Cheap Car Insurance for Supercars in 2026 (Top 10 Low-Cost Companies)

Geico, State Farm, and Progressive are our top picks for cheap car insurance for supercars, with rates starting at just $30 per month for minimum insurance. If you have room in your budget for more coverage, you can get the best supercar car insurance by adding agreed value or original parts replacement coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated January 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Supercars

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Supercars

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for Supercars

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsOur top picks for cheap car insurance for supercars are Geico, State Farm, and Progressive.

Geico takes our top spot because it offers the lowest average rates for supercars as well as discount opportunities to save more and solid coverage options. However, Geico doesn’t offer agreed value coverage. If that’s important to you, you’ll need to shop at the best car insurance companies that offer agreed value coverage.

Our Top 10 Company Picks: Cheap Car Insurance for Supercars

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | A++ | Competitive Rates | Geico | |

| #2 | $33 | B | Customizable Coverage | State Farm | |

| #3 | $39 | A+ | Competitive Rates | Progressive | |

| #4 | $43 | A+ | Tailored Coverage | The Hartford |

| #5 | $44 | A | Competitive Rates | American Family | |

| #6 | $45 | A+ | Multi-Policy Discounts | Nationwide |

| #7 | $53 | A | Specialized Coverage | Farmers | |

| #8 | $61 | A+ | Competitive Rates | Allstate | |

| #9 | $68 | A | Comprehensive Coverage | Liberty Mutual |

| #10 | $70 | A | Specialized Coverage | AIG |

Read on to find the best luxury performance car insurance for your supercar. Then, enter your ZIP code into our free comparison tool above to find the best rates in your area.

- Supercars are vehicles that have high-performance engines

- Higher repair and replacement costs lead to higher supercar insurance rates

- Geico and State Farm have the cheapest car insurance for supercars

#1 – Geico: Top Pick Overall

Pros

- Affordability: No matter where you live or what kind of supercar you drive, Geico is usually one of the most affordable insurance options.

- Government Discount: Take advantage of Geico’s 16 discounts to find cheap sports car insurance. Government employees, in particular, can save with Geico’s unique federal discount.

- Digital Tools: Geico relies more on its website and mobile app than local agents for car insurance management. Read our Geico car insurance review to see if Geico’s digital experience is right for you.

Cons

- Mixed Customer Service Reviews: Geico may offer cheap supercar insurance, but it doesn’t always provide the best customer service experience.

- Limited Supercar Insurance Options: Geico offers a more basic car insurance experience than some supercar owners might like.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Luxury Supercars

Pros

- Comprehensive Coverage: State Farm offers a variety of supercar car insurance options to maximize the protection on your vehicle. Explore the best supercar coverage options in our State Farm car insurance review.

- Discount Options: State Farm gives drivers 13 discount opportunities to help you find the best exotic car insurance rates for your supercar.

- Extensive Network of Local Agents: It’s easy to find personalized help for your State Farm policy as there are agents all over the country.

Cons

- Average Customer Service Ratings: State Farm’s customer service reviews are generally mixed, with ratings hovering around the national average.

- Higher Rates for Some: Although State Farm is a cheap option for sports car insurance, drivers with low credit scores will probably find cheaper coverage elsewhere.

#3 – Progressive: Best for Supercar Drivers on a Budget

Pros

- Name Your Price Tool: The Name Your Price tool lets you enter your monthly budget and gives you insurance options that match. Read more about Progressive’s digital tools in our Progressive car insurance review.

- Excellent Coverage Options: Get the best luxury performance car insurance with Progressive’s add-on options, including custom parts and equipment coverage and loan/lease payoff.

- Generous Discounts: Progressive offers 13 discounts to help you get the best insurance for sports cars at the right price.

Cons

- Limited Experience With Exotic Cars: Progressive has less experience insuring expensive or cheap supercars, which can make it difficult to get the most out of your policy.

- Coverage Limits: Progressive is not always the best of the exotic car insurance companies because it has smaller coverage limits, which don’t always cover expensive cars.

#4 – The Hartford: Best for Older Drivers

Pros

- AARP Benefits: The Hartford has partnered with AARP to provide car insurance and special discounts for older drivers. See what The Hartford offers AARP members in our car insurance review of AARP and The Hartford.

- Ample Discounts: Get affordable high-performance car insurance by taking advantage of The Hartford’s generous policy discounts.

- Agree Value Coverage: Buy this add-on to get a check for the agreed value of your car rather than its actual cash value if you total your supercar.

