Liberty Mutual Car Insurance Review for 2026 [See Rates & Discounts Here]

Liberty Mutual auto coverage starts at $60 per month, offering accident forgiveness, RightTrack, and OEM parts replacement. Explore our Liberty Mutual car insurance review to see how drivers can save up to 25% for bundling and 20% for safe driving, with rates based on age, credit, and violations.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated May 2025

Discover how the Liberty Mutual car insurance review reveals a data-driven approach to pricing, with rates starting at $60 per month based on individual risk factors.

Liberty Mutual Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.3 |

| Business Reviews | 4.0 |

| Claims Processing | 3.3 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.2 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.4 |

Backed by the Liberty Mutual Group, Liberty Mutual Insurance Company tailors coverage to driver profiles, offering personalized options that go beyond one-size-fits-all plans.

Compare quotes from other providers to see if Liberty Mutual offers the best deal for your driving habits, budget, and cheap car insurance options.

- Liberty Mutual car insurance starts at $60/month with flexible coverage options

- Offers savings up to 25% for bundling and 20% for safe driving

- Custom features include RightTrack, OEM parts, and accident forgiveness

Find better rates today with Liberty Mutual. Enter your ZIP code to compare quotes from trusted car insurance providers in your area and get customized offers instantly.

Liberty Mutual Car Insurance Cost

Liberty Mutual car insurance monthly rates by coverage level show a clear trend for younger drivers, especially males, pay significantly more than older, more experienced drivers. A 16-year-old male pays $325 for minimum coverage, while a 60-year-old female pays just $60, making comparison essential when searching for the best car insurance for 16-year-olds.

Liberty Mutual Car Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $283 | $723 |

| 16-Year-Old Male | $325 | $785 |

| 18-Year-Old Female | $231 | $522 |

| 18-Year-Old Male | $279 | $626 |

| 25-Year-Old Female | $72 | $187 |

| 25-Year-Old Male | $83 | $215 |

| 30-Year-Old Female | $67 | $174 |

| 30-Year-Old Male | $77 | $200 |

| 45-Year-Old Female | $66 | $171 |

| 45-Year-Old Male | $68 | $174 |

| 60-Year-Old Female | $60 | $148 |

| 60-Year-Old Male | $64 | $159 |

| 65-Year-Old Female | $65 | $167 |

| 65-Year-Old Male | $66 | $170 |

Rates decrease steadily with age, and females receive slightly lower premiums than males. This pricing reflects Liberty Mutual Insurance Company’s risk-based approach to setting premiums.

Full Coverage Car Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $160 | $200 | $275 | |

| $150 | $185 | $255 | |

| $155 | $195 | $260 | |

| $135 | $165 | $210 | |

| $180 | $220 | $290 |

| $145 | $175 | $240 |

| $150 | $185 | $250 | |

| $140 | $170 | $230 | |

| $155 | $190 | $265 | |

| $125 | $155 | $200 |

Full coverage car insurance rates vary by credit score, with Liberty Mutual charging $180 for good and $290 for bad credit. While Liberty Mutual offers solid options, USAA remains the most affordable at $125 and is often ranked among the best full coverage car insurance providers.

Credit scores affect insurance rates because they help predict risk. Improving your score can lower your premium. For example, paying down debt may reduce costs.

Michelle Robbins Licensed Insurance Agent

This data highlights how credit scores significantly impact insurance premiums across providers.

