Best Mercedes Car Insurance Rates in 2026 (Find the Top 10 Companies Here!)

Allstate, Geico, and Progressive provide the best Mercedes car insurance rates, starting at only $50 per month. These insurers are known for their budget-friendly policies and extensive coverage options, catering to a variety of needs and making them attractive choices for many people.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated February 2026

Company Facts

Full Coverage for Mercedes

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Mercedes

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage for Mercedes

A.M. Best Rating

Complaint Level

Pros & Cons

- Progressive begins at $50 per month, providing attractive rates

- Practicing safe driving to reduce Mercedes insurance expenses

- Varied coverage options guarantee superb Mercedes insurance

#1 – Allstate: Top Overall Pick

Pros

- Wide Range of Coverage Options: Allstate offers a diverse range of coverage options, including specialized coverage for luxury vehicles like Mercedes, allowing customers to tailor their policies to their specific needs. Read more through our Allstate car insurance review.

- Excellent Customer Service: With a reputation for exceptional customer service, Allstate provides responsive support and efficient claims processing, ensuring a smooth experience for policyholders.

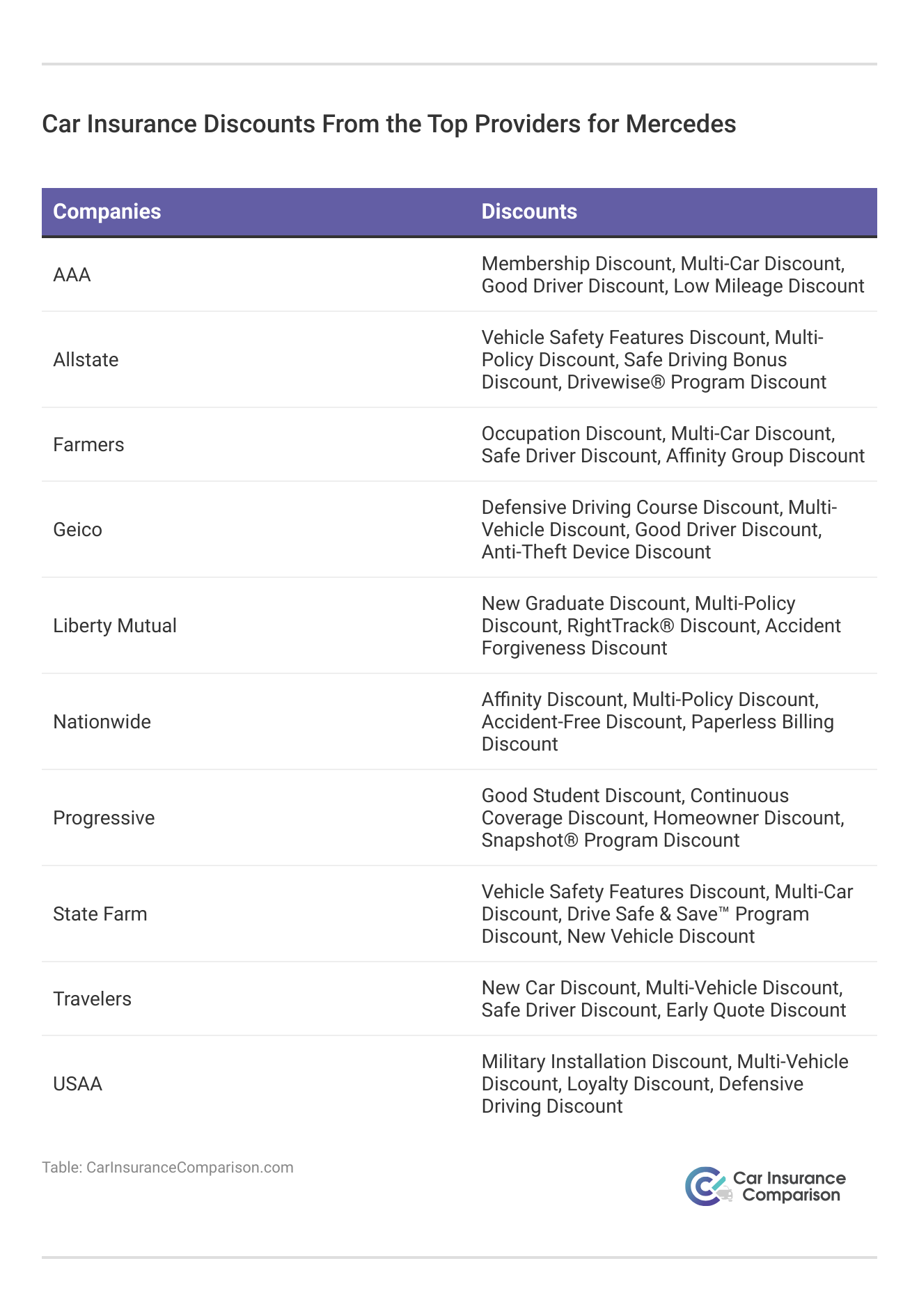

- Discount Opportunities: Allstate offers various discount opportunities, such as safe driver discounts and bundling policies, helping customers save money on their premiums.

Cons

- Higher Premiums: While Allstate provides comprehensive coverage and excellent service, their premiums may be higher compared to some other insurers, making it less budget-friendly for some customers.

- Limited Availability: Allstate may not be available in all regions, limiting access for potential customers who reside outside of their service areas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Affordability: Geico is known for offering competitive rates, making it an attractive option for budget-conscious customers seeking cost-effective insurance solutions for their Mercedes vehicles.

- User-Friendly Online Tools: Geico’s online platform is user-friendly and intuitive, allowing customers to easily manage their policies, file claims, and access resources, enhancing convenience and efficiency.

- Wide Availability: Our Geico insurance review highlights that Geico operates nationwide, ensuring accessibility for customers across the country, regardless of their location.

Cons

- Limited Coverage Options: While Geico offers standard coverage options, they may have fewer add-on coverage options compared to some other insurers, potentially limiting customization for customers with specific needs.

- Average Customer Service: While Geico provides adequate customer service, some customers may find their support less personalized compared to other insurers, with longer wait times for assistance.