Cons

- Higher Premiums: The Hartford’s rates are usually a bit higher than the national average, but they can be very high for young drivers being added to the policy.

- More Customer Complaints: The Hartford receives more complaints from its customers than expected for a company of its size.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Original Parts Replacement Coverage

Pros

- Opportunities for Savings: American Family offers 13 discounts to help you get the lowest supercar insurance costs. See how much you can save in our American Family car insurance review.

- High-End Vehicle Coverage Options: Add things like original equipment manufacturer coverage to your policy to ensure your supercar is always taken care of.

- Stellar Customer Service: American Family has more positive reviews of its customer service than negative ones.

Cons

- Limited Availability: American Family only sells supercar insurance in 19 states.

- Claims Issues: Many customers report that American Family is more critical of claims made for expensive supercars than it is for standard vehicles, which slows the process down.

#6 – Nationwide: Best for UBI Savings

Pros

- UBI Savings: Save up to 40% on your sports car insurance rates by signing up for Nationwide’s usage-based insurance program, SmartRide. See if SmartRide is a good choice for you in our Nationwide car insurance review.

- On Your Side Review: Once a year, you can sit down with a Nationwide agent to go over personalized insurance quotes for sports cars to make sure you’re getting the right coverage.

- Agreed Value Option: Nationwide also offers agreed value coverage, meaning you won’t have to worry about your car being replaced if it’s totaled or stolen.

Cons

- Long Claims Process: Many Nationwide customers complain that the claims process for supercars is excessively slow.

- Limited Availability: Despite its name, Nationwide is only available in 47 states.

<h2id=”Rank7″>#7 – Farmers: Best List of Discount Options

Pros

- Experienced Agents: Farmers agents are ready to help with any insurance situation, including complicated claims involving supercars.

- Tons of Discounts: With 23 discount options, Farmers has one of the best lists of discounts on the market. Explore all 23 discounts in our Farmers car insurance review.

- Ample Coverage Options: Get the best auto insurance for exotic cars with Farmers’ ample coverage options, like new car replacement, roadside assistance, and gap insurance.

Cons

- Availability Varies: Farmers sells insurance in every state, but there are often local limits when it comes to insuring an expensive supercar.

- Higher Rates: Farmers rates are typically a bit higher than the national average, no matter what type of driver gets a quote.

#8 – Allstate: Best Full Coverage Service

Pros

- Agreed Value Coverage: Allstate is another company that gives drivers the option of adding agreed value coverage to their policy.

- Telematics Savings: Allstate offers two UBI programs to get discounted insurance for supercars. Explore Drivewise and Milewise in our Allstate car insurance review.

- Valuable Add-OB: Aside from agreed value coverage, you can also add things like new car replacement and roadside assistance to your policy.

Cons

- Reports of Claims Problems: Many drivers report that filing claims for supercars with Allstate is a lengthy, time-consuming process.

- Higher Average Rates: Allstate is usually one of the priciest options for car insurance on the market, regardless of what type of car you drive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#9 – Liberty Mutual: Best for Diverse Selection of Insurance Options

Pros

- Multi-Vehicle Discounts: Looking for a policy that covers car insurance for high-performance cars and standard vehicles? Liberty Mutual will give you a multi-vehicle discount for having more than one car on the same policy.

- RightTrack: Safe drivers can save up to 30% on their supercar insurance by enrolling in RightTrack, Liberty Mutual’s UBI program.

- Customizable Coverage: Liberty Mutual sets itself apart as one of the best supercar insurance companies with its diverse set of add-on options. Explore your coverage options in our Liberty Mutual car insurance review.

Cons

- Less Competitive Rates: Liberty Mutual may have some of the best insurance for exotic cars, but it comes at rates that are usually higher than the national average.

- High Number of Complaints: According to the National Association of Insurance Commissioners, Liberty Mutual receives more complaints than similarly-sized companies.

#10 – AIG: Best for High-Value Vehicles

Pros

- Customizable Policies: AIG offers a variety of coverage options for your supercar. Popular options include original parts coverage, worldwide liability for travel, and agreed value coverage.

- Below Average Complaints: Customers typically report satisfaction with AIG’s service and it receives fewer complaints than the national average.

- High-End Coverage: AIG specializes in providing insurance for high-end cars to drivers with high net worths.

Cons

- Higher Premiums: Since AIG focuses on expensive cars, it usually charges more than the national average for insurance.

- Lacking Local Agents: AIG does most of its business online or over the phone – finding face-to-face help can be difficult as there aren’t many local AIG agents.

