Safeway Car Insurance Review for 2026 [Real User Experiences Shared]

Our Safeway car insurance review found it stands out for add-on coverage, including roadside assistance and custom equipment protection. However, Safeway auto insurance rates are higher than average, starting at $107/month, and customer complaints about poor responsiveness during claims might make some hesitate.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated January 2025

Our Safeway car insurance review found it has great add-on options and provides some of the best car insurance discounts for good drivers and bundling auto and home policies.

However, the company’s rates are higher than those of competitors like State Farm, and customer satisfaction is mixed, with complaints about unresponsiveness during claims.

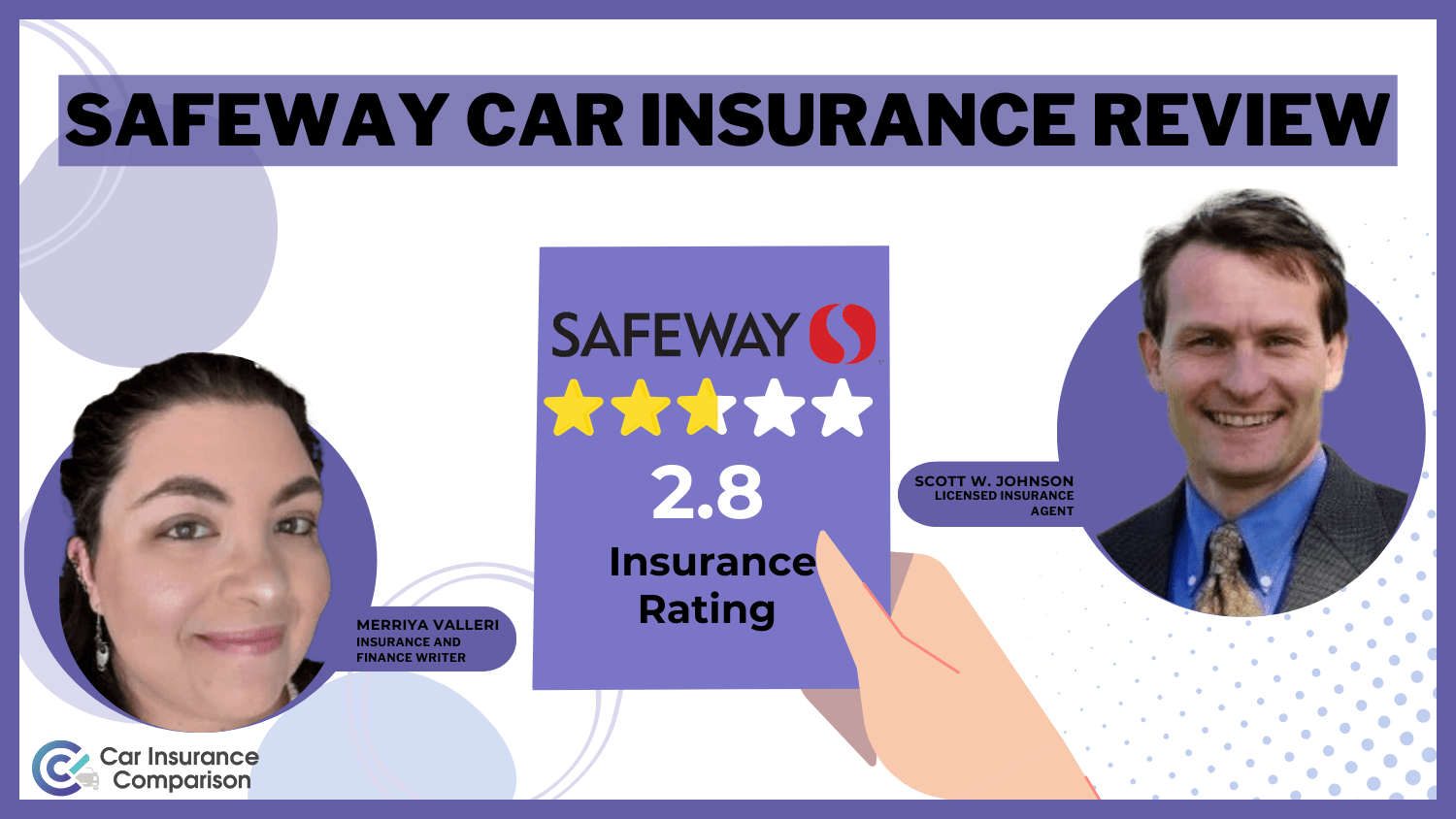

Safeway Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 2.8 |

| Business Reviews | 2.0 |

| Claim Processing | 2.0 |

| Company Reputation | 2.0 |

| Coverage Availability | 2.1 |

| Coverage Value | 2.6 |

| Customer Satisfaction | 3.5 |

| Digital Experience | 2.0 |

| Discounts Available | 4.7 |

| Insurance Cost | 3.7 |

| Plan Personalization | 2.0 |

| Policy Options | 2.5 |

| Savings Potential | 4.0 |

Safeway is best suited for drivers with clean records who value add-ons and discounts but may not be the best choice for those seeking the lowest rates and great customer service. Be sure to compare multiple insurance quotes to find the best deal.

