Amica Car Insurance Review for 2026 [See Their Cost & Ratings]

Amica car insurance review emphasizes the company’s top-tier reputation for customer satisfaction and competitive pricing. Starting at just $42 per month, it ranks among the most affordable insurers. Amica also provides a variety of discounts of up to 20% savings when bundling auto and home insurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

This Amica car insurance review emphasizes the company’s excellent track record for customer satisfaction and competitive pricing.

Formerly Amica Mutual, the company offers flexible coverage options and multiple discounts, including up to 20% for bundling home and auto insurance. Amica monthly car insurance rates start at $42.

Amica Mutual Car Insurance Rating

Rating Criteria ![]()

Overall Score 4.4

Business Reviews 4.5

Claim Processing 5

Company Reputation 4.5

Coverage Availability 5

Coverage Value 4.3

Customer Satisfaction 4.1

Digital Experience 4.5

Discounts Available 4.8

Insurance Cost 3.9

Plan Personalization 4.5

Policy Options 4.2

Savings Potential 4.2

As you take the time to understand your car insurance policy with Amica, you’ll discover what sets it apart. This review emphasizes Amica’s reliable service, user-friendly digital tools, and streamlined claims process, making it a smart choice for many drivers throughout the continental U.S.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

- Amica car insurance review offers rates starting at $42/month for good drivers

- Save up to 20% by bundling home and auto insurance policies with Amica

- Amica provides an efficient claims process and top-rated customer service

Amica Car Insurance Rates by Age and Gender

Take a look at the table below to explore Amica car insurance rates by age and gender. Teens and young drivers pay more with Amica than older, more experienced drivers.

