Best Dodge Challenger Car Insurance in 2025 (Find the Top 10 Companies Here)

The best Dodge Challenger car insurance is provided by Erie, Geico, and AAA, with rates starting at just $25 per month. Erie excels in low rates and service, while Geico and AAA provide strong coverage and discounts tailored for Challenger owners, ensuring affordable and comprehensive protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Dodge Challenger

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Dodge Challenger

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Dodge Challenger

A.M. Best Rating

Complaint Level

Pros & Cons

The best Dodge Challenger car insurance providers are Erie, Geico, and AAA, each excelling in different areas to offer comprehensive coverage and tailored benefits for Challenger owners.

Erie stands out as the top pick due to its combination of low rates and exceptional customer satisfaction, making it a reliable choice for budget-conscious drivers. Geico offers robust policies with extensive coverage options, while AAA provides additional savings opportunities through exclusive discounts.

Our Top 10 Company Picks: Best Dodge Challenger Car Insurance

Company Rank Good Driver Discount A.M. Best Best For Jump to Pros/Cons

#1 23% A+ Competitive Pricing Erie

#2 20% A++ Low Rates Geico

#3 25% A Roadside Assistance AAA

#4 25% B Customer Satisfaction State Farm

#5 12% A++ Claims Satisfaction Amica

#6 14% A Budget-Friendly Mercury

#7 18% A+ Personalized Policies Nationwide

#8 17% A Payment Options Safeco

#9 18% A+ Online Experience Farmers

#10 20% A+ AARP Members The Hartford

This article explores why these three companies are the top choices, helping you select the best insurance for your Dodge Challenger. Learn more in our article titled “Best Dodge Car Insurance Rates.”

See if you’re getting the best deal on Dodge Challenger car insurance by entering your ZIP code above.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

