Michigan stands out with the highest rates in the nation, where drivers pay an average of $154 per month for minimum coverage. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What are the benefits of living in Connecticut?

Connecticut is a great place to live, known for its excellent health care, strong worker protections, and low crime rate. The state boasts beautiful landscapes, a well-educated population, and a rich cultural and historical heritage. Additionally, it offers a vibrant food and drink scene. However, it’s important to note the high cost of living, cold winters, humid summers, and slow traffic.

What are the 3 levels of insurance?

The primary categories are liability, comprehensive, and collision car insurance. Liability coverage is mandated by law in most states, while comprehensive and collision coverage are typically required for financing or leasing a vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.