Car Industry Inflation [2025]

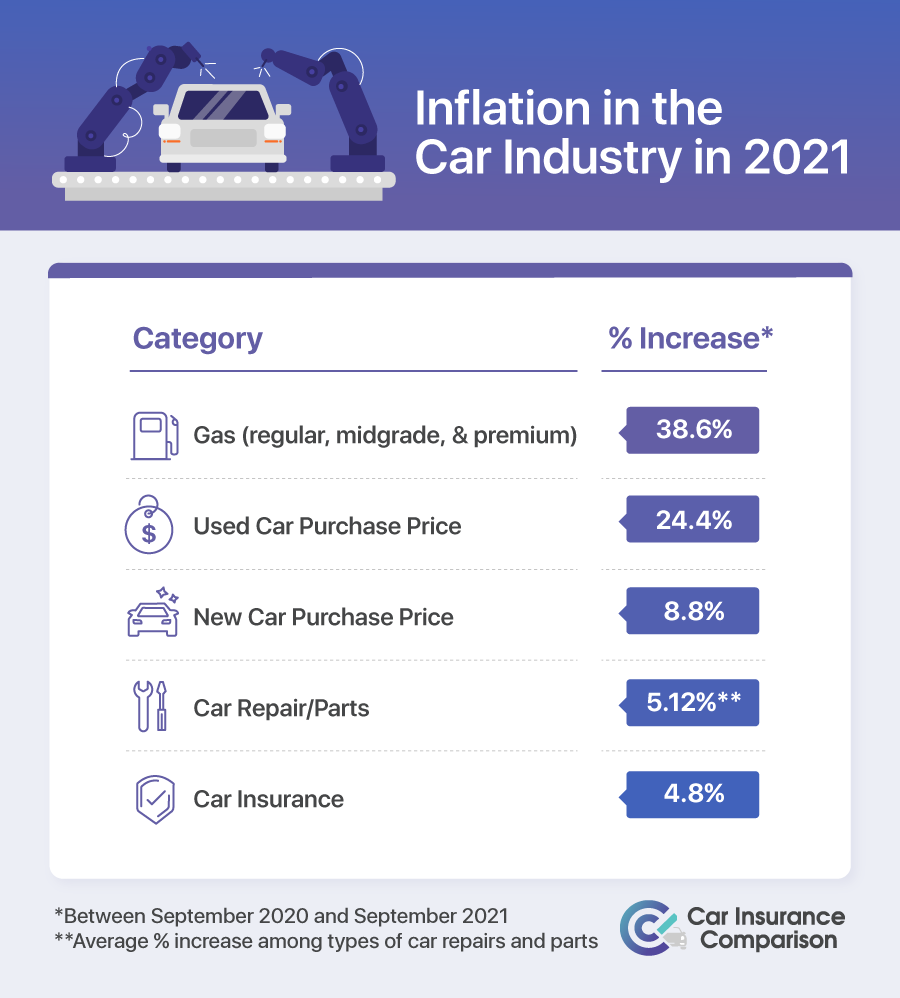

Since the start of the COVID-19 pandemic, there has been a steady rise in prices in the car industry. A close look at the numbers reveals that there have been significant increases in the following categories: new and used cars, gas, car insurance, car parts, and car repairs. Gas inflation shows the highest price hikes, followed by used car inflation.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Oct 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

From car inflation to gas inflation, a number of items in the car industry have risen in price during the COVID-19 pandemic. Several factors have caused the increase in prices, from shortages of car chips to supply chain interruptions.

The inflated prices have made shopping for vehicles, repairing current vehicles, or simply buying gas financially stressful for a multitude of consumers, even when consumers use savings such as car insurance discounts.

