Compare Detroit, MI Car Insurance Rates [2024]

Auto insurance for Detroit drivers has average rates of $208.33/mo with liability requirements of 20/40/10. Some Detroit auto insurance companies include AAA insurance, Nations insurance agency and Camden insurance agency.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Apr 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Because of crime rates in Detroit, auto insurance costs more than the national average

- Detroit hosts many insurance companies offering competitive rates to win customers’ business

- While you are not required to have comprehensive or collision on your vehicle, it is a good idea if you want to ensure your car will be covered in case of an accident

- Auto insurance for Detroit drivers has average rates of $208.33/mo with liability requirements of 20/40/10

Owning a vehicle is critical in Detroit. Having your vehicle properly insured is also crucial to residents of Detroit.

There are many neighborhoods in Detroit that experience high rates of crime.

Vehicle owners who drive into a neighborhood with an under insured or uninsured vehicle may find themselves paying thousands of dollars for repairs.

Enter your zip code above to compare car insurance rates from multiple companies today!

Detroit Auto Insurance Rates

Detroit minimum levels of auto insurance are the same levels required by Michigan state law.

Michigan law for auto insurance requires drivers have 20/40/10 coverage. Drivers must have $20,000 in coverage per person for bodily injury claims.

A driver is required to have $40,000 in coverage for the entire accident for bodily injury claims. Drivers must also carry $10,000 in property damage liability insurance for damage to other property when involved in an accident.

Detroit drivers are not required to have comprehensive or collision coverage on their vehicles.

However, it is strongly recommended that drivers who have a vehicle under lease or financing to have additional coverage. 20/40/10 coverage is also the minimum amount of auto insurance that is required.

Drivers can elect to raise their coverage amounts.

While this may increase premiums, it will allow for more coverage in the case of an accident.

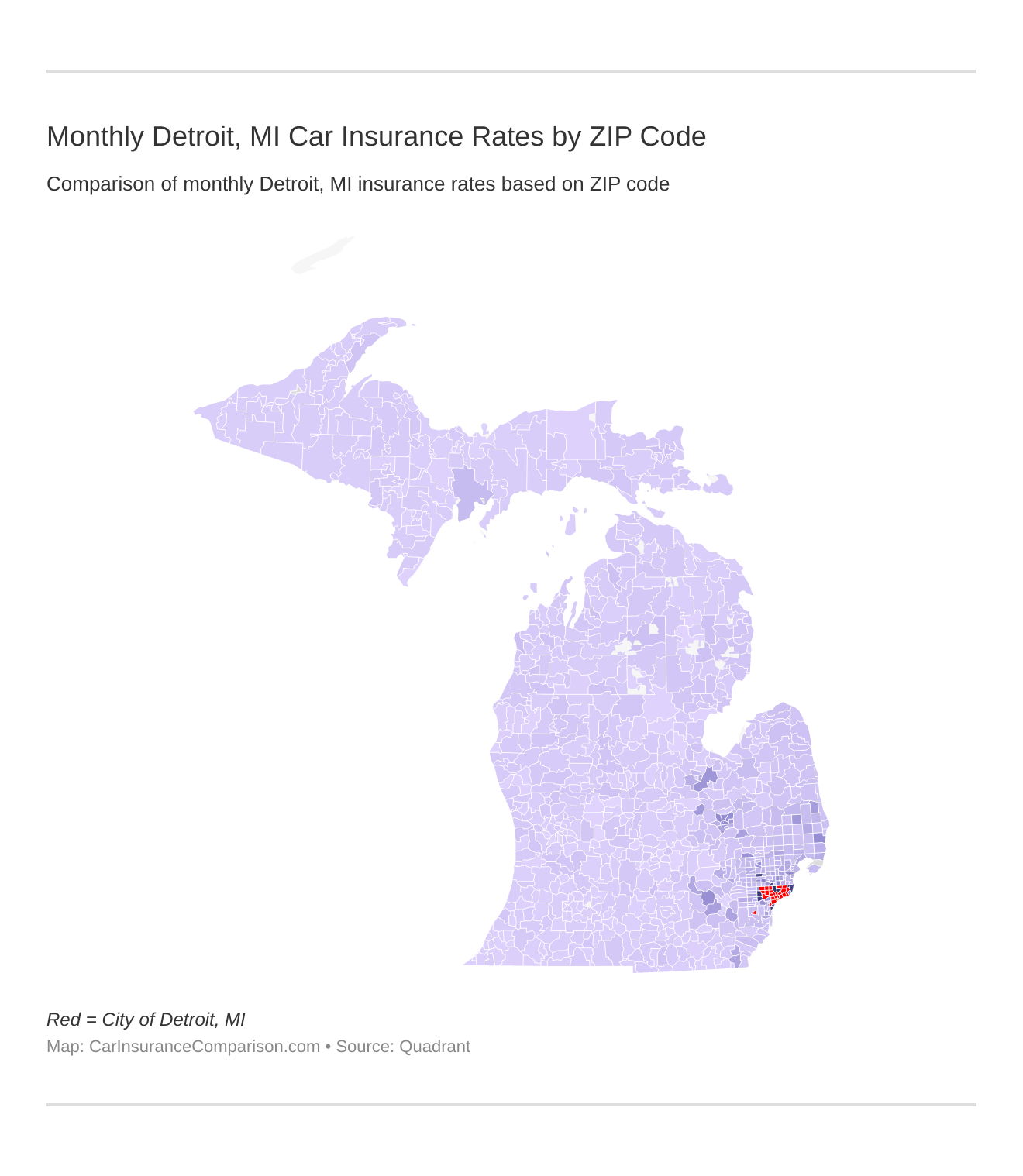

Monthly Detroit, MI Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Detroit, Michigan auto insurance rates by ZIP Code below:

