Cheapest Tennessee Car Insurance Rates in 2025 (Big Savings With These 10 Companies!)

Find the cheapest Tennessee car insurance rates from top providers like USAA, State Farm, and Geico with rates as low as $18 per month. Our top pick, USAA, offers competitive pricing and robust coverage options. Learn how to navigate Tennessee’s car insurance requirements and secure the best rates below.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated December 2025

Company Facts

Min. Coverage for Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Uncover the cheapest Tennessee car insurance rates from leading providers like USAA, State Farm, and Geico, with premiums starting at just $18 per month. Our top recommendation is USAA, offering competitive rates and comprehensive coverage options.

This guide will help you navigate Tennessee’s car insurance requirements and secure the best rates, ensuring you make informed and confident decisions.

Our Top 10 Company Picks: Cheapest Tennessee Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $18 A++ Military Affordability USAA

![]()

#2 $22 B Customer Satisfaction State Farm

![]()

#3 $24 A++ Low Rates Geico

![]()

#4 $27 A Comprehensive Coverage Farmers

#5 $28 A++ Discount Options Travelers

#6 $29 A+ Competitive Pricing Progressive

#7 $32 A Policy Discounts American Family

#8 $33 A Bundle Savings Liberty Mutual

#9 $37 A+ Affordable Plans Nationwide

#10 $45 A+ Reliable Coverage Allstate

Finding free car insurance quotes online is easy, Simply enter your ZIP code in our free online tool above to get started.

- Compare car insurance rates from top providers like USAA, State Farm, and Geico

- USAA is our top pick for competitive pricing and comprehensive coverage options

- Learn to navigate Tennessee’s car insurance requirements

#1 – USAA: Top Overall Pick

Pros

- Lowest Monthly Rates: USAA offers the lowest monthly car insurance rates in Tennessee, starting at just $18. This makes it an excellent choice for budget-conscious drivers looking to save on insurance costs without sacrificing coverage quality.

- Comprehensive Coverage: Despite its low rates, USAA provides robust coverage options, including liability, collision, and comprehensive coverage. This ensures that even the most affordable plans offer comprehensive protection, meeting all of Tennessee’s insurance requirements.

- Strong Financial Stability: As mentioned in our USAA car insurance review, they are known for its strong financial ratings, ensuring reliability and trustworthiness in fulfilling claims.

Cons

- Limited Eligibility: USAA’s services are restricted to military members, veterans, and their families. This limitation means that many Tennessee drivers might not be eligible for their highly competitive rates, potentially missing out on substantial savings.

- Mixed Customer Service Reviews: While generally positive, some USAA customers have reported issues with customer service responsiveness and claim resolution. This can be a concern for Tennessee drivers who value accessible and efficient support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Satisfaction

Pros

- Affordable Monthly Rates: State Farm offers competitive rates starting at $22 per month for minimum coverage in Tennessee. This affordability makes State Farm a strong contender for those seeking budget-friendly insurance options in the state.

- High Customer Satisfaction: With a strong reputation for customer satisfaction, State Farm provides personalized service through a broad network of agents. Tennessee drivers benefit from attentive support and tailored insurance solutions.

- Discounts for Safe Driving and Bundling: State Farm offers substantial discounts for safe driving habits and bundling multiple policies. Tennessee drivers can take advantage of these discounts to lower their insurance premiums, making State Farm an attractive choice for cost-conscious customers.

Cons

- Higher Rates for Younger Drivers: State Farm’s rates can be higher for younger drivers or those with less favorable driving records. This can be a drawback for younger Tennessee drivers looking for the most affordable insurance options.

- Limited Discounts: Compared to some competitors, State Farm offers fewer discount opportunities. This limitation may affect Tennessee drivers seeking to reduce their premiums through various discount programs. Learn more in our State Farm car insurance review.

#3 – Geico: Best for Low Rates

Pros

- Very Low Rates: Geico is known for offering some of the lowest rates in Tennessee, starting at $24 per month for minimum coverage. This makes it an ideal choice for drivers looking to minimize their insurance expenses.

- User-Friendly Online Platform: Geico provides a streamlined online platform and mobile app, allowing Tennessee drivers to manage their policies and file claims efficiently. This convenience is particularly beneficial for tech-savvy users.

- Good Customer Service: Geico generally receives positive reviews for its customer service. Tennessee drivers can expect reliable support and a satisfactory experience, even with their budget-friendly pricing.

Cons

- Limited Local Agent Availability: Geico primarily operates online, which might not suit Tennessee drivers who prefer in-person interactions with local agents. This could be a disadvantage for those who value face-to-face customer service.

- Less Comprehensive Coverage Options: While Geico offers low rates, its coverage options may be less comprehensive compared to some competitors. Tennessee drivers seeking extensive coverage might find Geico’s offerings somewhat limited. Learn more in our Geico car insurance review.

#4 – Farmers: Best for Comprehensive Coverage

Pros

- Diverse Coverage Options: Farmers provides a wide range of coverage options, including customizable policies. This flexibility allows Tennessee drivers to tailor their insurance to meet specific needs while maintaining affordability.

- Numerous Discounts: Farmers offers various discounts, including those for safe driving and bundling multiple policies. Tennessee drivers can take advantage of these discounts to lower their overall insurance costs.

- Strong Customer Service: As outlined in our Farmers car insurance review, Farmers is noted for its strong customer service, offering reliable support and assistance. This is beneficial for Tennessee drivers who value responsive and helpful customer service.

Cons

- Higher Premiums: Farmers’ premiums are generally higher compared to some competitors, starting at $27 per month for minimum coverage. This might be a drawback for Tennessee drivers seeking the most economical insurance options.

- Regional Variability: Customer experiences with Farmers can vary significantly by region. Tennessee drivers might encounter inconsistent service or claims processing depending on their specific location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Discount Options

Pros

- Extensive Coverage Options: Travelers offers a variety of coverage options and unique add-ons, such as accident forgiveness. Tennessee drivers can benefit from comprehensive protection tailored to their specific needs.

- Strong Financial Ratings: Travelers’ high financial stability ratings ensure reliable claims handling and financial security. This is important for Tennessee drivers who want assurance that their insurer can handle claims effectively.

- Variety of Discounts: Travelers provides several discounts, including multi-policy and safe driver discounts. Tennessee drivers can leverage these opportunities to reduce their insurance premiums and save on costs. See more details on our Travelers car insurance review.

Cons

- Premium Variability: Travelers’ rates can vary widely based on location and individual circumstances. Tennessee drivers might experience fluctuating premiums that could impact their overall insurance affordability.

- Less Intuitive Digital Experience: Travelers’ online and mobile platforms are considered less user-friendly compared to some competitors. Tennessee drivers seeking a seamless digital experience might find the platforms lacking in ease of use.

#6 – Progressive: Best for Competitive Pricing

Pros

- Competitive Rates: Progressive offers some of the lowest car insurance rates in Tennessee, with premiums starting at $29 per month for minimum coverage. This makes Progressive an attractive option for drivers seeking affordable insurance.

- Snapshot Program: Progressive’s Snapshot program allows Tennessee drivers to potentially lower their rates based on their driving habits. This program can reward safe driving and offer personalized discounts.

- Comprehensive Coverage Options: Progressive provides a range of coverage options, including liability, collision, and comprehensive insurance. Tennessee drivers can choose from these options to ensure they get the best value for their low premium. Learn more about their availability in our Progressive car insurance review.

Cons

- Higher Rates for High-Risk Drivers: Progressive’s rates can increase significantly for drivers with poor credit or a history of claims. Tennessee drivers with less favorable driving records might find their premiums less competitive.

- Customer Service Concerns: Some customers have reported issues with Progressive’s customer service, particularly regarding claims processing. Tennessee drivers might experience delays or difficulties when dealing with claims.

#7 – American Family: Best for Policy Discounts

Pros

- Affordable Premiums: American Family offers relatively low car insurance rates in Tennessee, starting at $32 per month. This affordability makes it a viable option for drivers seeking cost-effective insurance solutions.

- Diverse Coverage Options: American Family provides a wide range of coverage options, including unique add-ons such as accident forgiveness. Tennessee drivers can customize their policies to fit their specific needs while staying within budget.

- Discount Opportunities: American Family offers various discounts, including multi-policy and safe driving discounts. Tennessee drivers can use these discounts to further reduce their insurance costs.

Cons

- Limited Availability of Discounts: As mentioned in our American Family car insurance review, American Family might offer fewer discount opportunities. This can be a drawback for Tennessee drivers looking to maximize savings through various discount programs.

- Inconsistent Regional Service: Customer experiences with American Family can vary significantly by region. Tennessee drivers might encounter differences in service quality or claims handling based on their specific location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Bundle Savings

Pros

- Reasonable Rates: Liberty Mutual provides competitive rates in Tennessee, with premiums starting at $33 per month for minimum coverage. This makes it a strong contender for affordable insurance options.

- Extensive Coverage Options: Liberty Mutual offers a wide range of coverage options, including customized policies and unique features like accident forgiveness. Tennessee drivers can tailor their insurance to their specific needs.

- Discount Programs: Liberty Mutual provides numerous discount opportunities, including discounts for bundling policies and safe driving. Tennessee drivers can take advantage of these discounts to lower their insurance costs.

Cons

- Higher Rates for Certain Drivers: Liberty Mutual’s rates can be higher for drivers with poor credit or a history of claims. Tennessee drivers with less favorable profiles might find their premiums to be less competitive.

- Mixed Customer Service Reviews: Liberty Mutual has received mixed reviews for its customer service, particularly in claims handling. Tennessee drivers might experience varying levels of support and responsiveness. Learn more in our Liberty Mutual car insurance review.

