Best Ford Mustang Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Find the best Ford Mustang car insurance options with State Farm, American Family, and Travelers our top picks. These companies stands out for its exceptional value and coverage options, starting at just $80 per month. Its tailored program for Mustang owners offers unmatched coverage and savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Ford Mustang

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Company Facts

Full Coverage for Ford Mustang

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Ford Mustang

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

State Farm leads the pack for the best Ford Mustang car insurance, offering unparalleled value and comprehensive coverage. American Family and Travelers also stand out as top choices, providing robust protection and excellent customer service.

Each of these insurers excels in meeting the unique needs of Mustang owners, ensuring you get the best possible coverage.

Our Top 10 Company Picks: Best Ford Mustang Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Comprehensive Coverage State Farm

#2 15% A Discounts Options American Family

#3 13% A++ Hybrid Coverage Travelers

#4 12% A Custom Coverage Liberty Mutual

#5 10% A+ AARP Benefits The Hartford

#6 10% A++ Military Benefits USAA

#8 20% A+ Deductible Options Nationwide

#7 10% A Coverage Options Farmers

#9 12% A+ Snapshot Program Progressive

#10 25% A+ Safe Driving Allstate

Choose from these top providers to secure optimal protection for your Ford Mustang. To find out more, explore our guide titled, “Compare Car Insurance by Coverage Type.”

Ready to shop around for the best car insurance company? Enter your ZIP code above and see which one offers the coverage you need.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

Cons

- Discount Limitations: The multi-policy discount for Ford Mustang insurance with State Farm may not be as generous compared to some other insurers, possibly affecting total savings.

- Premiums: Despite the discounts, State Farm’s premiums for Ford Mustang insurance could still be relatively high for certain coverage tiers, potentially impacting affordability.

#2 – American Family: Best for Discount Options

Pros

- Flexible Discounts: American Family presents various discount opportunities for Ford Mustang insurance, including incentives for safe driving and multiple policies.

- Competitive Pricing: The available discounts often result in more favorable rates for Ford Mustang insurance compared to other providers. Explore further information about this provider in our guide titled, “American Family Car Insurance Review.”

- Strong A.M. Best Rating: With an A rating from A.M. Best, American Family signifies strong financial stability and reliability for Ford Mustang insurance.

Cons

- Discount Restrictions: Some Ford Mustang owners might find that American Family’s discount options do not cover all their insurance needs, which could lead to higher personal expenses.

- Service Variability: The customer service experience for Ford Mustang insurance with American Family might vary, with occasional reports of slower response times.

#3 – Travelers: Best for Hybrid Coverage

Pros

- Comprehensive Protection: Travelers offers hybrid coverage plans for Ford Mustang insurance, blending various protection types for comprehensive security.

- Top A++ Rating: Holding an A++ rating from A.M. Best, Travelers showcases outstanding financial strength and reliability for Ford Mustang coverage. Discover insights in our article called, “Travelers Car Insurance Review.”

- Diverse Discounts: Travelers provides a range of discounts for Ford Mustang insurance, including those for bundling and safe driving, enhancing overall value.

Cons

- Complex Options: The assortment of hybrid coverage choices for Ford Mustang insurance may be intricate, possibly making it more challenging to select the optimal plan.

- Premium Fluctuations: Premiums for Ford Mustang insurance with Travelers can fluctuate significantly based on coverage levels and discounts, leading to potential variability in costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Custom Coverage

Pros

- Tailored Policies: Liberty Mutual offers extensive customization for Ford Mustang insurance policies, addressing specific coverage requirements. To see monthly premiums and honest rankings, read our guide titled, “Liberty Mutual Car Insurance Review.”

- Policy Bundle Savings: Liberty Mutual provides a 12% discount on Ford Mustang insurance when bundled with other policies, enhancing cost efficiency.

- Reliable A.M. Best Rating: Liberty Mutual’s A rating from A.M. Best ensures dependable financial stability and reliability for Ford Mustang insurance.

Cons

- Discount Cap: The multi-policy discount for Ford Mustang insurance with Liberty Mutual may not match the higher rates of other competitors, limiting overall savings.

- Customer Feedback: Some clients report mixed experiences with Liberty Mutual’s customer service, which might affect overall satisfaction with Ford Mustang insurance.