Amica Car Insurance Monthly Rates by Age, Gender, & Coverage Level

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $215 $695

Age: 16 Male $238 $735

Age: 18 Female $175 $512

Age: 18 Male $204 $597

Age: 25 Female $55 $182

Age: 25 Male $57 $190

Age: 30 Female $51 $168

Age: 30 Male $53 $176

Age: 45 Female $46 $153

Age: 45 Male $46 $151

Age: 60 Female $42 $136

Age: 60 Male $44 $140

Age: 65 Female $45 $150

Age: 65 Male $46 $148

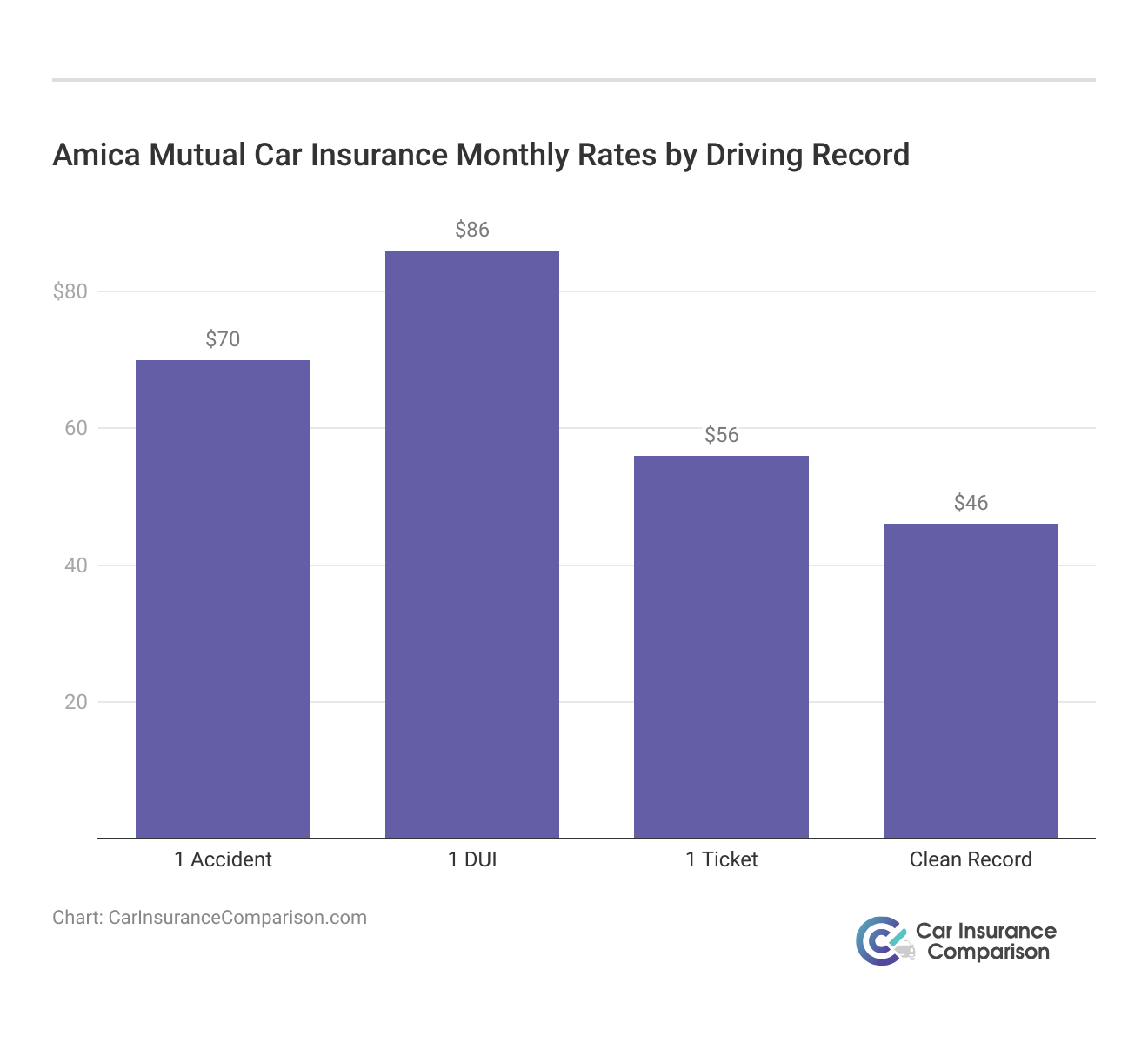

Scroll down to examine how driving records affect monthly premiums with Amica. Compare costs between minimum and complete coverage for various driving histories.

Auto accidents and DUIs have the biggest impact on Amica car insurance costs. Learn more about how auto insurance companies check driving records for tips on how to lower rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amica Monthly Car Insurance Rates vs. The Competition

Amica auto insurance rates are competitively priced and in the middle range among major providers. For minimum coverage, Amica is cheaper than Allstate and Nationwide. Amica is also more affordable than Nationwide when it comes to full coverage.

Amica Car Insurance Monthly Rates vs. The Competition

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $93 | $185 | |

| $85 | $175 | |

| $88 | $180 | |

| $97 | $194 | |

| $89 | $177 | |

| $104 | $211 |

| $90 | $180 | |

| $82 | $162 | |

| $127 | $240 |

| $114 | $223 |

Amica’s average monthly car insurance payment positions it as a balanced option for those seeking reasonable rates with high-quality service.

Unlock Savings With Amica Car Insurance Discounts

The table outlines various discounts available through Amica car insurance. It includes the discount names, maximum savings percentages, and descriptions.

Amica Car Insurance Discounts

| Discount Name | Maximum Savings | Description |

|---|---|---|

| Multi-Policy Discount | 30% | Save by bundling car insurance with other policies like home or life insurance. |

| Multi-Vehicle Discount | 25% | Save when insuring two or more vehicles on the same policy. |

| Safe Driver Discount | 20% | For drivers with a clean driving record over a specified number of years. |

| Loyalty Discount | 15% | Reward for staying with Amica over multiple years. |

| Good Student Discount | 10% | Available for full-time students with good academic performance (GPA of 3.0+). |

| Defensive Driving Discount | 10% | Complete a certified defensive driving course to earn this discount. |

| Paid-in-Full Discount | 10% | Save by paying the entire premium upfront. |

| AutoPay & Paperless Discount | 5% | Enroll in automatic payments and paperless billing to reduce your premium. |

For example, a multi-policy car insurance discount offers up to 30% savings when you bundle auto insurance with other Amica policies. A multi-vehicle discount provides up to 25% off for insuring two or more vehicles on the same policy. You can also enjoy extra savings with discounts for safe drivers, loyal customers, students with good grades, and those who set up automatic payments.

Amica Car Insurance Full-Spectrum Review

Amica makes filing claims a piece of cake and as smooth as possible. You can file a claim anytime online, through a mobile app, or by phone. They will keep you abreast at all times, and their knowledgeable customer service staff will be happy to help where necessary to make sure everything goes well.

Amica Mutual Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 903 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Great Business Practices |

|

| Score: 85/100 Excellent Customer Feedback |

|

| Score: 0.73 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength |

In addition, Amica has easy-to-use digital tools, such as a mobile app and online portal, to make managing insurance as simple as possible. Policyholders can pay bills, file claims, and access proof of insurance hassle-free from anywhere.

data-media-max-width=”560″>

Did you know the Amica app gives you information on your policies, payments and roadside assistance? Learn more: https://t.co/UxJj2o9BXR. pic.twitter.com/BSiRp3nh7S

— Amica Insurance (@Amica) November 1, 2023

Amica’s excellent record in customer satisfaction is evident from its high scores, where to find car insurance company reviews such as those from J.D. Power, which gave it 903 out of 1,000. Agencies like the BBB, Consumer Reports, and A.M. Best also rate it highly for its financial stability and customer feedback.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amica’s Comprehensive Coverage Options

Amica provides a wide range of coverage options designed to meet the needs of different drivers. Amica has flexible plans that suit various budgets and preferences, whether you’re looking for minimal legal coverage or more extensive protection.

- Liability Coverage: Protects against damages to others in case of an accident.

- Collision Coverage: Covers repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, or natural disasters.

- Roadside Assistance: Optional add-on for emergency services like towing and lockout assistance.

