Best Chevrolet Beretta Car Insurance in 2026 (Find the Top 10 Companies Here)

Progressive, Geico, and State Farm have the best Chevrolet Beretta car insurance, starting at just $35 per month. These companies excel in providing affordable rates, extensive coverage, and superior customer service specifically tailored for Chevrolet Beretta owners seeking reliable coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated October 2024

Company Facts

Full Coverage for Chevrolet Beretta

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Chevrolet Beretta

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Chevrolet Beretta

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews

The top picks for the best Chevrolet Beretta car insurance are Progressive, Geico, and State Farm, renowned for their exceptional coverage options and customer satisfaction.

These companies stand out for their comprehensive services and overall value, making them ideal choices for Beretta owners. See more details in our guide titled, “What is the best car insurance?”

Our Top 10 Company Picks: Best Chevrolet Beretta Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A+ Usage-Based Program Progressive

#2 25% A++ Competitive Rates Geico

#3 20% B Customer Service State Farm

#4 20% A+ Coverage Options Nationwide

#5 25% A+ Many Discounts Allstate

#6 10% A++ Military Families USAA

#7 15% A Personal Service Farmers

#8 10% A High-Risk Drivers Liberty Mutual

#9 15% A Young Drivers American Family

#10 15% A++ Safe Drivers Travelers

This article delves into the factors that affect insurance costs for the Chevrolet Beretta, such as vehicle specifications and driver history.

By understanding these elements, you can make a more informed decision when choosing the right insurer for your needs. To compare Chevrolet Beretta auto insurance quotes from top companies, enter your ZIP code above now.

- Progressive is the top pick for the best Chevrolet Beretta car insurance

- Factors like trim level and driving history impact Beretta insurance costs

- Comparing insurance options is crucial for finding the best rates for Beretta

#1 – Progressive: Top Overall Pick

Pros

- Personalized Rates: Progressive offers usage-based insurance programs, ideal for Chevrolet Beretta owners who drive less, potentially lowering rates significantly.

- Loyalty Rewards: Chevrolet Beretta owners can benefit from Progressive’s loyalty rewards, including discounts for continuous coverage. Discover insights in our guide titled, “Progressive Car Insurance Review.”

- Advanced Online Tools: Progressive provides advanced tools for managing policies online, making it convenient for Chevrolet Beretta owners to adjust coverage as needed.

Cons

- Higher Rates for High Mileage: Chevrolet Beretta owners with high mileage might face higher premiums under the usage-based program.

- Complexity in Discounts: The criteria for earning discounts can be complex, potentially confusing Chevrolet Beretta owners who are new to usage-based insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Competitive Pricing: Geico offers some of the most competitive rates for Chevrolet Beretta insurance, thanks to a 25% multi-policy discount.

- Excellent Financial Strength: With an A++ rating from A.M. Best, Geico promises reliability in claims handling for Chevrolet Beretta policies.

- Wide Range of Discounts: Chevrolet Beretta owners can access various discounts, including for safe driving and anti-theft devices. Delve into our evaluation of Geico car insurance review.

Cons

- Customer Service Variability: While generally good, Geico’s customer service quality can vary, which might affect some Chevrolet Beretta owners.

- Policy Customization Limits: There may be limitations in customizing policies specifically tailored to the unique needs of Chevrolet Beretta owners.

#3 – State Farm: Best for Customer Service

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies, beneficial for Chevrolet Beretta owners. Access comprehensive insights into our guide “State Farm Car Insurance Review.”

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage, perfect for Chevrolet Beretta owners who don’t drive frequently.

- Wide Coverage: State Farm offers various coverage options tailored for different needs, suitable for Chevrolet Beretta owners looking for specific protections.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors, affecting Chevrolet Beretta owners looking to maximize savings.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, which could impact Chevrolet Beretta owners with specific needs.

#4 – Nationwide: Best for Coverage Options

Pros

- Customizable Policies: Nationwide offers various coverage options, allowing Chevrolet Beretta owners to tailor their insurance to their specific needs. Discover more about offerings in our complete Nationwide car insurance discount.