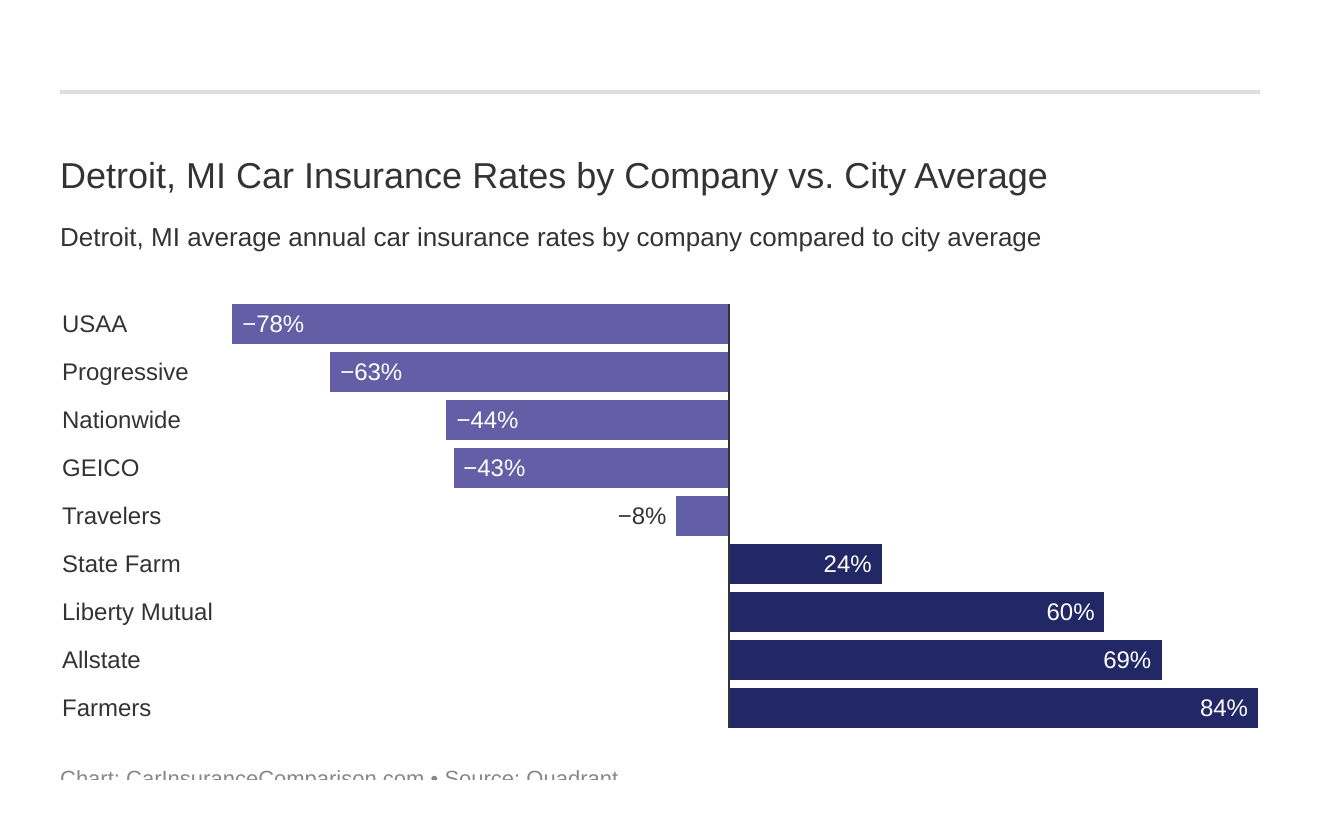

Detroit, MI Car Insurance Rates by Company vs. City Average

Which Detroit, MI car insurance company has the best rates? And how do those rates compare against the average Michigan car insurance company rates? We’ve got the answers below.

