Cheapest Delaware Car Insurance Rates in 2026 (Save Cash With These 10 Companies!)

Compare the cheapest Delaware car insurance rates with industry leaders like Travelers, AAA, and Progressive, starting as low as $43 per month. Rates vary based on factors like driving history and coverage options, but comparing quotes helps drivers find the most affordable auto insurance in Delaware.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated August 2025

Company Facts

Min. Coverage for Delaware

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

Travelers, AAA, and Progressive are the top picks for the cheapest Delaware car insurance rates, starting as low as $43 per month. Learn the minimum amount of liability insurance coverage requirements for Delaware car insurance and find the best coverage for your needs.

Average Delaware car insurance costs, though higher than the national average due to factors like heavy traffic, elevated repair and healthcare costs, and a significant number of uninsured drivers, can still be managed through strategic choices. To find the best insurance for your needs, compare rates from top providers.

Our Top 10 Company Picks: Cheapest Delaware Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $43 A++ Hybrid Vehicles Travelers

#2 $45 A Roadside Assistance AAA

#6 $47 A+ Snapshot Program Progressive

#4 $53 A++ Low Rates Geico

#5 $61 B Competitive Rates State Farm

#7 $68 A Low Mileage American Family

#3 $75 A+ Vanishing Deductible Nationwide

#8 $83 A Bundling Options Farmers

#9 $108 A+ Drivewise Program Allstate

#10 $259 A Car Replacement Liberty Mutual

This comparison ensures you secure the most suitable coverage at the best price available in Delaware. Find cheap car insurance quotes by entering your ZIP code above.

- Find the cheapest Delaware car insurance rates with Travelers

- Understand unique coverage needs in Delaware

- Compare quotes and discounts for savings on auto insurance

- Compare Delaware Car Insurance Rates

#1 – Travelers: Top Pick Overall

Pros

- Competitive Pricing: Travelers offers exceptionally low rates in Delaware, making it a cost-effective choice for residents seeking affordable coverage.

- Good Customer Service: Known for prompt claim handling and responsive customer support, ensuring peace of mind for Delaware drivers. See more details on our Travelers car insurance review.

- Wide Coverage Options: Provides extensive coverage options tailored to Delaware’s specific driving needs, including comprehensive and collision coverage.

Cons

- Limited Discounts: While Travelers offers competitive rates, it may not provide as many discount opportunities as some competitors, potentially limiting savings for Delaware drivers.

- Availability: Local agent availability may vary across Delaware, affecting personalized service accessibility in certain regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best for Roadside Assistance

Pros

- Membership Benefits: AAA offers comprehensive benefits like roadside assistance and member discounts, enhancing the overall value beyond insurance coverage for Delaware drivers.

- Local Presence: With numerous branch offices in Delaware, AAA ensures convenient access to customer service and support tailored to local needs.

- Discounts: As outlined in our AAA car insurance review, the company provides various discounts for members, including multi-policy and safe driver discounts, helping to reduce insurance costs for Delaware residents.

Cons

- Membership Requirement: Non-members may find the requirement for AAA membership for insurance services a drawback, limiting options for those who prefer standalone insurance providers.

- Pricing: While competitive, AAA’s premiums are slightly higher due to bundled benefits and services offered to members in Delaware.

#3 – Progressive: Best for Snapshot Program

Pros

- Affordable Rates: Progressive offers competitive rates in Delaware, coupled with innovative tools like Name Your Price® to help customize coverage within budget.

- Coverage Options: Provides a range of coverage options including Snapshot® for personalized rates based on driving habits, appealing to tech-savvy Delaware drivers.

- Online Experience: Known for user-friendly online platforms and mobile apps, making policy management and claims processing convenient for Delaware customers. Delve into our evaluation of Progressive car insurance review.

Cons

- Complex Discounts: Progressive’s discount structure may be intricate for some Delaware drivers, requiring careful navigation to maximize savings.

- Customer Service Variability: While generally praised, customer service experiences may vary, impacting satisfaction levels for Delaware policyholders.

#4 – Geico: Best for Low Rates

Pros

- Affordable Premiums: Geico offers competitive rates in Delaware, appealing to budget-conscious drivers seeking cost-effective coverage.

- Digital Tools: Easy-to-use mobile app and online quote system streamline policy management and claims processes for Delaware customers. Learn more in our Geico car insurance review.

