Best Chrysler Car Insurance Rates in 2026 (Check out the Top 10 Companies)

State Farm, Geico, and Progressive provide the best Chrysler car insurance rates, beginning at a mere $30 per month. These insurers deliver cost-effective and thorough coverage, ideal for individuals seeking discounted premiums and dependable protection customized to their driving requirements.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Expert

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated June 2024

Company Facts

Full Coverage for Chrysler

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chrysler

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chrysler

A.M. Best Rating

Complaint Level

Pros & Cons

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm has a vast network of agents and offices, providing personalized assistance and easy access to customer service.

- Strong Reputation: With a long history and positive customer reviews, State Farm is known for reliability and customer satisfaction.

- Multi-Line Discounts: State Farm offers discounts for bundling multiple insurance policies, such as auto and home insurance. Refer to our State Farm car insurance review.

Cons

- Potentially Higher Rates: While State Farm provides comprehensive coverage, its rates may be higher compared to some competitors.

- Limited Online Tools: State Farm’s online tools and digital experience may not be as advanced as some other insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates in the industry, making it a budget-friendly option for many.

- Online Convenience: Geico’s digital platform allows for easy policy management, claims filing, and quote comparisons, making it convenient for tech-savvy customers.

- Wide Range of Discounts: Our Geico insurance review highlights that Geico offers a variety of discounts that can help policyholders save money on their premiums.

Cons

- Limited Personalized Service: Geico’s focus on online and phone-based interactions may result in less personalized service compared to companies with a larger network of local agents.

- Potential Coverage Limitations: While Geico offers competitive rates, some policyholders may find that the coverage options are not as comprehensive as those offered by other insurers.

#3 – Progressive: Best for Roadside Assistance

Pros

- Name Your Price Tool: Progressive offers a unique tool that allows customers to customize their coverage and find a policy that fits their budget.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits with discounts, potentially lowering premiums for eligible drivers.

- Convenient Mobile App: Progressive’s mobile app provides easy access to policy information, claims filing, and roadside assistance.

Cons

- Average Customer Service: While Progressive offers competitive rates, some customers have reported average satisfaction with the company’s customer service. Read more through our Progressive car insurance review.

- Limited Agent Network: Progressive primarily operates online and may not have as extensive a network of local agents as some other insurers.

#4 – Allstate: Best for Add-on Coverages

Pros

- Wide Range of Coverage Options: Allstate offers a variety of coverage options and add-ons, allowing customers to tailor their policies to their specific needs. Read more through our Allstate car insurance review.

- Drivewise Program: Allstate’s Drivewise program rewards safe driving behavior with discounts, potentially reducing premiums for eligible drivers.

- Strong Financial Stability: Allstate has a strong financial standing, which provides reassurance to policyholders in the event of a claim.

Cons

- Higher Premiums: Allstate’s comprehensive coverage options may come with higher premiums compared to some other insurers.

- Mixed Customer Service Reviews: While some customers praise Allstate’s customer service, others have reported issues with claims processing and communication.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Discounts for Military Members: USAA offers exclusive discounts and benefits for military members and their families, including deployed vehicle storage savings and special rates for garaged vehicles.

- Top-Rated Customer Service: USAA consistently receives high ratings for customer satisfaction and claims handling, providing peace of mind to policyholders. Read more through our USAA car insurance review.

- Financial Stability: USAA has a strong financial reputation and stability, ensuring that policyholders’ claims are backed by a reliable company.

Cons

- Limited Eligibility: USAA membership is limited to military members, veterans, and their families, excluding the general public from accessing its insurance products.

- Limited Branch Locations: USAA primarily operates online and through phone support, which may be less convenient for customers who prefer in-person interactions.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies with a variety of coverage options, allowing customers to tailor their insurance plans to their specific needs. Read more through our Liberty Mutual car insurance review.

- 24/7 Claims Assistance: Liberty Mutual provides 24/7 claims assistance and a user-friendly claims process, ensuring that policyholders receive prompt support when they need it most.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling multiple insurance policies, such as auto and home insurance, helping customers save on their premiums.

Cons

- Potentially Higher Rates: Liberty Mutual’s comprehensive coverage options may come with higher premiums compared to some other insurers.

- Mixed Customer Reviews: While some customers praise Liberty Mutual for its customer service and claims handling, others have reported issues with billing errors and communication.

#7 – Farmers: Best for Safe Drivers

Pros

- Personalized Coverage Options: Farmers offers personalized coverage options and add-ons, allowing customers to tailor their policies to their specific needs.

