Cheap No-Deposit Car Insurance in 2025 (Unlock Big Savings From These 10 Companies)

Discover why Geico, State Farm, and Progressive lead the pack in offering cheap no-deposit car insurance, starting as low as $25 monthly. These providers excel in affordability, customer service, and flexible payment options, making them top choices for no-deposit car insurance seekers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for No Deposit

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for No Deposit

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for No Deposit

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best providers of cheap no-deposit car insurance are Geico, State Farm, and Progressive, leading the charge due to their exceptional service and flexible payment options.

Have you ever gone online and gotten a quote for car insurance, only to find out that you have to put down a large deposit to get monthly payments that fit your budget?

Our Top 10 Company Picks: Cheap No-Deposit Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $25 A++ Customer Service Geico

#2 $30 B Low Rates State Farm

#3 $35 A+ Coverage Options Progressive

#4 $40 A+ Nationwide Reach Allstate

#5 $45 A+ Personalized Service Nationwide

#6 $50 A Innovative Technology Farmers

#7 $55 A Policy Options American Family

#8 $60 A Trusted Brand Liberty Mutual

#9 $65 A++ Financial Strength Travelers

#10 $70 A High-Risk Coverage The General

This scenario has happened to virtually everyone who has ever looked for cheap car insurance. The good news is cheap, no deposit car insurance is available.

Enter your ZIP code now to receive cheap, no deposit car insurance quotes from multiple companies today.

- Geico leads as the top pick for no-deposit car insurance

- No-deposit options provide manageable payment without upfront costs

- Ideal for drivers needing immediate coverage with financial flexibility

#1 – Geico: Top Overall Pick

Pros

- Exceptional Customer Support: Geico is renowned for its strong customer service, with 24/7 availability and multiple channels for support.

- Competitive Pricing: Offers some of the lowest monthly rates at $25, making it highly accessible for many customers.

- Fast Claims Processing: Known for its efficiency in handling claims, ensuring quick resolutions for customers. If you want to learn more about the company, head to our Geico car insurance review.

Cons

- Coverage Limitations: While affordable, some of Geico’s coverage options may not be as comprehensive as those offered by higher-priced competitors.

- Discount Variability: Discounts can vary significantly between states and customer profiles, which might affect overall savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Low Rates

Pros

- Affordable Policies: Provides competitive pricing with monthly rates starting at $30. Discover insights in our State Farm car insurance review.

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- Extensive Agent Network: Large network of agents provides personalized service and local expertise.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Higher Premiums for Certain Coverages: Despite general affordability, premiums can be higher for specific coverage options.

#3 – Progressive: Best of Coverage Options

Pros

- Wide Range of Coverage: Progressive offers a variety of coverage options to suit diverse needs.

- Customizable Policies: Allows customers to tailor their policies with different levels of coverage and deductibles.

- Loyalty Rewards: Progressive rewards long-term customers with discounts and perks. Unlock details in our Progressive car insurance review.

Cons

- Higher Starting Rates: Starting monthly rate of $35 is higher compared to its closest competitors.

- Complexity in Policy Management: With many customizable options, managing the policy can be complicated for some users.

#4 – Allstate: Best for Nationwide Reach

Pros

- Extensive National Coverage: Provides insurance services across the nation, making it accessible for people in every state.

- Innovative Tools and Resources: Offers a variety of online tools and resources for better managing insurance needs.

- Strong Local Presence: Well-established local agencies that provide personalized service. Delve into our evaluation of Allstate car insurance review.

Cons

- Higher Monthly Premiums: Monthly rates start at $40, which can be higher than some competitors.

- Varied Customer Experiences: Customer satisfaction can vary widely depending on the region and the local agency.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Personalized Service

Pros

- Tailored Insurance Solutions: Known for offering personalized service to meet individual customer needs. Access comprehensive insights into our Nationwide car insurance discounts.

- Positive Customer Relationships: Builds strong, lasting relationships with clients through excellent customer service.

- Diverse Financial Services: Provides a range of financial products beyond insurance, benefiting customers looking for comprehensive financial solutions.

Cons

- Higher Price Point: Starting monthly rate of $45 is higher, which might not be the best for budget-conscious consumers.

- Limited Global Reach: While strong nationally, it has less presence internationally compared to some peers.

#6 – Farmers: Best for Innovative Technology

Pros

- Advanced Digital Tools: Utilizes cutting-edge technology to enhance customer interaction and service delivery.

- Customizable Coverage Options: Offers a variety of innovative and flexible insurance products. Discover more about offerings in our Farmers car insurance review.

- Proactive Claims Service: Employs technology to streamline the claims process, improving speed and accuracy.

Cons

- Higher Cost: Premiums start at $50 a month, potentially making it less attractive for those on a tight budget.

- Complexity in Offerings: The range of innovative products can be overwhelming and confusing for some customers.

#7 – American Family: Best for Policy Options

Pros

- Broad Policy Selection: Offers a wide range of policy options to cater to various needs and preferences.

- Family Discounts: Provides discounts that benefit families, encouraging policy bundling and loyalty. Check out insurance savings in our complete American Family car insurance review.