- Discount Opportunities: Geico provides various discounts, including for safe drivers and bundling policies, helping Delaware residents save on premiums.

Cons

- Customer Service: Some customers report mixed experiences with customer service, which may affect satisfaction levels in Delaware.

- Coverage Options: While comprehensive, Geico’s coverage options might not be as customizable as some competitors in Delaware, limiting tailored policy choices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Competitive Rates

Pros

- Personalized Service: State Farm’s extensive network of agents in Delaware ensures personalized service and local expertise for policyholders.

- Discounts: Offers multiple discounts such as for good driving and bundling, making it affordable for Delaware drivers. Unlock details in our State Farm car insurance review.

- Customizable Policies: State Farm offers a wide range of customizable coverage options tailored to the specific needs of Delaware residents, including comprehensive and collision coverage.

Cons

- Premiums: State Farm’s premiums may be slightly higher compared to some competitors in Delaware, affecting budget-conscious drivers.

- Policy Flexibility: While comprehensive, policy options might not offer as much flexibility in coverage customization for specific needs in Delaware.

#6 – American Family: Best for Low Mileage

Pros

- Customizable Policies: American Family provides customizable policies tailored to meet specific needs of Delaware drivers, offering flexibility in coverage options.

- Customer Service: American Family car insurance review highlights strong customer service reputation with personalized agent support, ensuring responsive assistance for Delaware policyholders.

- Discounts: Offers a variety of discounts, including for bundling policies and safe driving, helping Delaware residents save on insurance costs.

Cons

- Premiums: With premiums, American Family may be perceived as slightly higher priced in Delaware compared to some competitors.

- Availability: Local agent availability and office presence in Delaware may vary, affecting accessibility for personalized service.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Wide Coverage Options: Nationwide offers comprehensive coverage options suitable for diverse needs of Delaware drivers, including special endorsements and add-ons.

- Discounts: Provides substantial discounts for safe drivers, multi-policy holders, and other qualifying criteria, maximizing savings for Delaware residents. Check out insurance savings in our complete Nationwide car insurance discount.

- Customer Resources: Offers robust online tools and resources for policy management and claims handling, enhancing convenience for Delaware customers.

Cons

- Pricing: While competitive, premiums may be higher for some Delaware drivers compared to other insurers with similar coverage options.

- Claim Satisfaction: Some policyholders report mixed experiences with claims handling and customer service, impacting overall satisfaction in Delaware.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Bundling Options

Pros

- Customized Policies: Farmers Insurance offers tailored policies with flexible coverage options to suit individual needs of Delaware drivers. Learn more in our Farmers car insurance review.

- Agent Network: Strong network of local agents in Delaware provides personalized service and support, ensuring accessibility and responsiveness.

- Discount Programs: Farmers offers various discounts, including for multi-policy holders and safe drivers, helping Delaware residents save on insurance costs.

Cons

- Premiums: With premiums at $83, Farmers may be perceived as higher priced in Delaware, affecting affordability for some drivers.

- Coverage Options: While comprehensive, policy options might not offer as much customization or additional benefits compared to competitors in Delaware.

#9 – Allstate: Best for Drivewise Program

Pros

- Comprehensive Coverage: Allstate offers extensive coverage options and additional benefits like accident forgiveness, appealing to Delaware drivers seeking comprehensive protection.

- Brand Reputation: Well-known brand with a strong financial standing, ensuring reliability and stability in claims handling and customer service for Delaware residents.

- Discount Opportunities: Provides various discounts for safe drivers, bundling policies, and loyalty, helping Delaware customers save on insurance premiums. Discover more about offerings in our Allstate car insurance review.

Cons

- Premiums: Allstate’s premiums at $108 may be higher compared to competitors in Delaware, potentially impacting affordability for budget-conscious drivers.

- Customer Service: Mixed customer reviews regarding claims processing and customer service experiences in Delaware may influence overall satisfaction levels.

#10 – Liberty Mutual: Best for Car Replacement

Pros

- Coverage Options: Liberty Mutual offers extensive coverage options and additional features suitable for Delaware drivers seeking comprehensive protection.

- Digital Tools: User-friendly online platform and mobile app for easy policy management and claims processing, enhancing convenience for Delaware customers.

- Financial Strength: Strong financial stability and reputable claims handling processes ensure reliability and security for policyholders in Delaware. Learn more in our Liberty Mutual car insurance review.