#9 – Nationwide: Best for Affordable Plans

Pros

- Competitive Pricing: Nationwide offers affordable car insurance rates in Tennessee, starting at $37 per month. This competitive pricing makes it an option for drivers seeking reasonably priced insurance.

- Comprehensive Coverage Choices: Nationwide provides a variety of coverage options, including liability, collision, and comprehensive insurance. Tennessee drivers can select from these options to ensure they receive adequate protection.

- Discounts for Safe Driving: As outlined in our Nationwide car insurance discount, offers discounts for safe driving and other factors, such as bundling policies. Tennessee drivers can leverage these discounts to reduce their insurance premiums.

Cons

- Higher Premiums for High-Risk Drivers: Nationwide’s premiums can be higher for drivers with poor credit or previous claims. Tennessee drivers with less favorable driving records might not benefit as much from Nationwide’s competitive base rates.

- Customer Service Variability: Nationwide’s customer service quality can vary by region, leading to inconsistent experiences for Tennessee drivers. Some drivers might face challenges with claims processing or support.

#10 – Allstate: Best for Reliable Coverage

Pros

- Extensive Coverage Options: Allstate offers a broad range of coverage options, including accident forgiveness and new car replacement. Tennessee drivers can customize their policies to meet their specific needs and preferences.

- Strong Discount Programs: Allstate provides numerous discount opportunities, such as safe driving and multi-policy discounts. Tennessee drivers can use these discounts to reduce their overall insurance costs.

- Good Financial Stability: Allstate’s strong financial ratings ensure reliability in handling claims and providing customer support. Tennessee drivers can trust that Allstate will offer dependable service and support.

Cons

- Higher Starting Premiums: Allstate’s premiums start at $45 per month for minimum coverage, which is higher compared to some competitors. Tennessee drivers seeking the cheapest rates might find Allstate’s pricing less attractive.

- Mixed Customer Service Feedback: Some customers have reported mixed experiences with Allstate’s customer service, especially regarding claims handling. Tennessee drivers might encounter varying levels of service quality and responsiveness. Learn more about their premiums in our Allstate car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Cheapest Car Insurance in Tennessee

If shopping around for car insurance sounds like the very last thing on earth you want to do, you’re not alone.

The reality is, with so many auto insurance providers on the market touting why they stand out above the competition, it’s often difficult to identify which carriers are worth your consideration from those that just don’t meet the mark. See table below:

Tennessee Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $45 $144

American Family $32 $102

Farmers $27 $86

Geico $24 $78

Liberty Mutual $33 $184

Nationwide $37 $118

Progressive $29 $92

State Farm $22 $72

Travelers $28 $88

USAA $18 $58

If you’re one of the approximately 6.72 million individuals currently residing in the state of Tennessee, finding car insurance in your state to cover all the drivers in your household is one of the most crucial decisions you’ll ever make.

If your policy renewal is coming up, and you’re thinking of switching Tennessee car insurance companies but don’t know where to start, we’ll show you the best ways to compare Tennessee car insurance rates.

Satisfied overall with your current carrier, but want to make sure you’re getting the best rates and understand what your options are? Or maybe you’re wondering:

- Is car insurance cheaper in Tennessee?

- What is the average cost for car insurance in Tennessee?

- Who has the cheapest car insurance rates in TN?

- How much is car insurance per month in Tennessee?

You won’t want to miss our complete guide to Tennessee car insurance coverage, carrier rates, driving laws, road safety facts, and more.

So let’s get down to business. Want to start comparison shopping for Tennessee car insurance providers in just seconds?

- Compare Tennessee Car Insurance Rates

- Best Spring Hill, TN Car Insurance in 2025

- Best Speedwell, TN Car Insurance in 2025

- Best Rockwood, TN Car Insurance in 2025

- Best Millington, TN Car Insurance in 2025

- Best Memphis, TN Car Insurance in 2025

- Best Loretto, TN Car Insurance in 2025

- Best Knoxville, TN Car Insurance in 2025

- Best Johnson City, TN Car Insurance in 2025

- Best Gatlinburg, TN Car Insurance in 2025

- Best Cleveland, TN Car Insurance in 2025

- Best Clinton, TN Car Insurance in 2025

- Best Butler, TN Car Insurance in 2025

- Best Bethpage, TN Car Insurance in 2025

Tennessee Car Insurance Coverage and Rates

Between the incredible music of Nashville and Memphis, stunning outdoor landscapes like the Great Smoky Mountains National Park, tourist hotspots like Graceland, and endlessly beautiful trails and valleys, Tennessee has no shortage of things to see and enjoy for residents and visitors alike.

Tennessee’s income tax structure is known as Hall Tax, involving a flat tax only on dividends and interest.

U.S. News and World Reports ranked Tennessee number 26 out of all 50 states to live in their 2018 rankings while ranking the state number 30 overall in criteria like infrastructure, economy, opportunity, and fiscal stability.

Tennessee is one of a mere handful of states in the country that don't charge or barely charge income tax.

Brad Larson LICENSED INSURANCE AGENT

Christened The Volunteer State, Tennessee’s infamous nickname goes all the way back to the War of 1812 when the volunteer soldiers from the state showed remarkable courage and fortitude during the Battle of New Orleans.

Whether you’re considering relocating to The Volunteer State or are a lifelong resident, it’s key to understand your requirements and options for Tennessee car insurance so you can make the best choice for your needs.

Tennessee Minimum Car Insurance Coverage Requirements

Tennessee’s Financial Responsibility Law mandates that all drivers in the state purchase and maintain at least the minimum levels of liability car insurance coverage listed in the table below. You must also be able to show proof of insurance if you are ever pulled over by a law enforcement officer. Tennessee is one of 48 states that currently accept electronic proof of insurance.

Let’s take a closer look a what these Tennessee car insurance requirements mean for you:

- $25,000 per person to cover the bodily injury or death of an individual resulting from an accident you cause

- $50,000 per accident to cover the total bodily injury or death liability resulting from an accident you cause

- $15,000 property damage liability coverage to cover the total costs of another party or party’s property damage resulting from an accident you cause

These minimum liability coverages come into play to cover the costs of medical bills, property damage, and other losses incurred by passengers or pedestrians as the result of an accident you cause. Your insurance will cover these expenses up to and until your coverage limits are exhausted.

Tennessee Minimum Car Insurance Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Liability | $40,000 per person per accident ($20,000 for medical expenses and $20,000 for non-medical expenses) |

| Property Damage Liability | $30,000 per person and $60,000 for two or more people per accident |

| Uninsured/Underinsured Motorist | $10,000 |

| Personal Injury Protection (PIP) | $25,000 per person and $50,000 for two or more people per accident |

If your limits are exhausted and the other party’s bills are still mounting, you could be held personally liable to cover the rest. This is why it is critical to consider taking out higher policy limits than the state required minimum to safeguard your assets in the event of a severe crash.

Your liability insurance also applies to authorized individuals or family members who you permit to operate your vehicle. However, your liability insurance doesn’t cover any damages or injuries you may sustain after an auto accident.

It is worth considering adding other coverages to your policy (such as collision insurance coverage) to protect yourself if you sustain losses in the crash.

It is important to note that Tenessee adheres to the traditional system of assigning fault in auto accidents regarding financial responsibility for damages sustained, such as lost wages, injuries, property damage, etc.

In simple terms, this just means that whoever caused the accident is also responsible for covering any damages or injuries that result. Technically, the at-fault driver’s Tennessee car insurance company will cover these losses until policy limits are exhausted.

Forms of Financial Responsibility in Tennessee

Under Tennessee car insurance laws, you must not only maintain the minimum coverages specified above but have proof of financial responsibility to provide to law enforcement upon request.

You must be ready to show proof of insurance if you are involved in a collision resulting in injury, death, or property damage exceeding $400, or if you are pulled over for a routine traffic stop.

Acceptable forms of financial responsibility in Tennessee include:

- Your insurance policy binder

- Your insurance card from an insurer licensed and authorized to do business in the state

- Your insurance policy declaration page

- Electronic proof of insurance

Failure to provide proof of financial responsibility upon request is categorized as a Class C misdemeanor. Penalties include suspension of your driver’s license, fines, and potentially being unable to renew your vehicle registration if a “STOP” is put on your car.

You could also be required to file an SR-22 car insurance document with the Tennessee Department of Motor Vehicles, which is essentially a promise from your insurer that you will carry and maintain the state-mandated coverages for a minimum period of five years.

You may have the SR-22 filing requirement lifted following three year’s time if you have not received any additional suspensions during that period.

Premiums as a Percentage of Income in Tennessee

Have you ever wondered how much of your annual income is being eaten up by Tennessee car insurance rates? Check out the table below, illustrating the residents’ average disposable incomes between 2012 and 2014 as compared to the percentage of their earnings they paid out in monthly premiums.

Your disposable income is what you have remaining to spend or save once taxes are taken out.

As of 2014, the average Mississippian’s total disposable income was $31,365.00, which was around $5,500 less than what the average Tennessee worker took home that year. In addition, workers in Mississippi paid approximately $957.59 for full coverage in 2014, meaning that insurance premiums comprised roughly 3.05% of the average workers’ income.

However, if you look at the stats for premiums as a percentage of residents’ disposable income in bordering Mississippi, you’ll see that Tennessee’s figures aren’t so high after all.

