Lemonade Car Insurance Review for 2025 [Trustworthy Evaluation]

This Lemonade car insurance review examines why this is the best insurance company for tech-savvy drivers with its AI-based claims processing. Lemonade auto insurance rates start as low as $80/month, but its brief history since launching may alarm drivers looking for more established insurance companies.

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Lemonade, Inc.

Average Monthly Rate For Good Drivers

$80A.M. Best Rating:

AComplaint Level:

HighPros

- Excellent mobile app

- Pay-per-mile and usage-based plans

- Cheap car insurance rates

Cons

- Mixed customer service reviews

- Only available in seven states

This Lemonade car insurance review looks at a tech-savvy insurer that takes advantage of AI claims processing and offers rates that start as low as $80 per month.

With a fully digital platform, Lemonade modernizes the insurance experience by offering features like smartphone-based telematics that show how much mileage affects car insurance rates and pay-per-mile technology from its Metromile acquisition.

Lemonade Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.9 |

| Business Reviews | 4.0 |

| Claim Processing | 4.0 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.3 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 4.8 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 2.2 |

| Savings Potential | 4.2 |

Lemonade’s A. M. Best rating means it’s financially stable, but it has a below-average J.D. Power satisfaction score of 807/1000, meaning there’s room to improve.

Explore your car insurance options by entering your ZIP code and finding which companies have the lowest rates.

- Lemonade, Inc. has a 3.9 insurance rating

- Lemonade insurance rates start at $80/month for minimum coverage

- Lemonade’s AI-powered mobile app handles policy management and claims

Lemonade Car Insurance Cost Breakdown

Let’s examine Lemonade insurance rates by demographics and other scenarios. The tables below are broken down by age, gender, and coverage level, which can affect your rates.