- Supportive Customer Service: Known for its dedicated customer support that helps clients navigate their policy options efficiently.

Cons

- Premium Costs: With a starting rate of $55, premiums can be on the higher side compared to other competitors.

- Limited Availability: American Family’s insurance products may not be available in all states, which could limit options for some potential customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Trusted Brand

Pros

- Strong Brand Reputation: Highly trusted in the insurance industry, providing a sense of security for customers.

- Flexible Discounts: Offers a variety of discounts that can significantly lower premiums for eligible customers.

- Global Presence: One of the few insurers with a vast international presence, catering to global customers. Read up on the “Liberty Mutual Car Insurance Review” for more information.

Cons

- Higher Pricing Tier: Monthly rates start at $60, which might be less competitive for price-sensitive consumers.

- Complex Policies: Some customers might find their policy offerings to be complex and difficult to customize.

#9 – Travelers: Best for Financial Strength

Pros

- Superior Financial Stability: Possesses one of the strongest financial backings in the industry, with an A++ rating from A.M. Best.

- Risk Management Expertise: Offers specialized coverage options that incorporate comprehensive risk assessments.

- Wide Industry Coverage: Caters to a broad spectrum of industries with tailored insurance solutions. More information is available about this provider in our Travelers car insurance review.

Cons

- Costlier Premiums: With starting rates at $65, it’s one of the more expensive options on the list.

- Selective Policy Availability: Not all of their specialized policies are available in every state or for every industry.

#10 – The General: Best for High-Risk Coverage

Pros

- Accommodation of High-Risk Drivers: Specializes in providing coverage for drivers who may not be eligible for standard policies due to their driving history.

- Flexible Payment Options: Offers various payment plans to help high-risk drivers maintain coverage without financial strain.

- Quick Policy Issuance: Known for fast processing and approval, especially beneficial for drivers requiring immediate coverage. See more details on our The General car insurance review.

Cons

- Higher Premiums: Generally, premiums are higher due to the nature of covering high-risk drivers.

- Coverage Limitations: While it specializes in high-risk coverage, options for more comprehensive or lower-risk insurance might be limited.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparative Monthly Rates for No Deposit Auto Insurance: Minimum vs. Full Coverage

The cost of auto insurance varies significantly depending on the type of coverage selected. For those considering no deposit car insurance options, understanding the difference between minimum and full coverage rates can aid in making an informed decision. Below is a detailed comparison of monthly rates for both coverage levels across several leading insurance companies.

No-Deposit Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $40 $75

American Family $55 $90

Farmers $50 $85

Geico $25 $60

Liberty Mutual $60 $95

Nationwide $45 $80

Progressive $35 $70

State Farm $30 $65

The General $70 $105

Travelers $65 $100

The provided table showcases monthly auto insurance rates for no deposit coverage across various companies, revealing a range in pricing for both minimum and full coverage options. For instance, Allstate charges $40 for minimum coverage and $75 for full coverage, while Geico offers more competitive rates of $25 and $60, respectively.

On the higher end, The General’s rates stand at $70 for minimum and $105 for full coverage, reflecting its specialization in high-risk coverage. Progressive and State Farm provide middle-ground options at $35 and $30 for minimum coverage and $70 and $65 for full coverage, respectively.

This data indicates that the choice between minimum and full coverage involves a substantial price difference, emphasizing the need for consumers to carefully assess their insurance needs against their budget constraints. Learn more in our “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

What Is No Deposit Car Insurance

As the name suggests, no deposit car insurance allows you to get car insurance without paying money down when you sign up for a policy. You wait until the due date next month to make your first payment. However, your car insurance rates will be more expensive.

Read more: Do you get your deposit back from car insurance?

Pros of Buying No Deposit Car Insurance

One of the biggest benefits of buying cheap, no deposit car insurance is that it makes the payments more manageable. If you can find cheap insurance, you can afford to purchase the coverage that you need. Another benefit is that when you are presented with a quote that shows your monthly premiums, you will know that this is all you will need.

For example, if your monthly premium is quoted at $65, you won’t need $130 to start your policy. There is less confusion when you purchase cheap, no deposit car insurance and pay monthly. At the beginning of every month, you pay the premium to cover that month. Once the premium is paid, you don’t owe another dime for the rest of the month.

This type of payment structure also helps if you decide to change car insurance companies. You don’t have to figure out where you are in your policy because the first day of each month starts when you pay your bill. Discover insights in our Car insurance payment methods.

Lastly, most companies that allow you to pay monthly will also draw your payment out of your bank account for you. This option may not be a plus for everyone, but for many people, not having to think about when that bill is due can be quite a relief.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cons of Buying No Deposit Car Insurance

Sometimes cheap is just that—cheap. In some cases, you get what you pay for, and you could end up buying an insurance policy from a company with a lot of hidden fees. What’s more, some companies place a clause in their policy to raise your rates if they deem your initial application to be incorrect, which can lead to higher rates than initially expected.

