Best Buick Rendezvous Car Insurance in 2026 (Your Guide to the Top 10 Companies)

The best Buick Rendezvous auto insurance providers are Geico, State Farm, and Progressive, with a starting rate of just $29 per month. Geico shines with personalized policies, providing exclusive rewards for cautious drivers. These companies ensure full protection for your Buick Rendezvous.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Expert

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated October 2024

Company Facts

Full Coverage for Buick Rendezvous

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Buick Rendezvous

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Buick Rendezvous

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Buick Rendezvous car insurance are Geico, State Farm, and Progressive, known for their reliability and competitive coverage options.

These companies stand out in the market for their comprehensive coverage options and excellent customer service. Learn more in our article titled, “Cheap Car Insurance.”

Our Top 10 Company Picks: Best Buick Rendezvous Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 25% A++ Competitive Rates Geico

![]()

#2 17% B Customer Service State Farm

#3 20% A+ Online Tools Progressive

#4 25% A+ Local Agents Allstate

#5 10% A++ Military Families USAA

#6 15% A Custom Coverage Farmers

#7 20% A+ Bundle Options Nationwide

#8 12% A Personalized Service Liberty Mutual

#9 23% A Teen Drivers American Family

#10 13% A++ Hybrid Vehicles Travelers

When choosing a policy for your Buick Rendezvous, it’s essential to consider factors like the insurer’s reputation, coverage benefits, and overall cost-effectiveness. This guide will help you understand why these providers are favored by Buick Rendezvous owners looking for quality insurance.

To compare Buick Rendezvous auto insurance quotes from top companies, enter your ZIP code above now.

- Geico is the top pick for the best Buick Rendezvous car insurance

- Insurance for the Buick Rendezvous varies based on model and driver history

- Customizing coverage options can optimize protection and cost for Buick owners

#1 – Geico: Top Overall Pick

Pros

- Substantial Bundle Savings: Geico offers up to a 25% reduction on Buick Rendezvous insurance when combining it with other policies. Learn more in our complete guide, “Geico Car Insurance Review.”

- Exceptional Financial Strength: Geico’s A++ rating from A.M. Best reflects its solid financial footing, ensuring reliability in safeguarding your Buick Rendezvous.

- Economical Premiums: Geico frequently provides some of the most budget-friendly Buick Rendezvous insurance rates, beginning as low as $29 monthly.

- Flexible Payment Plans: Geico’s flexible payment options allow Buick Rendezvous owners to manage their premiums more conveniently.

Cons

- Limited In-Person Interaction: Geico’s focus on a digital-first approach means less personal support for Buick Rendezvous policyholders who prefer face-to-face consultations.

- Restrictions on Discounts: Some discounts for Buick Rendezvous policies may not be combinable, potentially reducing the total savings available.

- Variable Customer Service: Although financially robust, Geico’s customer service experience for Buick Rendezvous owners can differ depending on the location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Diverse Coverage

Pros

- Outstanding Customer Experience: State Farm is renowned for delivering excellent customer service, particularly to Buick Rendezvous owners.

- Comprehensive Coverage Options: Buick Rendezvous drivers can select from a diverse range of State Farm’s tailored insurance options. See more details in our guide, “State Farm Car Insurance Review.”

- Savings from Bundling: Buick Rendezvous owners can save up to 17% by combining their auto insurance with other policies like homeowners or renters insurance.

- Personalized Agent Assistance: State Farm provides Buick Rendezvous owners with personalized service through a widespread network of local agents.

Cons

- Higher Premiums: State Farm’s insurance for Buick Rendezvous can be more expensive when compared to other providers.

- Less Competitive Bundle Discount: With only a 17% discount for multiple policies, Buick Rendezvous owners might find State Farm’s savings less attractive.

- Moderate Financial Stability: State Farm’s B rating from A.M. Best indicates it may not be as financially secure as other top-rated insurers for Buick Rendezvous coverage.

#3 – Progressive: Best for Online Tools

Pros

- Cutting-Edge Digital Experience: Progressive offers a streamlined online platform for managing Buick Rendezvous insurance policies. More information about this provider is available in our “Progressive Car Insurance Review.”