#5 – The Hartford: Best for AARP Benefits

Pros

- AARP Perks: Ford Mustang insurance with The Hartford includes special benefits for AARP members, offering additional value and savings.

- A+ Rating: The Hartford’s A+ rating from A.M. Best indicates robust financial stability and reliability for Ford Mustang coverage. Learn more about the offerings in our guide titled, “The Hartford Car Insurance Discounts.”

- Customized Discounts: The Hartford provides personalized discounts for Ford Mustang insurance, including incentives for safe driving and policy bundling.

Cons

- Membership Restrictions: AARP benefits for Ford Mustang insurance with The Hartford are available only to eligible members, which may limit accessibility for some drivers.

- Higher Rates: The Hartford’s premiums for Ford Mustang insurance might be elevated for certain coverage levels, affecting affordability despite discounts.

#6 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts for Ford Mustang Owners: USAA extends a 10% multi-policy discount, specifically crafted for armed forces members, ensuring considerable savings on Ford Mustang insurance.

- Premier A.M. Best Rating for Ford Mustang Coverage: Holding an A++ rating, USAA promises superior financial strength and dependable protection for your Ford Mustang.

- Comprehensive Military Benefits: USAA provides a variety of advantages tailored for military families, including specialized insurance plans specifically designed for Ford Mustang vehicles. To learn more, explore our comprehensive resource on “USAA Car Insurance Review.”

Cons

- Moderate Multi-Policy Discounts: Though USAA provides a 10% discount, it may not rival the more substantial discounts available from other insurers for your Ford Mustang.

- Exclusivity Constraint for Ford Mustang Owners: USAA’s services are limited to military personnel and their families, which could exclude non-military Ford Mustang owners from accessing their coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Deductible Options

Pros

- Flexible Deductible Options: Nationwide’s 20% multi-policy discount allows Ford Mustang drivers to modify their deductibles to fit their financial situation and driving patterns.

- Robust A.M. Best Rating for Ford Mustang Insurance: With an A+ rating, Nationwide guarantees reliable financial backing and consistent coverage for your Ford Mustang.

- Customizable Coverage: Nationwide offers a variety of deductible choices and coverage plans, enabling Ford Mustang drivers to tailor their insurance precisely to their needs. Access detailed insights in our guide titled, “Nationwide Car Insurance Discounts.”

Cons

- Potentially Higher Premiums Despite Deductible Options for Ford Mustang: Even with flexible deductible options, Nationwide’s base premiums might remain relatively high for specific Ford Mustang insurance policies.

- Discount Limitations for Ford Mustang Owners: The 20% multi-policy discount might not completely offset the elevated base rates for insuring a Ford Mustang.

#8 – Farmers:Best for Coverage Options

Pros

- Wide Array of Coverage Options: Farmers provides an extensive range of coverage plans, accommodating the unique requirements of Ford Mustang owners, including various add-ons and enhancements.

- 10% Multi-Policy Discount for Ford Mustang Insurance: Farmers extends a 10% discount when bundling multiple policies, delivering extra savings for insuring your Ford Mustang.

- Reliable A.M. Best Rating: With an A rating, Farmers ensures solid financial stability and trustworthy coverage for your Ford Mustang. Dive into our article called, “Farmers Car Insurance Review.”

Cons

- Moderate Multi-Policy Discount: Despite Farmers offering a 10% discount, it may not be as competitive compared to other insurers for your Ford Mustang.

- Potentially Higher Costs for Specific Ford Mustang Coverage Levels: The diverse range of coverage options might lead to increased premiums for particular levels of protection for your Ford Mustang.

#9 – Progressive: Best for Snapshot Program

Pros

- Innovative Snapshot Program for Ford Mustang Drivers: Progressive’s Snapshot program offers personalized discounts based on driving behavior, which could reduce your Ford Mustang insurance expenses.

- 12% Multi-Policy Discount for Ford Mustang Insurance: Progressive provides a 12% discount for bundling policies, offering financial advantages for Ford Mustang drivers.

- A.M. Best Rating of A+ for Ford Mustang Coverage: Progressive’s A+ rating signifies strong financial health and reliable coverage for your Ford Mustang. If you want to learn more about the company, head to our article called, “Progressive Car Insurance Review.”

Cons

- Snapshot Program Participation Requirement: Enrollment in the Snapshot program necessitates tracking driving habits, which may not be suitable for all Ford Mustang drivers.