#3 – Progressive: Best for Customer Service

Pros

- Innovative Tools and Discounts: Progressive offers innovative tools such as Snapshot® for personalized rates and a variety of discounts, including multi-policy and safe driver discounts, helping customers save on their premiums. Learn more through our Progressive car insurance review.

- Flexible Payment Options: Progressive provides flexible payment options, including customized payment plans and automatic payments, offering convenience and flexibility for policyholders.

- Strong Financial Stability: Progressive boasts strong financial stability and a solid reputation in the insurance industry, providing customers with confidence and peace of mind regarding their coverage.

Cons

- Mixed Customer Reviews: While Progressive has many satisfied customers, some individuals have reported mixed experiences with their customer service and claims process, leading to varying levels of satisfaction.

- Complex Policy Options: Progressive’s wide range of policy options and add-ons may be overwhelming for some customers, potentially complicating the decision-making process when selecting coverage for their Mercedes.

#4 – State Farm: Best for Student Savings

Pros

- Personalized Service: State Farm is known for its personalized service, with a vast network of agents who can offer tailored guidance and assistance, ensuring that customers receive individualized attention and support.

- Strong Reputation: With a long history and positive customer reviews, State Farm is known for reliability and customer satisfaction.

- Discount Opportunities: State Farm offers various discount opportunities, such as good driver discounts and multi-policy discounts, enabling customers to save money on their premiums while still receiving quality coverage.

Cons

- Potentially Higher Premiums: While State Farm’s personalized service and extensive coverage options are appealing, their premiums may be higher compared to some other insurers, making it less affordable for certain customers. Refer to our State Farm car insurance review for guidance.

- Limited Online Tools: State Farm’s online platform may not offer as many features and functionalities as some other insurers, potentially limiting convenience for customers who prefer managing their policies digitally.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Diverse Coverage

Pros

- Customizable Coverage Options: Liberty Mutual offers customizable coverage options, allowing customers to tailor their policies to their specific needs and preferences, ensuring they receive the appropriate level of protection for their Mercedes vehicles.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, providing customers with peace of mind knowing that their rates won’t increase after their first accident, helping to maintain affordability and stability.

