Best Ford Shelby GT350 Car Insurance in 2025 (Top 10 Companies Ranked)

Discover the best Ford Shelby GT350 car insurance with State Farm, Geico, and Progressive, starting at $82 monthly. These providers offer competitive rates, comprehensive coverage, and exceptional customer service tailored to meet the specific needs of Ford Shelby GT350 owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Aug 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Ford Shelby GT350

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Ford Shelby GT350

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Ford Shelby GT350

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best Ford Shelby GT350 car insurance providers are State Farm, Geico, and Progressive, known for their exceptional coverage and customer service.

These companies stand out for their ability to offer comprehensive protection tailored to the unique needs of Ford Shelby GT350 owners. By comparing these top insurers, drivers can ensure they receive the best possible rates and terms tailored specifically for high-performance vehicles like the Shelby GT350. Learn more in our guide titled “Cheap Car Insurance for High-Performance Vehicles.”

Our Top 10 Company Picks: Best Ford Shelby GT350 Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Affordable Rates Geico

#3 20% A+ Flexible Plans Progressive

#4 10% A+ Local Agents Allstate

#5 20% A++ Military Families USAA

#6 12% A Comprehensive Cover Liberty Mutual

#7 15% A Policy Bundling Farmers

#8 20% A+ Vanishing Deductible Nationwide

#9 15% A Teen Drivers American Family

#10 13% A++ Hybrid Vehicles Travelers

Choosing the right insurer involves considering factors such as coverage options, customer reviews, and overall value.

To compare Ford Shelby GT350 auto insurance quotes from top companies, enter your ZIP code above.

- State Farm is the top pick for Ford Shelby GT350 car insurance

- Coverage is tailored for the high-performance nature of the Shelby GT350

- Insuring a Shelby GT350 involves specific considerations like repair costs

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies, beneficial for Ford Shelby GT350 owners.

- High Low-Mileage Discount: Owners of the Ford Shelby GT350 who drive fewer miles can benefit from State Farm’s substantial low-mileage discounts.

- Wide Coverage: State Farm provides a range of coverage options tailored to the unique needs of Ford Shelby GT350 owners. See the reviews and rankings in our full article titled “State Farm Car Insurance Review.”

Cons

- Limited Multi-Policy Discount: For Ford Shelby GT350 owners, State Farm’s multi-policy discount is lower compared to some competitors.

- Premium Costs: Despite available discounts, State Farm’s premiums may still be relatively higher for certain coverage levels for the Ford Shelby GT350.

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing: Geico offers affordable rates for Ford Shelby GT350 insurance, significantly lower than many competitors. Learn more about Geico’s rates in our guide titled “Geico Car Insurance Review.”

- High Customer Satisfaction: Geico is known for its excellent customer service, which is crucial for Ford Shelby GT350 owners looking for reliable support.

- Fast Claims Processing: Ford Shelby GT350 owners can benefit from Geico’s efficient claims processing, ensuring quicker resolution and less downtime.

Cons

- Coverage Limitations: Some Ford Shelby GT350 owners might find Geico’s coverage options less comprehensive than those of higher-priced competitors.

- Discount Specificity: While Geico offers a 25% multi-policy discount, the specific savings for Ford Shelby GT350 insurance may vary based on individual circumstances.

#3 – Progressive: Best for Flexible Plans

Pros

- Customizable Plans: Progressive offers highly customizable insurance plans, which is ideal for Ford Shelby GT350 owners with specific needs.

- Loyalty Rewards: Progressive provides loyalty rewards that can benefit Ford Shelby GT350 owners who stick with the company long-term.

- Online Tools: Progressive’s advanced online tools help Ford Shelby GT350 owners manage their policies and claims efficiently. Our complete “Progressive Car Insurance Review” goes over this in more detail.

Cons

- Variable Customer Service: The quality of customer service at Progressive can vary, potentially affecting Ford Shelby GT350 owners during claims.

- Higher Rates for High Risk: Ford Shelby GT350 owners with a high-risk profile might face steeper rates at Progressive compared to other insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Local Agents

Pros

- Personalized Service: Allstate’s strong network of local agents provides personalized service, making it easier for Ford Shelby GT350 owners to tailor their coverage. Find more information about Allstate’s rates in our article titled “Allstate Car Insurance Review.”

- Local Knowledge: Local agents have a deep understanding of regional regulations and risks, which can benefit Ford Shelby GT350 owners in optimizing their coverage.