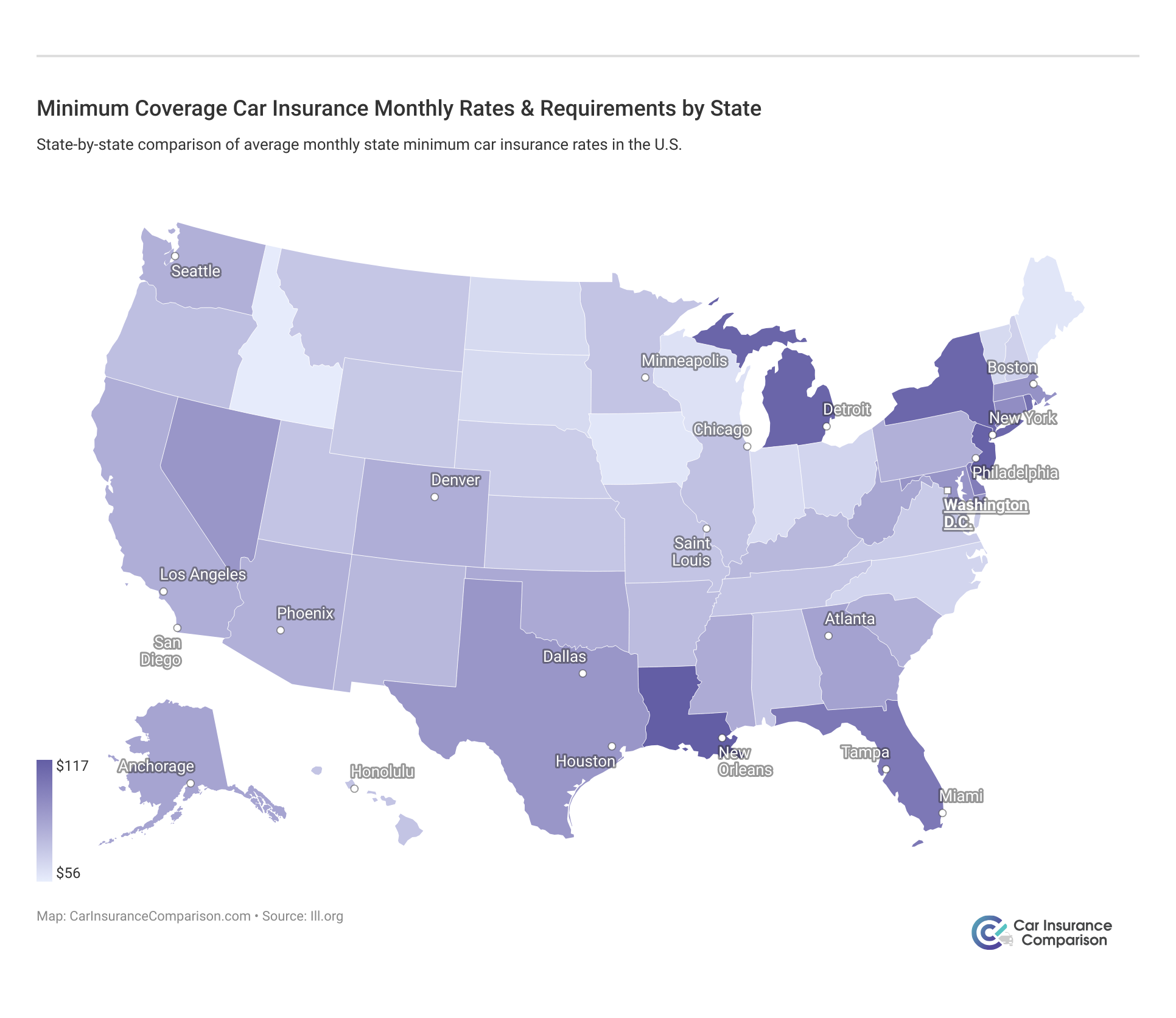

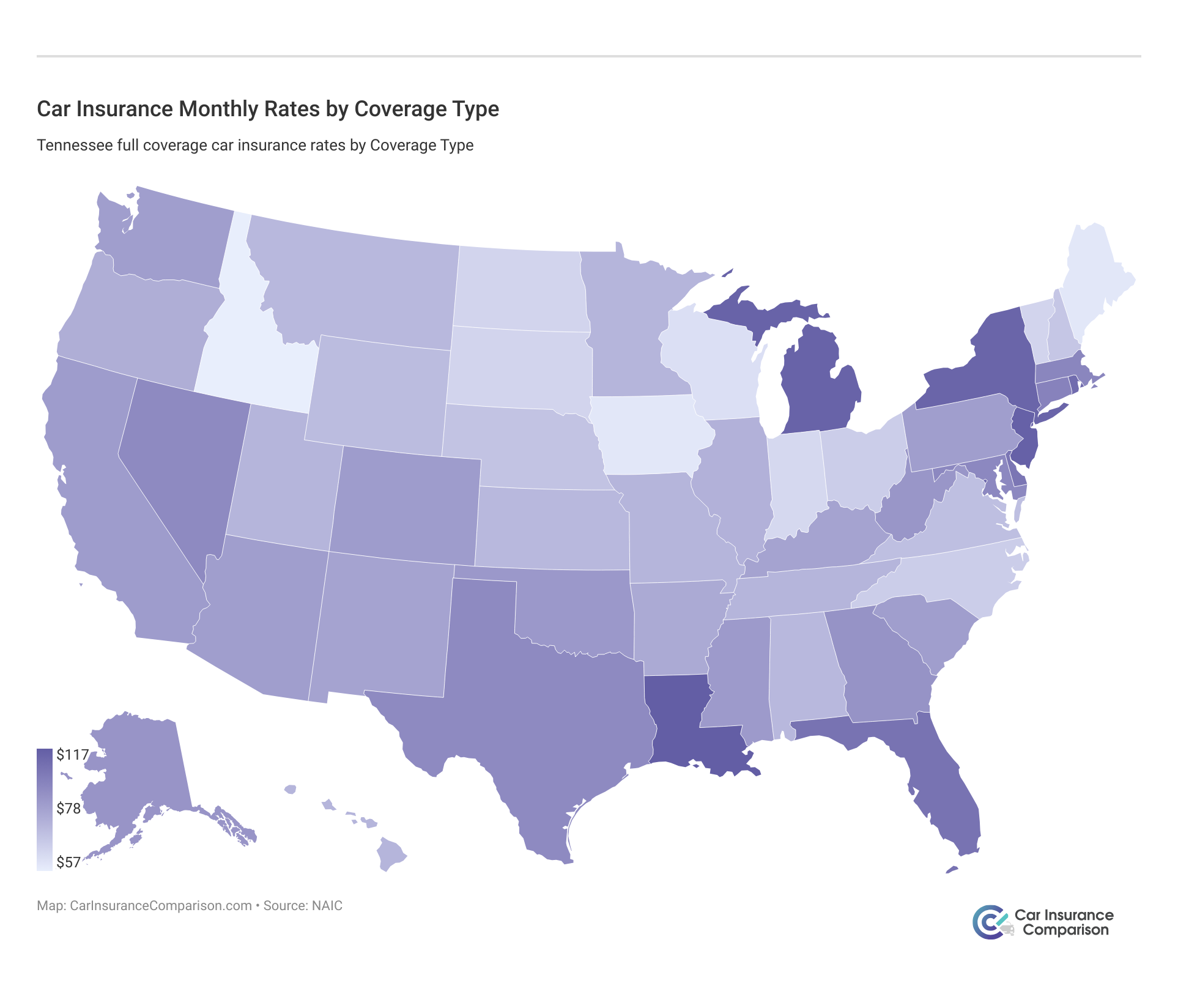

Average Monthly Car Insurance Rates in TN (Liability, Collision, Comprehensive)

The map below reveals the most recent data collected by the National Association of Insurance Commissioners regarding the average cost of car insurance.

You should expect rates to increase in 2019 and moving forward.

Let’s dig deeper into the additional liability coverage options you’ll want to consider when structuring your policy.

Additional Liability Coverage in Tennessee

The table we have here indicates the average insurer loss ratio in Tennessee, based on the most recent study conducted by the National Association of Insurance Commissioners. A company’s loss ratio is the percentage of losses they sustain compared to the premiums they are writing.

Tennessee Additional Liability Coverage by Loss Ratio

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments (MedPay) | 69 | 71 | 75 |

| Uninsured/Underinsured Motorist Coverage | 68 | 68 | 67 |

If a Tennessee car insurance company shows a loss ratio exceeding 100, this means they are paying out more in insureds’ claims than what they are getting back in premiums. As you can imagine, if this trend continues, it can spell disaster for the insurer.

The loss ratios revealed in the table above show that Tennessee car insurance companies are seeing healthy gains to losses overall for MedPay and uninsured/underinsured motorist coverage.

In the state of Tennessee, uninsured/underinsured motorist coverage, comprehensive car insurance, and collision insurance coverage are all optional policy add-ons.

Consider this, however.

Tennessee currently ranks number five in the entire nation for the largest number of uninsured drivers, with approximately 20% of motorists in the state getting behind the wheel without coverage.

It’s true that you might pay steeper premiums in the short term for higher coverages. However, if you are one of the unlucky motorists to get into a collision with one of these uninsured drivers and are injured as a result, you want to ensure you won’t have to worry about covering the costs of medical bills and other expenses.

Any of these optional policy coverages are there to protect you in case of an unanticipated collision or emergency.

Add-ons, Endorsements, and Riders

Consider various add-ons, endorsements, and riders to enhance your coverage and meet your specific needs. These options provide additional protection and peace of mind, ensuring you’re well-prepared for any situation. Here are some essential add-ons, endorsements, and riders you might want to include in your policy:

- Gap insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Usage-Based Car Insurance

By carefully selecting the right add-ons, endorsements, and riders, you can tailor your Tennessee car insurance policy to suit your unique requirements. This ensures comprehensive coverage and greater financial security on the road. Be sure to discuss these options with your insurance provider to create a policy that best fits your needs.