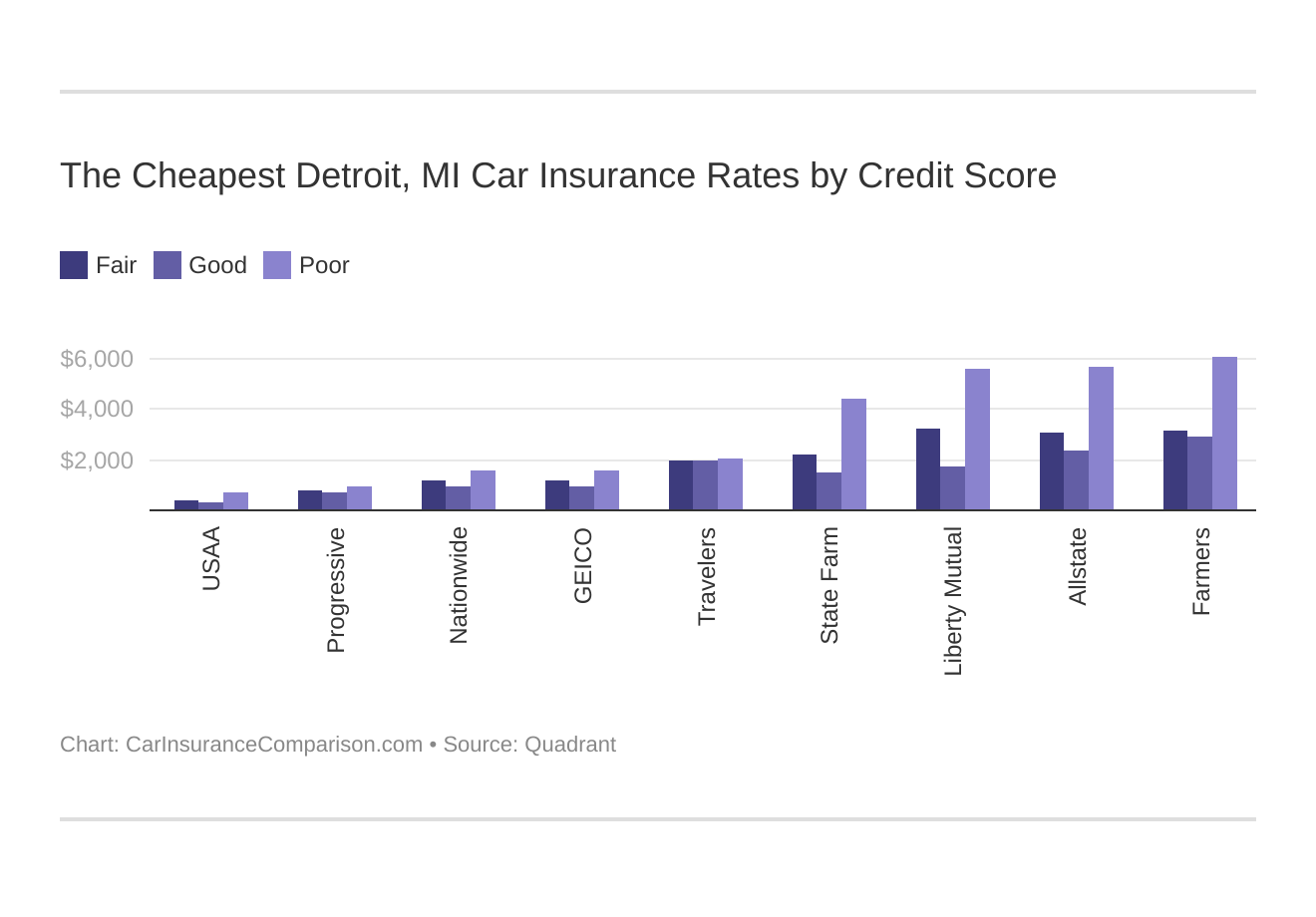

The Cheapest Detroit, MI Car Insurance Rates by Credit Score

Your credit score will play a significant role in your Detroit car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Detroit, MI car insurance rates by credit score below.

