Best Toyota Venza Car Insurance in 2026 (Your Guide to the Top 10 Companies)

For the best Toyota Venza car insurance, consider Travelers, AAA, and Safeco. These top companies offer extensive coverage at affordable rates with Travelers starting at a minimum of $100/mo. Their excellent service, variety of choices, and accessible discounts make them a great choice for Toyota Venza drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Expert

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated March 2025

Company Facts

Full Coverage for Toyota Venza

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Toyota Venza

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Toyota Venza

A.M. Best Rating

Complaint Level

Pros & Cons

For the best Toyota Venza car insurance, Travelers, AAA, and Safeco are three excellent choices. These providers are renowned for their extensive coverage options, outstanding customer service, and attractive discounts.

This article explores why these insurers are the best choices for Toyota Venza owners, focusing on their strengths and benefits.

Our Top 10 Company Picks: Best Toyota Venza Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 8% A++ Roadside Assistance Geico

#2 25% A Extensive Discounts AAA

#3 25% A Affordable Rates Safeco

#4 12% A+ Competitive Pricing Progressive

#5 25% A+ Comprehensive Coverage Allstate

#6 25% A++ Easy Claims Geico

#7 20% B Reliable Service State Farm

#8 20% A Flexible Policies Farmers

#9 10% A+ Strong Service Erie

#10 20% A Customer Satisfaction American Family

#1 – Travelers: Top Overall Pick

Pros

- Competitive Rates: Travelers provides some of the best Toyota Venza car insurance rates for Toyota Venza owners, starting around $110 per month. Their multi-vehicle discount of 8% helps further reduce costs for those insuring multiple vehicles.

- Strong Customer Service: Known for responsive and helpful customer support, Travelers’ A++ A.M. Best rating guarantees a reliable service experience for Toyota Venza enthusiasts seeking the best Toyota Venza car insurance.

- Discount Opportunities: Provides discounts for safety features and multi-policy bundles, contributing to more affordable rates for Toyota Venza owners looking for the best Toyota Venza car insurance.

Cons

- Availability Limitations: Travelers is not available in all states, which could affect access to the best Toyota Venza car insurance for some Toyota Venza drivers.

- Claims Processing Time: Some customers report slower claims resolution, which might impact your experience with the best Toyota Venza car insurance. Learn more in our article called “Travelers Car Insurance Review.“

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best for Extensive Discounts

Pros

- Extensive Discounts: AAA offers a significant 25% discount for multi-vehicle policies and other savings, making it a strong contender for the best Toyota Venza car insurance for Toyota Venza owners.

- Added Benefits: Includes perks like travel assistance and roadside service, adding extra value to the best Toyota Venza car insurance for Toyota Venza drivers.

- Local Presence: With a large network of local offices, AAA provides personalized service for Toyota Venza enthusiasts, enhancing your experience with the best Toyota Venza car insurance.

Cons

- Membership Requirement: AAA requires membership to access insurance services, which may limit the availability of the best Toyota Venza car insurance for non-members. More information is available about this provider in our article called “AAA Car Insurance Review.”

- Potentially Higher Premiums: Insurance rates might be higher compared to other providers, which could be a drawback for Toyota Venza owners seeking the most affordable best Toyota Venza car insurance.

#3 – Safeco: Best for Affordable Rates

Pros

- Affordable Rates: Safeco offers competitive premiums for the best Toyota Venza car insurance, with a 25% multi-vehicle discount to help keep costs down for Toyota Venza drivers.

- Flexible Coverage Options: Provides various policy choices tailored to Toyota Venza enthusiasts, ensuring you get the best Toyota Venza car insurance. Read more through our Safeco insurance review.

- Good Customer Service: Generally receives positive feedback for customer support, which contributes to a satisfactory experience with the best Toyota Venza car insurance for Toyota Venza owners.

Cons

- Limited Availability: Safeco’s coverage is not available in every state, which might restrict access to the best Toyota Venza car insurance for some Toyota Venza drivers.

- Smaller Local Presence: With fewer local agents compared to larger insurers, Safeco might offer less personalized service for Toyota Venza enthusiasts seeking the best Toyota Venza car insurance.

#4 – Progressive: Best for Competitive Pricing

Pros

- Competitive Pricing: Progressive provides some of the lowest rates for the best Toyota Venza car insurance, with a 12% multi-vehicle discount to further reduce costs for Toyota Venza owners.