- Discounts for Safe Driving: Buick Rendezvous owners can benefit from Progressive’s Snapshot program, which rewards safe driving habits with reduced premiums.

- Solid Financial Standing: Progressive’s A+ rating from A.M. Best underscores its financial stability in providing Buick Rendezvous insurance.

- Competitive Multi-Policy Savings: Buick Rendezvous owners can receive up to a 20% discount when bundling with other insurance products through Progressive.

Cons

- Complex Discount System: Buick Rendezvous policyholders may find Progressive’s discount structure difficult to fully understand and optimize.

- Inconsistent Support: Customer service quality for Buick Rendezvous insurance through Progressive can vary widely depending on location.

- Mid-Level Pricing: While competitive, Progressive’s premiums for Buick Rendezvous insurance aren’t the lowest in the market.

#4 – Allstate: Best for Local Expertise

Pros

- Customized Support: Buick Rendezvous owners benefit from Allstate’s extensive network of local agents, offering personalized insurance advice.

- Variety of Coverage Options: Allstate provides a wide range of coverage options specifically tailored to the needs of Buick Rendezvous drivers.

- Strong Financial Ratings: Allstate’s A+ rating from A.M. Best signifies reliable financial backing for Buick Rendezvous insurance claims.

- Generous Multi-Policy Discount: Buick Rendezvous owners can save up to 25% when bundling insurance policies with Allstate. Read up on the Allstate car insurance review for more information.

Cons

- Higher Insurance Costs: Allstate tends to have higher premiums for Buick Rendezvous insurance compared to other providers.

- Limited Digital Tools: Allstate’s online resources may not be as advanced as those offered by competitors, which could be less convenient for tech-savvy Buick Rendezvous owners.

- Inconsistent Discount Availability: Some discounts for Buick Rendezvous insurance might not be offered in every state, which can affect overall savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Family

Pros

- Exclusive Discounts for Military: USAA provides Buick Rendezvous insurance with special discounts for military members and their families.

- Top-Tier Financial Security: USAA’s A++ rating from A.M. Best reflects its superior financial strength, ensuring robust protection for Buick Rendezvous owners.

- Competitive Rates: USAA offers Buick Rendezvous insurance at affordable rates, especially for those eligible through military service. Check out insurance savings in our guide USAA car insurance review.

- Dedicated Support for Military Families: Buick Rendezvous owners in military families benefit from USAA’s high customer satisfaction and dedicated service.

Cons

- Restricted Eligibility: Buick Rendezvous insurance from USAA is only accessible to military members and their families, limiting availability.

- Limited Agent Presence: USAA’s lack of local agents might be less convenient for Buick Rendezvous owners who prefer face-to-face assistance.

- Lower Bundling Discount: With only a 10% discount for bundling policies, Buick Rendezvous owners may find USAA’s savings less competitive compared to other providers

#6 – Farmers: Best for Custom Coverage

Pros

- Customizable Plans: Farmers provides adjustable insurance solutions for your Buick Rendezvous, ensuring your coverage aligns with your individual needs.

- Versatile Options: Farmers delivers a variety of adaptable plans, allowing Buick Rendezvous owners to fine-tune their policies as circumstances evolve.

- Safety Feature Discounts: Farmers offers notable savings for Buick Rendezvous owners whose vehicles are equipped with modern safety enhancements.

- Strong Financial Security: With an A rating, Farmers guarantees dependable coverage for your Buick Rendezvous. Discover more about offerings in our complete Farmers car insurance review.

Cons

- Restricted Discounts: The 15% savings Farmers grants for your Buick Rendezvous might not be as attractive compared to other providers.

- Elevated Premiums: Farmers’ tailored policies for the Buick Rendezvous can result in higher costs.

- Limited Geographic Reach: Farmers’ specialized plans for Buick Rendezvous may not be accessible in all areas.

#7 – Nationwide: Best for Bundle Benefits

Pros

- Extensive Bundling Savings: Nationwide provides up to a 20% reduction for Buick Rendezvous owners who combine their auto insurance with other policies like homeowners.