- Safeway Insurance car insurance rates start at $107 a month

- Safeway customers can bundle home and auto insurance for a discount

- The company has multiple complaints from Safeway customers

Safeway Car Insurance Rates

How much is Safeway insurance? Most customers want coverage at an affordable price, but many factors affect how much you’ll pay for Safeway Insurance coverage, such as your age and gender (Learn More: Average Car Insurance Rates by Age and Gender).

Safeway Car Insurance Monthly Rates by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $223 | $407 |

| 16-Year-Old Male | $249 | $429 |

| 18-Year-Old Female | $196 | $364 |

| 18-Year-Old Male | $239 | $414 |

| 25-Year-Old Female | $163 | $287 |

| 25-Year-Old Male | $177 | $302 |

| 30-Year-Old Female | $143 | $268 |

| 30-Year-Old Male | $151 | $279 |

| 45-Year-Old Female | $127 | $239 |

| 45-Year-Old Male | $135 | $248 |

| 60-Year-Old Female | $112 | $221 |

| 60-Year-Old Male | $118 | $227 |

| 65-Year-Old Female | $107 | $213 |

| 65-Year-Old Male | $111 | $219 |

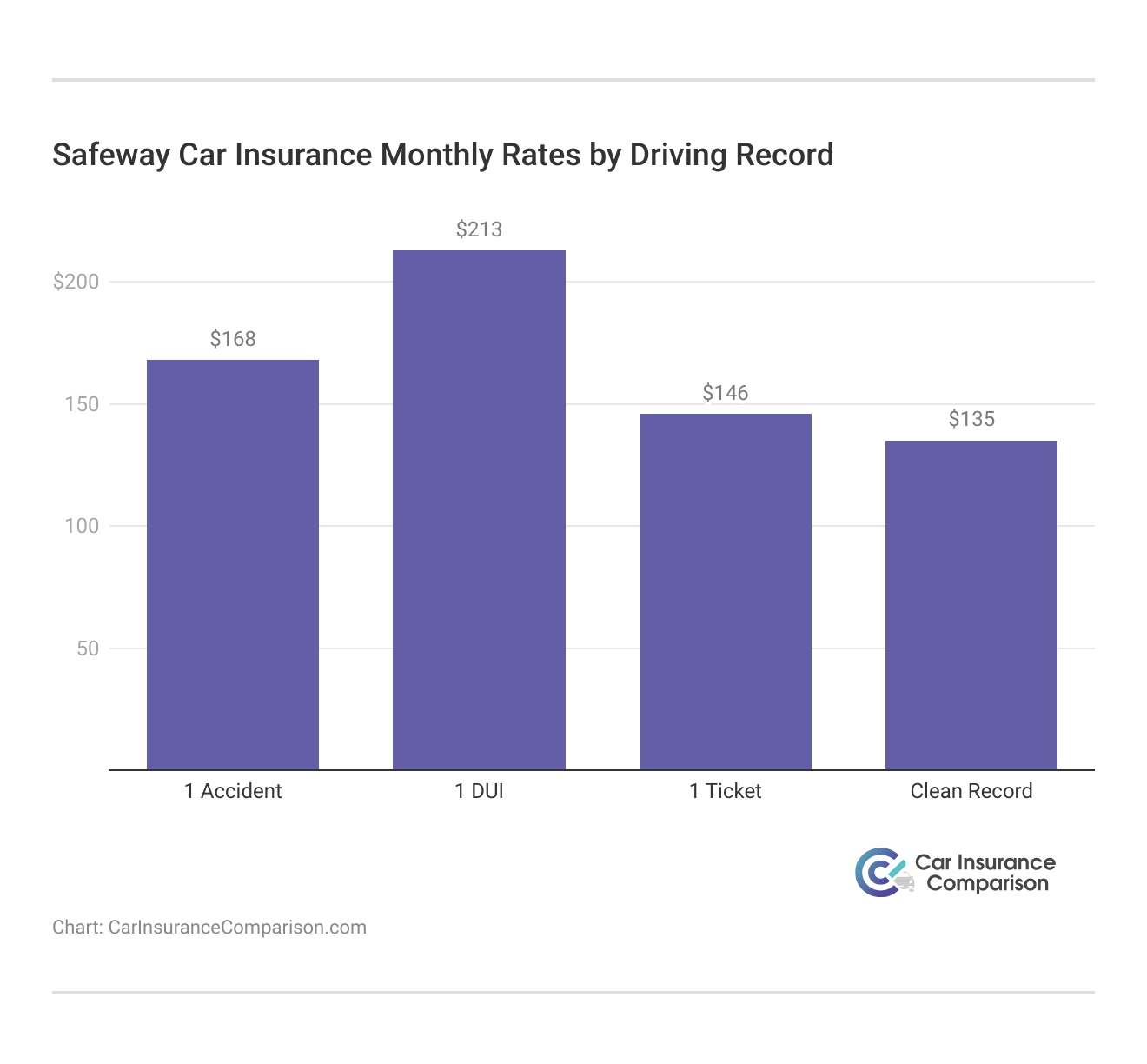

Safeway Insurance car insurance rates will also depend on a driver’s record. Rates will be the cheapest for drivers with no accidents, tickets, or DUIs in their history.

While minimum coverage seems like the economical choice at Safeway Insurance, it offers barely any protection to drivers. If you cause an accident or crash into a fence, for example, none of your costs will be covered unless you have full coverage.

Unless your vehicle is ancient and no longer worth much, we recommend purchasing Safeway full coverage if you can afford it.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safeway Car Insurance Rates vs. the Competition

Looking at Safeway auto insurance rates by themselves gives us just one part of the picture, so it is crucial to see how Safeway compares to other companies to determine its true affordability.

Safeway Car Insurance Monthly Rates vs. Top Competitors

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $92 | $162 | |

| $72 | $115 | |

| $80 | $139 | |

| $50 | $80 | |

| $105 | $171 |

| $69 | $113 |

| $65 | $112 | |

| $75 | $125 | |

| $50 | $86 | |

| $60 | $98 |

Other companies, such as Allstate and Farmers, are pricier than Safeway Insurance, but Safeway is still one of the more expensive companies. You will likely find a better deal at companies like State Farm or Progressive if you are a good driver.