- Discounts for Safety Features: Allstate offers discounts for vehicles with advanced safety features, which can be advantageous for Ford Shelby GT350 owners with equipped models.

Cons

- Higher Local Rates: In some areas, Allstate’s rates may be higher than national averages, impacting Ford Shelby GT350 owners depending on their location.

- Less Competitive Multi-Policy Discount: With a 10% multi-policy discount, Allstate may not offer as much savings for Ford Shelby GT350 owners compared to other insurers with higher discounts.

#5 – USAA: Best for Military Families

Pros

- Tailored to Military Needs: USAA offers insurance that’s specifically tailored to the needs of military families, ideal for service members who own a Ford Shelby GT350.

- Excellent Rates and Customer Service: Known for combining competitive rates with outstanding customer service, USAA is a top choice for Ford Shelby GT350 owning military families. Check out insurance savings for military members and their families in our complete “USAA Car Insurance Review.”

- Comprehensive Coverage: USAA provides comprehensive coverage options that are well-suited for the specific needs of Ford Shelby GT350 owners.

Cons

- Limited Availability: USAA’s services are only available to military members and their families, which limits access for other Ford Shelby GT350 owners.

- Restrictive Policy Changes: Changes to policies or coverage may be more restrictive at USAA compared to other insurers, potentially affecting Ford Shelby GT350 owners during relocations or deployments.

#6 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Broad Coverage Options: Liberty Mutual offers a wide range of comprehensive coverage options, ideal for the diverse needs of Ford Shelby GT350 owners.

- Accident Forgiveness: Liberty Mutual provides accident forgiveness policies, which can prevent premium increases for Ford Shelby GT350 owners after their first accident.

- Customizable Deductibles: Ford Shelby GT350 owners can benefit from Liberty Mutual’s customizable deductibles to fit their financial situations. Learn more about this provider in our thorough article titled “Liberty Mutual Car Insurance Review.”

Cons

- Premium Variability: Rates at Liberty Mutual can vary widely based on the Ford Shelby GT350 owner’s location and driving history, potentially leading to higher costs.

- Customer Service Variations: Some customers may experience variability in service quality, which could impact satisfaction for Ford Shelby GT350 insurance claims.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Policy Bundling

Pros

- Extensive Bundling Options: Farmers offers significant savings for Ford Shelby GT350 owners who bundle their auto insurance with other policies, like home or life insurance.

- Custom Coverage Levels: Farmers provides customizable coverage options, allowing Ford Shelby GT350 owners to tailor their policies according to their specific needs.

- Dedicated Agents: Personalized service from dedicated agents ensures Ford Shelby GT350 owners receive the guidance needed to make informed insurance decisions. Take a look at our article titled “Farmers Car Insurance Review.”

Cons

- Higher Base Rates: Despite bundling discounts, Farmers’ base rates can be higher compared to other insurers, potentially affecting Ford Shelby GT350 owners looking for budget-friendly options.

- Complex Claims Process: Some Ford Shelby GT350 owners may find Farmers’ claims process to be more complex and time-consuming than other insurers.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible that decreases for each year of safe driving, rewarding Ford Shelby GT350 owners for their good driving habits.

- Wide Network of Agents: A robust network of agents provides accessible and comprehensive support for Ford Shelby GT350 owners across the country. Explore more discount options in our guide titled “Nationwide Car Insurance Discounts.”

- Flexible Payment Options: Nationwide allows Ford Shelby GT350 owners to choose from various payment plans, making it easier to manage insurance expenses.

Cons

- Inconsistency in Customer Service: Customer service quality can vary, which might affect the experience of Ford Shelby GT350 owners during claims or policy adjustments.

- Rate Fluctuations: Ford Shelby GT350 owners might experience rate fluctuations based on their driving record and regional factors, which can lead to unexpected premium increases.

#9 – American Family: Best for Teen Drivers

Pros

- Focused Teen Driver Programs: American Family offers specialized programs and discounts for teen drivers, which can be beneficial for families with young drivers who own a Ford Shelby GT350.

- Strong Customer Support: Known for its excellent customer support, American Family helps Ford Shelby GT350 owners navigate their policy options and claims efficiently. Find out more about American Family in our article titled “American Family Car Insurance Review.”

- Safety Program Discounts: Discounts for participating in safety programs and using safe driving apps are available, which can reduce premiums for Ford Shelby GT350 owners.

