Best Allstate Car Insurance Discounts in 2026 (Save 40% With These Deals!)

Discover the best Allstate car insurance discounts that can save you up to 45% on your policy. By leveraging discounts like the good driver, low-mileage, and pay-in-full options, you can reduce your premium costs. Learn how to maximize your savings with the best Allstate car insurance discounts available today.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated October 2024

The best Allstate car insurance discounts can help you save up to 45% on your premiums, making coverage more affordable. With options like the good driver discount, low-mileage discount, and pay-in-full savings, Allstate offers a variety of ways to lower your rates.

Additionally, unique discounts such as the disappearing deductible can further enhance your savings. Explore these opportunities to find the best fit for your insurance needs and budget, and take control of your car insurance costs today.

Our Top 10 Picks: Best Allstate Car Insurance Discounts

| Discount | Rank | Savings Potential | Description |

|---|---|---|---|

| Safe Driving Bonus | #1 | 40% | Earn a big discount for maintaining a safe driving record. |

| Drivewise® Program | #2 | 30% | Track your driving habits and save based on your performance. |

| Multi-Policy Discount | #3 | 25% | Bundle home and auto policies for significant savings. |

| New Car Discount | #4 | 15% | Get a discount for insuring a new or recently purchased vehicle. |

| Anti-Lock Brakes | #5 | 10% | Vehicles with anti-lock brakes can qualify for reduced premiums. |

| Early Signing Discount | #6 | 10% | Save by signing up for your policy at least 7 days before it starts. |

| Good Payer Discount | #7 | 10% | Consistently paying your bill on time can earn you a discount. |

| Responsible Payer | #8 | 10% | Avoid late payments and get rewarded with lower premiums. |

| Safe Vehicle Discount | #9 | 10% | Vehicles with advanced safety features may qualify for savings. |

| Good Student Discount | #10 | 5% | Students with good grades can qualify for a lower rate. |

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Save up to 45% with the best Allstate car insurance discounts

- Unique savings like low-mileage, good driver, and disappearing deductible

- Monthly premiums range from $103 to $406, depending on location and history

Available Allstate Car Insurance Discounts

If you’re considering buying car insurance from Allstate, taking advantage of their discounts can significantly reduce your rates. Allstate offers 11 potential discounts on its website, many of which are commonly available across various insurance providers. However, there are a few unique offers that could help you save even more. Below is a breakdown of some key discounts.

For example, several discounts are widely available across most insurance companies, such as the Geico car insurance discounts, the safe driver discount, which can save you up to 45%, the Geico student discount with a maximum savings of 20%, the multi-policy discount at 10%, the Geico defensive driving discount at 10%, and the pay-in-full discount, which also offers savings of 10%.

Additionally, certain discounts related to car safety features can provide substantial savings. Allstate offers a passive restraint discount of 30%, an anti-lock brake discount of 10%, an anti-theft device discount of 10%, and a new car discount that can save you up to 30%.

There are also a few less common discounts offered by Allstate that might be of interest, such as the early signing discount, which gives a 10% reduction for switching from another insurer with an active policy, Geico employee discounts list, and the resident student discount, offering 30% off if your child attends school at least 100 miles from your home.

Senior citizens can benefit from the 55 and retired discount, saving 10%, while military personnel living in Louisiana can access a 25% military discount. By exploring these discounts, you may be able to reduce your Allstate car insurance premiums significantly.

Check out this table to see additional Allstate insurance discounts you might be able to add to your policy:

Allstate Car Insurance Discounts

| Discount | Savings Earned |

|---|---|

| Anti-lock Brakes | 10% |

| Anti-Theft | 10% |

| Claim Free | 35% |

| Daytime Lights | 2% |

| Defensive Driver | 10% |

| Distant Student | 35% |

| Driver's Ed | 10% |

| Driving Device | 20% |

| Early Signing | 10% |

| Stability Control | 2% |

| Farm Vehicle | 10% |

| Full Payment | 10% |

| Good Student | 20% |

| Green Vehicle | 10% |

| Multiple Policies | 10% |

| Newer Vehicle | 30% |

| On-Time Payments | 5% |

| Paperless Documents | 10% |

| Paperless Auto Billing | 5% |

| Passive Restraint | 30% |

| Safe Driver | 45% |

| Senior Driver | 10% |

| Utility Vehicle | 15% |

| Vehicle Recovery | 10% |

There are so many Allstate car insurance discounts offered that you’ll mostly qualify for at least one. For example, you could get an Allstate good student car insurance discount if you have a child in school. In addition, if you drive the speed limit and avoid phone distractions, you might benefit from Allstate’s safe driver car insurance discount through Drivewise.

