Cheapest Arizona Car Insurance Rates in 2026 (Find Savings With These 10 Companies!)

Geico, USAA, and State Farm stand out for offering the cheapest Arizona car insurance rates, starting at $25 monthly. These companies excel in affordability, customer satisfaction, and coverage options, making them the top choices for Arizona drivers seeking reliable and cost-effective insurance solutions.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated September 2024

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage for Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe top picks for the cheapest Arizona car insurance rates are Geico, USAA, and State Farm. Explore the strengths of each provider, focusing on their affordability, customer satisfaction, and full coverage car insurance.

These companies excel in offering cost-effective solutions and comprehensive protection, making them ideal choices for Arizona drivers.

Our Top 10 Company Picks: Cheapest Arizona Car Insurance Rates

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $25 | A++ | Online Tools | Geico | |

| #2 | $26 | A++ | Military Benefits | USAA | |

| #3 | $30 | B | Comprehensive Discounts | State Farm | |

| #4 | $32 | A+ | Snapshot Program | Progressive | |

| #5 | $39 | A++ | Hybrid Discounts | Travelers | |

| #6 | $43 | A | Loyal Customer | American Family | |

| #7 | $44 | A+ | Vanishing Deductible | Nationwide |

| #8 | $51 | A | Customizable Policies | Farmers | |

| #9 | $67 | A | Flexible Policies | Liberty Mutual |

| #10 | $68 | A+ | Claim Satisfaction | Allstate |

By comparing quotes and evaluating coverage options, drivers can find the best insurance to suit their needs and budget.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico is known for offering some of the most affordable rates, particularly advantageous for drivers with good credit or clean driving records.

- High Customer Satisfaction: Explore our Geico car insurance review to see why it ranks high in customer satisfaction.

- Comprehensive Online Tools: Geico provides an easy-to-use online platform for managing policies, making payments, and filing claims.

Cons

- Rate Increases: Some customers report significant rate increases over time, which can be a concern for long-term affordability.

- Limited Local Agents: Geico primarily operates online, which may be inconvenient for customers who prefer in-person service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Exclusive Military Focus: USAA specializes in serving military members and their families, offering tailored services and discounts.

- Excellent Customer Service: View our USAA car insurance review highlighting their exceptional customer service.

- Comprehensive Coverage Options: USAA provides a wide range of coverage options and add-ons, allowing for highly customizable policies.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families, limiting accessibility to the general public.

- Higher Premiums for Non-Members: Non-members may face higher premiums compared to military members.

#3 – State Farm: Best for Customer Satisfaction

Pros

- Extensive Family Discounts: Offers a variety of family discounts, including multi-car, good student, and policy bundling for additional savings.

- Nationwide Availability: See our State Farm car insurance review for its wide availability and family-friendly options.

- Strong Financial Stability: A large and financially stable insurance company, reassuring policyholders of its ability to fulfill claims.

Cons

- Potentially Higher Rates: While it offers various discounts, some customers may find that their base rates are higher compared to other insurers.

- Limited Online Interaction: The online experience with State Farm may be less intuitive due to its traditional focus on in-person agent interactions.

#4 – Progressive: Best for Usage-Based Insurance

Pros

- Snapshot Program: Offers usage-based insurance through its Snapshot program, potentially leading to significant savings for safe drivers.

- Wide Range of Discounts: Explore our Progressive car insurance review to learn about their numerous discounts.

- Comprehensive Online Resources: Strong online presence with comprehensive tools and resources for policy management.

Cons

- Customer Service Issues: Some customers report issues with customer service, particularly regarding claims handling.

- Rate Increases: Progressive may have higher rate increases at renewal compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Flexible Coverage Options

Pros

- Flexible Coverage Options: Delve into our Travelers car insurance review for customizable coverage options.

- Strong Financial Ratings: Travelers has strong financial ratings, indicating stability and reliability.

- Good Discount Programs: Provides numerous discount opportunities, including multi-policy and good student discounts.

Cons

- Average Customer Satisfaction: Customer satisfaction ratings are average, with some complaints about claims processing.

- Higher Premiums: Some customers may find Travelers’ premiums to be higher compared to other companies.