Cons

- Limited Coverage in Some States: American Family’s insurance products, including those for the Ford Shelby GT350, are not available in all states, limiting options for some owners.

- Premiums Dependent on Teen Driving: While beneficial for families, premiums can be higher if teen drivers are included on the policy, affecting the overall cost for Ford Shelby GT350 insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Hybrid Vehicles

Pros

- Specialized Hybrid Vehicle Discounts: Travelers offers discounts specifically for hybrid vehicles, which could benefit Ford Shelby GT350 owners considering eco-friendly modifications.

- Extensive Coverage Options: A broad array of coverage options allows Ford Shelby GT350 owners to choose plans that best fit their needs and lifestyle. Read more about Travelers’ ratings in our article titled “Travelers Car Insurance Review.”

- Accident Forgiveness: Like other top insurers, Travelers provides accident forgiveness, which can be crucial for maintaining lower rates after an initial accident for Ford Shelby GT350 owners.

Cons

- Higher Rates for High-Performance Models: Ford Shelby GT350 owners might face higher premiums due to the vehicle’s high-performance nature, which is considered a higher risk by Travelers.

- Complex Policy Customization: While offering extensive options, the customization process can be intricate and overwhelming for some Ford Shelby GT350 owners, requiring more time to tailor the perfect policy.