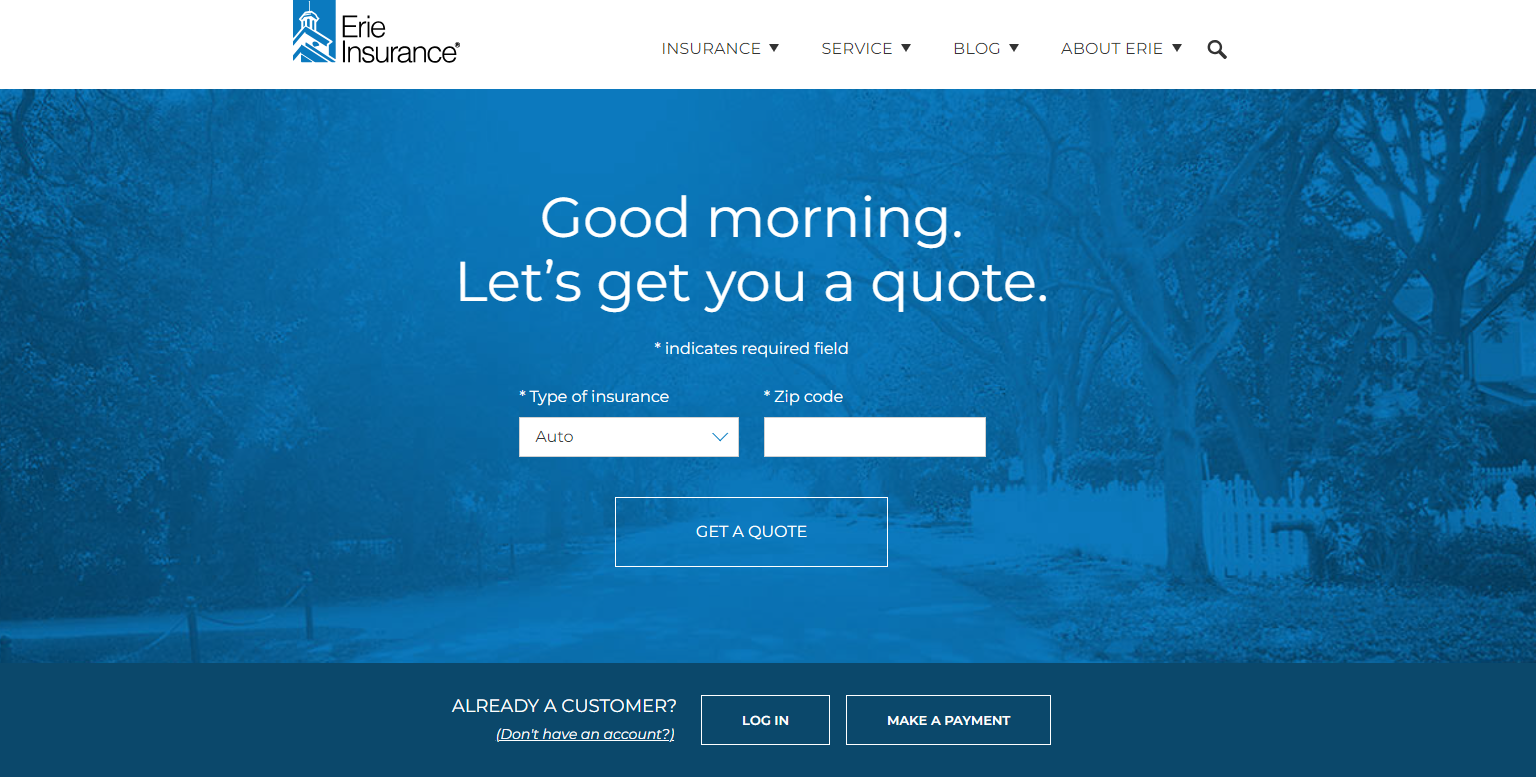

#1 – Erie: Top Overall Pick

Pros

- Competitive Rates: Erie offers some of the lowest rates for Dodge Challenger car insurance with a 23% good driver discount. Compare Erie’s rates with top competitors in our guide titled “Erie Car Insurance Review.”

- Customer Loyalty Discounts: Erie rewards long-term customers with discounts that can benefit consistent Dodge Challenger insurance holders.

- Accident Forgiveness: Erie includes accident forgiveness in its policies, which can prevent rate increases after a first at-fault accident involving a Dodge Challenger.

Cons

- Higher Rates for High-Risk Drivers: High-risk Dodge Challenger drivers may face significantly higher premiums with Erie.

- Fewer Tech Features: Erie’s mobile app and online tools are less robust compared to larger insurers, which could affect tech-savvy Dodge Challenger owners.

#2 – Geico: Best for Low Rates

Pros

- Low Premiums: Geico offers competitive rates with a 20% good driver discount for Dodge Challenger insurance. Learn more about Geico’s rates in our article titled “Geico Car Insurance Review.”

- Excellent Financial Strength: With an A++ rating from A.M. Best, Geico is highly reliable for claims service for Dodge Challenger owners.

- Wide Acceptance: Geico insures drivers with varying records, making it accessible for many Dodge Challenger owners.

Cons

- Up-selling Tactics: Dodge Challenger owners might experience aggressive up-selling of additional coverages.

- Standardized Policies: Less flexibility in policy customization which might not meet all Dodge Challenger owner’s unique needs.

#3 – AAA: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: AAA provides exceptional roadside assistance programs, crucial for Dodge Challenger owners. Learn more about AAA roadside assistance in our article titled “AAA Car Insurance Review.”

- High Good Driver Discount: Offers a 25% discount for safe Dodge Challenger drivers, one of the highest in the industry.

- Broad Coverage Options: Extensive options that cater to the unique aspects of insuring a performance vehicle like the Dodge Challenger.

Cons

- Complex Claims Process: Some customers report a more complicated claims process, which could be cumbersome for Dodge Challenger owners.

- Limited Coverage in Certain Areas: Some regions may offer less competitive terms for Dodge Challenger insurance, depending on the local club’s policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: State Farm is renowned for its customer service, providing peace of mind for Dodge Challenger owners. See the reviews and rankings in our full guide titled “State Farm Car Insurance Review.”

- Substantial Discounts: Offers a 25% discount for good drivers, significantly reducing insurance costs for safe Dodge Challenger operators.

- Robust Mobile App: State Farm’s advanced mobile app enables Dodge Challenger owners to manage their policies and file claims conveniently.

Cons

- Marketing Emphasis on Bundling: Heavily promotes bundling, which might not benefit Dodge Challenger owners needing standalone auto insurance.

- Slow Claim Resolution Times: Some customers report slower than average claim resolution times, which can be inconvenient for Dodge Challenger owners.

