Best Cadillac XLR-V Car Insurance in 2026 (Find the Top 10 Companies Here)

Discover the best Cadillac XLR-V car insurance with top providers Progressive, Geico, and State Farm offering rates as low as $160 monthly. These companies lead with competitive pricing, robust coverage options, and exceptional customer service tailored specifically for your Cadillac XLR-V.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated August 2024

Company Facts

Full Coverage for Cadillac XLR-V

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Cadillac XLR-V

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Cadillac XLR-V

A.M. Best Rating

Complaint Level

Pros & Cons

The top providers for the best Cadillac XLR-V car insurance are Progressive, Geico, and State Farm, known for their exceptional coverage and customer service.

These companies stand out in the competitive market by offering tailored policies that meet the unique needs of Cadillac XLR-V owners. Opting for insurance with these insurers ensures comprehensive protection and reliability.

Our Top 10 Company Picks: Best Cadillac XLR-V Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A+ Customizable Premiums Progressive

#2 25% A++ Competitive Rates Geico

#3 20% B Customer Service State Farm

#4 25% A+ Comprehensive Coverage Allstate

#5 10% A++ Military Benefits USAA

#6 25% A Personalized Options Liberty Mutual

#7 8% A++ Flexible Policies Travelers

#8 20% A Discount Variety Farmers

#9 20% A+ Flexible Policies Nationwide

#10 12% A++ High-Value Coverage Chubb

Exploring their various offerings will provide Cadillac owners with the peace of mind that their luxury vehicle is well-protected. Discover more in our article titled “Best Cadillac Car Insurance Rates.”

Find cheap car insurance quotes by entering your ZIP code above.