Lemonade Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $176 | $339 |

| Age: 16 Male | $189 | $368 |

| Age: 18 Female | $161 | $310 |

| Age: 18 Male | $178 | $347 |

| Age: 25 Female | $106 | $193 |

| Age: 25 Male | $117 | $214 |

| Age: 30 Female | $92 | $178 |

| Age: 30 Male | $99 | $186 |

| Age: 45 Female | $80 | $152 |

| Age: 45 Male | $87 | $165 |

| Age: 60 Female | $74 | $139 |

| Age: 60 Male | $79 | $147 |

| Age: 65 Female | $71 | $132 |

| Age: 65 Male | $76 | $140 |

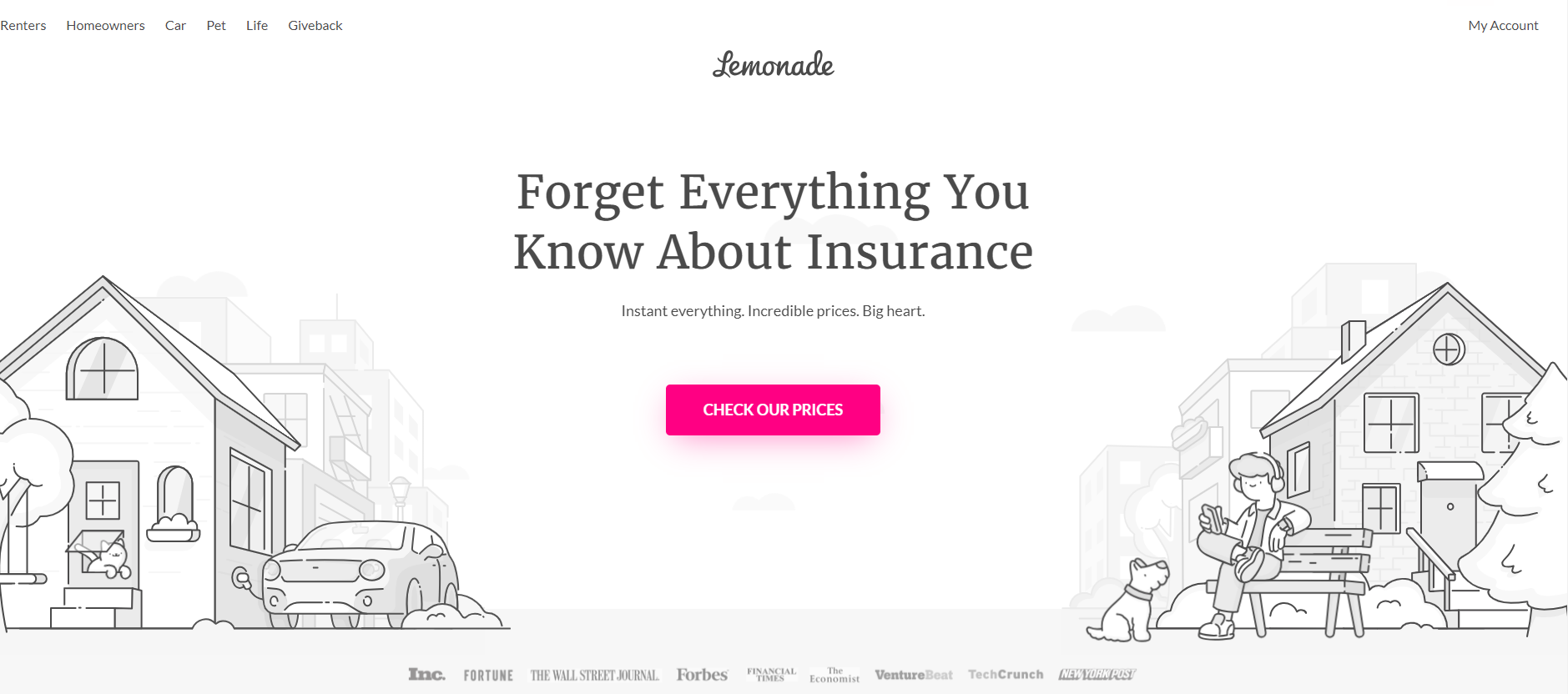

Lemonade is expensive for teens and young drivers, but it’s one of the most affordable car insurance companies for drivers over 30. Now let’s compare Lemonade car insurance by driving record.

If you have multiple accidents or DUIs on your record, you could benefit from Lemonade’s usage-based or pay-per-mile options to help lower rates. Compare the best usage-based car insurance companies to see if this type of plan could work for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Lemonade Car Insurance vs. Top Insurance Providers

To decide if Lemonade is right for you, it helps to know how Lemonade stacks up against the best car insurance companies. So, let’s see how Lemonade’s rates compare with the industry leaders by age, gender, and driving records.

Lemonade Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $158 | $157 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $136 | $136 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $78 | $78 | |

| $310 | $335 | $140 | $150 | $135 | $147 | $125 | $130 | |

| $522 | $626 | $174 | $200 | $171 | $174 | $167 | $170 |

| $303 | $387 | $124 | $136 | $113 | $115 | $111 | $112 |

| $591 | $662 | $131 | $136 | $112 | $105 | $109 | $103 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $84 | $84 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $96 | $97 |

Although they are far from the least expensive of their competitors, including Geico and State Farm, they beat premium insurers like Liberty Mutual and Travelers in rate competitiveness, especially for drivers in their 30s and 40s.

Lemonade’s Metromile Acquisition

Lemonade has expanded its auto insurance footprint to the tune of $145 million in an all-stock deal by acquiring Metromile. The $150 million purchase deal included cash and access to licenses to sell car insurance in 49 states. However, Lemonade auto insurance is still only available in seven states.

Together, Metromile’s decade of car insurance data and pioneering pay-per-mile technology and Lemonade’s AI-driven platform came together during the merger. Lemonade and Metromile use this technology, combined with its insurance expertise, to strengthen its position in the auto insurance market and expand its global reach.

Read More: Metromile Car Insurance Review

Lemonade Car Insurance Coverage Options

Lemonade provides all minimum car insurance requirements by state, including comprehensive liability protection for both bodily injury and property damage. Its core coverage includes:

- Liability Car Insurance Coverage

- Collision Coverage

- Comprehensive Coverage

- Personal Injury Protection

- Uninsured/Underinsured Motorist Coverage

It also offers pet injury coverage, which will help pay veterinary expenses if your pet is injured in a covered car accident.

Leomande collision coverage automatically includes this add-on, which comes standard with up to $1,000 in protection for cats and dogs.

Drivers can even add extra peace of mind with roadside assistance, temporary coverage while you’re temporarily without a vehicle during repairs, and gap coverage if you drive a leased or financed vehicle.

What Industry Experts Say About Lemonade Insurance

After the Metromile acquisition, Lemonade, a newcomer to the auto insurance industry, has been diligently assessed by prominent rating agencies. Here’s a comprehensive look at how industry experts and consumers rate their services:

Lemonade Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 807 / 1,000 Below Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 70/100 Average Customer Satisfaction |

|

| Score: 2.50 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Lemonade has great financial strength with an A rating from A.M. Best, yet its customer satisfaction isn’t as good. The company still has much to learn about the auto insurance market — as shown by the below-average J.D. Power satisfaction score (807/1,000) and average Consumer Reports rating (70/100).

“Gross profit is up 71% YoY” — @Lemonade_Inc CEO @daschreiber talks Q3 2024 Earnings with @YahooFinance pic.twitter.com/qgBjzk89vC

— Lemonade (@Lemonade_Inc) October 31, 2024

However, its B rating from BBB means it has fair business practices and a solid business foundation going forward. If you’re wondering how customer satisfaction ratings affect car insurance companies, this BBB rating shows that while Lemonade is growing, there’s still room for improvement in its customer service standards.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save with Lemonade Car Insurance Discounts

There are different ways to lower car insurance rates from Lemonade, all of which come from discounts and savings opportunities. See the table below:

Lemonade Car Insurance Discounts and Savings

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Policy Bundling | 30% | Bundle insurance policies |

| Safe Driver | 25% | Clean record required |

| Multi-Vehicle | 20% | Insure multiple vehicles |

| Anti-Theft Device | 15% | Install anti-theft devices |

| Good Student | 15% | Maintain "B" average |

| Defensive Driving Course | 10% | Complete driving course |

| Eco-Friendly Vehicle | 10% | Own hybrid/electric vehicle |

| Paperless Billing | 5% | Choose paperless billing |

Save up to 30% when combining policies, while eco-conscious drivers can benefit from hybrid/EV discounts. It doesn’t currently offer an early pay discount, but Lemonade makes up for it with paperless billing (5%) and defensive driving course completion (10%) savings opportunities.