#5 – Amica: Best for Claims Satisfaction

Pros

- Top-Tier Claims Service: Amica is celebrated for its efficient claims process, greatly benefiting Dodge Challenger owners after accidents.

- Exceptional Financial Stability: With an A++ rating from A.M. Best, Amica ensures reliability in paying out claims for Dodge Challenger owners.

- High Customer Retention: Known for high customer retention, indicating satisfaction among Dodge Challenger policyholders. Explore more coverage options in our guide titled “How do you get an Amica Mutual car insurance quote online?“

Cons

- Higher Premiums Without Discounts: Base rates can be higher, which might deter some Dodge Challenger owners without access to discounts.

- No High-Performance Vehicle Specialty: Lacks specific programs tailored for high-performance vehicles like the Dodge Challenger.

#6 – Mercury: Best for Budget-Friendly

Pros

- Competitive Pricing: Mercury offers budget-friendly options making it accessible for Dodge Challenger owners. See if Mercury has affordable policies near you in our guide titled “How do you get a Mercury car insurance quote online?“

- Good Driver Rewards: Provides a 14% discount for clean driving records, which can significantly reduce insurance costs for responsible Dodge Challenger drivers.

- Customizable Policies: Allows for a high degree of policy customization to meet the specific needs of Dodge Challenger owners.

Cons

- Regional Limitations: Coverage and options can vary greatly depending on the region, possibly affecting some Dodge Challenger owners.

- Basic Online Tools: Online and mobile tools are less developed, which could hinder tech-savvy Dodge Challenger owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Personalized Policies

Pros

- Customization: Nationwide allows for extensive customization of policies, ideal for Dodge Challenger owners with specific coverage needs. Find out if Nationwide might have the lowest rates for you in our article titled “Nationwide Car Insurance Discounts.”

- Discounts for Safe Drivers: Offers an 18% discount for safe driving, which can significantly lower premiums for careful Dodge Challenger drivers.

- Vanishing Deductible: Nationwide’s vanishing deductible option rewards Dodge Challenger owners with reduced deductibles for accident-free years.

Cons

- Higher Base Premiums: Basic premiums may be higher compared to competitors, potentially affecting budget-conscious Dodge Challenger owners.

- Inconsistent Customer Service: Customer service quality can vary, which might impact the insurance experience for Dodge Challenger owners.

#8 – Safeco: Best for Payment Options

Pros

- Flexible Payment Plans: Safeco offers various payment plans that can ease the financial burden for Dodge Challenger owners.

- Comprehensive Coverage: Provides a wide array of coverage options, ensuring thorough protection for Dodge Challengers. Compare Safeco’s rates to other providers in our article titled “Safeco Car Insurance Review.”

- Discounts for Multiple Policies: Offers discounts for bundling multiple policies, which can benefit Dodge Challenger owners with multiple insurance needs.

Cons

- Average Customer Service: Customer service may not always meet the expectations of Dodge Challenger owners, varying by region.

- Pricing Variability: Some Dodge Challenger owners may find Safeco’s rates higher than those of similar providers, depending on individual circumstances.

#9 – Farmers: Best for Online Experience

Pros

- Advanced Online Features: Farmers offers a superior online experience with tools and resources that are beneficial for managing Dodge Challenger insurance.

- Competitive Discounts: Offers an 18% good driver discount, helping to reduce costs for Dodge Challenger owners who maintain a clean driving record.

- Coverage Customization: Allows extensive customization of coverage, suiting the diverse needs of Dodge Challenger owners. Find more details in our article titled “Farmers Car Insurance Review.”

Cons

- Higher Premiums Without Discounts: Without qualifying for discounts, rates can be higher than some competitors for Dodge Challenger insurance.

- Promotional Focus on Bundling: Heavy promotion of bundling might not suit those seeking standalone auto insurance for their Dodge Challenger.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for AARP Members

Pros

- Tailored for Older Drivers: Specifically beneficial for AARP members, The Hartford offers policies that cater to the needs of older Dodge Challenger owners.

- Discounts for AARP Members: Offers substantial discounts for AARP members, which can significantly lower the cost of Dodge Challenger insurance.

- Lifetime Repair Assurance: Provides lifetime repair assurance on all covered repairs, giving peace of mind to Dodge Challenger owners. Learn more about The Hartford in our guide titled “The Hartford Car Insurance Discounts.”