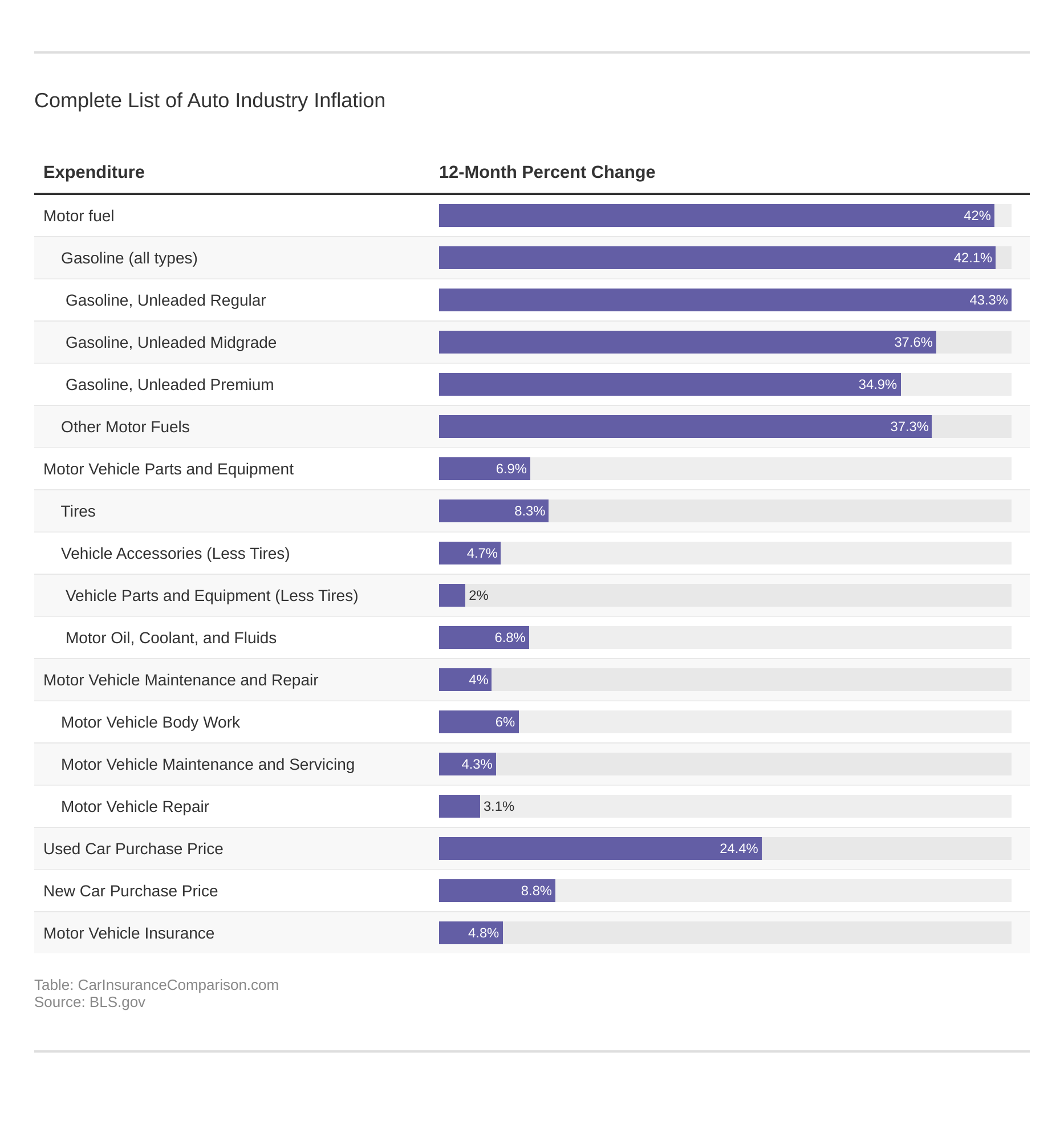

Some of the main items in the car industry that are affected are detailed in the graphic below.

In addition to covering the multiple aspects of the car industry that have increased in price, we will also go over expert advice and opinions on car industry inflation, as well as frequently asked questions.

Read on for a complete overview of how inflation in the car industry has increased over the last year.

- Gas prices have increased substantially since the start of the pandemic

- Used car inflation has resulted in pre-owned cars costing more than new cars

- Until production goes back to normal and the supply meets the demand, prices will continue to stay high

Inflation in the Car Industry

To find how much prices have increased, our team of researchers collected data from the Bureau of Labor Statistics’ (BLS) latest report on inflation. Our researchers pulled all data relating to the car industry: new and used car prices, car repairs and part prices, car insurance, and gas prices.

Take a look at the overall numbers below.

Colt Gunner, the Co-Founder of ColtFly, explains the causes behind the hike in prices: “Firstly, the rise in taxes is one of the major factors affecting this industry. Secondly, the depreciation of the dollar against most major currencies has increased prices for U.S.-built cars by 20% . . . These are some of the reasons why inflation in this industry market is so high.”

For a more detailed look into each category of inflation, read on. We will look at the full numbers for each one in order of the most to least affected by inflation.

#1 – Gas Inflation

Gasoline experienced the highest levels of inflation over the last year, with prices rising across the U.S. The demand for gas is increasing as Americans are going back to work. Unfortunately, numerous factors in the gas industry, such as delays in oil production and issues with supply overseas, have led to trouble with supply.