#6 – American Family: Best for Personalized Service

Pros

- Personalized Service: Known for its personalized customer service and dedicated local agents.

- Strong Financial Stability: Take a look at our American Family car insurance review for insights on financial stability.

- Good Range of Discounts: Offers a variety of discounts, including multi-policy, good student, and safe driver discounts.

Cons

- Limited Availability: Not available in all states, limiting accessibility for some customers.

- Average Online Experience: Online tools and resources are average compared to some competitors.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Offers the Vanishing Deductible program, which reduces deductibles for safe driving.

- Strong Financial Stability: Nationwide is financially stable, providing confidence in its ability to handle claims.

- Comprehensive Coverage Options: Offers a wide range of coverage options and add-ons. See our Nationwide car insurance discounts.

Cons

- Higher Rates: Some customers report higher base rates compared to other insurers.

- Customer Service Variability: Customer service experiences can vary, with some customers reporting issues.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customizable Policies

Pros

- Customizable Coverage: Offers highly customizable policies with a variety of coverage options and endorsements.

- Strong Customer Service: Discover our Farmers car insurance review emphasizing strong customer service.

- Good Discounts: Provides a variety of discounts, including multi-policy and good student discounts.

Cons

- Higher Premiums: Premiums can be higher compared to other insurance providers.

- Limited Online Tools: Online tools and resources may not be as comprehensive as some competitors.

#9 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers accident forgiveness to prevent rate increases after the first accident.

- Comprehensive Coverage Options: Based on our Liberty Mutual car insurance review, find out about their varied coverage options.

- Discount Opportunities: Offers various discounts, including multi-policy and good student discounts.

Cons

- Rate Increases: Some customers report significant rate increases over time.

- Average Customer Satisfaction: Customer satisfaction ratings are average, with some complaints about claims handling.

#10 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Offers a wide range of coverage options and customizable policies.

- Strong Financial Stability: Following our Allstate car insurance review, learn about their financial stability and claims handling.

- Good Discount Programs: Provides numerous discounts, including safe driver and multi-policy discounts.

Cons

- Higher Premiums: Some customers may find Allstate’s premiums to be higher compared to other companies.

- Mixed Customer Service Reviews: Customer service experiences can vary, with some customers reporting issues.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Arizona Vehicle Insurance: Proof and Alternatives

In Arizona, drivers must always have proof of financial responsibility. Acceptable forms of proof include a liability insurance coverage policy, a bond worth $40,000, a certificate of deposit worth $40,000, or $40,000 in cash. Motorists must carry one of these proofs whenever they drive.

Geico stands out as the top provider for the cheapest Arizona car insurance rates, combining unbeatable affordability with top-notch customer service.