Cons

- Age Requirement: Benefits primarily available to AARP members, which may exclude younger Dodge Challenger owners from obtaining optimal rates.

- Higher Rates for Non-AARP Members: Non-AARP members might find premiums higher than average for Dodge Challenger insurance.

Monthly Insurance Costs for Dodge Challenger: Minimum vs. Full Coverage

Dodge Challenger owners can make informed decisions about their car insurance by understanding the differences in monthly rates between minimum and comprehensive coverage. Here is a detailed breakdown of the rates that major insurance providers charge for each type of coverage:

Dodge Challenger Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

AAA $30 $100

Amica $45 $120

Erie $35 $108

Farmers $28 $98

Geico $25 $95

Mercury $33 $107

Nationwide $40 $115

Safeco $38 $113

State Farm $30 $100

The Hartford $34 $110

The monthly rates for minimum coverage insurance vary significantly among providers, with Geico offering the lowest rate at $25 and Amica presenting the highest at $45. For full coverage, which provides a broader protection level, Geico remains the most economical option at $95 per month, while Amica again stands as the costliest at $120.

Erie and Farmers also provide competitive rates, with Erie at $35 for minimum and $108 for full, and Farmers at $28 for minimum and $98 for full coverage.This variability highlights the importance of comparing rates to find the best deal for your specific needs and budget. Read our comprehensive “How do you get an Erie car insurance quote online?” to see if this auto insurance provider is right for you.

Understanding Dodge Challenger Insurance Costs: Factors and Averages

Around $141 a month is how much Dodge Challenger insurance costs on average.

The real cost of car insurance, on the other hand, relies on your age, credit score, driving record, the type of car you have, where you live, and other things. For example, the cost of car insurance might be less for an older model. Still, Dodge Challenger insurance will cost more than insurance for most other cars. See more details on our guide titled “Best Car Insurance by Age.”

The average monthly cost of insuring a Dodge Challenger is approximately $141, but this can vary based on several factors including the driver’s age, credit score, and driving history. While the Dodge Challenger typically incurs higher insurance rates compared to many other vehicles, comparing insurance rates and considering factors like deductibles and driver profiles can significantly influence the overall cost.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dodge Challenger Insurance Comparison Guide

The chart below details how Dodge Challenger insurance rates compare to other coupes like the Audi S5, Nissan 370Z, and Infiniti Q60. Check out insurance savings in our complete guide titled “Best Infiniti Car Insurance Rates.”

Dodge Challenger Car Insurance Monthly Rates vs. Other Vehicles Coverage Level

Vehicle Comprehensive Collision Liability Full Coverage

Dodge Challenger $34 $57 $35 $141

Audi S5 $33 $72 $33 $151

Nissan 370Z $28 $60 $38 $140

Infiniti Q60 $32 $62 $33 $140

Audi TT $32 $60 $33 $138

Mercedes-Benz CLA 250 $34 $70 $33 $150

MINI Hardtop 2 Door $24 $45 $28 $108

To get the most affordable Dodge insurance rates online, you can use a number of different methods. Looking into these choices could save you a lot of money.

Navigating Dodge Challenger Insurance: Key Factors & Rates

The insurance premiums for a Dodge Challenger are influenced by a variety of factors, one of which includes the age of the driver. Teen drivers, in particular, see a notable increase in rates due to their higher risk profile. Discover more about offerings in our guide titled “Compare Teen Driver Car Insurance Rates.”

Auto insurance for teens driving a high-performance vehicle like the Dodge Challenger can be significantly higher compared to adult drivers with more experience. This is because insurers typically view younger drivers as more likely to be involved in accidents, leading to higher claims rates.

Other factors impacting Dodge Challenger insurance rates include the model year, with newer, tech-enhanced models costing more to insure. Geographic location also influences rates; urban areas typically have higher premiums due to increased risks of accidents and theft. Lastly, a driver’s personal driving record and credit score significantly affect costs, with better histories generally leading to lower rates.

Age of the Vehicle

In general, it costs less to cover older Dodge Challenger models. For example, insurance for a 2020 Dodge Challenger costs about $141 a month, while insurance for a 2010 Dodge Challenger costs about $114 a month, which is a $27 difference.