- Variable Discounts for Ford Mustang Owners: The effectiveness of the 12% multi-policy discount may vary depending on individual circumstances and policy specifics for your Ford Mustang.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Safe Driving

Pros

- 25% Multi-Policy Discount for Safe Driving Ford Mustang Owners: Allstate offers a generous 25% discount for maintaining a clean driving record, benefiting Ford Mustang owners with exemplary driving habits.

- Comprehensive Safe Driving Incentives: Allstate’s programs reward responsible driving with additional benefits and savings, specifically designed for Ford Mustang owners.

- Strong A.M. Best Rating of A+ for Ford Mustang Insurance: With an A+ rating, Allstate provides robust and dependable coverage for your Ford Mustang. Find more information about Allstate’s rates in our article titled, “Allstate Car Insurance Review.”

Cons

- Higher Premiums for Some Ford Mustang Coverage Options: Despite the 25% discount, certain coverage levels might still result in higher premiums for your Ford Mustang.

- Discounts Dependent on Driving Record: The value of the safe driving discount hinges on maintaining an impeccable driving record, which may not be attainable for every Ford Mustang driver.

Monthly Insurance Rates for Ford Mustang: Minimum vs. Full Coverage

When selecting insurance for your Ford Mustang, it’s crucial to understand how different providers price their coverage options. The following table breaks down the monthly rates for both minimum and full coverage across various insurance companies, highlighting the range of costs you can expect depending on your chosen coverage level and insurer.

Ford Mustang Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $93 $143

American Family $89 $140

Farmers $91 $141

Liberty Mutual $95 $145

Nationwide $90 $140

Progressive $87 $137

State Farm $85 $135

The Hartford $92 $142

Travelers $88 $138

USAA $80 $130

The monthly premiums for insuring a Ford Mustang vary significantly based on the level of coverage and the insurance provider. For minimum coverage, USAA offers the lowest rate at $80, while Liberty Mutual presents the highest at $95.

When it comes to full coverage, USAA also leads with the most affordable rate of $130, compared to Liberty Mutual’s $145, the highest in this category. Uncover details in our guide titled, “Compare U.S. Car Insurance Rates.”

This demonstrates a clear cost advantage for USAA across both coverage levels, making it a notable option for those seeking both comprehensive protection and budget-friendly rates.

Ford Mustang Car Insurance Rates You Need to Know

When considering insurance for a Ford Mustang, understanding the costs involved is crucial. On average, insurance for a Mustang hovers around $139 per month. Gain insights from our guide titled, “Compare Car Insurance Rates by State.”

Ford Mustang Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $139 |

| Discount Rate | $82 |

| High Deductibles | $120 |

| High Risk Driver | $296 |

| Low Deductibles | $175 |

| Teen Driver | $507 |

Understanding these aspects can help you make informed decisions about your Mustang insurance, potentially saving you money while ensuring adequate coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ford Mustang Car Insurance Expensive

The chart below details how Ford Mustang insurance rates compare to other sports cars like the Jaguar F-TYPE, Porsche 718 Boxster, and Chevrolet Camaro.

Ford Mustang Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Mustang | $29 | $60 | $35 | $139 |

| Jaguar F-TYPE | $42 | $92 | $33 | $181 |

| Porsche 718 Boxster | $37 | $79 | $28 | $156 |

| Chevrolet Camaro | $29 | $50 | $31 | $123 |

| Cadillac ATS-V | $34 | $70 | $33 | $150 |

| Audi TT RS | $35 | $65 | $28 | $139 |

| Audi R8 | $50 | $112 | $33 | $207 |

However, there are a few things you can do to find the cheapest Ford insurance rates online. Read more: Compare Ford vs. Chevrolet Car Insurance Rates

Strategies to Save on Ford Mustang Car Insurance

If you want to reduce the cost of your Ford Mustang insurance rates, follow these tips below:

- Compare apples to apples when comparing Ford Mustang insurance quotes and policies.

- Re-check Ford Mustang quotes every 6 months.

- Ask about loyalty discounts.

- Understand the different types of auto insurance for your Ford Mustang.

- Buy a Ford Mustang with an anti-theft device.

By implementing these strategies, you can effectively manage and potentially reduce your Ford Mustang insurance costs. With a little effort and ongoing attention, you can ensure you’re getting the best value for your coverage. To discover more about the company, visit our guide titled, “How do car insurance table ratings affect car insurance rates?”