Unfortunately, there is no Allstate car insurance military discount listed on the company website.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Other Allstate Car Insurance Programs to Help You Save

Lately, more insurance companies have been offering programs that save you money over time, and Allstate is one of those companies. For instance, how to lower car insurance Geico is a common query that can be answered by exploring various discount programs similar to Allstate’s offerings.

Allstate offers several free programs that come with your auto insurance policy and some that you can add on. These programs can lower your Allstate car insurance rates significantly.

Daniel S. Young Insurance Content Team Lead

Allstate offers several free programs that come with your car insurance policy and some that you can add on. These programs can lower your Allstate car insurance rates significantly.

Included in every policy are:

- Allstate Safe Driving Bonus: Every six months, you’ll get an Allstate safe driver discount in the form of a check. You can receive a check for up to 5% of your total rates if you don’t have an accident during that time.

- Allstate Disappearing Deductible: You will receive an initial $100 off of your car insurance deductible when you sign up for a new policy. Each year you don’t have an accident, another $100 is deducted until $500 has been reached.

You can add the following services as a rider to your policy:

- Accident Forgiveness: Keeps your rates from increasing if you have an accident. One accident is allowed every three years.

- New Car Replacement: Any driver that has a car that is three years old or younger will receive enough money to replace that car with another new car—not a used car, and not the depreciated value of the car.

The Allstate discounts list is extensive and can help lower those high car insurance rates. The Allstate low-mileage car insurance discount may also be available through the company’s Milewise program, depending on your location.

Just like with car insurance coverage, discounts aren’t one size fits all. Speak with your agent to find all the discounts you can add to lower your rates. Discounts are a great way to save money on car insurance. Bundle all of the discounts you qualify for to get even more savings.

Allstate may also save you money in other areas, such as an Allstate car insurance car rental discount, but it depends on your policy.