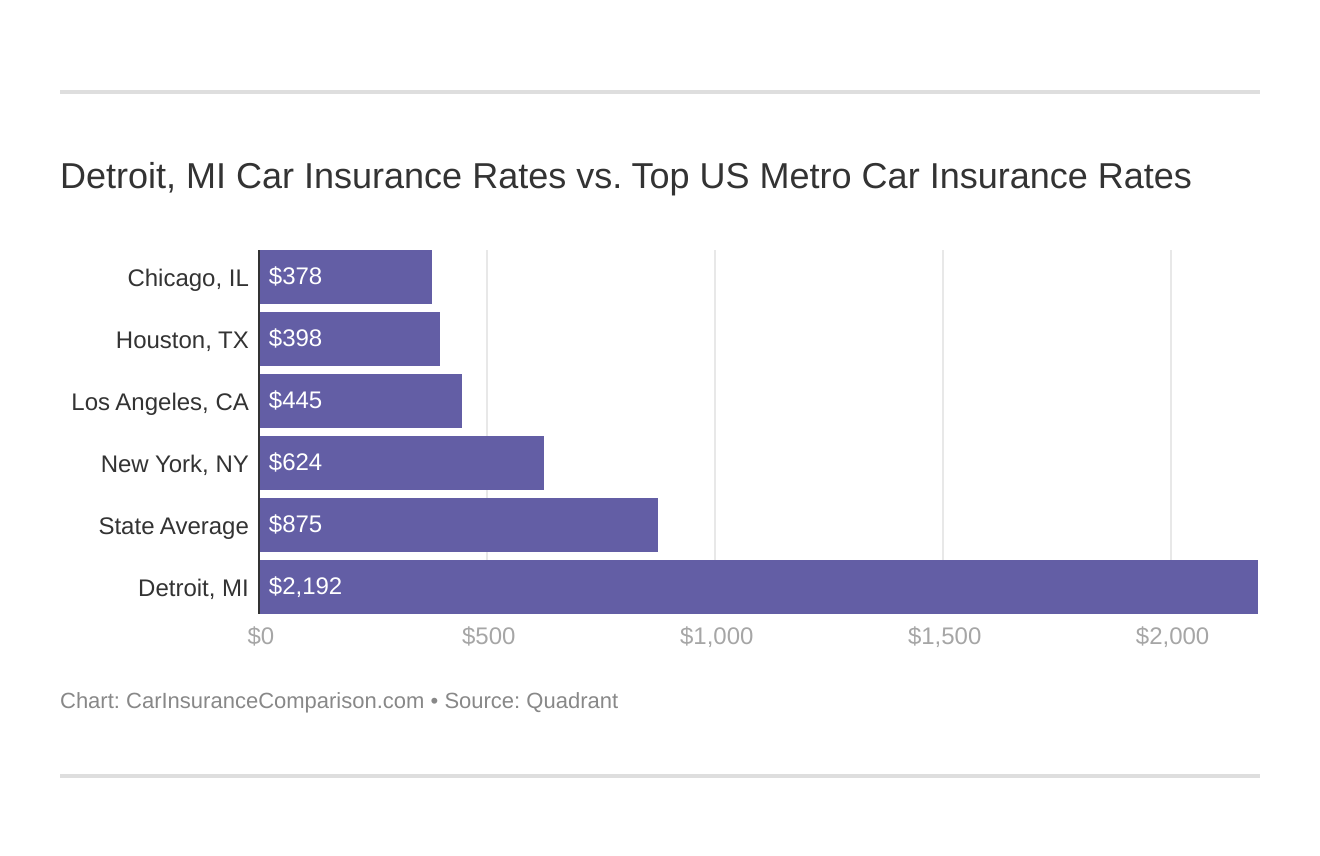

Detroit, MI Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Detroit, Michigan stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

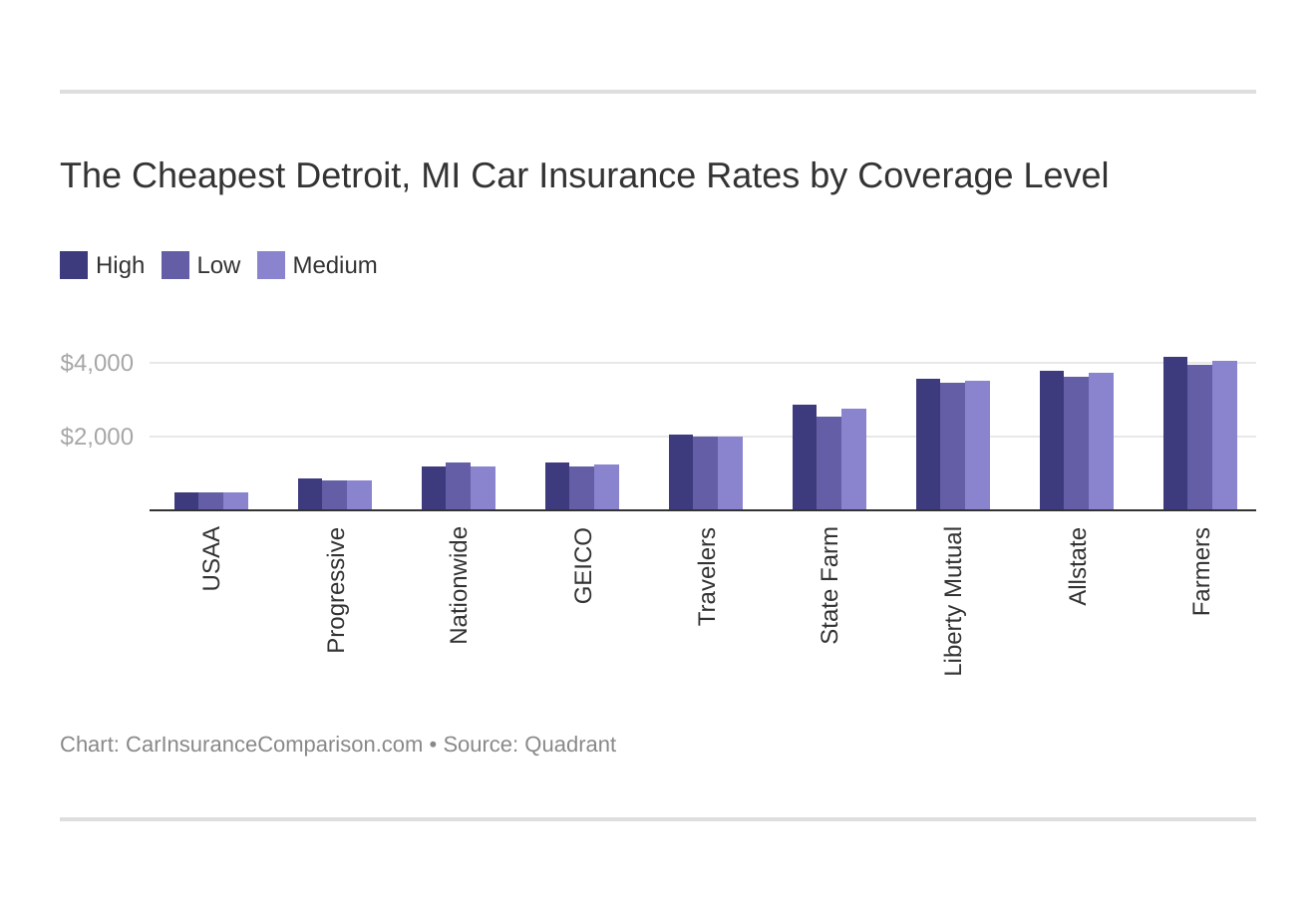

The Cheapest Detroit, MI Car Insurance Rates by Coverage Level

Your coverage level will play a major role in your Detroit car insurance rates. Find the cheapest Detroit, MI car insurance rates by coverage level below:

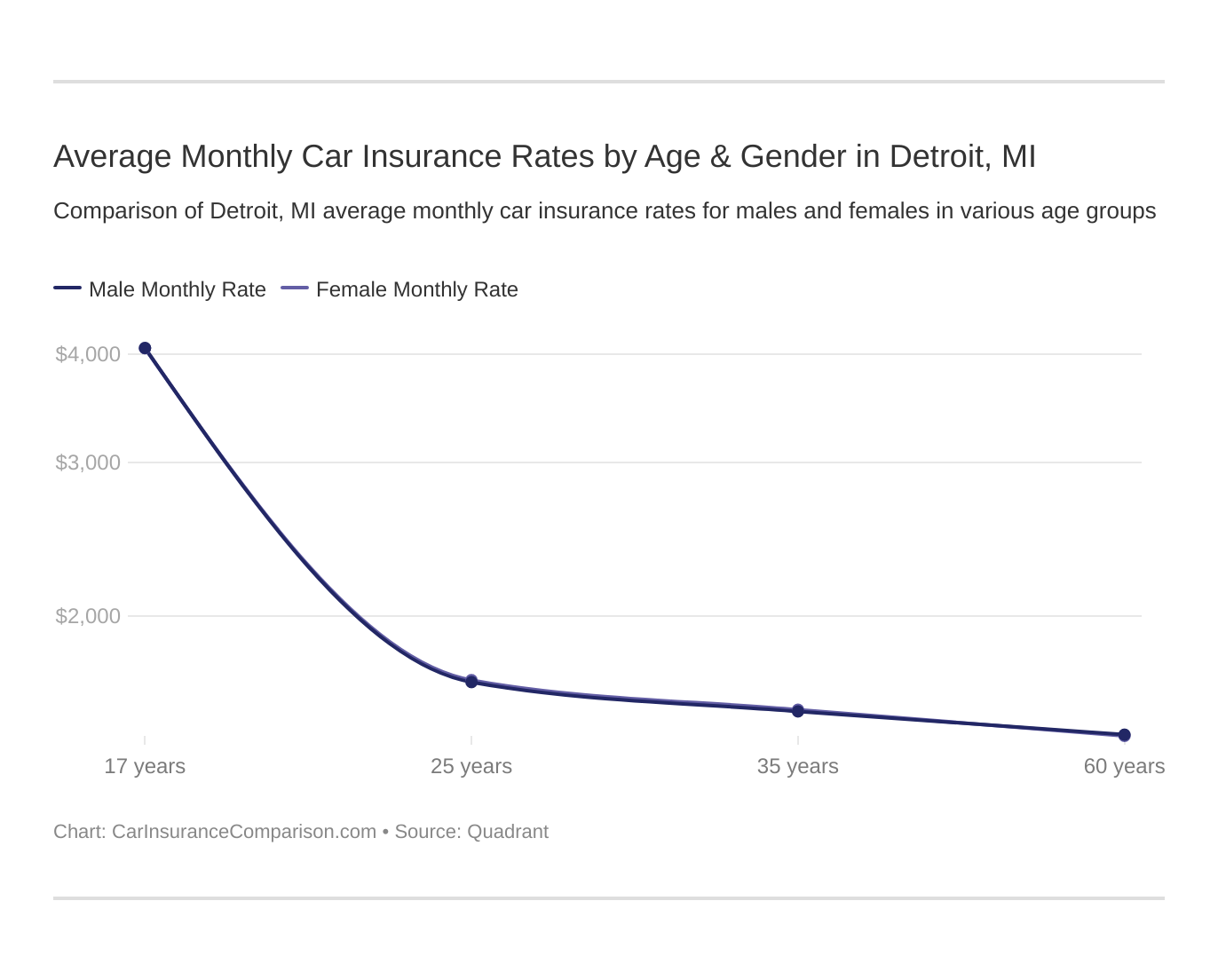

Average Monthly Car Insurance Rates by Age & Gender in Detroit, MI

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. MI does not use gender, so check out the average monthly car insurance rates by in Detroit, MI.