Cons

- Premiums: With premiums at $259, Liberty Mutual may be perceived as significantly higher priced compared to competitors in Delaware, potentially limiting affordability.

- Accessibility: Limited local agent presence in Delaware may impact personalized service and support availability for policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Delaware Car Insurance Rates by Company

We’re going to examine which of the top car insurance companies, on average, give the best rates statewide. The table below compares monthly rates for minimum and full coverage car insurance for in Delaware from various providers.

The table below highlights the car insurance rates for Delaware drivers based on a 10-mile and 25-mile commute, showing significant cost variations among different providers.

Delaware Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $45 $115

Allstate $108 $207

American Family $68 $130

Farmers $83 $157

Geico $53 $101

Liberty Mutual $259 $494

Nationwide $75 $144

Progressive $47 $90

State Farm $61 $116

Travelers $43 $84

In Delaware, Travelers consistently offers some of the most competitive car insurance rates across both minimum and full coverage options, making it a strong choice for budget-conscious drivers in the state.

Compare Delaware Rates by Carrier and Commute

The table below highlights the car insurance rates for Delaware drivers based on a 10-mile and 25-mile commute, showing significant cost variations among different providers.

Delaware Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $115 | $130 | |

| $125 | $140 | |

| $120 | $135 | |

| $110 | $125 | |

| $95 | $110 | |

| $130 | $145 |

| $105 | $120 | |

| $100 | $115 | |

| $115 | $130 |

| $90 | $105 | |

| U.S. Average | $118 | $124 |

For Delaware drivers with varying commute distances, USAA provides the most affordable car insurance rates, making it a top choice for cost-effective coverage.

Compare Delaware Rates by Carrier and Credit History

Curious about how your credit history impacts the quotes you receive from car insurance companies? Consumer Reports conducted a study for Delaware analyzing the effect of credit history on premiums.

Delaware Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $180 | $150 | $125 | |

| $225 | $190 | $160 | |

| $190 | $160 | $135 | |

| $145 | $120 | $100 | |

| $210 | $180 | $150 |

| $160 | $130 | $110 | |

| $175 | $150 | $125 |

| $200 | $170 | $140 | |

| $155 | $130 | $110 | |

| $200 | $170 | $140 | |

| $130 | $110 | $90 | |

| U.S. Average | $210 | $140 | $115 |

This study reveals that credit history can significantly impact car insurance premiums in Delaware, with rates varying widely between different companies and credit score categories.