- Diverse Discounts: Farmers provides a variety of discounts, including multi-policy, safe driver, and good student discounts, helping customers save on their premiums.

- Strong Financial Stability: Farmers has a strong financial standing and a history of financial stability, providing reassurance to policyholders.

Cons

- Higher Premiums: Farmers’ comprehensive coverage options may come with higher premiums compared to some other insurers. Learn more through our Farmers car insurance review.

- Limited Online Tools: Farmers’ online tools and digital experience may not be as advanced as those offered by some competitors, potentially leading to a less streamlined customer experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Multi-Policy Savings

Pros

- Wide Range of Coverage Options: Nationwide offers a wide range of coverage options, including customizable policies and add-ons, allowing customers to tailor their insurance plans to their specific needs, as highlighted in our Nationwide insurance review.

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible program rewards safe driving habits with deductible reductions, potentially lowering out-of-pocket expenses for eligible drivers.

- Strong Financial Strength: Nationwide has a strong financial reputation and stability, ensuring that policyholders’ claims are backed by a reliable company.

Cons

- Potentially Higher Rates: Nationwide’s comprehensive coverage options may come with higher premiums compared to some other insurers.

- Mixed Customer Service Reviews: While some customers praise Nationwide for its customer service, others have reported issues with claims processing and communication.

#9 – Travelers: Best for Bundling Policies

Pros

- Comprehensive Coverage Options: Travelers offers comprehensive coverage options and add-ons, allowing customers to tailor their policies to their specific needs.

- Strong Financial Stability: Travelers has a strong financial standing and a history of financial stability, providing reassurance to policyholders. Follow us through our Travelers car insurance review.

- Discount Opportunities: Travelers provides various discounts, including multi-policy, safe driver, and good student discounts, helping customers save on their premiums.

Cons

- Potentially Higher Premiums: Travelers’ comprehensive coverage options may come with higher premiums compared to some other insurers.

- Limited Availability: Travelers may not be available in all states, limiting its accessibility for some customers.

#10 – The Hartford: Best for Organization Discount

Pros

- Specialized Coverage Options: The Hartford offers specialized coverage options for specific demographics, such as AARP members, providing tailored insurance solutions.

- Dedicated Claims Service: The Hartford provides dedicated claims service and support, ensuring that policyholders receive prompt assistance when filing claims.

- Discount Opportunities: The Hartford offers various discounts, including bundling discounts and safety feature discounts, helping customers save on their premiums.

Cons

- Limited Availability: The Hartford may not be available in all states, limiting its accessibility for some customers. For further insights, visit our The Hartford insurance review.

- Mixed Customer Reviews: While some customers praise The Hartford for its customer service, others have reported issues with claims processing and communication.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Type of Chrysler Car Insurance

Compare quotes online from several insurance companies before you decide which coverage works best for you. Then, if you find that coverage for your Chrysler is still too pricey, you can search for discounts or increase your deductible to save even more. Enter your ZIP code now to begin.

Frequently Asked Questions

What type of Chrysler car insurance do I need?

You have the option of choosing a liability-only policy or a full coverage policy that includes collision and comprehensive coverage.

Do I need full coverage car insurance on a Chrysler?

Full coverage is recommended if you want additional protection for your vehicle, especially if it’s new or has a high actual cash value (ACV). Enter your ZIP code now to begin.

Can Chrysler owners get discounts on car insurance?

