Best Chevrolet Monte Carlo Car Insurance in 2026 (Check Out the Top 10 Companies)

For the best Chevrolet Monte Carlo car insurance, Progressive stands out as the top overall pick, with monthly rates starting at $65. Geico and Liberty Mutual also offer competitive rates and flexible coverage options. Compare these top providers to find the most affordable rates for your Monte Carlo.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

Company Facts

Full Coverage for Chevrolet Monte Carlo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Monte Carlo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Chevrolet Monte Carlo

A.M. Best Rating

Complaint Level

Pros & Cons

The top pick for the best Chevrolet Monte Carlo car insurance is Progressive, known for offering the best overall rates and comprehensive coverage. Geico and Liberty Mutual also provide excellent options with competitive pricing and flexible policies.

When selecting insurance for your Monte Carlo, it’s essential to consider factors like model year and safety features, as these can affect your premium. This article reviews the top providers to help you find the best coverage for your vehicle. Obtain further insights from our “Car Insurance Coverage Limits.”

Our Top 10 Company Picks: Best Chevrolet Monte Carlo Car Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A++ Online Tools Progressive

#2 15% A++ Low Rates Geico

#3 12% A Flexible Policies Liberty Mutual

#4 10% A++ Military Families USAA

#5 10% A+ Accident Forgiveness Allstate

#6 15% A+ Customer Service Amica

#7 15% A++ Customizable Policies Farmers

#8 13% A++ Teen Drivers American Family

#9 12% A High-Risk Drivers Safeco

#10 10% A Hybrid Vehicles Travelers

Ready to find affordable car insurance? Get started today by entering your ZIP code into our free comparison tool.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Chevrolet Monte Carlo Car Insurance Rates: Monthly Breakdown by Coverage Level

Find the best car insurance rates for your Chevrolet Monte Carlo by comparing top providers. Explore monthly premiums for both minimum and full coverage options from Allstate, Geico, USAA, and more. Knowing your options can help you save on insurance costs.

Chevrolet Monte Carlo Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $195

American Family $78 $180

Amica $92 $190

Farmers $93 $198

Geico $80 $170

Liberty Mutual $88 $195

Progressive $90 $185

Safeco $75 $185

Travelers $98 $198

USAA $65 $180

First, let’s consider a few things about the make and model. The Chevrolet Monte Carlo was first manufactured in the year 1970 and was produced all the way until the year 2007, with the last version rolling out of production line on June 19, 2007.

There are certainly many years and variations on this model of car. All of these variances can play a role in deciding the price of your insurance.

For example, insurance for the 2007 version of the Monte Carlo would typically cost more than an older version, say the 1998 model, as it would cost more for the best car insurance company to replace due to features. In short, insurance for Monte Carlo SS is dependent on age. As in, Monte Carlo SS insurance is cheaper for older models.

So, for instance, 2006 Monte Carlo SS insurance would be more expensive than 2002 Monte Carlo SS insurance which would be more expensive than 1987 Monte Carlo SS insurance and so on.

If you are restoring a 1970 model of the car and need classic car insurance coverage, that is a completely different scenario. There is no one-answer-fits-all when dealing with such a particular model for vintage car insurance.

The good news is that the Monte Carlo ranks on a lot of lists of cars that tend to have low-cost car insurance. This can be due to safety features on certain year models, such as:

- 4-wheel antilock brakes

- Airbags

- Stability control (which help you to stay more in control no matter the weather conditions)

Statistically speaking, some cars do carry greater risks than others. Why is this so? Some have speculated that this phenomenon could be due to the type of drivers that certain cars attract. For the most part, the Monte Carlo has a good reputation for attracting safe drivers. It is a two-door coupe and a personal luxury car, but it’s not the most expensive car on the market.

For the insurance company, figuring out what you will pay to insure your new Monte Carlo is all a matter of statistics.

Insurance companies are a business like any other, and they need to make money in order to stay in business. In order to make money, they have to assess risk and loss on a case by case basis. How is your case looking? Before we move any further, here is a slice of nostalgia, a Chevrolet Monte Carlo ad from 1979.

