Best Dodge Car Insurance Rates in 2025 (Find the Top 10 Companies Here!)

Progressive, State Farm, and Allstate offer the best Dodge car insurance rates, beginning at a mere $37 per month. These providers deliver cost-effective and thorough coverage, ideal for individuals seeking affordable premiums and dependable protection customized to their driving requirements.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jun 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Dodge

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Dodge

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Dodge

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

Progressive distinguishes itself as the premier option for the best Dodge car insurance rates, offering competitive premiums beginning at only $37 per month for comprehensive coverage.

Collaborating with State Farm and Allstate, they provide affordable and budget-friendly coverage, and a broad selection of options tailored to meet your driving requirements.

Our Top 10 Company Picks: Best Dodge Car Insurance Rates

Company Rank Good Driver Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Usage-Based Options Progressive

#2 20% B Excellent Service State Farm

#3 15% A+ Specialized Plans Allstate

#4 13% A++ Competitive Pricing Geico

#5 10% A+ Deductible Benefits Nationwide

#6 9% A New Replacement Liberty Mutual

#7 11% A Customized Policies Farmers

#8 21% A+ Comprehensive Coverage Amica

#9 24% A++ Safety Focus Travelers

#10 16% A++ Military Focus USAA

Dodge is one of America’s most popular brands and frequently tops the list of best-selling vehicles. From pickup trucks that can get the job done to sports cars offering a high-performance ride, it’s not hard to see why Dodge is so popular.

Drivers have to pay a little more for their car insurance when they buy a Dodge. However, the amount you pay depends on the model you buy. For example, you’ll pay a lot less for Dodge minivan insurance than you would for a sports car. Enter your ZIP code now to start.