Dodge Challenger Car Insurance Monthly Rates by Model Year & Coverage Type

Model Year Comprehensive Collision Liability Full Coverage

2024 Dodge Challenger $36 $59 $33 $144

2023 Dodge Challenger $35 $58 $34 $143

2022 Dodge Challenger $34 $57 $35 $141

2021 Dodge Challenger $34 $57 $35 $141

2020 Dodge Challenger $34 $57 $35 $141

2019 Dodge Challenger $32 $55 $37 $139

2018 Dodge Challenger $31 $55 $38 $138

2017 Dodge Challenger $30 $53 $39 $137

2016 Dodge Challenger $29 $51 $41 $135

2015 Dodge Challenger $27 $49 $42 $133

2014 Dodge Challenger $26 $46 $43 $129

2013 Dodge Challenger $25 $43 $43 $126

2012 Dodge Challenger $24 $39 $43 $121

2011 Dodge Challenger $23 $36 $43 $116

2010 Dodge Challenger $22 $33 $44 $114

As demonstrated, the cost of insuring a Dodge Challenger decreases as the model year ages, making older models more economical to insure. For Dodge Challenger owners, understanding this trend can help in planning for more cost-effective insurance coverage over the lifespan of the vehicle.

Driver Age

The age of the driver can have a big effect on how much Dodge Challenger car insurance costs each month. 20-year-old drivers, for example, pay more than 30-year-old drivers for their Dodge Challenger insurance—about $173 a month.

Age is a big factor in how much Dodge Challenger insurance costs. Younger drivers are thought to be more of a risk, so their rates are much higher. As a driver gets older and more experience, their insurance rates usually go down. This is because they are seen as less of a risk and drive more safely.

Driver Location

Location plays a big role in how much your monthly Dodge Challenger insurance costs. New York drivers might make about $37 more a month than Chicago drivers, for example. Access comprehensive insights into our guide titled “Cheapest New York Car Insurance Rates.”

The cost of insuring a Dodge Challenger can vary widely depending on your location, as demonstrated by the difference in monthly premiums between cities like New York and Chicago. It’s essential for Dodge Challenger owners to consider their city of residence when evaluating insurance options to ensure they find the most cost-effective coverage.

Your Driving Record

The cost of your Dodge Challenger car insurance may be affected by how well you drive. With moving violations on their record, teens and drivers in their 20s see the biggest jumps in their Dodge Challenger car insurance rates.

Your driving record plays a crucial role in determining your Dodge Challenger car insurance rates, with younger drivers facing significant increases after traffic violations or accidents. It’s essential to maintain a clean driving record to secure the most favorable insurance costs, especially for high-performance vehicles like the Dodge Challenger.

Dodge Challenger Safety Ratings

The safety ratings of the Dodge Challenger affect how much your auto insurance costs. Here’s how it breaks down:

Dodge Challenger Safety Ratings

Test Rating

Small overlap front: driver-side Marginal

Small overlap front: passenger-side Not Tested

Moderate overlap front Good

Side Good

Roof strength Acceptable

Head restraints and seats Acceptable

The safety ratings of the Dodge Challenger, as evaluated by the Insurance Institute for Highway Safety, reveal a mix of scores ranging from good to marginal. These ratings are crucial as they directly influence the cost of auto insurance, highlighting the importance of considering safety in managing insurance expenses.

Dodge Challenger Crash Test Ratings

If your Dodge Challenger does well in crash tests, your insurance rates may go down. See below for the results of the Dodge Challenger crash tests:

Dodge Challenger Crash Test Ratings

Vehicle Tested Overall Frontal Side Rollover

2024 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2024 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2024 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2023 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2023 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2023 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2022 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2022 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2022 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2021 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2021 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2021 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2020 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2020 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2020 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2019 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2019 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2019 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2018 Dodge Challenger SRT Demon 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2018 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2018 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2018 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2017 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2017 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2017 Dodge Challenger 2 DR AWD 5 stars 4 stars 5 stars 4 stars

2016 Dodge Challenger SRT 2 DR RWD 5 stars 4 stars 5 stars 4 stars

2016 Dodge Challenger 2 DR RWD 5 stars 4 stars 5 stars 4 stars

Strong crash test results, like those seen with many models of the Dodge Challenger, can lead to reduced insurance rates due to perceived lower risk. Particularly, models from 2016, 2017, 2018, and 2019 which received high ratings in several categories demonstrate the potential for safety-based savings on your car insurance.

