How do you get an Erie car insurance quote online?

Follow these 11 steps to get an Erie car insurance quote online. Erie offers auto, home, life, property, and business insurance policies, and you can save money on your premiums by having multiple policies from the company at once. Enter your ZIP code into our free tool below to compare multiple car insurance quotes for free.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Erie Insurance was founded in 1925 and has risen through industry ranks to be a top-rated Fortune 500 company

- Erie offers auto, home, life, property, and business insurance policies, and you can save money on your premiums by having multiple policies from the company at once

- Erie Insurance prides itself on it’s community initiative, the Erie Difference, and employs over 5,000 employees and 12,000 agents

Finding car insurance takes research, and it’s a wise choice to choose multiple companies and compare quotes before buying a policy. From humble beginnings in 1925 to a Fortune 500 status in 2018, Erie Insurance is a top-rated provider and worthy contestant for your next insurer.

This guide will give you the lowdown on Erie and walk you through the process of getting a free auto insurance quote online. Then, when you’re finished, you can enter your zip code on our site and compare more quotes at once.

Narrowing down the best contenders for your insurance based off coverage and cost has never been easier! Read More: Erie Car Insurance Review

Get an Erie Insurance Quote Online

Head over to erieinsurance.com. You’ll immediately notice the box to enter your zip code and request a quote, but take some time to explore first. Understanding a company and its values is vital toward finding the right provider for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Step #1 – Read Up on Erie’s Auto Coverage

Erie’s site has a dedicate and thorough auto insurance section that explores their various policies, optional add-ons and other benefits. Reading all of their offerings will help you get a good idea of what type of coverage you’d actually like to have, not just what you need by law.

Car insurance is all about balance, and even though you have to have it, you can still be in control and get your money’s worth.

Step #2 – Check Out the Company Blog

Erie Insurance has a blog you can read to get a feel for who they are and how they like to contribute to their customers’ driving experience beyond insurance limits.

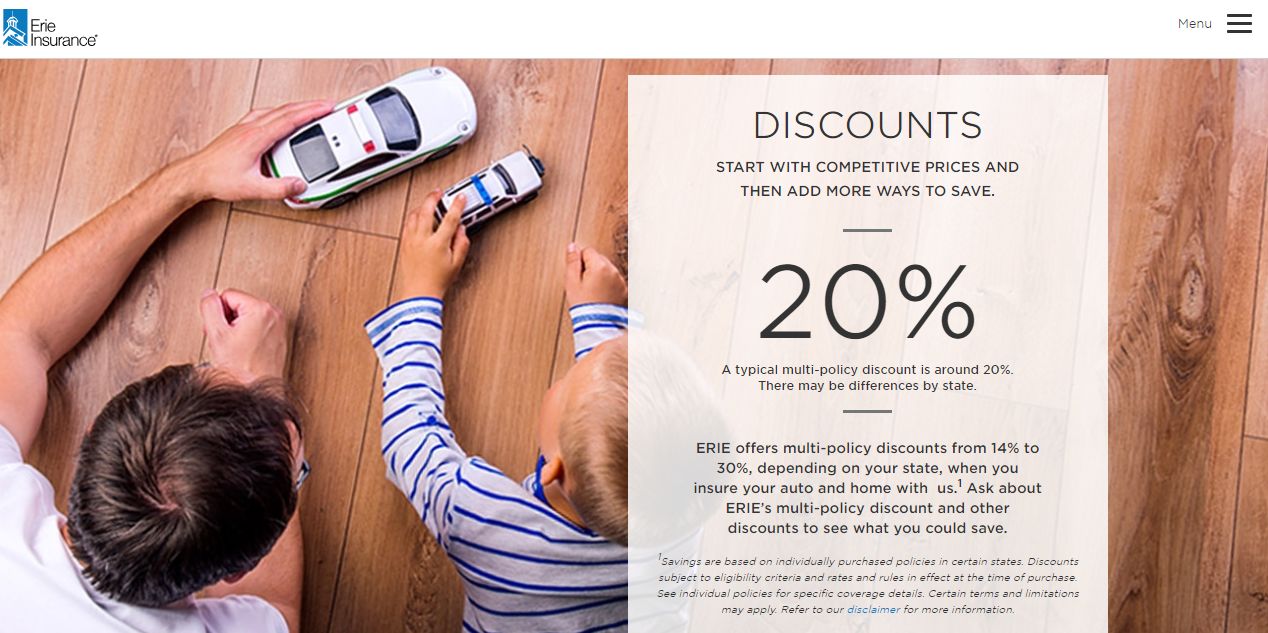

Step #3 – Discover Discounts

It may seem early, but part of company research includes knowing how they help their customers save money.