Naturally, any time supply can’t meet demand, prices go up. Regular, mid-grade, and premium gas averaged a 38.6% increase in price. These price increases are affecting drivers across America.

Consumers can expect to continue to pay higher prices for gas until the supply interruptions are worked out. For some, it may be worth looking into alternative fuel cars such as electric vehicles.

#2 – Used Car Inflation

Looking at used car inflation in 2021 reveals that the price of used cars has risen substantially during the COVID-19 pandemic. The price of used cars and trucks has risen 24% over the last year, reaching unprecedented highs.

Why are used cars so expensive right now? One of the main factors is a shortage of car chips contributing to car shortages, resulting in some used cars costing more now than when new.

As a result, some consumers are choosing to either wait to buy a car or custom order a new car and wait for it to be manufactured rather than buying a used car while prices are high. Keeping track of prices on used car inflation charts, such as the Manheim Used Vehicle Value Index, will help you decide when is the best time to buy.

#3 – New Car Inflation

The slowdown in the production of new cars has caused prices for new cars to rise, making shopping more stressful for the majority of consumers. Just how inflated are car prices?

New car inflation in 2021 has resulted in new vehicle prices increasing 8.8% over the last year.

Therefore, drivers who need a new car immediately are faced with paying an exorbitant amount for a car. Additionally, since used car prices have increased even more, customers may not save money by buying a used car instead of a new car.

#4 – Car Repair and Part Inflation

In addition to having to pay higher prices for new and used vehicles, consumers may also find that they are paying higher prices to repair their current vehicles due to part and repair inflation. Consumers may also find themselves waiting longer for new parts to repair their cars, as the supply chain issues with new cars also extend to parts.

The average inflation for car repair and parts was 5.1%. While a price increase for tires won’t raise costs too much, multiple vehicle parts and supplies rose in price. That raised the cost of vehicle repairs, which are already expensive for the majority of consumers.

#5 – Car Insurance Inflation

Despite the discounts offered by insurers for drivers who suddenly found themselves working from home during the COVID-19 pandemic and driving less, car insurance prices have inflated 4.8% over the last year.

This could partly be due to the increase in fatal crashes over the past year. Despite fewer people on the roads, crashes have increased as risky driving behaviors like speeding become more common.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Causes of Car Industry Inflation and Saving Tips

Rising inflation has put a strain on many people’s budgets, whether it’s shopping for a new car or simply filling up the car with gas. We’ve collected advice from multiple experts on what’s causing the recent inflation in the car industry and what consumers can do to save despite inflation.

Read on to see advice from CEOs, car dealerships, insurance agents, and other automotive experts.

“Having been in the automotive or car industry for over three decades, I happen to have seen a lot as times change. We have had a spike in car prices before, most notably in 1995 and 2000, but never has it been this high.

The key reason we are seeing the spike now is because of the lack of new cars. Think about all the people who graduated from school over the lockdown period. Many of them wanted cars, but there was nothing new, so the obvious choice was to go for a used one.

But if you are selling a car, you would obviously go for the highest bidder. Now effectively, what drove up the price was an incredible demand with a deflated supply.

On the other hand, the lack of new cars is mainly because original equipment manufacturers (OEMs) do not have all the necessary components for parts, with the most notable being semiconductors. This is also among the reasons there are fewer car parts, and thus, an increased price.

There is also immense pressure in logistics if you do get your hands on a part; even with express shipping, chances are you should expect to add a week or two to your expected date of delivery.

Gas prices were influenced by the surge in demand after lockdowns were lifted and the gas-producing nations refused to up the supply. The same occurred with insurance prices.

The best choice right now is going for hybrid vehicles or electric vehicles if possible. Their reduced dependency on gas will serve you well, now and as regulations change. Another choice is using the bus or a taxi if driving is not a necessity.”

Scott Killmer is the CEO of Car Windshields.

He has been in the car industry for over 30 years.

“Inflation in the car market will go down when inflation in other markets does as well. The reason we’re seeing such high prices is because of the interdependent global economy.

You have OPEC reducing oil production, chip manufacturers facing shortages, global supply chains delaying shipping times — all of these factors affect the auto industry the hardest. Getting parts for anything, whether new construction or repairs, is a greater challenge than it was in the past.

If you’re trying to buy a car now, focus on raising your credit first. Having good credit — by paying down outstanding debts and disputing credit report errors — helps you get financing for your vehicle. Be flexible on vehicle type, and if you have a trade-in, now is the time to flip for profit.

It’s widely expected (though not a certainty) that the Federal Reserve will raise interest rates by the summer of 2022. This means that getting financing on things like automobiles will be somewhat more expensive, and therefore fewer people will be buying cars.