Dani Best Licensed Insurance Producer

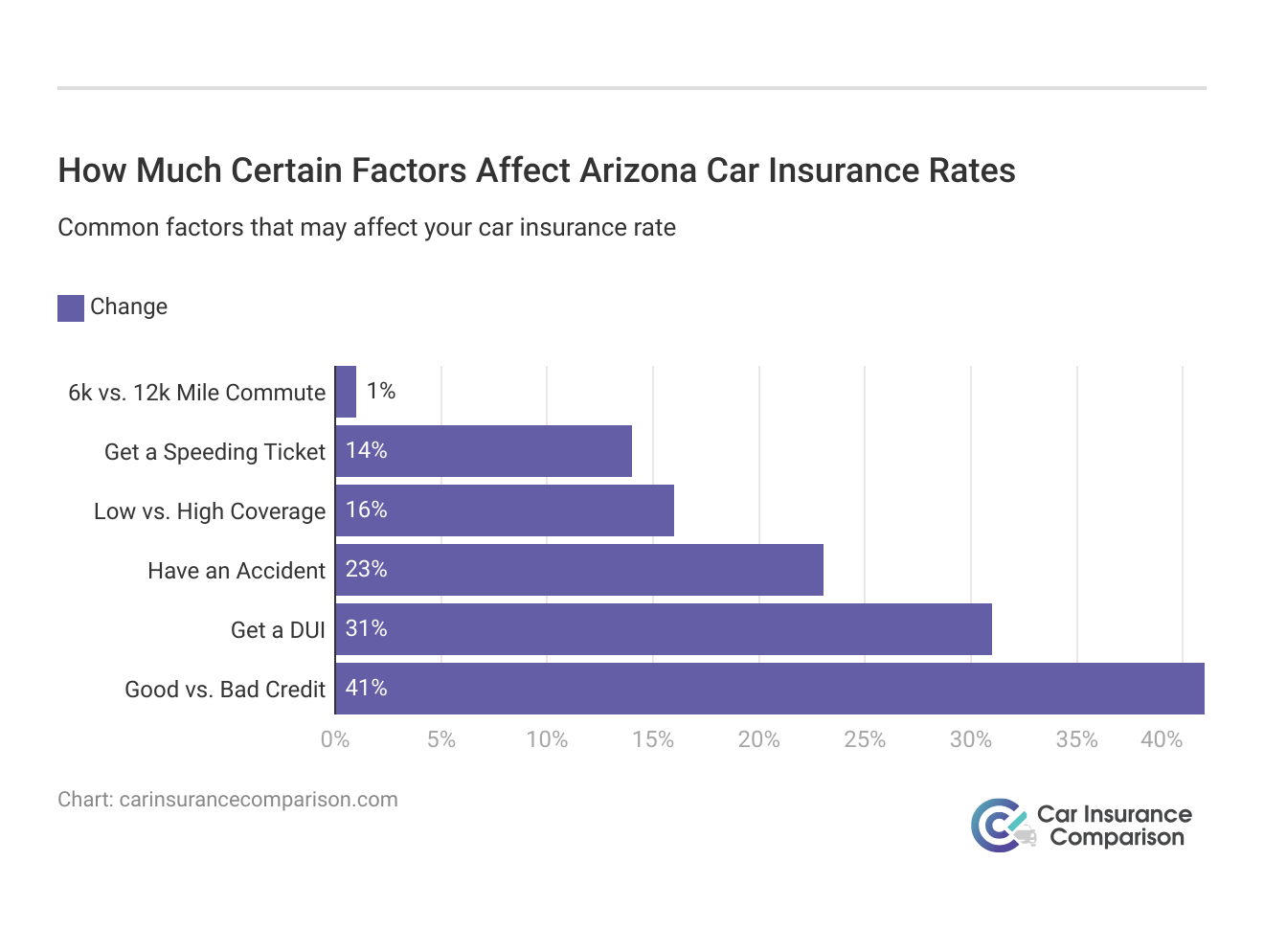

Arizona can cancel your insurance for reckless driving, non-payment, fraud, license issues, permanent disability without a physician’s certificate, criminal negligence, DUI, hit-and-run, false statements on an application, insurer issues, using a private vehicle commercially, or if continuation violates state laws.