- On Your Side Review: Nationwide provides a free personal insurance review, ensuring Chevrolet Beretta owners have the optimal coverage as their circumstances change.

- Accident Forgiveness: Chevrolet Beretta owners can benefit from Nationwide’s accident forgiveness program, which prevents rates from increasing after a first at-fault accident.

Cons

- Higher Base Premiums: Nationwide’s extensive coverage options can come with higher base premiums, which may be costly for some Chevrolet Beretta owners.

- Complex Claim Process: Some Chevrolet Beretta owners might find Nationwide’s claim process complex and time-consuming.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Many Discounts

Pros

- Multiple Discount Opportunities: Allstate offers a variety of discounts, including a 25% multi-policy discount, which can significantly lower premiums for Chevrolet Beretta owners.

- Safe Driving Bonuses: Chevrolet Beretta owners adhering to safe driving practices can earn bonuses and premium reductions with Allstate.

- Innovative Tools: Allstate’s mobile app and online resources provide Chevrolet Beretta owners easy access to manage their policies and file claims. Check out insurance savings in our guide titled, “Allstate Car Insurance Review.”

Cons

- Price Variation by Location: Allstate’s premiums can vary significantly by location, which might affect Chevrolet Beretta owners in higher-cost areas.

- Customer Satisfaction Variability: While Allstate offers many benefits, customer satisfaction can vary, potentially affecting service quality for Chevrolet Beretta owners.

#6 – USAA: Best for Military Families

Pros

- Exclusive Military Benefits: USAA provides specialized benefits for military families, which is ideal for Chevrolet Beretta owners serving in the armed forces.

- Superior Customer Service: Known for exceptional customer service, USAA ensures that Chevrolet Beretta owning military families receive prompt and efficient service.

- Competitive Rates: USAA offers competitive rates with a 10% multi-policy discount, making it a cost-effective choice for eligible Chevrolet Beretta owners. Read up on the USAA car insurance review for more details.

Cons

- Eligibility Restrictions: USAA’s services are only available to military members, veterans, and their families, limiting access for other Chevrolet Beretta owners.

- Limited Physical Locations: While USAA excels in online and phone services, there are few physical locations, which might be a drawback for some Chevrolet Beretta owners preferring in-person service.

#7 – Farmers: Best for Personal Service

Pros

- Dedicated Agents: Farmers provides personalized service through dedicated agents, ensuring Chevrolet Beretta owners receive tailored advice and support.

- Custom Coverage Options: Farmers offers customizable coverage plans, allowing Chevrolet Beretta owners to adjust their policies based on specific needs and budgets.

- Discounts for Multiple Policies: Chevrolet Beretta owners can save with Farmers’ 15% multi-policy discount, enhancing the affordability of their insurance. More information about this provider is available in our Farmers car insurance review.

Cons

- Higher Premiums Without Discounts: Without qualifying for discounts, Farmers’ premiums can be higher compared to other insurers, impacting Chevrolet Beretta owners budgeting for insurance.

- Variable Customer Experience: Customer experience can vary significantly based on the local agent, which might affect the consistency of service for Chevrolet Beretta owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for High-Risk Drivers

Pros

- Tailored Policies for High Risks: Liberty Mutual specializes in providing coverage for high-risk drivers, including those Chevrolet Beretta owners with less-than-perfect driving records.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, helping to prevent premium increases for Chevrolet Beretta owners after their first at-fault accident.

- Wide Range of Discounts: With various discounts available, Chevrolet Beretta owners can significantly reduce their premiums at Liberty Mutual. See more details in our guide titled, “Liberty Mutual Car Insurance Review.”

Cons

- Higher Rates for High-Risk Profiles: While it offers specialized services, Liberty Mutual’s rates can be higher for Chevrolet Beretta owners with high-risk profiles.

- Customer Service Variations: The level of customer service can vary, potentially affecting the insurance experience for some Chevrolet Beretta owners.

#9 – American Family: Best for Young Drivers

Pros

- Young Driver Focus: American Family offers programs and discounts specifically designed for young Chevrolet Beretta owners, making insurance more affordable.