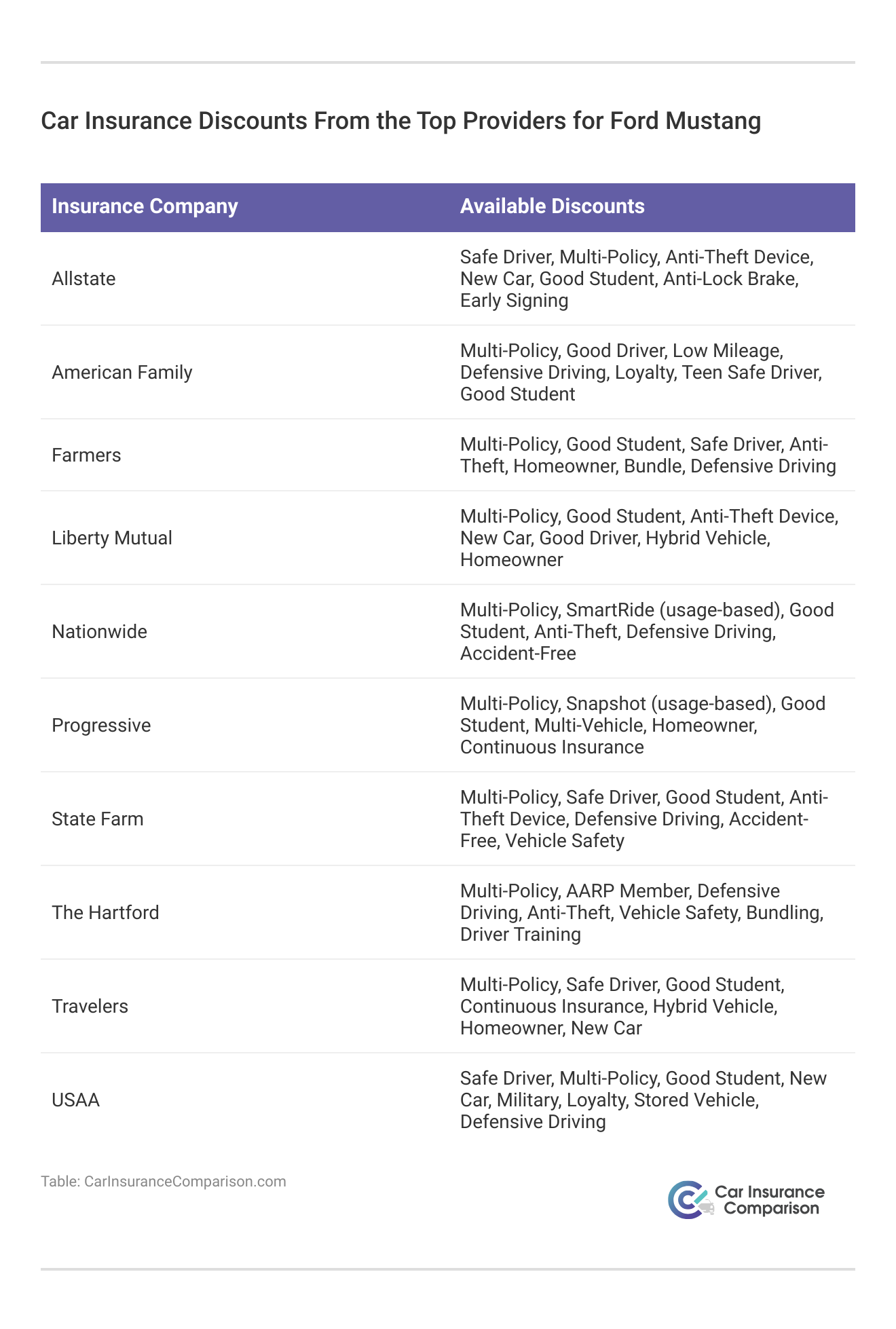

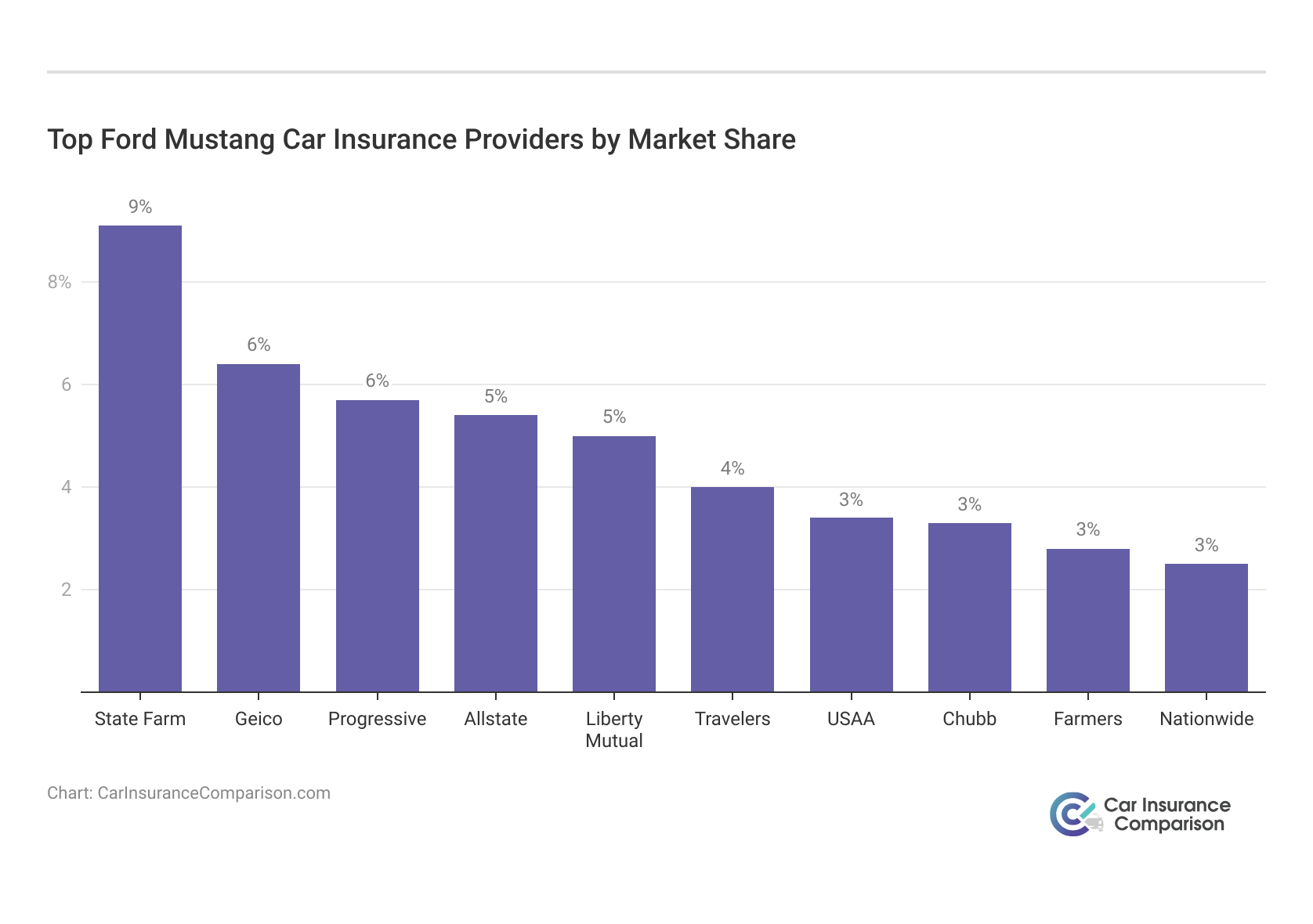

Top Ford Mustang Car Insurance companies

Several insurance companies offer competitive rates for the Ford Mustang based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Ford Mustang drivers organized by market share.

Top Car Insurance Company for Ford Mustang

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Each company offers various benefits, which may include discounts for safety features, comprehensive coverage options, and more.

Each of these companies has unique strengths and potential drawbacks, so it’s important to compare their offerings based on your specific needs and preferences. You can start comparing quotes for Ford Mustang auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Factors That Affect Ford Mustang Car Insurance Rates

The Ford Mustang trim and model you choose can impact the total price you will pay for Ford Mustang insurance coverage. For more information, check out our complete guide titled, “Factors That Affect Car Insurance Rates.”

Age of the Vehicle

Older Ford Mustang models generally cost less to insure. For example, auto insurance for a 2020 Ford Mustang costs $1,666, while 2010 Ford Mustang insurance costs are $1,346, a difference of $320.