- Snapshot Program: Offers the Snapshot program, which adjusts premiums based on driving behavior, making it an attractive option for Toyota Venza drivers seeking the best Toyota Venza car insurance.

- Variety of Coverage Options: Provides a range of customizable insurance policies, allowing Toyota Venza enthusiasts to find the best Toyota Venza car insurance to suit their needs.

Cons

- Inconsistent Customer Service: Reviews of Progressive’s customer service are mixed, which can affect your overall experience with the best Toyota Venza car insurance for Toyota Venza drivers.

- Rate Variability: Premiums can vary based on individual driving history, leading to unpredictable costs for the best Toyota Venza car insurance. More information is available about this provider in our article called Progressive car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate offers extensive coverage options, making it a top choice for the best Toyota Venza car insurance with a 25% multi-vehicle discount for Toyota Venza drivers.

- High Customer Service Ratings: Known for strong customer support, Allstate’s high ratings contribute to a positive experience with the best Toyota Venza car insurance for Toyota Venza enthusiasts.

- Discount Opportunities: Includes discounts for safe driving and bundling, which help make the best Toyota Venza car insurance more affordable for Toyota Venza owners. Learn more in our article called “Allstate Car Insurance Review.”

Cons

- Higher Premiums: Rates may be higher compared to some competitors, which could be a drawback for Toyota Venza drivers seeking the most cost-effective best Toyota Venza car insurance.

- Complex Policy Details: Allstate’s policies can be complicated, requiring more time for Toyota Venza enthusiasts to understand and select the best Toyota Venza car insurance coverage.

#6 – Geico: Best for Easy Claims

Pros

- Efficient Claims Process: Geico’s streamlined claims handling process simplifies getting your claims resolved quickly, making it a strong option for Toyota Venza drivers seeking the best Toyota Venza car insurance.

- User-Friendly Online Tools: Provides easy-to-use online tools for managing policies and claims, enhancing convenience for Toyota Venza enthusiasts looking for the best Toyota Venza car insurance.

- Discounts for Various Factors: Offers numerous discounts, such as for safe driving and multiple policies, helping Toyota Venza owners obtain the best Toyota Venza car insurance at a lower cost.

Cons

- Limited Personalized Service: Primarily an online provider, which might offer less personal interaction compared to other insurers for Toyota Venza drivers seeking the best Toyota Venza car insurance.

- Coverage Limitations: May offer fewer coverage options compared to competitors, potentially limiting customization for Toyota Venza enthusiasts looking for the best Toyota Venza car insurance. Read up on the “Geico Car Insurance Review” for more information.

#7 – State Farm: Best for Reliable Service

Pros

- Reliable Service: State Farm is known for dependable customer service, making it a reliable choice for the best Toyota Venza car insurance, supported by their B A.M. Best rating for Toyota Venza owners.

- Extensive Local Network: Offers personalized service through a large network of local agents, enhancing your access to the best Toyota Venza car insurance for Toyota Venza drivers.

- Discount Opportunities: Provides discounts for safe driving and bundling multiple policies, which can help lower your overall costs for the best Toyota Venza car insurance for Toyota Venza enthusiasts. Learn more in our in our guide titled State farm car insurance review.

Cons

- Higher Premiums: Rates might be higher compared to some competitors, potentially impacting affordability for Toyota Venza drivers seeking the most cost-effective best Toyota Venza car insurance.

- Variable Agent Experience: Quality of service can vary depending on the agent, leading to inconsistent experiences with the best Toyota Venza car insurance for Toyota Venza enthusiasts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Flexible Policies

Pros

- Customizable Policies: Farmers provides a variety of flexible insurance options for Toyota Venza drivers, allowing for the best Toyota Venza car insurance coverage.

- Positive Customer Service: Generally receives favorable reviews for customer support, contributing to a better experience with the best Toyota Venza car insurance for Toyota Venza enthusiasts.

- Comprehensive Coverage: Includes various types of coverage to meet different needs, ensuring thorough protection for Toyota Venza drivers seeking the best Toyota Venza car insurance.

Cons

- Higher Premiums: Insurance rates might be higher compared to some other providers, which could be a drawback for Toyota Venza enthusiasts seeking the most affordable best Toyota Venza car insurance.

