Metromile Car Insurance Review for 2026 [What Customers Have to Say]

Our Metromile car insurance review shows how drivers can get up to 47% on traditional coverage with its pay-per-mile pricing model. Base Metromile insurance rates start at $29 monthly, and low-mileage drivers pay around $41/month. Metromile was acquired by Lemonade, which uses telematics to track driver mileage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated February 2026

This Metromile car insurance review explores how low-mileage drivers get the lowest rates, starting at $41 per month. Drivers can save up to 47% with Metromile compared to traditional insurance.

Through the Metromile tracking device (Pulse Device), customers can monitor their car’s location, track car insurance mileage, and access vehicle diagnostics via a user-friendly mobile app.

Metromile Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 1.9 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.0 |

| Discounts Available | 3.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 2.8 |

| Savings Potential | 3.6 |

Do you have to buy car insurance if you only drive occasionally? Yes, and this company excels at serving drivers who travel less than 10,000 miles annually. However, potential customers should note coverage is currently limited to only eight states.

Keep reading to compare the pros and cons of Metrolmile low-mileage car insurance. If you drive less than 10,000 miles annually, enter your ZIP code above to see how much you could save.

- Metromile offers pay-per-mile insurance starting at $29 monthly

- The Metromile Tracking Device (Pulse Device) monitors mileage

- Metromile car insurance is currently limited to eight states

Metromile Pay-Per-Mile Car Insurance Explained

Metromile offers a unique pay-per-mile car insurance model that can be cost-effective for low-mileage drivers. It was acquired by Lemonade Insurance in order to expand this type of car insurance in more states.

The cornerstone is the Metromile Pulse Device, a small tracking device that plugs into your car’s OBD-II port. This Metromile tracking device monitors your mileage to set premiums.

Through the Metromile auto insurance app, customers can access real-time information about their driving habits, track their car’s location, monitor vehicle health, and manage their policy. The app also provides detailed trip information and helps users avoid street-sweeping tickets in select cities.

Read More: How to Get Metromile Car Insurance Quotes Online

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Metromile Car Insurance Rate Comparison

Does driving less affect car insurance rates? Yes, less driving means lower insurance rates since it reduces accident risk. Metromile’s pay-per-mile car insurance model specifically targets low-mileage drivers.

Metromile Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $220 | $565 |

| Age: 16 Male | $241 | $591 |

| Age: 18 Female | $179 | $417 |

| Age: 18 Male | $206 | $481 |

| Age: 25 Female | $52 | $139 |

| Age: 25 Male | $55 | $147 |

| Age: 30 Female | $49 | $129 |

| Age: 30 Male | $51 | $136 |

| Age: 45 Female | $45 | $118 |

| Age: 45 Male | $44 | $115 |

| Age: 60 Female | $41 | $104 |

| Age: 60 Male | $42 | $107 |

| Age: 65 Female | $44 | $116 |

| Age: 65 Male | $43 | $113 |

It’s important to note that the Metromile car insurance quotes above are for drivers who are on the road 12,000 miles per year or more. Your rates will be considerably less because Metromile offers up to 47% savings for those driving under 10,000 miles per year.

The more you drive, the more you pay, making it ideal for those who drive less than 10,000 miles annually.