Ford Mustang Car Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Ford Mustang | $30 | $62 | $36 | $142 |

| 2023 Ford Mustang | $30 | $61 | $36 | $141 |

| 2022 Ford Mustang | $29 | $60 | $36 | $140 |

| 2021 Ford Mustang | $29 | $59 | $35 | $139 |

| 2020 Ford Mustang | $29 | $60 | $35 | $139 |

| 2019 Ford Mustang | $28 | $58 | $37 | $137 |

| 2018 Ford Mustang | $27 | $57 | $38 | $136 |

| 2017 Ford Mustang | $26 | $56 | $39 | $136 |

| 2016 Ford Mustang | $25 | $53 | $41 | $134 |

| 2015 Ford Mustang | $24 | $52 | $42 | $132 |

| 2014 Ford Mustang | $23 | $48 | $43 | $128 |

| 2013 Ford Mustang | $22 | $45 | $43 | $125 |

| 2012 Ford Mustang | $21 | $40 | $43 | $119 |

| 2011 Ford Mustang | $19 | $37 | $43 | $115 |

| 2010 Ford Mustang | $19 | $35 | $44 | $112 |

Newer Ford Mustang may offer the latest features and advancements, it comes at a higher insurance cost. On the other hand, an older model provides a more budget-friendly insurance option without compromising the iconic performance and style that Mustangs are known for.

Driver Age

Driver age can have a significant effect on the cost of Ford Mustang car insurance. For example, a 20-year-old driver could pay around $170 more each month for their Ford Mustang car insurance than a 30-year-old driver.

Ford Mustang Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $1,200 |

| Age: 18 | $507 |

| Age: 20 | $315 |

| Age: 30 | $145 |

| Age: 40 | $139 |

| Age: 45 | $135 |

| Age: 50 | $127 |

| Age: 60 | $124 |

The cost of insuring a Ford Mustang can vary dramatically based on the driver’s age. Younger drivers face higher premiums due to perceived higher risks, while older drivers benefit from reduced rates as their experience and driving record improve.

Driver Location

Where you live can have a large impact on Ford Mustang insurance rates. For example, drivers in New York may pay $1,016 a year more than drivers in Seattle.

Ford Mustang Car Insurance Monthly Rates by State

| City | Rates |

|---|---|

| Los Angeles, CA | $237 |

| New York, NY | $219 |

| Houston, TX | $218 |

| Jacksonville, FL | $201 |

| Philadelphia, PA | $186 |

| Chicago, IL | $183 |

| Phoenix, AZ | $161 |

| Seattle, WA | $135 |

| Indianapolis, IN | $118 |

| Columbus, OH | $115 |

When considering insurance for your Ford Mustang, it’s crucial to take your location into account. Understanding the regional variations in insurance rates can not only help you anticipate your costs but also guide you in finding ways to potentially lower them.

Your Driving Record

Your driving record can have an impact on the cost of Ford Mustang auto insurance. Teens and drivers in their 20’s with violations on their record see the highest jump in their Ford Mustang auto insurance rates.

Ford Mustang Car Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $1,200 | $1,850 | $2,100 | $1,750 |

| Age: 18 | $507 | $880 | $1,100 | $800 |

| Age: 20 | $315 | $640 | $850 | $600 |

| Age: 30 | $145 | $290 | $410 | $280 |

| Age: 40 | $139 | $280 | $390 | $270 |

| Age: 45 | $135 | $270 | $380 | $265 |

| Age: 50 | $127 | $260 | $370 | $255 |

| Age: 60 | $124 | $255 | $360 | $250 |

While a clean driving record always results in the lowest insurance premiums, even minor infractions can lead to significant increases in costs. Young drivers face the highest rates due to their perceived risk, while older drivers benefit from more stable and lower insurance premiums.

Ford Mustang Safety Ratings

The safety ratings of the Ford Mustang will have a significant impact on your overall Ford Mustang car insurance rates, as insurance providers take these ratings into account when determining the level of risk and corresponding premiums for the vehicle.

Ford Mustang Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Acceptable |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

These ratings are critical not only for your safety but also for determining your insurance premiums. Higher safety ratings often lead to lower insurance rates, as insurers view the vehicle as less risky.