Supercar Car Insurance Rates

Standard car insurance policies are designed to protect the owners of standard private passenger vehicles that can range in size and value. Standard models of compact cars, trucks, vans, and full-size cars will all qualify for standard insurance because they hold a reasonable value.

Since supercars are rare, most companies in the standard market will not cover them. Instead, you must purchase a specialty plan that is designed to cover a unique yet high-risk vehicle. To truly understand why the rates are significantly different depending on where you shop, you need to understand the difference between classic and standard car insurance and learn how rate determination differs between the two.

Every insurance company, no matter what type of market or demographic they target, will take the time to assess risk and to determine how much they need to collect in premiums from a driver in order to make a profit.

Since there’s no real way for an insurer to know if they’ll have to pay for claims throughout a term, the only thing it can do is review an application, review demographic factors, look for red flags, use claims information, compare data, and assign rates based on what is found. How rates for a specialty supercar insurance plan and a traditional plan are calculated vary dramatically.

Take a look below to see how much you might pay for supercar insurance at our top companies.

Supercar Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $70 | $120 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $45 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

This variance plays a major role in why the rates can be much higher for exotic car insurance. Even routine insurance for an exotic car can be outlandishly expensive.

For instance, routine service on a Bugatti Veyron, valued at over a million dollars, costs about $21,000. Insurance companies take this into account, which is why the average annual insurance cost for a Bugatti is a whopping $50,855.