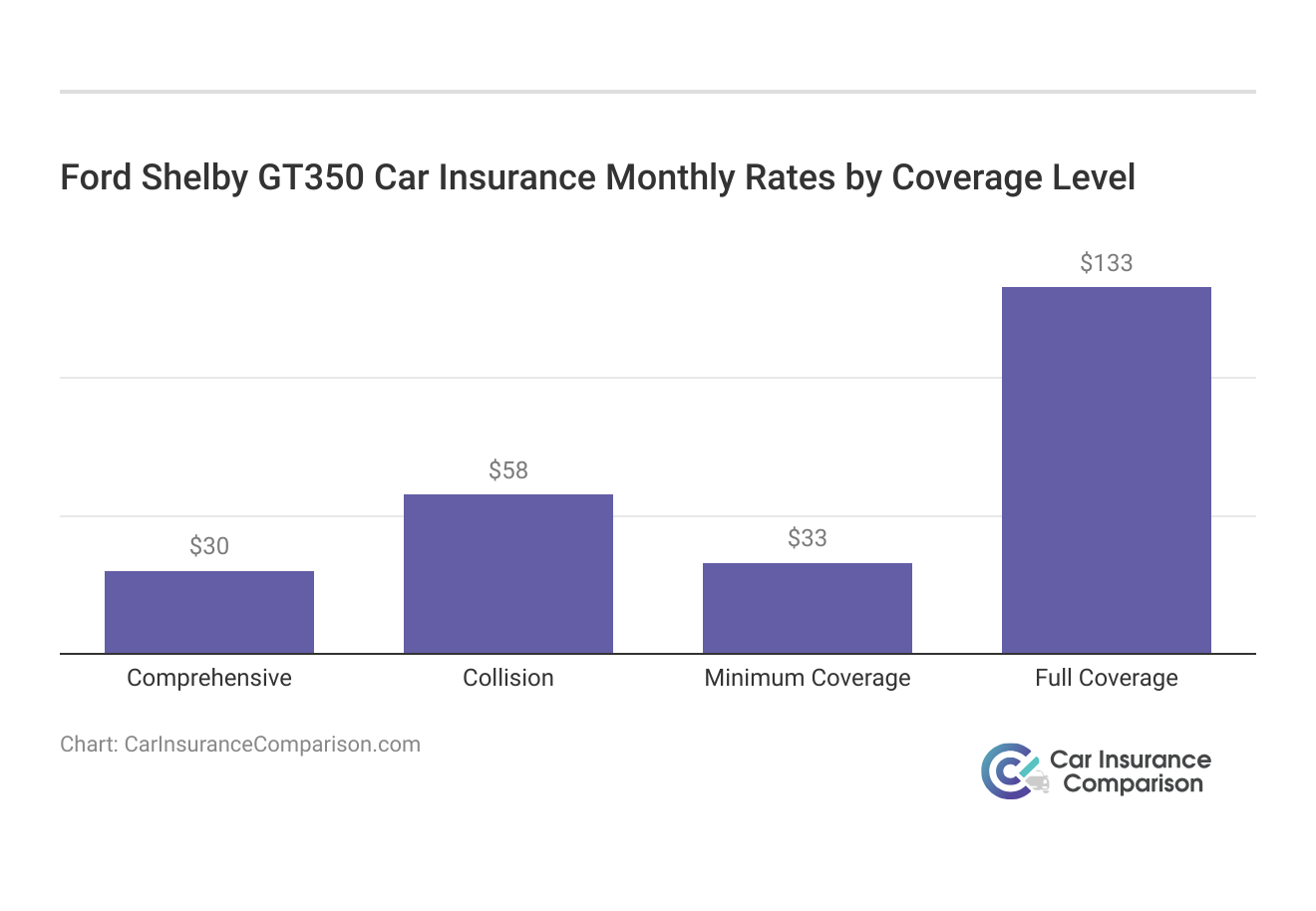

Monthly Insurance Rates for Ford Shelby GT350: Minimum vs. Full Coverage

The table below presents the monthly insurance rates for a Ford Shelby GT350, segmented by minimum and full coverage across various providers. This information is crucial for owners to identify the most cost-effective insurer that meets their coverage needs.

Ford Shelby GT350 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $112 $225

American Family $99 $207

Farmers $100 $210

Geico $89 $195

Liberty Mutual $110 $220

Nationwide $108 $215

Progressive $95 $205

State Farm $105 $212

Travelers $103 $218

USAA $82 $190

For owners of the Ford Shelby GT350, choosing between minimum and full coverage involves weighing cost against risk. USAA offers the lowest rates for both minimum and full coverage, at $82 and $190 respectively, making it an attractive option for military families.

Geico presents the next most affordable option, with monthly rates of $89 for minimum coverage and $195 for full coverage. On the higher end, Allstate charges $112 for minimum and $225 for full coverage.

The rates indicate a significant variation in pricing between providers, underscoring the importance of comparing these costs to find the best insurance solution for your Ford Shelby GT350. See more details on our guide titled “Compare Ford vs. Chevrolet Car Insurance Rates.”