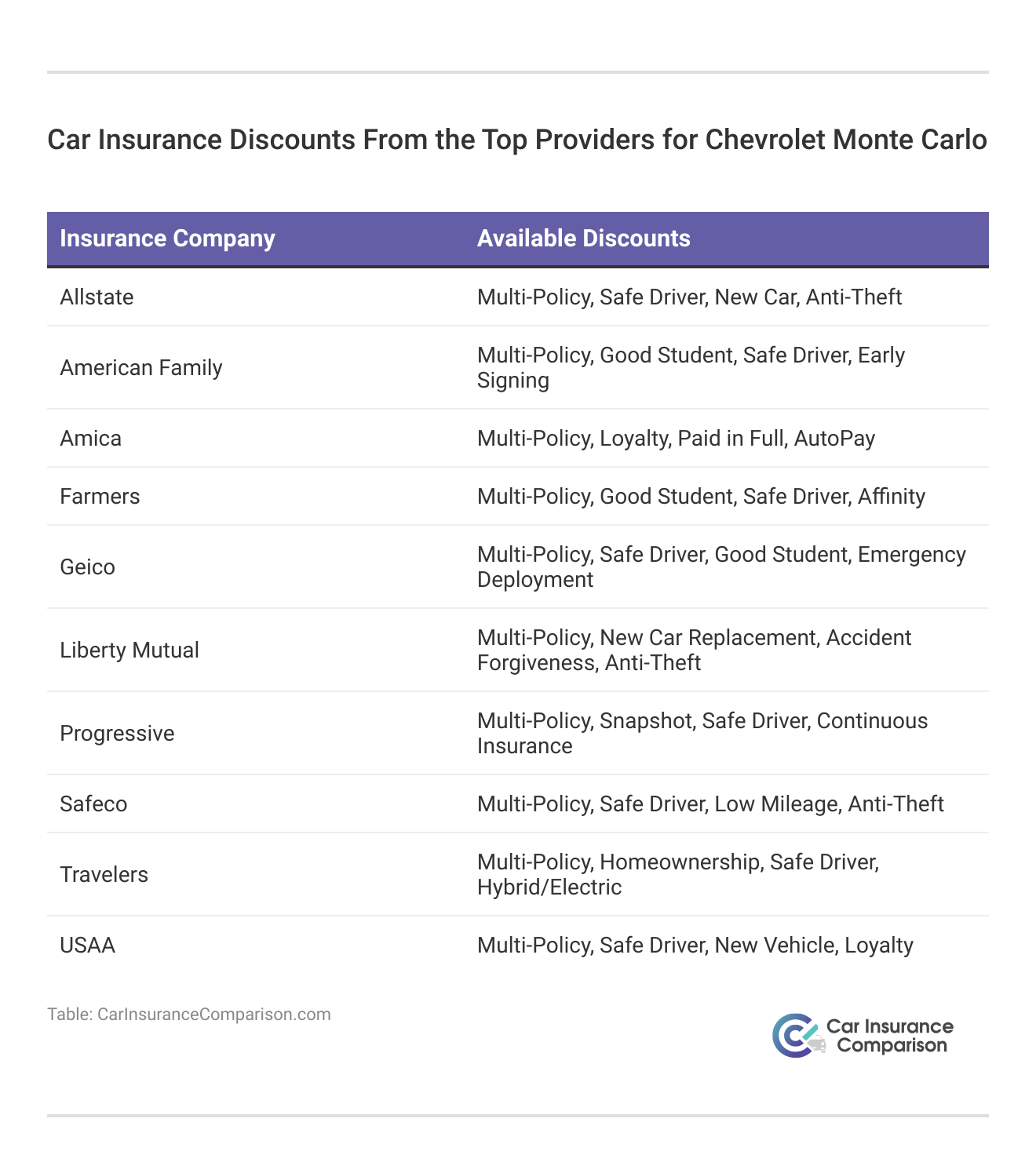

A great way to accrue discounts is to either drive a car that comes preloaded with safety features or add them to the car after purchasing it. Let’s take a look at some more safety features car insurance discounts.