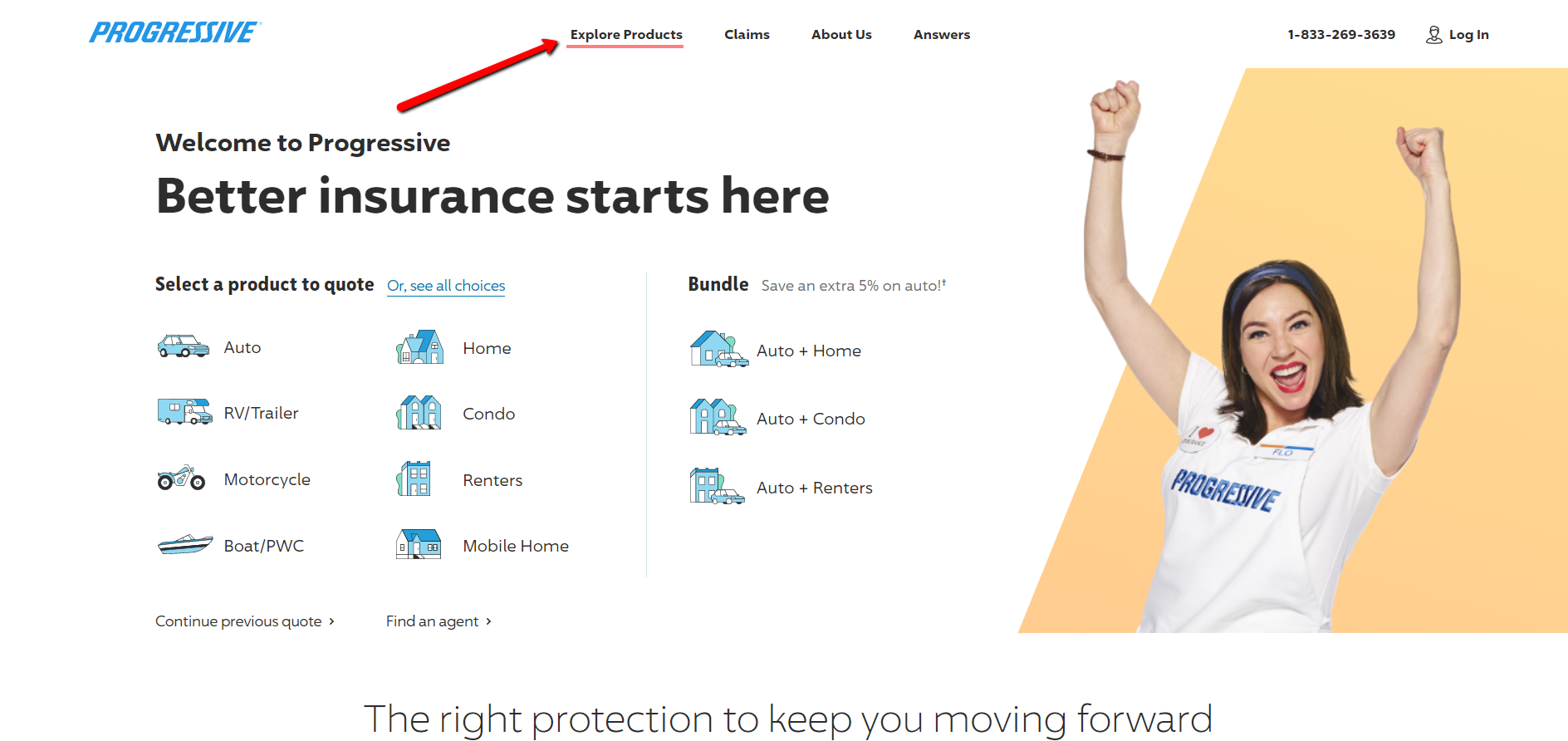

#1 – Progressive: Top Overall Pick

Pros

- Tailored Rate Adjustments: Progressive offers flexible premium adjustments specifically suited for Cadillac XLR-V owners. Our complete “Progressive Car Insurance Review” goes over this in more detail.

- Loyalty Rewards: Progressive provides loyalty benefits which can be advantageous for long-term Cadillac XLR-V insurance customers.

- 12% Multi-Vehicle Discount: For those insuring a Cadillac XLR-V along with other vehicles, Progressive offers a 12% discount.

Cons

- Higher Base Rates: Base rates for Cadillac XLR-V insurance might be higher due to its customizable policy structure.

- Complex Policy Options: Some Cadillac XLR-V owners might find the wide array of customizable options overwhelming.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Significant Multi-Vehicle Discount: Geico offers a substantial 25% discount for Cadillac XLR-V owners insuring multiple vehicles.

- Top Industry Rating: With an A++ rating from A.M. Best, Geico promises financial reliability for Cadillac XLR-V insurance.

- Competitive Base Rates: Geico provides some of the most competitive rates for Cadillac XLR-V policies. Learn more about Geico’s rates in our guide titled “Geico Car Insurance Review.”

Cons

- Basic Coverage Options: Cadillac XLR-V owners might find Geico’s coverage options less tailored than competitors.

- Customer Service Variability: Some users report variability in customer service quality, which can affect the insurance experience for Cadillac XLR-V owners.

#3 – State Farm: Best for Customer Service

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies for the Cadillac XLR-V.

- High Low-Mileage Discount: Substantial discounts are available for Cadillac XLR-V owners who drive less frequently.

- Wide Coverage: State Farm provides a variety of coverage options specifically tailored to Cadillac XLR-V needs. See the reviews and rankings in our full article titled “State Farm Car Insurance Review.”

Cons

- Limited Multi-Policy Discount: The multi-policy discount for Cadillac XLR-V insurance is lower than some competitors.

- Premium Costs: Despite discounts, premiums might still be higher for certain Cadillac XLR-V coverage levels.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Complete Protection Plans: Allstate offers an array of comprehensive insurance options for Cadillac XLR-V owners. Find more information about Allstate’s rates in our article titled “Allstate Car Insurance Review.”

- 25% Multi-Vehicle Discount: Allstate provides a significant discount for those insuring a Cadillac XLR-V with other vehicles.

- Personalized Agent Support: Dedicated agent support ensures tailored advice and coverage solutions for Cadillac XLR-V owners.

Cons

- Higher Premiums for Advanced Coverage: Enhanced coverage options for the Cadillac XLR-V come with higher premiums.

- Policy Adjustment Fees: Fees may apply when adjusting coverage options for a Cadillac XLR-V policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA offers exclusive benefits and discounts for military members who own a Cadillac XLR-V.

- Lower Rates for Veterans: Competitive rates for veterans and their families specifically on Cadillac XLR-V insurance.

- 10% Multi-Vehicle Discount: A solid discount for those insuring more than one vehicle, including a Cadillac XLR-V. Check out insurance savings for military members and their families in our complete “USAA Car Insurance Review.”

Cons

- Limited Availability: USAA’s Cadillac XLR-V insurance is only available to military personnel and their families.

- Restrictive Eligibility Criteria: The eligibility criteria can limit access to benefits for wider Cadillac XLR-V owner demographics.