- Rental Car Reimbursement: This covers the cost of a rental vehicle while your car is being repaired.

With Amica, you’re in the driver’s seat when it comes to your coverage. Whether you’re after the essentials for straightforward protection or seeking more comprehensive coverage for that extra layer of peace of mind, Amica has your back. Their flexible plans allow you to tailor your protection to match your lifestyle perfectly, ensuring you find just the right fit.

With Amica, personalized service means that each driver gets support according to their needs, especially when it comes to selecting comprehensive car insurance. They make sure that ‘one size fits all’ is just a figure of speech, so you get precisely the protection you need.

Amica Car Insurance: Weighing the Benefits and Drawbacks

Amica is different from other car insurance providers because of its great customer service and flexible coverage options. Indeed, for many drivers, the company is reliable, but like any insurer, it has its strengths and weaknesses. Let’s explore these in detail.

Amica offers drivers seeking reliable car insurance products due to its exceptionally high customer satisfaction and strong financial health.

- Exceptional Service to Customers: Amica consistently receives high ratings in customer satisfaction, which makes it a very good choice for drivers who value personal service.

- Flexible Coverage Options: Amica gives drivers plenty of choices with its coverage plans, allowing them to pick options that fit their specific needs perfectly.

- Financial Stability: Amica boasts an A+ rating from A.M. Best and has therefore assured customers that it is financially strong and very capable of paying claims.

While Amica certainly offers great service, there are a couple of things to watch out for. These might make all the difference in whether it’s your best fit for budget and coverage needs.

- Higher Premiums: Although their service is among the best, Amica can charge a little higher than most other insurance providers. They may be out of the budget for economically-minded customers.

- Limited Discounts: Amica doesn’t offer as many discounts as some of its major competitors, which could make it harder for certain drivers to save as much as they’d like.

While Amica can provide an adequate option for drivers who value pleasing customer service along with variable coverage, drivers who are looking for additional ways of lowering car insurance rates or obtaining impressive discount options will find more options elsewhere.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Amica Car Insurance: A Well-Rounded Option for Reliable Coverage

In our Amica car insurance review, we explore top customer service rankings and a broad range of coverage options from term lengths to financial strength. Although their premium rates were not the cheapest among others, they have a number of digital features available to make handling claims so easy and insured does mostly satisfaction with high rate service.

Amica stands out for exceptional customer satisfaction, flexible coverage options, and efficient claims handling, making it a top pick for reliable car insurance.

Michael Leotta Insurance Operations Specialist

It may not have the best rates or offer as many discounts to high-risk drivers though and some consumers are probably out there trying to figure out what affects a car insurance quote. It is still a solid insurer for safe, claim-free drivers who hold customer service in high regard.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes from local companies near you.

Frequently Asked Questions

Is Amica good at paying claims?

Amica is known for its efficient claims process, which often handles claims quickly and provides updates. This commitment to prompt and reliable service has earned Amica high customer satisfaction ratings for claim settlements.

Is Amica a reliable car insurance company?

Amica has a very reliable level of coverage with strong financial stability. It consistently pulls in excellent ratings from agencies such as A.M. Best and J.D. Power based primarily on customer satisfaction and the health of its finances, making it one of the trusted options among policyholders.

Does Amica car insurance have accident forgiveness?

Yes, Amica offers accident forgiveness, which helps prevent your insurance premium from increasing after your first at-fault accident. This feature provides additional peace of mind for drivers worried about the financial impact of an accident on their rates, promoting a better understanding of how car accidents can affect insurance costs.

Who owns Amica Insurance?

Amica is a mutual insurance company, meaning its policyholders rather than shareholders own it. This ownership structure allows Amica to focus on providing value and service to its customers rather than maximizing profits for shareholders.

How long has Amica Insurance been around?

Amica has been in business for over 100 years, providing insurance services since 1907. With a long history of financial stability and excellent customer service, Amica is one of the oldest mutual insurance companies in the United States.

How do I cancel Amica car insurance?

You can contact Amica customer service or your local agent to cancel Amica auto insurance. They will guide you through the cancellation process, which may involve submitting a written request or providing specific details about your policy. Learning how to cancel car insurance effectively will protect you from coverage lapses and higher rates in the future.

What does Amica stand for in insurance?

Amica stands for “Automobile Mutual Insurance Company of America.” The company was founded to provide auto insurance but has since expanded to offer a wide range of insurance products, including home and life insurance.

Does Amica Insurance have local agents?

Amica has local agents nationwide to assist customers with their insurance needs. These agents provide personalized service, helping customers find the right coverage and manage their policies effectively.

Which type of Amica car insurance is best?

Amica offers many types of car insurance coverage, but comprehensive car insurance is often considered the best because it protects against many risks, including theft, vandalism, natural disasters, and non-collision-related damage.

What affects Amica car insurance quotes

Several factors affect Amica auto insurance quotes, including your driving record, age, gender, location, and the type of coverage you choose. Additional factors like vehicle type, mileage, and whether you qualify for discounts (such as bundling home and auto) can also influence your premium. By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.