Best Knoxville, TN Car Insurance in 2026

Car insurance in Knoxville, TN averages $309 a month. Knoxville, Tennessee car insurance requirements are 25/50/15, but you might need full coverage insurance if your car is financed. To find cheap Knoxville car insurance rates, compare quotes from the top car insurance companies in Knoxville, TN.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated February 2026

- The cheapest car insurance company in Knoxville for teen drivers is Travelers

- Average car insurance rates in Knoxville, TN after a DUI are $4,327/year

- The cheapest ZIP code in Knoxville is 37920

If you need to buy Knoxville, Tennessee car insurance, the options can be confusing. Everything you need to know about car insurance in Knoxville, TN is right here.

You’ll find Knoxville car insurance rates, the cheapest Knoxville, TN car insurance companies, and information on Tennessee car insurance laws. You can also compare Knoxville, Tennessee car insurance rates to Murfreesboro car insurance rates, Clarksville car insurance rates, and Knoxville car insurance rates.

Ready to find affordable Knoxville, TN car insurance today? Enter your ZIP code for fast, free Knoxville car insurance quotes.

Cheapest Knoxville, TN Car Insurance Rates By Age, Gender, and Marital Status

How do age, gender, and marital status affect Knoxville, TN car insurance rates? Every Knoxville, Tennessee car insurance company weighs these factors differently, so check out the comparison rates.

Annual Car Insurance Rates by Age, Gender, and Marital Status in Knoxville, Tennessee

| Insurance Company | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $2,759 | $2,644 | $2,489 | $2,583 | $10,546 | $11,492 | $2,929 | $3,024 |

| Farmers | $1,674 | $1,704 | $1,493 | $1,643 | $7,038 | $7,506 | $2,285 | $2,430 |

| Geico | $2,043 | $2,055 | $1,874 | $1,874 | $6,465 | $6,554 | $2,091 | $2,159 |

| Liberty Mutual | $3,725 | $129 | $3,051 | $3,405 | $15,770 | $17,518 | $4,004 | $4,269 |

| Nationwide | $2,239 | $2,254 | $2,008 | $2,036 | $6,253 | $8,044 | $2,579 | $2,792 |

| Progressive | $1,912 | $1,794 | $1,563 | $1,634 | $8,786 | $9,880 | $2,305 | $2,513 |

| State Farm | $1,624 | $1,624 | $1,477 | $1,477 | $5,147 | $6,423 | $1,840 | $2,145 |

| Travelers | $1,812 | $1,909 | $1,644 | $1,751 | $5,059 | $6,274 | $1,931 | $2,033 |

| USAA | $1,579 | $1,602 | $1,430 | $1,425 | $5,732 | $6,579 | $2,067 | $2,190 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Car Insurance in Knoxville, TN

Every driver must carry the minimum car insurance in Knoxville, TN. Take a look at the Tennessee car insurance requirements.

Minimum Required Car Insurance Coverage in Knoxville, Tennessee

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $15,000 minimum |

It’s recommended that you get a higher coverage limit. Tennessee’s coverage car insurance requirements are lower than average. Therefore, it would be best to buy a higher coverage limit, such as 50/100/50.

Cheapest Knoxville, TN Car Insurance Rates by Credit Score

Your credit affects car insurance costs in Knoxville, TN. Compare credit history car insurance rates in Knoxville from top companies for good, fair, and poor credit.

Annual Car Insurance Rates by Credit Score in Knoxville, Tennessee

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $6,131 | $4,703 | $3,591 |

| Farmers | $3,810 | $3,008 | $2,847 |

| Geico | $3,557 | $3,053 | $2,809 |

| Liberty Mutual | $9,283 | $5,708 | $4,460 |

| Nationwide | $4,226 | $3,364 | $2,987 |

| Progressive | $4,257 | $3,687 | $3,452 |

| State Farm | $3,950 | $2,369 | $1,840 |

| Travelers | $3,566 | $2,797 | $2,042 |

| USAA | $4,084 | $2,405 | $1,987 |

Cheapest Knoxville, TN Car Insurance Rates by Driving Record

Your driving record is one of the biggest factors affecting car insurance costs. Compare bad driving record car insurance rates in Knoxville, TN to rates for a clean record with top companies.