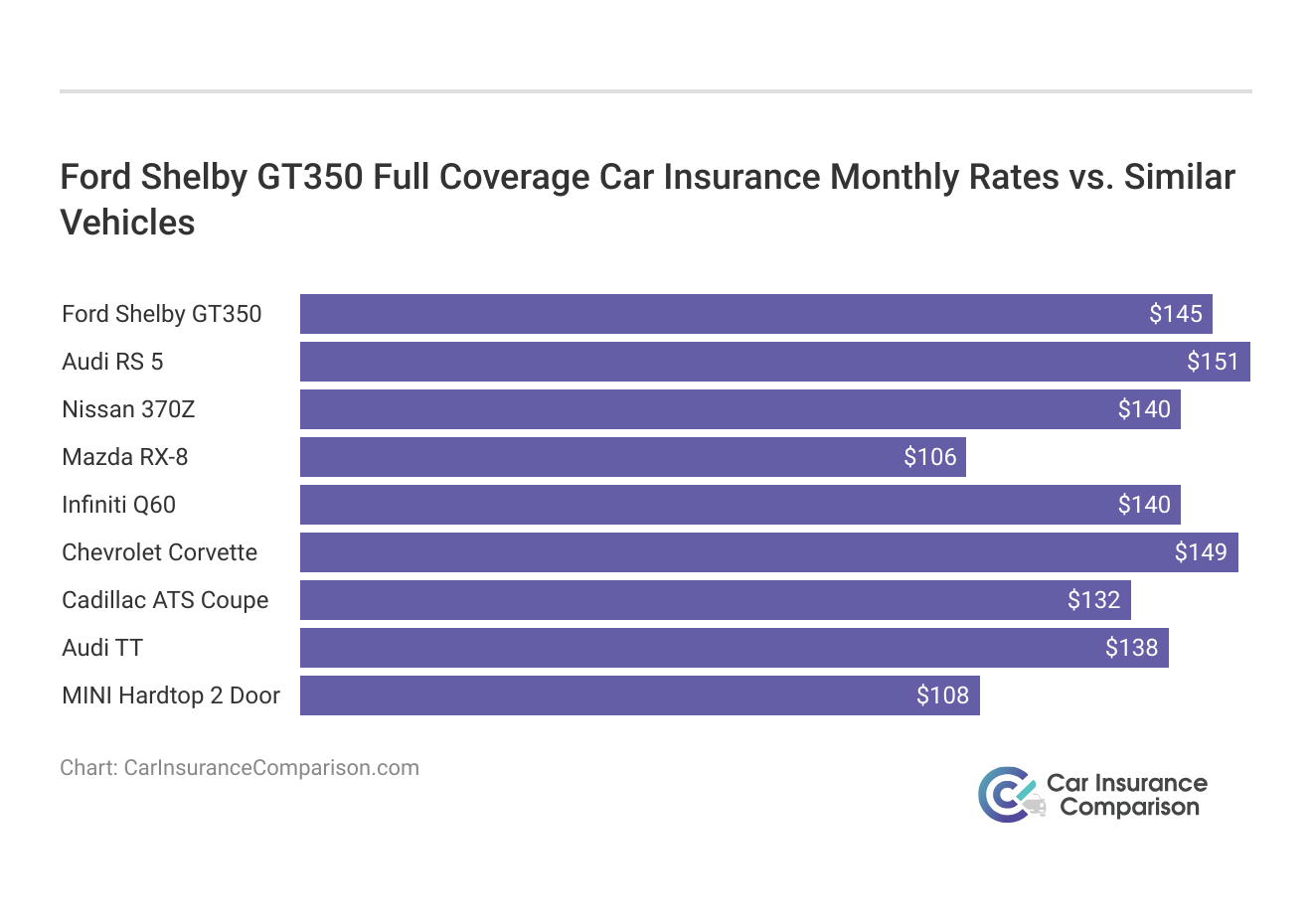

Are Vehicles Like the Ford Shelby GT350 Expensive to Insure

Take a look at how insurance rates for similar models to the Ford Shelby GT350 look. These insurance rates for other coupes like the BMW 1 Series M, Mercedes-Benz CLA-Class, and Mercedes-Benz GT give you a good idea of what to expect.

Vehicles like the Ford Shelby GT350, along with other high-performance coupes, tend to have higher insurance rates due to their advanced features and repair costs.

The comparative data from similar models, such as the Audi RS 5 and Chevrolet Corvette, illustrates a trend where comprehensive, collision, and liability costs contribute to substantial total premiums. Check out insurance savings in our complete guide titled “When should I drop collision coverage?”

Ford Shelby GT350 Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

Ford Shelby GT350 $35 $70 $40 $145

Cadillac ATS Coupe $29 $57 $33 $132

Chrysler Sebring $17 $29 $39 $98

Audi S5 $33 $72 $33 $151

Subaru BRZ $27 $44 $30 $111

Audi RS 5 $35 $74 $31 $151

Chevrolet Corvette $41 $77 $22 $149

Nissan 370Z $28 $60 $38 $140

Audi TT $32 $60 $33 $138

Understanding these costs is crucial for potential owners to budget appropriately for insurance expenses, ensuring that they account for these higher-than-average rates when considering ownership of such dynamic and luxurious vehicles.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Ford Shelby GT350 Insurance

The cost of insuring a Ford Shelby GT350 varies widely, influenced by factors such as trim level, which can affect premiums due to value and repair costs, and personal details like age, driving history, home address, and credit score. Discover more about offerings in our article titled “Do I have to repair my car with the insurance money?”

Younger drivers typically face higher premiums due to inexperience, whereas a clean driving record can lower costs. Residing in high-crime or congested areas can also hike premiums due to increased risks. The model year of your Shelby GT350 influences insurance costs; newer models are more expensive but may depreciate in cost, whereas older models can have higher rates due to outdated safety features.

Furthermore, the car insurance deductible you choose can affect your monthly premiums; opting for a higher deductible can lower your monthly payments, but it means more out-of-pocket expenses in the event of a claim. By understanding these factors, you can take proactive steps to mitigate some of the costs associated with insuring your vehicle.