#6 – Liberty Mutual: Best for Personalized Options

Pros

- Tailored Insurance Solutions: Liberty Mutual offers highly personalized insurance options specifically for Cadillac XLR-V owners.

- 25% Multi-Vehicle Discount: Owners who insure their Cadillac XLR-V along with other vehicles enjoy a significant discount.

- Customizable Add-Ons: Enhanced coverage options like accident forgiveness and new car replacement for Cadillac XLR-V. Learn more about this provider in our thorough article titled “Liberty Mutual Car Insurance Review.”

Cons

- Variable Premiums: Premium costs for Cadillac XLR-V can vary greatly depending on personal circumstances and chosen add-ons.

- Customer Feedback: Some customers have reported inconsistencies in service, which might affect satisfaction for Cadillac XLR-V owners.

#7 – Travelers: Best for Flexible Policies

Pros

- Wide Range of Policy Options: Travelers offers flexible policy options that can be tailored to the specific needs of Cadillac XLR-V owners.

- 8% Multi-Vehicle Discount: A beneficial discount for Cadillac XLR-V owners insuring multiple vehicles. Read more about Travelers’ ratings in our article titled “Travelers Car Insurance Review.”

- Efficient Claim Process: Known for an efficient claims process, aiding Cadillac XLR-V owners in quick recoveries from incidents.

Cons

- Slightly Lower Discounts: Compared to other insurers, Travelers offers a lower multi-vehicle discount for Cadillac XLR-V insurance.

- Policy Complexity: The wide array of options can sometimes lead to complexity in choosing the right coverage for a Cadillac XLR-V.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Discount Variety

Pros

- Diverse Discounts Available: Farmers offers a variety of discounts that Cadillac XLR-V owners can take advantage of. Take a look at our article titled “Farmers Car Insurance Review.”

- 20% Multi-Vehicle Discount: Competitive multi-vehicle discount makes Farmers a good choice for those insuring a Cadillac XLR-V and other cars.

- Custom Coverage Options: Specific options such as new car replacement or accident forgiveness are available for Cadillac XLR-V owners.

Cons

- Higher End Premiums: Premiums might be on the higher end, particularly for more comprehensive Cadillac XLR-V coverage plans.

- Discount Eligibility: Not all discounts are automatically available; eligibility requirements must be met by Cadillac XLR-V owners.

#9 – Nationwide: Best for Flexible Policies

Pros

- Broad Policy Flexibility: Nationwide offers considerable flexibility in policy adjustments to suit the needs of Cadillac XLR-V owners.

- 20% Multi-Vehicle Discount: Good savings potential for those who insure their Cadillac XLR-V alongside other vehicles. Explore more discount options in our guide titled “Nationwide Car Insurance Discounts.”

- Customer-Centric Services: Nationwide provides customer-centric services, enhancing the insurance experience for Cadillac XLR-V owners.

Cons

- Rate Variability: Rates can vary significantly based on the Cadillac XLR-V owner’s location and driving history.

- Service Inconsistencies: Some regions report less favorable customer service experiences, which could impact Cadillac XLR-V owners.

#10 – Chubb: Best for High-value Coverage

Pros

- Premium High-Value Options: Chubb specializes in high-value coverage, making it ideal for luxury vehicles like the Cadillac XLR-V.

- 12% Multi-Vehicle Discount: Competitive discount for those who insure multiple vehicles including a Cadillac XLR-V. Check out our page titled “How do you file a car insurance claim?” to learn more details.

- Superior Claim Service: Chubb is known for its superior claim service, offering white-glove treatment to Cadillac XLR-V owners.

Cons

- Higher Cost of Premiums: Premiums are generally higher, reflecting the extensive coverage and high-value services provided for Cadillac XLR-V.

- Selective Policy Offerings: Chubb’s tailored policies are excellent but may not be accessible to all Cadillac XLR-V owners due to stricter underwriting standards.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Insurance Rates for Cadillac XLR-V: Minimum vs. Full Coverage

Exploring insurance rates for the Cadillac XLR-V based on coverage levels can help owners make informed decisions. The table below provides a breakdown of monthly rates for both minimum and full coverage across various insurance companies.