What Drivers Say About Lemonade Insurance

Traditional reviews give you one story, but the real customer experience tells you something different about Lemonade’s service. Here’s what actual users are saying about their experience with Lemonade car insurance on Reddit:

Comment

byu/jlee9355 from discussion

inLemonadeInvestorsClub

This user experience highlights two of Lemonade’s key strengths: The company’s electric vehicle owners will get green car insurance discounts, and low-mileage drivers can opt for the pay-per-mile option.

Lemonade Car Insurance Pros and Cons

If you are looking for Lemonade as your auto insurance provider, you need to take the pros and cons in mind before choosing. These are the best perks of Lemonade insurance:

- Competitive Bundle Savings: It offers up to 30% discounts for customers who bundle multiple policies, and that sounds like a nice opportunity for current Lemonade customers.

- Strong Digital Experience: Fully app-based platform with AI-powered claims processing and telematics for usage-based rates.

- Quick Claims Processing: AI-powered claims system promises faster processing times than traditional insurers.

Lemonade car insurance is different than most companies in the industry thanks to its modern approach and unique benefits — it’s particularly appealing to tech-savvy drivers and folks with multiple policies. However, some negative aspects of the company include:

- Limited Track Record: As a newer auto insurance provider, they have a less established history in handling auto claims.

- Below Average Satisfaction: J.D. Power rating of 807/1,000 indicates room for improvement in customer service.

Some customers may find this attractive, given its digital-first model and appealing discounts. Still, customers should also consider its relative newness in the auto insurance space and its current customer satisfaction ratings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Making Your Lemonade Insurance Decision

Lemonade takes a digital-first approach to auto insurance. Artificial intelligence and mobile technology are used by the company to reduce the number of steps required to get quotes and file claims. Customers can manage their policies entirely through the Lemonade app, and its telematics program tracks driving behavior through smartphones, potentially offering discounts for safe driving habits.

One standout feature is its integration of Metromile’s pay-per-mile technology, offering monthly rates as low as $80 for older drivers who don’t drive frequently.

Tech-savvy drivers, especially those with electric vehicles or multiple policies to bundle, benefit most from Lemonade's modern features and stackable discounts.

Scott W. Johnson LICENSED INSURANCE AGENT

Our Lemonade car insurance review found that while it offers an innovative digital-first approach with AI-powered claims processing, its limited track record in auto insurance may concern some drivers seeking established providers that sell car insurance.

Ready to find affordable car insurance? Get started today by entering your ZIP code into our free comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What are the downsides of Lemonade car insurance?

The main downsides include a below-average J.D. Power score (807/1,000), limited experience in auto insurance since 2021, and mixed customer service reviews, as shown by their average Consumer Reports rating (70/100).

Why is Lemonade car insurance so cheap?

Lemonade keeps costs low through AI automation and digital-first operations instead of traditional agent networks. Acquiring Metromile technology also enables usage-based pricing, offering better rates for low-mileage drivers.

How good is Lemonade at paying claims?

Lemonade uses AI for faster claims processing and is backed by an A rating from A.M. Best for financial stability. However, its below-average J.D. Power score suggests mixed customer experiences with claims.

Is Lemonade a valid insurance company?

Yes, Lemonade, Inc. is legitimate and licensed in 49 states. They maintain an A rating from A.M. Best for financial strength and a B rating from BBB for fair business practices. Find cheap car insurance quotes by entering your ZIP code.

Why is Lemonade better than other insurance companies?

Lemonade excels with AI-powered claims, digital-first service, and 30% bundle discounts. They’re ideal for tech-savvy drivers and those seeking usage-based insurance options.

Is it easy to cancel Lemonade car insurance?

Yes, you can cancel your car insurance directly through the Lemonade mobile app without calling or visiting an office, following their digital-first approach.

Does Lemonade car insurance cover car theft?

Yes, theft protection is included under Lemonade’s comprehensive coverage, along with protection against vandalism and other non-collision damages.

Learn More: Collision vs. Comprehensive Coverage: What’s the difference?

How long does it take Lemonade insurance to pay out?

With AI-powered claims processing, simple claims can be handled quickly through their app, though complex claims may require additional review time.

Is Lemonade credible?

Yes, Lemonade is a credible insurer with an A rating from AM Best and B rating from BBB, offering licensed coverage in 49 states since their Metromile acquisition.

Who owns Lemonade car insurance?

Lemonade, Inc. is a publicly traded company (NYSE: LMND) that acquired Metromile for $145 million to expand its auto insurance operations.

Ready to shop around for the best car insurance company? Enter your ZIP code and see which one offers the coverage you need.

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Misha221tg

Super duper great experience!