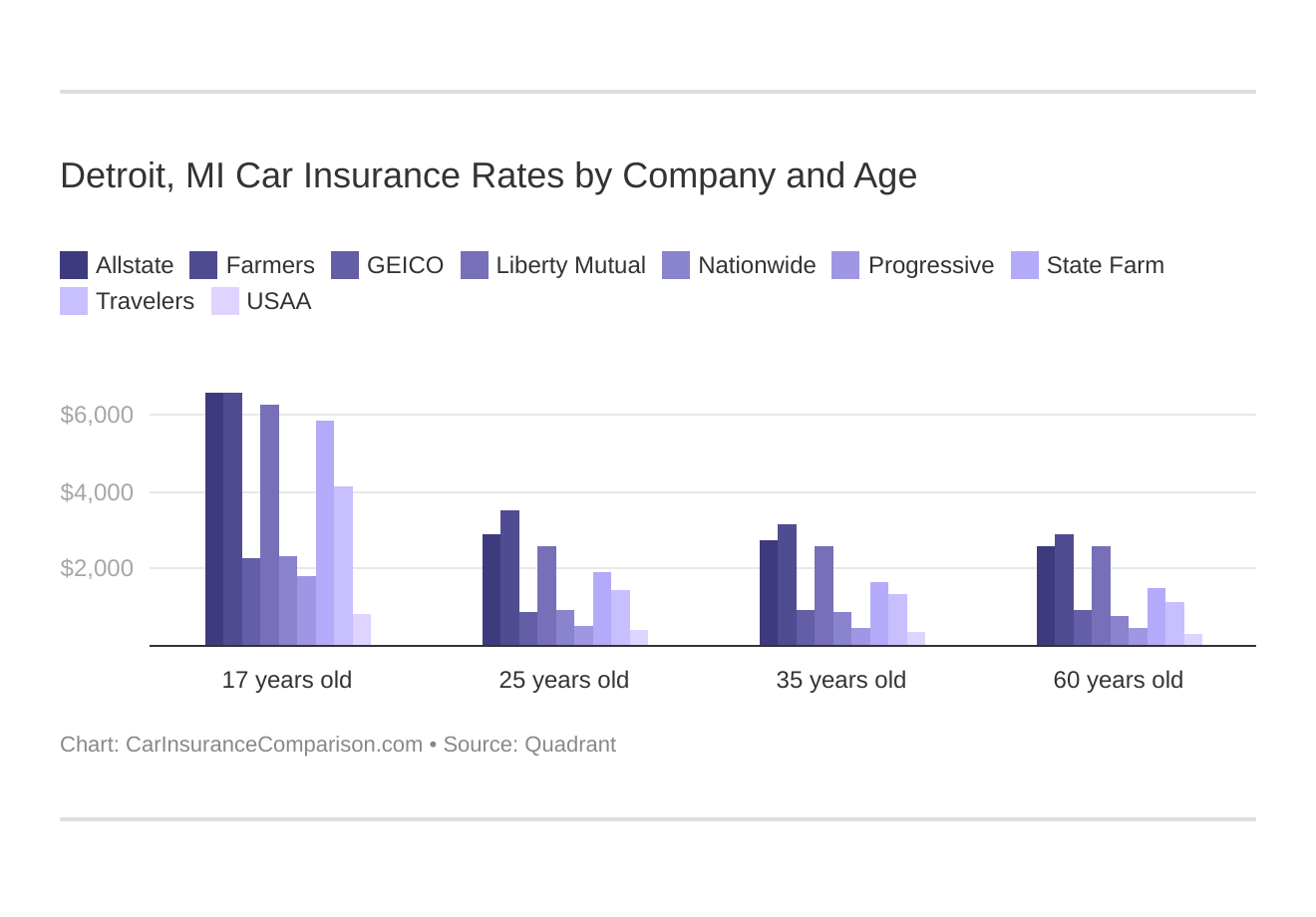

Detroit, MI Car Insurance Rates by Company and Age

Detroit, MI car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

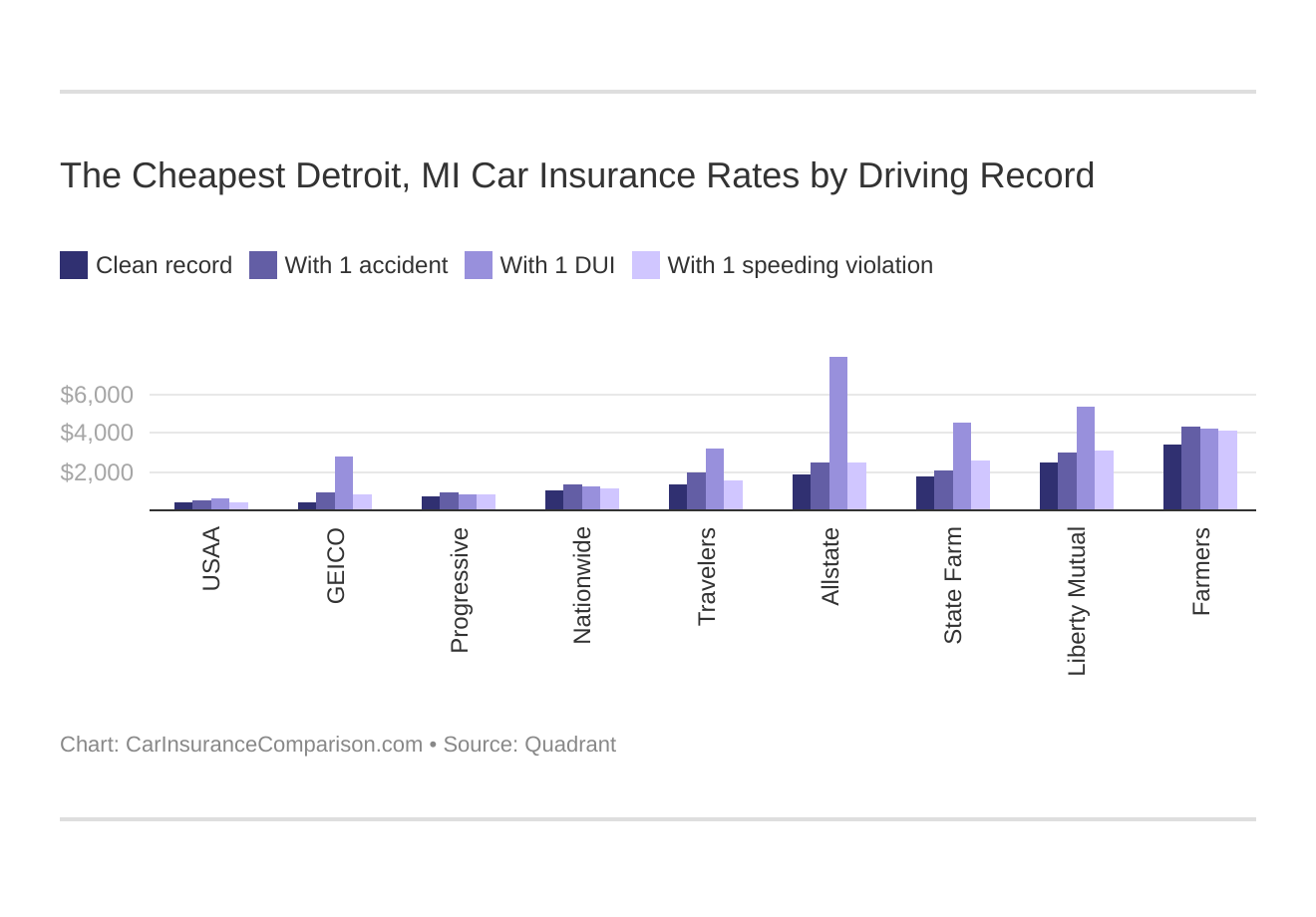

The Cheapest Detroit, MI Car Insurance Rates by Driving Record

Your driving record will play a major role in your Detroit car insurance rates. For example, other factors aside, a Detroit, MI DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Detroit, MI car insurance rates by driving record.