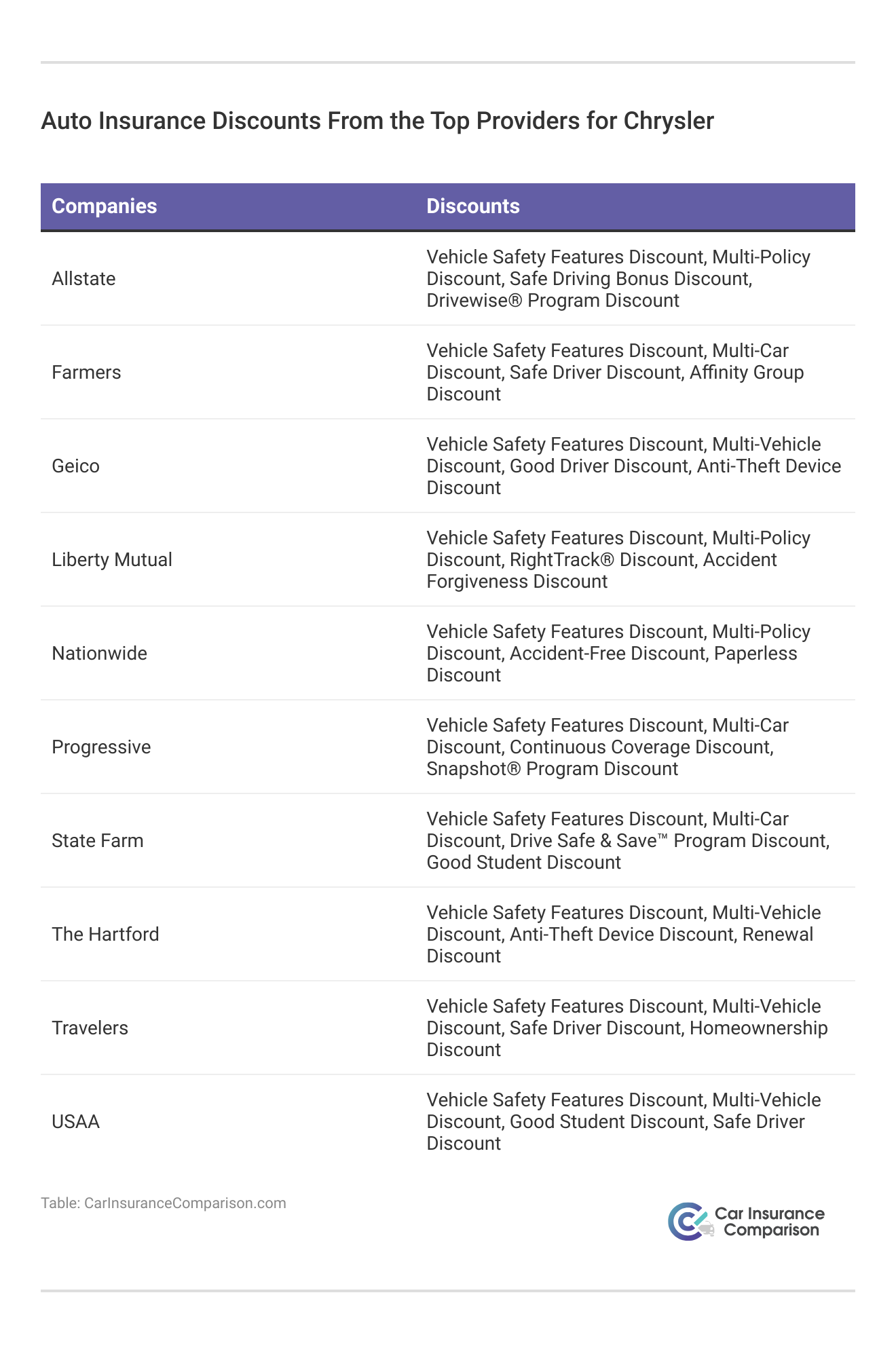

Yes, Chrysler owners may qualify for cheapest car insurance discounts. Common discounts include safe driver discounts, multi-policy discounts, and vehicle safety feature discounts.

How much are Chrysler car insurance rates?

The average cost of car insurance for a Chrysler is around $2,609 annually or $217 per month. Rates vary based on the model, year, location, and driving history.

Can I save money on my Chrysler car insurance rates?

Yes, you can save money by comparing quotes from multiple insurance companies and taking advantage of available discounts. Increasing your deductible can also help lower your premiums. Enter your ZIP code now to start.

What are three factors to consider when choosing Chrysler car insurance?

Three factors to consider when choosing Chrysler car insurance are the level of coverage needed (minimum or full coverage), average insurance rates for Chrysler vehicles, and available discounts, good driver discounts or benefits from insurance providers.

Which insurance provider offers competitive rates beginning at $30 per month for Chrysler car insurance?

State Farm offers competitive rates beginning at $30 per month for Chrysler car insurance, according to the article.

What are two pros and two cons of State Farm as an insurance provider for Chrysler vehicles?

Two pros of State Farm as an insurance provider for Chrysler vehicles are its extensive network of agents and offices, providing personalized assistance, and its strong reputation for reliability and customer satisfaction. Two cons are potentially higher rates compared to some competitors and limited online tools and digital experience. Enter your ZIP code to start comparing.

How does Geico differentiate itself in the insurance market, according to the article?

Geico differentiates itself in the insurance market by offering competitive rates, providing online convenience through its digital platform, and offering a wide range of discounts or affordability of insurance rates to help customers save on their premiums.

What are two benefits and two drawbacks of Progressive’s insurance offerings for Chrysler owners?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.