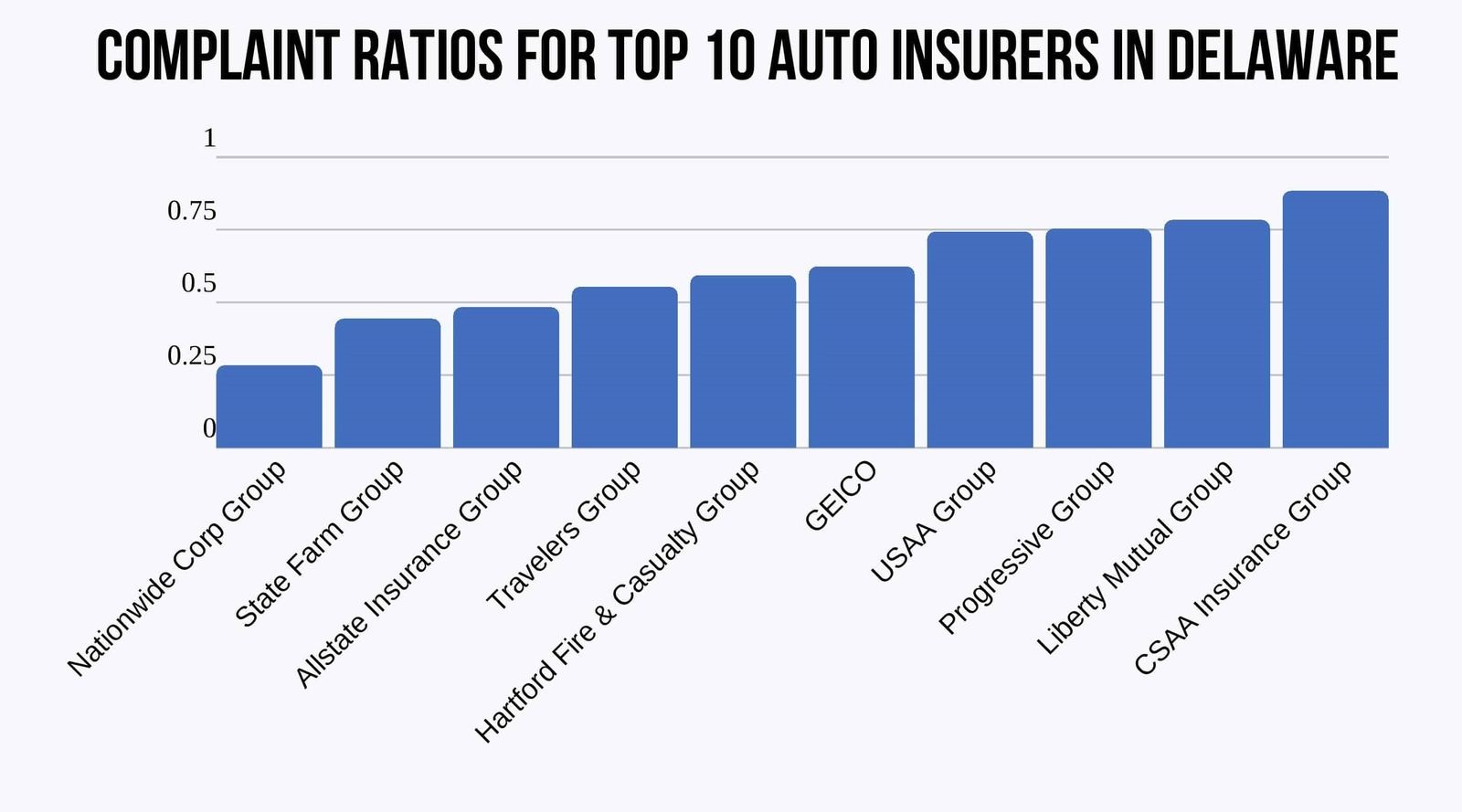

Compare Delaware Rates by Carrier and Driving Record

When it comes to owning a not-so-clean driving record, your reputation can precede you. Each car insurance company has its own underwriting criteria, and each views certain violations differently. Here is a quick look at how much car insurance with a bad driving record can cost in Delaware:

Delaware Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $190 | $220 | $300 | $240 | |

| $180 | $210 | $285 | $230 | |

| $170 | $200 | $280 | $225 | |

| $160 | $195 | $275 | $220 | |

| $145 | $180 | $250 | $200 | |

| $200 | $230 | $315 | $260 |

| $150 | $175 | $263 | $215 | |

| $137 | $163 | $245 | $150 | |

| $175 | $205 | $290 | $235 |

| $120 | $157 | $210 | $130 |

Having a bad driving record can drastically increase car insurance premiums in Delaware, with significant variations depending on the type of violation and the insurance provider.

Compare Delaware Rates by Carrier and Demographic

Exploring Delaware car insurance rates reveals significant variations based on demographics, highlighting the importance of tailoring your search to your specific personal and situational factors.

Delaware Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| $670 | $625 | $320 | $295 | $180 | $175 | $150 | $145 | |

| $753 | $698 | $315 | $290 | $170 | $165 | $140 | $135 | |

| $664 | $620 | $310 | $285 | $165 | $160 | $135 | $130 | |

| $725 | $675 | $325 | $300 | $175 | $170 | $145 | $140 | |

| $453 | $415 | $225 | $210 | $130 | $125 | $110 | $105 | |

| $720 | $670 | $320 | $295 | $175 | $170 | $145 | $140 |

| $664 | $620 | $310 | $285 | $165 | $160 | $135 | $130 | |

| $469 | $432 | $215 | $200 | $125 | $120 | $105 | $100 | |

| $416 | $382 | $210 | $195 | $125 | $120 | $105 | $100 |

| $375 | $345 | $190 | $175 | $115 | $110 | $95 | $90 |

Note: All carriers and situations are not created equal. Examine the vast difference between the rates offered to a 60-year-old married female and a 17-year-old single female by Travelers:

A married 60-year-old female will pay $135 on average with Travelers, while a 17-year-old single female will pay $770 with the same company.

When it comes to shopping for the best car insurance rates, remember these two words: Do You.

Choose the company offering the best rates for your personal situation, not anybody else’s.

The best way to ensure that you’re getting the best possible coverage at the best possible rates for your specific circumstance is to compare rates from multiple carriers.