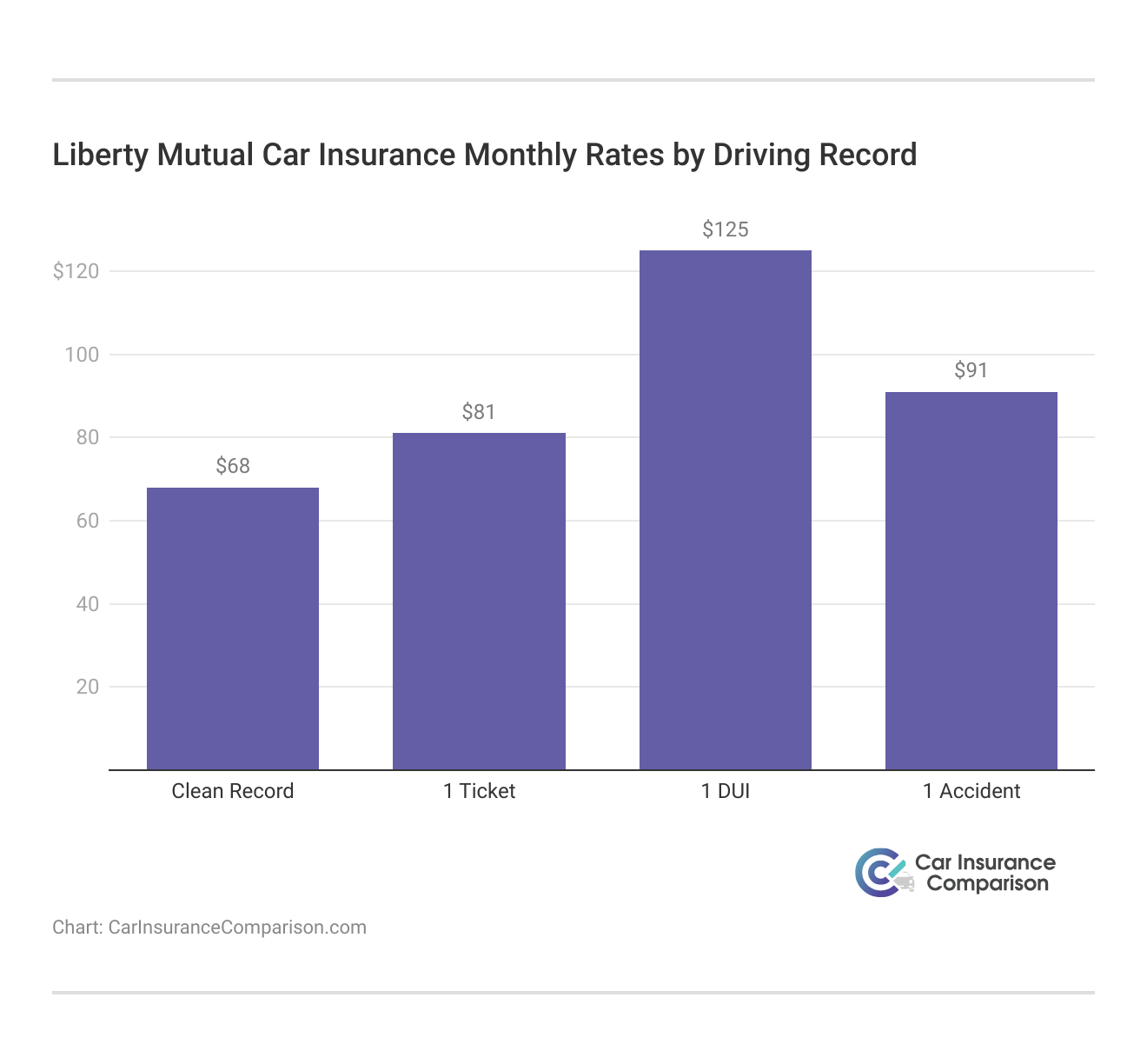

Liberty Mutual car insurance rates rise with violations, from $81 with a clean record to $125 after a DUI. Even a single accident or ticket increases premiums, showing how driving history impacts costs.

Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $50 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Compare car insurance rates by company, and you’ll see Liberty Mutual is one of the more expensive options at minimum and $248 for full coverage. USAA has the least expensive rates for at $32 and $84. This comparison also serves as reminder that it pays literally to shop around for value.

Liberty Mutual’s prices are determined by age, credit score, driving history, and its policies are often more expensive than its competition, like USAA and Geico. Reviewing the average car insurance rates by age and gender can help you understand how your profile affects premiums. Comparing quotes is essential to find the best value.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual Car Insurance Discounts and Ways to Save

Liberty Mutual offers a ton of discounts, factoring in driving habits, vehicle features, and even personal elements, such as up to a 25% discount for bundling and up to a 20% discount for safe driving. These choices would make it an attractive choice for budget-oriented drivers.