Car Insurance Safety Discounts Offered by Insurance Companies

| Discount Name | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Adaptive Headlights | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Anti-lock Brakes | 10% | ✓ | ✓ | 5% | 5% | 5% | ✓ | 5% | ||

| Anti-Theft | 10% | ✓ | 23% | 20% | 25% | ✓ | 15% | |||

| Claim Free | 35% | ✓ | ✓ | 26% | ✓ | 10% | ✓ | 15% | 23% | 12% |

| Continuous Coverage | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | ||

| Daytime Running Lights | 2% | ✓ | 3% | 5% | 5% | ✓ | ✓ | |||

| Defensive Driver | 10% | 10% | ✓ | ✓ | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | ✓ | ✓ | ✓ | ✓ | 10% | ✓ | 7% | ||

| Driver's Ed | 10% | ✓ | ✓ | ✓ | 10% | ✓ | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | ✓ | ✓ | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | ✓ | ✓ | ✓ | ✓ | 8% | ✓ | ✓ | 10% | 12% |

| Electronic Stability Control | 2% | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Emergency Deployment | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Engaged Couple | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Family Legacy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 10% |

| Family Plan | ✓ | ✓ | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ |

| Farm Vehicle | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Fast 5 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Federal Employee | ✓ | ✓ | 12% | 10% | ✓ | ✓ | ✓ | ✓ | ||

| Forward Collision Warning | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Full Payment | 10% | ✓ | ✓ | $50 | ✓ | ✓ | ✓ | 8% | ✓ | |

| Further Education | ✓ | ✓ | 10% | 15% | ✓ | ✓ | ||||

| Garaging/Storing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 90% | ||

| Good Credit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Good Student | 20% | ✓ | 15% | 23% | 10% | ✓ | 25% | 8% | 3% | |

| Green Vehicle | 10% | ✓ | 5% | ✓ | 10% | ✓ | ✓ | ✓ | 10% | ✓ |

| Homeowner | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | 3% | 5% | ✓ | |

| Lane Departure Warning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Life Insurance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Low Mileage | ✓ | ✓ | ✓ | 30% | ||||||

| Loyalty | ✓ | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | |

| Married | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Membership/Group | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | |||

| Military | ✓ | ✓ | 15% | 4% | ✓ | ✓ | ||||

| Military Garaging | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% |

| Multiple Drivers | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Multiple Policies | 10% | 29% | ✓ | 10% | 20% | 10% | 12% | 17% | 13% | |

| Multiple Vehicles | ✓ | ✓ | 25% | 10% | 20% | 10% | 20% | 8% | ||

| New Address | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Customer/New Plan | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| New Graduate | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Vehicle | 30% | ✓ | ✓ | 15% | ✓ | 40% | 10% | 12% | ||

| Newly Licensed | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Newlyweds | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Non-Smoker/Non-Drinker | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Occasional Operator | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Occupation | ✓ | 10% | 15% | ✓ | ✓ | ✓ | ||||

| On-Time Payments | 5% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | |

| Online Shopper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7% | ✓ | ✓ | ✓ |

| Paperless Documents | 10% | ✓ | ✓ | ✓ | 5% | $50 | ✓ | ✓ | ✓ | |

| Paperless/Auto Billing | 5% | ✓ | ✓ | ✓ | $30 | ✓ | $20 | 3% | 3% | |

| Passive Restraint | 30% | 30% | 40% | 20% | ✓ | 40% | ||||

| Recent Retirees | ✓ | ✓ | ✓ | ✓ | 4% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Renter | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Roadside Assistance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Safe Driver | 45% | ✓ | 15% | ✓ | 35% | 31% | 15% | 23% | 12% | |

| Seat Belt Use | ✓ | ✓ | ✓ | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Senior Driver | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Stable Residence | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Students & Alumni | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | ✓ | ||

| Switching Provider | ✓ | ✓ | 10% | ✓ | ✓ | ✓ | ✓ | |||

| Utility Vehicle | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Vehicle Recovery | 10% | ✓ | ✓ | 15% | 35% | 25% | ✓ | 5% | ||

| VIN Etching | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | |||

| Volunteer | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Young Driver | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | $75 |

As you can see there are a variety of discounts that are applicable to most vehicles. With a standard car like the Monte Carlo, you could most likely take advantage of a fair amount of these discounts.

Driving a reasonable car like the Monte Carlo is a good start to get lower premiums. More luxurious cars such as the Porsche 911, Dodge Viper, and Jaguar pretty much guarantee you will be paying through the nose for regular car coverage.

From a statistical standpoint, small, fast, sports cars get into more crashes and have more speeding tickets and smaller fender-benders than sedan style cars do. This car is a large coupe version of a traditional sedan. It would be prudent to determine how your car insurance company defines sportscar.