Another surefire way to make sure your rates stay as low as possible is to be a good driver. And being a good driver entails knowing the rules of the road and adhering to them. We’ll go over the laws of the land to keep you informed and your driving record spotless.

Benefits of Price Comparison Shopping

For families and individuals on a restricted budget seeking the best car insurance at a reasonable price, cost is paramount in the shopping process. Car insurance companies understand this and typically offer a free rate quote service to help consumers shopping around for car insurance compare premiums, discover incentives, and use competitive quotes for negotiation leverage.

How to Compare Delaware Car Insurance Quotes

The advent of the internet has made it possible for major car insurance providers such as Nationwide, USAA, Geico, and Progressive Direct to provide an online quote in a matter of minutes.

When shopping for car insurance online, consumers typically select from comprehensive, liability, collision, and personal injury protection coverage options to customize their car insurance package and receive a rate quote based on their chosen details.

When shopping for car insurance online, the process of rate quote comparison shopping typically requires consumers to select specific details that they desire to have as part of their total car insurance package. Depending upon the level of coverage that the consumer desires, a rate quote is generated using data that is provided by the car insurance company’s website.

🔔 #SafeDrivingTip: Turning on your phone’s “do not disturb” function before you begin driving can help reduce the temptation to browse online at a red light or immediately respond to a text message.

Find more tips from the @NatlDDCoalition: https://t.co/iS4wx4sbQW #FocusOn pic.twitter.com/y0btT0vBOt

— Travelers (@Travelers) October 19, 2023

According to the Delaware Insurance Department, a driver must carry the following minimum liability coverage before registering or operating any vehicle in the state:

- $10,000 for property damage

- $15,000 for personal injury or death for one person

- $30,000 for personal injury or death for more than one person

Once the minimum state car insurance requirements and personal desires are calculated by the car insurance quote software, a monthly rate quote is provided to the consumer.

Generally, the online quote is valid and will be honored within a specified period of time after the quote is generated.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting More Than One Delaware Car Insurance Quote

Obtaining more than one rate quote allows the consumer to conduct a price comparison analysis between car insurance companies. Having several valid car insurance rate quotes gives the consumer leverage in price negotiations between Delaware car insurance providers.

Because the car insurance industry is so fiercely competitive, many major car insurance companies provide extra features to attract customers that their competitors may not offer. For example, an car insurance company may offer free roadside assistance to customers who meet certain criteria or commit to a certain type of car insurance coverage.

Sometimes these added features are not advertised, and consumers may only learn of these special incentives when conducting price comparison shopping for car insurance.

Car insurance companies may offer additional features such as reduced deductibles, accident forgiveness, and cash rewards for good driving.

Obtaining several car insurance quotes through multiple car insurance providers allows the consumer to determine the cost-effectiveness of the rate quote in association with the level of coverage. In addition to a negotiation tool, consumers can determine which car insurance companies fit their personal needs and budgetary restrictions.