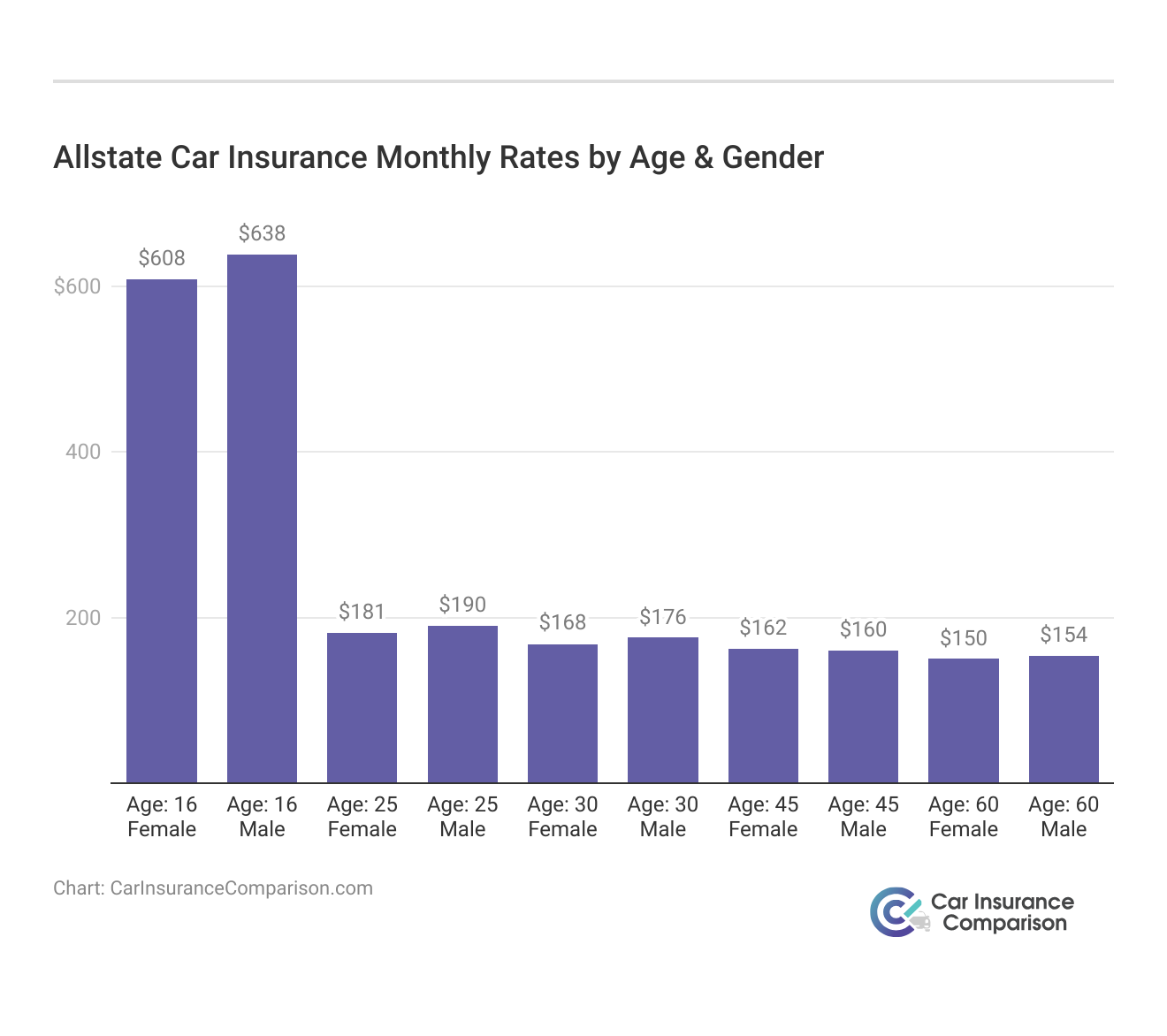

Allstate Car Insurance Monthly Rates

There are various factors that affect car insurance rates, including age, driving record, where you live, and how far you drive. Average monthly premiums for Allstate car insurance range from $103 to $406, depending on your location.

If you have anything on your driving record, such as a DUI, speeding ticket, or at-fault accident, you’ll see your Allstate insurance rates go up. But it’s not the only thing that impacts them. Your credit score is also a big one, but each insurer is different.

Allstate Car Insurance Monthly Rates by State & Provider

| State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $108 | $105 | $133 | $89 | $162 | $96 | $112 | $108 | $79 | $56 |

| Alaska | $135 | $105 | $127 | $76 | $164 | $108 | $97 | $65 | $93 | $60 |

| Arizona | $180 | $114 | $135 | $65 | $178 | $116 | $84 | $81 | $104 | $63 |

| Arkansas | $162 | $137 | $165 | $91 | $99 | $128 | $131 | $80 | $111 | $55 |

| California | $199 | $138 | $167 | $101 | $216 | $142 | $132 | $108 | $122 | $74 |

| Colorado | $166 | $118 | $163 | $94 | $92 | $107 | $120 | $94 | $114 | $78 |

| Connecticut | $196 | $125 | $151 | $62 | $201 | $112 | $133 | $91 | $83 | $77 |