Dodge Challenger Safety Features

The more safety features you have on your Dodge Challenger, the more likely it is that you can earn a discount. The Dodge Challenger’s safety features include:

- Driver and Passenger Air Bags: Enhances safety for both the driver and the front passenger in the event of a collision.

- Head and Side Air Bags: Includes front and rear head air bags, and front side air bags for comprehensive occupant protection.

- Braking and Stability Features: Equipped with 4-wheel ABS, 4-wheel disc brakes, brake assist, and electronic stability control to maintain vehicle control.

- Driving Assistance Technologies: Features adaptive cruise control, blind spot monitor, and cross-traffic alert for improved driving safety.

- Additional Safety Features: Comes with daytime running lights and traction control to enhance visibility and traction under various driving conditions.

If you have a new car, anti-lock brakes, passive restraints, anti-theft features, or emergency roadside assistance, you may be able to get a discount on your auto insurance.

Essential Coverage for Financed Dodge Challengers

If you are financing a Dodge Challenger, most lenders will require you to carry higher Dodge Challenger coverages, including comprehensive coverage. Discover insights in our article titled “How much car insurance coverage do I need for a new car?”

Erie stands out with its competitive $35 minimum coverage rate, making it a top choice for budget-conscious Dodge Challenger owners.

Michelle Robbins Licensed Insurance Agent

This is why with financed vehicles, it’s often better to carry above the minimum, just in case anything happens to the vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Optimizing Dodge Challenger Insurance Costs

Your Dodge Challenger auto insurance premiums can be further reduced in a number of ways. Here are some pointers to consider:

- Get savings information from your insurance company.

- Consider getting special insurance if you only drive your car during the seasonal months.

- To reduce your mileage, think about using a rideshare or finding an alternative form of transportation.

- To find out how much money you can save by installing safety features, ask around.

- Insurance for your car and house can be bundled together.

To save on Dodge Challenger auto insurance, seek discounts and consider bundling with other policies like home insurance. Additionally, implementing safety features and adjusting your driving habits, such as using rideshare services to lower mileage, can lead to significant premium reductions. Delve into our evaluation of our article titled “How much does mileage affect car insurance rates?”

Dodge Challenger Top Insurance Companies

Which car insurance company has the best prices for Dodge Challengers? Here are some of the best companies for Dodge Challenger car insurance, listed by market share. The rates you actually pay will depend on a lot of things. There are savings at a lot of these stores on security systems and other safety features that come with the Dodge Challenger.

Top Dodge Challenger Insurance Companies

Rank Insurance Company Premiums Written Market Share

#1 State Farm $65.6 million 9.3%

#2 Geico $46.1 million 6.6%

#3 Progressive $39.2 million 5.6%

#4 Liberty Mutual $35.6 million 5.1%

#5 Allstate $35 million 5%

#6 Travelers $28 million 4%

#7 USAA $23.4 million 3.3%

#8 Chubb $23.3 million 3.3%

#9 Farmers $20.6 million 2.9%

#10 Nationwide $18.4 million 2.6%

Choosing the right insurance company for your Dodge Challenger involves considering various factors, including market share and the specific offerings of each provider. State Farm leads the pack with the highest market share, indicating strong consumer trust and extensive coverage options. Unlock details in our article titled “State Farm vs. Progressive Car Insurance Comparison.”

However, companies like Geico and Progressive also offer competitive rates and discounts, especially for vehicles equipped with advanced safety features, making them strong contenders for Dodge Challenger owners seeking quality insurance.

Estimating Insurance Costs for the Dodge Challenger

The average cost of insurance for the Dodge Challenger is a little over $100 per month. Of course, that is just an estimate as there are many different factors that will affect your specific rate.

Comparing quotes online will tell you exactly how much the cost of car insurance for the Dodge Challenger is.

The Dodge Challenger was introduced as a muscle car in 1970. The wheelbase was stretched two inches more than its Barracuda based platform to give it a larger interior.

Available as both a hardtop and convertible, different versions allowed for different packages including leather interior or optional dual 440 engines. Explore more ways to save in our article titled “Cheap Car Insurance for Convertibles.”