Annual Knoxville, Tennessee Car Insurance Rates by Driving Record

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $4,016 | $4,796 | $5,816 | $4,605 |

| Farmers | $2,761 | $3,402 | $3,473 | $3,251 |

| Geico | $2,300 | $3,060 | $4,897 | $2,300 |

| Liberty Mutual | $5,246 | $7,591 | $7,057 | $6,042 |

| Nationwide | $3,052 | $3,052 | $4,577 | $3,421 |

| Progressive | $3,344 | $4,354 | $3,561 | $3,936 |

| State Farm | $2,468 | $2,972 | $2,720 | $2,720 |

| Travelers | $2,272 | $2,918 | $3,223 | $2,793 |

| USAA | $2,051 | $3,086 | $3,618 | $2,547 |

Cheapest Knoxville, TN Car Insurance for Teen Drivers

Teen car insurance in Knoxville, TN can be expensive. Take a look at rates from the top car insurance companies in Knoxville for teenagers.

Annual Car Insurance Rates for Teen Drivers in Knoxville, Tennessee

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male |

|---|---|---|

| Allstate | $10,546 | $11,492 |

| Farmers | $7,038 | $7,506 |

| Geico | $6,465 | $6,554 |

| Liberty Mutual | $15,770 | $17,518 |

| Nationwide | $6,253 | $8,044 |

| Progressive | $8,786 | $9,880 |

| State Farm | $5,147 | $6,423 |

| Travelers | $5,059 | $6,274 |

| USAA | $5,732 | $6,579 |

Cheapest Knoxville, TN Car Insurance for Seniors

Take a look at Knoxville, TN senior car insurance rates from top companies. Shopping around can make a big difference for senior drivers.

Annual Car Insurance Rates for Senior Drivers in Knoxville, Tennessee

| Insurance Company | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|

| Allstate | $2,489 | $2,583 |

| Farmers | $1,493 | $1,643 |

| Geico | $1,874 | $1,874 |

| Liberty Mutual | $3,051 | $3,405 |

| Nationwide | $2,008 | $2,036 |

| Progressive | $1,563 | $1,634 |

| State Farm | $1,477 | $1,477 |

| Travelers | $1,644 | $1,751 |

| USAA | $1,430 | $1,425 |

Cheapest Knoxville, TN Car Insurance Rates After a DUI

A DUI in Knoxville, TN increases car insurance rates. Compare Knoxville, Tennessee DUI car insurance by company to find the cheapest option.

Annual Car Insurance Rates After a DUI in Knoxville, Tennessee

| Insurance Company | Annual Car Insurance Rates With a DUI |

|---|---|

| Allstate | $5,816 |

| Farmers | $3,473 |

| Geico | $4,897 |

| Liberty Mutual | $7,057 |

| Nationwide | $4,577 |

| Progressive | $3,561 |

| State Farm | $2,720 |

| Travelers | $3,223 |

| USAA | $3,618 |

Read More: Compare Best Car Insurance Companies That Accept DUI

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Knoxville, TN Car Insurance Rates by Commute Length

How does how far you drive affect car insurance rates in Knoxville, TN by commute? Take a look at a comparison of the top companies by commute length.

Annual Car Insurance Rates by Commute Length in Knoxville, Tennessee

| Insurance Company | 10 Mile Commute, 6,000 Annual Mileage | 25 Mile Commute, 12,000 Annual Mileage |

|---|---|---|

| Allstate | $4,808 | $4,808 |

| Farmers | $3,222 | $3,222 |

| Geico | $3,116 | $3,163 |

| Liberty Mutual | $6,484 | $6,484 |

| Nationwide | $3,526 | $3,526 |

| Progressive | $3,798 | $3,798 |

| State Farm | $2,654 | $2,785 |

| Travelers | $2,691 | $2,912 |

| USAA | $2,747 | $2,904 |

Monthly Knoxville, TN Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Knoxville, TN auto insurance rates by ZIP Code below:

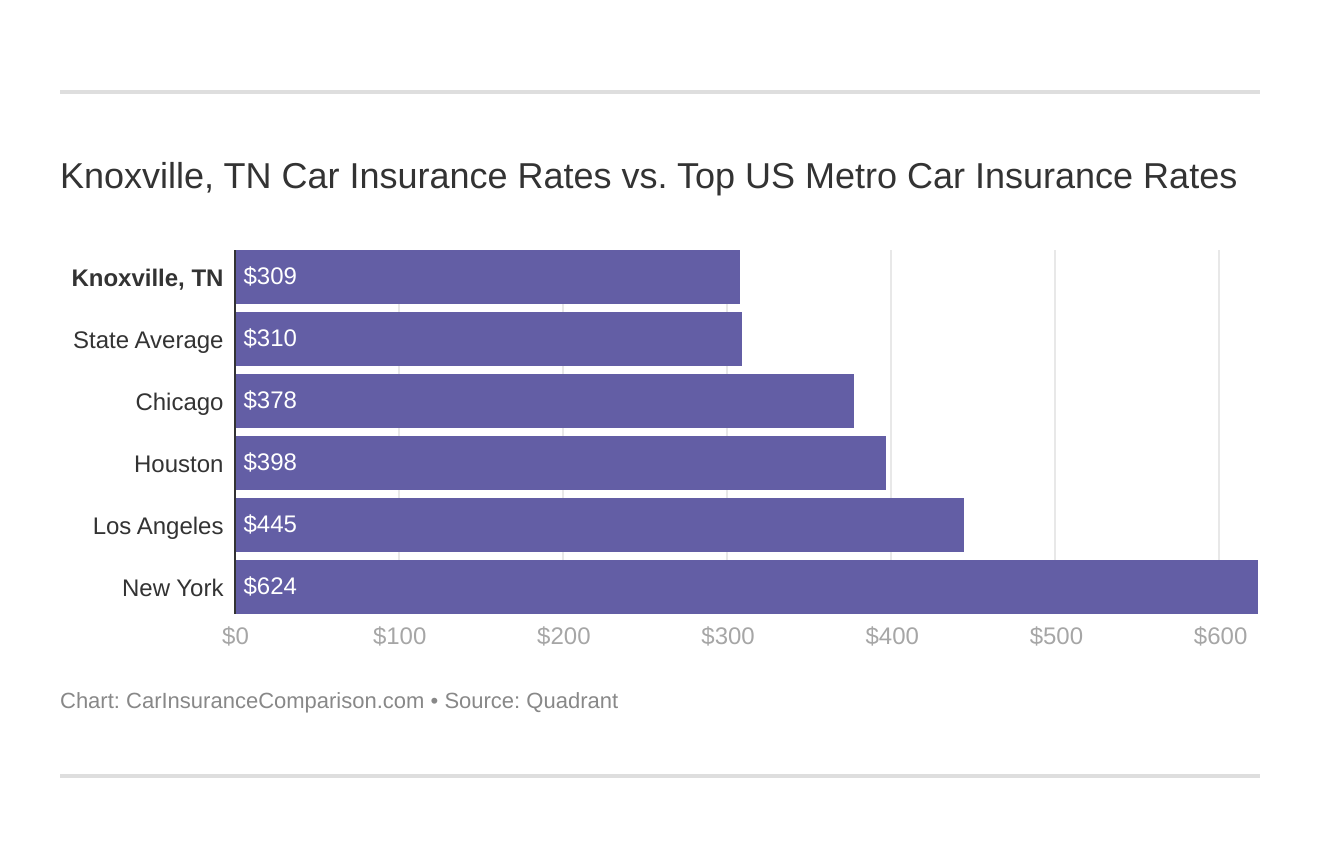

Knoxville, TN Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Knoxville, TN against other top US metro areas’ auto insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Cheap Car Insurance Companies in Knoxville, TN

Take a look at a side-by-side comparison of the top car insurance companies in Knoxville, TN to find the best option for your needs.

Average Annual Car Insurance Rates by Company in Knoxville, Tennessee

| Insurance Company | Average Annual Rates |

|---|---|

| Allstate | $4,808 |

| Farmers | $3,222 |

| Geico | $3,139 |

| Liberty Mutual | $6,484 |

| Nationwide | $3,526 |

| Progressive | $3,799 |

| State Farm | $2,720 |

| Travelers | $2,802 |

| USAA | $2,825 |

Category Winners: Cheapest Car Insurance in Knoxville, Tennessee

Find the cheapest car insurance companies in Knoxville, TN for each category right here.

Best Annual Car Insurance Rates by Company in Knoxville, Tennessee

| Category | Insurance Company |

|---|---|

| Teenagers | Travelers |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | Travelers |

| With 1 DUI | State Farm |

| With 1 Speeding Violation | Geico |

Cheapest Knoxville, TN Car Insurance Rates by Coverage Level

How much coverage you choose will have an impact on your Knoxville car insurance rates. Find the cheapest Knoxville, TN car insurance rates by coverage level.