Another downside is, when you don’t pay a deposit, you usually pay more for your monthly premiums. Typically, you will spend $30 to $40 more every six months for the no deposit monthly payment option. For many people, this could make a difference in what they can afford.

When you choose a cheap, no deposit car insurance plan, most insurance companies require you to pay directly from your bank account, which negates the risk of defaulting on a payment. See more details on how do you get your deposit back from car insurance.

For many people, this would be a plus; for some, however, it’s negative because it offers no wiggle room if you are short on your premiums for the month. Some people don’t like to give any company access to their bank account for direct withdrawal because this leaves them vulnerable to payment mistakes.

For example, there is the possibility that the computer doesn’t see a payment, and it withdraws the payment twice. Or, if you cancel your account and it isn’t updated quickly enough, the insurance company may extract the payment even if you are no longer a customer. While these things don’t happen to everyone, it is an unfortunate fact that it happens far too often.

Some insurance companies will allow you to pay with direct bill pay, which means you control the transactions rather than the insurance companies, but most won’t if you choose the no deposit option. In some cases, if you choose no deposit car insurance, your rates will increase more often. This is because these companies renew your policy every six months instead of once a year.

Any changing risk factors in your area or any claims you have made will affect your insurance costs faster. If the risk factors change for the better and you don’t have any claims, you could pay less money sooner. This means you can qualify for benefits if you are an excellent driver with no claims on your account. Here’s an example of how claims can affect your car insurance costs.

Car Insurance Rates Increase After Claims

| Car Insurance Increase Summary | Car Insurance Rates Increase |

|---|---|

| Increase at Six Months | +$384 |

| Increase at 12 Months | +$767 |

| Increase at Three Years | +$2,301 |

For many people, the pros outweigh the cons. There is a way for them to purchase car insurance without having to pay hundreds of dollars up-front. That is why so many people are willing to pay a little more over time to avoid parting with so much money in a single transaction.

Who Can Get No Deposit Car Insurance

Anyone can get no deposit car insurance. The best way you can get no deposit car insurance is to have a clean driving record and a good credit score.

According to Experian, the credit score correlates to a consumer’s level of risk in car insurance. No deposit car insurance is also available for those who may not have enough money to cover the deposit’s cost. It could cost more, but you may skip the deposit if an agent finds you eligible.

How Does Signing up for No Deposit Car Insurance Work

Purchasing no deposit car insurance is just like any other policy that you get. However, you’ll skip the part where you’re supposed to deposit money on your car insurance policy.

The next month you can make your first payment. However, it could be more expensive than average.

Here’s an example of how no deposit car insurance can affect your car insurance rates per month.

No-Deposit vs. Deposit Car Insurance: Monthly Rates by Down Payment Amount

| Deposit | Rates |

|---|---|

| 0% | $133 |

| 10% or $80 | $120 |

| 20% or $160 | $107 |

| 30% or $240 | $93 |

What does this data mean? The data shows that a no deposit car insurance policy will produce higher monthly premiums. Any deposits you make on your car insurance policy will reduce your monthly payments. Learn more on how do you get the lowest down payment on car insurance.

The more you deposit, the cheaper your car insurance costs will be per month.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Where Can You Purchase No Deposit Car Insurance

Finding less expensive car insurance is easy these days with the internet, especially with the advent of free quote tools. With quote tools, you can compare the cost of several insurance companies all in a single location. However, one area where quote tools may not be able to help you narrow down your choices is between no deposit car insurance companies and car insurance companies that do require a deposit.

The good news is that it doesn’t matter if the quote tool you use can manage this because it’s easy and quick enough to check. You can do the math yourself by checking your total premium with the quoted monthly premium. Another way to do this is to simply select the link to the insurance company you are considering to see what it says on their website.

The great thing about using a quote tool is that your information is saved to go right back to if you aren’t happy with the insurance company you are investigating. You don’t have to start over either—all of your information is still there. While it is entirely your decision to choose a cheap, no deposit car insurance or cheap car insurance that requires a deposit, you should start right here by using our free quote tool.

What Should You Look for When Shopping for No Deposit Insurance

If you want to buy car insurance with no deposit, find a company that will let you make monthly payment installments. You’ll be charged for paying monthly.

- In most cases, you must have a monthly payment plan to find insurance without a deposit.

- The drawbacks to this are higher costs for processing fees and the possibility of losing coverage at the last minute.

- You are better off choosing a plan that allows you to pay a few times over a year.

Buying car insurance with no deposit can be tricky, especially if your credit is not good. However, it is possible to do so by finding an insurance company that will accept a pay-as-you-go payment plan. Car insurance is usually purchased in six month or annual terms. Since you can almost always cancel a car insurance policy at any time, this is usually the preferred route to ensure you have insurance regularly.

Paying monthly rates is too risky, leaving you open to being without insurance due to a forgotten payment or simply not getting renewed the next month. Most car insurance companies will review and rate your credit report as part of the application process.

If you have never had car insurance before or have a poor credit history, the car insurance company will most likely consider hiring a higher-risk applicant. This can cause your premiums to be higher or require you to need a large deposit upfront. Check out insurance savings in our complete “Shopping for Car Insurance Quotes.”

