Progressive Name Your Price Tool Review: Compare Rates, Discounts, & Requirements [2024]

With the “Name Your Price” tool from Progressive, you can enter how much coverage you want and what you’re looking to pay. Be aware that you’ll have to go through Progressive's car insurance quote process to utilize the tool.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jul 17, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 17, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- “Name Your Price” helps drivers customize car insurance by coverage and price

- This tool provides drivers with an easy solution finding cheap insurance

- Don’t sacrifice adequate coverage just to get a cheap price on insurance

Does the Name Your Price tool with Progressive really save you money? Are you able to actually name your own price? Unfortunately, this isn’t the case, though there is actually a “Name Your Price” tool and it may point you in the right direction of what type of coverage you want.

However, you cannot name your price for car insurance at Progressive Insurance and be done. Just like some travel sites that offer “name your price hotel,” it is just a way to advertise to get people to buy the company’s insurance product. Flo with Progressive has become a really popular part of the culture, with a lot of Progressive name your price tool memes floating around.

So let’s take a look at a company that has built a reputation and review Progressive’s various ways to get rates. Enter your ZIP code now in our free tool and compare online cheap name your rate car insurance quotes now.

The ‘Name Your Price’ Tool: How it Helps Balance Coverage & Affordability

What is the Name Your Price tool? Progressive’s Name Your Price tool, also known as Progressive Pick Your Price, was the first of its kind in the car insurance industry. Basically, with Progressive, you build your own policy based on how much you’re willing to pay.

While this certainly gives the driver more control over the quote process, it doesn’t always mean you will get the cheapest rates, and you may find that a lower price on your auto policy means a lower level of coverage on your vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of the Progressive Name Your Price Tool

How does the Name Your Price tool work? The Progressive Insurance Name Your Price tool is convenient because it gives the person searching for car insurance an easy-to-read and understand the solution.

Seeing how the coverage options change as the monthly price changes are simple.

One of the drawbacks to this tool is that just because the person likes the price-per-month amount does not mean they will have adequate insurance coverage.

And though there are other “name your price” tools, like Priceline, out there, Progressive is the one that started it. If you’re a little nervous about using the tool, think of it as just a way to compare the types of coverage Progressive offers. We can help you find out if Progressive, Geico, or an independent agency can provide the best price.

You can also check out reviews for the Progressive Name Your Price Tool on Reddit to see how the program benefits others.

How the Name Your Price Tool From Progressive Works

The first step is to go to the Progressive Insurance website. Once on the website for the insurer, you have to go through the quote process.

Find a rate that works for you. Get in the driver’s seat with the Name Your Price® tool.

— Flo from Progressive (@ItsFlo) April 28, 2022

To obtain a quote, some necessary basic information you’ll need to add in the steps includes:

- Address

- Gender

- Marital status

- Number of drivers and cars

Some necessary information about the car and the person’s driving history includes:

- Make and model of the car

- Use of the car

- Whether the car is owned or leased

- Whether the car has a passive or active alarm

- Any accidents in the past five years

- Any moving violations or insurance claims in the past three years

After completing the Name Your Price tool questionnaire, the person is taken to a screen with a sliding bar that they can drag to the left or right to change the number of monthly payments on a six-month car insurance policy.

As you drag the bar to the left, the payment amount will decrease as the coverage available changes, and if you drag the bar to the right, the payment amount will increase along with the insurance coverage options, giving you an auto insurance quote based on how much coverage you want.

The more optional coverage you add, the higher the price will be.

All of this information and more will be used by Progressive to determine your insurance premium. Drivers with a clean driving record will always pay the lowest premiums.

Your credit history might also be taken into account, though several states have made it illegal for insurance companies to consider credit scores when setting rates.

So even though the Name Your Price Progressive treatment may be different than what you were first expecting, it may still be worth it to end up with a quote that shows you how much money you’ll be spending for the coverage you want.

Other Ways You Can Save Money With Progressive

The way Progressive works is that you must first apply for auto insurance coverage. Upon applying for coverage, you will receive a quote, and from there they will tell you about all the discounts that are available. However, if you want to know what you’re able to do ahead of time, you can always check out their website, but we’ll also offer a look further below into what discounts they have. You can also ask them about their Snapshot program.

If you decide to purchase insurance from Progressive, you are then given the option of signing up for a few different discounts, including Snapshot. It’s essentially a way for them to monitor your driving and then provide you with a discount based on your abilities. If you sign up for the tool, Progressive will give you a 10% discount on your first term premium. After that, you are charged $30 for every term to cover the measuring device that is placed in your vehicle.