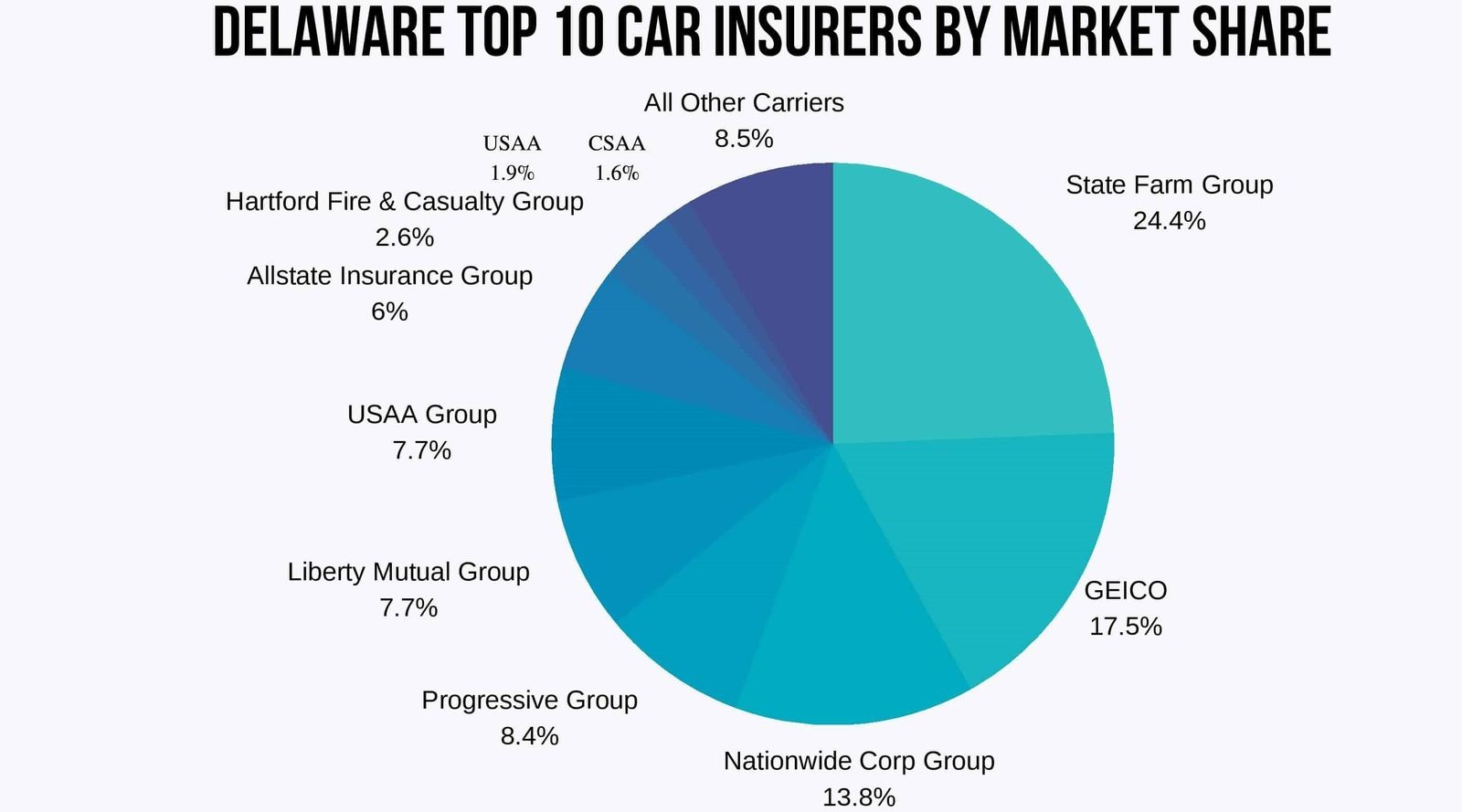

Delaware Car Insurance Companies

According to the Delaware Department of Insurance, car insurance companies that offer car insurance products and services in Delaware include:

- Nationwide: Nationwide is an insurance provider that offers various types of insurance products to Delaware residents. Drivers who insure vehicles with air bags, have multiple policies with the company, and insure students with good grades may qualify for discounts.

- Geico: Geico car insurance offers affordable coverage to residents of Delaware and offers car insurance discounts to qualified drivers who have a good driving record, insure more than one vehicle on the policy, and have completed driver education courses.

- USAA: USAA car insurance provides coverage to active military members, veterans, and their families. Among the discounts offered by USAA are discounts for air bags, low annual mileage, and multiple vehicles insured on the policy.

- Progressive: Known for its service of providing quote estimates of competing car insurance companies, Progressive car insurance offers qualifying Delaware residents discounts for good claims history, good driving record, and multiple vehicle coverages with the company.

Consumers who desire to find the cheapest car insurance while maintaining the peace of mind that accompanies quality insurance coverage would be wise to conduct a thorough price comparison analysis when shopping for their car insurance.

The utilization of rate quotes during the shopping process can ensure that the best possible price is obtained and the highest quality coverage is established.

Make sure you’re getting the best deal on quality coverage with our free ZIP code search below.

Delaware Insurance Coverage and Rates

Why is car insurance so expensive in Delaware? Who has the cheapest car insurance in Delaware? Finding the time to research all there is to know about car insurance companies in Delaware and their rates and practices can seem like an impossible task.

The good news is we’ve paved the way for you to get the information you want and need to make an informed decision about your car insurance. We will help you discover the key indicators that insurance companies consider risks and how you can mitigate those risks.

We’ll help you to know what the state requires, what you may want or need, and where you can get it at the best price.

Delaware Minimum Car Insurance Coverage

Is car insurance required in Delaware? Well, Delaware is one of only a few no-fault insurance states meaning, regardless of who is found to be at fault for an accident, all drivers must seek compensation for damages from their own insurance companies.

