Best Ford Car Insurance Rates in 2026 (Your Guide to the Top 10 Companies)

The best Ford car insurance rates come from Travelers, American Family, and Progressive. With rates starting at $38 per month, our top companies offer a variety of coverage for every Ford car insurance need. For example, you can get gap insurance from Travelers and roadside assistance from American Family.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated July 2024

1,734 reviews

1,734 reviewsCompany Facts

Full Coverage for Ford

A.M. Best Rating

Complaint Level

1,734 reviews

1,734 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for Ford

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Ford

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsTravelers, American Family, and Progressive have the best Ford car insurance rates.

Travelers has the best car insurance for Fords thanks to its low rates, generous car insurance discounts, and the variety of types of car insurance it sells. However, Progressive may be a better choice if you want a more digital insurance experience.

Our Top 10 Company Picks: Best Ford Car Insurance Rates

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Accident Forgiveness | Travelers | |

| #2 | 15% | A | Family Discounts | American Family | |

| #3 | 30% | A+ | Flexible Policies | Progressive | |

| #4 | 25% | B | Comprehensive Coverage | State Farm | |

| #5 | 20% | A+ | Exclusive Discounts | Allstate | |

| #6 | 10% | A++ | Military Benefits | USAA | |

| #7 | 20% | A | Customized Policies | Liberty Mutual | |

| #8 | 22% | A++ | Affordable Rates | Geico | |

| #9 | 25% | A+ | Vanishing Deductible | Nationwide | |

| #10 | 20% | A | Personalized Service | Farmers |

Explore your options for Ford insurance below, including which companies might have the lowest rates for you. Then, enter your ZIP code into our free quote comparison tool to see Ford auto insurance rates in your area.

- As a reliable, safe brand, Ford auto insurance quotes are usually affordable

- You can lower your Ford insurance rates with car insurance discounts

- Travelers and American Family have the best Ford car insurance rates

- Compare Ford Car Insurance Rates

- Best Ford Transit Van Car Insurance in 2024 (Top 10 Companies Ranked)

- Best Ford Transit Connect Car Insurance in 2026 (Check Out These 10 Companies)

- Best Ford Shelby GT500 Car Insurance in 2026 (Find the Top 10 Companies Here)

- Best Ford Shelby GT350 Car Insurance in 2026 (Top 10 Companies Ranked)

- Best Ford Mustang Mach-E Car Insurance in 2026 (Find the Top 10 Companies Here)

- Best Ford Expedition EL Car Insurance in 2026 (Compare the Top 10 Companies)

- Best Ford Bronco Sport Car Insurance in 2026 (Check Out These 10 Companies)

- Best Ford Focus ST Car Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Ford F-350 Super Duty Car Insurance in 2026 (Find the Top 10 Companies Here)

- Best Ford Flex Car Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Ford Explorer Car Insurance in 2026 (Top 10 Companies Ranked)

- Best Ford Edge Car Insurance in 2026 (Check Out the Top 10 Companies)

- Compare Honda vs. Ford Car Insurance Rates [2026]

- Best Ford Focus Car Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Ford LTD Car Insurance in 2026 (Check Out These 10 Companies)

- Best Ford Taurus Car Insurance in 2026 (Top 10 Companies)

- Best Ford Ranger Car Insurance in 2026 (Check Out the Top 10 Companies)

- Best Ford Fiesta Car Insurance in 2026 (Top 10 Companies Ranked)

- Best Ford Falcon Car Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Ford Fairlane Car Insurance in 2026 (Top 10 Companies Ranked)

- Best Ford Expedition Car Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Ford EcoSport Car Insurance in 2026 (Top 10 Companies Ranked)

- Best Ford F-150 Car Insurance in 2026 (Compare the Top 10 Companies)

- Best Ford Fusion Car Insurance in 2026 (Check Out the Top 10 Companies)

- Best Ford Escape Car Insurance in 2026 (Top 10 Companies Ranked)

- Best Ford Mustang Car Insurance in 2026 (Your Guide to the Top 10 Companies)

#1 – Travelers: Top Overall Pick

Pros

- Customizable Coverage: Travelers can tailor policies to include comprehensive and collision coverage specific to Fords.