- A+ Financial Standing: Nationwide’s A+ rating offers Buick Rendezvous owners confidence, backed by substantial financial strength. Access comprehensive insights into our guide titled, “Nationwide Car Insurance Discount.”

- Roadside Support: Buick Rendezvous drivers benefit from Nationwide’s comprehensive roadside assistance program, included with select policies.

- Accident Protection: Nationwide offers accident forgiveness, an excellent feature for Buick Rendezvous owners seeking to avoid premium hikes after their initial accident.

Cons

- Moderate Savings Rates: Although the 20% bundling reduction is significant, other companies might offer more competitive discounts for Buick Rendezvous owners.

- Complex Policy Structures: Nationwide’s bundling packages for Buick Rendezvous can be intricate, with multiple layers of coverage and stipulations.

- Limited Personalization: Despite the bundling savings, Buick Rendezvous owners may find fewer opportunities to customize individual policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Personalized Service

Pros

- Dedicated Support: Liberty Mutual offers personalized assistance, ensuring Buick Rendezvous owners receive customized guidance.

- Flexible Policies: Liberty Mutual enables Buick Rendezvous drivers to adjust their policies according to specific needs. Delve into our evaluation of Liberty Mutual car insurance review.

- Discounts for Safe Drivers: Buick Rendezvous owners who maintain a spotless driving record can benefit from substantial savings with Liberty Mutual.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program helps Buick Rendezvous drivers maintain stable premiums after an accident.

Cons

- Lower Savings Rates: Liberty Mutual’s 12% discount for Buick Rendezvous coverage is less competitive when compared to other insurers.

- Higher Base Costs: Buick Rendezvous owners may find Liberty Mutual’s base premiums to be on the expensive side.

- Cumbersome Claims Process: Some Buick Rendezvous drivers have reported that Liberty Mutual’s claims procedure can be tedious and slow.

#9 – American Family: Best for Teen Driver

Pros

- Teen Driver Savings: American Family offers significant reductions of up to 23% for Buick Rendezvous owners with teenage drivers on their policy.

- Safe Driving Programs: Buick Rendezvous owners can enroll their teen drivers in American Family’s safe driving programs to lower premiums.

- A-Rated Security: American Family’s A rating ensures reliable coverage and financial stability for Buick Rendezvous owners. Discover insights in our guide titled, “American Family Car Insurance Review.”

- Bundling Discounts: Additional savings are available for Buick Rendezvous owners who combine their auto insurance with other policies.

Cons

- Higher Risk for Teen Drivers: Insuring teenage drivers with a Buick Rendezvous may still lead to increased premiums, even with discounts.

- Limited Accessibility: American Family’s coverage for Buick Rendezvous may not be offered in all regions, limiting availability.

- Strict Eligibility: The discounts for Buick Rendezvous with teenage drivers may require stringent compliance, such as the completion of a safe driving course.

#10 – Travelers: Best for Hybrid Vehicle

Pros

- Hybrid Discounts: Travelers provides exclusive savings for Buick Rendezvous hybrid models, rewarding eco-conscious choices.

- A++ Financial Rating: Travelers’ A++ rating assures robust financial security for Buick Rendezvous owners. Access comprehensive insights into our guide titled, “Travelers Car Insurance Review.”

- Eco-Friendly Incentives: Buick Rendezvous owners can enjoy additional discounts under Travelers’ Green Car initiative, promoting sustainable driving.

- Extensive Coverage Options: Travelers offers a wide range of coverage options for Buick Rendezvous, including gap insurance and rental reimbursement.

Cons

- Lower Discount Rates: The 13% reduction for Buick Rendezvous hybrid insurance might be less competitive than others.

- Premium Expenses: Travelers’ policies for Buick Rendezvous hybrids may involve higher costs due to the specialized coverage.

- Limited Hybrid Model Availability: The savings for Buick Rendezvous hybrids apply only to specific models, limiting its reach.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buick Rendezvous Insurance Cost Breakdown

The table below presents a detailed comparison of monthly insurance rates for the Buick Rendezvous, segmented by coverage level and provider. This information is essential for owners looking to balance cost with coverage depth.