The Diamond State mandates that all drivers carry Personal Injury Protection coverage (PIP). The minimum amount of PIP coverage required by law is $15,000 per person and $30,000 per occurrence. In addition, $5,000 funeral services coverage is required.

The required minimum limits for basic coverage in Delaware is 25/50/10 for all motorists. This means that car owners must carry the following minimum levels of liability insurance:

$25,000 for bodily injury or death per person in an accident caused by the owner of the insured vehicle, $50,000 for total bodily injury or death per accident caused by the owner of the insured vehicle, and $10,000 for property damage per accident caused by the owner of the insured vehicle.

Delaware does not require you to carry Uninsured/Underinsured Motorist coverage, but it is a viable option and can protect you and your passengers if the at-fault driver has no insurance, or if you’re the victim of a hit-and-run.

How much risk are you assuming by only carrying the minimum amount of liability insurance? It depends on your monthly budget and on how exposed you want to be to potential litigation. If you have assets or future assets that you wish to protect, you want to consider increasing your liability coverage.

The experts at the Wall Street Journal recommend liability limits of 100/300/50 and offer the following advice for choosing your coverage limits:

Make sure you’re covered for an amount equal to the total value of your assets (Add up the dollar values of your house, your car, savings, and investments.).

Please be aware that basic coverage only provides you with liability protection; It will not pay to repair or replace your car for an accident that you cause.

If you’re looking to repair or replace your car after an accident, then collision and comprehensive coverage are worth the investment. These policies come with a deductible and they pay based on the current value of your car, not necessarily the price you might have paid for it.

Self-insurance is available in Delaware to individuals and businesses with 15 or more cars registered in the state.

Next, we will take a look at how much motorists in Delaware pay on average for car insurance. The amount you actually will pay may be slightly lower or higher than these figures, but this data will provide you with some context from which you can project your own situation with reasonable accuracy.

Frequently Asked Questions

What factors can affect car insurance rates in Delaware?