- Complex Policy Details: Policies can be complex and difficult to navigate, requiring more effort from Toyota Venza owners to understand the best Toyota Venza car insurance coverage. Delve into our evaluation of Farmers car insurance review.

#9 – Erie: Best for Strong Service

Pros

- Excellent Service: Erie is known for providing outstanding customer service, making it a top choice for the best Toyota Venza car insurance for Toyota Venza owners, supported by their A+ A.M. Best rating.

- Competitive Rates: Offers affordable premiums with a 10% multi-vehicle discount available to further reduce costs for Toyota Venza drivers seeking the best Toyota Venza car insurance.

- Comprehensive Coverage Options: Provides a variety of coverage types to ensure thorough protection, making it ideal for Toyota Venza enthusiasts looking for the best Toyota Venza car insurance.

Cons

- Regional Availability: Erie’s coverage is limited to specific regions, which could restrict access to the best Toyota Venza car insurance for some Toyota Venza drivers. Check out insurance savings in our complete guide titled “Erie Car Insurance Review.”

- Limited Digital Tools: Fewer online tools for managing policies compared to some competitors, which might impact convenience for Toyota Venza enthusiasts seeking the best Toyota Venza car insurance.

#10 – American Family: Best for Customer Satisfaction

Pros

- Strong Customer Satisfaction: American Family is highly rated for customer satisfaction, making it a great option for Toyota Venza owners looking for the best Toyota Venza car insurance with strong support.

- Discount Opportunities: Offers a 20% multi-vehicle discount and additional savings for safety features, which enhances the affordability of the best Toyota Venza car insurance for Toyota Venza drivers. Learn more through our American Family car insurance review.

- Good Financial Strength: With an A rating from A.M. Best, American Family ensures reliable financial backing for their insurance policies, contributing to a secure experience for Toyota Venza owners seeking the best Toyota Venza car insurance.

Cons

- Higher Premiums for Some: Insurance rates may be higher compared to some competitors, which could be a drawback for Toyota Venza drivers seeking more budget-friendly options for the best Toyota Venza car insurance.

- Limited Regional Availability: Coverage might be limited in some areas, potentially restricting access to the best Toyota Venza car insurance for Toyota Venza enthusiasts in certain regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Toyota Venza Car Insurance Rate Quotes

To find Toyota Venza car insurance rate quotes, start by understanding that rates can vary significantly based on location and individual circumstances. Insurance providers set different rates depending on factors such as your driving record, age, and the area where you live.

Toyota Venza Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $115 $300

Allstate $130 $325

American Family $125 $305

Erie $115 $290

Farmers $140 $340

Geico $100 $260

Progressive $105 $275

Safeco $120 $310

State Farm $125 $315

Travelers $110 $285

To secure the best rate and potentially find cheap car insurance, it’s crucial to compare quotes from multiple insurance companies. This process involves gathering quotes from various insurers, reviewing their coverage options, and assessing how each policy fits your needs.

By shopping around and considering different offers, you can find a rate that provides the coverage you need at a price that suits your budget. Enter your ZIP code now.

Toyota Venza Safety Features

The Toyota Venza’s comprehensive safety features can significantly lower your insurance costs. The 2020 Toyota Venza is equipped with a range of advanced safety technologies designed to enhance driver and passenger protection.

These include driver and passenger airbags, front and rear head airbags, and front side airbags. For improved braking performance, it comes with 4-wheel ABS, 4-wheel disc brakes, and brake assist.

The vehicle also features electronic stability control and traction control to help maintain stability and prevent skidding. Daytime running lights, child safety locks, and integrated turn signal mirrors add further layers of safety and convenience.

Additionally, features like a “Backup Camera” can lead to car insurance discounts. Insurance companies often offer lower premiums for vehicles equipped with such advanced safety systems because they reduce the likelihood of accidents and damages.

Overall, these safety features contribute to a lower risk profile, which insurance companies reward with reduced premiums.

Toyota Venza Finance and Insurance Cost

When financing a Toyota Venza, lenders typically require you to have higher coverage options, such as comprehensive insurance, to protect their investment. This means you’ll need to secure a policy that meets these requirements, which may be more expensive than basic coverage.