Is There Really Such a Thing as No Deposit Car Insurance

If you want to buy car insurance with no deposit, then you’ll need to find an insurance company that will allow you to make monthly payment installments.

In this scenario, you may need to pay one month in advance to ensure that the car insurance company has the premium before the next month’s coverage begins.

By paying one month in advance, you will always be assured to have coverage.

If you pay for your August Insurance in July and have an accident in August, you are covered. More information is available here Understanding car accidents.

If you don’t pay for August until sometime in August and you have an accident that same month, then there could be a question about whether the accident is an insurable event.

Some dangers with paying month-to-month are:

- Forgetting to pay your bill in a timely fashion

- Losing a check in the mail

- The insurance company fails to process your payment

If you decide to buy car insurance with no deposit and get a month-to-month payment plan, you need to make sure your payments are made and processed every month.

You may also be charged a maintenance fee for a monthly payment plan, which is an additional expense.

If you’re concerned about no deposit car insurance schemes, rest assured the insurance market is strictly regulated.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Does Your Credit History Affect Your Auto Insurance Rates

Some people may not be aware that their credit score plays an important role in determining car insurance rates. It can also impact the amount of a deposit that you may need to secure your auto insurance policy. The best auto insurance companies decide your car insurance rate based on several factors, including:

- Your Driving Record

- Your Age

- Your Marital Status

- The Make and Model of Your Car

- Where You Work

- Where You Live

Many states also allow car insurance companies to use your credit report as another deciding factor. If your credit score is low, then the auto insurance company may consider you to be a risk and raise your rate or demand a higher insurance deposit.

Statistics generalize people with low credit scores to be less responsible than people with high credit scores. Because of this, insurance companies consider individuals with low credit scores to be a higher risk for insurance claims.

If your credit report is tied to a poor payment history or a lot of credit card debt, for instance, the car insurance company may charge you more money. Granted, if you don’t make your insurance payment, you simply won’t have insurance. However, it is more work to track payments and chase debt so that you may be penalized for this in advance.

What Is a Car Insurance Down Payment

If you can buy no deposit car insurance with no money upfront and avoid monthly payments, this would be the best approach. By purchasing car insurance for a six-month term or an annual term, you lock in your rate and assure you have car insurance for that length of time.

On a monthly plan, if your car insurance company decides not to renew you the next month or raises your premium, then you may be scrambling for a new car insurance company.

You can also avoid paying monthly maintenance fees by getting a longer-term contract. Usually, an annual term can be paid off in two or three payments during the year, and you’ll only be charged a nominal amount for administrative costs. Since you need car insurance to drive, you will have to buy the plan for which you are approved. Unlock details on how do you have to pay car insurance every month.

Do I Have to Pay for Car Insurance Upfront

Some car insurance companies will ask for an upfront payment no matter what. When you buy car insurance, you’re billed for the coverage you select before the coverage is afforded.

- An auto insurance quote isn’t binding and doesn’t provide any type of protection to the person who requested it.

- Once an application for coverage is submitted, coverage may be afforded until the information has been fully underwritten.

- For a claim to be covered during this underwriting period, a payment must be submitted.

- Some companies will only charge for the first month’s premium to start a policy, while others will charge a down payment.

- It’s important to review the payment options before selecting a policy if you’re looking for flexibility.

- If you’re a high-risk driver or you have a low credit-based insurance score, there’s a good chance that you’ll be asked to put down money to secure coverage.

Since you pay in advance for your liability and sometimes physical damage coverage, you have peace of mind knowing that any future claims you file during that period will be covered.

Unfortunately, things aren’t so cut and dry when it comes to paying for a policy at the time of inception.

Consumers have the right to compare car insurance rate quotes for free. Since they don’t have to pay to look at the rates from insurer to insurer, it’s a very competitive marketplace.

When that consumer goes from quoting coverage to applying for it, it’s time for the tender. Companies will ask all serious applicants to provide their initial payment upfront when they submit their application.

How much the company asks for depends upon your rates, the state, and the company’s policy as it pertains to down payments.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Why Are Car Insurance Rates Charged in Advance

Whether you pay for the entire year or you choose to pay in installments, you’re paying for coverage that will be provided in the weeks or months to come and not in the months that have recently passed.

This is because insurance is a unique product. Unlike a cable contract that you use every month, insurance is a contract that you hope not to put to use.

If you don’t have a claim, it’s nothing more than a piece of paper saying that the company will have your back in the future if you need them.

The only way for the company to protect itself is to collect money for coverage dates before they come. There will be no issues regarding backdated claims and no collections notices because of missing payments.

If the policy isn’t paid within the time allotted for the grace period, the coverage cancels, and the insurer is no longer on the hook. Discover insights in our “How to Cancel Car Insurance: Step-by-Step.”

Are No Deposit Car Insurance Quotes Binding

A quote isn’t binding. That means you’re welcome to get another quote from another company. Getting a car insurance quote doesn’t mean you have to buy a policy with that particular company.

