How to Get Metromile Car Insurance Quotes Online in 2026 [5 Simple Steps]

You can get Metromile car insurance quotes online by entering your ZIP code, providing driving and vehicle details, and selecting coverage. Metromile’s pay-per-mile model saves low-mileage drivers an average of 47% on premiums. Start with a Metromile insurance quote for affordable coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated August 2025

You can get Metromile car insurance quotes online by inputting the ZIP code, accurately providing the details of your vehicle and driving information, and choosing the right coverage options.

Metromile’s pay-per-mile platform saves drivers enormous amounts; on average, drivers save 47% compared to their traditional insurance. Adjust your plan according to how you drive, and you can secure coverage at affordable prices. Explore the Metromile cost per mile and read our Metromile car insurance review for more details.

Start with a Metromile insurance quote to see how much you can save today. Use our free quote tool above to learn how to get Metromile car insurance quotes online and find the most affordable coverage in your area.

- Step #1: Enter ZIP Code – Enter your ZIP code for location-based quotes

- Step #2: Provide Personal Info – Fill in your personal and vehicle details

- Step #3: Choose Coverage – Select coverage options like liability or collision

- Step #4: Review Estimate – Review your pay-per-mile cost estimate

- Step #5: Confirm and Buy – Finalize and purchase your policy online

5 Steps to Get Metromile Car Insurance Quotes Online

Getting the necessary information for car insurance can be stressful and overwhelming, but not at Metromile. Metromile offers easy and adjustable insurance plans for people driving low average miles yearly. To get Mequotes online, follow five easy, safe steps.

Step #1: Enter ZIP Code

Enter your ZIP code on the Metromile website or a reliable quote comparison tool to get started. This step is essential as insurance rates depend on location-specific factors, such as local regulations, risk factors, and available coverage options.

Enter your ZIP code to receive a personalized Metromile car insurance quote based on your driving habits.

Scott W. Johnson Licensed Insurance Agent

You’ll receive a more accurate Metromile quote by inputting your ZIP code, ensuring your offers are relevant to your area, and saving time. This also helps evaluate Metromile auto car insurance reviews and determine how to purchase the correct car insurance quote online.

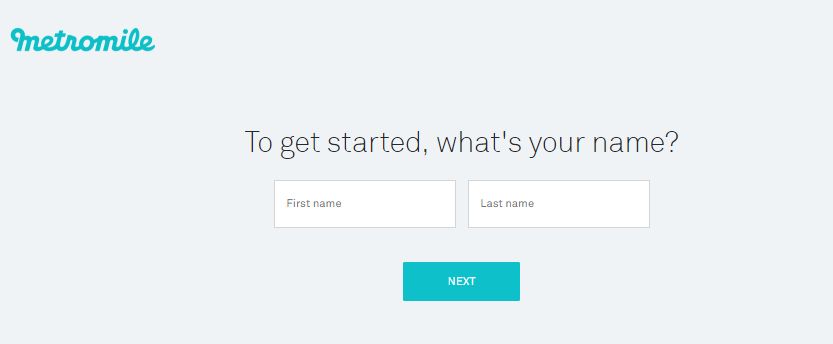

Step #2: Provide Personal Info

You will provide your details, including your name, date of birth, driving record, and vehicle information. Make sure it is accurate so that you get the correct quote. From the provided data, Metromile assesses the risk and determines your premium rate, giving you a fair price in competition, depending on your driving skills.

You may request the Metromile insurance address if further information is required. Even with the Metromile insurance review, you can know how good their services are. With a bad driving history, you can look at Metromile as a choice when looking for good car insurance with a bad driving record.

Step #3: Choose Coverage

Select the coverages that fit your needs, such as liability, comprehensive, and collision insurance. California car insurance offered by Metromile means you can structure a policy uniquely tailored to your specific needs, ensuring you are “getting what you pay for.”

Comparison of Metromile vs. Traditional Car Insurance Plans

| Feature | Metromile (Pay-Per-Mile) | Traditional Car Insurance |

|---|---|---|

| Pricing Model | Pay-per-mile + base rate | Fixed monthly or annual premium |

| Ideal for | Low-mileage drivers | All drivers, especially high-mileage |

| Cost Savings | Potential savings for drivers under 10,000 miles annually | Less savings for low-mileage drivers |

| Tracking Requirement | Requires a device to track mileage | No tracking required |

| Customization | Charges based on actual miles driven | Rates determined by risk factors |

| Monthly Premium Variation | Fluctuates with miles driven | Consistent unless policy changes |

| Mileage Cap for Savings | Best suited for under 10,000 miles/year | Not mileage-dependent |

| Availability | Limited to specific states | Widely available |

The most appropriate insurance plan will match your driving habits and wallet while still being within the law. Compare the coverage types of car insurance to determine which suits you best, especially if you prefer the flexible Metromile pay-per-mile model.

Step #4: Review Estimate

Metromile’s pricing approach combines a base rate with a per-mile charge. Reviewing this estimate helps you understand the potential savings of pay-per-mile insurance, especially if you drive less frequently.

This step determines whether Metromile’s cost-effective model suits your driving pattern. For more information, call the Metromile phone number.

Check out a Metromile review to see if it meets your needs. Also, if you require knowledge of total loss value in case the concern is that you do not want to lose too much of it with the resale value, you can get all that information online to make more informed decisions.

Step #5: Confirm and Buy

After reviewing the quote and coverage, you can complete your purchase online. Metromile auto insurance guarantees that your coverage is up-to-date and legally valid. If purchasing auto insurance online is safe, taking advantage of immediate discounts becomes convenient and secure.