A lower demand could mean a higher supply, particularly as supply chains reorganize themselves and more cars arrive on the market.

That’s still a fair few months away. In the meantime, try saving for a car by putting your money into short-term investments so you can stay ahead of inflation.

You can lower your risk by trying a savings account instead, but the yield on those is less than 1%, and inflation is rising multiple percentage points. There really is no 100% safe bet right now for keeping ahead of inflation — all you can do is your best.

The issues in the car market actually go back decades. Honda’s Just In Time manufacturing system relies on manufacturers being available immediately — not shut down due to a pandemic or lack of labor. Car companies are doing all they can to improve, but until then, we’ll fight over the supply of what’s available.”

Nate Tsang is the CEO of Wall Street Zen.

His company provides industry and stock analysis for investors.

What are the top issues facing the car industry right now that have contributed to why inflation in the car industry market has risen so high for gasoline, new cars, vehicle repairs, etc.?

“The car industry has been facing numerous challenges lately, one of the most pertinent of which is the recent hike in gasoline prices. This is due to several reasons. As the pandemic restrictions have eased, Americans have gotten back to driving more, leading to very high demand levels. The current supply is not enough to match the demand.

Moreover, oil and energy markets overseas are in a crunch, leading to extremely low production levels.

Car prices have also seen a rise mainly due to semiconductor chip shortages. These shortages have impacted the production of many latest models, leading directly to an increase in prices.”

When can consumers expect inflation to go down in the automotive industry?

“Until the supply constraints and energy market issues are solved, it doesn’t look like inflation in the automobile industry will go down. Most experts state that inflation will continue till the last quarter of 2022 and even beyond that.”

Do you have any tips on how consumers can save money during inflation on gas, new cars, used cars, car repairs, and/or car insurance?

“My best tip in this regard is to avoid making unnecessary trips. To do this, it might help to make a list of all items you need and get them in a single trip instead of making multiple trips.

For instance, if you want to buy groceries and some work tools, you’re better off stopping at a convenience store and then a hardware store in just one trip. This will save you a good amount of money on gas expenses as well as car repairs.”

Have you personally experienced inflation in the automotive industry, such as when buying a car, paying for car repairs, insuring a vehicle, or buying gasoline?

“Yes, I have noticed that the prices for car repairs and gasoline have skyrocketed in the past couple of months. Inflation in the industry has impacted my purchasing power considerably.”

Do you think where you live is better or worse for this inflation compared to other parts of the U.S.?

“I live in San Diego, and I can safely say that it is one of the worst-affected states when it comes to energy and transportation costs. My expenses for both these sectors have increased by nearly 30% since the pandemic started.”

Zach Wimpey is the founder of Craig and Landreth Cars.

His company is a Southern Indiana used car dealership.

“One of the prominent issues contributing to inflation in the automotive industry is the global semiconductor chip shortage. This shortage has contributed to reduced sales for most automobile manufacturers, which has contributed to the rising prices for vehicles in the automotive industry.

There is not a definite answer for when the inflation will go down when considering the semiconductor chip shortage — even the biggest and best-resourced semiconductor manufacturers are far from catching up with the current demands.

There are a few ways consumers can save money during these times. If you purchase a new vehicle, make sure to present the vehicle to an authorized dealership for warranty repair work — most repairs, aside from wear and tear, are covered under the manufacturer’s limited and powertrain warranties.

If you buy a used vehicle, try to find a vehicle that is still under the original manufacturer limited and powertrain warranties. This can help you save a ton of money if you need repairs or if your vehicle turns out to be a lemon.

It is important to do research about vehicles before making a decision to purchase one. Many vehicles have known defects that can be easily researched on the internet. Being informed at the outset and making decisions based on research prior to purchasing will save you time, money, and a lot of headaches in the long run.

Last, if you purchase a used vehicle, make sure to run a Carfax on the vehicle before signing the contract — aside from known vehicle defects, you never know what that specific vehicle has been through until you read up on it.

I live in Los Angeles, California. The inflation here appears to be worse compared to other parts of the U.S., with the price of gasoline exceeding $5 per gallon, which is where I have personally experienced inflation in the industry the most.”

Jessica Anvar is the founder of the Lemon Law Experts.

Lemon Law is an automotive lemon law firm based in California.

What are the top issues facing the car industry right now that have contributed to why inflation in the car industry market has risen so high for petrol, new cars, vehicle repairs, etc.?

