NJM Car Insurance Review for 2026 [Unbiased Evaluation]

Our NJM car insurance review shows the company has great coverage options, satisfied customers, and solid finances. Rates start at $31/mo, and with an A+ rating from A.M. Best, NJM Insurance promises dependable coverage. However, it only sells policies in Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated August 2025

This NJM car insurance review showcases a company that offers comprehensive car insurance at low rates, starting at $31/month.

Rated A+ by A.M. Best, NJM Insurance Group also tops customer satisfaction scores for financial stability and customer service. Learn about what’s included in a standard car insurance policy and whether NJM’s offerings fit your needs.

NJM Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.3 |

| Business Reviews | 5.0 |

| Claim Processing | 5.0 |

| Company Reputation | 5.0 |

| Coverage Availability | 2.7 |

| Coverage Value | 4.4 |

| Customer Satisfaction | 4.6 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.0 |

| Policy Options | 3.4 |

| Savings Potential | 4.5 |

NJM Insurance only provides car insurance in five states: Maryland, Connecticut, New Jersey, Ohio, and Pennsylvania.

Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

- NJM rates average $33/month for minimum and $150/month for full coverage

- NJM Insurance Group is rated 4.3 for discounts and claims service

- NJM excels in customer service and efficient claims handling

NJM Car Insurance Cost Factors

Whether you’re looking for minimum or full coverage, rates can vary significantly based on age and gender. In this guide, we provide a breakdown of NJM car insurance monthly rates:

NJM Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $168 | $493 |

| Age: 16 Male | $184 | $516 |

| Age: 18 Female | $137 | $363 |

| Age: 18 Male | $158 | $419 |

| Age: 25 Female | $40 | $121 |

| Age: 25 Male | $42 | $128 |

| Age: 30 Female | $37 | $112 |

| Age: 30 Male | $39 | $119 |

| Age: 45 Female | $34 | $103 |

| Age: 45 Male | $33 | $101 |

| Age: 60 Female | $31 | $91 |

| Age: 60 Male | $32 | $93 |

| Age: 65 Female | $34 | $101 |

| Age: 65 Male | $33 | $98 |

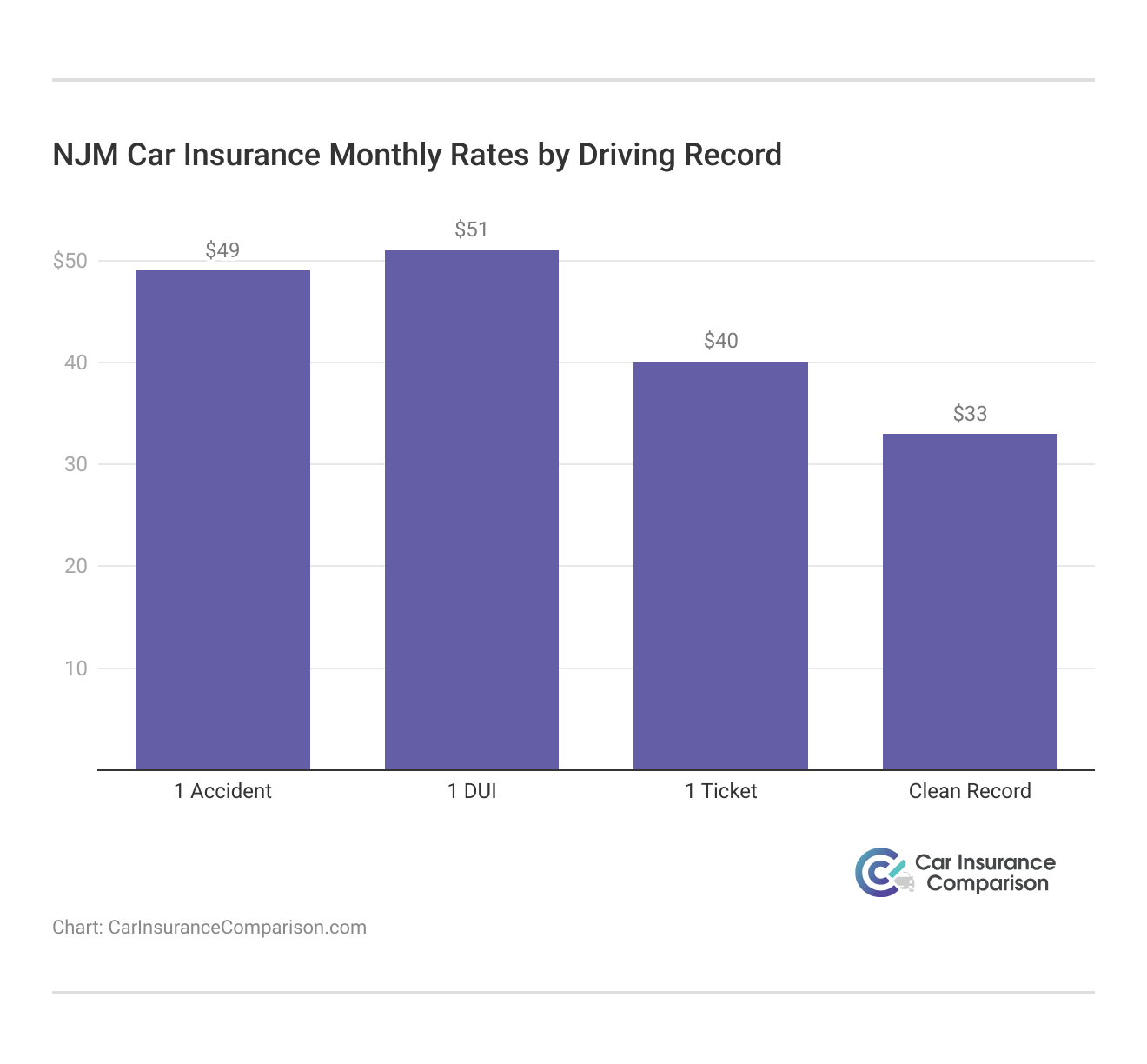

Your age and gender, as well as your driving history, can affect car insurance rates. A price breakdown for car insurance after an at-fault accident or DUI will help you understand what to expect.

NJM offers pretty affordable high-risk car insurance rates. But keep in mind that your NJM car insurance premium is also subject to the underwriting requirements that are needed to qualify you for the policy.

Don’t rush and take the time to compare different options to make sure you pick the right coverage for your situation at a price that works for you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

NJM Insurance Rates vs. The Competition

As part of our comprehensive NJM insurance review, we break down how each insurance provider stacks up on pricing. NJM is cheaper than most providers. Only Geico and USAA have better rates.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $158 | $157 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $113 | $114 | |

| $597 | $629 | $160 | $167 | $139 | $141 | $136 | $137 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $78 | $78 | |

| $522 | $626 | $174 | $200 | $171 | $174 | $167 | $170 |

| $303 | $387 | $124 | $136 | $86 | $89 | $84 | $70 |

| $363 | $419 | $112 | $119 | $103 | $101 | $101 | $98 | |

| $591 | $662 | $131 | $136 | $112 | $105 | $109 | $103 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $96 | $97 | |

| $180 | $203 | $74 | $79 | $59 | $60 | $58 | $61 |

But remember, your actual rates may differ depending on your driving record, the car you drive, and where you live. It’s worth getting quotes from a few companies to see who has the best price for you.

Read More: Cheapest New Jersey Car Insurance Rates

Saving on Your NJM Car Insurance Rates

If you’re looking to save money on your New Jersey car insurance, this table shows the best car insurance discounts you could ask for from major insurers. Safe driving rewards, such as good driver discounts, are popular ways insurers help you save.

NJM Car Insurance Discounts vs. Top Providers

| Insurance Company | Defensive Driving | Good Student | Bundling | Multi-Vehicle | Paid-in-Full | Safety Features | Anti-Theft |

|---|---|---|---|---|---|---|---|

| 10% | 20% | 25% | 25% | 10% | 20% | 10% | |

| 5% | 20% | 25% | 20% | 5% | 20% | 25% | |

| 5% | 15% | 20% | 20% | 10% | 15% | 10% | |

| 15% | 15% | 25% | 25% | 10% | 26% | 25% | |

| 10% | 15% | 25% | 25% | 10% | 20% | 35% |

| 10% | 15% | 20% | 20% | 10% | 20% | 5% |

| 20% | 15% | 5% | 10% | 5% | 10% | 10% | |

| 31% | 10% | 10% | 12% | 5% | 15% | 25% | |

| 10% | 8% | 13% | 8% | 10% | 10% | 5% | |

| 5% | 10% | 10% | 10% | 10% | 20% | 15% |

NJM offers a 20% discount on defensive driving for careful drivers. Comparing NJM with other insurers helps you find the best mix of discounts and coverage.

NJM Car Insurance Coverage Options: What You Need to Know

When selecting a car insurance policy, NJM offers a variety of coverage options to suit different needs. Find the best value by comparing different types of car insurance:

- Minimum Coverage: This is the most basic form of car insurance required by law. It includes liability coverage for bodily injury and property damage.

- Full Coverage: Provides more comprehensive protection, including collision and comprehensive coverage, in addition to liability.

- Collision & Comprehensive Coverage: Pays for repairs to your vehicle after an accident, regardless of fault, and covers damages to your car from non-collision events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who either has no insurance or insufficient coverage.

Is basic car insurance coverage a smart choice? While minimum coverage may be a cost-effective option, it may leave you vulnerable to higher out-of-pocket expenses in the event of a major accident.

Full coverage may offer greater peace of mind depending on your vehicle's value and driving habits. Be sure to evaluate your needs to determine the best policy for you.

Dani Best Licensed Insurance Producer

The good news is that NJM car insurance offers plenty of policy options at affordable prices, with cheap rates in Pennsylvania, New Jersey, Connecticut, Ohio, and Maryland.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

NJM Insurance Business Ratings & Customer Satisfaction

Another company that’s rated highly in multiple key industry ratings for both customer satisfaction and financial strength is NJM Car Insurance. With an A+ rating from A.M. Best for superior financial strength, you can be sure that NJM can meet its financial obligations and pay claims when needed.