Learn about car insurance discounts to discover new ways you could be paying less for your policy just by having a certain safety feature or good driving record.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Step #4 – Enter Your Zip Code

If your investigation has won you over (or at least piqued your interest), enter your zip code in one of the boxes on the site to get started with your quote request.

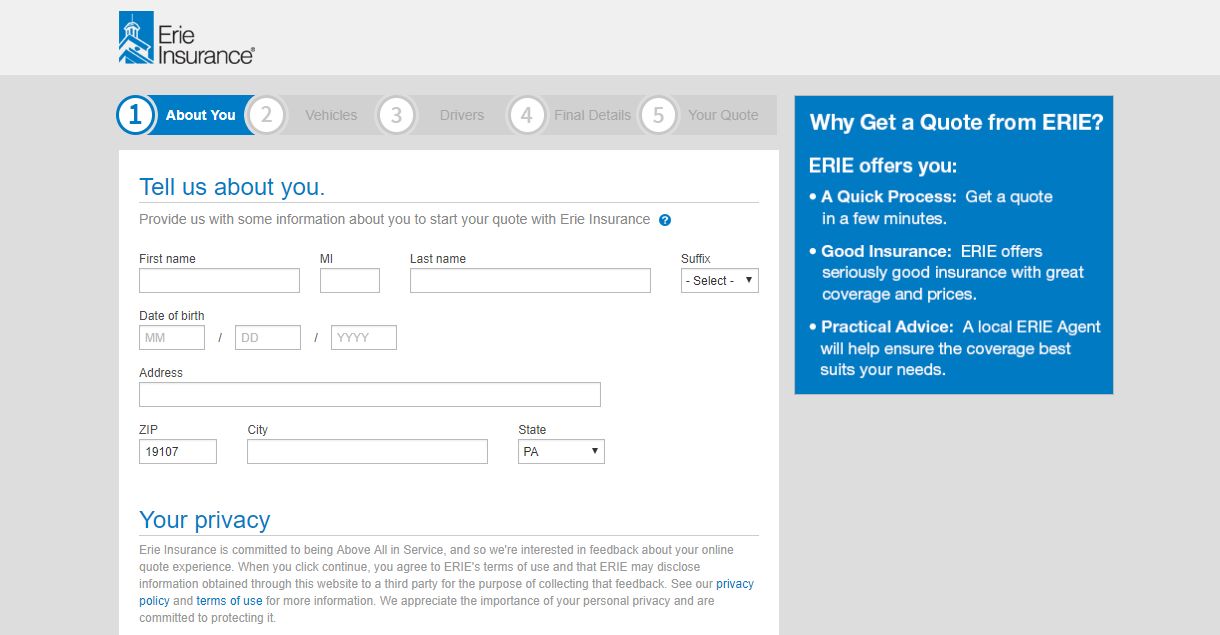

Step #5 – Provide Your Basic Details

A lot of people have understandable concerns about providing personal information for a car insurance quote online. This is another reason why research is so important.

Check out a company’s privacy policy and any disclosure agreements before you offer any details about yourself.

If things check out, entering your information will allow your quote to be more accurate and, in some cases, spare you time by pulling up relevant information from public records and inputting data for you.

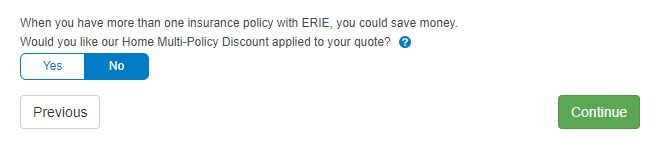

Step #6 – Get a Multi-Quote

You can get a homeowner’s insurance quote from Erie during this process as well. If you have a home and auto policy through Erie, you’ll get a discount on your premium that will be reflected in your quote.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