Comparing companies' rates allows you to evaluate different coverage options and pricing, helping you find the best auto insurance deal that fits your needs and budget.

Brandon Frady Licensed Insurance Producer

Because driving records also play a big role in your auto insurance rates, see how Safeway Insurance compares to other companies based on tickets, accidents, and DUIs.

Monthly Car Insurance Rates by Driving Record: Safeway vs. Competitors

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $130 | $165 | $200 | $155 | |

| $120 | $150 | $185 | $145 | |

| $125 | $155 | $195 | $150 | |

| $100 | $135 | $170 | $120 | |

| $140 | $175 | $210 | $165 |

| $115 | $145 | $180 | $135 |

| $115 | $155 | $190 | $140 | |

| $125 | $160 | $185 | $150 | |

| $110 | $145 | $180 | $135 | |

| $120 | $150 | $190 | $140 |

Once again, Safeway is not the most expensive company for drivers with driving infractions, but it is also not the cheapest (Read More: Best Car Insurance for a Bad Driving Record).

Car Insurance Coverages at Safeway

Safeway car insurance company sells coverages that meet your state’s requirements and a few extras for those who want more coverage.

Safeway Car Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage to others |

| Collision Coverage | Pays for damage to your vehicle in an accident |

| Comprehensive Coverage | Covers non-collision events like theft or vandalism |

| Uninsured/Underinsured Motorist | Protects you from drivers with little or no insurance |

| Medical Payments (MedPay) | Covers medical expenses for you and your passengers |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages |

| Roadside Assistance | Provides services like towing and jump-starts |

| Rental Car Reimbursement | Pays for a rental car while your vehicle is being repaired |

| Custom Equipment Coverage | Protects aftermarket additions like custom wheels |

Safeway offers some great add-ons like roadside assistance and custom equipment coverage. However, Safeway doesn’t offer gap coverage, which can be a great way to protect new vehicles for the first year or two of ownership.

Learn More: Compare Car Insurance by Coverage Type

Safeway Car Insurance Discounts

One way to save on your Safeway insurance payment online is to apply for discounts at the company. The two biggest discounts Safeway offers are a good driver discount and a bundling discount, which is available when you buy both auto and home or renters insurance.