Buick Rendezvous Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $40 $130

American Family $32 $117

Farmers $45 $140

Geico $31 $100

Liberty Mutual $36 $125

Nationwide $34 $110

Progressive $35 $115

State Farm $39 $122

Travelers $37 $120

USAA $29 $105

Rates for minimum coverage insurance for the Buick Rendezvous start as low as $29 with USAA and can go up to $45 with Farmers, reflecting a range that accommodates various budgetary needs.

For those seeking more comprehensive protection, full coverage rates are also provided, with Geico offering the most affordable option at $100 per month, whereas Farmers presents the highest at $140.

This table allows Buick Rendezvous owners to assess which insurer offers the best value for either basic liability or enhanced full coverage, tailoring their insurance to their specific needs and financial circumstances.

Read more: How do you get competitive quotes for car insurance?

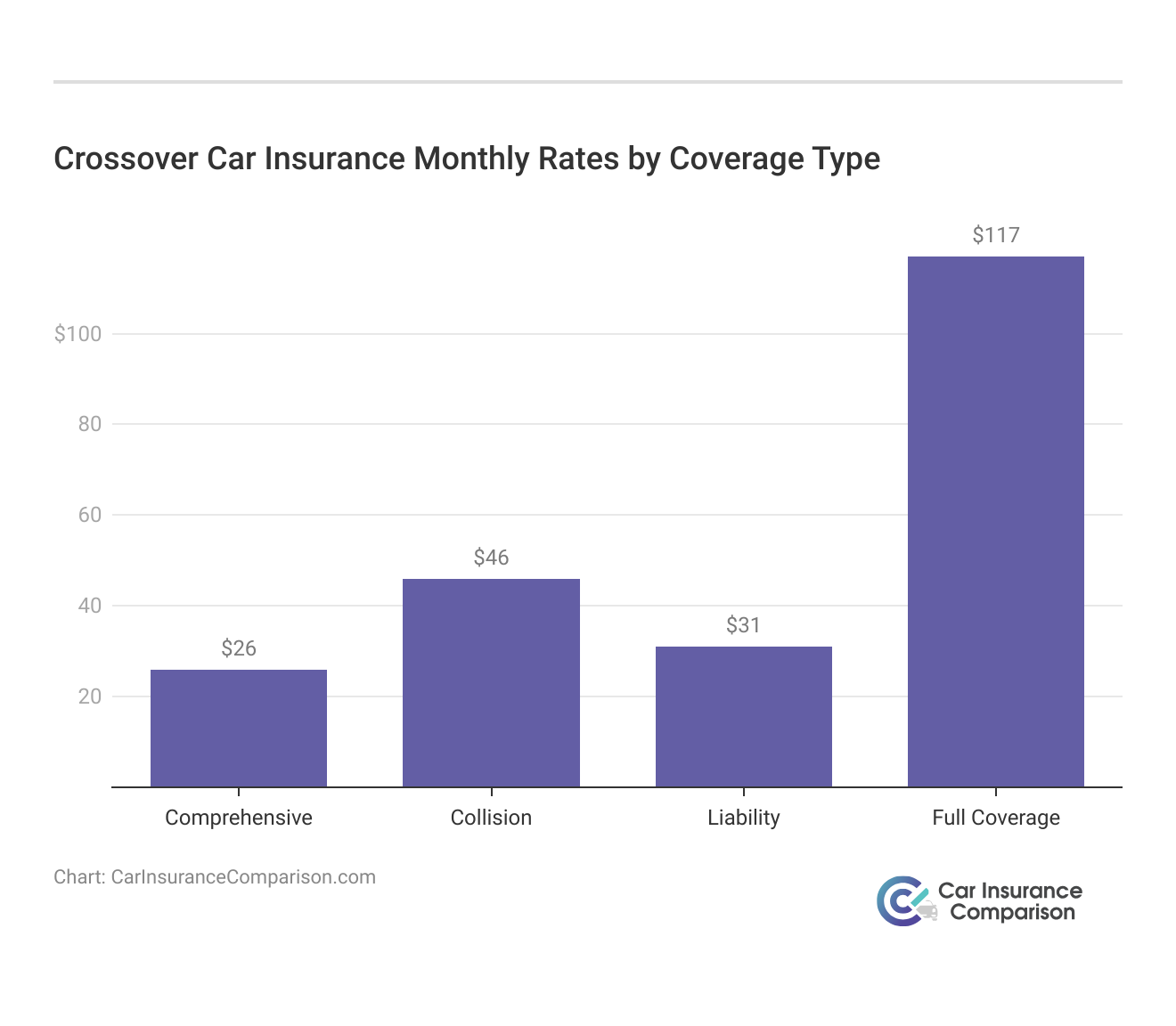

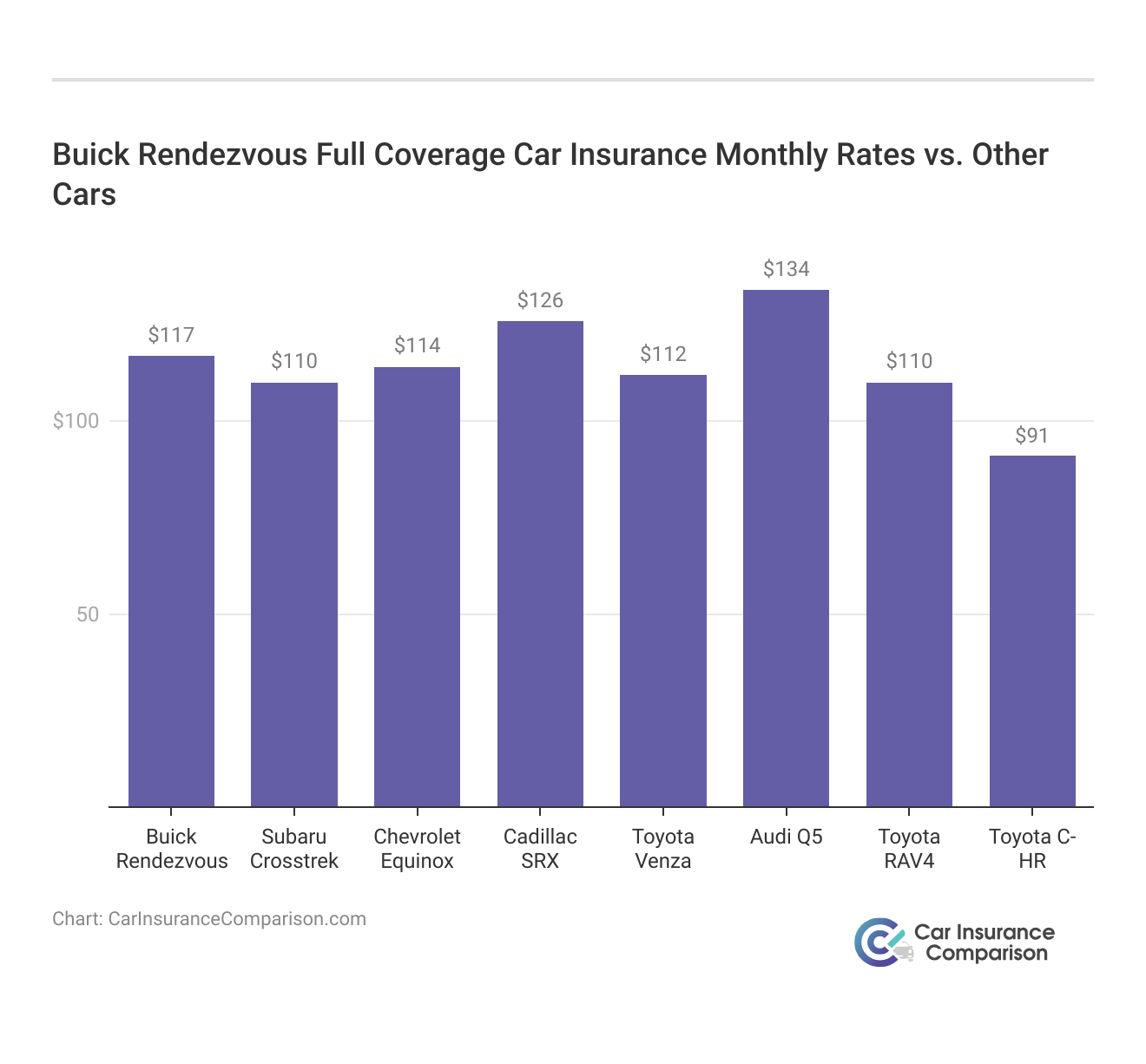

Insuring Vehicles Like the Buick Rendezvous: Costs and Considerations