- Progressive offers competitive rates, starting at $37 per month

- Good driving and safer vehicles can reduce costs with Dodge car insurance

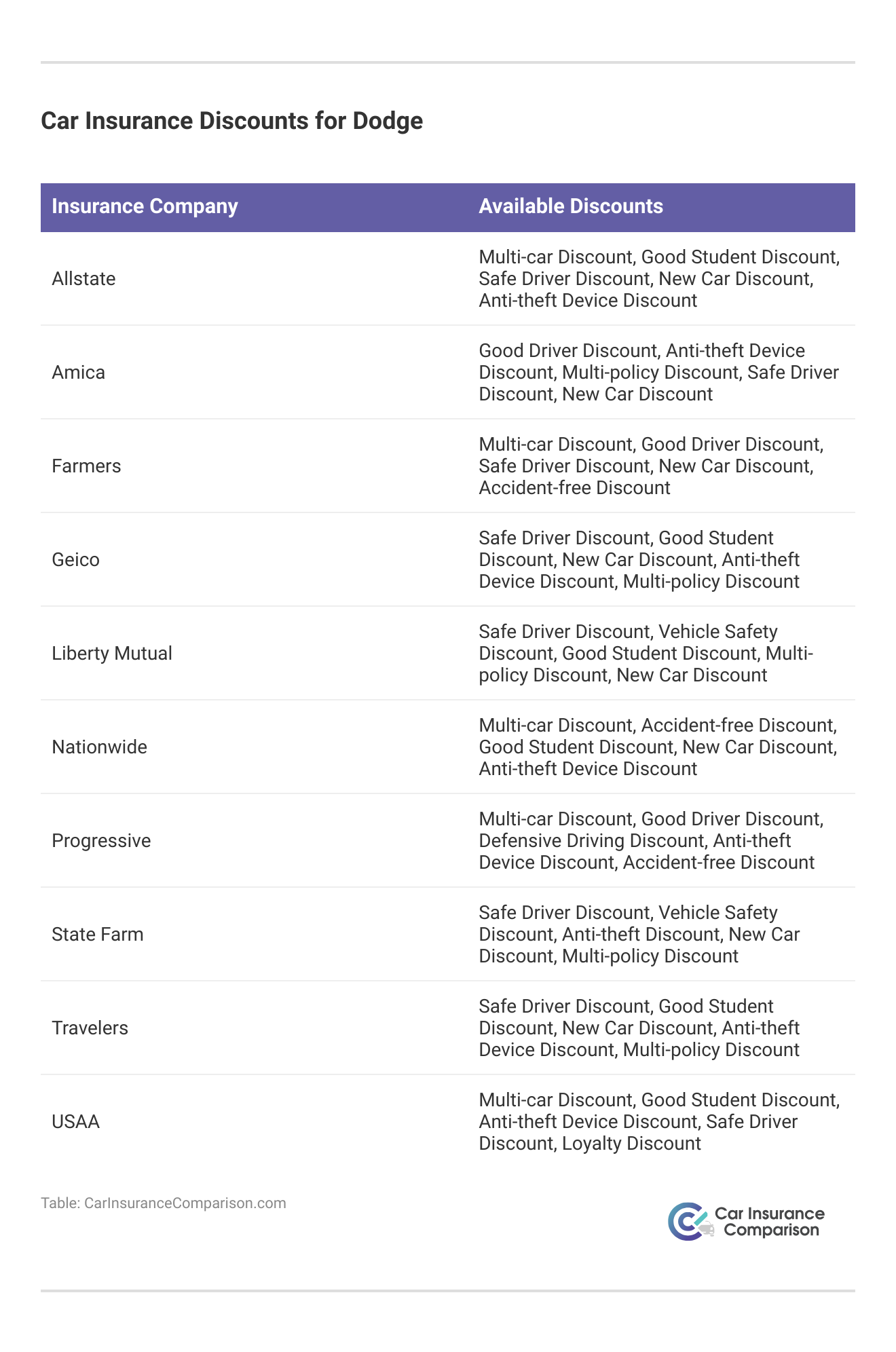

- Comprehensive options and discounts guarantee the best Dodge car insurance

#1 – Progressive: Top Overall Pick

Pros

- Competitive Pricing: Progressive often offers competitive rates, making it appealing for budget-conscious customers. Learn more through our Progressive car insurance review.

- Extensive Coverage Options: Progressive provides a wide range of coverage options, allowing customers to tailor their policies to their specific needs.

- User-Friendly Online Tools: Progressive’s online platform and mobile app are user-friendly, making it easy for customers to manage their policies, file claims, and access resources.

Cons

- Mixed Customer Service Reviews: While some customers praise Progressive’s customer service, others report dissatisfaction with responsiveness and claim handling.

- Limited Agent Interaction: Progressive primarily operates online and via phone, which may not suit customers who prefer face-to-face interaction with agents for personalized assistance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Excellent Service

Pros

- Exceptional Customer Service: State Farm is known for its excellent customer service, with dedicated agents available to assist customers throughout the claims process. Refer to our State Farm car insurance review for guidance.

- Financial Stability: State Farm’s long-standing presence and strong financial stability provide customers with peace of mind regarding the company’s ability to fulfill claims and commitments.

- Wide Range of Insurance Products: State Farm offers not only auto insurance but also a variety of other insurance products, allowing customers to bundle policies for potential discounts.

Cons

- Potentially Higher Rates: While State Farm’s service is highly regarded, its premiums may be slightly higher compared to some competitors.

- Limited Discounts: State Farm may not offer as many discounts as other providers, potentially limiting savings opportunities for some customers.

#3 – Allstate: Best for Specialized Plans

Pros

- Innovative Features: Allstate offers innovative features such as Drivewise, which tracks driving habits to potentially lower premiums for safe drivers. Read more through our Allstate car insurance review.

- Strong Financial Standing: Allstate’s financial strength and stability provide customers with confidence in the company’s ability to meet its financial obligations.

- Wide Network of Agents: With a vast network of agents across the country, Allstate offers personalized service and support to customers.

Cons

- Higher Premiums for Some: While Allstate’s coverage is comprehensive, some customers may find its premiums to be higher compared to other providers.