Brad Larson LICENSED INSURANCE AGENT

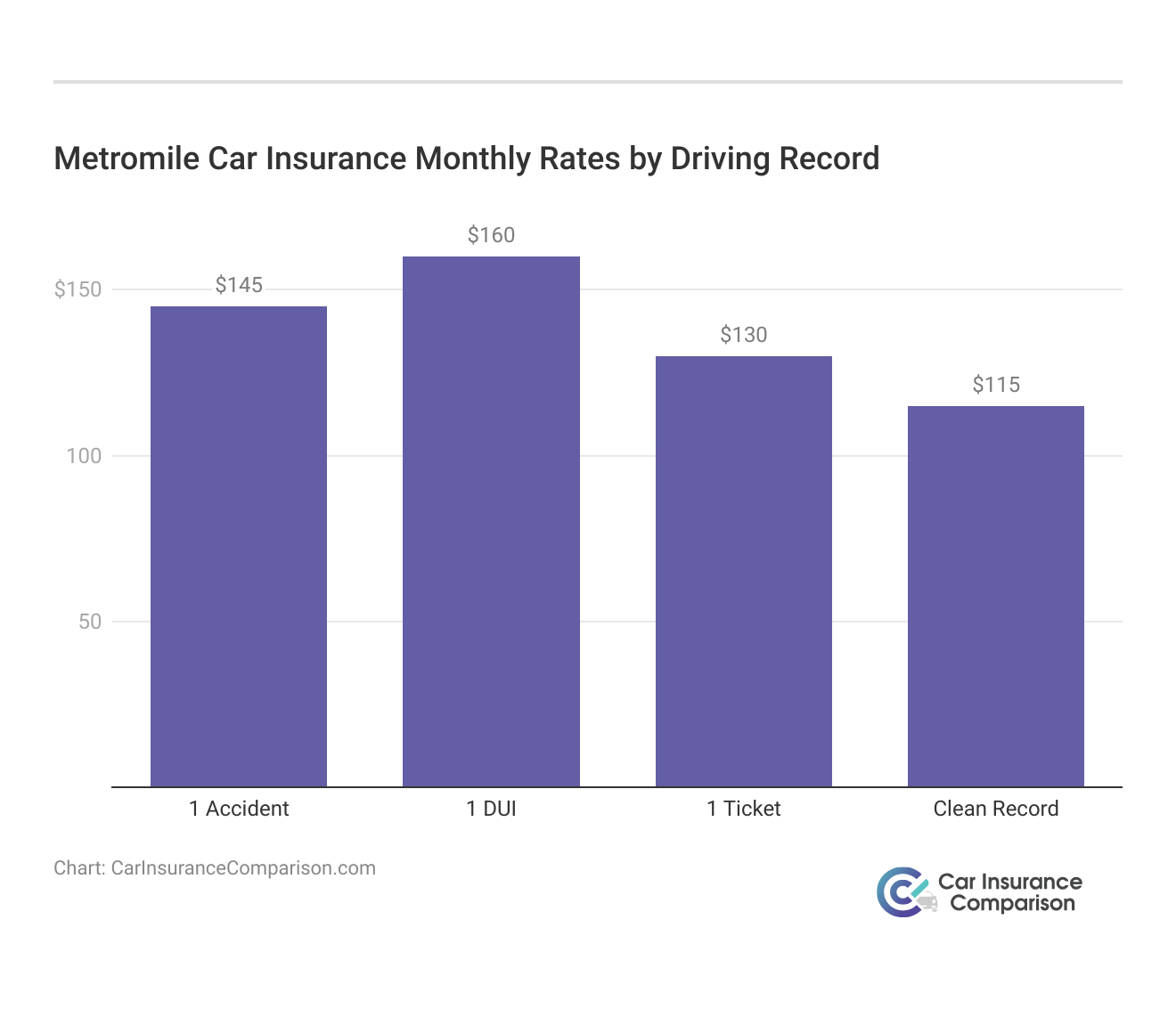

However, driving record will impact Metromile insurance costs, and a poor driving history will raise your base rates. The following table breaks down monthly premium variations based on different driving scenarios, from clean records to more serious infractions like DUIs.

As shown above, driving history significantly affects Metromile’s rates, with DUI convictions resulting in the highest premiums at $160 monthly, while maintaining a clean record can save drivers up to $45 per month.

Metromile Insurance vs. The Competition

Compare Metromile auto insurance to popular companies to see how mileage impacts car insurance rates. The following table illustrates how various providers adjust their coverage rates based on demographic factors.

Metromile vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | |

| $131 | $178 | $43 | $51 | $43 | $44 | $40 | |

| $305 | $414 | $116 | 137 | $115 | $117 | $113 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 |

| $417 | $481 | 129 | $136 | $118 | $115 | $104 | |

| 522 | $626 | $174 | $200 | $171 | $174 | $148 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | |

| $530 | $740 | 99 | 108 | $98 | $99 | $89 |

Metromile car insurance is often cheaper than many popular providers because it bases rates primarily on mileage rather than non-related driving factors like age and credit history. This table shows how much cheaper Metromile auto insurance rates are after an accident or DUI.

Metromile vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $169 | $171 | $139 | |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 |

Compared to other companies, Metromile will not raise your rates as high since it focuses primarily on mileage, making it an excellent choice for high-risk drivers who need to lower their rates.

Metromile Car Insurance Coverage Options

The Metromile auto insurance coverage includes standard options like liability auto insurance coverage, comprehensive coverage, collision coverage, coverage for uninsured/underinsured motorists, and personal injury protection, depending on your state’s requirements.

This list of Metromile coverage options is shorter than you’d find with national providers, but it does offer special add-ons you can’t find everywhere:

- Roadside Assistance: Policyholders can use the Lemonade or Metromile app to call roadside assistance for towing, tires, batteries, or fuel delivery.

- EV Coverage: If your EV dies, you can call for emergency charging services. This add-on also covers wall or portable EV chargers.

- Rental Reimbursement: Metromile will pay for rental cars or rideshare services used while your vehicle is being repaired during a covered claim.

- Glass Coverage: This is available with comprehensive policies, allowing drivers to choose a lower deductible for windshield and window repairs without raising rates.

These are great coverage options for most drivers, but you should consider shopping elsewhere if you need a more customized policy.

Complete List of Metromile Insurance Discounts

Beyond its signature pay-per-mile car insurance, customers can stack multiple car insurance discounts to maximize Metromile insurance savings. Potential savings range from 10% to 25%.