The device will provide a reading of how, how much, and when you drive.

According to Progressive, the measuring device can save you up to 25% on your policy or cost you up to 9% more depending on the actual driving habits and patterns.

There are other discounts including savings for a multi-policy, good student savings, and even if you choose paperless billing.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Why Progressive Offers the Name Your Price Feature

Progressive Insurance began offering this feature in 2009 at the beginning of the current economic recession. At that time, it was estimated that one in six drivers would cancel their car insurance policies as a way to save money.

If you remember the Progressive Name Your Price tool commerical with Flo, the Name Your Price tool was central to the company’s marketing, as Flo would use the Name Your Price tool gun to help customers save.

Here’s a look at how Progressive’s average annual car insurance rates stack up against a Geico quote, one from Allstate, and other top companies.

| Insurance Company | Monthly Rate |

|---|---|

| Allstate | $160 |

| American Family | $117 |

| Farmers | $139 |

| Geico | $80 |

| Liberty Mutual | $174 |

| Nationwide | $115 |

| Progressive | $105 |

| State Farm | $86 |

| Travelers | $99 |

| USAA | $59 |

Not only would this mean that many people would be without the protection of car insurance but also that insured drivers would be at a greater risk of being in an accident with an uninsured driver.

A car accident with one or more uninsured driver could have an adverse affect on a policyholder’s insurance rates.

Progressive hoped that Name Your Price insurance could show people that they could still afford to stay insured.

Progressive Name Your Price Tool Guarantee

When you use the Name Your Price tool from Progressive, the only way that you’re going to be guaranteed the rate you choose is if you don’t add on any other coverage types, or have other policies with Progressive. Plus, the tool won’t take into consideration discounts that you might be qualified to be given.

Once you use the Name Your Price tool and get a quote from Progressive, you can always ask about what discounts may affect the price. As mentioned above, Progressive has quite a few ways that you can save money.

There are a lot of ways that insurance companies will reward you for being a safe and efficient driver. For example, many insurance companies will give you a lower car insurance premium if you drive at off times. If you do not drive in rush hour every day for miles to the office, there is a pretty good chance your insurance will be lower than someone who does. Your commute is a big deal. The average commute in the United States is 25.7 minutes, according to DataUSA. If yours is shorter, you might get a discount.

Other Progressive Car Insurance Discounts

In the table below, we’ll showcase a list of Progressive discounts:

| Progressive Discounts |

|---|

| Adaptive Cruise Control |

| Adaptive Headlights |

| Anti-lock Brakes |

| Anti-Theft |

| Daytime Running Lights |

| Electronic Stability Control |

| Vehicle Recovery |

| VIN Etching |

| Lane Departure Warning |

| Newer Vehicle |

| Forward Collision Warning |

| Claim Free |

| Continuous Coverage |

| Defensive Driver |

| Distant Student |

| Driver's Ed |

| Driving Device/App |

| Early Signing |

| Family Legacy |

| Full Payment |

| Good Credit |

| Good Student |

| Homeowner |

| Low Mileage |

| Loyalty |

| Married |

| Multiple Policies |

| Multiple Vehicles |

| Online Shopper |

| Paperless Documents |

| Paperless/Auto Billing |

| Passive Restraint |

| Safe Driver |

| Stable Residence |

| Switching Provider |

| Young Driver |

The multi-policy discount, also known as the bundle discount, gives you a deal for buying more than one line of insurance with Progressive, such as auto insurance and homeowners or renters insurance.

As you can see, Progressive offers a wide range of insurance discounts, but it also helps to shop around, as each insurer differs on what discounts they offer.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Name Your Own Price Without the Name Your Price Tool

You may be able to talk to an insurance agent and explain to them exactly what you’re looking for and what you’re hoping to pay, but the Name Your Price® tool is ultimately where you’ll be able to enter this information. The only way that you’re able to get to the tool is by going through the quote process, so just make sure it’s really what you’d like to do.

However, the website will not allow you to go below a certain level of coverage due to industry regulations.

There is always a minimum amount of coverage that a driver is required to have, so be mindful of this when you’re using the tool.

Also, as your amount is adjusted, so is your coverage. Your price will get lower as the insurance coverage decreases or as your deductible increases. A deductible is an amount you will have to pay when you file an insurance claim before your insurer covers any of the damages.

So, if you have a high collision deductible, for instance, your out-of-pocket costs after an accident will be high as well.

Other Insurance Companies That Let You Pick Your Price

You can name your own price with any auto insurance company but with certain restrictions. Again, insurance companies are regulated by how much or how little they can charge.