- Discount Opportunities: With 15 ways to save, there are plenty of Travelers discounts to help you get cheap Ford Fusion insurance costs and low quotes for other models.

- Good Customer Service: Travelers typically gets positive reviews for its customer service experience. See what customers have to say in our Travelers car insurance review.

Cons

- Digital Tools Lacking: Online and mobile tools at Travelers are less developed compared with other large companies.

- Limited Local Agents: Not only does Travelers lack a strong online presence, but it also has a smaller network of local agents. If you need help with your Travelers policy, you’ll probably have to call the customer support hotline.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best for Quick Claims Handling

Pros

- Tailored Coverage Options: Get the best Ford insurance with American Family’s flexible policy options.

- Discount Options: American Family offers an impressive 18 discounts to help drivers save.

- Personalized Service: It’s not the biggest insurance company in America, but American Family promises a personalized touch to every policy it sells.

Cons

- Rates Can Be High: American Family doesn’t usually have the cheapest Ford Bronco insurance costs and rates for other Ford models.

- Limited Availability: You can only purchase American Family coverage in 19 states. See if your state is covered in our American Family car insurance review.

#3 – Progressive: Best for Digital Insurance Tools

Pros

- Snapshot Program: Progressive’s usage-based insurance (UBI) program, Snapshot, offers savings of up to 30% if you agree to have your driving habits tracked.

- Customizable Insurance: Purchase Ford car insurance online and get exactly what you want with Progressive’s coverage option.

- Competitive Rates: You can usually get low Ford Ranger insurance costs and affordable premiums for other Ford models.

Cons

- Rate Variations: Progressive premiums can fluctuate significantly based on driving data and ZIP code.

- Low Customer Loyalty: Despite making strides to improve its services, Progressive struggles with its customer loyalty ratings. See how the problem is being fixed in our Progressive car insurance review.

#4 – State Farm: Best for Personalized Service

Pros

- Customizable Policies: State Farm has tailored coverage options so Ford drivers can get the perfect coverage for their needs.

- Safety Feature Discounts: Earn savings on car insurance for Fords equipped with advanced safety features. Check out all 13 discount opportunities in our State Farm car insurance review.

- Local Agents: State Farm relies on its wide network of local agents to sell the best Ford auto insurance policies.

Cons

- Strict Underwriting: State Farm has stringent approval processes for certain coverages.

- Inconsistent Discounts: The availability of some State Farm discounts may vary by agent and location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Full Coverage Insurance

Pros

- Comprehensive Coverage: Allstate offers a broad range of options for full coverage policies, including accident forgiveness and new car replacement.

- Opportunities to Save: Allstate has various discounts such as safe driver, new car, and bundling policies.

- Local Agent Network: Allstate has one of the largest networks of local agents in the country, making it easy to access personalized help. See why having a large network of agents is important in our Allstate car insurance review.

Cons

- Higher Rates: Ford auto insurance reviews usually mention that Allstate is one of the most expensive coverage options.

- Mixed Reviews: Allstate’s customer service and claims handling experience reviews are often mixed.

#6 – USAA: Best for Military Members

Pros

- Competitive Prices: Generally speaking, USAA is almost always the cheapest option for car insurance. See how rates stay so low in our USAA car insurance review.

- Excellent Customer Service: USAA has strong customer service ratings, particularly for how quickly the company resolves claims.

- Comprehensive Coverage Options: USAA car insurance options include options for new car replacement and accident forgiveness.

Cons

- Eligibility Restrictions: You can only buy USAA coverage if you qualify for membership. See if you qualify for USAA membership in our USAA car insurance review.

- Higher Rates for Young Drivers: USAA is usually cheap, but young, inexperienced drivers will likely see higher premiums.

