Best Audi Car Insurance Rates in 2025 (Compare the Top 10 Companies)

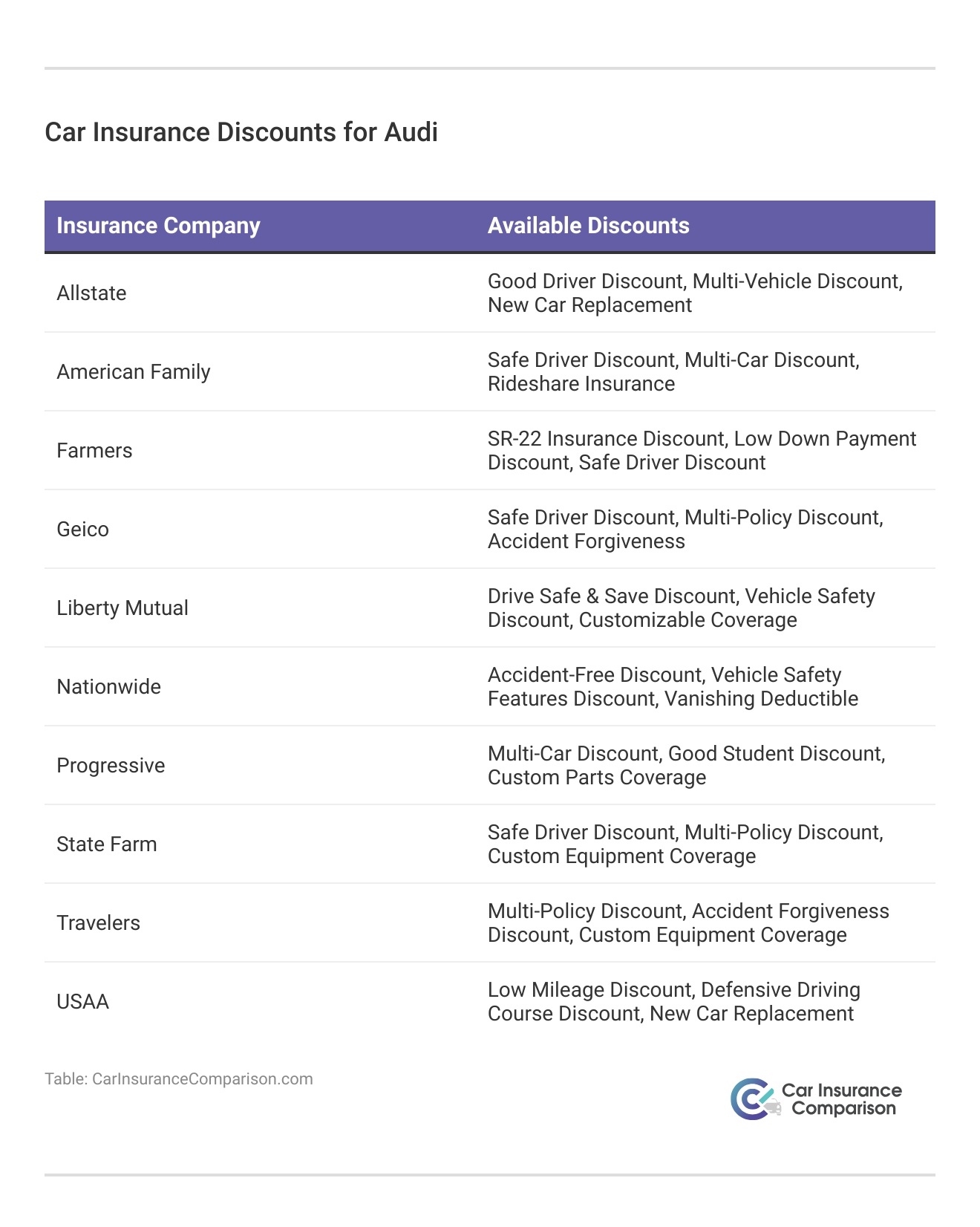

State Farm, USAA, and Geico offer the best Audi car insurance rates, starting as low as $30 per month. These insurance companies deliver affordable and extensive coverage, catering to individuals seeking discounts and reliable protection customized to their driving requirements and peace of mind.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Audi

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Audi

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Audi

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm has a vast network of agents and offices, making it convenient for customers to access support and services in person. Refer to our State Farm car insurance review.

- Personalized Service: The company is known for its personalized approach to insurance, offering tailored coverage options and attentive customer service.

- Strong Financial Stability: State Farm boasts strong financial stability ratings, providing customers with confidence in the company’s ability to fulfill claims.

Cons

- Potentially Higher Rates: While State Farm offers personalized service, its rates may be higher compared to some competitors, particularly for certain demographics or coverage options.

- Limited Discounts: State Farm may have fewer discount opportunities compared to other insurers, potentially resulting in higher overall premiums for some customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Military Focus: USAA caters specifically to military members and their families, offering specialized coverage options, discounts, and exceptional customer service tailored to their unique needs.