| Delaware | $207 | $130 | $157 | $101 | $494 | $144 | $90 | $116 | $82 | $43 |

| D.C. | $241 | $115 | $139 | $69 | $180 | $172 | $115 | $111 | $102 | $48 |

| Florida | $183 | $188 | $227 | $89 | $161 | $103 | $153 | $99 | $166 | $47 |

| Georgia | $165 | $124 | $149 | $61 | $263 | $152 | $115 | $107 | $110 | $71 |

| Hawaii | $118 | $82 | $99 | $60 | $128 | $84 | $78 | $64 | $72 | $44 |

| Idaho | $128 | $93 | $92 | $57 | $79 | $82 | $91 | $53 | $57 | $40 |

| Illinois | $176 | $114 | $117 | $47 | $76 | $93 | $89 | $64 | $87 | $62 |

| Indiana | $140 | $107 | $79 | $63 | $183 | $97 | $69 | $71 | $69 | $43 |

| Iowa | $126 | $95 | $82 | $81 | $116 | $73 | $75 | $65 | $92 | $55 |

| Kansas | $160 | $114 | $144 | $75 | $174 | $92 | $127 | $81 | $87 | $56 |

| Kentucky | $236 | $164 | $197 | $80 | $168 | $184 | $111 | $98 | $139 | $72 |

| Louisiana | $206 | $176 | $212 | $141 | $274 | $181 | $161 | $124 | $156 | $98 |

| Maine | $143 | $99 | $120 | $72 | $155 | $103 | $95 | $78 | $88 | $53 |

| Maryland | $201 | $116 | $140 | $135 | $181 | $106 | $121 | $107 | $103 | $80 |

| Massachusetts | $108 | $84 | $117 | $37 | $120 | $87 | $94 | $59 | $61 | $37 |

| Michigan | $406 | $204 | $335 | $99 | $424 | $257 | $152 | $209 | $183 | $107 |

| Minnesota | $160 | $93 | $108 | $90 | $375 | $87 | $101 | $67 | $94 | $68 |

| Mississippi | $147 | $120 | $145 | $72 | $119 | $96 | $120 | $82 | $88 | $54 |

| Missouri | $148 | $106 | $135 | $90 | $129 | $66 | $98 | $85 | $114 | $50 |

| Montana | $154 | $125 | $164 | $82 | $59 | $88 | $171 | $70 | $111 | $50 |

| Nebraska | $125 | $112 | $130 | $92 | $179 | $77 | $95 | $69 | $102 | $56 |

| Nevada | $165 | $140 | $155 | $110 | $111 | $112 | $82 | $103 | $91 | $69 |

| New Hampshire | $128 | $77 | $93 | $50 | $198 | $77 | $63 | $59 | $69 | $41 |

| New Jersey | $157 | $115 | $231 | $74 | $279 | $119 | $93 | $113 | $136 | $61 |

| New Mexico | $158 | $103 | $131 | $90 | $161 | $96 | $86 | $69 | $91 | $65 |

| New York | $147 | $137 | $165 | $78 | $200 | $164 | $96 | $137 | $175 | $85 |

| North Carolina | $169 | $82 | $99 | $69 | $82 | $111 | $32 | $77 | $99 | $44 |

| North Dakota | $136 | $145 | $107 | $61 | $398 | $77 | $110 | $76 | $88 | $44 |

| Nebraska | $125 | $112 | $130 | $92 | $179 | $77 | $95 | $69 | $102 | $56 |

| New Hampshire | $128 | $77 | $93 | $50 | $198 | $77 | $63 | $59 | $69 | $41 |

| New Jersey | $157 | $115 | $231 | $74 | $279 | $119 | $93 | $113 | $136 | $61 |

| New Mexico | $158 | $103 | $131 | $90 | $161 | $96 | $86 | $69 | $91 | $65 |

| Nevada | $165 | $140 | $155 | $110 | $111 | $112 | $82 | $103 | $91 | $69 |

| New York | $147 | $137 | $165 | $78 | $200 | $164 | $96 | $137 | $175 | $85 |

| Ohio | $120 | $62 | $96 | $59 | $106 | $114 | $85 | $70 | $63 | $41 |

| Oklahoma | $135 | $118 | $136 | $109 | $184 | $122 | $110 | $91 | $105 | $68 |

| Oregon | $153 | $106 | $111 | $93 | $141 | $111 | $78 | $75 | $97 | $58 |

| Pennsylvania | $148 | $108 | $131 | $68 | $219 | $86 | $148 | $76 | $75 | $57 |

| Rhode Island | $189 | $151 | $183 | $125 | $235 | $190 | $116 | $76 | $103 | $65 |