#7 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Flexible Policies: Get the right coverage for your Ford with Liberty Mutual’s customizable coverage options. Explore all your coverage options in our Liberty Mutual car insurance review.

- Valuable Discounts: Get the cheapest possible Ford insurance costs by taking advantage of Liberty Mutual’s 17 discounts.

- Accident Forgiveness: Keep your cheap Ford car insurance rates after your first at-fault accident with this add-on.

Cons

- Customer Service: Geico doesn’t always leave the best impression on its customers, especially for its claims resolution process.

- Small Network of Agents: Fewer Liberty Mutual agents in some regions make it hard for some drivers to get personalized service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Affordable Ford Coverage

Pros

- Affordable Rates: Whether you need to find low Ford Explore insurance costs or cheap Ford truck insurance, Geico has you covered with low average premiums.

- Multi-Policy Discounts: Geico offers 16 discounts to help you save, including excellent savings for bundling home and auto insurance.

- Strong Digital Presence: Find the best average insurance cost for a Ford F-150, Focus, or other model with Geico’s user-friendly digital options. Explore your digital options in our Geico car insurance review.

Cons

- Limited Physical Offices: Geico focuses on its online service, so it maintains fewer physical locations.

- Higher Rates for Low Credit: Geico premiums can be on the expensive side if your credit score needs improvement.

#9 – Nationwide: Best for Vanishing Deductible Savings

Pros

- Vanishing Deductible: Add the vanishing deductible to your comprehensive coverage to save up to $500 on your deductible for every year you’re claims-free.

- SmartRide Program: Save up to 40% by enrolling in SmartRide, Nationwide’s UBI program.

- Solid Discounts: Nationwide only offers 11 discounts, but they can help you find affordable Ford Focus insurance rates and low prices for other models. To maximize your savings, check all of the car insurance discounts Nationwide offers.

Cons

- Premium Increases: Many Nationwide customers complain that their rates increased unexpectedly.

- Digital Experience: Nationwide’s digital insurance experience often leaves customers disappointed.

#10 – Farmers: Best for Car Insurance Discounts Opportunities

Pros

- Customizable Plans: Farmers offers a variety of ways to customize your Ford insurance quotes, including options like accident forgiveness and full glass coverage.

- Generous Discounts: Farmers offers 23 discounts to help you find the cheapest car insurance for Fords.

- Local Agent Support: There are plenty of Farmers agents spread across the country to help you with your Ford auto insurance quotes whenever you need it.

Cons

- Average Rates: Farmers’ rates tend to hover a bit above the national average. See how much you might pay in our Farmers car insurance review.

- Lacking Online Options: Farmers does not have the best online tools, with many customers saying that the website and mobile app could be more user-friendly

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford Car Insurance Rates

Ford car insurance is a little higher than the national average, with the typical driver paying about $143 a month for their car insurance. However, there are several factors that affect car insurance rates, including:

- Age and gender

- Location

- Credit score

- Driving record

- Marital status

- Your vehicle

The amount of coverage you purchase will also affect your rates. The more add-on coverages you buy, the more your monthly rates will be. Whether you choose full coverage or minimum coverage also impacts your rates. Finally, the type of car you purchase will impact your insurance rates. For example, an electric vehicle usually has higher insurance rates because it costs more to repair.

Go off-road. Go all-thrills. Go where no you has gone before. With an exciting lineup of gas, hybrid and all-electric options, you can choose to power up however you want. Our only rule is that you do something with it.

Disclaimer: Optional equipment shown. pic.twitter.com/e1yZ0EfGSx

— Ford Motor Company (@Ford) May 28, 2024

The table below allows you to compare Ford car insurance rates from our top companies.

Ford Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $45 | $100 |

| American Family | $37 | $87 |

| Farmers | $46 | $105 |

| Geico | $35 | $85 |

| Liberty Mutual | $50 | $110 |

| Nationwide | $40 | $90 |

| Progressive | $38 | $88 |

| State Farm | $42 | $95 |

| Travelers | $44 | $98 |

| USAA | $30 | $80 |

As you can see, there are many factors that affect car insurance rates, like the Ford model. While the average Ford driver pays $143 a month for insurance, some models cost much more. The Ford Mustang has one of the highest rates, while the Escape is one of the cheapest.