It’s nothing more than an estimate that shows a prospective policyholder how much they’d pay for insurance with a specific company. See more details on our “Car Insurance Policyholder: Explained Simply.”

Using personal information, the company can tell you how much you will pay for an entire term of coverage as long as you are honest and forthcoming.

When Is an Application Binding

After you compare quotes, you will then need to decide which company you’ll proceed with. When you proceed, you enter the application stage of the process.

This is where you must provide accurate information and sign disclosures so that the company can verify your driving record and credit record. Learn more on how do all car insurance companies check your driving records.

In addition to providing details on your driving record and driving history, you’ll be asked to submit your initial payment. An application isn’t submitted until you submit a minimum payment amount that’s required by the carrier.

This is because car insurance is a contract, and for that contract to be a valid consideration, money must be collected.

When the payment is submitted and the application is in the hands of the underwriting department, you will have coverage against losses.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Much Consideration Is Due to Binding Coverage

How much you must pay when you’re starting a policy depends on a few different factors. Years ago, most insurers would charge their customers a down payment for insurance.

Geico leads the pack with exceptionally low rates, offering minimum coverage for as little as $25 a month.

Daniel Walker Licensed Insurance Agent

This down payment would cover the costs to underwrite and process an application so that the insurer wouldn’t suffer a loss if the customer canceled the policy. Discover insights in our “How do you calculate total loss for car insurance.”

Now, down payments aren’t always required. If they are, the state will dictate how much a company can require that someone pays. Here are some factors that can affect whether or not a down payment will be requested:

- The carrier that you’re buying from

- Whether or not you’re a high-risk driver

- If the company typically does business in the high-risk market

- If you’re doing business with a brokerage

- Your credit record if you’re in a state where insurers can run credit

- If you want to pay the policy in full

- State requirements

The initiation of an insurance policy can entail varying upfront costs, influenced by factors such as the insurance carrier, the client’s risk profile, and specific state regulations. While down payments were traditionally mandatory to offset initial processing costs, current practices vary, with some states and insurers requiring minimal to no initial payment.

What Is the Most Common Down Payment Option

If you can’t afford to pay in full or quarterly, you should have more than a monthly payment available to start your policy. Discover more about offerings in our “Can I pay car insurance quarterly.”

The most common down payment requirement for six-month policies with standard insurers is the Five Pay Plan.

Under the Five Pay Plan, you’ll pay the first and last month down. You’ll then pay four installments, and you won’t have a monthly payment the last month because you paid the fee at startup.

Not having the payment at the end of the term is something many clients look forward to.

What Payment Methods Are Accepted for a Down Payment

You can pay your initial payment in several different ways. Most insurance companies accept payments by credit or debit card as long as the card is in your name. If someone else is paying your premiums, you’ll need their authorization before you can run the card. If you’re going to have the payments automatically drafted from your account, you’ll need a canceled check.

This will show your routing and account number so that you can set up the EFT draft. Just be sure to cancel that draft if you ever decide to leave the carrier.

Read more: Car Insurance Payment Methods

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Is the Binding Period

Insurance companies in most states have a 60-day binding period to review the risk they have taken. During this time, the insurer can modify the rates or even terminate the policy.

It’s common for a company to order cancellation if the applicant wasn’t honest.

If this happens and the policy goes through a rescission, the cancellation is backdated and the entire premium that you paid will be returned.

You do have to pay for your premiums upfront. How much you’ll need to pay can vary. Be sure to compare car insurance quotes to find the best rates before you apply.

With full coverage premiums at just $60, Geico stands out for combining affordability with comprehensive protection.

Brad Larson Licensed Insurance Agent

After using an online comparison shopping tool, proceed with an application and choose a payment method that works for you. Discover insights in our “Should you shop around for car insurance.”

How Can You Find Cheap No Deposit Car Insurance Quotes

Payment for no deposit car insurance is divided into 12 monthly installments. Save up to 20% more on car insurance rates by comparing multiple quotes online. Discover more about offerings in our “Cheapest Car Insurance in the World.”

- There are no deposit car insurance policies out there. Compare them to find the one best suited to your needs.

- Be sure to evaluate the reputation and claims processing history of a company before you choose them. There’s more to insurance than premiums.

- Search online for quotes and then compare the companies on your shortlist side by side.

People who need car insurance can usually find no deposit insurance policies. They are very beneficial for customers who are having cash difficulties when they apply for coverage.

With the current state of the economy, drivers often find it tough to pay for deposits on insurance policies in advance. Many people are looking for a no deposit insurance policy to get their car insured fast.

How Can You Get Cheap Auto Insurance Without Paying an Initial Deposit

Some companies provide no down payment car insurance as an alternative way to get car insurance, while many others require advance payment for insurance policies.

Deposits on insurance policies are often required because these policies are legally binding contracts. Insurance companies want to make sure that consumers hold up their end of the deal.

It is difficult for many car insurance companies to stay profitable in the insurance market nowadays. Therefore, some companies want to reach a broader client base and provide car insurance without advance deposits to give consumers an option for better cash flexibility. See more details on our “Cash Back Car Insurance.”