To ensure you’re getting the best deal, it’s crucial to shop around and compare comprehensive car insurance quotes from various top insurance companies. Using our free comparison tool below can help you find the most competitive rates and coverage options tailored to your needs. Enter your ZIP code now.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Toyota Venza Insurance

To effectively save on your Toyota Venza insurance costs, consider these strategies. Regularly checking the odometer can ensure you’re not overpaying for coverage based on inaccurate mileage estimates.

Removing young drivers from your insurance plan if they no longer use the vehicle can significantly lower your premium. Additionally, ask about a student away-from-home discount, which might be available if you have a student driver living away at school.

Brad Larson

Licensed Insurance Agent

Exploring Toyota Venza auto insurance through Costco can also be beneficial, as they often provide discounted rates to members.

Lastly, you might save on rental car costs by checking with your credit card company for any insurance benefits they offer. For a comprehensive approach, perform a car insurance comparison to find the best rates and discounts tailored to your needs.

Frequently Asked Questions

How can I compare car insurance rates for a Toyota Venza?

To compare car insurance rates for a Toyota Venza, you can start by reaching out to different insurance companies directly and requesting quotes.

Many insurance providers have online tools or dedicated phone lines where you can obtain quotes specific to the Toyota Venza.

Additionally, you can use online comparison platforms that allow you to compare quotes from multiple insurers, making it easier to find the best rate for your Toyota Venza.

What factors affect car insurance rates for a Toyota Venza?

Car insurance rates for a Toyota Venza are influenced by various factors.

Common factors include the model and year of the vehicle, your driving record, your age, gender, and marital status, your location, the coverage options you choose, and your deductible amount.

Additionally, factors such as the cost of repairs, the likelihood of theft or accidents for the Toyota Venza, and the frequency of insurance claims for this particular model can impact insurance rates. Enter your ZIP code now to begin.

Are car insurance rates higher for Toyota Venza compared to other SUV models?

Car insurance rates can vary depending on the specific make and model of the vehicle, as well as other factors.

While the Toyota Venza is a popular SUV known for its reliability and fuel efficiency, insurance rates can still differ based on factors such as the cost of repairs, the likelihood of theft or accidents, and the frequency of insurance claims for this particular model.

To get a comprehensive view of how Toyota Venza car insurance rates stack up against other SUV models, it’s advisable to compare car insurance rates by state.

This will help you understand how regional factors influence your insurance premiums.