| South Carolina | $133 | $118 | $166 | $79 | $185 | $118 | $105 | $88 | $105 | $69 |

| South Dakota | $136 | $151 | $113 | $57 | $230 | $76 | $105 | $67 | $97 | $58 |

| Tennessee | $144 | $102 | $86 | $78 | $11 | $118 | $92 | $72 | $88 | $58 |

| Texas | $201 | $176 | $137 | $105 | $178 | $154 | $121 | $90 | $101 | $62 |

| Utah | $117 | $105 | $115 | $73 | $119 | $93 | $95 | $103 | $88 | $50 |

| Virginia | $103 | $83 | $100 | $69 | $129 | $86 | $61 | $63 | $73 | $43 |

| Vermont | $142 | $85 | $103 | $38 | $100 | $77 | $181 | $87 | $75 | $42 |

| Washington | $114 | $91 | $102 | $75 | $92 | $70 | $60 | $69 | $81 | $46 |

| West Virginia | $123 | $63 | $109 | $62 | $84 | $226 | $94 | $58 | $72 | $47 |

| Wisconsin | $162 | $115 | $139 | $83 | $196 | $104 | $110 | $79 | $102 | $67 |

| Wyoming | $155 | $111 | $130 | $111 | $75 | $114 | $106 | $82 | $98 | $57 |

You can see that Allstate is very expensive compared to other car insurance companies. So, it’s important to utilize savings such as the Allstate car insurance discount for seniors or defensive driving courses. Read more about how to get a defensive driver car insurance discount with Allstate.

Allstate Car Insurance Coverages

Alongside its extensive discounts list, Allstate offers various car insurance options, such as liability, collision, comprehensive, roadside assistance, personal injury protection or medical payments, and uninsured motorist coverage. It’s important to consider your coverage needs before purchasing an Allstate insurance policy.

However, if you find that you require extensive coverage, you can always save by taking advantage of Allstate’s multi-policy car insurance discount. Once you know how much coverage you need, take a look at the table below to compare Allstate car insurance rates by location:

Allstate Car Insurance Monthly Rates by State and Coverage Type

| State | Collision | Liability | Comprehensive |

|---|---|---|---|

| Alabama | $29 | $46 | $14 |

| Alaska | $29 | $49 | $14 |

| Arizona | $23 | $45 | $16 |

| Arkansas | $26 | $36 | $12 |

| California | $36 | $56 | $17 |

| Colorado | $32 | $50 | $15 |

| Connecticut | $35 | $51 | $14 |

| Delaware | $27 | $67 | $10 |

| Florida | $24 | $74 | $10 |

| Georgia | $31 | $49 | $14 |

| Hawaii | $29 | $40 | $13 |

| Idaho | $19 | $31 | $10 |

| Illinois | $26 | $38 | $11 |

| Indiana | $21 | $33 | $10 |

| Iowa | $22 | $31 | $10 |

| Kansas | $26 | $41 | $11 |

| Kentucky | $27 | $42 | $13 |

| Louisiana | $32 | $60 | $15 |

| Maine | $23 | $34 | $10 |

| Maryland | $30 | $53 | $13 |

| Massachusetts | $33 | $51 | $11 |

| Michigan | $37 | $70 | $15 |

| Minnesota | $28 | $45 | $12 |

| Mississippi | $29 | $39 | $13 |

| Missouri | $29 | $39 | $12 |

| Montana | $23 | $31 | $11 |

| Nebraska | $25 | $34 | $11 |

| Nevada | $34 | $62 | $14 |

| New Hampshire | $27 | $40 | $10 |

| New Jersey | $32 | $75 | $11 |

| New Mexico | $24 | $38 | $11 |

| New York | $36 | $62 | $15 |

| North Carolina | $28 | $40 | $11 |

| North Dakota | $24 | $32 | $10 |

| Ohio | $23 | $34 | $10 |

| Oklahoma | $26 | $38 | $12 |

| Oregon | $19 | $51 | $8 |

| Pennsylvania | $28 | $42 | $12 |

| Rhode Island | $34 | $50 | $14 |

| South Carolina | $29 | $45 | $13 |

| South Dakota | $24 | $30 | $10 |

| Tennessee | $27 | $38 | $13 |

| Texas | $32 | $46 | $17 |

| Utah | $26 | $42 | $12 |

| Vermont | $23 | $33 | $10 |

| Virginia | $24 | $36 | $12 |

| Washington | $22 | $51 | $9 |

| Washington D.C. | $39 | $55 | $19 |

| West Virginia | $28 | $42 | $17 |

| Wisconsin | $23 | $33 | $10 |

| Wyoming | $24 | $30 | $10 |

You should also evaluate average Allstate insurance cost vs. its competitors below:

Car Insurance Monthly Rates by Provider and Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $22 | $59 |

As you can see, you can probably find the cheapest rates with USAA after you apply USAA car insurance discounts. However, only military members, veterans, and their families qualify for coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Decide if Allstate Car Insurance is Right for You

If you haven’t guessed it already, Allstate is typically more expensive than companies like Progressive or Geico, even after discounts apply. However, some may be able to find the best savings with Allstate discounts depending on location, demographics, and driving record.

Compare Allstate car insurance discounts against ones offered by its competitors in the table below:

Car Insurance Discounts Available by Provider

| Discount | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Adaptive Headlights | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Anti-lock Brakes | 10% | ✓ | ✓ | 5% | 5% | 5% | ✓ | 5% | NA | NA |

| Anti-Theft | 10% | ✓ | NA | 23% | 20% | 25% | ✓ | 15% | NA | NA |

| Claim Free | 35% | ✓ | ✓ | 26% | ✓ | 10% | ✓ | 15% | 23% | 12% |

| Continuous Coverage | NA | ✓ | ✓ | NA | ✓ | ✓ | ✓ | ✓ | 15% | ✓ |

| Daytime Running Lights | 2% | NA | ✓ | 3% | 5% | 5% | ✓ | ✓ | NA | NA |

| Defensive Driver | 10% | 10% | ✓ | ✓ | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | ✓ | ✓ | ✓ | ✓ | 10% | ✓ | NA | 7% | NA |

| Driver's Ed | 10% | ✓ | ✓ | ✓ | 10% | ✓ | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | ✓ | ✓ | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | ✓ | ✓ | ✓ | ✓ | 8% | ✓ | ✓ | 10% | 12% |

| Electronic Stability Control | 2% | ✓ | ✓ | ✓ | 5% | NA | ✓ | ✓ | ✓ | ✓ |

| Emergency Deployment | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | NA | ✓ | ✓ | ✓ |

| Engaged Couple | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Family Legacy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 10% |

| Family Plan | ✓ | ✓ | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ |

| Farm Vehicle | 10% | ✓ | ✓ | NA | ✓ | ✓ | NA | ✓ | ✓ | ✓ |

| Fast 5 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Federal Employee | ✓ | ✓ | NA | 12% | 10% | ✓ | NA | ✓ | ✓ | ✓ |

| Forward Collision Warning | ✓ | ✓ | ✓ | ✓ | 5% | NA | ✓ | ✓ | ✓ | ✓ |

| Full Payment | 10% | ✓ | ✓ | NA | $50 | ✓ | ✓ | ✓ | 8% | ✓ |

| Further Education | ✓ | ✓ | NA | NA | 10% | 15% | NA | ✓ | ✓ | |

| Garaging/Storing | ✓ | ✓ | ✓ | NA | ✓ | ✓ | ✓ | ✓ | NA | 90% |

| Good Credit | NA | NA | ✓ | ✓ | ✓ | NA | ✓ | NA | ✓ | ✓ |

| Good Student | 20% | ✓ | NA | 15% | 23% | 10% | ✓ | 25% | 8% | 3% |

| Green Vehicle | 10% | ✓ | 5% | ✓ | 10% | ✓ | ✓ | ✓ | 10% | ✓ |

| Homeowner | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | 3% | 5% | ✓ | |

| Lane Departure Warning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Life Insurance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Low Mileage | NA | ✓ | NA | ✓ | NA | NA | ✓ | 30% | NA | NA |