Understanding the insurance costs for vehicles like the Buick Rendezvous can help you budget more effectively. By comparing the rates for similar crossovers such as the Lexus UX Hybrid, Acura ZDX, and Honda HR-V, you can gain a clearer picture of the potential expenses.

The provided data on crossover insurance rates showcases the varied costs associated with different types of coverage, from comprehensive to full coverage.

This information is invaluable for those seeking to make informed decisions about their vehicle insurance, ensuring that they choose a plan that best suits their needs and budget.

The data clearly outlines the insurance expenses for models comparable to the Buick Rendezvous, highlighting a range of costs that potential buyers and current owners should consider. This comparison serves as a valuable tool for making informed decisions about vehicle insurance.

Insurance Rates for Vehicles Similar to the Buick Rendezvous

Understanding the insurance rates for vehicles similar to the Buick Rendezvous provides a broader perspective on potential costs and helps in making informed decisions when comparing vehicle insurance.

Buick Rendezvous Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Buick Rendezvous | $26 | $46 | $31 | $117 |

| Honda CR-V | $23 | $34 | $26 | $95 |

| Cadillac SRX | $26 | $51 | $36 | $126 |

| Infiniti QX30 | $29 | $57 | $33 | $132 |

| Infiniti QX70 | $31 | $63 | $35 | $142 |

| Toyota RAV4 | $25 | $42 | $31 | $110 |

| Chrysler PT Cruiser | $13 | $21 | $33 | $78 |

| Ford Escape | $23 | $37 | $26 | $98 |

| Lincoln MKT | $31 | $52 | $38 | $136 |

This comparison of insurance rates among vehicles like the Buick Rendezvous showcases the variety in costs based on vehicle type and coverage, guiding owners in selecting an insurance plan that best suits their needs and budget. Learn more by reading our guide, “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Factors Impacting the Cost of Buick Rendezvous Insurance

The Buick Rendezvous trim and model you choose can impact the total price you will pay for Buick Rendezvous insurance coverage.

For top-tier car insurance for the Buick Rendezvous, Geico consistently delivers quality and value.

Brad Larson Licensed Insurance Agent

You can also expect your Buick Rendezvous rates to be affected by where you live, your driving history, and in most states your age and gender. Explore our review of “What affects a car insurance quote?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