- 24/7 Claims Assistance: Liberty Mutual provides 24/7 claims assistance and support, ensuring that customers can receive assistance and file claims at any time, enhancing convenience and accessibility.

Cons

- Limited Availability of Discounts: While Liberty Mutual offers various discounts, such as multi-policy and good student discounts, their discount opportunities may be more limited compared to some other insurers, potentially resulting in fewer opportunities for savings. Read more through our Liberty Mutual car insurance review.

- Mixed Customer Reviews: Liberty Mutual has received mixed reviews regarding their customer service and claims handling, with some customers expressing dissatisfaction with their experiences, which may impact overall satisfaction levels.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Wide Range of Coverage Options: Nationwide offers a wide range of coverage options, including specialized coverage for luxury vehicles like Mercedes, ensuring that customers can find the right level of protection for their specific needs.

- Member Benefits: Nationwide offers member benefits such as accident forgiveness and vanishing deductibles, rewarding customers for their loyalty and safe driving habits, and helping to lower their insurance costs over time.

- Strong Financial Stability: Nationwide boasts strong financial stability and a solid reputation in the insurance industry, providing customers with confidence in their coverage and the assurance that claims will be handled efficiently and fairly.

Cons

- Potentially Higher Premiums: While Nationwide provides comprehensive coverage and valuable member benefits, their premiums may be higher compared to some other insurers, making it less affordable for certain customers.

- Limited Availability of Discounts: Nationwide’s discount opportunities may be more limited compared to some other insurers, potentially resulting in fewer opportunities for customers to save money on their premiums, as highlighted in our Nationwide insurance review.

#7 – Farmers: Best for Safety Discounts

Pros

- Customizable Policies: Farmers offers customizable policies, allowing customers to tailor their coverage to their specific needs and preferences, ensuring they receive the appropriate level of protection for their Mercedes vehicles. Learn more through our Farmers car insurance review.

- Additional Coverage Options: Farmers provides additional coverage options such as new car replacement and rideshare insurance, offering customers added peace of mind and protection against unexpected events.

- Strong Agent Network: Farmers boasts a strong network of agents who can offer personalized guidance and assistance, ensuring that customers receive individualized support and expert advice when selecting and managing their policies.

Cons

- Potentially Higher Premiums: While Farmers provides comprehensive coverage and additional options, their premiums may be higher compared to some other insurers, making it less budget-friendly for certain customers.

- Mixed Customer Reviews: Farmers has received mixed reviews regarding their customer service and claims handling, with some customers expressing dissatisfaction with their experiences, which may impact overall satisfaction levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Savings

Pros

- Exclusive Membership Benefits: USAA offers exclusive membership benefits, including competitive rates, dedicated customer service, and a variety of discounts tailored to military members and their families, providing exceptional value and support. Read more through our USAA car insurance review.

- Financial Strength and Stability: USAA boasts strong financial stability and a solid reputation in the insurance industry, ensuring that members can rely on their coverage and trust that claims will be handled efficiently and fairly.

- High Customer Satisfaction: USAA consistently receives high ratings for customer satisfaction and loyalty, with members praising their responsive service, claims handling, and overall experience, making it a top choice for Mercedes owners in the military community.

Cons

- Membership Restrictions: USAA membership is limited to military members, veterans, and their families, excluding eligibility for the general public, which may limit access to their insurance products and services.

- Limited Availability of Physical Locations: USAA primarily operates online and via phone, with fewer physical branch locations compared to traditional insurers, potentially limiting in-person support and assistance for some members.

#9 – AAA: Best for Roadside Assistance

Pros

- Member Benefits and Discounts: AAA offers a variety of member benefits and discounts, including roadside assistance, travel perks, and insurance savings, providing added value and convenience for members who own Mercedes vehicles.

- Reputation for Reliability: AAA has a longstanding reputation for reliability and trustworthiness, with a strong commitment to serving its members and providing quality insurance products and services.

- Local Agent Support: AAA provides access to local agents who can offer personalized support and assistance, ensuring that members receive individualized guidance and expert advice when selecting and managing their insurance policies.

Cons

- Membership Requirements: AAA membership is required to access their insurance products and services, which may exclude eligibility for individuals who are not AAA members, limiting access to their coverage options. Read more through our AAA insurance review.