Although the Dodge Challenger ended its career as a muscle car in 1974, today it is remade as a classic car that can be insured for approximately $100 per month.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracing the History of the Dodge Challenger

Muscle cars were marked as meatier than sports cars with their beefed-up V-8 engines. The Dodge Challenger initially came out with a 383 engine but offered a dual 440 engine option. A 426 Hemi was also available for buyers who chose it for an additional $1,200.

Approximately 73,000 versions of the 1970 Dodge Challengers were produced.

In 1971, the Dodge Challenger was introduced with a couple of minor cosmetic changes. Additionally, government regulations caused the 383 engine to be produced at 300bhp.

Due to a significant drop in sales, the production numbers dwindled, resulting in only about 29,000 Dodge Challengers being manufactured that year. This decrease reflects market challenges and shifting consumer preferences during that period.

1972 brought a whole new look to the front end of the Dodge Challenger, but convertibles were dropped as were the Hemi engines. The 340 engine was reduced to 24bhp. 1972 production netted only about 28,000 cars. Explore more coverage options in our comprehensive guide titled “Does car insurance cover a hydrolocked engine?”

1973 saw the continued reduction in BHP emissions, with 150bhp in the 318 being the largest muscle offered by the Dodge Challenger.

To compensate, Dodge introduced a new 360 V8 that had 245hp. This move may have saved the declining sales of the Challenger as production was increased to approximately 32,600 cars. The Dodge Challenger entered its final year of production in 1974. Only 16,000 cars were produced with two different engine options.

Introduction of the New Dodge Challenger

Although the Dodge Challenger stopped being produced in 1974, Dodge reintroduced the Challenger as a classic model remake in 2008. The first concept car for the new Dodge Challenger was introduced at the Detroit Auto Show in 2006.

The remake is a high reproduction of the original model, down to the detailing, headlights, and shape, although the front bumper and fog lights were slightly redesigned. The standard engine for the 2008 Dodge Challenger was the 5.7L Hemi. Get more info in our detailed report titled “Adaptive Headlights Car Insurance Discounts.”

The Dodge Challenger Concept Car was featured with the original classic color Challenger orange and a black interior. It could go 0 to 60 in 4.5 seconds with the 6.1L Hemi engine. The top speed was rated at 174 miles per hour with a range of 300 miles.

Cost of Insuring a New Dodge Challenger

Whether you have a rare Dodge Challenger original or a new Dodge Challenger classic, you will need to have some type of insurance on it. Every state has different requirements for the legal minimum liability and or personal injury protection (PIP) requirements.

Offering accident forgiveness, Erie not only provides affordable rates but also peace of mind for Dodge Challenger drivers.

Daniel Walker Licensed Insurance Agent

You will need to carry the legal minimum to drive your car. The price to insure a Dodge Challenger could range drastically depending on your needs. How much more additional optional coverage you want to select depends on some factors.

Take the time to check out state laws and compare Dodge Challenger insurance quotes, which can save you tons in the long run.

Finding the average insurance costs for a Dodge Challenger is certainly important, but what is critical is finding how much car insurance costs for your Dodge Challenger.

Just like Texas insurance rates can vary dramatically from those found in California, you will want to shop around to find out exactly how much the insurance costs will be for your Challenger.

You should also know that the 2016 Dodge Challenger insurance rates might end up being quite a bit different.

This is because rates change over time. This is one of the various reasons it’s always a good idea to see what is constantly available on the market, because you may not be getting the most updated price for insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Selecting the Best Insurance for Your Needs

If your car is financed or leased, you will need to carry collision and comprehensive insurance as a requirement from your lender. If you own the car outright, it is up to you to insure your car for this type of coverage.

Collision insurance will cover your car in the event you are at fault for an accident while liability will only cover the other party’s car.

Comprehensive coverage will take care of many of other incidents, such as fire and theft. When deciding on the amount of coverage, it is best to go by the average insurance for a Dodge Challenger that your company suggests, which will ensure that your car is properly covered.

Some car insurance companies offer insurance for specialty vehicles that are only intended for joyriding and are not driven by more than a certain amount of miles annually, such as 7,500 miles per year.

If you own a rare classic Dodge Challenger, you probably only drive your car for special occasions. However, if you own a Dodge Challenger classic remake, you may be using it as your primary vehicle.