You can lower your premiums by adjusting your coverage. A few adjustments to coverage can save you hundreds of dollars.

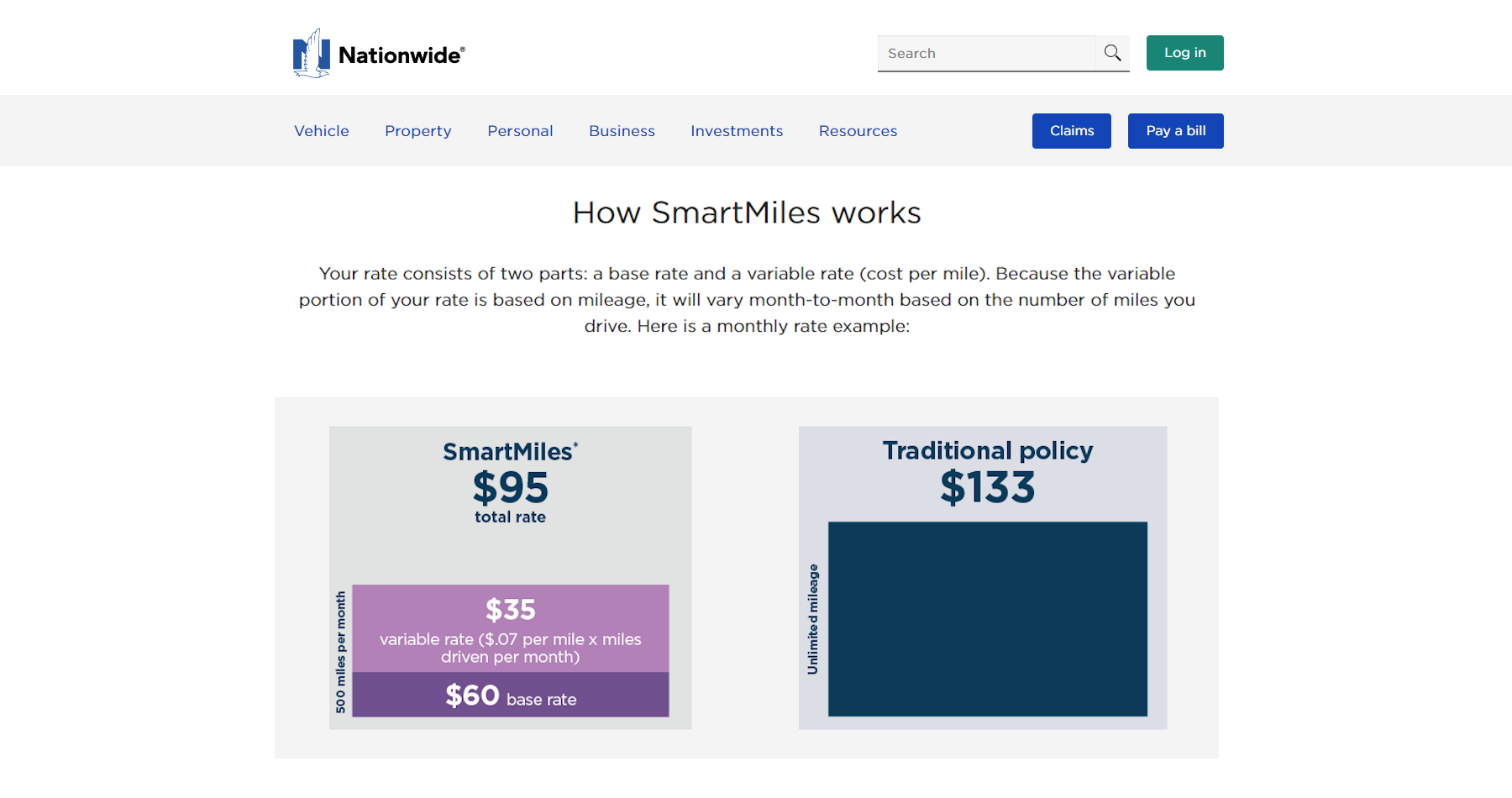

In addition, Nationwide’s SmartMiles pay-per-mile car insurance essentially allows drivers to pick their price, as it charges you based on how many miles you drive each month.

Other companies have their own telematics programs too, such as State Farm, with their Drive Save and Save program. You should also ask for or research possible discounts for car safety features, driver’s education courses, good student discounts, marital status, or bundling of coverage.

Essentially, when you make these adjustments, you are naming your own price in the insurance industry. After all, you are determining the minimum required coverage for the lowest price.