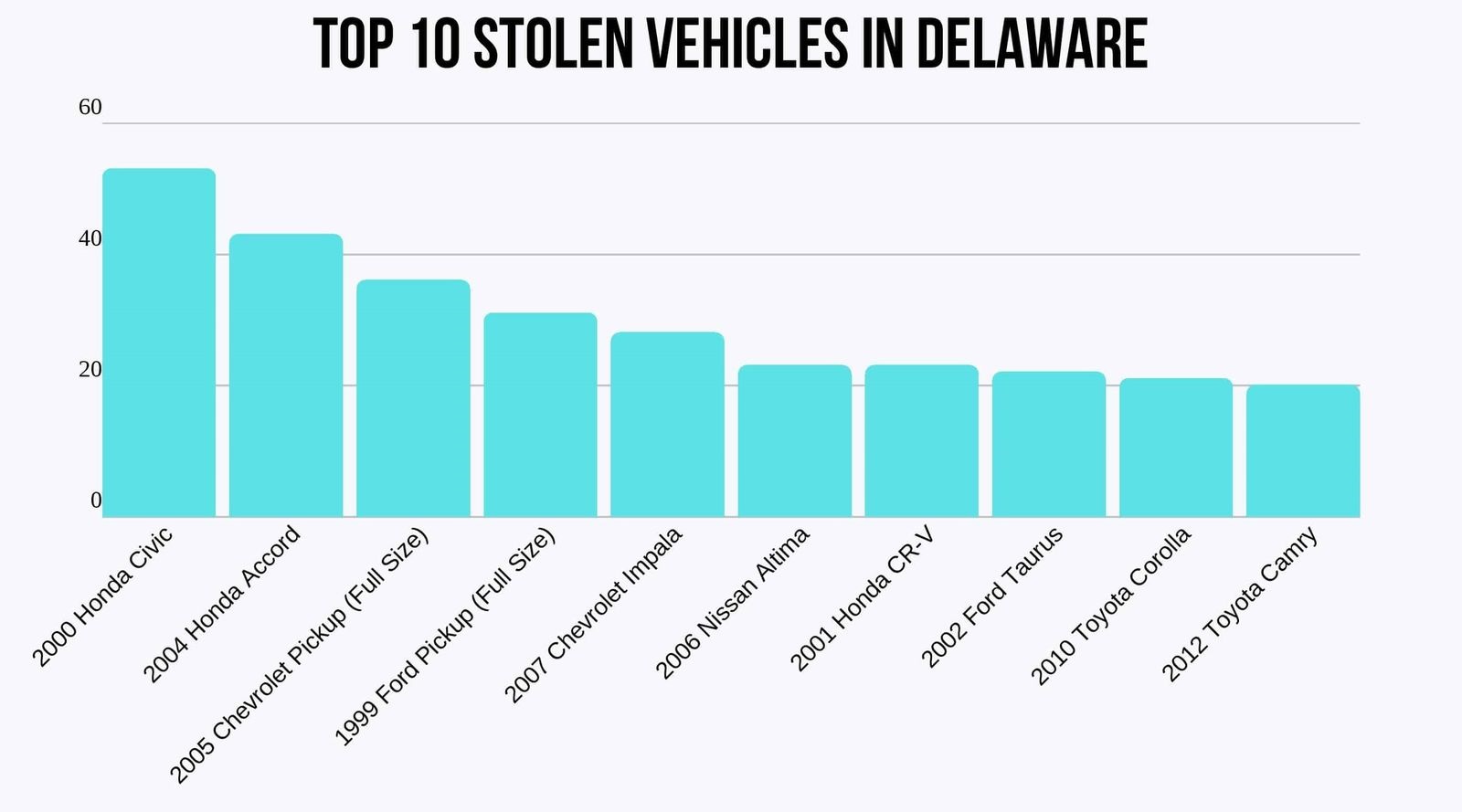

Car insurance rates in Delaware can be influenced by various factors. These include your driving record, age, gender, marital status, type of vehicle, coverage options, car insurance deductibles, and credit history. Additionally, factors such as the location where you live in Delaware, the frequency of accidents and thefts in the area, and the average cost of repairs can also impact insurance rates.

What are the minimum car insurance requirements in Delaware?

In Delaware, the minimum car insurance requirements include liability coverage of at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage per accident. Additionally, drivers are required to carry personal injury protection (PIP) coverage of at least $15,000 per person and $30,000 per accident.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Are there any specific insurance considerations for Delaware?

Delaware is a unique state with its own specific insurance considerations. One factor to consider is the high population density in some areas, which can lead to more traffic congestion and potentially higher accident rates. Additionally, certain coastal areas may be prone to flooding and other weather-related risks. These factors can impact insurance rates and coverage options in Delaware.

How can I find affordable car insurance in Delaware?

To find affordable car insurance in Delaware, it’s recommended to shop around and compare quotes from different insurance providers. Additionally, maintaining a good driving record, bundling your car insurance with other policies, opting for higher deductibles, and taking advantage of available discounts, such as safe driver or multi-policy discounts, can help lower your insurance premiums.

What discounts are available for car insurance in Delaware?

Insurance providers in Delaware often offer various discounts for car insurance. Common discounts include safe driver discounts, multiple policy car insurance discounts, good student discounts, and discounts for vehicles equipped with safety features such as anti-lock brakes or airbags. It’s advisable to inquire with insurance providers about the specific discounts they offer.

Is Delaware a no-fault state for car insurance?

No, Delaware is not a no-fault state. Delaware follows a tort system, meaning the driver who is found to be at fault for causing an accident is responsible for paying for the damages and injuries resulting from the accident.

What is gap insurance, and do I need it in Delaware?

Gap insurance covers the difference between the actual cash value of your car and the amount you owe on your car loan if your car is totaled or stolen. It’s particularly useful for new car owners or those who have financed a vehicle, ensuring you don’t owe money on a car you no longer have.

Are there specific car insurance requirements for leased vehicles in Delaware?

Yes, if you lease a vehicle in Delaware, your leasing company may require you to carry higher levels of coverage, such as comprehensive and collision coverage, in addition to the state’s minimum liability requirements. Always check with your leasing company for their specific insurance requirements.

Can I get car insurance in Delaware if I have a foreign driver’s license?

Yes, some insurance companies in Delaware offer policies to drivers with foreign licenses. However, the process might be more complicated, and you may need to provide additional documentation. It’s best to contact insurance providers directly to discuss your options.

Read More: Best Car Insurance for Foreigners

What should I do if I can’t afford my car insurance premiums in Delaware?

If you’re struggling to afford your car insurance premiums, consider shopping around for lower rates, increasing your deductible, or asking about available discounts. Additionally, maintaining a good driving record and improving your credit score can help lower your premiums over time. You may also explore state assistance programs or low-income insurance options.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.