“Here in the U.K., as with the U.S., inflation has been driven by an increase in demand as we continue the road to recovery from the pandemic. There has also been a shortage of microchips and raw materials, which has slowed the supply of new cars, which will then have a domino effect into the used car market too.

As for petrol, prices plummeted at the start of the pandemic but have since increased as people got back on the roads, and we even had a fuel crisis a few months back due to a shortage of heavy goods vehicle (HGV) drivers post-Brexit.”

When can consumers expect inflation to go down in the automotive industry?

“From what we’re noticing, not any time soon. There has been a lot of pent-up demand, and consumers have managed to save money since the start of the pandemic as they’ve had fewer places to spend the extra cash.

There also seems to be a reluctance towards returning to public transport and the health implications of doing so, which has fuelled demand for cars. Some people have simply wanted to treat themselves by buying a car, given they haven’t been able to travel on holiday and do other things.”

Do you have any tips on how consumers can save money during inflation on petrol, new cars, used cars, car repairs, and/or car insurance?

“If you’re searching for your next car or any associated motor service, always do your research on both the product you are buying and the company. Clearly, with the internet, you can search for vehicles from all around the country, particularly if used, but be careful not just to judge on price alone.

Check the reputation of the company, for example, by Google reviews, and also check what assurances the vehicle comes with, such as warranty, roadside assistance, and servicing.

Even if something is a little more expensive at first, it may have a greater package of coverages/assurances that save you a lot in the long run! You are also much more likely to receive a better level of personal care and attention if visiting a family-run dealership or business.”

Mike Lane is the operations director at Ron Brooks Motor Group.

Ron Brooks is a car dealership that also provides servicing and auto parts.

“Automakers and regulators will continue to be concerned about fuel economy rules.

In January 2021, the Biden administration announced a review of federal fuel economy requirements. As a result, the Environmental Protection Agency may reverse some of the Trump administration’s decisions, such as loosening regulations and suing California over its power to create its own state-specific laws.

Some automakers have already agreed to a deal with California, but GM is not one of them. By 2026, California will require automakers to achieve an average of 51 miles per gallon. As of March 2021, a new federal agreement is currently being negotiated.

The new generation of automotive startups is concentrating on developing platforms with high-tech modules that can subsequently be customized to meet the needs of the end user. The paradigm is changing from a traditional, complex automobile production process with limited flexibility to a process driven by the end customer’s needs.

The management of this supply chain is evolving in a similar way to that of the semiconductor and high-tech industries. Before reaching the client, the focus is on effective product development and then a personalized customer production process for order fulfillment and quality.

In Asia, chip and semiconductor production requires time to catch up with demand before auto production can ramp up domestically. What’s the bad news? The chip scarcity, in particular, is expected to last until 2023.

Customer demand continues to outstrip supply, owing to consumer demand for personal transportation and ongoing supply chain disruption by manufacturers. Prices are unlikely to return to 2019 levels in the next nine to 12 months, in my opinion. Prices will return to normal when new car inventories return to normal, which will take the entire next year.”

Todd Bissell is the founder of RideFAQs.com.

His site provides practical advice for rideshare drivers.

What are the top issues facing the car industry right now that have contributed to why inflation in the car industry market has risen so high for gasoline, new cars, vehicle repairs, etc.?

“Right now, the semiconductor shortage is one of the biggest challenges the industry is currently facing. It has put massive pressure on the automotive supply chains. As a result, many car manufacturers have to shut down their factories and assembly plants.

It also caused the diminishing auto sales since last year. Without the chips, automakers have difficulty producing new cars.

The economy is starting to reopen. Since many people were vaccinated, Americans have begun going out and driving more. The increasing demand for gasoline has led to rising prices and at present hit a seven-year high.

Also, there’s a constrained supply of gas in the country. Despite the U.S. pushing for higher exports production, the OPEC agreement moderates their oil production.

For vehicle repairs, the prices of some vehicle parts made of rubber are starting to increase. Analysts expect the cost of rubber products, such as tires and belts, will increase in the coming years due to the global rubber shortage.”

When can consumers expect inflation to go down in the automotive industry?

“Inflation in the automotive industry is currently happening. Previously, only the prices of brand new cars were affected, while the used car prices showed no change. However, the pandemic changed that.

According to MarketWatch, used cars and trucks have seen a 32% price jump in the first six months of 2021. Since automakers cannot produce many brand new vehicles, the demand for used cars has caused inflation.”

Do you have any tips on how consumers can save money during inflation on gas, new cars, used cars, car repairs, and/or car insurance?

“If you cannot afford a brand new vehicle, keeping your old car isn’t a crime. The same thing applies to buying a used car.