Cadillac XLR-V Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $185 $240

Chubb $200 $260

Farmers $187 $235

Geico $165 $215

Liberty Mutual $195 $250

Nationwide $183 $232

Progressive $175 $225

State Farm $180 $230

Travelers $170 $220

USAA $160 $210

For Cadillac XLR-V owners seeking budget-friendly options, USAA offers the lowest monthly rate for minimum coverage at $160, while also leading in full coverage affordability at $210. On the higher end, Chubb’s rates stand at $200 for minimum and $260 for full coverage, reflecting its premium service offerings.

Companies like Geico and Travelers present competitive middle-ground options with Geico charging $165 for minimum and $215 for full coverage, and Travelers at $170 and $220, respectively. See more details on our guide titled “Farmers vs. Travelers Car Insurance Comparison.”

Are Vehicles Like the Cadillac XLR-V Expensive to Insure

Take a look at how insurance rates for similar models to the Cadillac XLR-V look. These insurance rates for other convertibles like the Ford Mustang SVT Cobra, Mazda Mazdaspeed MX 5 Miata, and BMW 4 Series give you a good idea of what to expect. Check out insurance savings in our complete guide titled “Best BMW Car Insurance Rates.”

In conclusion, insurance costs for vehicles like the Cadillac XLR-V and other luxury convertibles can vary widely, reflecting a blend of comprehensive, collision, and liability coverages.

For instance, the BMW M6 emerges as the most expensive to insure, largely due to its high collision and comprehensive rates, whereas the MINI Convertible offers a more economical option.

Cadillac XLR-V Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

Cadillac XLR-V $32 $62 $32 $139

Volkswagen Eos $25 $44 $36 $118

BMW M6 $43 $94 $38 $190

BMW Z4 $28 $51 $30 $120

Mercedes-Benz SLC 300 $36 $67 $33 $149

Mercedes-Benz SL 450 $40 $77 $33 $163

Buick Cascada $28 $55 $33 $129

MINI Convertible $25 $45 $22 $100

These examples underline the importance of considering individual coverage components and overall costs when selecting insurance for high-end convertible cars like the Cadillac XLR-V.

What Impacts the Cost of Cadillac XLR-V Insurance

The cost of insuring a Cadillac XLR-V is influenced by a variety of factors that go beyond the basic metrics of car insurance. The Cadillac XLR-V’s high market value and luxury status inherently drive up insurance costs, as replacement parts and repair work are more expensive compared to less luxurious vehicles. Discover more about offerings in our article titled “Best Insurance for Luxury Cars.”

Performance characteristics such as a powerful engine increase the risk profile, leading to potentially higher premiums, especially for drivers with a history of claims or traffic violations. Location also significantly affects insurance rates; vehicles in urban areas or regions with high theft and accident rates typically incur higher costs.

Furthermore, the choice of coverage plays a critical role; comprehensive and collision coverage, which are advisable for luxury cars, tend to increase premiums. Lastly, insurance costs can vary widely between providers based on how they assess risk and calculate premiums, emphasizing the importance of shopping around to ensure competitive pricing for Cadillac XLR-V insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Cadillac XLR-V Insurance

Save more on your Cadillac XLR-V car insurance rates. Take a look at the following five strategies that will get you the best Cadillac XLR-V auto insurance rates possible.

- Ask about usage-based insurance for your Cadillac XLR-V.

- Check Cadillac XLR-V auto insurance rates through Costco.

- Drive your Cadillac XLR-V safely.

- Ask about Cadillac XLR-V discounts if you were listed on someone else’s policy.

- Buy a dashcam for your Cadillac XLR-V.

To secure the best possible rates on your Cadillac XLR-V car insurance, consider innovative strategies such as opting for usage-based insurance programs and installing a dashcam.

Progressive offers a 12% discount on multi-vehicle policies, making it a top choice for families insuring more than one car.

Daniel Walker Licensed Insurance Agent

Additionally, exploring discounts through memberships like Costco, maintaining a safe driving record, and leveraging previous insurance experiences can lead to substantial savings on your premiums.

Top Cadillac XLR-V Insurance Companies

What is the best auto insurance company for Cadillac XLR-V insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Cadillac XLR-V auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features found on the Cadillac XLR-V.

Choosing the right insurance provider for your Cadillac XLR-V involves considering various factors, including market share, customer service, and available discounts.