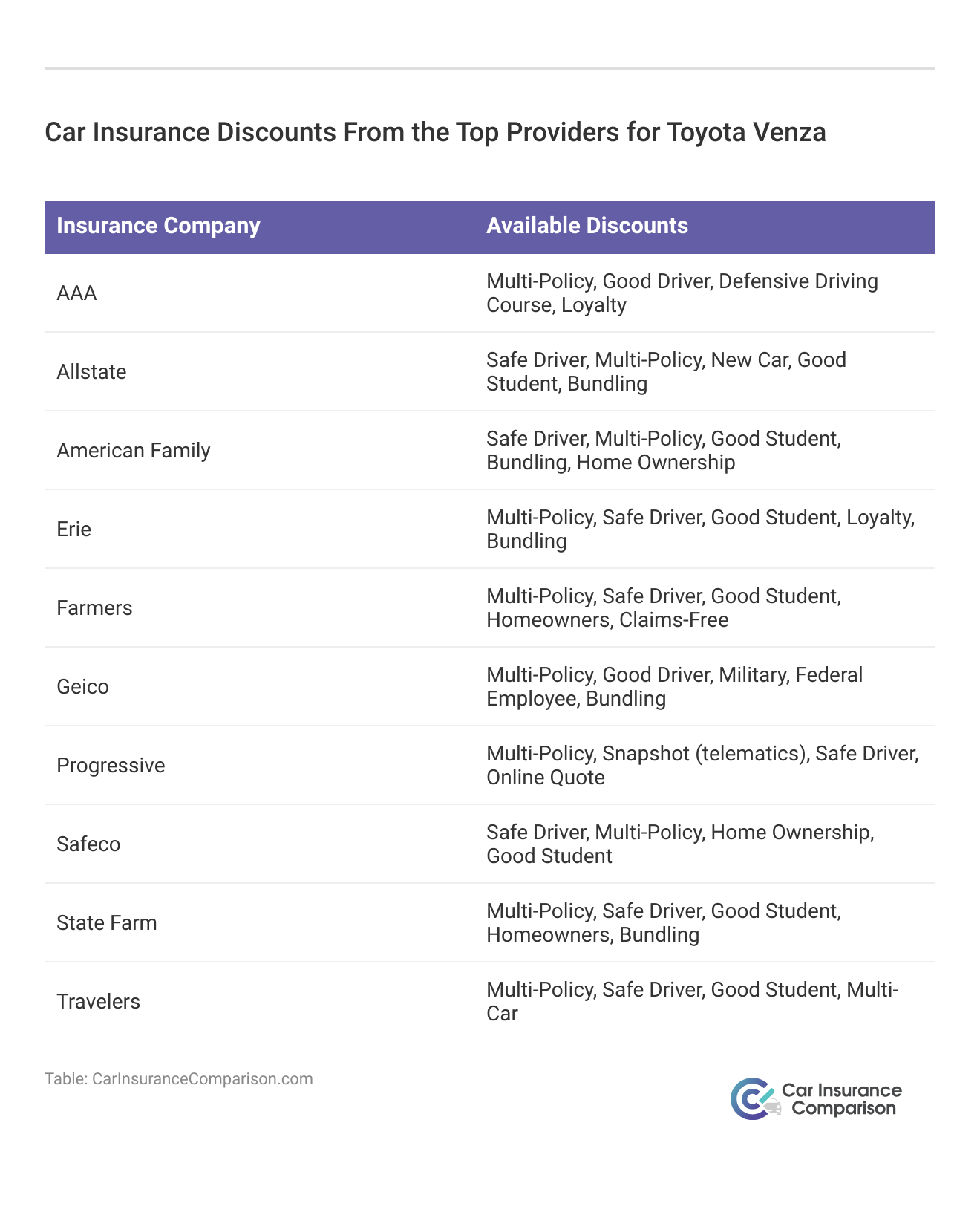

Are there any discounts available for Toyota Venza car insurance?

Yes, many insurance companies offer various discounts that can help you save on Toyota Venza car insurance.

Common discounts include safe driver discounts, multi-policy discounts (if you have multiple policies with the same insurer), good student discounts, and discounts for having safety features installed in your vehicle.

Additionally, if you use your Toyota Venza for business purposes, you may qualify for additional discounts or specialized commercial auto insurance coverage.

How can I lower my car insurance rates for my Toyota Venza?

There are several strategies you can consider to lower your car insurance rates for your Toyota Venza.

Maintaining a clean driving record, opting for higher deductibles, bundling multiple policies with the same insurer, and taking advantage of available discounts are some effective methods.

Additionally, the safety features of the Toyota Venza, such as anti-lock brakes, airbags, and an anti-theft system, can help lower insurance rates. Enter your ZIP code now to begin.

Is it necessary to have full coverage car insurance for a Toyota Venza?

Whether you need full coverage car insurance for your Toyota Venza depends on various factors, including your personal circumstances and preferences.

While liability insurance is typically required by law, full coverage, which includes comprehensive and collision coverage, is not mandatory.

However, if your Toyota Venza is financed or leased, the lender or leasing company may require you to have full coverage until the loan or lease is paid off.

To find the best options, you should compare the best discounts available and evaluate how they impact the cost of full coverage insurance.

Which company is ranked #1 for providing the best Toyota Venza car insurance?

Travelers is ranked #1 for the best Toyota Venza car insurance. It is known for its strong roadside assistance and a competitive starting rate of $110 per month.

What is the key advantage of AAA for Toyota Venza owners compared to other providers?

AAA offers an extensive 25% multi-vehicle discount, which is highly beneficial for Toyota Venza owners looking to save on insurance.

Additionally, AAA is recognized for its broad range of discounts and excellent coverage options. Enter your ZIP code now to begin.

How does Safeco’s multi-vehicle discount benefit Toyota Venza drivers?

What rating does State Farm have from A.M. Best, and how does it impact its reputation for the best Toyota Venza car insurance?

State Farm has a B rating from A.M. Best, which indicates a good level of financial stability but is lower compared to some competitors. Despite this, State Farm is known for its reliable service and substantial multi-vehicle discount, making it a solid option for Toyota Venza owners.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.