- Financial Strength: USAA consistently receives high ratings for financial strength and stability, providing reassurance to customers about the company’s ability to fulfill claims.

- Tech-Savvy Solutions: USAA offers innovative digital tools and resources, making it easy for customers to manage their policies, file claims, and access support online or through the mobile app.

Cons

- Membership Restrictions: USAA membership is limited to military members, veterans, and their families, excluding the general public from accessing its insurance products and services. Read more through our USAA car insurance review.

- Limited Branch Locations: While USAA provides excellent online and phone support, it has a limited number of physical branch locations, which may be inconvenient for some customers seeking in-person assistance.

#3 – Geico: Best for Bundling Option

Pros

- Competitive Rates: Geico is renowned for its competitive rates, often offering lower premiums compared to other insurers, making it an attractive option for cost-conscious customers.

- User-Friendly Technology: Geico offers intuitive online tools and a user-friendly mobile app, allowing customers to manage their policies, file claims, and access support with ease.

- Wide Range of Coverage Options: Geico provides a variety of coverage options, allowing customers to customize their policies to suit their specific needs and budget.

Cons

- Limited Agent Interaction: Our Geico insurance review highlights that Geico primarily operates online and over the phone, which may be a drawback for customers who prefer face-to-face interactions with agents or personalized guidance.

- Potentially Complex Claims Process: Some customers have reported challenges with Geico’s claims process, citing delays or difficulties in communication, which may lead to frustration during the claims handling process.

#4 – Progressive: Best for Accident Forgiveness

Pros

- Innovative Coverage Options: Progressive offers innovative coverage options such as Snapshot, which uses telematics to potentially lower premiums based on driving behavior, appealing to customers seeking personalized and technology-driven solutions. Read more through our Progressive car insurance review.

- High-Risk Coverage: Progressive is known for providing coverage to high-risk drivers, offering options for those with past accidents or violations, making it a valuable choice for individuals with less-than-perfect driving records.

- Convenient Bundling: Progressive offers bundling options for various insurance products, including auto, home, and renters insurance, allowing customers to streamline their coverage and potentially save money on premiums.

Cons

- Average Customer Service: While Progressive offers competitive rates and innovative options, some customers have reported average satisfaction with its customer service, citing issues with responsiveness or claims handling.

- Limited Discounts: Progressive may have fewer discount opportunities compared to some other insurers, potentially resulting in higher overall premiums for customers who do not qualify for specific discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Coverage

Pros

- Wide Range of Coverage Options: Allstate offers a comprehensive range of coverage options, including standard policies, as well as specialized coverage for items like electronic devices or identity theft protection, providing customers with flexibility to tailor their policies to their needs. Consult our Allstate car insurance review for guidance.

- Strong Agent Network: Allstate boasts a vast network of agents across the country, providing customers with personalized support and guidance when selecting coverage options or filing claims.

- Innovative Tools and Resources: Allstate provides innovative tools and resources, such as the Drivewise program, which offers potential discounts based on safe driving behavior, and the Allstate mobile app, making it easy for customers to manage their policies and access support on the go.

Cons

- Potentially Higher Rates: While Allstate offers extensive coverage options and personalized service, its rates may be higher compared to some competitors, particularly for certain demographics or coverage types.

- Mixed Claims Satisfaction: While Allstate has a strong agent network and offers innovative tools, some customers have reported mixed satisfaction with the claims process, citing issues such as delays or difficulty in communication, which may impact overall customer experience.

#6 – Nationwide: Best for Safe Driving

Pros

- Multi-Policy Discounts: Nationwide offers significant discounts for bundling multiple insurance policies, such as auto and home insurance, making it an attractive option for customers looking to save on overall insurance costs, as highlighted in our Nationwide insurance review.

- Strong Financial Stability: Nationwide maintains strong financial stability ratings, providing customers with confidence in the company’s ability to fulfill claims and provide reliable coverage.

- Customizable Coverage: Nationwide provides customizable coverage options, allowing customers to tailor their policies to their specific needs and budget, ensuring they have the right level of protection for their assets.

Cons

- Limited Local Presence: Nationwide’s local presence may be limited in some areas compared to other insurers, potentially resulting in fewer opportunities for in-person support or guidance from agents.

- Average Customer Service: While Nationwide offers customizable coverage options and multi-policy discounts, some customers have reported average satisfaction with its customer service, citing issues such as responsiveness or claims handling.

#7 – Travelers: Best for Policy Options

Pros

- Variety of Coverage Options: Travelers offers a wide range of coverage options, including standard policies, as well as specialized coverage for items like valuable personal property or identity theft, giving customers flexibility to customize their policies.

- Strong Financial Ratings: Travelers consistently receives high financial strength ratings, providing customers with confidence in the company’s ability to meet its financial obligations and provide reliable coverage. Read more through our Travelers car insurance review.

- Discount Opportunities: Travelers offers various discount opportunities, such as safe driver discounts or multi-policy discounts, helping customers save on their insurance premiums.

Cons

- Limited Availability: Travelers may have limited availability in some regions, potentially limiting options for customers seeking coverage in those areas.