| Loyalty | ✓ | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | NA |

| Married | ✓ | ✓ | ✓ | ✓ | NA | NA | ✓ | NA | ✓ | NA |

| Membership/Group | ✓ | ✓ | ✓ | NA | 10% | 7% | NA | ✓ | NA | ✓ |

| Military | NA | ✓ | ✓ | 15% | 4% | ✓ | NA | NA | ✓ | NA |

| Military Garaging | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% |

| Multiple Drivers | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Multiple Policies | 10% | 29% | ✓ | 10% | 20% | 10% | 12% | 17% | 13% | NA |

| Multiple Vehicles | NA | ✓ | ✓ | 25% | 10% | 20% | 10% | 20% | 8% | NA |

| New Address | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Customer/New Plan | ✓ | ✓ | ✓ | ✓ | NA | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Graduate | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Vehicle | 30% | ✓ | ✓ | 15% | ✓ | NA | NA | 40% | 10% | 12% |

| Newly Licensed | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Newlyweds | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Non-Smoker/Non-Drinker | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Occasional Operator | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | NA |

| Occupation | NA | ✓ | NA | NA | 10% | 15% | ✓ | ✓ | NA | ✓ |

| On-Time Payments | 5% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | |

| Online Shopper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7% | ✓ | ✓ | ✓ |

| Paperless Documents | 10% | ✓ | NA | ✓ | ✓ | 5% | $50 | ✓ | ✓ | ✓ |

| Paperless/Auto Billing | 5% | ✓ | NA | ✓ | ✓ | $30 | ✓ | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | NA | 40% | 20% | ✓ | 40% | NA | NA | |

| Recent Retirees | ✓ | ✓ | ✓ | ✓ | 4% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Renter | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Roadside Assistance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Safe Driver | 45% | ✓ | NA | 15% | ✓ | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | ✓ | ✓ | ✓ | 15% | ✓ | ✓ | NA | ✓ | ✓ | ✓ |

| Senior Driver | 10% | ✓ | NA | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | NA |

| Stable Residence | ✓ | ✓ | ✓ | ✓ | ✓ | NA | ✓ | ✓ | ✓ | ✓ |

| Students & Alumni | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | ✓ | ||

| Switching Provider | ✓ | NA | NA | ✓ | 10% | ✓ | NA | ✓ | ✓ | ✓ |

| Utility Vehicle | 15% | ✓ | ✓ | ✓ | ✓ | NA | ✓ | ✓ | ✓ | |

| Vehicle Recovery | 10% | ✓ | ✓ | 15% | 35% | 25% | ✓ | 5% | NA | NA |

| VIN Etching | ✓ | ✓ | ✓ | ✓ | 5% | NA | ✓ | ✓ | NA | NA |

| Volunteer | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Young Driver | ✓ | ✓ | ✓ | ✓ | NA | ✓ | ✓ | ✓ | ✓ | $75 |

As you can see, Allstate has various discounts but expensive starting rates. So, it’s essential to compare car insurance companies‘ quotes from multiple companies to see if Allstate is the best for you. However, you can save with Allstate’s safe driver, good student, pay-in-full, and Esmart discounts.

You should also check out reviews of Allstate insurance from customers to see what others say about their discounts and customer service. For instance, some Reddit users claim that the online discount process can be confusing.

Buying Allstate car insurance online – when do the discounts come in?

byu/Rude-Mountain-2620 inInsurance

One Reddit user also says they were initially charged the full premium despite qualifying for discounts.

Fortunately, if you find that Allstate is too expensive even after discounts, you can always find other companies offering affordable rates.

Case Studies: Allstate Car Insurance Discounts

Allstate offers a variety of car insurance discounts to help policyholders save on their premiums. Through real-life examples, we will explore how these discounts have benefited customers in different situations. From student discounts to accident forgiveness, these case studies highlight the savings potential of Allstate’s car insurance features.

- Case Study #1 – Good Student Discount: John is a high school student with excellent grades. His parents have an Allstate car insurance policy, and they are eligible for the Allstate good student discount. By providing John’s academic records, they were able to save 20% on their car insurance premium.