Progressive offers the best overall car insurance for Chevrolet Monte Carlo owners with competitive rates starting at $65 a month and comprehensive coverage options.

Jimmy McMillan Licensed Insurance Agent

Common sense tells us when you deal with insurance companies, as soon as the risk goes up, the price goes up. Expenses of fixing the car also impact your rates. The same goes for older vehicles, who’s parts are harder to find, like the ’83 model shown in the next video.

If a car is rare or very pricey, you are once again paying the insurance company for the risks, this time from the mechanical replacement cost arena.

Your personal history and stats also play a big role in your overall rate. According to the Huffington Post, things such as age and gender will affect your price and cannot be controlled. Here is a quick video on factors that affect premiums.

The good news is, there are numerous factors within your power that you can use to your advantage:

- Your driving record will play a key role. Driving safely and following the rules of the road can help you to keep your record clean.

- Your credit score can also have an impact on your premiums. Many insurance companies have studied the statistics linking low credit scores to accident rates. Keep your score in the good range if you want to get the best deal on insurance.

- Marital status also affects rates. Married persons tend to make fewer claims and overall are involved in fewer accidents than those with a single status. We aren’t saying to rush out and get hitched just for a discount, of course, but it is something to know if you’re getting hitched anyway.

- Adding more drivers and vehicles onto a policy can qualify you for a discount. This can sometimes backfire, however, if your sweetheart has a terrible driving record.

And, of course, the amount of coverage you have is a factor. So, for instance, Allstate’s types of insurance include Allstate rideshare insurance and Allstate storage insurance.

You most likely don’t need these, but they would elevate your annual premium expenditure. Allstate’s full coverage cost would most likely be more worth it. Let’s take a look at all personal factors driving discounts available.

Personal Factor Discounts Offered by Car Insurance Companies

| Personal Car Insurance Discounts Offered |  |  |  |  |  |  | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Newer Vehicle | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||||

| Green Vehicle | x | x | x | x | x | x | x | |||||||||||||||

| Claim Free | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Continuous Coverage | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||||

| Defensive Driver | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Distant Student | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||||

| Driver's Ed | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||

| Early Signing | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||

| Engaged Couple | x | |||||||||||||||||||||

| Family Legacy | x | x | x | x | x | x | ||||||||||||||||

| Family Plan | x | x | x | x | x | |||||||||||||||||

| Federal Employee | x | x | x | x | ||||||||||||||||||

| Full Payment | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||

| Further Education | x | x | x | x | x | x | x | x | x | |||||||||||||

| Good Credit | x | x | x | x | ||||||||||||||||||

| Good Student | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Homeowner | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||

| Life Insurance | x | x | ||||||||||||||||||||

| Low Mileage | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||

| Loyalty | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||||

| Married | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||

| Membership/Group | x | x | x | x | x | x | x | x | x | x | x | |||||||||||

| Military | x | x | x | x | x | x | x | x | x | x | x | |||||||||||

| Multiple Drivers | x | x | ||||||||||||||||||||

| Multiple Policies | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |

| Multiple Vehicles | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |

| New Address | x | |||||||||||||||||||||

| New Customer/New Plan | x | x | x | |||||||||||||||||||

| New Graduate | x | |||||||||||||||||||||

| Newly Licensed | x | |||||||||||||||||||||

| Newlyweds | x | |||||||||||||||||||||

| Non-Smoker/Non-Drinker | x | |||||||||||||||||||||

| Occasional Operator | x | |||||||||||||||||||||

| Occupation | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||||

| On Time Payments | x | x | x | x | ||||||||||||||||||

| Online Shopper | x | x | ||||||||||||||||||||

| Paperless Documents | x | x | x | x | x | x | x | x | ||||||||||||||

| Paperless/Auto Billing | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||

| Recent Retirees | x | x | ||||||||||||||||||||

| Renter | x | x | x | |||||||||||||||||||

| Safe Driver | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||

| Seat Belt Use | x | |||||||||||||||||||||

| Senior Driver | x | x | x | x | x | x | x | x | x | |||||||||||||

| Stable Residence | x | x | x | x | ||||||||||||||||||

| Students & Alumni | x | x | x | x | x | x | ||||||||||||||||

| Switching Provider | x | x | x | x | x | x | x | x | x | x | x | |||||||||||

| Volunteer | x | |||||||||||||||||||||

| Young Driver | x | x | x | x | x | x |

Notice how almost every insurer — with the exception of Country Financial, Liberty Mutual, and The Hanover — offers a safe driver discount. Take advantage of this if it applies. For additional insights, refer to our “Safe Driver Car Insurance Discounts.”