Top Cadillac XLR-V Car Insurance Providers by Market Share

Rank Insurance Company Premiums Written Market Share

#1 State Farm $66,153,063 9%

#2 Geico $46,358,896 6%

#3 Progressive $41,737,283 6%

#4 Allstate $39,210,020 5%

#5 Liberty Mutual $36,172,570 5%

#6 Travelers $28,786,741 4%

#7 USAA $24,621,246 3%

#8 Chubb $24,199,582 3%

#9 Farmers $20,083,339 3%

#10 Nationwide $18,499,967 3%

State Farm leads the market, but companies like Geico and Progressive also offer competitive rates and substantial discounts, making them top contenders for insuring your luxury vehicle. Access comprehensive insights into our guide titled “Geico vs. The Hartford Car Insurance Comparison.”

Comparing Free Cadillac XLR-V Insurance Quotes Online

When insuring a luxury vehicle like the Cadillac XLR-V, utilizing online tools to compare insurance quotes can significantly simplify the process. By having your vehicle details, driving history, and personal information ready, you can ensure the accuracy of the quotes you receive.

Dedicated comparison websites allow you to view multiple insurers’ rates side by side, making it easier to assess not only the cost but also the coverage details. It’s essential to look beyond the price by checking the coverage levels, noting available discounts, and reviewing each insurer’s customer service ratings and financial stability.

This thorough approach not only helps in finding the most cost-effective policy but also ensures that you choose an insurer that offers reliable coverage and excellent service for your Cadillac XLR-V. Unlock details in our guide titled “Understanding Your Car Insurance Policy.”

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

What factors affect the insurance rates for a Cadillac XLR-V?

Several factors can influence the insurance rates for a Cadillac XLR-V. Some common ones include the driver’s age, driving record, location, coverage options chosen, deductible amount, the value of the car, and the level of risk associated with the model.

For additional details, explore our comprehensive resource titled “Average Car Insurance Rates by Age and Gender.”

Is the Cadillac XLR-V considered an expensive car to insure?

Generally, the Cadillac XLR-V is considered a high-performance luxury vehicle, which tends to have higher insurance costs compared to average cars. The cost of insurance can vary depending on the driver’s profile and other factors, so it’s advisable to obtain personalized insurance quotes to get accurate pricing information.

How can I find and compare insurance rates for a Cadillac XLR-V?

There are several ways to find and compare insurance rates for a Cadillac XLR-V. You can contact insurance providers directly and request quotes, use online insurance comparison websites to get multiple quotes from different insurers, or work with an independent insurance agent who can assist you in finding the best rates based on your specific needs.

Are there any specific insurance companies that offer competitive rates for Cadillac XLR-V coverage?

Insurance rates can vary significantly between insurance companies, so it’s recommended to compare quotes from multiple insurers to find the best rates for your Cadillac XLR-V. Companies that specialize in luxury or high-performance vehicles may be worth considering, as they might have tailored coverage options and competitive rates for such vehicles.

To find out more, explore our guide titled “Compare Car Insurance Rates by Vehicle Make and Model.”

Are there any discounts available to help reduce the insurance costs for a Cadillac XLR-V?

Yes, many discounts may reduce Cadillac XLR-V insurance costs, such as safe driver, multi-policy, anti-theft, and safety feature discounts. It’s wise to ask about these when getting quotes.

Are Cadillacs more expensive to insure?

Yes, Cadillacs, including the Cadillac XLR-V, are typically more expensive to insure due to their high value and repair costs.

What is the best car insurance for older Cadillac XLR-V cars?

For older Cadillac XLR-V cars, the best insurance often comes from providers offering customized policies for classic or older vehicles.

Ready to find affordable car insurance? Use our free comparison tool below to get started.

Is it worth getting full coverage on an old Cadillac XLR-V car?

Getting full coverage on an old Cadillac XLR-V can be worthwhile if its value, risk of theft, and your desire for peace of mind justify the cost.

At what age is Cadillac XLR-V car insurance cheapest?

Cadillac XLR-V car insurance is generally cheapest for drivers aged 50-65, assuming a clean driving record.

What is the best company for Cadillac XLR-V car insurance?

Progressive is often considered the best company for Cadillac XLR-V car insurance due to its flexible coverage options and competitive rates.

Learn more by reading our guide titled “Best Car Insurance Companies for High-Risk Drivers.”

What color vehicles have the highest Cadillac XLR-V insurance?

Does insurance go up for a luxury vehicle like the Cadillac XLR-V?

What state has the worst Cadillac XLR-V insurance rates?

Does Cadillac XLR-V insurance go down after paying off a car?

Which insurance is best for a Cadillac XLR-V car after 5 years?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.