Arizona Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $68 $180

American Family $43 $114

Farmers $51 $135

Geico $25 $65

Liberty Mutual $67 $178

Nationwide $44 $116

Progressive $32 $84

State Farm $30 $81

Travelers $39 $104

USAA $26

$63

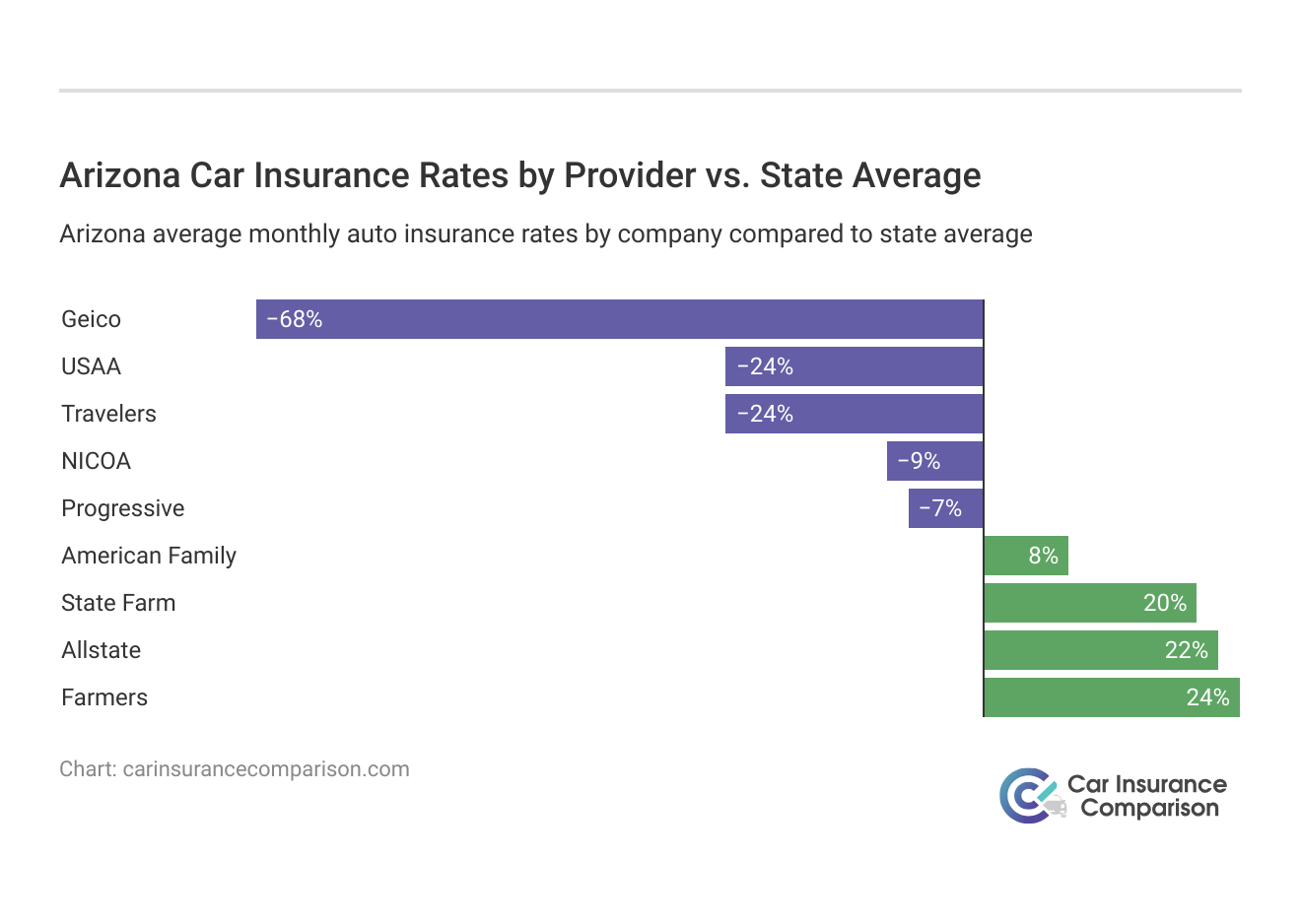

This table compares monthly car insurance rates in Arizona for minimum and full coverage across various providers. Geico offers the lowest rates at $25 for minimum coverage and $65 for full coverage. USAA follows with $26 for minimum coverage and $63 for full coverage. State Farm offers $30 for minimum and $81 for full coverage, while Progressive offers $32 for minimum and $84 for full coverage.

American Family, Farmers, Nationwide, Travelers, and Liberty Mutual offer a range of rates, with Liberty Mutual being the highest at $67 for minimum coverage and $178 for full coverage. Allstate’s rates are $68 for minimum coverage and $180 for full coverage. This comparison helps Arizona drivers find the best insurance options tailored to their coverage needs and budgets.

Arizona Auto Insurance Costs Relative to Income

In 2017, Arizona’s monthly per capita disposable personal income (DPI) was $2,860, which represents the money available to an individual after taxes. The average monthly car insurance cost in Arizona is $80, approximately 3 percent of the average DPI.

With an average monthly DPI of $2,806, Arizona residents spend nearly $100 per month on car insurance, potentially higher for those with car insurance for bad driving records. American Consumer Credit Counseling recommends saving 20 percent of each paycheck, translating to $561 monthly savings based on Arizona’s DPI.

