Best Hanover Car Insurance Discounts in 2025 [Save 25% With These Offers]

The best Hanover car insurance discounts, including multi-policy, safe driver, and good student, can reduce premiums by as much as 25%. Bundling home and auto insurance offers even more savings. Explore these top Hanover car insurance discounts to find the best deal for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best Hanover car insurance discounts offer substantial savings, including up to 25% off with multi-policy, safe driver, and good student discounts.

These discounts allow policyholders to bundle home and auto coverage for additional savings. Hanover provides competitive rates across various age groups, especially for safe drivers. Expand your understanding with our “Car Insurance Comparison.”

Our Top 10 Picks: Best Hanover Car Insurance Discounts

Discount Rank Savings Potential Who Qualifies?

Multi-Policy #1 25% Save by bundling multiple policies

Safe Driver #2 20% For drivers with a clean record

Good Student #3 15% For students with good grades

Anti-Theft #4 10% For vehicles with anti-theft features

Low Mileage #5 10% For driving fewer miles than average

Defensive Driving Course #6 10% For completing a defensive driving course

New Car #7 8% For insuring a new vehicle

Home Ownership #8 5% If you own a home

Electronic Payments #9 5% For automatic electronic payments

Loyalty #10 3% For long-term customers

Drivers can maximize their savings and reduce monthly premiums by taking advantage of the best Hanover car insurance discounts. See if you’re getting the best deal on car insurance by entering your ZIP code.

- Bundle home and auto with Hanover’s multi-policy discount for additional savings

- The best Hanover car insurance discounts include safe driver and student savings

- Save up to 25% on monthly premiums with Hanover’s available discount programs

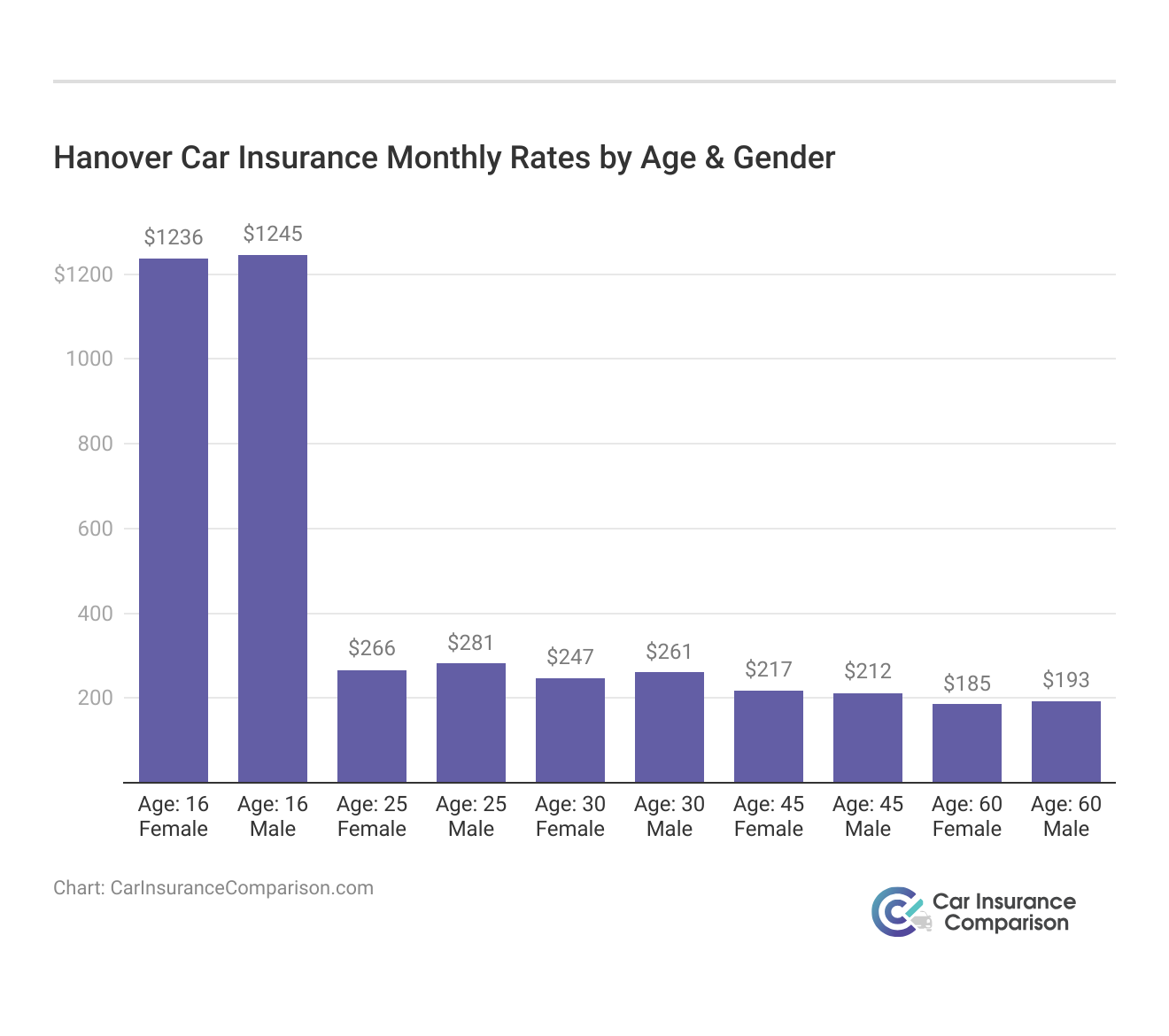

Hanover Car Insurance Monthly Rates by Age & Gender

Hanover car insurance rates vary based on age and gender. Younger drivers, especially teenage males, tend to face higher premiums, while older drivers generally benefit from lower rates. Understanding these differences can help you find the right coverage for your needs.