NJM Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 909 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 93/100 Positive Customer Feedback |

|

| Score: 0.24 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength |

The company is praised by consumers and business peers for its excellent business practices. It receives an A+ rating from the BBB and a strong score from Consumers Union’s Consumer Reports, which notes its positive customer feedback.

Below is a Reddit review from a long-time customer highlighting the company’s reliability and customer-focused service:

Comment

byu/Cashneto from discussion

innewjersey

This Reddit customer review shows how much NJM cares about taking care of its customers and handling claims quickly. NJM’s good NAIC score is also evidence of the fact that NJM resolves customer issues better than many of its competitors.

Vanessa says: “I’ve been participating in the NJ & PA Heart Walks since 2018, which are personal for me. This year, I’m honored to be the Philadelphia Heart Walk team coach for NJM. In my spare time, I love traveling with my family & rocking out at concerts!”#EmployeeSpotlight pic.twitter.com/N47UklhoWi

— NJM Insurance Group (@NJMIns) November 22, 2024

How do customer satisfaction ratings affect car insurance companies? The positive NJM car insurance customer review ratings help build consumer trust and demonstrate that the insurer is reliable and financially sound. These should be key factors in your decision to choose NJM insurance or keep your current provider.

Pros and Cons of NJM Car Insurance

NJM is one of the best car insurance companies out there, and it has great customer satisfaction and financial stability:

- High Customer Satisfaction: BBB and Consumer Reports report that NJM gets positive reviews for responsive service and efficient claims handling.

- Strong Financial Stability: A.M. Best rates NJM an A+, which means it can pay its financial obligations and claims.

- Low Complaint Ratio: With fewer complaints than competitors, NJM shows that it is good at resolving issues and prioritizing customer satisfaction.

Though NJM provides excellent coverage, it is not available everywhere, and young drivers pay more for the same coverage.

- Limited Availability: NJM car insurance is only available to drivers in Connecticut, New Jersey, Maryland, Ohio, and Pennsylvania.

- Higher Premiums for Young Drivers: The rates may be higher for younger drivers, especially teens, than for older and more experienced drivers.

If you happen to live where NJM auto insurance is available, the company is worth checking out due to its customer reviews, affordable rates, and financial stability.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

NJM Insurance Group: Key Insights on Coverage and Satisfaction

Our NJM car insurance review shows it is a good choice for many policyholders. It has great customer satisfaction and financial stability. NJM covers all bases with its coverage options — liability, collision, and comprehensive coverage — enabling you to find the policy that best suits you.

However, NJM is not available in all states, and younger drivers might pay higher premiums than other companies. When looking at your options, make sure you use car insurance comparison tools to see what is best for you, depending on your special situation. Enter your ZIP code to get instant car insurance quotes from top providers in your city.

Frequently Asked Questions

What is the NJM A.M. Best rating?

NJM maintains an A+ (Superior) rating from A.M. Best. This strong rating allows NJM to offer competitive insurance premium savings and various discount programs to its policyholders.

What does NJM stand for?

NJM (New Jersey Manufacturers Insurance Company) was founded in 1913. Today, it is known for its comprehensive car insurance premium savings programs and loyalty rewards for long-term customers.

Does NJM Insurance Group have a mobile app?

Yes, NJM’s mobile app helps manage policies and claims. Users can access their premium reduction options, track their safe driver discounts, and view available auto insurance discounts through the app.

Does NJM car insurance cover New York?

No, NJM doesn’t operate in New York. NJM currently serves Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania and offers loyalty rewards to long-term customers across these states. Find the cheapest New York car insurance rates.

Is New Jersey insurance expensive?

While New Jersey rates are generally high, you can find premium reduction options through various auto insurance discounts. Many insurers offer safe driver discounts and savings for vehicle safety features.

Who has the cheapest car insurance in New Jersey?

Geico typically offers the lowest base rates, but the best way to find affordable coverage is through insurance policy comparison. Enter your ZIP code to find cheap car insurance near you.

What is the largest insurance company in NJ?

State Farm leads the New Jersey car insurance market, followed by Geico and Progressive. Each company offers different auto insurance discounts and premium reduction options, so it’s worth comparing policies and discount programs from each.

Is NJM car insurance only for NJ residents?

No, NJM operates in Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania.

Read More: What states require car insurance?

What is the recommended car insurance coverage in NJ?

Beyond the state minimums, it’s recommended to get comprehensive coverage. Look for insurers offering multi-policy bundling discounts when combining different coverage types, which often provide the best value.

Do you need an NJ license to get insurance in New Jersey?

Yes, a valid New Jersey driver’s license is required. When getting insurance, ask about good driver car insurance discounts and vehicle safety features that could qualify you for lower rates with your new policy.

Does NJM give you money back?

Does NJM still pay dividends?

What insurance pays dividends?

Is NJM in Florida?

Is NJM insurance in Ohio?

At what age is car insurance cheapest?

What is the credit rating of NJM?

Which insurance company has the most complaints?

Who is the best car insurance company?

What is the most reliable car insurance company?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.