- Mixed Claims Experience: While Travelers offers a variety of coverage options and discounts, some customers have reported mixed experiences with the claims process, citing issues such as delays or difficulty in communication, which may impact overall satisfaction.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Low Complaints

Pros

- Low Complaint Levels: American Family has a reputation for low complaint levels, indicating a commitment to customer satisfaction and effective claims handling. Read more through our American Family car insurance review.

- Personalized Service: American Family offers personalized service through its network of agents, providing customers with individualized guidance and support when selecting coverage options or filing claims.

- Innovative Coverage Options: American Family provides innovative coverage options, such as rideshare insurance for drivers working with companies like Uber or Lyft, catering to evolving customer needs in the gig economy.

Cons

- Limited Availability: American Family may have limited availability in certain regions, potentially limiting options for customers seeking coverage in those areas.

- Potentially Higher Rates for Some Demographics: While American Family offers personalized service and innovative coverage options, its rates may be higher compared to some competitors, particularly for certain demographics or coverage types.

#9 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor their coverage to their specific needs and budget, ensuring they have the right level of protection for their assets.

- Strong Financial Stability: Liberty Mutual maintains strong financial stability ratings, providing customers with confidence in the company’s ability to fulfill claims and provide reliable coverage.

- Discount Opportunities: Liberty Mutual offers various discount opportunities, such as multi-policy discounts or discounts for safety features on vehicles, helping customers save on their insurance premiums.

Cons

- Mixed Customer Service Reviews: While Liberty Mutual offers customizable policies and discount opportunities, some customers have reported mixed experiences with its customer service, citing issues such as responsiveness or claims handling.

- Potential for Higher Rates: Liberty Mutual’s rates may be higher compared to some competitors, particularly for certain demographics or coverage options, potentially impacting affordability for some customers. Read more through our Liberty Mutual car insurance review.

#10 – Farmers: Best for High-Risk Drivers

Pros

- Personalized Service: Farmers Insurance offers personalized service through its network of agents, providing customers with individualized guidance and support when selecting coverage options or filing claims.

- Variety of Coverage Options: Farmers provides a wide range of coverage options, allowing customers to tailor their policies to their specific needs and budget, ensuring they have the right level of protection for their assets.

- Discount Opportunities: Farmers offers various discount opportunities, such as bundling multiple policies or discounts for safety features on vehicles, helping customers save on their insurance premiums. Read more through our Farmers car insurance review.

Cons

- Potentially Higher Rates for Some Demographics: While Farmers Insurance offers personalized service and a variety of coverage options, its rates may be higher compared to some competitors, particularly for certain demographics or coverage types.

- Mixed Claims Experience: Some customers have reported mixed experiences with Farmers’ claims handling process, citing issues such as delays or difficulty in communication, which may impact overall satisfaction with the company’s service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Audi Car Insurance Rates

Factors Affecting Audi Car Insurance Premiums

Understanding Different Types of Audi Car Insurance Coverages

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Audi Car Insurance Rates: The Bottom Line

Frequently Asked Questions

How much are the average Audi car insurance rates?

The average Audi driver pays around $178 a month for full coverage. Monthly rates can go as low as $42 if you only carry liability insurance. However, rates can vary based on the model you drive, with sports cars or racing models potentially costing over $200 per month.

What factors into my Audi car insurance rates?

Several factors impact Audi car insurance rates, including the model you drive, your age, driving record, location, and coverage options. Since Audis are considered luxury vehicles, insurance companies charge higher rates to cover expensive repairs or replacement parts. Enter your ZIP code now.

Are Audi cars expensive to insure?

Why are Audis so expensive to insure?

Audi car insurance can be expensive due to several factors. Audis are luxury vehicles, and their repairs or replacements can be costly. Additionally, sports or racing models increase the likelihood of filing a claim, leading to higher insurance rates.

Is Audi cheaper to insure than BMW?

No, Audis are not always more expensive to insure than BMWs. The insurance rates vary depending on the model you choose. For example, some Audi A Series models may be less expensive to insure compared to BMW M Series. It’s best to compare Audi car insurance rates with other luxury insurance companies in your area to find the cheapest vehicle to insure. Enter your ZIP code now to begin.

How much is insurance for an Audi A4?

What are the top three insurance companies recommended for Audi car insurance rates?

The top three insurance companies recommended for Audi car insurance rates are State Farm, USAA, and Geico, according to the article.

What is the average monthly premium for full coverage Audi car insurance?

The average monthly premium for full coverage Audi car insurance is approximately $178, as mentioned in the article. Enter your ZIP code now to start.

What are some factors affecting Audi car insurance premiums?

What are some potential drawbacks mentioned for each of the top insurance provider?

Some potential drawbacks mentioned for each of the top insurance providers listed in the article include potentially higher rates and limited discounts for State Farm, membership restrictions and limited branch locations for USAA, limited agent interaction and potentially complex claims process for Geico, and mixed satisfaction with customer service and claims handling for Allstate.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.