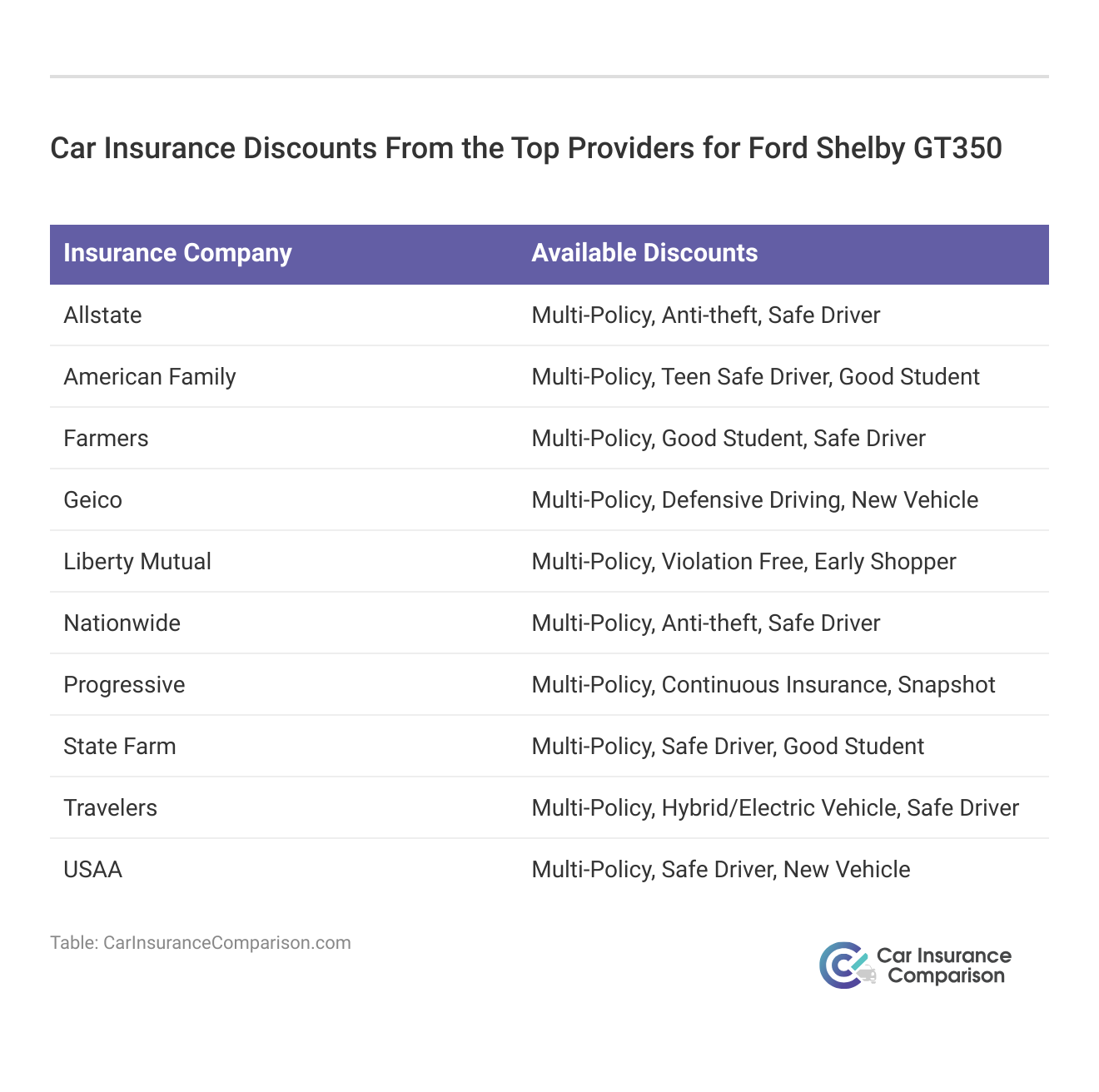

Ways to Save on Ford Shelby GT350 Insurance

If you want to reduce the cost of your Ford Shelby GT350 insurance rates, follow these tips below:

- Ask your insurance company about Ford Shelby GT350 discounts.

- Check your Ford Shelby GT350 policy carefully to ensure all information is correct.

- Check Ford Shelby GT350 auto insurance rates through Costco.

- Move to an area with better weather.

- Make sure you use an accredited driver safety program.

To secure lower insurance rates for your Ford Shelby GT350, utilize these strategies and continuously explore new opportunities for discounts and savings. Access comprehensive insights into our guide titled “Company Discounts on Car Insurance.”