Ford Car Insurance Coverage Options

When buying a policy for your Ford, you have two main options: minimum insurance and full coverage. The type you should buy depends on your Ford. Older, less valuable Fords are probably fine with a minimum insurance policy (learn about minimum car insurance required by state). It costs much less than full coverage but doesn’t protect your vehicle.

Full coverage offers much better protection but usually costs at least double what minimum insurance does. Drivers with a new or more valuable Ford should consider buying full coverage, especially if they have a loan or lease. When you purchase full coverage, you’re buying everything listed below:

- Liability: Liability auto insurance coverage pays for injuries and damages you cause in an at-fault accident. It saves you from paying expensive bills but doesn’t protect your car (learn how to compare liability car insurance).

- Uninsured/Underinsured Motorist: Most states require at least liability insurance, but not everyone follows the law. If someone without insurance hits you, uninsured or underinsured motorist coverage will pay for your repairs.

- Collision: If you want help with your repair bills after an at-fault accident, you need collision insurance. Collision car insurance pays for your vehicle in the event of an accident, unlike liability which covers the other driver. Collision also covers you if you hit a stationary object, like a light post.

- Comprehensive: Comprehensive insurance covers damage from animals, extreme weather, fire, vandalism, and theft. You can compare comprehensive car insurance to find the best rates by looking at different companies.

- Personal Injury Protection/Medical Payments: Medical payments and personal injury protection insurance pay for your health care bills if you get injured in an accident. Most plans also cover your passengers.

While full coverage costs more than minimum insurance, it’s worth it for most Ford owners. You can also buy add-ons like gap insurance, rental car reimbursement, and roadside assistance, but you should only add what you need. Car insurance add-ons can quickly increase your monthly rates.

Ford Car Insurance Savings Tips

As one of America’s most trusted brands, it should be no surprise that the best Ford car insurance is usually affordable. However, you can still get affordable Ford car insurance quotes. Consider the following Ford car insurance savings tips:

- Lower Your Coverage: Choosing the minimum required coverage is a great way to keep rates down. You should also be cautious of add-ons, which can significantly increase your rates.

- Raise Your Deductible: Your car insurance deductible is the amount you pay when you file a claim. Increasing your deductible will lower your monthly rates, but you’ll be financially responsible for a larger bill if you need to make a claim.