Rank by Demographic and Insurance Carrier

Navigate the table below and see how your Tennessee car insurance company ranks according to the average car insurance rates by age and gender demographics.

Tennessee Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $720 | $690 | $340 | $320 | $220 | $210 | $190 | $180 |

| American Family | $680 | $650 | $320 | $300 | $210 | $200 | $180 | $170 |

| Amica | $710 | $680 | $330 | $310 | $215 | $205 | $185 | $175 |

| Farmers | $740 | $710 | $350 | $330 | $230 | $220 | $200 | $190 |

| Geico | $650 | $620 | $300 | $280 | $200 | $190 | $170 | $160 |

| Liberty Mutual | $780 | $750 | $370 | $350 | $240 | $230 | $210 | $200 |

| Progressive | $670 | $640 | $310 | $290 | $210 | $200 | $180 | $170 |

| State Farm | $700 | $670 | $320 | $300 | $210 | $200 | $180 | $170 |

| The Hartford | $760 | $730 | $350 | $330 | $230 | $220 | $200 | $190 |

| USAA | $640 | $610 | $290 | $270 | $190 | $180 | $160 | $150 |

As you can see, Safeco makes it to the number one ranking position, charging the highest rates of all to single, 17-year-old male drivers. If you scroll down a bit, you’ll see that State Farm charges the cheapest male teen driver rates.

Read more: Mid Century Car Insurance Review

At the end of the list is Travelers, who charges the cheapest rates of all ”to 60-year-old male drivers.

The moral of the story here is that the carrier you pick can significantly determine the rates you will end up paying. When looking at different Tennessee car insurance companies, consider the rates they charge to your particular age, gender, and marital status demographic to see which carrier best fits your needs.

Best Tennessee Car Insurance Companies

With so many Tennessee car insurance companies trying to snag your business, how do you know which ones will fulfill their promises and which will fall short?

We’ve got you covered. Keep reading for the 10 largest Tennessee car insurance companies’ financial ratings, carriers with the best ratings, customer complaint data, and so much more.

Let’s dive right in.

The Largest Tennessee Car Insurance Companies’ Financial Ratings

One very essential aspect to take into account when considering a Tennessee car insurance carrier is the financial strength rating of the company. A company’s financial strength rating not only indicates it’s financial state but also reveals its ability to continue to fulfill its obligations to insureds.

AM Best is a global rating entity that releases financial strength ratings for carriers across the insurance market. Take a look at the table below, revealing AM Best’s ratings for the 10 largest Tennessee car insurance companies.

A.M. Best Financial Strength Ratings From the Top Tennessee Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| Erie Insurance Group | A+ |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| Tennessee Farmers Group | A+ |

| Travelers | A++ |

| USAA | A++ |

Companies assigned an A+ or A++ rating are revealed to have a superior ability to fulfill their ongoing obligations to insureds. An A rating means the company has an excellent ability to fulfill their financial obligations to consumers.

How Much Auto Insurance Costs in Tennessee

Discover auto insurance costs in Tennessee cities, including Bethpage, Butler, Cleveland, Clinton, Gatlinburg, Johnson City, Knoxville, Loretto, Memphis, Millington, Rockwood, Speedwell, and Spring Hill.

Tennessee Car Insurance Cost by City

This concise overview provides insights into factors influencing car insurance rates, assisting you in making informed decisions about coverage.

Number of Car Insurance Providers in Tennessee

The car insurance market in Tennessee is served by a variety of providers, offering numerous options for consumers. Here is a breakdown of the number of car insurance companies operating in the state:

Number of Tennessee Car Insurance Companies

| Summary | Totals |

|---|---|

| Domestic | 15 |

| Foreign | 930 |

| Total | 945 |

With a diverse range of both domestic and foreign car insurance providers, Tennessee residents have plenty of choices when it comes to selecting an insurer. This variety allows you to find a policy that best fits your needs and preferences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving Laws in Tennessee

In addition to securing the best rates for your Tennessee car insurance coverage, another important element motorists need to be aware of is the state’s driving laws. In order to stay safe behind the wheel and keep your premiums down, you which laws govern motorists and how they apply to you.

Keep reading for the lowdown on everything from Tennessee car insurance laws to vehicle licensing laws to rules of the road and beyond.

Tennessee’s Car Insurance Laws

Car insurance laws can fluctuate widely from state to state, and Tennessee is certainly no exception. From high-risk insurance options to the statute of limitations governing personal injury actions in the event of a collision—it’s all here.

Without further ado, let’s jump right in.

High-Risk Insurance

If you have a history of auto accidents or traffic violations, insurance companies could view you as too high a risk to insure and you could find it extremely challenging or even impossible to secure high-risk car insurance coverage through the voluntary insurance market.

If this scenario applies to you, you could be eligible to secure coverage through the state’s high-risk program, known as the Tennessee Automobile Insurance Plan (TNAIP). Since its inception in 1949, TNAIP has existed to offer coverage to drivers who are unable to obtain insurance through the voluntary market.

TNAIP doesn’t provide coverage but is a state-sponsored organization that assigns high-risk motorists to carriers across Tennessee. Any carrier that wishes to write premiums in the state must agree to take on part of the high-risk driving population.

TNAIP assigns high-risk drivers to carriers based on the company’s share of the insurance market. For example, if Geico represented 10% of the total auto insurance market in Tennessee, they would receive 10% of all high-risk drivers in the TNAIP program.

Bear in mind, that you won’t be able to choose your carrier through TNAIP. Instead, the program assigns an insurer to you.

Assuming you hold a current Tennessee driver’s license and have a car registered (or soon to be registered) in The Volunteer State, you are technically eligible to apply for coverage through TNAIP.

To qualify, you must also fulfill the following criteria:

- You must confirm in your application that you have tried to secure insurance through the voluntary market during the past 60 days but were unsuccessful in doing so.

- You must complete the application thoroughly and truthfully. If a carrier has trouble validating your driver information, this could be enough for them to refuse you coverage.

- If you haven’t fulfilled a carrier premium during the 12 months prior to your application, TNAIP mandates that you pay this before moving your application forward.

- If you want insurance to cover physical car damage, you must allow your vehicle to undergo an inspection, or that part of your insurance could be denied.

If you have any issues with your initial TNAIP application, such as outstanding bills, you can reapply to the program once the matter or matters have been resolved.

However, if the insurer deems that the information you submitted on your application was not completely truthful (such as leaving out important pieces of information), it is at their discretion to deny coverage. In that case, you would have to wait another 12 months before you could apply to TNAIP again.

Your coverage through TNAIP will be very much like the insurance you would obtain through the voluntary market, with the difference being that your premiums will be higher. After an insurer is assigned to you, your policy will be in force for a period of three years following.

You can use this window of time to work on your driving record so that it is possible for you to secure coverage through the voluntary market at lower rates. You must also stay up to date with your monthly auto insurance payments.

If you do find that you are able to secure better coverage before the three year period is completely up, you have the option to notify your insurer and switch over.

Your assigned insurer would then provide a refund of the premium remaining, in addition to a 10% surcharge for early policy termination.

On the other hand, if the three-year period ends and you are still considered a high-risk driver, you can always re-apply to the program for coverage.

You have three different options to pay your auto insurance premiums through TNAIP, which are as follows:

- Pay 100% of the premium at the outset.

- Pay 30% of the premium at the outset when you submit your application, and the rest after 30 days.

- Pay 25% of the premium at the outset, then the remainder over the course of five monthly payments of equal amounts. The full premium would then be paid off after six months.

Installment plans do carry a $4 processing fee. Any insurance agent licensed to do business in the state can tell you more about TNAIP if you are interested and can assist you with applying through the electronic program EASi.

Visit TNAIP’s website or contact the Tennesee Department of Commerce for additional information.

Low-Cost Insurance

Only a few states offer sponsored low-cost insurance programs to drivers who meet certain eligibility factors for coverage. However, Tennessee doesn’t have one of these programs at this time.

Windshield Coverage

Some states require a waived deductible if you need repairs done on your car, while others make it mandatory to use only original manufacturer replacement parts.

Currently, The Volunteer State doesn’t have any laws in place unique to broken windshield car insurance, such as a preferred repair shop choice or the use of original manufacturer parts instead of aftermarket ones.

Read more: Does insurance cover broken car windows?

Automobile Insurance Fraud in Tennessee

As is the case in other states nationwide, Tennessee car insurance fraud is a very grave offense that can carry very steep penalties for offenders.

Essentially, insurance fraud is when someone tries to receive benefits or make money in the course of an insurance transaction that they would not otherwise be due, such as by lying or misrepresenting the facts of the scenario.

Both insurers and insureds can be found guilty of committing insurance fraud, but for the purposes of this guide, we will focus solely on consumer auto insurance fraud.

Tennessee laws governing insurance fraud in the state include Tennessee Code Title 56 Chapter 53 and Tennessee Code Section 39-14-133.

It is a crime to with full knowledge and intent defraud an insurer for money or some other benefit and engage in insurance transactions containing misrepresentation of facts, such as on your renewal, payment, or policy application. Knowingly supplying a false claim or documents for insurance benefits is also banned.

The penalties for insurance fraud are as follows, based on the severity of the offense at play:

- Fraudulent acts involving $500 or under for property or services acquired are categorized as a Class A Misdemeanor, punishable by under 11 months and 29 days imprisonment and fines up to $2,500.

- Fraudulent acts involving $500 to $10,000 acquired are categorized as a Class E Felony, punishable by 1-6 years imprisonment and up to $3,000 in fines.