Metromile Car Insurance Discounts & Potential Savings

| Discount Name | Savings Potential | Description |

|---|---|---|

| Multi-Policy | 17% | For bundling auto with home or renters insurance |

| Good Student | 25% | For students maintaining a B average or higher |

| Safe Driver | 15% | For drivers with a clean record |

| Defensive Driving | 10% | For drivers who complete an approved safety course |

| Anti-Theft | 15% | For vehicles equipped with an anti-theft device |

| Low Mileage | 10% | For drivers who drive below the annual mileage limit |

| Driver Training | 15% | For young drivers who complete a driver training course |

| Accident-Free | 20% | For drivers without accidents over a specified period |

| Paperless | 10% | For enrolling in paperless billing and policy documents |

Metromile is particularly cost-effective for responsible, low-mileage drivers who qualify for multiple savings programs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Metromile Insurance Reviews: What Customers Are Saying

How do customer satisfaction ratings affect car insurance companies? This Reddit review explains how Metromile is good for low mileage drivers, including actual premium costs, coverage details and nice things about claims and customer service.

Comment

byu/joepa_2017 from discussion

inInsurance

According to the Reddit reviewer who drives 400-700 miles a month, if you work from home or don’t need to travel much, Metromile’s usage-based model really shines.

Let’s examine Metromile’s reviews across major industry ratings agencies before their acquisition by Lemonade Insurance. These historical ratings provide context for understanding the company’s service quality and financial stability.

Metromile Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 845 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.85 Fewer Complaints |

|

| Score: A- Good Financial Strength |

While these Metromile insurance ratings reflect strong performance, including impressive J.D. Power scores (845/1000), note that the company now operates under Lemonade Insurance following their acquisition. Customers benefit from Lemonade’s innovative technology while maintaining Metromile’s pay-per-mile model.

Metromile Car Insurance Pros and Cons

The advantages of Metromile auto insurance are designed to benefit low-mileage drivers who need simple policies with ample coverage:

- Pay-Per-Mile Savings: Drivers who travel less than 10,000 miles annually can save up to 47% compared to traditional insurance.

- Technology Integration: Real-time car diagnostics, location services, and trip optimization comes with the Metromile Tracking Device.

- Transparent Pricing: Base rate plus per-mile charge provides a clear cost structure with no hidden fees.

While Metromile offers attractive benefits for some drivers, potential customers should consider these significant drawbacks:

- Limited Availability: Service is only available in eight states, restricting access for many potential customers.

- High-Mileage Costs: Not cost-effective for drivers who regularly exceed 10,000 miles annually.

Consider your annual mileage and state availability when deciding if Metromile’s technology-driven, pay-per-mile approach matches your insurance requirements.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Making Your Metromile Insurance Decision

Those who work from home or drive fewer than 10,000 miles a year would benefit most from Metromile pay-per-mile car insurance. It also has a notable J.D. Power rating of 845 out of 1000, which speaks to its customer satisfaction.

However, our Metromile car insurance review found that, while it’s one of the best usage-based car insurance companies with savings of up to 47%, its limited availability in only eight states is very restrictive.

Fortunately, you can find affordable car insurance near you with our free comparison tool. Enter your ZIP code below to get started today.

Frequently Asked Questions

Is Metromile car insurance legit?

Yes, Metromile is a legitimate insurance provider now owned by Lemonade Insurance Company, with an A- rating from A.M. Best and an 845/1000 score from J.D. Power, indicating strong financial stability and customer satisfaction.

What does Metromile charge per mile?

Metromile charges start at a $29 base rate per month plus a per-mile rate that typically ranges from $0.05 to $0.15, depending on your driving history, coverage options, and location.

Read More: Cheap Car Insurance for Part-Time Drivers

Who is the parent company of Metromile Insurance?

Lemonade Insurance Company acquired Metromile and is now the parent company, combining Metromile’s pay-per-mile technology with Lemonade’s digital insurance platform.

What happened to Metromile?

Lemonade Insurance Company acquired Metromile, maintaining the pay-per-mile model while integrating it into Lemonade’s tech-driven insurance platform.

Can you cancel Metromile car insurance at any time?

Yes, you can cancel Metromile insurance at any time without cancellation fees. Simply contact the customer service team or use the mobile app to initiate the cancellation process, unlike traditional cancellations, in which you must learn how to write a car insurance cancellation letter.

Is Metromile Insurance still in business?

Yes, Metromile, Inc. continues to operate under Lemonade Insurance Company, offering the same pay-per-mile insurance.

Does Metromile track speed?

Yes, the Metromile Pulse Device tracks speed along with mileage, location, and other driving habits, but the company primarily uses this data for providing driver insights rather than rate adjustments.

What states is Metromile available in?

According to reviews of Metromile insurance, they are currently available in eight states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington.

Read More: Minimum Car Insurance Requirements by State

What is the Metromile car insurance mileage cap?

Metromile caps daily mileage charges at 250 miles per day (150 miles in New Jersey), meaning you won’t be charged for miles driven beyond this limit.

What happens if I unplug my Metromile tracking device?

Unplugging the Metromile Pulse Device may result in a “no signal” fee and could affect your coverage. The device should remain plugged in to accurately track mileage and maintain proper coverage.

How long has Metromile been in business?

What is the Metromile no signal fee?

Is Metromile car insurance cheaper?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.