Either way, you still need a Dodge Challenger car insurance policy to protect your vehicle. The amount of coverage you select will depend on your vehicle use as well as how much insurance coverage you can afford to protect your financial assets.

If you want to buy car insurance on a Dodge Challenger, you must shop around and compare rates from multiple insurers. Don’t settle for just the first low-priced rate quote that you see. Often, taking the extra time will pay off handsomely with even cheaper rates.

Exploring Different Types of Car Insurance Coverage

Insurance coverage for a Dodge Challenger varies from state to state. Some states are historically more expensive than others based on a variety of statistics. Where you live, and the state income average can impact your base rate insurance.

Your personal driving record coupled with your age will then affect the base rate. Read our full review titled “Do all car insurance companies check your driving records?”

Erie's tailored policies for high-performance vehicles like the Dodge Challenger ensure that owners receive coverage that matches their car's unique needs.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

The type of car you drive also makes a big difference in your car insurance premium. Insurance for the Dodge Challenger usually ranges from $400 to $600 every six months, totaling approximately $1,000 per year.

The Dodge Challenger is a powerful engine that’s designed for speed and performance. Coverage may come expensive, considering its safety and reliability ratings. However, the choice of model, build options, and other factors can impact the cost of car insurance. That’s why it’s important to compare different options and choose the company that best suits your budget.

Enter your ZIP code below to access car insurance quotes from multiple companies today.

Frequently Asked Questions

What is the average cost of Dodge Challenger car insurance?

The average cost is $141 per month.

Are Dodge Challengers expensive to insure?

Compared to other coupes, Dodge Challengers can be more expensive to insure. However, there are ways to find cheaper insurance rates.

What factors affect the cost of Dodge Challenger insurance?

Factors such as the car’s model, driver’s age, location, driving record, and safety ratings can impact insurance costs.

Explore more coverage options in our guide titled, “Does driving less affect car insurance rates?”

How can I save money on Dodge Challenger insurance?

You can save money by comparing quotes from different insurance companies, maintaining a good driving record, and taking advantage of available discounts.

Which insurance companies offer Dodge Challenger insurance?

Some top insurance companies offering coverage for Dodge Challengers include those with high market share and discounts for safety features.

Who has the cheapest insurance for a Dodge Challenger?

Geico offers the cheapest insurance for a Dodge Challenger, with rates starting at $25 for minimum coverage.

Explore more add-on options in our guide titled, “Geico vs. Allstate Car Insurance Comparison.”

Is insurance higher on a Dodge Challenger?

Yes, insurance tends to be higher on a Dodge Challenger due to its classification as a high-performance sports car.

Is a Charger cheaper on insurance than a Dodge Challenger?

Typically, insurance for a Dodge Charger is slightly cheaper than for a Dodge Challenger due to lower base prices and repair costs.

What type of insurance has the lowest premium for Dodge Challenger?

Minimum liability insurance typically has the lowest premium for a Dodge Challenger, with costs varying by provider.

Find out more in our guide titled, “When should I switch to liability only car insurance?”

How much is insurance for a 2015 Dodge Challenger?

Insurance for a 2015 Dodge Challenger averages around $108 per month for full coverage.

Your Dodge Challenger car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

Is Geico cheaper than Progressive for Dodge Challenger insurance?

Yes, Geico is generally cheaper than Progressive for Dodge Challenger insurance, with lower starting rates for both minimum and full coverage.

Do newer Dodge Challenger cars cost less to insure?

No, newer Dodge Challenger cars typically cost more to insure due to higher value and repair costs.

Learn more by reading our article titled, “Does car insurance cover non-accident repairs?”

How much does insurance go up for a Dodge Challenger?

Insurance can increase significantly for a Dodge Challenger, often costing more than average due to its sports car classification and associated risks.

At what age is Dodge Challenger car insurance cheapest?

Dodge Challenger car insurance is cheapest for drivers aged 25 and above, as premiums drop significantly with increased age and driving experience.

Access comprehensive insights into our guide titled, “Best Car Insurance for Drivers Under 25.”

Are older Dodge Challenger cars cheaper to insure?

Yes, older Dodge Challenger cars are generally cheaper to insure due to lower replacement values and depreciation.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.