- Generous Discount Programs: With multiple discounts, including for completing safe driver programs, young Chevrolet Beretta owners can enjoy lower rates. Learn more in our complete American Family car insurance review.

- Supportive Claims Process: American Family provides a supportive and efficient claims process, crucial for young Chevrolet Beretta owners navigating their first claims.

Cons

- Coverage Cost Variability: The cost of coverage can vary widely, especially for young Chevrolet Beretta owners without a driving history.

- Limited Availability: American Family insurance is not available in all states, which could limit options for some Chevrolet Beretta owners.

#10 – Travelers: Best for Safe Drivers

Pros

- Discounts for Safe Driving: Travelers rewards safe driving with substantial discounts, benefiting Chevrolet Beretta owners with clean driving records. Find more information in our guide, “Travelers Car Insurance Review.”

- Intuitive Mobile App: Travelers’ mobile app allows Chevrolet Beretta owners to manage their policies and file claims easily, enhancing their insurance experience.

- Flexible Payment Options: Travelers offers flexible payment options, making it easier for Chevrolet Beretta owners to handle their insurance payments.

Cons

- Stringent Requirements for Discounts: The requirements for obtaining discounts can be stringent, which might exclude some Chevrolet Beretta owners from savings.

- Premium Variability: Premiums can vary based on several factors, potentially making Travelers less affordable for some Chevrolet Beretta owners compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chevrolet Beretta Insurance Rates Breakdown

The cost of insuring a Chevrolet Beretta can vary significantly depending on the level of coverage and the provider you choose. The table below provides a detailed comparison of monthly rates from various insurers for both minimum and full coverage.

Chevrolet Beretta Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $140

American Family $43 $127

Farmers $48 $138

Geico $39 $115

Liberty Mutual $52 $145

Nationwide $44 $132

Progressive $47 $135

State Farm $45 $130

Travelers $46 $133

USAA $35 $110

The table below provides a detailed comparison of monthly car insurance rates for Chevrolet Beretta by coverage level and provider. For minimum coverage, rates start as low as $35 with USAA and can go up to $52 with Liberty Mutual.

On the other hand, full coverage rates show a broader range, with USAA again being the most affordable at $110 per month and Liberty Mutual the highest at $145.

This spread in pricing illustrates the importance of comparing not just costs but also the extent of coverage that fits the specific needs and budget constraints of Chevrolet Beretta owners. Learn more by reading our guide titled, “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