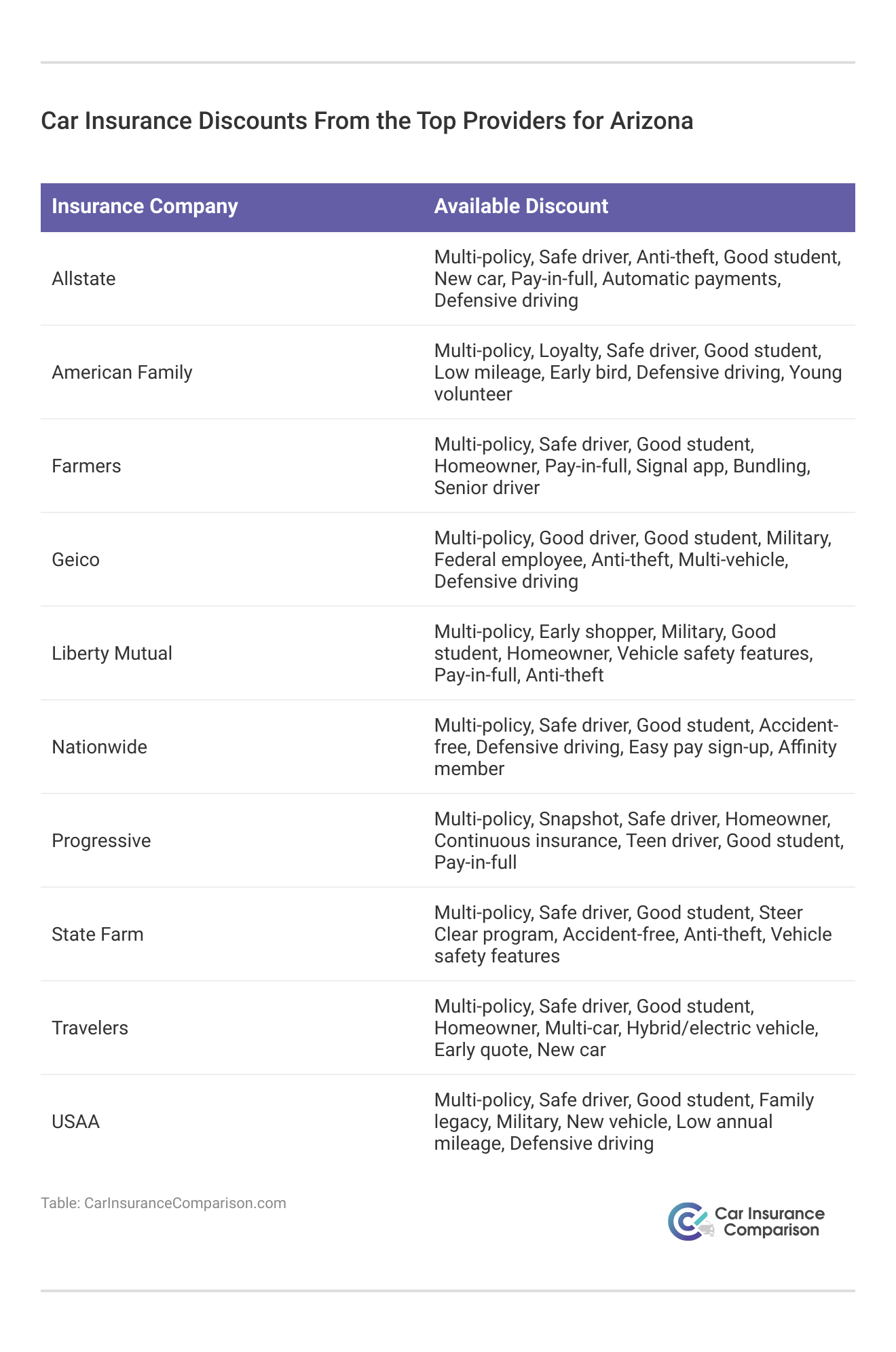

The table highlights various car insurance discounts available from leading insurance companies in Arizona. It lists the providers along with the specific discounts they offer, ranging from multi-policy and safe driver discounts to those for good students and military members. This provides a comprehensive overview to help Arizona drivers identify which insurance companies offer discounts that might suit their needs.