Liberty Mutual Car Insurance Discounts

| Discount |  |

|---|---|

| Accident-Free | 20% |

| Affinity Group | 15% |

| Bundling | 25% |

| Good Student | 12% |

| Hybrid/Electric Vehicle | 10% |

| Loyalty | 10% |

| Military | 10% |

| Multi-Car | 20% |

| New Driver | 15% |

| Paperless | 3% |

| Pay-in-Full | 12% |

| Safe Driver | 20% |

| Vehicle Safety | 12% |

Alongside its standard discounts, Liberty Mutual offers extra savings for safe driving, low mileage, and responsible lifestyle choices, providing added value for qualifying drivers.

- RightTrack Program: This usage-based program tracks braking, acceleration, and mileage through an app or device, offering discounts to drivers who show safe habits.

- Defensive Driving Course: A state-approved defensive driving course can reduce your premium, especially if you’re over 50, and may help you practice safer driving.

- Low Mileage Discount: Drivers who travel less than 5,000 miles a year may qualify for lower rates, making this discount ideal for remote workers, retirees, or short-distance commuters.

- Homeowner Discount: Liberty Mutual offers a homeowner discount, even if your home is insured elsewhere, rewarding the financial stability of homeownership.

- New Graduate Discount: Recent grads might qualify for a discount because Liberty Mutual sees education as an indicator of responsible, low-risk behavior.

With a wide range of standard and specialized discounts, Liberty Mutual makes it easier for drivers to find savings tailored to their lifestyle and habits.

Whether bundling policies, driving safely, or qualifying through education or homeownership, these options help reduce costs while maintaining quality coverage, especially when paired with strategies from the best defensive driving tips to enhance your on-road safety and lower risk profile.

Liberty Mutual Car Insurance Rates by State and Mileage

Liberty Mutual car insurance rates differ significantly by state, with premiums in places like Delaware, Minnesota, and North Dakota more than double the U.S. average. Meanwhile, states such as Montana, Illinois, and North Carolina offer below-average rates.

Liberty Mutual Full Coverage Insurance Monthly Rates vs. U.S. Average by State

| States |  | U.S. Average | Percent Difference |

|---|---|---|---|

| Alabama | $334 | $297 | 12% |

| Alaska | $441 | $285 | 55% |

| Arizona | $350 | $314 | 11% |

| Arkansas | $375 | $344 | 9% |

| California | $253 | $307 | -18% |

| Colorado | $233 | $323 | -28% |

| Connecticut | $607 | $385 | 58% |

| Delaware | $1,530 | $499 | 207% |

| Florida | $447 | $390 | 15% |

| Georgia | $838 | $414 | 102% |

| Hawaii | $266 | $213 | 25% |

| Idaho | $192 | $248 | -23% |

| Illinois | $190 | $275 | -31% |

| Indiana | $482 | $285 | 69% |

| Iowa | $368 | $248 | 48% |

| Kansas | $399 | $273 | 46% |

| Kentucky | $494 | $433 | 14% |

| Louisiana | $500 | $476 | 5% |

| Maine | $361 | $246 | 47% |

| Maryland | $775 | $382 | 103% |

| Massachusetts | $362 | $223 | 62% |

| Michigan | $1,667 | $875 | 91% |

| Minnesota | $1,130 | $367 | 208% |

| Mississippi | $371 | $305 | 22% |

| Missouri | $377 | $277 | 36% |

| Montana | $111 | $268 | -59% |

| Nebraska | $520 | $274 | 90% |

| Nevada | $517 | $405 | 28% |

| New Hampshire | $704 | $263 | 168% |

| New Jersey | $564 | $460 | 23% |

| New Mexico | $325 | $289 | 13% |

| New York | $545 | $357 | 52% |

| North Carolina | $182 | $283 | -36% |

| North Dakota | $1,071 | $347 | 209% |

| Ohio | $369 | $226 | 63% |

| Oklahoma | $573 | $345 | 66% |

| Oregon | $361 | $289 | 25% |

| Pennsylvania | $505 | $336 | 50% |

| Rhode Island | $515 | $417 | 24% |

| South Carolina | $342 | $315 | 8% |

| South Dakota | $626 | $332 | 89% |

| Tennessee | $517 | $305 | 70% |

| Texas | $375 | $337 | 11% |

| Utah | $361 | $301 | 20% |

| Vermont | $302 | $270 | 12% |

| Virginia | $208 | $196 | 6% |

| Washington | $333 | $255 | 31% |

| Washington, D.C. | $408 | $370 | 10% |

| West Virginia | $244 | $216 | 13% |

| Wisconsin | $563 | $301 | 87% |

| Wyoming | $166 | $267 | -38% |

These differences show how location heavily influences pricing based on local risk and regulations. Comparing your state’s rates to the national average can help you better assess Liberty Mutual’s value.