Car insurance is crucial in owning any vehicle, whether used or brand new. It saves you money in the future and helps with the financial burden if you ever get into an accident. Vehicle maintenance can be costly, but it’s the best way to prevent more expensive damages in the long run.”

Have you personally experienced inflation in the automotive industry, such as when buying a car, paying for car repairs, insuring a vehicle, or buying gasoline?

“For now, I’m sticking with my vehicle. It’s a few years old but still running well. If I want something new, I can just install a few simple truck parts and accessories. Upgrading and replacing old parts of the vehicle can be fun, especially if you’re stuck at home and want something to keep you busy.”

Do you think where you live is better or worse for this inflation compared to other parts of the U.S.?

“I can’t say we’re living better or worse here in Florida. I think we’re experiencing the same thing that’s happening across the country. Although, I noticed that used car prices soar in Jacksonville, and this is supported by this dataset from WJCT News.”

Average Used Car Price Increases in June by City

| Rank | City | % Price Change from June 2020 | $ Price Change from June 2020 |

|---|---|---|---|

| 1 | Jacksonville, FL | 39.8% | $8,473 |

| 2 | Orlando-Daytona Beach, FL | 39.6% | $8,062 |

| 3 | San Antonio, TX | 39.5% | $8,911 |

| 4 | Oklahoma City, OK | 39.1% | $9,079 |

| 5 | Atlanta, GA | 38.7% | $8,926 |

| 6 | Raleigh-Durham (Fayetteville), NC | 38.2% | $8,446 |

| 7 | Charlotte, NC | 37.8% | $8,379 |

| 8 | Houston, TX | 37.7% | $8,828 |

| 9 | Nashville, TN | 37.3% | $8,393 |

| 10 | Greensboro-Winston Salem, NC | 37.0% | $8,078 |

Jen Demkin is an auto expert at 4 Wheel Online.

They provide vehicle parts, accessories, and how-to videos.

What are the top issues facing the car industry right now that have contributed to why inflation in the car industry market has risen so high for gasoline, new cars, vehicle repairs, etc.?

“The COVID-19 pandemic has caused widespread supply chain issues, from manufacturing and shipping to port backlogs. These supply chain issues are driving up prices in all verticals of the U.S. economy, including the car industry, causing the consumer price index to increase at the fastest rate in the last 31 years.”

When can consumers expect inflation to go down in the automotive industry?

“There is no definitive end in sight to the rising inflation in the automotive industry as demand continues to outpace supply. However, there is hope that as the economy opens back up, prices may start to stabilize. That being said, as new strains of the virus emerge, such as the Delta variant, there is no way to tell when that time will be.”

Do you have any tips on how consumers can save money during inflation on gas, new cars, used cars, car repairs, and/or car insurance?

“The best way for consumers to save is to exercise restraint where possible. Try to cut down on miles driven by carpooling or using public transportation when and where it’s feasible. Of course, strictly necessary repairs are unavoidable.

Insurance is your best bet for saving money. Regularly review your policy with your agent for discounts and also have the policy priced by multiple agents and brokers to ensure you get the best policy at the best price.”

Have you personally experienced inflation in the automotive industry, such as when buying a car, paying for car repairs, insuring a vehicle, or buying gasoline?

“Yes, I have personally experienced inflation in the automotive industry. Car dealerships have such a low supply of new and used vehicles that they have little incentive to offer deals on the small amount of inventory in their possession.

After the COVID-19 pandemic greatly reduced miles driven in 2020, as the vaccine became readily available and U.S. businesses opened back up, insurance companies were faced with the same issues as consumers, needing to pay much more for repairs and having longer repair times. All of these factors drive up premiums for insurance policies.”

Do you think where you live is better or worse for this inflation compared to other parts of the U.S.?

“I live in Wilmington, Delaware. The Northeast Corridor has experienced some of the lowest inflation rates in the country. The Midwest and South have been more significantly impacted by inflation than my neck of the woods.”

He has been a licensed insurance agent for over 13 years.

What are the top issues facing the car industry right now that have contributed to why inflation in the car industry market has risen so high for gasoline, new cars, vehicle repairs, etc.?

“The biggest factor that has fed inflation in the automotive industry is the semiconductor shortage. Almost all new cars are dependent on chips, especially electric vehicles. These chips have been in shortage as demand went down at the start of the pandemic, causing less to be made.

With no chips to be installed into new cars, most of the latest models have been unavailable in the market, causing a price hike.