Top Ford Shelby GT350 Insurance Companies

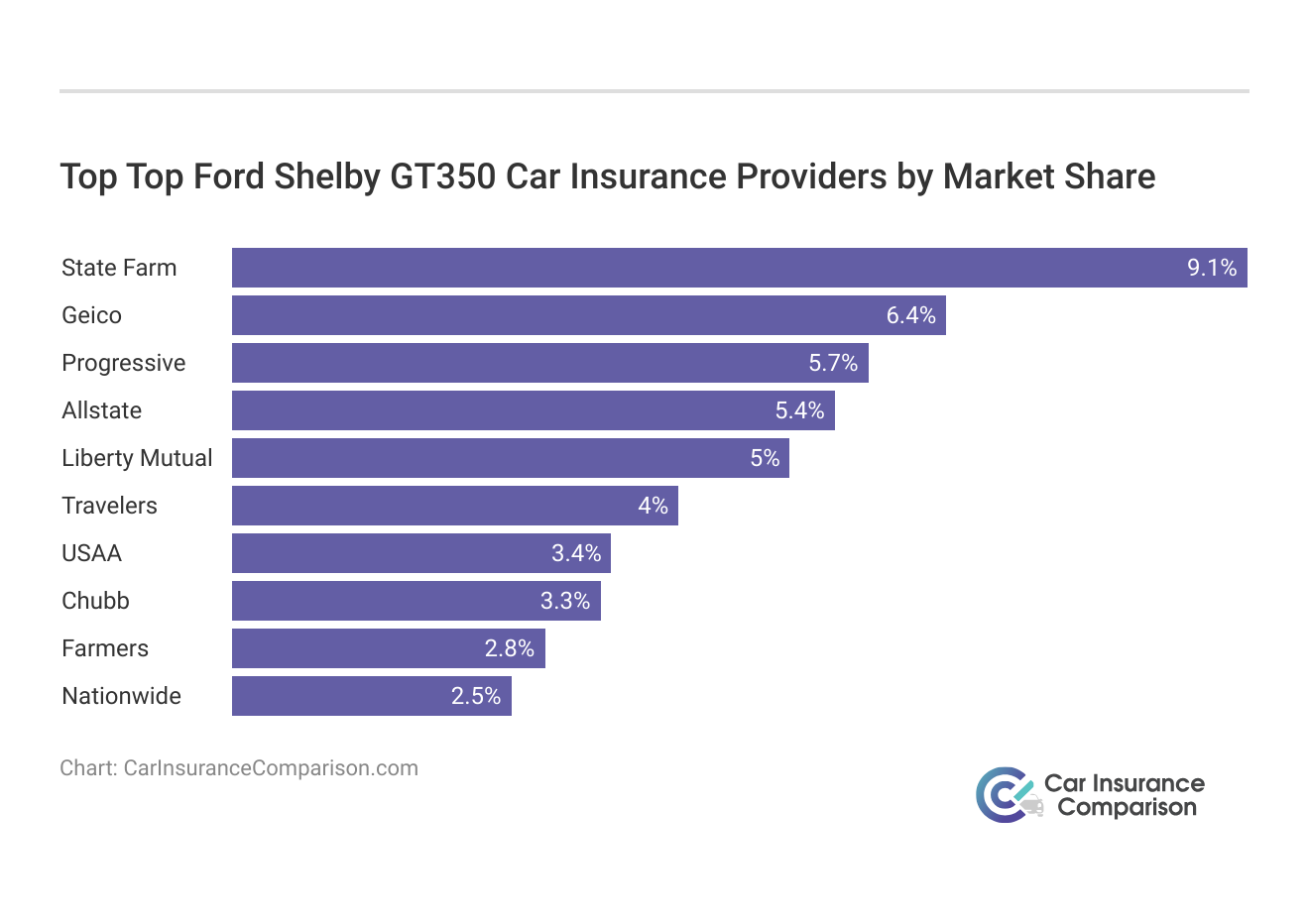

What is the best auto insurance company for Ford Shelby GT350 insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Ford Shelby GT350 auto insurance coverage (ordered by market share).

State Farm's commanding market presence and substantial insurance volume underscore its position as the top choice for Ford Shelby GT350 owners seeking dependable coverage.

Brad Larson Licensed Insurance Agent

Many of these companies offer discounts for security systems and other safety features found on the Ford Shelby GT350. Delve into our evaluation of our guide titled “Safety Features Car Insurance Discounts.”

Selecting the right insurer for your Ford Shelby GT350 involves considering the top companies by market share, such as State Farm, Geico, and Progressive, which lead in providing tailored auto insurance coverage for this model.