- Limited Discounts for Safe Drivers: Despite offering features like Drivewise, Allstate’s discounts for safe driving behavior may not be as substantial as expected for some customers.

#4 – Geico: Best for Competitive Pricing

Pros

- Competitive Pricing: Geico is often praised for its competitive pricing, offering affordable premiums compared to many other insurers.

- Convenient Online Services: Our Geico insurance review highlights that Geico’s user-friendly website and mobile app make it easy for customers to manage their policies, make payments, and file claims.

- Wide Range of Discounts: Geico offers numerous discounts, including those for safe driving, vehicle safety features, and bundling policies, helping customers save on their premiums.

Cons

- Limited Agent Interaction: Geico primarily operates online and over the phone, which may not suit customers who prefer in-person interaction with agents.

- Average Customer Service Ratings: While Geico’s pricing is competitive, its customer service ratings are somewhat mixed, with some customers reporting issues with claim handling and responsiveness.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Deductible Benefits

Pros

- Variety of Coverage Options: Nationwide offers a wide range of coverage options, allowing customers to customize their policies to meet their specific needs, as highlighted in our Nationwide insurance review.

- Member Benefits: Nationwide provides various benefits to its members, including access to resources, discounts on travel and entertainment, and financial services.

- Strong Financial Stability: Nationwide’s strong financial stability provides customers with confidence in the company’s ability to fulfill its commitments.

Cons

- Potentially Higher Premiums: Nationwide’s premiums may be higher compared to some competitors, particularly for certain coverage options or demographics.

- Limited Availability of Local Agents: While Nationwide has agents across the country, some customers may find it challenging to access local agents in their area for personalized assistance.

#6 – Liberty Mutual: Best for New Replacement

Pros

- New Car Replacement Coverage: Liberty Mutual offers new car replacement coverage, which can be beneficial for customers with newer vehicles, providing added peace of mind.

- Customized Policies: Liberty Mutual allows customers to customize their policies with various coverage options and features to suit their individual needs. Read more through our Liberty Mutual car insurance review.

- Convenient Claims Process: Liberty Mutual’s claims process is often praised for its efficiency and convenience, making it easy for customers to file and track claims online or via the mobile app.

Cons

- Potentially Higher Premiums: Liberty Mutual’s premiums may be higher compared to some competitors, particularly for certain coverage options or demographic profiles.

- Mixed Customer Service Reviews: While Liberty Mutual offers convenient online services, some customers report mixed experiences with customer service, including issues with responsiveness and claim handling.

#7 – Farmers: Best for Customized Policies

Pros

- Customized Policies: Farmers offers customized policies tailored to meet customers’ individual needs, allowing them to choose from various coverage options and features.

- Extensive Network of Agents: With a vast network of agents across the country, Farmers provides personalized service and support to customers, including in-person assistance with policy management and claims.

- Multiple Policy Discounts: Farmers offers discounts for customers who bundle multiple policies, such as auto and home insurance, helping them save on their overall insurance costs.

Cons

- Potentially Higher Premiums: Farmers’ premiums may be higher compared to some competitors, particularly for certain coverage options or demographic profiles. Learn more through our Farmers car insurance review.

- Limited Online Services: While Farmers offers in-person assistance through its network of agents, its online platform may be less robust compared to some competitors, limiting convenience for customers who prefer digital interaction.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Amica: Best for Comprehensive Coverage

Pros

- High Customer Satisfaction: Amica consistently receives high ratings for customer satisfaction, with customers often praising its attentive service and claims handling. Read more through our Amica insurance review.

- Dividend Policy: Amica is a mutual insurance company, meaning policyholders may receive dividends when the company performs well financially.

- Comprehensive Coverage Options: Amica offers a wide range of coverage options, including specialized coverage for items like identity fraud expense coverage and full glass coverage.

Cons

- Limited Availability: Amica may not be available in all states, limiting its accessibility to potential customers outside of its coverage area.

- Potentially Higher Rates for Some: While Amica’s service is highly regarded, its premiums may be higher compared to some competitors, particularly for certain demographics or coverage options.