- Case Study #2 –New Car Discount: Sarah recently purchased a brand new car and decided to insure it with Allstate. As a new car owner, she qualified for the Allstate new car discount. This discount helped her save 15% on her car insurance premium for the first year.

- Case Study #3 – Resident Student Discount: Mark’s son, Mike, is attending college out of state but still maintains his parents’ address as his permanent residence. Mark contacted Allstate and asked about the resident student discount. By providing the necessary documentation, Mark was able to save 25% on Mike’s car insurance while he was away at college.

- Case Study #4 – Disappearing Deductible: Lisa has been a safe driver for many years and has an Allstate car insurance policy. She opted for the Allstate disappearing deductible program, which reduces her deductible by $100 for every year of accident-free driving. Over time, Lisa’s deductible has decreased significantly, providing her with additional savings and peace of mind.

- Case Study #5 – Accident Forgiveness: Tom had a minor at-fault accident and was worried about the impact it would have on his car insurance rates. Fortunately, he had the Allstate accident forgiveness car insurance feature included in his policy. This meant that his rates did not increase as a result of the accident, saving him from potential financial strain.

These case studies demonstrate the value that Allstate’s car insurance discounts and programs provide to customers in diverse situations. By taking advantage of the right discounts, drivers can enjoy both financial savings and peace of mind, ensuring their car insurance policy offers maximum benefits.

Unlocking Savings With Allstate Car Insurance

In summary, Allstate offers a diverse array of discounts and programs that can help you significantly reduce your car insurance premiums. From standard savings like the good driver and multi-policy discounts to more unique opportunities such as the disappearing deductible and resident student discounts, Allstate provides numerous ways to lower your insurance rates.

By understanding and leveraging these discounts, you can maximize your savings and potentially secure more affordable coverage. However, it’s crucial to compare Allstate’s offerings with those of other insurance providers to ensure you’re getting the best deal. Each company has its own set of discounts and pricing structures, so shopping around and evaluating all available options will help you make an informed decision.

Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

How can I find the best deal on Allstate car insurance?

To find the best deal on Allstate car insurance, you can compare quotes from top companies by entering your ZIP code into our free quote comparison tool. For example, how to lower my car insurance with Geico can be a good alternative.

What discounts does Allstate car insurance offer?

Allstate offers a variety of car insurance discounts, including a good student, new car, resident student, pay-in-full, Esmart, disappearing deductible, and accident forgiveness discount. You could also get a 10% Allstate senior car insurance discount if you qualify.

What other programs does Allstate offer to save money on car insurance?

There are various Allstate car insurance benefits, including the Drivewise program, safe driving bonus, deductible rewards, and new car replacement. For information on similar programs, you might look into Geico insurance discounts.

Can I bundle Allstate car insurance discounts?

Yes, Allstate insurance says you can save up to 25% for bundling policies such as home and car insurance. You might also explore the Geico multi-car discount and Geico multi-policy discount for additional savings.

How much can I save with Allstate car insurance discounts?

You can save up to 45% with Allstate Drivewise, the company’s safe driver car insurance program.

Do Allstate car insurance discounts vary by state?

Yes, Allstate insurance discount availability varies by state. So, contact a local Allstate agency to see a list of available discounts.

How does Allstate’s car insurance discounts compare to its competitors?

Allstate offers a long list of discounts compared to competitors and offers higher percentage savings.

Does Allstate offer a military car insurance discount?

Unfortunately, Allstate doesn’t list a military discount on its website. However, the state of Louisiana requires insurers to offer all military members a discount of at least 25%. So, you can get a 25% Allstate military discount if you need to compare Louisiana car insurance rates.

How do I qualify for Allstate car insurance discounts?

Some Allstate discounts, such as the multi-car discount, automatically apply when you get coverage for more than one vehicle. However, you’ll need to let Allstate know if you received good grades in school to get the good student car insurance discount.

What’s the difference between Allstate Milewise and Drivewise?

Allstate Drivewise is a telematics program that tracks driving behavior and offers a discount based on how well you drive. On the other hand, Allstate Milewise is the company’s pay-per-mile car insurance, where you pay a base rate each month and a per-mile amount.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.