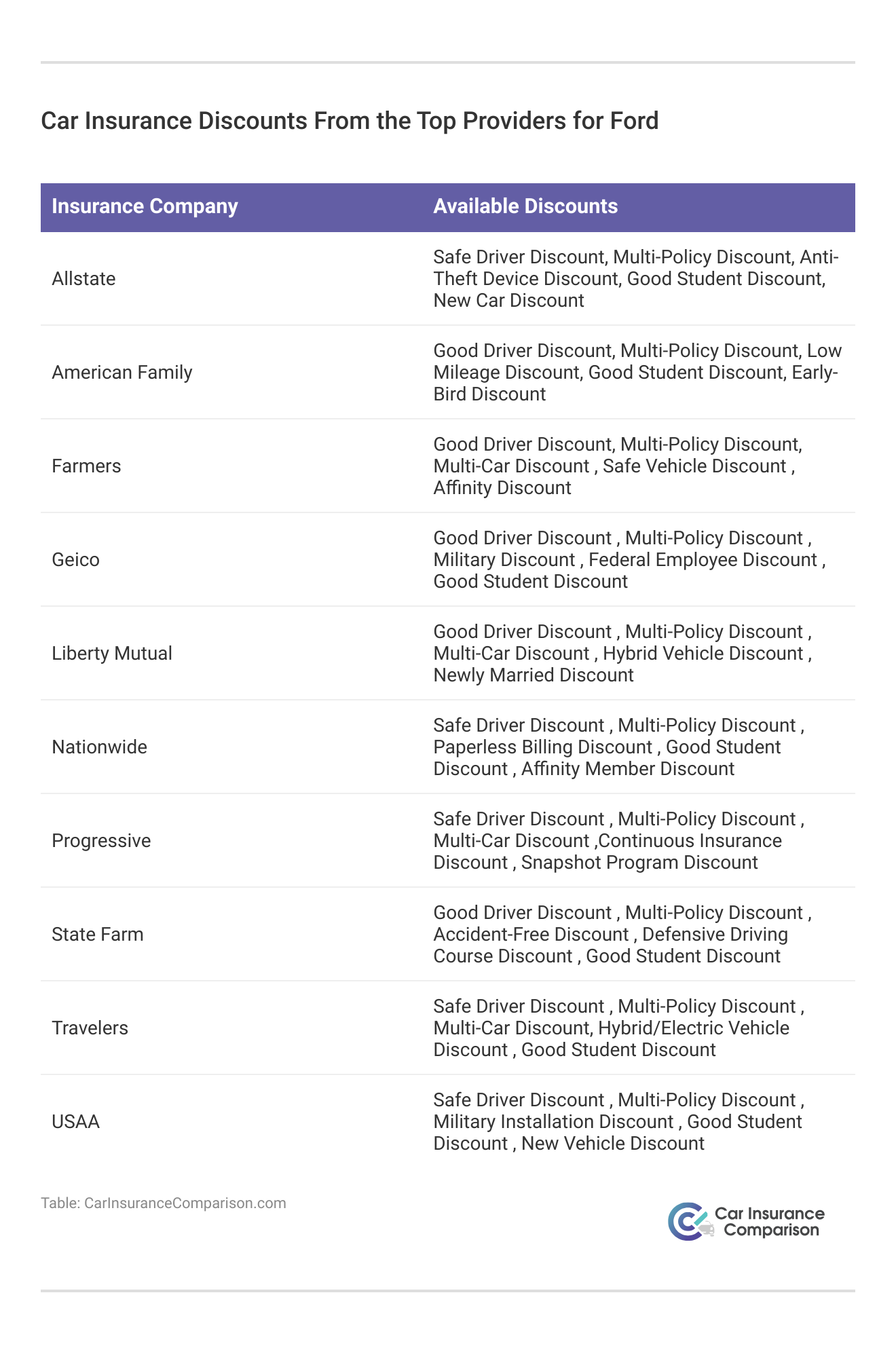

- Look for Discounts: There are many discounts to take advantage of, but you need to find the company that offers you the most. Popular discounts for Ford owners include bundling discounts, good student discounts, and multi-car discounts.

- Enroll in Telematics: Usage-based car insurance helps low-mileage, safe drivers significantly reduce their rates. If you allow your company to track your driving habits, you can save up to 40%.

- Stay Out of Trouble: Keeping your driving record clean is one of the most important ways to keep Ford car insurance rates low. Drivers with speeding tickets or reckless driving charges pay much more for their insurance.

The amount of coverage you need for your Ford will also affect your rates. Brand-new Fords should have full coverage, especially if you have a loan or lease. Full coverage costs more but can save you thousands if you ever need to make a claim.

Older, less valuable Fords might be fine with a minimum insurance policy. Minimum insurance doesn’t protect your car in most states, but it’s your cheapest option for coverage.

Dani Best Licensed Insurance Producer

You can also elect add-ons for your policy if your budget has a little wiggle room. Popular add-ons for Ford vehicles include roadside assistance, rental car reimbursement, and gap insurance. Comparing rates for gap insurance, other additional coverage, or any other add-ons will show you what you may want to include in your car insurance policy. (For more information, read our “How do I find out if gap insurance is included in my car lease?“).

Finding discounts is an important way to save on your insurance. Check below to see a selection of discounts Ford drivers often take advantage of from our top companies.

Of course, the most important step in getting affordable coverage is to compare quotes. You can fill out applications on the front page of every company’s website you’re interested in.