Vehicle repairs have also seen the effects of inflation because of the new emission limits. The Biden government has introduced stricter laws for CO2 emissions, which have caused an increased demand for more carbon-efficient cars and vehicle repairs.”

When can consumers expect inflation to go down in the automotive industry?

“Consumers should not expect inflation to go down anytime this year. Until the chip shortage is over, prices are still going to be at a high. Consumers should expect prices to stabilize in the second quarter of 2022, but they won’t be at their original rate.”

Do you have any tips on how consumers can save money during inflation on gas, new cars, used cars, car repairs, and/or car insurance?

“My best tip for consumers to save money during this inflationary period is to go for a small, fuel-efficient car. These cars are relatively cheaper and will help you be economical with your travel expenses.

When driving, make sure to pay attention to your car’s fuel efficiency and try to maintain it at an optimal level. Switch off the air conditioning when you don’t need it. This can save you almost $400 annually.”

Have you personally experienced inflation in the automotive industry, such as when buying a car, paying for car repairs, insuring a vehicle, or buying gasoline?

“I have experienced the adverse effects of inflation. My fuel costs have increased exponentially from what they were before the pandemic.”

Do you think where you live is better or worse for this inflation compared to other parts of the U.S.?

“I live in Seattle, and inflation is quite bad here, not just for transportation but also for all other sectors. My expenses on fuel and transportation have increased by almost 20% this year.”

Greg Rozdeba is the president of DundasLife.com.

His site provides online insurance quote comparisons.

“Though there is a high demand for vehicles, there is a lack of supply availability, which is why vehicle prices are so high. This doesn’t just apply to new cars either — even used cars are incredibly expensive right now.

Production, however, is the main problem. Early on in the pandemic and throughout most of 2020, production slowed down intentionally because people were driving way less, but that made it incredibly hard to get back up to normal production rates, especially with greater demand than usual.

One specific shortage has been computer chips, which have impacted the car industry globally.

Right now, there isn’t an agreed-upon estimate of when inflation in the automotive industry will go down, but most agree that it won’t be for a while. I think that it might get a little bit better in 2022, but I don’t expect any significant improvement until 2023 at the earliest.

My best advice for anyone looking to buy a new car right now is to invest in an electric one. Not only are they better for the environment, but you won’t have to pay for gas ever again, which will save you a ton of money.

Electric cars will become much more prevalent on the road in the next couple of decades, and several car companies have committed to only creating electric vehicles from this point on.

I live in San Jose, California, and it was just recently signed into state law that by 2035, all new vehicle sales must be zero-emission, meaning that no car companies in the state of California can sell gas-powered cars after 2035. I wouldn’t be surprised if other states follow in these footsteps.”

Kyle MacDonald is the director of operations at Force by Mojio.

Force by Mojio provides GPS fleet tracking for small businesses.

What are the top issues facing the car industry right now that have contributed to why inflation in the car industry market has risen so high for gasoline, new cars, vehicle repairs, etc.?

“The real issue is that we as a society have failed to develop and embrace sustainable, long-term energy models. Fossil fuels (coal and petroleum) will eventually run out, and we need to use them sparingly while we slowly adopt alternative energy sources like wind and solar.

The big obstacle is the fact these alternatives are much more expensive than fossil fuels currently. However, there is a great deal of economic competition between nations that will result in the price of fossil fuels continuing to rise.

This will cause wind and solar energy to become more cost-effective sooner than later. But since we are addicted to oil-based products for nearly every facet of our daily lives (including cars), it’s going to be an arduous switch.”

When can consumers expect inflation to go down in the automotive industry?

“When the price of oil goes up. It’s not that simple, but close enough for government work. In fact, it would be more accurate to say when the price of oil goes up and stays up for a while.

Inflation in the automotive industry has been low by historical standards over the past few years. It looks set to stay that way. Even when the price of oil goes up, it usually does not last long enough to force automakers to pass higher costs on to consumers in the form of higher prices.”

Do you have any tips on how consumers can save money during inflation on gas, new cars, used cars, car repairs, and/or car insurance?

“Although it’s not always possible, buying a car with cash instead of taking out a car loan is the simplest, most effective way to save money.”

Have you personally experienced inflation in the automotive industry, such as when buying a car, paying for car repairs, insuring a vehicle, or buying gasoline?

“In the last year, I’ve seen a dramatic rise in prices across all of those areas — not just a little bit but by significant percentages. The annual service costs soared by 30%, insurance premiums went up 10-40% in most cases, and gasoline shot up in price to around $1.90 per liter at the time of this writing.

That’s even though the global recession has caused a drop in sales volume — according to Canadian Vehicle Sales Statistics, new car sales are down between 10% and 30% in most provinces.”