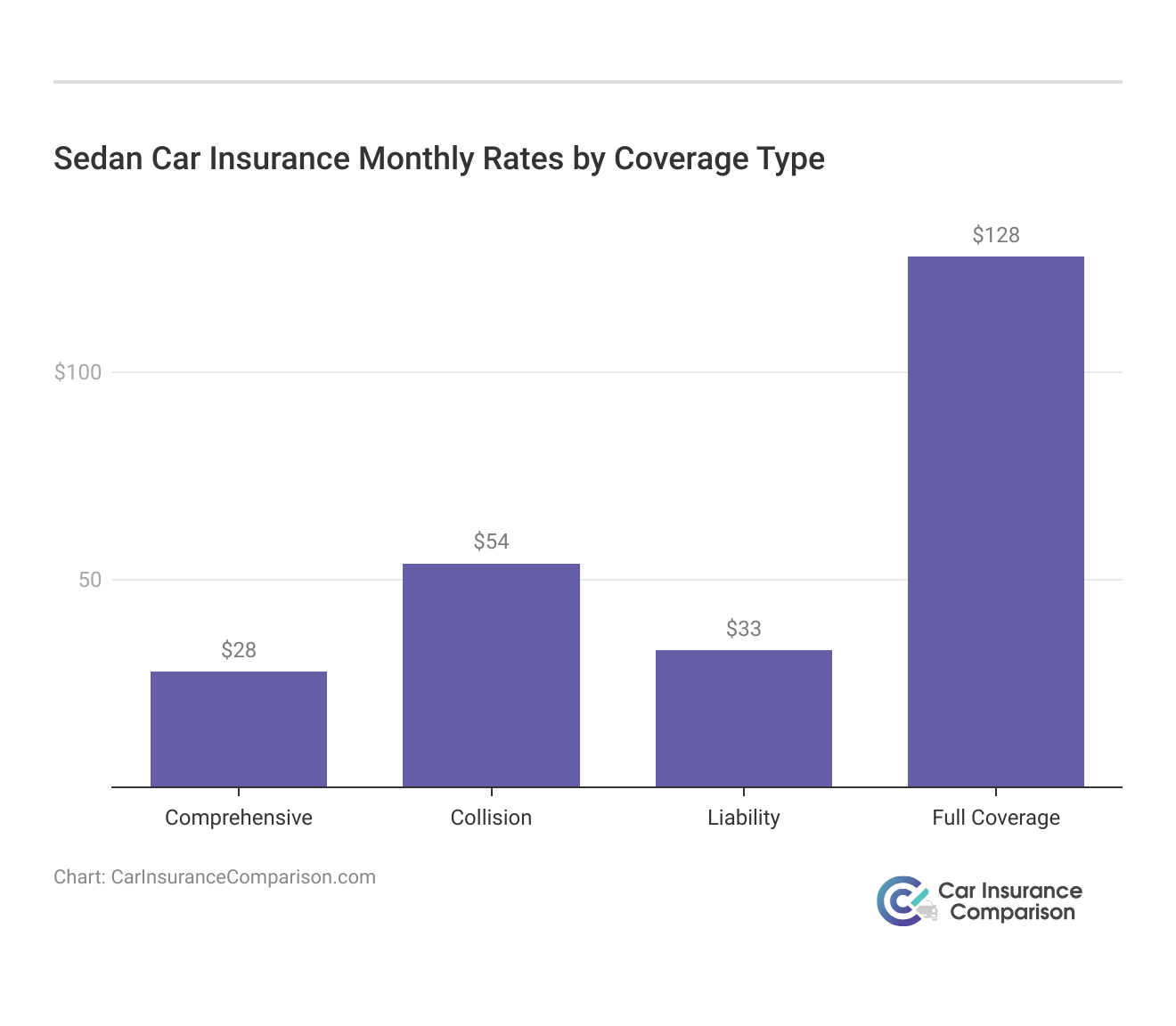

Cost Considerations for Insuring a Chevrolet Beretta

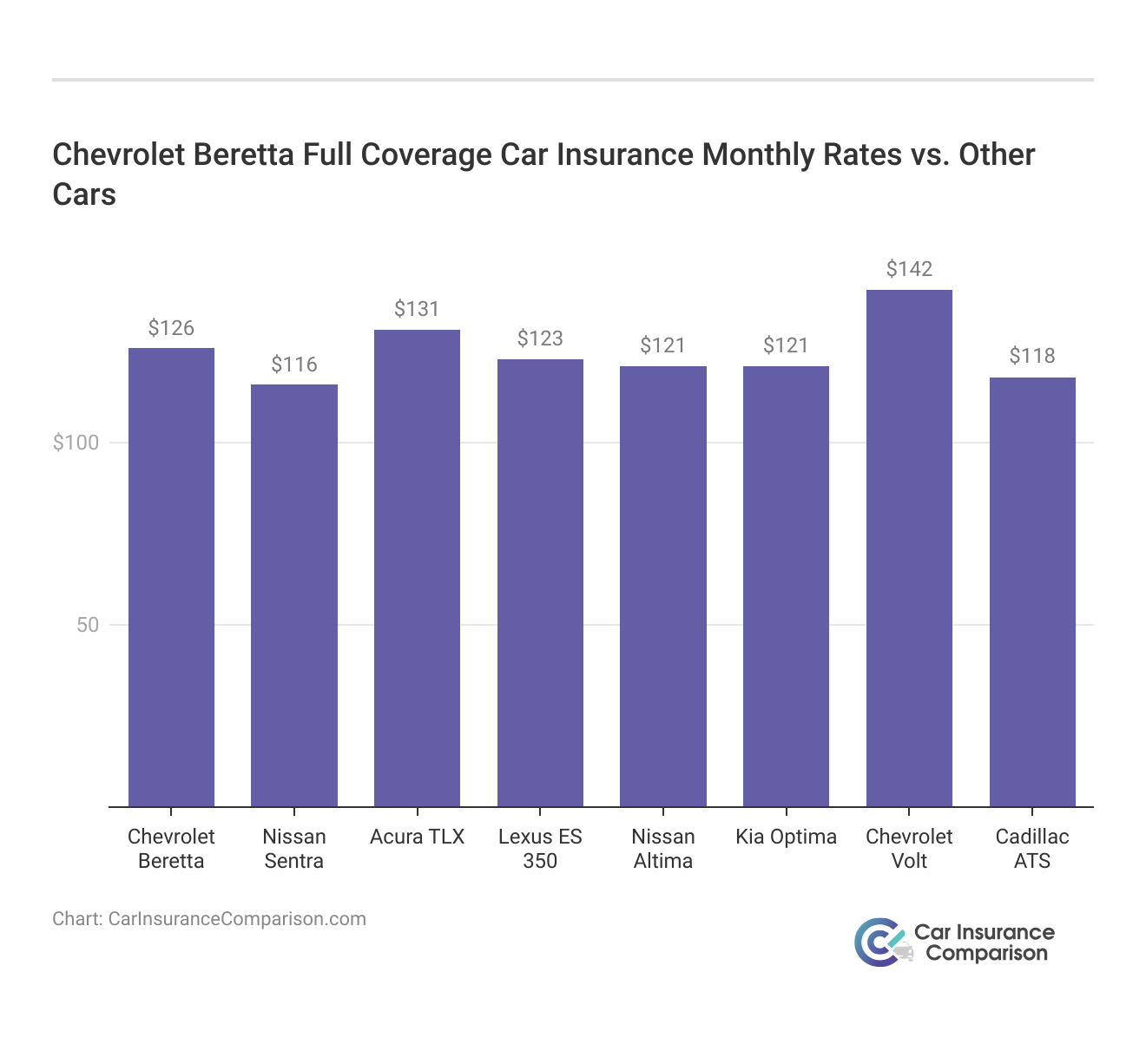

When considering the Chevrolet Beretta, one common question is whether it’s costly to insure. By comparing it with similar models, you can gauge the general insurance landscape for sedans like the Audi A8, Toyota Yaris iA, and Nissan Maxima.

The data presented highlights the diverse range of insurance costs for sedans, reflecting a mix of comprehensive, collision, and liability charges. For anyone assessing whether to purchase a Chevrolet Beretta or a similar vehicle, these figures provide a clear picture of potential insurance expenditures.

Exploring insurance rates for similar vehicles provides Chevrolet Beretta owners with a broader perspective on potential insurance costs, helping them make more informed financial decisions regarding their auto insurance needs.

Insurance Rates for Vehicles Similar to the Chevrolet Beretta

When considering car insurance, it’s useful to compare rates for vehicles similar to the Chevrolet Beretta. This comparison helps to contextualize the potential costs involved in insuring different types of vehicles within the same category.

Chevrolet Beretta Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Chevrolet Beretta | $27 | $44 | $31 | $113 |

| Ford Fusion | $28 | $52 | $31 | $124 |

| Lexus ES 350 | $30 | $55 | $26 | $123 |

| Cadillac CT6 | $32 | $65 | $33 | $143 |

| Nissan Maxima | $33 | $55 | $31 | $131 |

| Mercedes-Benz S450 | $41 | $82 | $33 | $169 |

| Kia Forte | $27 | $42 | $31 | $113 |

| Volkswagen CC | $27 | $51 | $35 | $125 |

| Hyundai Sonata | $25 | $44 | $35 | $119 |

The insurance costs for vehicles similar to the Chevrolet Beretta vary widely, reflecting the diversity in vehicle value and risk profiles. Such comparisons provide valuable insights for potential car buyers and those looking to adjust their existing vehicle insurance coverage.

Determinants of Chevrolet Beretta Insurance Premiums

The average annual rate for the Chevrolet Beretta is just that, an average. Your insurance rates for a Chevrolet Beretta can be higher or lower depending on the trim level and personal factors.