- Fraudulent acts involving $1,000 to $10,000 acquired are categorized as a Class D Felony, punishable by 2-12 years imprisonment and up to $5,000 in fines.

- Fraudulent acts involving $10,000 to $60,000 acquired are categorized as a Class C Felony, punishable by 3-15 years imprisonment and up to $10,000 in fines.

- Fraudulent acts involving $60,000 or more acquired are categorized as a Class B Felony, punishable by 8-30 years imprisonment and up to $25,000 in fines.

If convicted of insurance fraud, the individual may also be obligated to pay restitution back to the injured parties.

Insurance fraud is no joke. Don’t commit insurance fraud, and you can rest easy that none of these penalties will ever apply to you.

Statute of Limitations

If you get into an auto accident in the state of Tennessee and are injured as a result, you have a period of one year from the date of the collision to file a lawsuit with the courts against the at-fault driver. This one-year window is known as your statute of limitations.

You must pursue your case within that one-year period, or be forever barred from doing so. Note that the statute of limitations for bringing forward a property damage lawsuit is three years from the date of the collision.

It is also worth noting that a case’s statute of limitations is not to be confused with the period in which you should file a claim with your insurer following a collision. Most carriers want you to notify them of an accident within a few days, or at most a few weeks after the fact.

Tennessee’s Modified Comparative Fault Rule

There may be times when a driver gets into an auto accident in Tennessee, pursues a case or files suit, and is accused by other parties of having been totally or partially at fault for the wreck themselves.

Under Tennessee’s modified comparative fault rule, courts in the state can reduce or eliminate the person’s total awarded damages based on the amount of fault they bear for the collision.

Let’s look at an example.

Imagine that you are at a red light when another driver rear-ends your vehicle. When the accident occurred, one of your brake lights was on the fritz.

As a result, the court rules that you are 30% at fault for the collision and the other driver bears 70% of the blame.

Let us also suppose that your total damages are $20,000. Since you were determined to bear 30% of the fault for the accident, the modified comparative fault rule means that your damages would be cut by 30%, or $6,000. You would still be eligible to be awarded the remaining $14,000.

However, you can only be partially at fault for a collision and still collect damages if you are less 50% to blame. If your fault totals 50% or more, you will not be able to recover any damages at all.

Tennessee’s Vehicle Licensing Laws

The REAL ID Act sets certain security standards in place for the issuance of licenses and bars Federal agencies from accepting IDs for certain purposes (such as boarding a domestic flight) if they do not fulfill the REAL ID criterion.

Tennessee is currently in compliance with the REAL ID Act, which means that Federal agencies can accept IDs and a driver’s license from the state at nuclear power plants and other Federal facilities.

The Department of Homeland Security began enforcing REAL ID standards in January 2018, but any individual wishing to travel via air will require a REAL ID-compliant license or similarly accepted ID form like a passport by October 1, 2020, in order to fly domestically.

Let’s take a closer look at the key vehicle licensing laws in Tennessee.

Penalties for Driving Without Insurance

If you wish to get behind the wheel in Tennessee, you must carry and maintain at least the state-mandated minimum car insurance coverages and carry proof of insurance with you at all times.

You can provide proof of insurance in the following ways:

- Your insurance policy binder

- Your insurance card from an insurer licensed and authorized to do business in the state

- Your insurance policy declaration page

- Electronic proof of insurance

Being caught driving without insurance in The Volunteer State means you could face fines up to $300, in addition to being charged with a Class C Misdemeanor which could see you having your vehicle towed, license suspended, and registration suspended.

You may also be obliged to file an SR-22 car insurance document with Tennessee’s Department of Insurance every year for three years following the offense, which your insurer will charge you additional filing fees for.

To have your registration and/or license reinstated, you will need to fulfill a $65 restoration fee, pay $50 to the Commissioner of Safety, and potentially pass a driver’s licensing exam again.

The state of Tennesee implements an online insurance verification system to check for consumer coverage. If a driver comes back as uninsured, the Department of Revenue will submit a notice to the driver asking them to furnish proof of insurance within 15 days time.

If you can provide proof of insurance within that window, the charge will be dismissed. If you cannot, however, you will be required to pay a $25 coverage failure fee within 30 days time.

If you do not pay this fee within 30 days, you will be charged an additional $100 continued coverage failure fee, plus the revocation of your license and registration. Reinstatement necessitates you to pay a $115 fee, which is $50 to the Commissioner of Safety, and $65 in restoration fees.

If you get into an accident resulting in bodily injury or death to other parties involved, you could be charged with a Class A Misdemeanor carrying even steeper penalties under Tennessee’s Financial Responsibility Laws.

A conviction carries fines up to $2,500 and up to 11 months and 29 days in jail, not to mention other expenses you will have to cover if the injured party decides to take legal action.

Long story short, don’t get behind the wheel without auto insurance. Ever.

Teen Driver Laws

Here’s what you need to know about teen driver laws in Tennessee.

Teen drivers must be at least 15 years of age to obtain their learner’s permit. To move to an intermediate license, they must:

- Hold their learner’s permit for at least six months

- Complete a minimum of 50 hours of supervised driving, 10 of which must be at nighttime

To graduate to the intermediate licensing stage, you must be at least 16 years old. Restrictions during the intermediate stage include:

- Unsupervised driving is not allowed between the hours of 11 p.m. and 6 a.m.

- No more than one non-family member passenger

The nighttime and passenger restrictions can be lifted after 12 months or once the driver turns 18, whichever happens first. The teen driver must be at least 17 years old for these restrictions to be lifted.

Older Driver and General Population License Renewal Procedures

Here’s a quick overview of the license renewal procedures in your state. For both the general and older driving population, you must:

- Renew once every eight years

- Proof of adequate vision is not required

- Either mail or online renewal is permitted

In the state of Tennessee, it is also at the insurance commissioner’s discretion to issue an initial license or renewal that is in force for three to eight years, to make the transition from a five-year to an eight-year license.

New Residents

If you are considering a move or just relocated to The Volunteer State, here’s a breakdown of what you’ll need to provide to obtain your new Tennessee driver’s license.

As a new resident, you must provide:

- Your current driver’s license or other acceptable ID or certified copy of your driving record. If you provide a certified copy of your driving record, called a Motor Vehicle Record or MVR, the record must be original and have been issued a maximum of 30 days before the date of your application.

- Proof of name change if applicable, such as a marriage certificate, certified court order, or divorce decree.

- Two forms of Proof of Tennessee residency including your name and residential address. Documents must be from the past four months.

- Proof of U.S. Citizenship, Lawful Permanent Residence Status, Proof of Authorized Stay, or Temporary Legal Presence in the U.S.

- Your Social Security Number or a sworn affidavit stating that you haven’t been issued one

Visit the Tennessee Department of Safety and Homeland Security’s New Residents page for more information.

Negligent Operator Treatment System

Reckless driving examples include:

- Driving with blatant disregard for the well-being of other people or their property

- Driving into a clearly marked flooded area

Penalties for reckless driving in Tennessee can be steep, ranging from up to six months in jail and up to $580 in fines. Two reckless driving convictions within a one-year period could lead to a full year’s suspension of your driver’s license.

Each reckless driving conviction adds six demerit points to your driving record. Gathering 12 or more points in a year’s time could lead to a six to 12-month license suspension.

Tennessee’s Rules of the Road

Check out the important rules of the road governing all drivers in Tennessee. Don’t miss these if you want to stay safe and informed when you next hit rubber to the road.

Fault vs. No-Fault

Remember, Tennessee adheres to the traditional system of assigning fault when it comes to auto accidents and any resulting damages. The at-fault driver is responsible for covering the costs of medical bills, lost income, property damage, and other damages resulting from a collision they caused.

In reality, the at-fault driver’s insurance company will cover these losses up to and until the policy limits are exhausted. At that point, the at-fault driver could be held personally liable for remaining damages yet unpaid, which is why it is always advisable to carry coverages above the state-required minimum amounts.

Keep Right and Move Over Laws

Tennessee’s “Slow Poke Law” or Keep Right Law went into effect back in 2016, barring drivers from operating their vehicle in the passing lane on a multilane divided highway with three or more lanes on each side or on an interstate except if they are passing or overtaking a car in the non-passing lane.

Violations incur a $50 fine.

Tennessee’s Move Over Law requires drivers nearing a stationary emergency vehicle, municipal vehicle, utility vehicle, tow truck or recovery vehicle, or road maintenance vehicle with flashing lights going the same direction, to lower their speed and move over to the closest lane if safe to do so.

Speed Limits

Understanding speed limits is essential for safe and legal driving. In Tennessee, the maximum posted speed limits are established to promote safety and efficiency on the roads. Here are the maximum speed limits for different types of roads in the state:

- 70 mph on rural and urban interstates

- 70 mph on other limited-access roads

- 65 mph on other roads

Adhering to these speed limits is crucial for your safety and the safety of others on the road. Always stay aware of posted signs and adjust your speed accordingly to ensure a safe driving experience in Tennessee.

Seat Belt and Carseat Laws

Tennessee’s seat belt laws seat belt laws cover passengers 16 years and up in the front seat. Failure to wear a seat belt could incur fines of up to $30 for first-time offenders.

Read more: Do seat belt laws impact my car insurance?

Children younger than one year or who weigh 20 pounds or less must be secured in a rear-facing child safety restraint. Children between the ages of one and three years old who weigh over 20 pounds or more may be secured in a forward-facing child restraint.

Children between the ages of four and eight who are less than 4’9 in height may be secured in a booster seat. An adult belt is permissible for children between the ages of 9-15, as well as any child 12 or younger who is taller than 4’9.