With top ratings of 5 stars in Overall, Frontal, Side, and Rollover tests, the Ford Mustang stands out as a leader in vehicle safety.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

The Ford Mustang’s solid performance across various safety tests reflects a commitment to occupant protection, which can be beneficial both on and off the road.

Ford Mustang Crash Test Ratings

The crash test ratings of your Ford Mustang will have a significant impact on your Ford Mustang car insurance rates, as insurers use these ratings to assess the vehicle’s safety and potential risk in the event of an accident.

Ford Mustang Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford Mustang GT350R 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2024 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2024 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Ford Mustang GT350R 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Ford Mustang GT350R 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Ford Mustang GT350R 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Ford Mustang GT350R 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Ford Mustang GT350R 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Ford Mustang GT350R 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Ford Mustang C RWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Ford Mustang 2 DR RWD | 5 stars | 5 stars | 5 stars | 5 stars |

The Ford Mustang’s impressive crash test ratings demonstrate its strong safety performance across various model years. For Mustang owners or prospective buyers, these ratings can be a key factor in securing favorable insurance rates.

Ford Mustang Safety Features

The Ford Mustang safety features can help lower insurance costs. According to AutoBlog, the 2020 Ford Mustang has the following safety features:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

These safety features help protect occupants in the event of an accident, which can reduce the risk and severity of injuries. Insurance companies often offer discounts for vehicles equipped with advanced safety systems, as they contribute to overall safety and potentially lower claim costs. Thus, the comprehensive safety features of the Ford Mustang can help make insurance more affordable.

Ford Mustang Insurance Loss Likelihood Overview

Review the Ford Mustang car insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury.

Ford Mustang Insurance Loss Probability

| Coverage | Loss Rate |

|---|---|

| Collision | 75% |

| Property Damage | -20% |

| Comprehensive | 31% |

| Personal Injury | 9% |

| Medical Payment | 36% |

| Bodily Injury | 17% |

The lower percentage means lower Ford Mustang auto insurance costs; higher percentages mean higher Ford Mustang auto insurance costs. For further details, see our guide titled, “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

How much are Ford Mustang car insurance rates?

Ford Mustang car insurance rates average around $139 per month.

For further details, see our guide titled “How Do You Get Competitive Quotes for Car Insurance?“

Is Ford Mustang car insurance expensive?

Ford Mustang car insurance rates can be high compared to other sports cars, but there are ways to find cheaper insurance rates.

What are ways to save on Ford Mustang car insurance?

To reduce the cost of Ford Mustang insurance rates, consider a few key strategies. First, compare quotes from different insurance companies to ensure you’re getting the best deal available.

Additionally, take advantage of discounts offered for safety features equipped in your Mustang, such as airbags and anti-lock brakes. Finally, maintaining a clean driving record is crucial, as a history free of accidents and violations will help keep your premiums lower.

How does what I drive affect my car insurance costs?

The type of car you drive, including the year, model, and value, can influence your car insurance costs.

What is the 2004 Mustang insurance cost?

The insurance cost for a 2004 Mustang varies depending on factors such as your location, driving record, and coverage level, but averages between $83 and $125 monthly.

Discover more by exploring our in-depth guide titled “Finding Reasonable Car Insurance.”

What is the average insurance on a Mustang?

The average insurance on a Mustang across models is approximately $116 to $166 monthly, depending on age, driving history, and coverage.

Do Mustangs have high insurance rates?

Yes, Mustangs tend to have higher insurance rates due to their classification as performance vehicles and higher repair costs.

What is the Ford Mustang insurance for a 17-year-old?

Insurance for a 17-year-old driving a Ford Mustang can be quite expensive, typically ranging from $291 to $500 per month.

How much does insurance cost on a Mustang?

Insurance on a Mustang generally costs between $100 and $166 monthly, depending on the model and driver specifics.

Read our guide titled “Safe Driver Car Insurance Discounts.” for more information

How much is insurance for a V6 Mustang?

Insurance for a V6 Mustang typically costs around $100 to $150 monthly, with some variation based on the driver’s record and coverage.

Is insurance on a Mustang expensive?

Yes, insurance on a Mustang is generally considered expensive due to its performance and higher risk of accidents.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

What is the Mustang insurance cost for a 20-year-old?

A 20-year-old can expect to pay between $208 and $333 monthly for Mustang insurance, influenced by driving history and location.

Are Ford Mustangs safe?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.