Liberty Mutual Full Coverage Insurance Monthly Rates by Annual Mileage

| Mileage |  |

|---|---|

| 6,000 Miles | $500 |

| 12,000 Miles | $513 |

Liberty Mutual car insurance rates increase slightly with higher annual mileage, rising from $500 at 6,000 miles to $513 at 12,000 miles.

Bundle auto and home or renters insurance with Liberty Mutual to unlock up to 25% in savings and streamline your coverage.

Chris Tepedino Feature Writer

This modest difference highlights why Liberty Mutual can be a competitive option for drivers seeking the best low-mileage car insurance with minimal rate impact.

Liberty Mutual Auto Insurance Coverage Options Explained

When it comes to finding the best auto insurance, the hunt begins with knowing what your choices are. Liberty Mutual Insurance provides important insurance options such as liability, collision, and comprehensive coverage to help protect you and your vehicle against damage and provide coverage for injuries.

- Liability Coverage: Liability coverage pays for bodily injury and property damage to others you cause in an at-fault accident. It covers things like medical costs, lost wages and repair costs and is mandatory in most states.

- Collision Coverage: Covers repair or replacement costs for your vehicle after a collision, whether you hit another car or an object or are in a single-car accident, regardless of fault.

- Comprehensive Coverage: Protects your vehicle against non-collision damage such as theft, vandalism, natural disasters, fire, and animal collisions, saving you from unexpected events.

- Uninsured/Underinsured Motorist Coverage: Provides coverage if you’re hit by a driver with no or insufficient insurance, helping pay for medical bills, lost income, and other related expenses.

- Medical Payments Coverage (MedPay): Assists with paying for medical expenses for you and your passengers as a result of an accident, regardless of fault.

Understanding these key coverage options can help you build a policy that fits your needs and offers peace of mind.

From being able to protect yourself from uninsured drivers to cover medical expenses following an accident, understanding car accidents is key to choosing the proper protection. Liberty Mutual’s flexible coverage choices provide essential support when it matters most.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual Car Insurance Reviews and Ratings

Liberty Mutual’s business ratings and consumer reviews present a mixed but generally positive picture of its performance and reliability. With a J.D. Power score of 717 out of 1,000, the company ranks above average in customer satisfaction.

Liberty Mutual Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 717 / 1,000 Above Avg. Satisfaction |

|

| Score: A- Good Business Practices |

|

| Score: A- Good Business Practices |

|

| Score: 4.28 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Liberty Mutual earns an A from BBB and Consumer Reports for solid business practices, while A.M. Best rates it A for strong financial stability. However, its 4.28 NAIC score indicates more customer complaints than the industry average.

This 5-star review from Reddit user John A. highlights a long-term positive experience with Liberty Mutual. A satisfied customer since 1992 for both auto and home insurance, John is very happy with how the company has been very flexible and provided better than average service.

His feedback reflects strong satisfaction and trust built over decades, reinforcing Liberty Mutual’s commitment to customer loyalty and reliable support in a competitive car insurance company comparison.

Liberty Mutual Car Insurance Pros and Cons

It is important to compare the pros and cons that may affect your coverage and total costs before you select the car insurance provider that is right for you.

Pros

- Customizable Coverage Options: Liberty Mutual allows drivers to tailor policies with optional add-ons like accident forgiveness, deductible fund, and new car replacement coverage.

- Strong Digital Tools: The mobile app and online portal make it easy to manage policies, file claims, and access ID cards without needing to log in.

- Wide Availability: Liberty Mutual operates in all 50 states and Washington, D.C., making it accessible to a broad customer base.