Michelle Robbins Licensed Insurance Agent

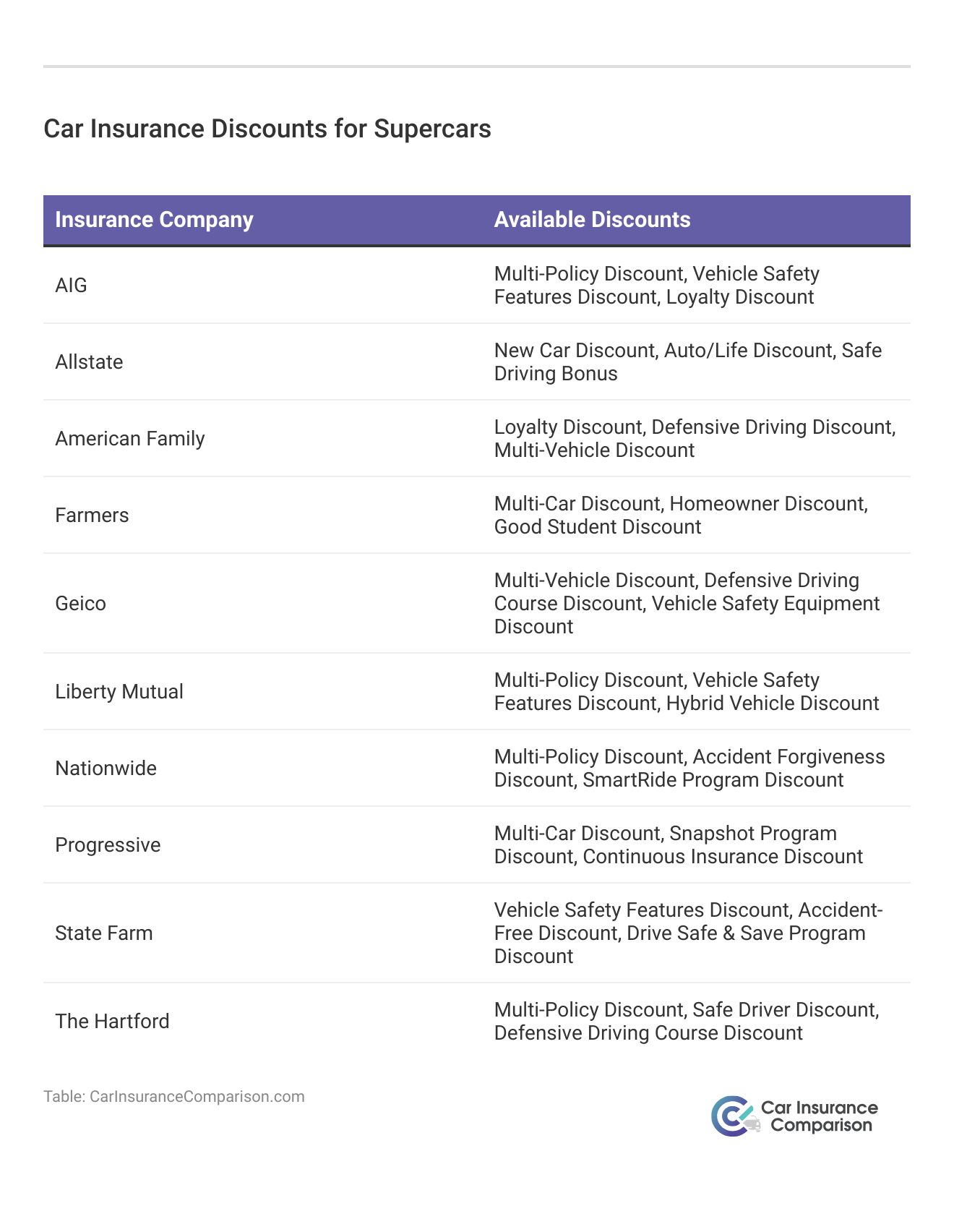

Luckily, there are ways to save. Check below to see a selection of discounts from our top companies that supercar owners may qualify for.

Aside from standard car insurance discounts, you can also enroll in a UBI program.

Have you heard of Drivewise? It’s located in our Allstate app. We recently found out that customers who choose to use Drivewise are 25% less likely to have a severe collision than those who don’t. https://t.co/HNMxg3hVAZ

— Allstate (@Allstate) May 13, 2024

The insurance companies also know that just because someone can afford a sports car doesn’t mean they can drive it well. This is why most exotic car insurers are of the specialty variety. These specialty car insurance companies, like Grundy or Hagerty Insurance, use agreed-value policies, according to NASDAQ. This is where the owner decides what the car is worth and pays a premium based on that preset value.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Supercar Insurance Cost Determination for Supercar Specialty Insurance

Supercar insurance cost determination for a supercar is a bit more involved than traditional coverage. All the factors that are used during the determination of rates for a traditional car, discussed below, will extend to a specialty plan as well. The main difference will be in how risk is assessed for the vehicle.

Since the car is rare, there will not be a long list of claims or data from repair shops that the company can use to decide what is appropriate. This is why private specialty insurers will consider different aspects of setting a premium for an exotic car. Some of the factors that private insurers use during underwriting include:

- Original purchase price

- Current appraised value of the car

- Add-ons or modifications

- Accessories

- Age of the vehicle

- Parts used in the engine

- Maintenance history

- Condition of the interior

- Repair history or parts used in repairs

- How often the vehicle is driven

- If the vehicle is stored in a locked garage

Even with supercars, what is truly being analyzed is driving habits and history. The owner’s level of responsibility comes into play not just in terms of accident history, but in how they’re going to treat their supercar.

The fact that the insurer will want to know if you’re going to store your car in a locked garage is proof of this.

Car insurance companies are serious about precautionary measures like these, and chances are, so are you. It’s highly doubtful that an individual would spend an inordinate amount of money on a car and classic car insurance without a garage.

Still, even most specialty companies will deny supercar coverage if the vehicle is just going to sit in someone’s driveway. Supercars are like classic cars. These are not the standard four-door sedans you use to get to work. They’re essentially novelty items. Be honest with your insurance company about how you’ll treat your prized possession, and you should be just fine.

Factors That Determine Supercar Insurance Rates

When a car insurance company is establishing rates for a standard car, they reference an industry-wide and specific set of factors that affect car insurance rates based on how much risk is present and ultimately how much the applicant should pay for six or 12 months for the best sports car insurance.

While some companies have their own special brand discounts, most of the information and data referenced when determining and filing rates will be the same. The most common rating factors used by standard insurers include the following:

- Driving history affects your insurance rates

- Accident history

- Driving experience and habits

- Vehicle usage and mileage

- Vehicle type and classification

- Your job affects your car insurance

- Gender, age, and marital status

- ZIP code where the vehicle is stored

Vehicle type does play a role in how much insurance will cost, but not as big of a role as it will play when you’re buying supercar insurance.

Standard companies only use a car’s average cost of repairs and claims history to assign the vehicle a class.

The insurer may also use claims data to determine if a model is known to cause injuries or significant damage to third-party passengers and property.

The value of the car really is not a determinant that will impact pricing if you own a car that can be covered under traditional policies. The history of the driver is what will be most important. You’ll need some of this information when you request a quote.

If you want to save time, enter your information into a free comparison tool to see rates from multiple companies in your area.

Why Supercar Insurance Costs Are Higher for Most Specialty Plans on Exotic Cars

You might assume that people who can afford to buy a high-priced supercar will expect the premiums to be exorbitant, but when you learn just how much higher they can be, you might be shocked. After all, even though a supercar can hold a six-figure price tag, there are standard cars that cost well over $60,000 as well that are driven daily.