- Coverage Limitations: AAA’s coverage options and discounts may be more limited compared to some other insurers, potentially resulting in fewer opportunities for members to customize their policies and save on their premiums.

#10 – Travelers: Best for Specialized Coverage

Pros

- Comprehensive Coverage Options: Travelers offers a wide range of comprehensive coverage options, including specialized coverage for luxury vehicles like Mercedes, ensuring that customers can find the right level of protection for their specific needs.

- Discount Opportunities: Travelers provides various discount opportunities, such as safe driver discounts and multi-policy discounts, enabling customers to save money on their premiums while still receiving quality coverage.

- Strong Financial Stability: With a solid reputation and strong financial stability, Travelers provides customers with confidence in their coverage and the assurance that claims will be handled efficiently and fairly. Follow us through our Travelers car insurance review.

Cons

- Potentially Higher Premiums: While Travelers offers comprehensive coverage and valuable discount opportunities, their premiums may be higher compared to some other insurers, making it less affordable for certain customers.

- Limited Online Tools: Travelers’ online platform may not offer as many features and functionalities as some other insurers, potentially limiting convenience for customers who prefer managing their policies digitally.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Mercedes Car Insurance Rates

Mercedes Car Insurance Rates by Model

Mercedes Car Insurance Savings Tips

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Mercedes Car Insurance Rates

Frequently Asked Questions

Are Mercedes more expensive to insure?

Compared to non-luxury cars, Mercedes car insurance is expensive. Drivers can find cheap insurance for Mercedes-Benz by shopping around. Compare multiple insurance companies to find the most affordable coverage.

What is the car insurance price for Mercedes?

Full coverage car insurance for a Mercedes costs around $200 a month. However, rates vary by model and driver factors such as age, driving record, and ZIP code. Enter your ZIP code now to begin.

Is Mercedes a luxury car?

Yes, Mercedes is considered a luxury vehicle. While other brands may have luxury models, every Mercedes model is a luxury vehicle. All Mercedes models include high-end interiors and upgraded technology, cheapest car insurance, and safety features.

Are car insurance rates the same for all Mercedes models?

No, car insurance rates can vary depending on the specific model of your Mercedes. Factors such as the car value, repair costs, safety features, and historical claims data for that model can influence insurance rates. Generally, more expensive and high-performance Mercedes models may have higher insurance premiums.

Can I save money on car insurance for a Mercedes?

Yes, there are ways to potentially save money on car insurance for your Mercedes. Here are some tips:

- Shop around and compare quotes from multiple insurers specializing in luxury car insurance.

- Consider bundling your Mercedes insurance with other policies like home or umbrella insurance.

- Maintain a good driving record and consider taking defensive driving courses.

- Install anti-theft devices and safety features in your Mercedes.

- Inquire about discounts specific to luxury vehicles or Mercedes owners.

- Review and adjust your coverage needs periodically to ensure you are not overpaying for unnecessary coverage.

Abovementioned steps are the factors that can help one to save money. Enter your ZIP code now to start.

How much is insurance on a Mercedes C-Class?

A 2023 Mercedes-Benz C300 costs $165 monthly for full coverage, making it a more affordable option compared to the overall Mercedes average. However, you should compare Mercedes car insurance quotes to find the best deal for your C300 and good driver discount.

How much is insurance for a Mercedes GLE 350?

You’ll pay $189 monthly to insure a Mercedes GLE 350, higher than the overall Mercedes average. You can still follow Mercedes car insurance savings tips to find low rates for your GLE 350.

Why is Mercedes insurance so expensive?

Mercedes car insurance is expensive because Mercedes are luxury cars that are more expensive to replace to repair after an accident. Enter your ZIP code now to begin.

Will car insurance go up if you buy a Mercedes?

Most Mercedes car insurance insurance policies like affordability of insurance rates are expensive, so your rates may go up. The best way to keep your insurance affordable is to compare Mercedes car insurance quotes to find the best rate.

How much is car insurance for a Mercedes-Benz?

Mercedes-Benz auto insurance will be more expensive, but you may be able to find cheaper rates by shopping around.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.