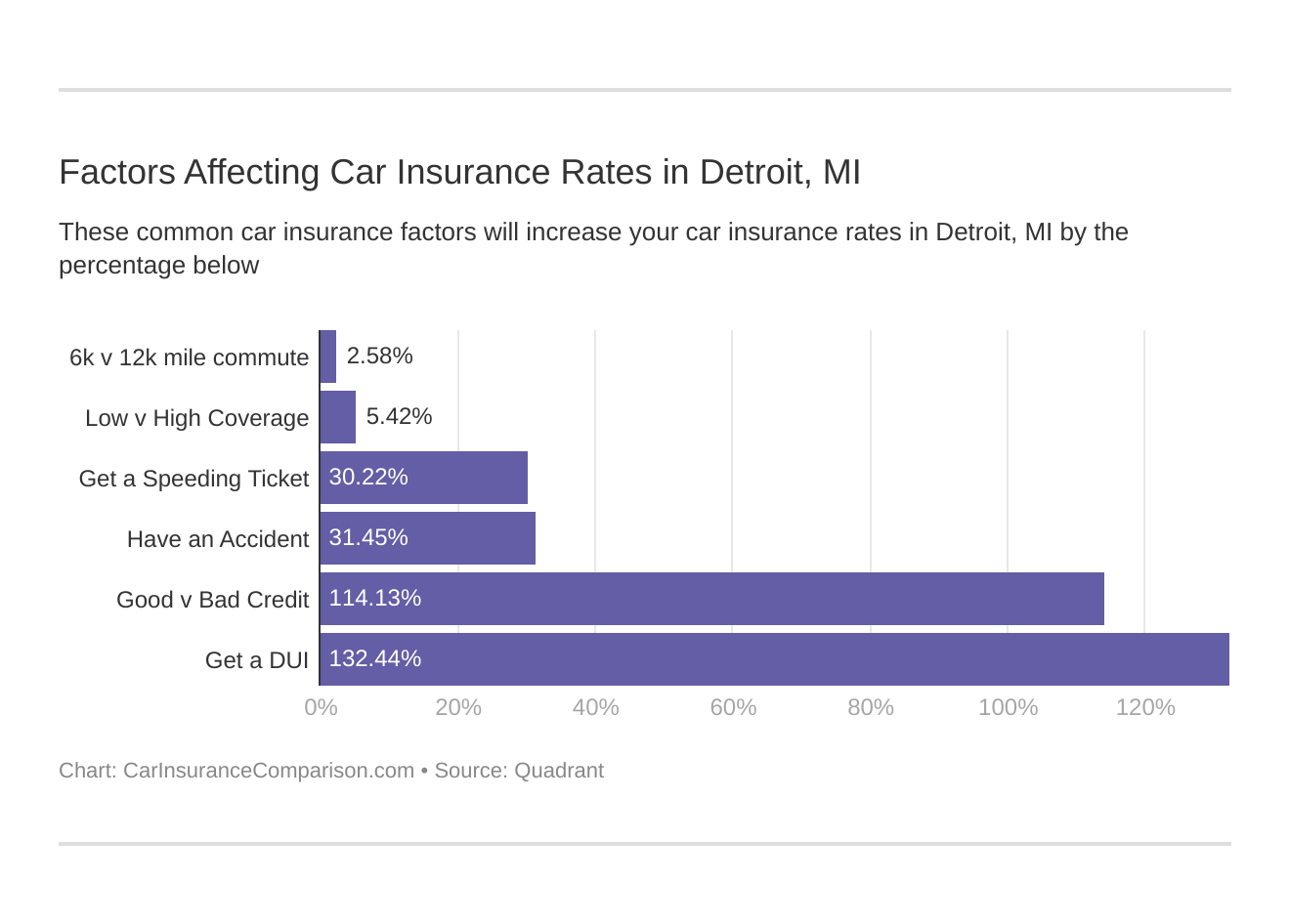

Factors Affecting Car Insurance Rates in Detroit, MI

Factors affecting car insurance rates in Detroit, MI may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Detroit, Michigan car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laws in Detroit for Auto Insurance

The state of Michigan utilizes no fault auto coverage. No fault auto insurance was designed to reduce the amount of litigation that occurred after a vehicle accident.