Choose your coverage and purchase directly from Metromile’s easy-to-use portal to obtain free car insurance quotes online and save.

In the long run, online policy management makes updating or filing claims easy. You can quickly get roadside assistance through Metromile.

Once you have followed these steps to get your Metromile car insurance quotes online, you can easily compare options, save money, and get a policy tailored to your driving habits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Metromile’s Pay-Per-Mile Model Saves You Money

Metromile’s pay-per-mile insurance model will be cost-effective for infrequent drivers. It charges only for the miles you drive, which makes it a generally inexpensive option for people with low annual mileage.

Metromile/Lemonade Renewal on Sept 1. Got a big price decrease!

byu/SparkySF inInsurance

They know how this pricing model works when getting quotes for Metromile car insurance online. It involves estimating potential savings based on driving patterns. According to reviews of Metromile insurance, most customers find this model very lucrative in keeping their premiums affordable.

If you ask how many miles driven will affect your insurance, this model ties your miles directly into your payment, potentially saving you money. You can also manage your payments through their pay bill option.

How Accurate Information Impacts Your Metromile Quote

When requesting a Metromile car insurance quote online, providing accurate information is essential to ensure you receive the best possible estimate.

Your driving history, vehicle type, and mileage all play a significant role in determining your premium. Here’s why being precise with your details is so important:

- Accurate details like your driving history, vehicle type, and mileage directly affect your quote.

- Providing correct personal and vehicle information ensures a fair estimate.

- Accurate details ensure the right coverage if you insure a rental car with Metromile.

- The phone number for Metromile can assist if you need help with the quoting process.

- Ensure your data matches your driving habits to get the best low-mileage car insurance rates.

By entering accurate details, you’ll receive a fair and competitive quote and ensure the coverage matches your unique needs. Whether insuring your regular car or a rental car with Metromile, your information is critical for getting the best low-mileage car insurance rates.

Comparing Metromile With Traditional Car Insurance Plans

Before you submit your online request for a Metromile car insurance quote, you should first understand how it compares to traditional types of car insurance. Pay-per-mile rates from Metromile benefit drivers who are not driving a lot. However, you may only be interested in moving if you drive occasionally.

Metromile offers a cost-effective alternative to traditional car insurance by tailoring premiums to low-mileage drivers, making it a smart choice for those who drive less.

Brad Larson Licensed Insurance Agent

Knowing what is covered in a standard car insurance policy is essential. This helps you evaluate whether Metromile’s mileage-based plan will suit your needs or help you save against your average car insurance policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Quick Overview of Getting Metromile Car Insurance Quotes Online

To get a Metromile car insurance quote online, enter your ZIP code and a few details about yourself and your vehicle, and then choose your coverage. Metromile’s pay-per-mile structure is ideal for low-mileage drivers, saving them a lot of money while making it affordable for those who infrequently commute.

You can quickly and accurately obtain car insurance quotes with Metromile online by visiting their website and furnishing your driving information for an instant personalized estimate.

If you want to compare cheap ways to save money on car insurance, this online quote process lets you quickly locate a personalized, low-cost plan. Use your ZIP code below to learn how to get Metromile auto insurance quotes online and compare the best rates from top providers in your area.

Frequently Asked Questions

How much is Metromile per mile?

Metromile’s per-mile cost typically ranges from 3 to 8 cents, depending on factors like location and driving history. This is in addition to a base rate, which varies based on your personal details and vehicle type. To make the best decision, compare U.S. car insurance rates to understand how Metromile compares to other options.

How to cancel Metromile insurance?

To cancel Metromile insurance, you can either contact their customer service directly via phone or through their online portal. You will need to provide your policy details, and they may require you to submit a written request for cancellation.

Is Metromile a good insurance company?

Metromile can be a great option for low-mileage drivers since it offers a pay-per-mile model, which can save you money compared to traditional car insurance. However, it may not be ideal for drivers who log a high number of miles. Reviews often praise its affordability and flexibility, though some mention it’s better suited for city dwellers or those who drive infrequently.

What is Metromile phone number?

Metromile’s customer service phone number is (888) 242-5204. Finding cheaper insurance rates is simple when you know how to get Metromile car insurance quotes online by entering your ZIP code into our free comparison tool below.

How do I get a quote for Metromile insurance?

To get a quote for Metromile, visit their website and enter your personal details, vehicle information, and driving habits. You’ll need to provide your location, driving patterns, and car type for an accurate quote. Also, it’s helpful to compare car insurance rates by state, as rates can differ depending on where you live.

Does Metromile offer coverage for all states?

No, Metromile is not available in all states. As of now, it operates in select states, including California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington. Check their website to see if it’s available in your state.

Can I adjust my Metromile coverage?

Yes, Metromile allows you to adjust your coverage. You can modify your plan or add optional coverage options through their website or customer service. Common adjustments include increasing liability coverage or adding additional protection for theft or damage.

How does Metromile track my miles?

Metromile uses a device called the “Metromile Pulse” that plugs into your car’s OBD-II port. This device tracks the miles you drive and sends the data to Metromile to calculate your monthly rate. It also provides insights into your driving habits and helps with claims.

Does Metromile offer any discounts?

Metromile offers discounts like safe driver car insurance discounts, paying your premium in full, and other promotions. You can also earn discounts by referring friends who sign up for Metromile.

How do I file a claim with Metromile?

Policyholders can file claims with Metromile through the mobile app or the online portal. The claims process requires you to submit information about the accident, including photos and other documentation needed; however, their claims support team is also available for further support.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.