Payment for these car insurance policies is divided into 12 monthly installments, and the coverage starts when the first monthly payment is made.

You can receive car insurance without a deposit, but it’s important to get a few quotes for no deposit car insurance. These quotes are easy to find on the internet these days.

It is good to compare insurance companies online and choose a company that will suit individual consumer needs. Here are a few steps that people may take to find the right no deposit car insurance quotes:

- Look Online: Drivers can search for the best quotes on car insurance policies with no advanced deposits online. Consumers should look for insurance policies that will suit their needs and financial capacity.

- Evaluate Reputation: Once a consumer has found suitable no deposit car insurance policies, it is a good idea to learn more about the insurance providers. It is important to get an idea of how individual insurance companies do business. Finding a company with a solid reputation in the insurance industry is essential.

- Examine Claims Process: People need to ask about the process of filing claims after automobile accidents. It is also vital to know how long the filing process will take. Insurance companies should manage consumer claims on time.

- Ask People: Sometimes, asking family, friends, and even co-workers is a great way to find the best no deposit car insurance quotes. Mechanics at car repair shops are also good people to ask. They encounter clients who have had positive and negative experiences with insurance companies.

Find cheap car insurance in your area right now by entering your ZIP code in the free online tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Can You Save Money With the Cheapest Car Insurance Companies

Finding affordable car insurance with no deposit is possible and easy to do under the right circumstances. Learn more in our “How can I find affordable car insurance rates.”

There are a lot more insurance companies to choose from. The best car insurance companies have to offer more things to appeal to potential customers. One benefit that most insurance companies are providing today is a flexible payment option.

Many insurance companies now allow you to pay monthly, quarterly, twice a year, or once a year. This flexibility makes buying car insurance more affordable for many people. However, your car insurance company may charge you up to an extra $10 per month.

Choose the Best Car Insurance Companies

When searching for car insurance, consumers should always choose the policy that will suit their needs best. They should see that the insurance agent or representative can answer all their questions about insurance policies and coverage.

Drivers should use a car insurance comparison chart to compare policies from the best car insurance companies after they have obtained quotes.

Popular auto insurance providers do not always provide good quotes for no deposit car insurance. It is often best to choose smaller insurance companies. Let’s examine the top car insurance companies’ cost to give you an idea of what you’ll pay with no deposit.

Car Insurance Monthly Rates from the Top 10 Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Chubb | $75 | $185 |

| Farmers | $53 | $139 |

| Geico | $39 | $105 |

| Liberty Mutual | $68 | $174 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| USAA | $22 | $59 |

The best car insurance companies show that you’ll pay between $211 to $506 per month. What if you deposited money on your car insurance policy? You could knock off a few more dollars per month.