Liberty Mutual offers a range of benefits tailored to tech-savvy and safety-conscious drivers, but there are also some drawbacks to consider depending on your profile and needs.

Cons

- Higher Premiums for High-Risk Drivers: Rates are less competitive for young drivers, those with poor credit, or individuals with a driving violation.

- Inconsistent Claims Satisfaction: While many customers report positive experiences, Liberty Mutual has a higher-than-average complaint index with the NAIC.

Liberty Mutual has customizable coverage, digital convenience and a national network of trusted advisors. But its higher rates for some driver profiles and mixed claims satisfaction might not be the right fit for every driver.

Comparing Liberty Mutual’s rates, coverage options, and best car insurance discounts with competitors helps you find the correct value for your budget and driving needs.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Liberty Mutual Car Insurance Flexible Coverage and Savings

With great financial stability, numerous coverage options and generous discounts, Liberty Mutual remains a trustworthy option for many drivers. The Liberty Mutual auto insurance review shows strengths such as flexibility to customize policies, digital convenience and savings such as RightTrack discounts.

However, it shows weaknesses like higher rates for high-risk drivers and more complaints than average. While not the best car insurance for high-risk drivers, Liberty Mutual offers flexible coverage and digital tools, making quote comparison key to finding the best value.

Finding cheap car insurance quotes is easy. Enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Frequently Asked Questions

How much can I save with RightTrack Liberty Mutual?

Drivers can earn up to 30% discount on their car insurance premium, depending on how safely they drive during the program’s monitoring period.

What do Liberty Mutual RightTrack reviews say about the app’s accuracy?

Many users find the tracking accurate for most trips, but some reviews mention occasional trip misclassification or challenges when passengers use the phone.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

What type of Liberty car insurance does Tesla recommend for EV owners?

Tesla often recommends Liberty Mutual’s comprehensive policy with OEM parts coverage, which ensures repairs use Tesla-approved components for safety and performance, making it one of the best car insurance companies that cover OEM parts for electric vehicle owners.

How good is Liberty Mutual car insurance for safe drivers?

Liberty Mutual rewards safe drivers with programs like RightTrack, which offers discounts of up to 30% for consistent safe driving habits.

How do Liberty car insurance reviews rate the mobile app and online tools?

Many reviewers praise Liberty Mutual’s app and website for ease of use, including features like paperless billing, claims tracking, and digital ID access.

Can I schedule a future date for Liberty Mutual insurance cancellation?

Liberty Mutual allows you to set a future cancellation date to avoid coverage gaps while transitioning to a new provider, which is especially important when managing gap insurance pricing and coverage on financed or leased vehicles.

Will Liberty Mutual’s comprehensive insurance cover flood or hail damage?

Yes, Liberty Mutual comprehensive insurance includes protection against natural disasters such as floods, hailstorms, and falling branches.

Who provides more discounts, American Family vs Liberty Mutual?

Both offer a range of discounts, but Liberty Mutual provides unique options like the RightTrack usage-based program, whereas American Family includes teen driver and generational discounts.

Is AAA or Liberty Mutual cheaper for car insurance?

AAA is usually cheaper than Liberty Mutual, with rates starting around $55/month versus Liberty Mutual’s $81/month, though Liberty offers more customization and efficient claims processing despite occasional delays. To avoid issues, file a car insurance claim promptly and ensure all required documentation is accurate and complete.

Can I retrieve my Liberty Mutual policy number without logging in?

You may be able to retrieve your policy number by calling customer service and verifying your identity, but logging into your account is the fastest method.

How much is Liberty Mutual car insurance a month for high-risk drivers?

Which company offers lower rates between Liberty Mutual vs Infinity?

What are the most common Liberty Mutual RightTrack complaints?

What’s the difference between Liberty Mutual roadside assistance vs. AAA?

Can I adjust coverage options after receiving a car insurance quote Liberty Mutual shows?

How should I interpret Liberty Mutual car insurance rating when choosing coverage?

Can I customize coverage when requesting a Liberty insurance quote?

Is Liberty Mutual a good car insurance provider for new drivers?

Does Liberty Mutual average car insurance cost vary by state?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.