Understanding Arizona Car Insurance Requirements

If you’re drawn to Arizona for its Western charm and outstanding Mexican cuisine, it’s important to know the costs associated with owning and operating a vehicle in the state. While Arizona ranks 24th in the U.S. for uninsured drivers, with about 12 percent of motorists uninsured, it’s crucial to have at least the minimum required liability insurance.

The minimum coverage includes $15,000 per person and $30,000 per accident for bodily injury liability, $10,000 for property damage liability, $15,000 per person and $30,000 per accident for uninsured motorist bodily injury, and $10,000 for uninsured motorist property damage.

Arizona is an “at-fault” state, meaning if you’re responsible for an accident, you must cover personal injury and property claims.

The required liability insurance covers $25,000 per person for injury or death, $50,000 for total injuries or death per person, and $15,000 for property damage per accident. These are just minimum requirements by state, and additional coverage options are available.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

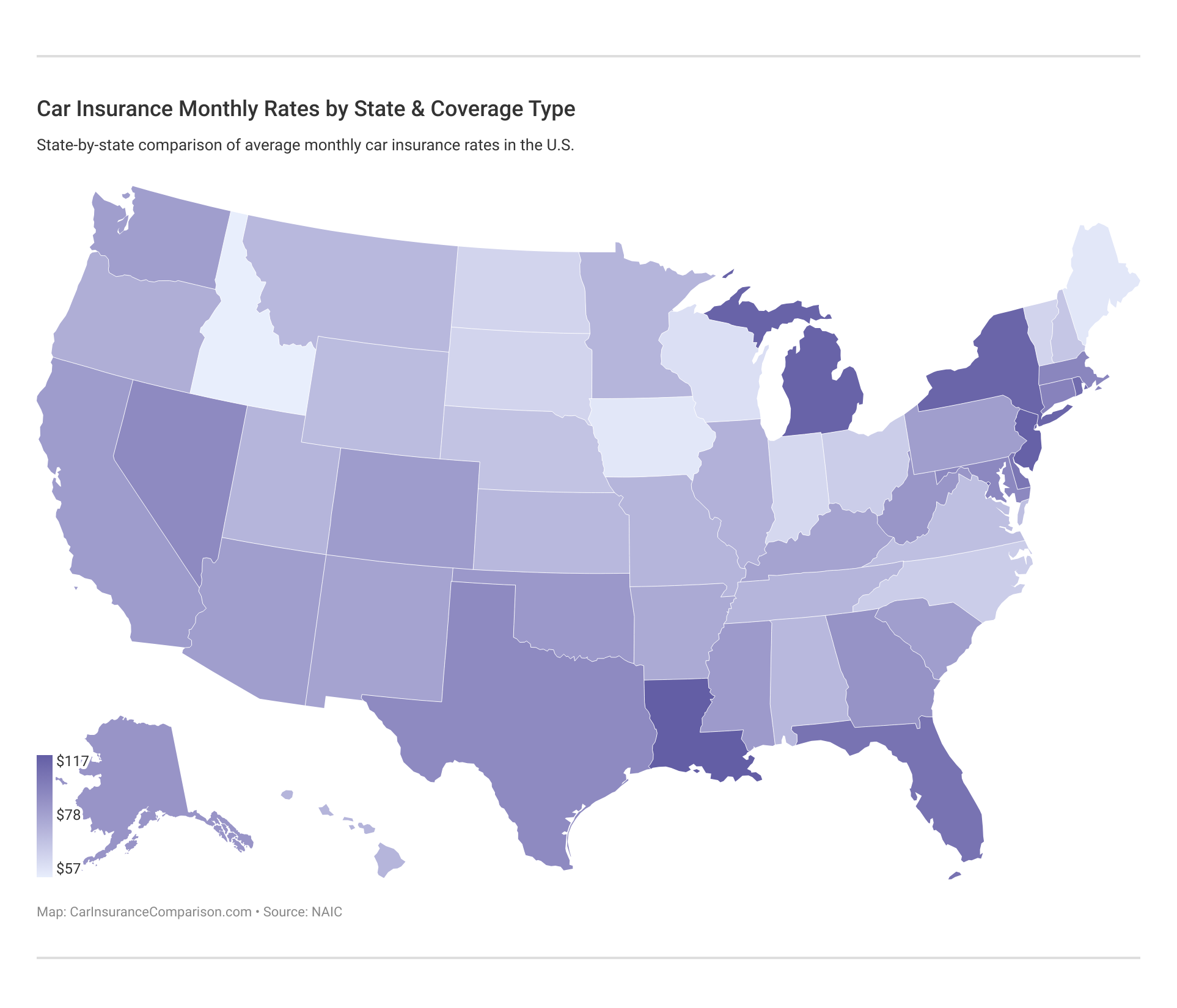

Arizona Car Insurance Rates and Coverage Recommendations

The average monthly costs for core car insurance in Arizona are as follows: liability $43, collision $23, comprehensive $16, with a combined total of $81. These figures, sourced from the National Association of Insurance Commissioners, indicate that car insurance rates in Arizona are expected to rise significantly from 2019 onwards.

Arizona, an “at-fault” state, has minimum liability coverage requirements, but experts recommend purchasing more coverage than the state mandates. The attorneys at Begam, Marks, and Traulsen highlight that medical expenses, such as an MRI costing up to $3,000, can quickly surpass these minimum limits.

Therefore, they advise carrying underinsured and uninsured policies above the minimum required amounts. While basic car insurance has its pros and cons, there are many options to customize your coverage. While there are pros and cons to purchasing basic car insurance—such as affordability and meeting legal requirements versus potential coverage gaps—there are many options to customize your coverage.

Pedestrian fatalities accounted for 216 deaths, motorcyclist fatalities numbered 163, and there were 32 fatalities involving bicyclists and other cyclists. This data highlights why Arizona is among the most dangerous states for pedestrians.