If you don’t want to spend time gathering individual quotes, you can always use a free comparison tool to see multiple personalized rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Ford Car Insurance Today

Ford car insurance rates are usually affordable regardless of the model you drive. Even if you have the most expensive Ford model to insure, there are plenty of ways to save on your insurance. Now that you know how to compare multiple car insurance quotes online for free, finding coverage should be easy.

While you can save by finding Ford car insurance discounts, trying a telematics program, and being a safe driver, comparing quotes is the best way to find affordable Ford car insurance. Whether you need average insurance for Ford Rangers or low Ford Fiest insurance costs, comparing quotes is vital.

The more companies you look at, the more likely you’ll find affordable Ford car insurance quotes. Enter your ZIP code into our free comparison tool below to get started.

Frequently Asked Questions

Can I get Ford car insurance if I have a poor driving record?

Yes, it is generally possible to obtain Ford car insurance even if you have a poor driving record. However, having a poor driving record can result in higher insurance rates due to the increased risk associated with your driving history.

It’s recommended to shop around, compare Ford car insurance quotes from different insurance providers, and consider improving your driving record to potentially qualify for lower rates in the future. Until you improve your record, you’ll probably need to find the best auto insurance for high-risk drivers.

Are there any specific insurance considerations for electric or hybrid Ford vehicles?

Yes, there may be specific insurance considerations for electric or hybrid Ford vehicles in 2023. These vehicles often have unique features and require specialized repair or maintenance procedures. Insurance providers may have different Ford coverage options or discounts available for electric or hybrid vehicles. It’s advisable to inquire with insurance companies about any specific considerations or incentives for insuring electric or hybrid Ford vehicles.

Who has the best car insurance for Fords?

Travelers, American Family, and Progressive have the best car insurance for Fords. However, you should use a car insurance calculator to determine the exact company with the best rates for you.

Can modifications or aftermarket additions to my Ford vehicle affect insurance rates?

Yes, modifications or aftermarket additions to your Ford vehicle can potentially affect insurance rates. If you’ve installed custom parts, you may want to consider the best auto insurance companies for modified cars.

Certain modifications that enhance performance or increase the vehicle’s value can result in higher premiums. Examples include engine modifications, suspension upgrades, or aftermarket spoilers. It’s crucial to inform your insurance provider about any modifications to ensure you have adequate coverage and to accurately reflect the value of your Ford vehicle.

Does the age of my Ford vehicle affect the insurance rates?

Yes, the age of your Ford vehicle can influence the insurance rates in 2023. Generally, newer Ford models may have higher insurance rates due to their higher value and repair costs. However, older Ford vehicles may have lower rates if they have lower market value and are less prone to theft or expensive repairs.

It’s best to consult with insurance providers to understand how the age of your specific Ford model can impact the insurance rates. To find the best rates for your Ford no matter how old your vehicle is, enter your ZIP code into our free comparison tool today.

Is there a difference in car insurance rates for Ford vehicles compared to other brands?

Yes, car insurance rates can vary based on the make and model of the vehicle, including Ford cars. Insurance companies consider factors such as the vehicle’s safety ratings, repair costs, theft rates, and overall risk profile when determining insurance premiums. It’s advisable to compare insurance rates for specific Ford models to understand the potential differences.

Why is Ford Focus car insurance so expensive?

Ford Fusion full coverage car insurance cost is actually only an average of $149/mo, which is only slightly above the average for Ford car insurance rates.

Is a Ford F-150 expensive to insure?

Ford F-150s are one of the cheaper Ford models to insure, as full coverage costs an average of $132/mo.

What is Ford Insure on the Ford app?

Ford Insure is a usage-based program by Nationwide that rewards drivers for safe driving with a discount.

Are Fords expensive to insure?

Most Fords have average insurance rates, but some Ford models will definitely be more expensive to insure than others. If your Ford costs more, then you can expect your Ford auto insurance rates to be higher.

What is the cheapest car insurance for a Ford?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.