Children 8 years of age and under who are less than 4’9 tall must be secured in the rear seat if available and the rear seat is advised for children between 9 and 12.

Tennessee law also imposes restrictions on who may ride in the cargo bed areas of pickup trucks. Situations where these restrictions do not apply include:

- Individuals 12 years of age and older

- Individuals between the ages of six and 11 if the vehicle is being used off the interstate or state highways

- A parade provided the vehicle is operating under 20 mph

- Agricultural activities

- On county or city roads unless banned by local laws

The maximum base fine for first-time violations is $50. It is also important to note that Tennessee law states a preference for the rear seat.

Ridesharing

Rideshare providers like Lyft and Uber require all their drivers to carry auto insurance policies that meet at least the minimum state standards for coverage.

Drivers rarely carry their own commercial coverage, instead being covered under the rideshare service’s commercial policy to protect both passengers and drivers. However, drivers can purchase rideshare car insurance.

Automation on the Road

Tennessee has currently authorized the deployment of autonomous vehicles.

The operator does not need to be licensed or in the vehicle but must maintain liability insurance of at least $5,000,000.

Tennessee’s Safety Laws

Here’s what you need to know about Tennessee’s major safety laws to protect you whenever you’re behind the wheel.

DUI Laws

Here are some figures for DUI laws in Tennessee and how they affect your insurance. These laws specify the legal limits for blood alcohol concentration (BAC) and outline the penalties for violations.

Tennessee DUI Laws

| Tennessee DUI Laws | Penalties |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.2 |

| Criminal Status by Offense | 1st-3rd: Class A misdemeanors. 4th+ within 10 years: Class E felony. |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period | 10 years |

| 1st Offense | - ALS or Revocation: 1 year - Imprisonment: 48 hours to 11 months (7 days min for HBAC) - Fine: $350 - $1,500 - Other: DUI school, possible IID and/or treatment |

| 2nd Offense | - DL Revocation: 2 years (restricted license after 1 year) - Imprisonment: 45 days to 11 months - Fine: $600 - $10,000 - Other: DUI school, possible vehicle seizure, treatment, 6 months IID after reinstatement |

| 3rd Offense | - DL Revocation: 6-10 years (no restricted license) - Imprisonment: 120 days to 11 months - Other: DUI school, possible vehicle seizure, treatment, 6 months IID after reinstatement |

| 4th Offense | - DL Revocation: 5 years (no restricted license) - Imprisonment: 1 year (150 days min served) - Fine: $3,000 - $15,000 - Other: Possible vehicle seizure, DUI school, treatment, 6 months IID after reinstatement |

| Mandatory Interlock | All offenders |

Understanding Tennessee’s DUI laws and their severe penalties is crucial for all drivers. Adhering to these regulations not only helps you avoid legal consequences but also ensures the safety of yourself and others on the road. Always drive responsibly and make informed choices to stay within the legal limits.

Marijuana-Impaired Driving Laws

Tennessee doesn’t currently have a marijuana-specific drugged driving law in force.

Distracted Driving Laws

As of July 1, 2019, a hand-held device ban while behind the wheel will go into effect for all drivers. Young drivers with a learner’s permit or intermediate license are barred from any cell phone usage. There is also a texting ban in force for all drivers.

Fascinating Facts Every Tennessee Driver Needs to Know

Before we send you on your way, it’s crucial to know how safe the roads in your state are for motorists.

From vehicle theft rates to traffic fatalities, let’s dig deeper.

Vehicle Theft in Tennessee

According to the FBI’s 2016 Crime in the United States report, there were 1,728 motor vehicle thefts in the Nashville metro area alone that year.

Top 10 Tennessee Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2004 | 690 |

| Ford Pickup (Full Size) | 2006 | 510 |

| Honda Accord | 1997 | 383 |

| Nissan Altima | 2017 | 297 |

| Dodge Pickup (Full Size) | 2001 | 264 |

| Chevrolet Impala | 2008 | 263 |

| Honda Civic | 2000 | 258 |

| Toyota Camry | 2016 | 238 |

| GMC Pickup (Full Size) | 2018 | 221 |

| Nissan Maxima | 2014 | 206 |

The table above reveals the top 10 stolen vehicles in the state of Tennessee as of 2016, along with the most popular model year stolen for each manufacturer listed.

Risky/Harmful Driving Behavior

The following tables reveal the latest driving statistics from the National Highway Traffic Safety Administration (NHTSA) illustrating the top road dangers for drivers in the state of Tennessee.

Rather than scaring you, let these statistics serve as a reminder of the importance of safe, cognizant driving while educating you regarding potential risky behaviors you could encounter from other motorists on the road.

Traffic Fatalities by Weather Condition and Light Condition

Weather and light conditions play a significant role in traffic safety. Understanding how these factors impact road fatalities can help in developing effective safety measures. Here’s an overview of Tennessee road fatalities by weather and light conditions:

Tennessee Road Fatalities by Weather and Light Condition

| Weather Condition | Daylight | Dark, but Lit | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 443 | 134 | 236 | 22 | 3 | 838 |

| Rain | 51 | 18 | 24 | 3 | 0 | 96 |

| Snow/Sleet | 1 | 0 | 1 | 0 | 0 | 2 |

| Other | 1 | 4 | 6 | 3 | 0 | 14 |

| Total | 498 | 157 | 269 | 28 | 7 | 959 |

Analyzing the data on traffic fatalities by weather and light conditions highlights the importance of adapting driving behavior to different environments. This information can be instrumental in enhancing road safety strategies in Tennessee.

Fatalities by County

Traffic fatalities can vary significantly by location. Examining fatalities by county provides insights into regional safety issues and helps identify areas requiring targeted interventions. Here are the total fatalities from all crashes in Tennessee by county:

Tennessee Car Crash Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Anderson | 12 | 14 | 13 |

| Bedford | 10 | 12 | 11 |

| Benton | 6 | 8 | 7 |

| Bledsoe | 4 | 5 | 6 |

| Blount | 20 | 22 | 23 |

| Bradley | 18 | 20 | 21 |

| Campbell | 8 | 9 | 10 |

| Cannon | 3 | 4 | 4 |

| Carroll | 5 | 6 | 7 |

| Carter | 10 | 11 | 12 |

| Cheatham | 7 | 8 | 9 |

| Chester | 4 | 5 | 5 |

| Claiborne | 6 | 7 | 8 |

| Clay | 2 | 3 | 4 |

| Cocke | 8 | 9 | 10 |

| Coffee | 10 | 11 | 12 |

| Crockett | 4 | 5 | 5 |

| Cumberland | 12 | 14 | 15 |

| Davidson | 63 | 68 | 70 |

| Decatur | 3 | 4 | 5 |

| Dekalb | 5 | 6 | 7 |

| Dickson | 10 | 11 | 12 |

| Dyer | 6 | 7 | 8 |

| Fayette | 7 | 8 | 9 |

| Fentress | 3 | 4 | 4 |

| Franklin | 8 | 9 | 10 |

| Gibson | 7 | 8 | 9 |

| Giles | 5 | 6 | 7 |

| Grainger | 3 | 4 | 4 |

| Greene | 11 | 12 | 13 |

| Grundy | 4 | 5 | 5 |

| Hamblen | 9 | 10 | 11 |

| Hamilton | 42 | 45 | 47 |

| Hancock | 2 | 3 | 4 |

| Hardeman | 6 | 7 | 8 |

| Hardin | 5 | 6 | 7 |

| Hawkins | 8 | 9 | 10 |

| Haywood | 6 | 7 | 8 |

| Henderson | 5 | 6 | 7 |

| Henry | 6 | 7 | 8 |

| Hickman | 7 | 8 | 9 |

| Houston | 2 | 3 | 3 |

| Humphreys | 5 | 6 | 7 |

| Jackson | 3 | 4 | 4 |

| Jefferson | 10 | 11 | 12 |

| Johnson | 3 | 4 | 4 |

| Knox | 39 | 42 | 44 |

| Lake | 2 | 3 | 3 |

| Lauderdale | 4 | 5 | 6 |

| Lawrence | 8 | 9 | 10 |

| Lewis | 2 | 3 | 3 |

| Lincoln | 6 | 7 | 8 |

| Loudon | 7 | 8 | 9 |

| Macon | 4 | 5 | 6 |

| Madison | 12 | 13 | 14 |

| Marion | 5 | 6 | 7 |

| Marshall | 6 | 7 | 8 |

| Maury | 10 | 11 | 12 |

| Mcminn | 8 | 9 | 10 |

| Mcnairy | 4 | 5 | 6 |

| Meigs | 2 | 3 | 3 |

| Monroe | 6 | 7 | 8 |

| Montgomery | 33 | 35 | 36 |

| Moore | 2 | 3 | 3 |

| Morgan | 4 | 5 | 6 |

| Obion | 5 | 6 | 7 |

| Overton | 4 | 5 | 6 |

| Perry | 3 | 4 | 4 |

| Pickett | 1 | 2 | 2 |

| Polk | 3 | 4 | 4 |

| Putnam | 10 | 11 | 12 |

| Rhea | 6 | 7 | 8 |

| Roane | 7 | 8 | 9 |

| Robertson | 12 | 14 | 15 |

| Rutherford | 30 | 32 | 33 |

| Scott | 4 | 5 | 6 |

| Sequatchie | 3 | 4 | 4 |

| Sevier | 16 | 17 | 18 |

| Shelby | 96 | 100 | 105 |

| Smith | 6 | 7 | 8 |

| Stewart | 3 | 4 | 4 |

| Sullivan | 27 | 29 | 30 |

| Sumner | 24 | 26 | 27 |

| Tipton | 9 | 10 | 11 |

| Trousdale | 5 | 6 | 6 |

| Unicoi | 1 | 2 | 2 |

| Union | 7 | 8 | 9 |

| Van Buren | 2 | 3 | 3 |

| Warren | 10 | 11 | 12 |

| Washington | 11 | 12 | 13 |

| Wayne | 4 | 5 | 6 |

| Weakley | 4 | 5 | 6 |

| White | 5 | 6 | 7 |

| Williamson | 13 | 14 | 15 |

| Wilson | 26 | 28 | 29 |

Tracking fatalities by county over the years reveals trends and helps pinpoint high-risk areas. This information is crucial for local authorities and communities to improve road safety measures.