Pima County showed an increase from 96 fatalities in 2013 to 114 in 2017. Other counties, such as Apache, Coconino, and Mohave, exhibited fluctuating fatality numbers over the years. Gila and Yuma counties generally had lower fatality counts, with Gila ranging from 17 to 31 and Yuma from 16 to 33 over the five-year period.

Frequently Asked Questions

How much should car insurance cost in AZ?

In Arizona, the average cost for state minimum car insurance is about $65 per month, while a full coverage policy averages around $81 per month.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Compare Monthly Car Insurance” for valuable insights.

What is the minimum car insurance for Arizona?

Minimum levels of financial responsibility are: $25,000 bodily injury liability for one person and $50,000 for two or more persons. $15,000 property damage liability.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

What is the cheapest form of car insurance?

The cheapest type of car insurance is liability insurance, with an average cost of $780 per year.

For a comprehensive analysis, refer to our detailed guide titled “Minimum Car Insurance Requirements by State” for complete insights.

Who typically has the cheapest insurance?

The best and cheapest car insurance State Farm is the cheapest national car insurance company, at $50 per month for liability-only coverage. American Family and Geico also have affordable quotes, averaging $61 per month. USAA has the cheapest rates overall, charging $26 per month.

Can I have out of state car insurance in Arizona?

No. All vehicles registered in Arizona must be insured by a company licensed to do business in this state.

What is full coverage car insurance in AZ?

Sometimes, a complete package of car insurance is called “full coverage,” but what does that mean in Arizona? Here’s the word from our lawyers. Full coverage is a shorthand for a combination of liability, collision, and comprehensive insurance.

For detailed information, refer to our comprehensive report titled “Compare Car Insurance by Coverage Type” for full details.

What is full coverage insurance in AZ?

If you have an accident and are at fault, this policy covers the costs of both you and the other party. Full coverage includes numerous options, such as rental reimbursement, additional medical coverage, life insurance, towing fees, and uninsured/underinsured motorist..

Is it cheaper to register a car in Arizona or California?

Arizona is the cheapest state to register a car in, with a base registration fee of $8.

Ready to find affordable car insurance? Use our free comparison tool below to get started.