Annual Car Insurance Rates by Coverage Level in Knoxville, Tennessee

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $4,630 | $4,797 | $4,998 |

| Farmers | $3,058 | $3,211 | $3,395 |

| Geico | $2,972 | $3,133 | $3,313 |

| Liberty Mutual | $6,223 | $6,485 | $6,743 |

| Nationwide | $3,549 | $3,452 | $3,577 |

| Progressive | $3,543 | $3,802 | $4,050 |

| State Farm | $2,553 | $2,734 | $2,872 |

| Travelers | $2,635 | $2,800 | $2,970 |

| USAA | $2,730 | $2,815 | $2,932 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

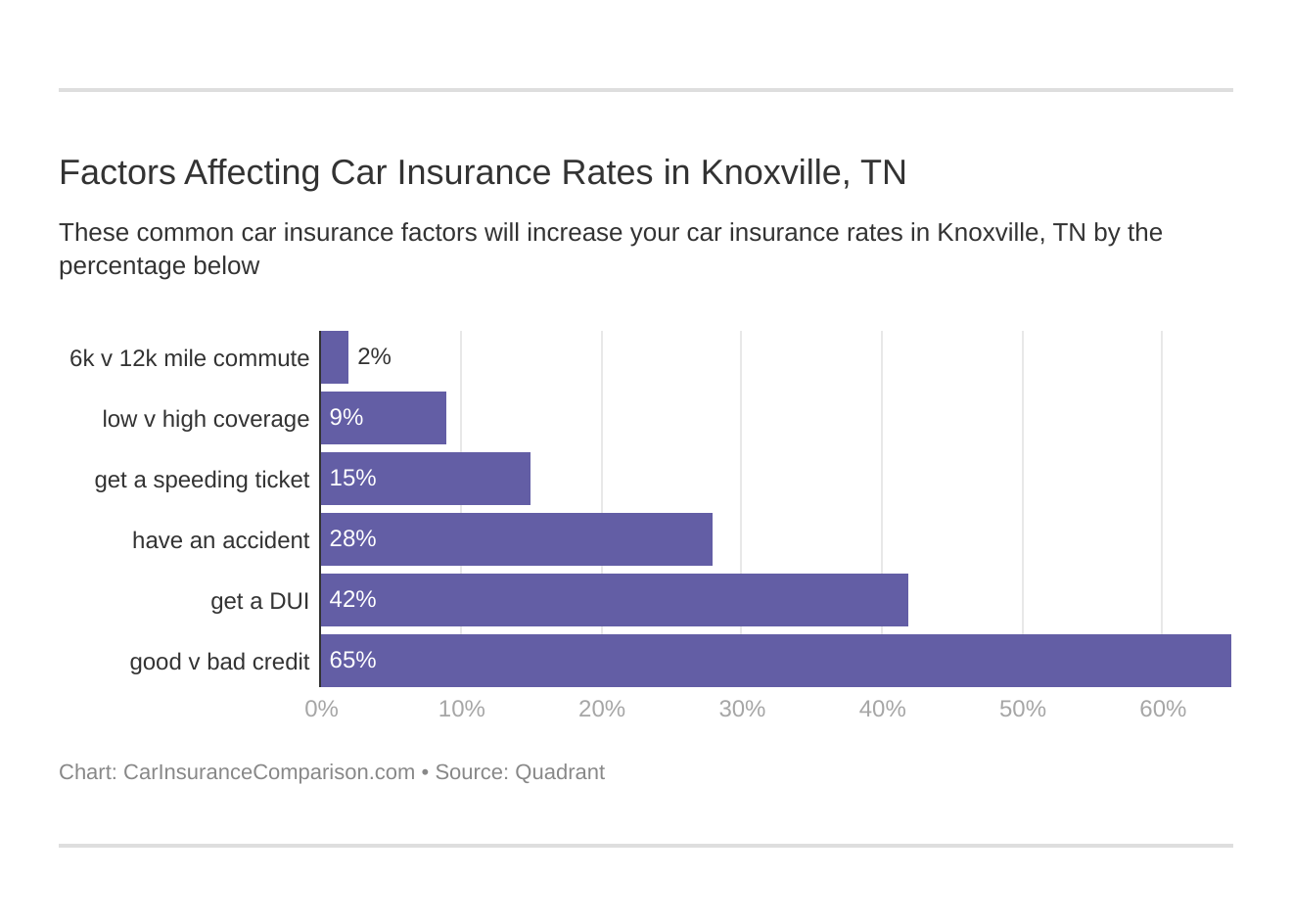

What affects car insurance rates in Knoxville, Tennessee?

What factors can have an impact on Knoxville, TN car insurance? There are several reasons why Knoxville car insurance may be different from surrounding cities. Take a look at what affects car insurance rates in Knoxville, Tennessee.

Age is a significant factor for Knoxville, TN car insurance rates. Young drivers are often considered high-risk. Therefore, teen car insurance is more expensive.

Commute Time in Knoxville

The more time you spend in your car the higher the risk of an accident. The average commute length in Knoxville, TN is 20.5 minutes according to City-Data.