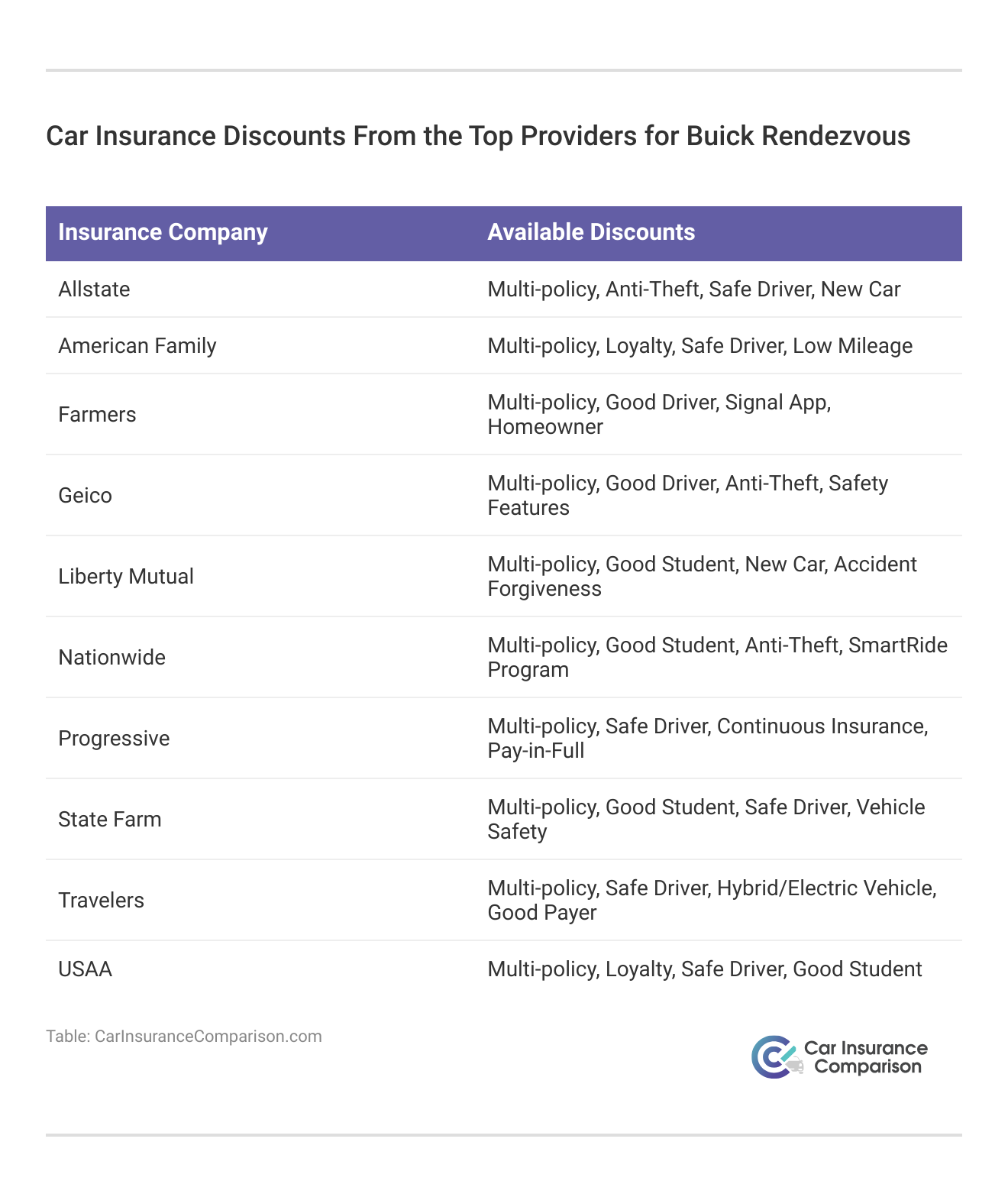

Ways to Save on Buick Rendezvous Insurance

Saving on car insurance premiums for your Buick Rendezvous doesn’t have to be complicated. Here are some straightforward strategies that can help you reduce your premiums effectively.

- Use paperless billing for your Buick Rendezvous insurance policy.

- Add a more experienced driver to your Buick Rendezvous policy.

- Tell your insurer about different drivers or uses for your Buick Rendezvous.

- Ask about seasonal insurance for your Buick Rendezvous.

- Consider ride-sharing services to lower your Buick Rendezvous mileage.

Implementing these cost-saving measures can lead to significant reductions in your Buick Rendezvous insurance expenses.

By adapting your policy to fit your specific usage patterns and taking advantage of available discounts, you can enjoy more affordable coverage. Learn more in our article titled, “Is it cheaper to purchase car insurance online?“

Top Buick Rendezvous Insurance Companies

Choosing the right insurance provider is crucial for securing optimal coverage for your Buick Rendezvous at a competitive rate. Here’s a look at some of the top insurers, ranked by market share, known for their reliable Buick Rendezvous insurance policies.

Largest Auto Insurers by Market Share

Understanding the landscape of the auto insurance market can be insightful, especially when considering the largest players by market share. Here’s a look at how major insurers stack up against each other regarding volume and market presence. Read more in our article titled, “Factors That Affect Car Insurance Rates.”