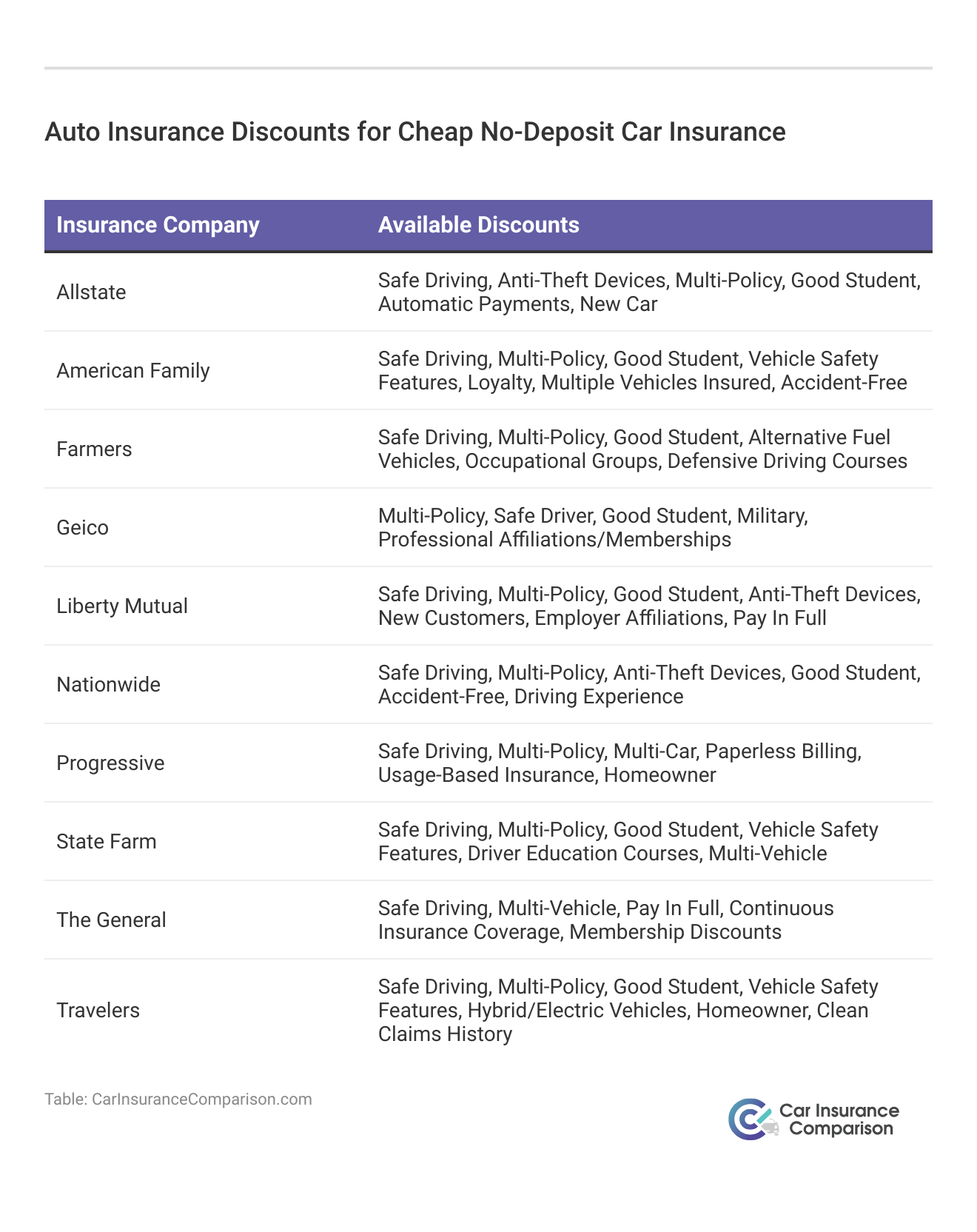

If you’re unable to deposit, don’t worry. Car insurance discounts can always cut expensive costs.

Here’s a list of discounts that you should ask about if you want to decrease your car insurance costs:

- Good Driver Discount

- Student Discount

- Paperless Discount

- Multi-Policy Discount

- Payment by Bank Account

- Paid-In-Full Discount

- Multi-Vehicle Discount

- Telematics and Usage-Based Car Insurance Programs

- In-Vehicle Safety Devices

A telematics or usage-based car insurance program uses a mobile app or plug-in device to monitor your driving habits and rewards you with a discount for driving safely. Many people successfully lower their monthly rate with these programs, but you will have to drive the speed limit and avoid hard-braking to save money.

Use discounts to your advantage. Be sure to compare different companies to get the most discounts and to lower car insurance prices.

Should You Buy the Cheapest Car Insurance Policy

Consumers should always remember that the cheapest, no deposit car insurance premium does not automatically mean that they will get the best value in their car insurance coverage. Consumers should always get at least three car insurance quotes from three different car insurance companies. Compare these quotes and look further into what is covered in the policies. Consumers should be aware of:

- The Coverage Type

- The Monthly Premiums

- The Deductibles

- What Is Not Included in the Policy

There are many sites online that will help consumers obtain and compare quotes for affordable no deposit car insurance. With this, car insurance consumers will be able to find the insurance companies they want.

No-Deposit Liability Car Insurance Monthly Rates by Provider

| Insurance Company | Minimum Coverage |

|---|---|

| Allstate | $40 |

| American Family | $55 |

| Farmers | $50 |

| Geico | $25 |

| Liberty Mutual | $60 |

| Nationwide | $45 |

| Progressive | $35 |

| State Farm | $30 |

| The General | $70 |

| Travelers | $65 |

Higher deductibles produce cheaper car insurance rates. Liability-only produces the cheapest car insurance rates, but the coverage is minimal. Liability insurance only pays for the other driver’s damages in accidents you cause. If you want your own damages covered, you will need to add collision and comprehensive coverages.

A policy featuring liability, comprehensive, and collision coverage is called full-coverage auto insurance. You will pay more for a full-coverage policy, but you’ll have much better protection.

If you try to save money by skimping on coverage, you could end up paying exorbitant medical and repair costs if you’re in a bad accident. Shop around until you find the auto insurance coverage you need at a price you can afford. Many sites online also provide reviews of car insurance companies.

Former and current customers that have dealt with particular car insurance companies use these sites to provide feedback about their experiences.

Although people should be cautious when reading these reviews, consumers can use this information to weigh all of their choices before making a final decision.

It is important to compare multiple insurance providers when reviewing and comparing no deposit car insurance policies. Getting the most reliable no down payment car insurance policy is easy when consumers have all of the right information. (For more information, read our “Compare No-Down-Payment Car Insurance: Rates, Discounts, & Requirements“).

After receiving multiple quotes, the consumer can narrow down a few options and make one-on-one comparisons of no down payment car insurance to see what is covered by the particular policies they may be considering.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

No Deposit Car Insurance: The Bottom Line

Depending on the company, you could get no deposit car insurance. Getting no deposit car insurance may depend on specific conditions, but it’s more expensive in the long term.

It does seem underhanded to receive a quote for a car insurance rate only to learn that you have to deposit two or three months’ worth of money to qualify for that price. In some cases, if you don’t have the deposit, then you cannot purchase the insurance.

For a long time, nearly every car insurance company required a deposit to purchase insurance. There were even some companies that didn’t accept payments at all and required you to pay six months in advance. See more details on our “Can you buy car insurance for six months?”