Do you think where you live is better or worse for this inflation compared to other parts of the U.S.?

“It is far worse. I’m based in Southern California (Los Angeles).

Labor, taxes, transportation, and insurance costs make it difficult to manufacture in the U.S. Even with low gas prices, the price of labor makes it not feasible to manufacture when China can do it cheaper.”

Andrew Drow is the chief operating officer at Wiringo.com.

His company specializes in automobile wiring harness and power cables.

“As a car insurance agent, I am already seeing inflation in car insurance premiums. The single most important factor in determining the premium for a comprehensive car insurance policy is the cash value of the car being insured.

With car prices going up across the board, insurance premiums are rising with them. In this manner, inflation in the cost of ownership for vehicles is manifesting even if there isn’t a rise yet in the rates insurance companies are charging per dollar of vehicle covered. These rates themselves, however, will go up eventually as they are driven mainly by vehicle repair costs.”

As the cost of labor and replacement parts rise, vehicle repair costs will rise accordingly.

“The other component of car insurance costs is the liability portion of the policy. While they represent a lower part of the overall insurance costs, these liability costs are also very likely to rise as they are subject to the same inflationary pressures.

Liability insurance covers payments to third parties other than the insured and covers repairs to other vehicles and injuries to other motorists. Rising healthcare and auto repair costs will translate into increased costs for insurance companies, and they will pass on these costs through raised insurance premiums.

Motorists should be aware that their premiums will likely rise over the next year, even if they aren’t actively in the car market or changing vehicles. It will be prudent for drivers to shop their insurance policy around to various carriers come renewal time.”

Jaime Arias is a licensed insurance agent at Dynamic Insurance Solutions.

Dynamic is a broker with over 100 years in the insurance industry.

Methodology: Looking Into Car Industry Inflation Rates

In order to calculate inflation and rank the inflation in the car insurance industry, our team collected data from the Bureau of Labor Statistics’ inflation report. All data relating to the car industry was pulled: new and used car prices, car repairs and part prices, car insurance, and gas prices.

Our researchers used these numbers to calculate the average overall inflation for each category. These averages allowed us to get a thorough look at inflation in the car insurance industry over the last year. The numbers show that inflation in the car industry has risen alarmingly high over the last year, which adds stress to consumers as they shop for cars and fill up their cars with gas.

Hopefully, as production returns to normal during the pandemic, prices will drop in the car insurance industry.

Frequently Asked Questions

What is car industry inflation?

Car industry inflation refers to the increase in the prices of vehicles, parts, and related services within the automotive industry over time. It is the result of various factors, such as rising production costs, changes in supply and demand, economic conditions, and technological advancements.

How does car industry inflation affect car insurance?

Car industry inflation can impact car insurance in several ways. Firstly, as the cost of vehicle repairs and replacement parts increases, insurance companies may need to raise their premiums to cover these higher expenses. Additionally, if the overall value of vehicles rises due to inflation, it can also lead to higher insurance premiums.

Are car insurance premiums directly linked to car industry inflation?

Car insurance premiums are not directly linked to car industry inflation but can be influenced by it. Insurance companies consider various factors when determining premiums, including the cost of repairs, replacement parts, and the overall value of vehicles. If these factors increase due to car industry inflation, it can result in higher premiums.

Are there any benefits of car industry inflation for car insurance?

While car industry inflation generally leads to higher insurance premiums, there can be some benefits. As vehicles become more technologically advanced, they often come equipped with safety features that can reduce the risk of accidents. This can potentially lower insurance claims and premiums, offsetting some of the inflationary effects.

How can car owners mitigate the effects of car industry inflation on insurance premiums?

Car owners can take several steps to mitigate the effects of car industry inflation on insurance premiums. Here are some recommendations:

- Shop around for insurance: Compare quotes from different insurance providers to ensure you are getting the best possible rate.

- Maintain a good driving record: Safe driving habits and a clean record can often lead to lower premiums.

- Increase deductibles: Opting for a higher deductible can lower your premium, but make sure you can afford the out-of-pocket expenses in case of a claim.

- Seek discounts: Inquire about any available discounts such as multi-policy discounts, safe driver discounts, or discounts for installing anti-theft devices or safety features in your vehicle.

- Consider the vehicle’s impact on premiums: When purchasing a vehicle, research its insurance costs beforehand, as certain models may have higher premiums due to factors like repair costs or theft rates.

- Review coverage regularly: Periodically review your insurance coverage to ensure it still meets your needs and make adjustments if necessary.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.