Top Buick Rendezvous Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

This ranking of the largest auto insurers by market share highlights these companies’ significant influence in the industry. Knowing who leads the market can help consumers make informed decisions when choosing their insurer. You can start comparing quotes for Buick Rendezvous insurance from some of the top car insurance companies by using our free online tool below today.

Frequently Asked Questions

Are vehicles like the Buick Rendezvous expensive to insure?

Insurance rates for vehicles like the Buick Rendezvous can vary. Comparing rates for similar models can give you an idea of what to expect. To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

What impacts the cost of Buick Rendezvous insurance?

Factors such as the trim and model of the Buick Rendezvous, your location, driving history, age, and gender can impact insurance rates.

How can I save on Buick Rendezvous insurance?

Reducing your insurance expenses for a Buick Rendezvous can be straightforward with the right strategies. Here are some effective tips to help you lower your premiums and ensure your vehicle is adequately protected.

- Shop around and compare quotes from different insurance companies.

- Look for discounts offered by insurance providers for security systems and safety features.

- Maintain a clean driving record.

By shopping around, leveraging discounts, and maintaining a clean driving record, you can significantly cut costs on Buick Rendezvous insurance. Implementing these tips not only helps manage expenses but also secures reliable coverage for your vehicle.

What are some top insurance companies for Buick Rendezvous coverage?

Some top insurance companies known for offering competitive coverage for the Buick Rendezvous include:

- Geico: Known for its affordable rates and comprehensive coverage options.

- State Farm: Offers a range of customizable policies and good customer service.

- Progressive: Favored for their online tools and flexible policy options.

- Allstate: Provides excellent local agent support and a variety of discount options.

- Farmers: Known for their customized insurance solutions tailored to individual needs.

These companies are recognized for their reliable service and the ability to provide tailored coverage that can suit the specific needs of Buick Rendezvous owners.

How can I compare free insurance quotes for the Buick Rendezvous online?

You can compare free insurance quotes for the Buick Rendezvous online by using our free tool. Enter your ZIP code to get started. Access comprehensive insights into our guide titled, “What makes car insurance more expensive?“

Is a Buick Rendezvous a luxury car for insurance purposes?

No, the Buick Rendezvous is not classified as a luxury car for insurance purposes; it falls into a more affordable insurance category due to its crossover SUV design.

How much does insurance typically cost for a Buick Rendezvous?

Insurance costs for a Buick Rendezvous vary depending on factors like location, driver history, and the specific model year, but it generally offers competitive rates compared to luxury vehicles.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

When did they stop making the Buick Rendezvous, and how does it affect insurance rates?

Production of the Buick Rendezvous stopped in 2007, often leading to lower insurance rates as the vehicle ages and its value depreciates.

How long does Buick Rendezvous typically last and what does this mean for insurance?

A well-maintained Buick Rendezvous can last over 200,000 miles, which may affect long-term insurance premiums due to decreased value and higher maintenance costs as the vehicle ages.

Learn more by reading our guide: 16 Ways to Lower the Cost of Your Insurance

Are Buick Rendezvous models considered economical on insurance due to fuel efficiency?

While the Buick Rendezvous is not the most fuel-efficient model, its moderate fuel consumption does not significantly impact insurance costs compared to other factors like safety ratings and repair costs.

What type of insurance coverage is recommended for a Buick Rendezvous?

Why might a Buick Rendezvous experience higher insurance claims for overheating issues?

How does the mileage of a Buick Rendezvous affect its insurance rates?

What is the typical gas mileage of a Buick Rendezvous, and how does it impact its insurance?

Why was the Buick Rendezvous discontinued, and what are the insurance implications?

What makes a Buick Rendezvous a more economical choice for insurance?

Can regular gas usage in a Buick Rendezvous affect its insurance rates?

Is Buick considered a reliable brand for insurance purposes?

Does the drivetrain of a Buick Rendezvous (FWD vs. AWD) affect its insurance costs?

Is a Buick Rendezvous considered a luxury car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.