Drivers in Michigan are provided with up to three years of wage benefits when they are involved in an accident.

A driver who has their vehicle damaged in an automobile accident may have their claim fall under no-fault auto insurance as well. However, a driver must purchase a collision and comprehensive auto insurance policy to protect their own vehicle.

Detroit laws require that drivers have the minimum levels of insurance required by the state of Michigan. Drivers also must have all vehicles registered through the secretary of state.

Any driver who is found to be driving a vehicle that is not registered or insured may have their drivers license suspended. Drivers may also have the vehicle impounded until they register or insure the vehicle.

Drivers in Detroit who do not have their vehicle insured and are involved in an auto accident may be personally liable.

A driver can be taken to court and will have to pay court costs as well as a lawyer out of their own money.

An individual who drives his vehicle without having it insured can be fined $500 as well as sentenced to up to one year in jail.

This also applies to anyone who drives a vehicle that they know is uninsured. A driver does not have to own a vehicle to be prosecuted. Compare state coverage levels and make sure you are properly covered.

Companies Offering Car Insurance in Detroit

Drivers in Detroit qualify to be covered by some national as well as Detroit auto insurance companies.

Many Detroit drivers have policies with companies including Geico, Allstate, Nationwide, Farm Bureau and State Farm. These companies are registered to sell auto insurance in the state of Michigan. L.A. insurance agency has a number of different locations throughout metropolitan Detroit.

Detroit agencies include AAA insurance, Nations insurance agency, Camden insurance agency and Camelot insurance agency. An insurance agency differs from going with an insurance company.

When a driver meets with an insurance broker at an insurance agency they will either be dealing with a captive or independent broker. A captive broker sells insurance for one company; an independent broker sells insurance for several different companies.

Insurance brokers make a commission off of the policies that they sell.

While most insurance brokers are honest and legitimate, there are some insurance brokers who have low ethics. Consumers should always carefully review their policy and ask any questions that they may have.

Average Car Insurance Rates in Detroit

Detroit has some of the highest automobile insurance rates in the country.

Drivers in the state of Michigan pay an average of over $2,500 annually to insure their vehicles. Many drivers in the city of Detroit pay over $6,000 a year in automobile insurance premiums.

These premiums often only include the minimum amount of coverage by the state. Detroit auto insurance companies pay high rates due to

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Detroit Driving and Car Insurance Statistics

AAA has conducted several national surveys about driving and car insurance statistics. Detroit has ranked as the most expensive city in America to insure a vehicle.

A 2010 Chevy Malibu with $100,000/$300,000/$50,000 liability limits as well as comprehensive and collision coverage with a $500 deductible costs $5,948 to insure annually.

Car theft in Detroit increased 83 percent in 2010.

Drivers who have not reviewed their policy or asked for an auto insurance quote recently should strongly consider comparison shopping to see if reduced rates are available.

Detroit Drivers Need to Save Money

Paying almost $6,000 a year to insure a mid-level sedan with full coverage is ridiculous.

However, drivers will be unable to find out whether they qualify for more affordable car insurance premiums without comparison shopping.

Any driver who has a vehicle in the city of Detroit or the Detroit metropolitan area should ask for a few auto insurance quotes. You would be crazy to not save hundreds of dollars a year on your auto insurance!

Enter your zip code below to access car insurance rates!

Frequently Asked Questions

What factors can affect car insurance rates in Detroit, MI?

Several factors can influence car insurance rates in Detroit, MI. Common factors include your driving record, age, gender, marital status, type of vehicle, credit history, coverage limits, deductible amount, and the insurance provider’s underwriting guidelines. Additionally, factors such as the location of your residence in Detroit and the local crime rate can also impact your rates.

Are there any discounts available on car insurance in Detroit, MI?

Yes, insurance providers often offer various discounts on car insurance policies in Detroit, MI. Some common discounts include:

- Multi-policy discount: If you bundle your car insurance with other policies like home insurance or renters insurance.

- Good driver discount: For drivers with a clean driving record and no recent accidents or violations.

- Good student discount: For students who maintain a certain GPA or are on the honor roll.

- Safety features discount: If your vehicle has safety features such as anti-lock brakes, airbags, or anti-theft devices.

- Low mileage discount: If you drive fewer miles than the average driver.

- Loyalty discount: If you stay with the same insurance provider for an extended period.

What types of car insurance coverage should I consider in Detroit, MI?

In Detroit, MI, it’s generally recommended to consider liability coverage (bodily injury and property damage), uninsured/underinsured motorist coverage, personal injury protection (PIP), and optional coverages like comprehensive and collision coverage. The specific coverage you need depends on your circumstances and preferences.

Can I customize my car insurance coverage in Detroit, MI?

Yes, many insurance providers in Detroit, MI allow you to customize your car insurance coverage based on your specific needs. You can often choose deductibles, coverage limits, and additional optional coverages to tailor the policy to your requirements.

How can I obtain car insurance quotes in Detroit, MI?

To obtain car insurance quotes in Detroit, MI, you have a few options. You can contact local insurance agents who serve the area and request quotes from them. Additionally, many insurance companies provide online quote forms that allow you to enter your information and receive quotes from multiple insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.