Hanover car insurance monthly rates differ by age and gender, with younger drivers, particularly males, often paying more than older drivers. By comparing rates across age groups, you can identify the best coverage options suited to your profile and potentially save on premiums. Gain deeper insights by exploring our “Best Car Insurance Companies.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Hanover Car Insurance Discounts

The Hanover offers a range of car insurance discounts aimed at helping policyholders lower their premiums. Some of the top deals include multi-policy discounts, student discounts, and safe driver discounts.

These savings can be significant, especially when combined with other qualifying factors like anti-theft features or home and auto insurance bundling. Drivers should explore all available discounts to maximize their savings. Learn more about our “Compare Group Car Insurance” for a broader perspective.

Best Companies to Compare Hanover Insurance Discounts

When comparing Hanover car insurance discounts with other providers, it’s essential to look at companies like Geico, State Farm, and Progressive, which also offer competitive discounts for drivers.

The key to finding the best deal is to compare the total discount percentage you can receive and how each company calculates its premiums based on factors like your driving record and vehicle features. Elevate your knowledge with our “Multiple Policy Car Insurance Discounts.”

How Monthly Rates Are Affected by Hanover Discounts

Using Hanover’s car insurance discounts can significantly reduce your monthly premium. On average, policyholders who qualify for a combination of discounts, such as safe driver and multiple policies, can see their rates drop by 10-25%.

These discounts are applied after The Hanover evaluates your risk factors, including driving history, vehicle type, and location, all of which influence your final monthly payment. Check out our “Best Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Qualify for Hanover’s Safe Driver Discount

The Hanover rewards safe drivers with a discount that can lower monthly premiums. To qualify, you must maintain a clean driving record free of moving violations and accidents for a set period. This discount is particularly beneficial for drivers who consistently follow traffic laws and prioritize safety.

Enrolling in a defensive driving course can also help you secure this discount. Find out more by reading our “Anti-Theft Car Insurance Discounts.”

Maximizing Savings with Multiple Policy Discounts

One of the most valuable discounts The Hanover offers is the multi-policy discount. If you bundle auto insurance with another product, such as homeowners or renters insurance, you can save a significant percentage on your premium.

Combining policies simplifies your insurance management, making it easier to stay on top of coverage and payments while enjoying reduced rates. Unlock additional information in our “Occupation Car Insurance Discounts.”

How to Get a Hanover Auto Insurance Quote

Obtaining a Hanover car insurance quote is a straightforward process. You can visit the company’s website or contact a local agent for a personalized quote based on your driving history, vehicle type, and location. Whether looking for car insurance in Hanover, PA, or elsewhere, comparing quotes is essential to finding the best rate.

The Hanover auto insurance quote includes various coverage options and potential discounts, such as the Hanover insurance good student discount or multi-policy discounts. These offers help you tailor your policy to meet your needs while saving on premium costs. Access supplementary details in our “Safe Driver Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Hanover Roadside Assistance and Other Benefits

As part of its comprehensive coverage options, The Hanover Insurance Group offers Hanover roadside assistance, providing peace of mind for drivers. If you experience a breakdown or need help with flat tires, towing, or battery jumps, Hanover insurance roadside assistance is available 24/7.

This service is available to Hanover auto insurance policyholders and Hanover citizens insurance, ensuring help is just a phone call away. The Hanover American Insurance Company also offers similar benefits, including support for emergencies on the road, making it a great choice for reliable and affordable coverage. Enhance your comprehension with our “Good Credit Car Insurance Discounts.”

Hanover Car Insurance Discounts Overview

The Hanover offers several car insurance discounts to help drivers reduce their premiums. These include the safe driver discount, available to those with a clean driving record; the student discount, designed for academically successful students; and the multi-policy discount, which provides savings when bundling auto insurance with other policies like home or renters insurance.

By taking advantage of Hanover's multi-policy discount, drivers can reduce premiums by 25%.

Brad Larson Licensed Insurance Agent

Additionally, drivers with vehicles equipped with anti-theft devices can benefit from an anti-theft discount. Policyholders can maximize their savings on Hanover car insurance by combining these discounts and comparing rates with other companies like Geico, State Farm, and Progressive.

Look at our “Student Away at School Car Insurance Discounts” for expanded insights. Our free online comparison tool allows you to compare cheap car insurance instantly quotes — enter your ZIP code to get started.

Frequently Asked Questions

What are the best Hanover car insurance discounts?

The best discounts include safe driver, good student, and multi-policy discounts. Access the complete picture in our “Best Senior Citizen Car Insurance Discounts.”

How can I qualify for a safe driver discount?

Maintain a clean driving record with no accidents or moving violations.

What is the multi-policy discount?

This discount applies when you bundle auto insurance with other policies, like homeowners insurance.

How much can I save with Hanover car insurance?

Policyholders can save up to 25% through various discount programs. Discover what lies beyond our “Credit Card Car Insurance Discounts.”

Are there discounts for students?

Yes, Hanover offers discounts for students with good academic performance. Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

How do I get a quote for Hanover car insurance?

Visit Hanover’s website or contact a local agent for a personalized quote.

What factors affect my car insurance premium?

Premiums are influenced by driving history, vehicle type, location, and coverage options. Gain a deeper understanding through our “Low-Risk Jobs Car Insurance Discounts.”

Can I get discounts for anti-theft features?

Yes, vehicles equipped with anti-theft devices may qualify for additional discounts.

Is roadside assistance included with Hanover insurance?

Yes, Hanover offers roadside assistance as part of their comprehensive coverage options. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code to begin.

How often should I compare car insurance rates?

It’s wise to compare rates at least once a year to ensure you’re getting the best deal. Obtain a more nuanced perspective with our “Safety Features Car Insurance Discounts.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.