#9 – Travelers: Best for Safety Focus

Pros

- Extensive Coverage Options: Travelers offers a comprehensive selection of coverage options, including specialized coverage for items like roadside assistance, rental car reimbursement, and umbrella insurance. Follow us through our Travelers car insurance review.

- Strong Financial Standing: Travelers has a strong financial standing, providing customers with confidence in the company’s ability to fulfill its financial obligations.

- Discount Opportunities: Travelers offers various discounts, such as those for safe driving, bundling policies, and vehicle safety features, helping customers save on their premiums.

Cons

- Mixed Customer Service Reviews: While Travelers offers comprehensive coverage options, some customers report mixed experiences with its customer service, including issues with responsiveness and claims handling.

- Potentially Higher Premiums for Some: Travelers’ premiums may be higher compared to some competitors, particularly for certain coverage options or demographic profiles.

#10 – USAA: Best for Military Focus

Pros

- Excellent Customer Service: USAA consistently receives high ratings for customer service, with dedicated support for military members and their families. Read more through our USAA car insurance review.

- Exclusive Membership: USAA membership is exclusive to military members, veterans, and their families, providing specialized service tailored to their unique needs.

- Financial Strength: USAA has a strong financial strength rating, ensuring that it can meet its financial obligations and provide security for its members.

Cons

- Limited Eligibility: USAA membership is limited to military members, veterans, and their families, excluding others from accessing its services.

- Potentially Limited Availability: USAA may not be available in all states or areas, limiting its accessibility to potential customers outside of its coverage area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Determining Dodge Car Insurance Rates

Types of Dodge Car Insurance You Should Buy

Money-Saving Tips for Dodge Auto Insurance

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Find the Best Dodge Car Insurance Today

Frequently Asked Questions

Is Dodge expensive to insure?

Dodge insurance is slightly above the national average, averaging around $158 per month. However, certain models, like the Viper, have higher insurance rates compared to others.

Why is Dodge Hellcat insurance so expensive?

The Dodge Challenger SRT Hellcat is one of the most stolen sports car in the country and reaches 60 mph in less than four seconds. All of these factors increase your risk of filing a claim, thus raising rates. Enter your ZIP code now to start.

How much is Dodge Challenger insurance for a 16 year old?

Since Challengers have high Dodge car insurance rates, and teen drivers pay the most for coverage, you can expect to pay around $600 per month, which is not under the cheapest car insurance.

Do I need full coverage car insurance for a Dodge?

If you’re leasing or financing a Dodge vehicle, you’ll need to purchase full coverage car insurance, which includes liability, comprehensive, and collision insurance.

How can I find the best Dodge car insurance rates?

You’ll get better quotes if you have a clean driving record and drive an older model, but comparison shopping online is free and an easy way to find cheap Dodge auto insurance from local companies. Enter your ZIP code now to start comparing.

Which insurance providers offer the best Dodge car insurance rates according to the article?

The insurance providers that offer the best Dodge car insurance rates according to the article are Progressive, State Farm, and Allstate.

What factors influence Dodge car insurance rates, as mentioned in the article?

Factors that influence Dodge car insurance rates include the type of Dodge vehicle, age and gender of the driver, location, driving history, good driver discount, marital status, and credit score.

What are some tips provided in the article for saving money on Dodge auto insurance?

Tips provided in the article for saving money on Dodge auto insurance include looking for car insurance discounts, reducing coverage if you own your car outright, raising your deductible, keeping your car safe, using telematics for usage-based savings, and maintaining a clean driving record. Enter your ZIP code now to begin.

How does the article suggest determining the types of insurance coverage needed for a Dodge vehicle?

The article suggests determining the types of insurance coverage needed for a Dodge vehicle based on factors such as the vehicle’s age and value. For newer or high-value Dodges, full coverage is preferable, while older or less valuable Dodges might only require minimum liability insurance for affordability of insurance rates.

What innovative features does Allstate offer to potentially lower premiums for safe drivers, as mentioned in the article?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.