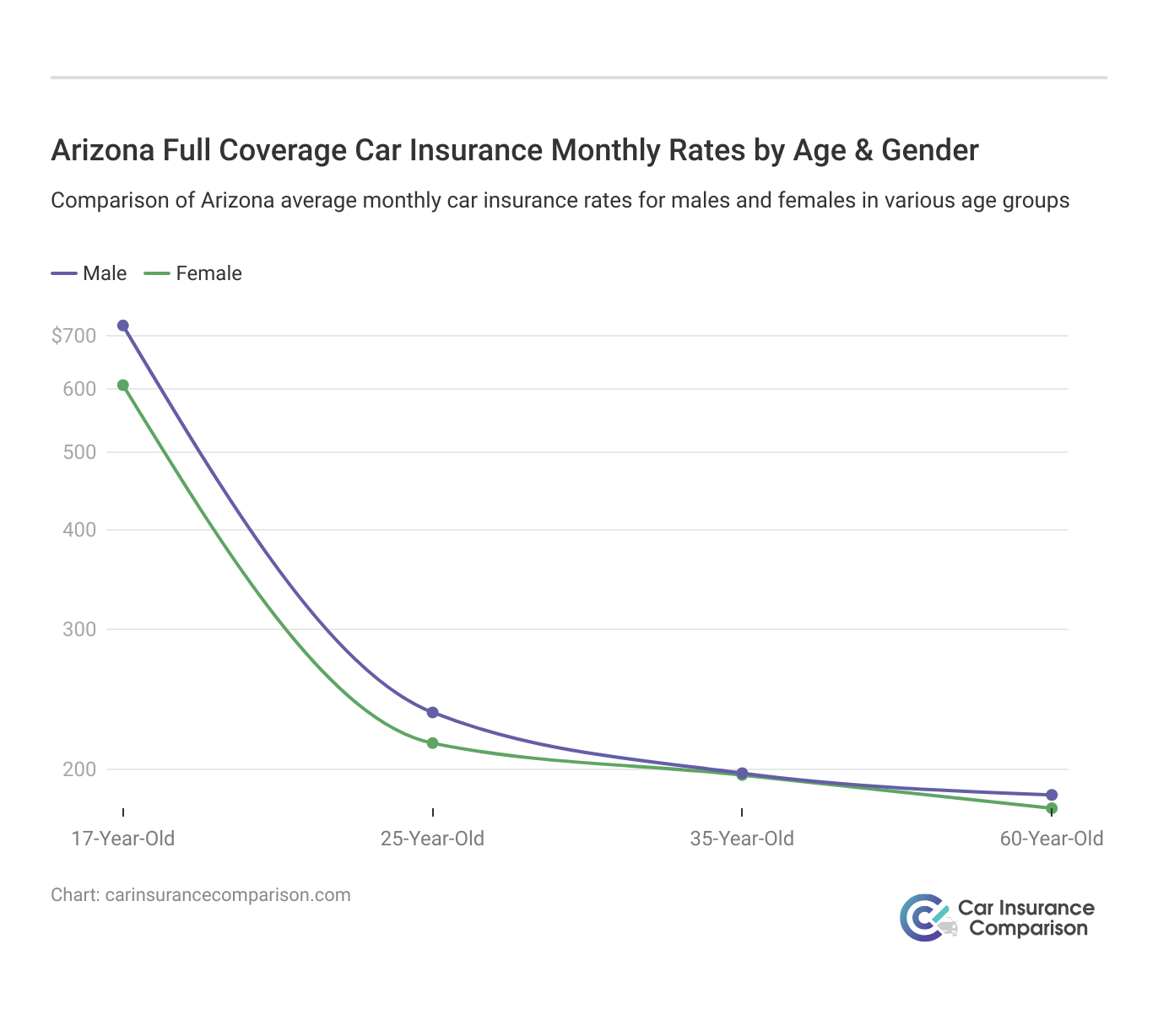

What age is insurance cheapest?

Age and car insurance As a general rule of thumb, you can expect to pay the most for your car insurance when you’re under 25. Once people are over 25, they tend to find that the cost of their car insurance starts to fall. The price usually declines gradually between the ages of 25 and 60.

What are the insurance laws in Arizona?

Arizona law requires all drivers to carry a minimum level of liability coverage. Every driver has to carry at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident and $15,000 in property damage liability coverage per accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.