Just be sure you know what you’re adding and dropping on your policy. If you’re not familiar with a type of auto insurance coverage and what it does, do some research online or call your insurance provider and ask questions.

There are many types of coverages out there and they all have unique functions and coverage limits, which vary by insurer.

Remember you should always receive at least three quotes when shopping for car insurance. You should always compare the cost of coverage and be sure you purchase insurance from a reputable company.

The Name Your Price Tool With Progressive Helps You Save on Coverage You Need

How can I name my price with Progressive? The Name Your Price tool on the website helps drivers customize their car insurance by coverage and price. This tool provides drivers with an easy solution to the overwhelming problem of finding insurance. However, this particular name your own price tool will only show you Progressive prices, and will only allow you to utilize it once you’ve gone through the quote process. Make sure that you don’t sacrifice adequate coverage just to get a cheap price on insurance.

The Name Your Price tool from Progressive lets a person who is searching for car insurance customize their policy by indicating their insurance needs and the amount they would prefer to pay. (For more information, read our “How do you get Progressive car insurance quotes online?”).

Who has the cheapest auto insurance? Instantly compare your Progressive Name Your Price quote to other leading companies today by entering your ZIP code below. Get the best cheap auto insurance for you.

Frequently Asked Questions

What is the Progressive Name Your Price tool?

Many readers wonder, “What is the Name Your Price tool?” Progressive’s Name Your Price tool allows you to choose your desired coverage based on how much you are willing to pay for the product. However, Name Your Price car insurance does not guarantee that you will get the cheapest rates or the desired coverage level.

What are the pros and cons of the Progressive “Name Your Price” tool?

What does Name Your Price mean with Progressive, and what are the pros and cons? The Progressive price tool is convenient and provides an easy-to-understand solution for comparing coverage options based on price. However, Name Your Price car insurance does not ensure adequate insurance coverage, and other factors such as discounts and additional coverage types are not considered in the tool.

How does Progressive Name Your Price work?

A top question readers ask is, “How does Name Your Price work?” To use the tool, you need to go through the quote process on the Progressive Insurance website.

You provide necessary information about your car and driving history, and then you can adjust a sliding bar to change the number of monthly payments and coverage options. The tool gives you an auto insurance quote based on your preferred coverage and payment amount.

Is the Name Your Price tool worth it? A good way to see if the program is right for you is by reading customer reviews for the Name Your Price tool Progressive on Reddit.

What other ways can you save money with Progressive?

Progressive offers various discounts, such as a multi-policy discount, good student savings, and discounts for choosing paperless billing. They also have a program called Snapshot, where they monitor your driving habits and provide a discount based on your abilities.

Why does Progressive offer the Name Your Price feature?

Progressive introduced the Name Your Price auto insurance feature in 2009 during the economic recession to address the potential increase in uninsured drivers due to canceled policies. They aimed to show people that they could still afford insurance by allowing them to customize their coverage based on their preferred price.

Are you able to use the Name Your Price tool anywhere in the US?

Yes, using the Progressive price comparison tool can be done as soon as anyone obtains a quote from the website. However, prices may change depending on where you’re located. The Progressive comparison tool may have different rates varying from state to state. Insurance companies are required to charge a certain minimum rate for insurance depending on location.

This is because the risk factor associated with the state might be higher than others. Insurance companies must keep enough reserves on hand in case of catastrophic payouts. If they charge too little, the reserves will not grow or will become depleted. In certain states, there is less leverage to adjust rates.

Does Progressive price match?

You may be wondering, “Will Progressive price match?” No, there is no Progressive price match tool, though Progressive allows you to comparison shop on its website.

Why is Progressive so cheap?

Progressive may be cheaper due to discounts, efficient claims, and its direct-to-consumer model.

How much is Progressive car insurance? Full coverage insurance with Progressive costs around $105 monthly.

Does Progressive raise rates after 6 months?

How does Progressive pricing work after six months? Like most insurers, Progressive may adjust rates after your six-month policy period ends due to many factors, such as driving record, claims history, inflation, and more.

Is Progressive insurance good?

Progressive is generally considered a good company due to its claims satisfaction, competitive rates, and various coverage options.

Who is cheaper, Geico or Progressive?

Is Progressive insurance really cheaper than Geico? Progressive costs around $105 monthly for full coverage, while Geico’s monthly rates average $80.

Does the Progressive Name Your Price tool actually save you money?

You could save money by using the Name Your Price tool to customize a policy within your budget constraints, but it depends on your coverage needs.

Are there any hidden Progressive discounts?

There are several lesser-known discounts offered by Progressive, such as:

- Automatic payment discount

- Paperless discount

- Sign online discount

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.