2017 Traffic Fatalities

Traffic fatalities in Tennessee can be influenced by whether the crashes occur in rural or urban settings. Here’s a comparison of the number of traffic fatalities in rural versus urban areas:

Tennessee Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 620 |

| Urban | 730 |

Understanding the distribution of traffic fatalities between rural and urban areas can guide the development of specific safety measures tailored to each environment, ultimately reducing the overall number of fatalities.

Fatalities by Person Type

Different types of road users face varying levels of risk on the road. Here is a breakdown of traffic fatalities in Tennessee by person type:

Tennessee Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Occupants (Enclosed Vehicles) | 980 |

| Motorcyclists | 175 |

| Non-Occupants | 195 |

Recognizing which types of road users are most affected by fatalities can help in formulating targeted safety campaigns and interventions to protect vulnerable groups.

Fatalities by Crash Type

The nature of a crash can significantly impact the severity of the outcome. Here’s an overview of traffic fatalities in Tennessee categorized by crash type:

Tennessee Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Single Vehicle | 480 |

| Involving a Large Truck | 120 |

| Involving Speeding | 320 |

| Involving a Rollover | 85 |

| Involving a Roadway Departure | 400 |

| Involving an Intersection (or Intersection Related) | 260 |

Identifying the types of crashes that result in the most fatalities can inform the creation of specific strategies to mitigate these incidents and improve road safety across the state.

Fatalities Involving Speeding by County

Speeding is a significant factor contributing to traffic fatalities. Examining fatalities involving speeding by county can help identify areas where speed enforcement and education may be needed. Here is the data for Tennessee:

Tennessee Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Anderson | 15 | 14 | 12 |

| Bedford | 10 | 12 | 11 |

| Benton | 7 | 6 | 8 |

| Bledsoe | 5 | 4 | 6 |

| Blount | 19 | 20 | 18 |

| Bradley | 14 | 17 | 16 |

| Campbell | 12 | 13 | 11 |

| Cannon | 3 | 4 | 5 |

| Carroll | 6 | 8 | 7 |

| Carter | 10 | 11 | 9 |

| Cheatham | 8 | 9 | 10 |

| Chester | 5 | 4 | 6 |

| Claiborne | 6 | 7 | 5 |

| Clay | 2 | 3 | 4 |

| Cocke | 12 | 13 | 11 |

| Coffee | 14 | 15 | 13 |

| Crockett | 5 | 5 | 6 |

| Cumberland | 10 | 11 | 12 |

| Davidson | 95 | 98 | 92 |

| Decatur | 4 | 5 | 3 |

| DeKalb | 7 | 8 | 7 |

| Dickson | 12 | 14 | 13 |

| Dyer | 10 | 9 | 8 |

| Fayette | 6 | 11 | 9 |

| Fentress | 4 | 5 | 6 |

| Franklin | 8 | 9 | 7 |

| Gibson | 10 | 11 | 10 |

| Giles | 8 | 7 | 6 |

| Grainger | 5 | 6 | 5 |

| Greene | 12 | 14 | 13 |

| Grundy | 3 | 4 | 5 |

| Hamblen | 15 | 17 | 16 |

| Hamilton | 40 | 43 | 41 |

| Hancock | 2 | 3 | 2 |

| Hardeman | 6 | 5 | 5 |

| Hardin | 8 | 7 | 6 |

| Hawkins | 10 | 11 | 9 |

| Haywood | 8 | 11 | 10 |

| Henderson | 6 | 7 | 5 |

| Henry | 7 | 8 | 9 |

| Hickman | 5 | 6 | 7 |

| Houston | 2 | 3 | 4 |

| Humphreys | 5 | 6 | 5 |

| Jackson | 3 | 4 | 3 |

| Jefferson | 10 | 11 | 12 |

| Johnson | 3 | 4 | 5 |

| Knox | 75 | 78 | 76 |

| Lake | 2 | 3 | 2 |

| Lauderdale | 2 | 6 | 5 |

| Lawrence | 8 | 7 | 6 |

| Lewis | 3 | 4 | 5 |

| Lincoln | 6 | 7 | 6 |

| Loudon | 12 | 13 | 11 |

| Macon | 6 | 7 | 6 |

| Madison | 15 | 16 | 14 |

| Marion | 7 | 8 | 9 |

| Marshall | 6 | 7 | 6 |

| Maury | 14 | 15 | 14 |

| McMinn | 10 | 11 | 10 |

| McNairy | 7 | 8 | 7 |

| Meigs | 4 | 5 | 4 |

| Monroe | 10 | 11 | 12 |

| Montgomery | 33 | 29 | 31 |

| Moore | 2 | 3 | 4 |

| Morgan | 5 | 6 | 5 |

| Obion | 7 | 8 | 6 |

| Overton | 5 | 6 | 5 |

| Perry | 3 | 4 | 3 |

| Pickett | 2 | 3 | 4 |

| Polk | 4 | 5 | 4 |

| Putnam | 12 | 14 | 13 |

| Rhea | 7 | 8 | 7 |

| Roane | 10 | 11 | 9 |

| Robertson | 12 | 21 | 19 |

| Rutherford | 30 | 39 | 37 |

| Scott | 6 | 7 | 5 |

| Sequatchie | 3 | 4 | 3 |

| Sevier | 16 | 17 | 15 |

| Shelby | 255 | 247 | 239 |

| Smith | 6 | 7 | 6 |

| Stewart | 3 | 3 | 4 |

| Sullivan | 27 | 29 | 28 |

| Sumner | 21 | 23 | 22 |

| Tipton | 8 | 11 | 10 |

| Trousdale | 5 | 6 | 5 |

| Unicoi | 1 | 2 | 3 |

| Union | 7 | 8 | 7 |

| Van Buren | 2 | 3 | 2 |

| Warren | 10 | 11 | 10 |

| Washington | 11 | 13 | 12 |

| Wayne | 5 | 6 | 5 |

| Weakley | 7 | 8 | 6 |

| White | 6 | 7 | 5 |

| Williamson | 13 | 26 | 24 |

| Wilson | 26 | 19 | 17 |

Addressing speeding-related fatalities requires targeted enforcement and public awareness campaigns. This county-level data can help prioritize resources and efforts to reduce speeding incidents and save lives.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Alcohol impairment is a major cause of traffic fatalities. Understanding the distribution of these fatalities by county can assist in directing preventive measures. Here is the data for Tennessee:

Tennessee DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Anderson | 3 | 2 | 2 |