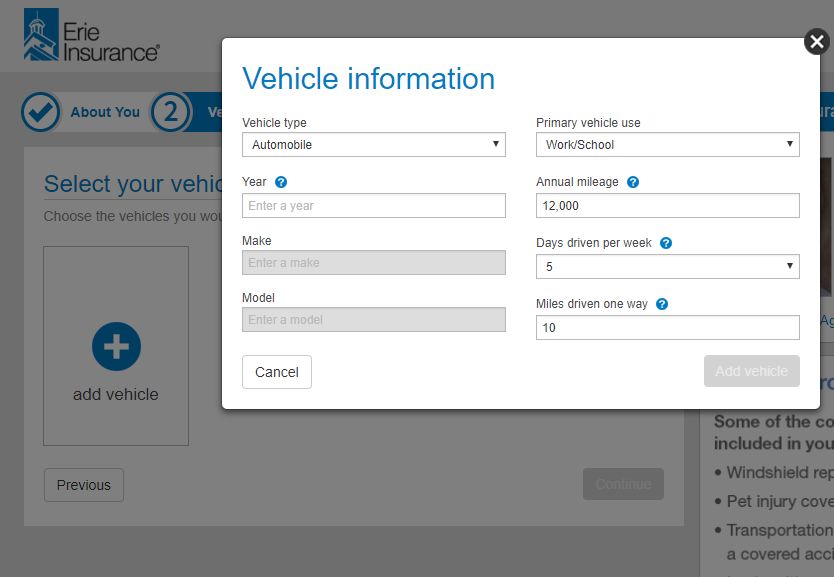

Step #7 – Enter Vehicle Info

Specify the year, make, model and type of vehicle you’re looking to insure.

There are plenty of options to choose from even if you aren’t looking for standard auto insurance. Regardless of the type of vehicle, you’ll also need to specify what you use it for, approximately how much you drive each week, each year, and one way during a typical commute.

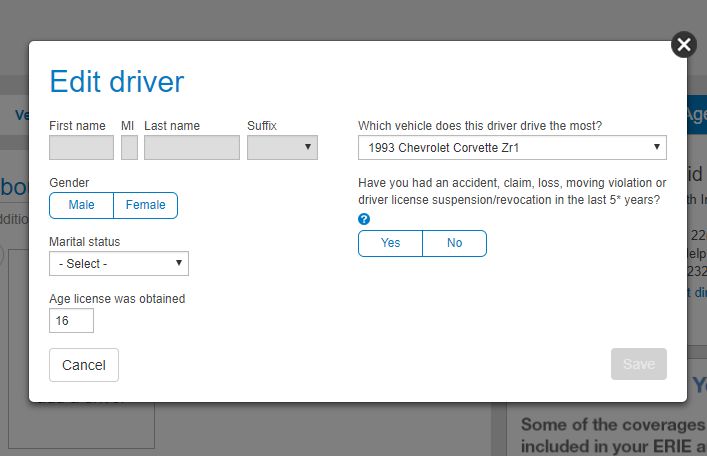

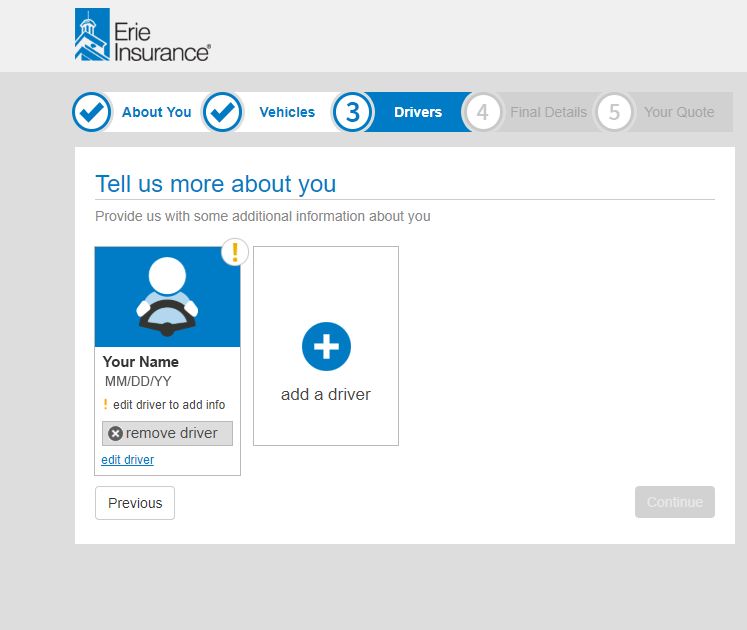

Step #8 – Add Drivers

You’ll need to add some additional details about yourself as the primary driver on the policy. You can also add additional drivers from your household.

You can add multiple drivers to a single policy, and this is recommended if there are multiple people in the same residence who use the same vehicle(s).