Enter your ZIP code in our car insurance comparison tool below for free no deposit car insurance quotes.

Frequently Asked Questions

What is no-deposit car insurance?

No-deposit car insurance refers to an insurance policy where you don’t have to pay a large upfront deposit or down payment. Instead, you pay your insurance premiums on a monthly or periodic basis.

For additional details, explore our comprehensive resource titled “How to Purchase the Right Car Insurance Quote Online?“

How does no-deposit car insurance work?

With no-deposit car insurance, you typically pay your insurance premiums on a monthly basis, spreading the cost over the policy term. This can make it more affordable for individuals who cannot afford a lump-sum payment upfront.

Are there any discounts available for no-deposit car insurance?

Discounts for no-deposit car insurance policies may vary depending on the insurance provider. Some companies may offer discounts for safe driving, bundling policies, or having multiple vehicles insured. It’s best to check with individual insurers to see what discounts they offer.

What are the requirements for obtaining no-deposit car insurance?

The specific requirements for obtaining no-deposit car insurance vary depending on the insurance provider. However, most insurers will consider factors such as your driving history, credit score, type of vehicle, and other personal information when determining your eligibility and premiums.

Are there any pros to getting no-deposit car insurance?

No-deposit car insurance is designed to be affordable by allowing you to spread the cost of your premiums over time, which can be particularly beneficial for individuals on a tight budget. It also offers flexibility through monthly payment options that can be easier to manage for some people. Additionally, no-deposit car insurance is often accessible to individuals with lower credit scores or those with limited financial resources, making it a viable option for a wider range of drivers.

To find out more, explore our guide titled “Finding Free Car Insurance Quotes Online.”

What is very cheap car insurance no deposit?

Very cheap car insurance no deposit is a policy option where you pay no upfront costs, making car insurance immediately more accessible and affordable.

How can I get car insurance today no deposit required?

To obtain car insurance today with no deposit, start by comparing online quotes from insurers offering instant coverage without an initial payment, allowing you to secure insurance on the same day.

Where can I find cheap monthly car insurance with no deposit?

Cheap monthly car insurance with no deposit can be found through insurers that specialize in low-cost policies, offering the flexibility to pay your premiums on a monthly basis without a deposit.

What does zero deposit car insurance mean?

Zero deposit car insurance means you are not required to pay any money upfront to start your car insurance policy, easing the financial burden and simplifying the process of getting insured.

To learn more, explore our comprehensive resource on “Is it cheaper to purchase car insurance online?“

Can I get 12 month car insurance no deposit?

Yes, some insurers offer 12 month car insurance no deposit plans, allowing you to spread your insurance payments over the year without needing to pay a lump sum at the beginning of your policy term.

Which car insurance companies with no down payment are available?

Many car insurance companies with no down payment offer flexible policies, including large providers like Geico and Progressive, which allow you to start a policy without an upfront financial commitment.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Is it possible to get car insurance with the first month free?

Yes, some insurers offer promotions such as car insurance with the first month free as an incentive to attract new customers, though these deals may be subject to eligibility criteria.

Where can I find car insurance first month free no deposit?

Finding car insurance first month free no deposit can be challenging but is occasionally offered during special promotions by some insurers, aimed at reducing the initial cost of obtaining coverage.

Learn more by reading our guide titled “How do you get car insurance fast?“

What options are there for car insurance with a low deposit?

Car insurance with a low deposit is offered by several insurers, providing an option to pay a small upfront amount rather than the full premium or a large deposit, making insurance more accessible.

How does car insurance no deposit monthly payments work?

Car insurance no deposit monthly payments allow you to pay for your insurance in installments over the policy period without requiring an upfront deposit, easing the initial financial burden.

Which insurance doesn’t require a down payment?

Technically, auto insurance policies that claim to have no down payment or “free car insurance” don’t actually exist. All legitimate car insurance policies necessitate an upfront payment. If an insurer promotes “low-down-payment insurance” or “low-deposit car insurance,” this down payment typically equates to the premium for the first month.

Who normally has the cheapest car insurance?

According to a cost analysis by our research team on national average prices for minimum coverage, Geico offers the lowest car insurance rate at $38 a month. The top 10 most affordable car insurance providers include Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers, and USAA.

Access comprehensive insights into our guide titled “How do you get car insurance fast?“

Why do car insurance companies require a deposit?

No insurance provider is willing to assume the risk of covering claims for someone who hasn’t paid, so they typically insist on receiving at least the first month’s premium before initiating coverage.

How not to pay a down payment?

USDA and VA mortgages typically do not necessitate a down payment. Alternatives to mortgages without a down payment include loans that require a minimal down payment, like conventional or FHA loans, or receiving monetary gifts from relatives or friends.

Can you pay car insurance with a credit card?

Yes, it’s usually possible to pay for your car insurance using a credit card. This method can offer advantages such as cash back or other rewards associated with your credit card. With the widespread availability of insurance apps and online platforms, using a credit card to pay for insurance has become a standard practice.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.