Safeway Car Insurance Discounts

| Discount Name |  |

|---|---|

| Good Driver | 20% |

| Bundling | 20% |

| Multi-Car | 15% |

| Paid-in-Full | 12% |

| Defensive Driving | 10% |

| Good Student | 10% |

| Military/Veteran | 10% |

| Homeownership | 8% |

| Low Mileage | 6% |

| Anti-Theft Device | 5% |

You can also take advantage of a few other small discounts, such as installing an anti-theft device in your car (Read More: Best Anti-Theft Car Insurance Discounts).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Reviews of Safeway

Seeing what customers say about Safeway is important, as negative reviews could point to issues with customer service and more.

Reviews of Safeway are mixed, and there are multiple complaints from drivers who were hit by a Safeway customer having issues with a third-party claim, such as in the Reddit review below.

Was rear-ended by driver with Safeway Insurance earlier this year. Safeway won’t answer their phones or return my calls. What are my options at this point?

byu/secretgoose inInsurance

A recurring theme in negative Safeway reviews seems to be issues with unresponsiveness on the Safeway insurance phone number during the claim process. Some drivers have also stated that they filed a Safeway insurance lawsuit because of denied claims.

Read More: How do you file a claim on someone else’s car insurance?

Business Ratings of Safeway Car Insurance Company

Business ratings of Safeway Insurance Group are mixed, as you can see in the table of Safeway business ratings below.

Safeway Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 815 / 1,000 Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 68/100 Avg. Customer Feedback |

|

| Score: 1.22 More Complaints Than Avg. |

|

| Score: A- Good Financial Strength |

How do customer satisfaction ratings affect car insurance companies? Safeway has a higher-than-average number of complaints filed against it with the NAIC, and it only has average customer satisfaction scores with J.D. Power and Consumer Reports.

J.D. Power rates car insurance companies based on customer satisfaction, evaluating claims experience, pricing, policy offerings, and customer service to help consumers make informed decisions.

Laura Berry Former Licensed Insurance Producer

While Safeway does have an A- from A.M. Best for financial strength, it only has a B rating from the BBB for business practices.

Safeway Car Insurance Pros and Cons

We’ve covered quite a bit in our review, so we want to take a moment to recap the most important pros and cons of Safeway Insurance. We found that the main pros of Safeway are:

- Discount Options: Safeway customers can apply for several discounts, making coverage more affordable.

- Add-On Options: Safeway has roadside assistance, rental car reimbursement, and custom equipment coverage for modified cars (Learn More: Best Car Insurance for Modified Cars).

- Financial Strength: Safeway has a decent rating from A.M. Best.

While these pros are great, we found some cons that may give potential customers pause. Consider the following before buying Safeway car insurance:

- Customer Satisfaction: Safeway has just average ratings for satisfaction and more complaints than the average.

- Higher Rates: Safeway is not the cheapest for car insurance, as several other providers are offering better deals.

If Safeway had better customer and business ratings, the higher cost would have been justified, but Safeway doesn’t stand out in terms of customer service or price.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Safeway as Your Car Insurance Provider

Our Safeway car insurance review found Safeway’s valuable add-on options like roadside assistance and custom equipment coverage and a strong financial rating of A- from A.M. Best. However, a major con is its higher-than-average rates compared to competitors.

Safeway also has poor reviews from customers and multiple complaints. If you’re considering Safeway but want to stop overpaying for car insurance, make sure to compare multiple insurance companies online to ensure you find the best policy for your needs. Enter your ZIP in our free tool to get started.

Frequently Asked Questions

Is Safeway insurance good for car insurance?

Safeway may be the right choice for some customers, but it is not one of the best car insurance companies on the market.

Does Safeway insurance pay claims?

Yes, Safeway pays auto insurance claims. However, it only has average ratings from customers for claims satisfaction.

Does Safeway insurance have full coverage?

Yes, Safeway Insurance Company sells full coverage auto insurance policies (Read More: Full Coverage vs. Liability Car Insurance).

Who is Safeway Insurance owned by?

The Parrillo family owns Safeway Insurance Group.

What is the most trusted car insurance company?

One of the most trusted companies is USAA. Learn more by checking out our USAA car insurance review.

Is Safeway insurance non-standard?

Safeway does offer non-standard insurance. What does non-standard auto insurance mean? It is simply high-risk coverage for drivers with a DUI or other driving infractions. If you want to find cheap coverage as a high-risk driver, compare rates with our free quote tool.

How much can I get from a Safeway settlement?

How much you can get from a Safeway settlement depends on the claim, your coverage, and more.

Does Safeway insurance have a grace period?

Yes, Safeway has a grace period if you miss a payment, but you will be charged a late fee. To avoid this, choose a car insurance payent method that is reliable, such as automatic payments.