Those factors include your age, home address, driving history, and the model year of your Chevrolet Beretta. To find out more, explore our guide titled, “Factors That Affect Car Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save on Chevrolet Beretta Insurance

Save more on your Chevrolet Beretta car insurance rates. Take a look at the following five strategies that will get you the best Chevrolet Beretta auto insurance rates possible.

- Drive your Chevrolet Beretta safely.

- Consider ride-sharing services to lower your Chevrolet Beretta mileage.

- Buy winter tires for your Chevrolet Beretta.

- Reduce modifications on your Chevrolet Beretta.

- Buy your Chevrolet Beretta with cash, or get a shorter-term loan.

Implementing these strategies can lead to substantial savings on your Chevrolet Beretta insurance. Start applying these tips today and enjoy lower costs while maintaining great coverage. Access comprehensive insights into our guide titled, “What makes car insurance more expensive?“

Top Picks for Insuring Your Chevrolet Beretta

Choosing the right insurance provider for your Chevrolet Beretta is crucial, as various factors including security features and driving history influence rates.

The following overview highlights the top insurers based on market share, demonstrating their popularity among consumers and potential for cost-effective coverage.

Largest Auto Insurers by Market Share

Understanding the landscape of the auto insurance industry can be essential for consumers looking to choose a provider. Here is a breakdown of the largest auto insurers by market share, reflecting their dominance and customer reach within the market. To learn more, explore our comprehensive resource on “Compare Car Insurance by Coverage Type.”

Top Chevrolet Beretta Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

This list of the top auto insurers by market share reveals how market presence correlates with consumer trust and company size.

For Chevrolet Beretta owners, Progressive not only offers competitive rates but also tailors coverage to fit diverse driving habits.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Analyzing these figures helps potential customers gauge which insurers might offer the stability and comprehensive services they seek. Save money by comparing Chevrolet Beretta insurance rates with our free quotes online tool below now.

Frequently Asked Questions

Are Chevrolet Berettas expensive to insure?

Insurance rates can vary, so compare rates with similar sedans like the Audi A8, Toyota Yaris iA, and Nissan Maxima. For additional details, explore our comprehensive resource titled, “How do you get competitive quotes for car insurance?“

What affects the cost of Chevrolet Beretta insurance?

Factors include trim level, age, address, driving history, and model year.

How can I save on Chevrolet Beretta insurance?

Shop around, maintain a good record, consider higher deductibles, ask for discounts on safety features, and bundle policies. Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Which companies offer affordable Chevrolet Beretta insurance?

Top companies vary, but consider those with market share and discounts for safety features.

How can I compare free Chevrolet Beretta insurance quotes online?

Enter your ZIP code to view companies with cheap rates and compare quotes. To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

What car replaced the Chevy Beretta?

The Chevrolet Malibu replaced the Chevy Beretta in 1997, impacting insurance classifications and potentially affecting policy options for similar models.

Who are the top five insurance companies for the Chevy Beretta?

The top five insurance providers for the Chevy Beretta are Progressive, Geico, State Farm, Nationwide, and Allstate, known for their competitive rates and comprehensive coverage.

Which type of insurance is best for a Chevy Beretta?

Comprehensive insurance is best for the Chevy Beretta, offering extensive coverage that includes theft, vandalism, and weather-related damages.

Which company is best for Chevy Beretta car insurance claims?

State Farm stands out for Chevy Beretta insurance claims, offering prompt service and high customer satisfaction. Learn more in our “Is it cheaper to purchase car insurance online?”

Which company offers the best insurance for the Chevy Beretta?

Progressive is highly recommended for Chevy Beretta insurance, providing customizable coverage and usage-based pricing that can lead to cost savings.

Which insurance is the most popular for the Chevy Beretta?

Is the Chevy Beretta a good car for insurance purposes?

Why did Chevy stop making the Beretta, and how does it affect insurance?

What car company makes the Beretta, and what are the implications for insurance?

Which insurance company is most expensive for the Chevy Beretta?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.