Traffic in Knoxville

Traffic and commute times go hand in hand, with more traffic meaning more time on the road. Knoxville, TN traffic data from INRIX ranks Knoxville as the 796th-most congested in the world.

Knoxville, TN Auto Insurance: The Bottom Line

You can secure cheap car insurance in Knoxville, Tennessee, by maintaining a clean driving record. If you have a good credit score, take advantage of the low prices provided by your auto insurance provider.

Also, your vehicle’s safety and anti-theft features can save you money with car insurance discounts.

Before you buy car insurance in Knoxville, TN, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Knoxville, TN car insurance quotes.

Frequently Asked Questions

How can I compare car insurance rates in Knoxville, TN?

Comparing car insurance rates in Knoxville, TN can be done by following these steps:

- Gather information: Collect details about your vehicle, driving history, and any other relevant information that insurance companies may require.

- Research insurance companies: Look for reputable insurance companies that operate in Knoxville, TN. Consider factors such as their financial stability, customer reviews, and available coverage options.

- Obtain quotes: Contact insurance companies directly or use online tools to request quotes. Provide accurate information to get the most accurate quotes.

- Compare coverage options: Evaluate the coverage options offered by different insurance companies. Assess the extent of coverage, deductibles, limits, and any additional benefits or discounts.

- Consider pricing: Compare the quotes you receive, keeping in mind the level of coverage offered. Ensure that the rates are competitive and fit within your budget.

- Review customer satisfaction: Check customer reviews and ratings to gauge the satisfaction level of policyholders with the company’s claims process, customer service, and overall experience.

- Consult with an agent: If you have specific insurance needs or require guidance, consider speaking with an independent insurance agent who can provide personalized assistance.

What factors can affect car insurance rates in Knoxville, TN?

Several factors can influence car insurance rates in Knoxville, TN, including:

- Location: The area where you live affects rates due to factors like population density, crime rates, and frequency of accidents.

- Driving record: A history of accidents, traffic violations, or DUI offenses may lead to higher premiums.

- Vehicle type: The make, model, year, and value of your vehicle can impact insurance rates. Expensive or high-performance cars typically have higher premiums.

- Age and gender: Younger, inexperienced drivers and male drivers often face higher rates due to statistical risk factors.

- Coverage and deductibles: The level of coverage you choose and the deductibles you select will affect your premiums. Higher coverage limits and lower deductibles generally result in higher rates.

- Credit history: Insurers in Tennessee may consider credit history when calculating premiums, as it is believed to be an indicator of financial responsibility.

- Insurance history: Continuous coverage with no lapses and a clean claims history can result in lower rates.

- Annual mileage: The more you drive, the higher the chances of an accident, potentially increasing your premiums.

- Bundling policies: Insuring multiple vehicles or combining your car insurance with other policies, such as home insurance, may lead to discounts.

Are there any specific discounts available for car insurance in Knoxville, TN?

Yes, insurance companies in Knoxville, TN often offer various discounts that can help lower your car insurance rates. Some common discounts include:

- Multi-policy discount: Insuring multiple vehicles or bundling your car insurance with other policies, such as home or renters insurance, can lead to discounted rates.

- Good driver discount: Maintaining a clean driving record, free of accidents and traffic violations, can qualify you for lower premiums.

- Good student discount: Full-time students who maintain good grades can often avail themselves of discounted rates.

- Safety features discount: If your vehicle is equipped with safety features such as anti-lock brakes, airbags, or anti-theft devices, you may be eligible for lower premiums.

- Defensive driving course discount: Completing an approved defensive driving course can result in a discount on your car insurance rates.

- Low mileage discount: If you drive fewer miles annually, you may qualify for a lower premium.

- Loyalty discount: Some insurers offer discounts to policyholders who remain with them for an extended period.

Are there any state-specific regulations or requirements for car insurance in Knoxville, TN?

Yes, Tennessee has specific regulations and requirements for car insurance. In Knoxville, TN, the minimum insurance coverage requirements include:

- Liability insurance: You must carry liability insurance that covers at least $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $15,000 per accident for property damage.

- Uninsured motorist coverage: You are also required to have uninsured motorist coverage with limits that match your liability coverage, unless you decline this coverage in writing.

- Proof of insurance: You must carry proof of insurance with you while driving and provide it when requested by law enforcement or other authorized parties.

Can I get car insurance quotes online for Knoxville, TN?

Yes, many insurance companies offer online platforms where you can obtain car insurance quotes for Knoxville, TN. These online tools usually require you to provide some basic information, such as your zip code, vehicle details, driving history, and coverage preferences. By entering these details, you can receive quotes from multiple insurance companies to compare rates and coverage options conveniently.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.