Unfortunately, to afford the cost of maintaining and insuring a supercar, you will need to be astronomically wealthy.

The reason supercar rates are so high is because of the value of these cars and the fact that they’re more likely to be targeted by thieves. Understanding market value and car insurance can help you understand the price. Unlike a traditional policy, where the insurer can calculate the fair market value of a car and then make an offer, private insurers must pay a 100 percent agreed-upon value for a supercar claim.

The agreed value provision means that the owner of the car can set the value, and the insurer is on the line to cover this regardless of the car’s age. The cost of insurance can vary from car to car and from agent to agent. Since there is no depreciation and one claim could cost the insurer millions, the insurer must collect adequate premiums to justify the risk being taken.

While it may seem enticing to own such a formidable and rare vehicle, you need to be aware that insurers view them the same way. Supercars are seen as a specialty item, so a special policy is in order. Most insurers do not see the risk as worth the potential gain.

Justin Wright Licensed Insurance Agent

These vehicles are infrequently made — not in bulk — and so the parts are even less widely available. So, really, you have to do a cost-benefit analysis of your own. If you’re willing to pay thousands a year for insurance, now is the time to analyze coverage level costs. After all, if you’re going to own a supercar, you’re going to need insurance to take it out on the road.

Many companies that provide insurance for luxury cars allow you to pay your premiums both on a monthly and yearly basis; that is completely up to you. You should comparison shop and try to find the best deal with a company that knows this market in and out. Use an online comparison tool that connects you to supercar insurers and lets you browse through instant quotes.

Supercars and Standard Car Insurance Policies

Because of the high replacement and repair costs for supercars, your auto insurance provider will require you to purchase a special policy for your vehicle. If you’re financing your supercar, your loan company may require you to carry full coverage insurance.

Most regular auto insurance policies will not cover a supercar. Before you even show up at the car dealership, you may want to have conversations with various auto insurance companies about what options there are for supercar coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find Cheap Car Insurance for Supercars Today

There are a number of factors that will determine how much you will pay for your supercar auto insurance policy. The cost of your vehicle, your credit history, the types of car insurance you want to purchase, and many other factors go into determining your supercar insurance costs or rates.

It may come as a shock to many drivers that auto insurance companies take your credit rating into account when determining your supercar insurance policy pricing. Many companies that provide insurance for luxury cars allow you to pay your premiums both on a monthly and yearly basis; that is completely up to you. Find the best deals by entering your ZIP code into our free tool below to compare rates now.

Frequently Asked Questions

Is car insurance for supercars expensive?

Yes, car insurance for supercars can be quite expensive due to their high value and specialized coverage requirements.

Can I get coverage for track use or racing events for my supercar?

If you frequently use your supercar for racing events, you can check out the best race car insurance for the perfect coverage.

Can I cover my supercar with my regular auto insurance policy?

No, most regular auto insurance policies will not provide adequate coverage for a supercar. You will need a specialized policy designed for exotic and high-performance vehicles.

How are supercar insurance rates determined?

Supercar insurance rates are determined based on various factors, including the vehicle’s value, the owner’s driving history, storage and security measures, and the insurer’s risk assessment.

What is agreed value for supercars?

Agreed value car insurance is an agreement between you and your provider about how much you’ll receive if your car is totaled or stolen. It costs more than traditional insurance, which pays for actual cash value, but it ensures you’ll be able to replace your car if something happents.

Why are supercar insurance costs higher for specialty plans?

Supercar insurance costs are higher for specialty plans due to the unique nature of these vehicles and the higher risk associated with them. Insurers must account for the high value of the cars and the potential for expensive repairs or claims.

Which companies have the cheapest supercar insurance?

While you’ll need to compare multiple free car insurance quotes, the companies with the overall cheapest rates for supercars are Geico, State Farm, and Progressive.

Can I save money on supercar insurance?

While supercar insurance tends to be expensive, you can still save money by comparing quotes from different insurance companies specializing in supercars. It’s important to shop around and consider factors like coverage limits, deductibles, and discounts to find the best rates.

How do you keep a supercar safe?

To keep your supercar safe, you should always park it in a safe spot every night. You should also purchase the right coverage. For example, comprehensive insurance protects against theft. You can also have devices installed in your vehicle to prevent theft. If you install one of these devices, you may be eligible for an anti-theft device car insurance discount.

Do modifications affect supercar insurance rates?

Yes, modding your car will likely cause your car insurance rates to increase. If you enjoy making modifications to your vehicle, it’s especially important to compare quotes. Enter your ZIP code to get started.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.