Ready to buy Chevrolet Monte Carlo car insurance? Get started right now by entering your ZIP code and comparing Monte Carlo car insurance rates.

Frequently Asked Questions

How much does car insurance cost for a Chevrolet Monte Carlo?

Costs vary based on factors like model year and features. Comparison shopping online can help you find the best rates.

Explore further details in our “Best Chevrolet Spark Car Insurance.”

What factors affect car insurance rates for a Chevrolet Monte Carlo?

Factors include model year, safety features, and car value. Newer models may have higher costs.

How do personal factors affect car insurance costs for a Chevrolet Monte Carlo?

Personal factors like age, gender, driving record, and location can influence costs.

Ready to shop around for the best car insurance company? Enter your ZIP code and see which one offers the coverage you need.

How can I compare car insurance quotes for a Chevrolet Monte Carlo?

Use a comparison tool with your ZIP code to find quotes from different companies.

Are there discounts available for car insurance on a Chevrolet Monte Carlo?

Yes, discounts may be available for safety features, good driving records, and more.

Dive deeper into our “Best Chevrolet Aveo Car Insurance” for a comprehensive understanding.

What should I know about comprehensive coverage for a Chevrolet Monte Carlo?

Comprehensive coverage for a Chevrolet Monte Carlo protects against non-collision-related damages like theft, vandalism, natural disasters, and falling objects. It’s essential for full protection but increases your premium. Consider it if your Monte Carlo has a high value or is frequently parked in areas prone to risks.

Does adding safety features to my Chevrolet Monte Carlo lower insurance costs?

Yes, adding safety features to your Chevrolet Monte Carlo can lower insurance costs. Features like anti-lock brakes, airbags, and anti-theft devices reduce the risk of accidents and theft, leading to discounts on your insurance premium.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

How does my location affect Chevrolet Monte Carlo insurance rates?

Your location significantly affects Chevrolet Monte Carlo insurance rates. Urban areas with higher traffic and crime rates typically result in higher premiums, while rural areas with fewer accidents and thefts may have lower rates. Additionally, states have different minimum insurance requirements that can influence costs.

What is the average cost of full coverage for a Chevrolet Monte Carlo?

The average cost of full coverage for a Chevrolet Monte Carlo typically ranges between $100 to $150 per month, depending on the provider and location. Full coverage includes liability, collision, and comprehensive insurance, providing more extensive protection.

Delve into the depths of our “Best Chevrolet HHR Car Insurance” for additional insights.

Can I insure a modified Chevrolet Monte Carlo?

Yes, you can insure a modified Chevrolet Monte Carlo, but it may require specialized insurance. Standard policies might not cover aftermarket modifications, so consider a policy that includes or is tailored for custom parts and modifications, ensuring full coverage.

How does my credit score influence Chevrolet Monte Carlo insurance rates?

What is the difference in insurance costs between a new and used Chevrolet Monte Carlo?

How much does uninsured motorist coverage cost for a Chevrolet Monte Carlo?

What are the most common claims for Chevrolet Monte Carlo owners?

Does the Chevrolet Monte Carlo have a higher theft rate affecting insurance?

How do multi-car policies affect Chevrolet Monte Carlo insurance rates?

What are the penalties for not insuring a Chevrolet Monte Carlo?

How does the annual mileage driven affect Chevrolet Monte Carlo insurance costs?

Can I get usage-based insurance for a Chevrolet Monte Carlo?

How does the resale value of a Chevrolet Monte Carlo impact insurance?

What is gap insurance, and do I need it for my Chevrolet Monte Carlo?

How do I compare Chevrolet Monte Carlo insurance quotes?

Does bundling home and auto insurance lower Chevrolet Monte Carlo rates?

What are the top insurance providers for classic Chevrolet Monte Carlos?

How do insurance rates for the Chevrolet Monte Carlo vary by state?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.