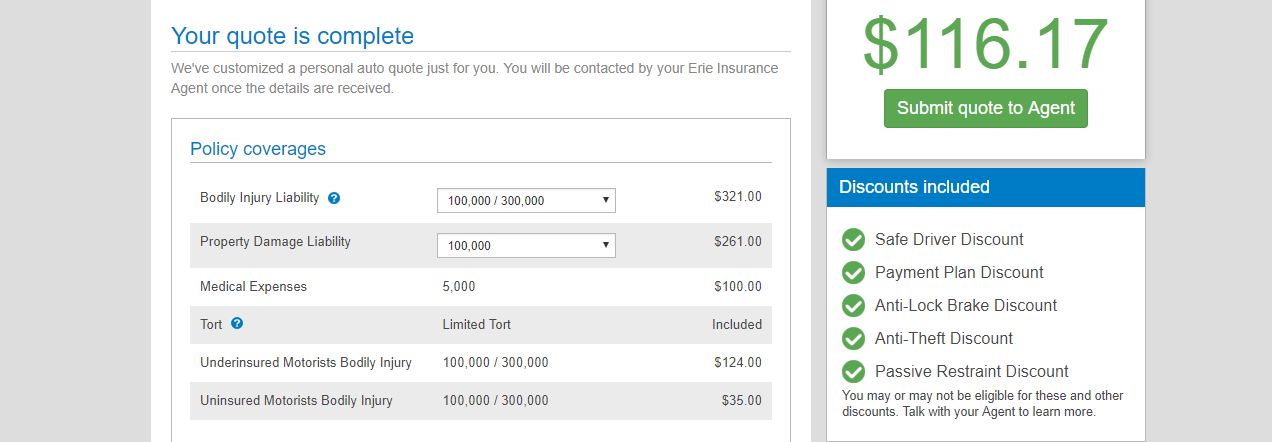

Step #9 –Review Your Quote

Erie will present your quote with a breakdown of coverages and discounts applied to your estimate. You can use the drop-down menu to increase your bodily injury and property damage liability limits, which will, in turn, affect the final quote.

If you’ve already compared quotes and are ready to buy, click “Submit a quote to an Agent” to have a local agent contact you and help you purchase a policy.

If not, continue to the next step.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Step #10 – Compare Car Insurance Quotes Online

Getting quotes from companies you’ve handpicked is great, but it’s also convenient to compare multiple quotes in one place to save yourself time. That’s where we come in.

Read more: Is it possible to get instant online car insurance?

Enter your zip code below to get free car insurance quotes to compare and find the right policy for your needs today.

- https://www.flickr.com/photos/gerrydincher/14449478846/sizes/h/

- https://www.erieinsurance.com/about/

-us - https://www.erieinsurance.com/our-history

- https://www.erieinsurance.com/

- https://www.erieinsurance.com/auto-insurance

Case Studies: Getting an Erie Car Insurance Quote Online

Case Study 1: New Policy Seeker

John is in the process of purchasing a new car and wants to obtain an Erie car insurance quote online. He navigates to the Erie Insurance website and follows the prompts to enter his personal information, vehicle details, and coverage preferences. John completes the online quote request and awaits the quote to be provided via email or displayed on the website.

Case Study 2: Policy Renewal

Sarah is an existing Erie Insurance policyholder and wants to review her options for renewal. She visits the Erie Insurance website and logs into her account. Sarah navigates to the quote section and enters any updated information about her vehicle or coverage preferences. She completes the online quote request and awaits the renewal quote to be provided.

Case Study 3: Policy Upgrade

Mike is already insured with Erie Insurance but wants to explore additional coverage options. He visits the Erie Insurance website and uses the online tools to modify his existing policy. Mike selects the coverage upgrades he is interested in, such as adding comprehensive or collision coverage. He completes the online quote request and awaits the quote reflecting the requested policy changes.

Case Study 4: Multi-Vehicle Quote

Samantha wants to insure multiple vehicles with Erie Insurance. She goes to the Erie Insurance website and uses the online quote feature specifically designed for multiple vehicles. Samantha enters the necessary information for each vehicle and selects the desired coverage options. She completes the online quote request and awaits the multi-vehicle quote from Erie Insurance.

Frequently Asked Questions

How can I get an Erie car insurance quote online?

Visit erieinsurance.com, enter your ZIP code, provide basic details and vehicle information, review the quote, and contact a local agent if ready to buy.

Can I compare multiple car insurance quotes online?

Yes, you can compare quotes from different companies by using a comparison website after receiving a quote from Erie.

Is my personal information safe when getting a quote online?

Erie Insurance takes privacy seriously and uses secure encryption to protect your information. Review their privacy policy before providing personal details.

Can I get a multi-policy quote from Erie?

Yes, you can request a homeowner’s insurance quote along with your car insurance quote from Erie to potentially qualify for a premium discount.

Can I get an Erie car insurance quote without giving personal information?

No, you need to provide basic personal and vehicle details to receive an accurate quote. Rest assured, Erie Insurance values data security and privacy. Check their privacy policy for more information.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.