| Bedford | 2 | 1 | 3 |

| Benton | 1 | 1 | 2 |

| Bledsoe | 1 | 0 | 1 |

| Blount | 4 | 5 | 4 |

| Bradley | 2 | 3 | 2 |

| Campbell | 1 | 2 | 2 |

| Cannon | 1 | 0 | 1 |

| Carroll | 2 | 1 | 1 |

| Carter | 1 | 2 | 1 |

| Cheatham | 1 | 2 | 1 |

| Chester | 0 | 1 | 1 |

| Claiborne | 1 | 1 | 1 |

| Clay | 0 | 0 | 1 |

| Cocke | 2 | 2 | 2 |

| Coffee | 3 | 2 | 3 |

| Crockett | 1 | 1 | 1 |

| Cumberland | 2 | 3 | 2 |

| Davidson | 25 | 24 | 23 |

| Decatur | 1 | 1 | 1 |

| DeKalb | 1 | 1 | 2 |

| Dickson | 2 | 2 | 3 |

| Dyer | 1 | 1 | 1 |

| Fayette | 1 | 2 | 1 |

| Fentress | 1 | 1 | 1 |

| Franklin | 2 | 2 | 2 |

| Gibson | 2 | 1 | 1 |

| Giles | 1 | 1 | 1 |

| Grainger | 1 | 1 | 1 |

| Greene | 2 | 3 | 2 |

| Grundy | 1 | 0 | 1 |

| Hamblen | 3 | 2 | 2 |

| Hamilton | 10 | 11 | 10 |

| Hancock | 0 | 1 | 1 |

| Hardeman | 1 | 1 | 1 |

| Hardin | 2 | 1 | 1 |

| Hawkins | 2 | 2 | 1 |

| Haywood | 1 | 2 | 2 |

| Henderson | 1 | 1 | 1 |

| Henry | 1 | 1 | 1 |

| Hickman | 1 | 1 | 2 |

| Houston | 0 | 0 | 1 |

| Humphreys | 1 | 1 | 1 |

| Jackson | 1 | 1 | 1 |

| Jefferson | 2 | 2 | 2 |

| Johnson | 0 | 1 | 1 |

| Knox | 15 | 14 | 13 |

| Lake | 0 | 0 | 1 |

| Lauderdale | 0 | 1 | 1 |

| Lawrence | 1 | 1 | 1 |

| Lewis | 0 | 1 | 1 |

| Lincoln | 1 | 1 | 1 |

| Loudon | 2 | 2 | 2 |

| Macon | 1 | 1 | 1 |

| Madison | 3 | 3 | 2 |

| Marion | 1 | 1 | 1 |

| Marshall | 1 | 1 | 1 |

| Maury | 2 | 3 | 2 |

| McMinn | 2 | 2 | 2 |

| McNairy | 1 | 1 | 1 |

| Meigs | 1 | 0 | 1 |

| Monroe | 2 | 2 | 2 |

| Montgomery | 7 | 6 | 6 |

| Moore | 0 | 0 | 1 |

| Morgan | 1 | 1 | 1 |

| Obion | 2 | 1 | 1 |

| Overton | 1 | 1 | 1 |

| Perry | 0 | 0 | 1 |

| Pickett | 0 | 0 | 1 |

| Polk | 1 | 1 | 1 |

| Putnam | 3 | 3 | 3 |

| Rhea | 2 | 2 | 2 |

| Roane | 2 | 2 | 2 |

| Robertson | 3 | 4 | 4 |

| Rutherford | 7 | 8 | 7 |

| Scott | 1 | 1 | 1 |

| Sequatchie | 1 | 1 | 1 |

| Sevier | 4 | 4 | 3 |

| Shelby | 55 | 53 | 51 |

| Smith | 1 | 1 | 1 |

| Stewart | 0 | 1 | 1 |

| Sullivan | 5 | 5 | 5 |

| Sumner | 4 | 5 | 4 |

| Tipton | 2 | 2 | 2 |

| Trousdale | 1 | 1 | 1 |

| Unicoi | 0 | 0 | 1 |

| Union | 2 | 2 | 2 |

| Van Buren | 0 | 1 | 1 |

| Warren | 2 | 2 | 2 |

| Washington | 2 | 3 | 2 |

| Wayne | 1 | 1 | 1 |

| Weakley | 1 | 1 | 1 |

| White | 1 | 1 | 1 |

| Williamson | 4 | 5 | 5 |

| Wilson | 5 | 4 | 4 |

Combatting alcohol-impaired driving requires a combination of strict enforcement, education, and community involvement. County-specific data helps in deploying resources effectively to reduce these preventable fatalities.

Teen Drinking and Driving

Teen drinking and driving poses significant risks and requires focused attention. Here’s a look at statistics related to alcohol-impaired driving among teens in Tennessee:

Tennessee Teens and Drunk Driving Statistics

| Teens and Drunk Driving | Details |

|---|---|

| Under 21 Alcohol-Impaired Driving Fatalities Per 100K of the Population | 1 |

| Higher/Lower Than National Average (1.2) | Lower |

| DUI Arrests (Under 18 Years Old) | 143 |

| DUI Arrests (Under 18 Years Old ) Total Per Million People | 95 |

Efforts to reduce teen drinking and driving must include education, strict enforcement, and community programs. These statistics highlight the need for ongoing vigilance and targeted interventions to protect young drivers.

EMS Response Time

Emergency Medical Services (EMS) response times are critical in saving lives after a crash. Here is a breakdown of EMS response times in rural and urban areas of Tennessee:

Tennessee EMS Response Time by Location

| Location | Notification | Arrival |

|---|---|---|

| Rural | 9 | 13 |

| Urban | 4 | 8 |

Transportation

Did you know that the typical Tennessean has an average commute time of 23.9 minutes? This travel time is actually a bit under the national median of 25.5 minutes.

Data USA‘s 2017 study revealed that just 2.04% of workers in the state have commutes categorized as “super commutes” exceeding 90 minutes in length.

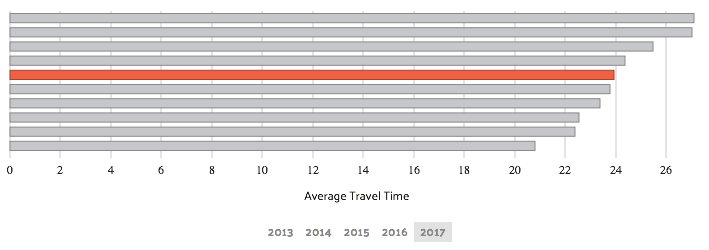

Commute Time

Commute times reflect the efficiency of transportation networks and can significantly affect the daily lives of workers. Here’s a visual representation of average travel times for commuters over several years:

Understanding the trends in commute times can help in planning and improving transportation infrastructure, leading to better time management and overall quality of life for commuters in Tennessee.

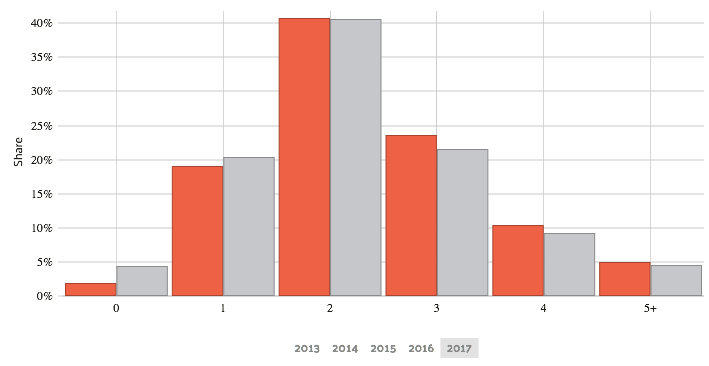

Car Ownership

Car ownership statistics provide valuable insights into the transportation preferences and economic conditions of a region. Here’s a graphical depiction of car ownership trends over the years:

Analyzing car ownership trends helps in understanding the reliance on personal vehicles and can guide the development of alternative transportation options to meet the needs of the population in Tennessee.

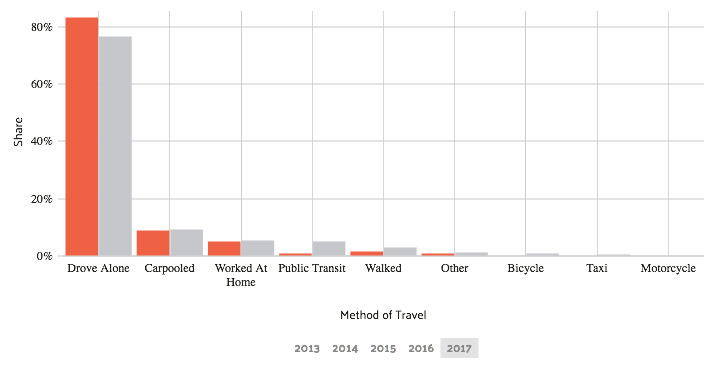

Commuter Transportation

The mode of transportation chosen by commuters reflects the availability and convenience of different transportation options. This image illustrates the various methods of travel used by commuters over the years:

By examining commuter transportation trends, policymakers and planners can identify areas for improvement in public transit and other transportation modes, ultimately enhancing the commuting experience for residents in Tennessee.

The Top Two Cities in Tennessee for Traffic Congestion

The table below indicates the top two cities in Tennessee for traffic congestion according to INRIX’s Global Traffic Scorecard. Not surprisingly, Tennessee’s two largest cities in terms of population made it to the top of the list.

Tennessee Traffic Congestion by City

| City Name | Hours Lost | Congestion Cost | Travel Time | Mile Speed |

|---|---|---|---|---|

| Memphis | 38 | $530 | 3 | 19 |

| Nashville | 87 | $1,221 | 4 | 16 |

Don’t spend time in traffic worrying about car insurance. Start comparison shopping today the quick and easy way.

Get your free quote in seconds with our online rate tool. Just enter your ZIP code below to get started.

Frequently Asked Questions

What factors influence the cost of car insurance in Tennessee?

There are several factors that affect car insurance rates in Tennessee, including your driving record, the type of vehicle you drive, your location, age, and credit score. Other considerations include your annual mileage and the amount of coverage you choose. Insurance providers assess these factors to determine your premium.

Is car insurance expensive in Tennessee?

The cost of car insurance in Tennessee can vary depending on several factors, including your location, driving record, coverage options, and the insurance company you choose. While rates can differ, Tennessee’s average car insurance rates are $83 per month.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What forms of financial responsibility are accepted in Tennessee?

In Tennessee, acceptable forms of financial responsibility include your insurance policy binder, insurance card from a licensed insurer, insurance policy declaration’s page, and electronic proof of insurance. You must be able to provide proof of insurance when requested by law enforcement.

What are the average monthly car insurance rates in Tennessee?

The average monthly rates for different types of coverage in Tennessee are as follows: liability coverage is $35, collision coverage is $26, comprehensive coverage is $12, and full coverage is $73. Please note that these rates are subject to change.

Read More: Compare Full Coverage vs. Liability Car Insurance

How do car insurance premiums in Tennessee compare to income?

Car insurance premiums in Tennessee account for a small percentage of residents’ income. On average, between 2012 and 2014, car insurance premiums constituted around 2.21% to 2.33% of residents’ disposable income.

How can I find the cheapest car insurance rates in Tennessee?

To find the cheapest car insurance rates in Tennessee, compare quotes from multiple insurance providers. Use online comparison tools to get estimates based on your specific profile and coverage needs. Additionally, consider discounts for safe driving, bundling policies, or maintaining a good credit score to lower your premiums.

What are the minimum car insurance coverage requirements in Tennessee?

Tennessee requires drivers to have a minimum of 25/50/15 liability car insurance coverage. This means you need at least $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

How does Tennessee’s DUI law impact car insurance rates?

A DUI conviction in Tennessee can significantly impact your car insurance rates. Insurance companies view DUI offenses as high-risk behavior, which can lead to increased premiums or difficulty obtaining coverage. To mitigate this, you may need to complete DUI education programs or install an ignition interlock device, which can also influence your rates.

Are there specific areas in Tennessee where car insurance rates are higher?