Top Ford Shelby GT350 Car Insurance Providers by Market Share

Rank Insurance Company Premium Written Market Share

#1 State Farm $66.1 million 9.1%

#2 Geico $46.3 million 6.4%

#3 Progressive $41.7 million 5.7%

#4 Allstate $39.2 million 5.4%

#5 Liberty Mutual $36.1 million 5%

#6 Travelers $28.7 million 4%

#7 USAA $24.6 million 3.4%

#8 Chubb $24.1 million 3.3%

#9 Farmers $20 million 2.8%

#10 Nationwide $18.4 million 2.5%

These companies not only dominate the market but also offer competitive rates and discounts for safety features, making them ideal choices for securing comprehensive insurance for high-performance vehicles like the Shelby GT350.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparing Free Ford Shelby GT350 Insurance Quotes Online

When looking to insure your Ford Shelby GT350, utilizing online comparison tools can be a highly effective way to ensure you’re getting the best possible deal. These platforms allow you to quickly gather quotes from leading insurers like State Farm, Geico, and Progressive, who are known for offering competitive rates and robust coverage options for high-performance vehicles.

By entering detailed information about your Shelby GT350, as well as personal data like your driving history and location, you can receive personalized quotes tailored to your specific needs. Unlock details in our article titled “Compare Car Insurance Rates by State.”

It’s important to thoroughly review each quote, paying close attention to the coverage details and checking for applicable discounts such as those for safe driving or vehicle security features. This way, you can compare and choose an option that not only meets your budget but also provides adequate protection for your cherished vehicle.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

Are vehicles like the Ford Shelby GT350 expensive to insure?

Insurance rates for vehicles like the Ford Shelby GT350 can vary.

What impacts the cost of Ford Shelby GT350 insurance?

Factors such as age, address, driving history, and model year can affect the cost of insurance.

For additional details, explore our comprehensive resource titled “Does the age of a car affect car insurance rates?”

How can I save on Ford Shelby GT350 insurance?

Compare quotes, maintain a clean driving record, utilize available discounts, and consider raising your deductible.

Which are the top auto insurance companies for Ford Shelby GT350 coverage?

Some top insurance companies for Ford Shelby GT350 coverage include Progressive, State Farm, and USAA.

Access comprehensive insights into our guide titled “Progressive vs. USAA Car Insurance Comparison.”

How can I compare free Ford Shelby GT350 insurance quotes online?

Use our free online tool to compare quotes from multiple insurance companies. Enter your ZIP code to get started.

What is the best car insurance for Shelby vehicles?

The best car insurance for Shelby vehicles typically comes from providers like State Farm, Geico, and Progressive, known for their comprehensive coverage options and competitive pricing tailored to high-performance cars.

How can I find the best cheap car insurance for Shelby models?

To find the best cheap car insurance for Shelby models, compare quotes from multiple insurers, look for discounts related to vehicle safety features, and consider adjusting your deductible to lower premiums.

Who is known for the cheapest Ford Shelby GT500 car insurance?

Geico often offers the cheapest rates for Ford Shelby GT500 car insurance, due to their competitive pricing structures and various discount options.

Learn more by reading our guide titled “Cheapest Car Insurance in the World.”

What insurance does Ford Shelby GT500 use?

Ford Shelby GT500 owners typically use auto insurance from major providers like State Farm, Progressive, and Geico, which offer comprehensive and collision coverage tailored for high-performance vehicles.

Is it worth having full coverage on an old car like the Ford Shelby GT500?

Yes, it is worth having full coverage on an old Ford Shelby GT500, especially due to its high value as a performance car and potential costs related to repairs or replacements.

Why is my insurance so high for a Ford Shelby GT500?

Insurance is typically high for a Ford Shelby GT500 due to its status as a high-performance sports car, which carries higher repair costs and a greater likelihood of being involved in speed-related incidents.

For additional details, explore our comprehensive resource titled “Will a single vehicle accident affect car insurance rates?”

At what age is Ford Shelby GT500 car insurance cheapest?

Ford Shelby GT500 car insurance is usually cheapest for drivers in their mid to late 50s, as they are considered less risky due to more driving experience and typically more stable insurance records.

Which gender pays more for Ford Shelby GT500 car insurance?

Generally, male drivers often pay more for Ford Shelby GT500 car insurance compared to female drivers, especially if they are younger, due to higher statistics of risk and claims among young male drivers.

Does Ford Shelby GT500 car insurance go down when a car is paid off?

Yes, Ford Shelby GT500 car insurance can go down when the car is paid off, as owners may opt to reduce coverage from full insurance to liability only, depending on their needs and the car’s value.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Does credit score affect Ford Shelby GT500 car insurance?

Yes, a credit score can affect Ford Shelby GT500 car insurance rates, as insurers use credit scores to gauge risk and determine pricing, with higher scores generally leading to lower premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.