Does Safeway insurance cover rental cars?

Safeway insurance will cover a rental car during a covered claim if you have rental reimbursement coverage (Learn More: Best Rental Car Reimbursement Coverage).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Safeway insurance rated by AM Best?

Yes, Safeway Insurance Group has an A- rating from A.M. Best.

Safeway may be the right choice for some customers, but it is not one of the best car insurance companies on the market.

Yes, Safeway pays auto insurance claims. However, it only has average ratings from customers for claims satisfaction.

Does Safeway insurance have full coverage?

Yes, Safeway Insurance Company sells full coverage auto insurance policies (Read More: Full Coverage vs. Liability Car Insurance).

Who is Safeway Insurance owned by?

The Parrillo family owns Safeway Insurance Group.

What is the most trusted car insurance company?

One of the most trusted companies is USAA. Learn more by checking out our USAA car insurance review.

Is Safeway insurance non-standard?

Safeway does offer non-standard insurance. What does non-standard auto insurance mean? It is simply high-risk coverage for drivers with a DUI or other driving infractions. If you want to find cheap coverage as a high-risk driver, compare rates with our free quote tool.

How much can I get from a Safeway settlement?

How much you can get from a Safeway settlement depends on the claim, your coverage, and more.

Does Safeway insurance have a grace period?

Yes, Safeway has a grace period if you miss a payment, but you will be charged a late fee. To avoid this, choose a car insurance payent method that is reliable, such as automatic payments.

Does Safeway insurance cover rental cars?

Safeway insurance will cover a rental car during a covered claim if you have rental reimbursement coverage (Learn More: Best Rental Car Reimbursement Coverage).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Safeway insurance rated by AM Best?

Yes, Safeway Insurance Group has an A- rating from A.M. Best.

Yes, Safeway Insurance Company sells full coverage auto insurance policies (Read More: Full Coverage vs. Liability Car Insurance).

The Parrillo family owns Safeway Insurance Group.

What is the most trusted car insurance company?

One of the most trusted companies is USAA. Learn more by checking out our USAA car insurance review.

Is Safeway insurance non-standard?

Safeway does offer non-standard insurance. What does non-standard auto insurance mean? It is simply high-risk coverage for drivers with a DUI or other driving infractions. If you want to find cheap coverage as a high-risk driver, compare rates with our free quote tool.

How much can I get from a Safeway settlement?

How much you can get from a Safeway settlement depends on the claim, your coverage, and more.

Does Safeway insurance have a grace period?

Yes, Safeway has a grace period if you miss a payment, but you will be charged a late fee. To avoid this, choose a car insurance payent method that is reliable, such as automatic payments.

Does Safeway insurance cover rental cars?

Safeway insurance will cover a rental car during a covered claim if you have rental reimbursement coverage (Learn More: Best Rental Car Reimbursement Coverage).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Safeway insurance rated by AM Best?

Yes, Safeway Insurance Group has an A- rating from A.M. Best.

One of the most trusted companies is USAA. Learn more by checking out our USAA car insurance review.

Safeway does offer non-standard insurance. What does non-standard auto insurance mean? It is simply high-risk coverage for drivers with a DUI or other driving infractions. If you want to find cheap coverage as a high-risk driver, compare rates with our free quote tool.

How much can I get from a Safeway settlement?

How much you can get from a Safeway settlement depends on the claim, your coverage, and more.

Does Safeway insurance have a grace period?

Yes, Safeway has a grace period if you miss a payment, but you will be charged a late fee. To avoid this, choose a car insurance payent method that is reliable, such as automatic payments.

Does Safeway insurance cover rental cars?

Safeway insurance will cover a rental car during a covered claim if you have rental reimbursement coverage (Learn More: Best Rental Car Reimbursement Coverage).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Safeway insurance rated by AM Best?

Yes, Safeway Insurance Group has an A- rating from A.M. Best.

How much you can get from a Safeway settlement depends on the claim, your coverage, and more.

Yes, Safeway has a grace period if you miss a payment, but you will be charged a late fee. To avoid this, choose a car insurance payent method that is reliable, such as automatic payments.

Does Safeway insurance cover rental cars?

Safeway insurance will cover a rental car during a covered claim if you have rental reimbursement coverage (Learn More: Best Rental Car Reimbursement Coverage).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Safeway insurance rated by AM Best?

Yes, Safeway Insurance Group has an A- rating from A.M. Best.

Safeway insurance will cover a rental car during a covered claim if you have rental reimbursement coverage (Learn More: Best Rental Car Reimbursement Coverage).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Yes, Safeway Insurance Group has an A- rating from A.M. Best.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.