Best Toyota Tacoma Car Insurance in 2025 (Top 10 Companies Ranked)

The best Toyota Tacoma car insurance is offered by Safeco, AAA, and Farmers, with rates starting from $95 per month. Safeco excels in comprehensive coverage, AAA provides member discounts, and Farmers stands out for competitive rates, ensuring Toyota Tacoma owners get the best value for their insurance needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,278 reviews

1,278 reviewsCompany Facts

Full Coverage for Toyota Tacoma

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Toyota Tacoma

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Toyota Tacoma

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best Toyota Tacoma car insurance options are Safeco, AAA, and Farmers, with Safeco emerging as the top pick overall due to its comprehensive coverage and competitive rates at just $95 per month. AAA excels in offering valuable member discounts, while Farmers provides strong coverage at affordable prices.

These companies balance cost, coverage, and perks, making them the leading choices for Toyota Tacoma owners seeking reliable and cost-effective insurance. Find out more by reading our article titled “Best Toyota Corolla Hybrid Car Insurance.”

Our Top 10 Company Picks: Best Toyota Tacoma Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Comprehensive Coverage | Safeco | |

| #2 | 25% | A | Member Discounts | AAA |

| #3 | 20% | A | Competitive Rates | Farmers | |

| #4 | 12% | A+ | Flexible Policies | Progressive | |

| #5 | 25% | A+ | Strong Support | Allstate | |

| #6 | 20% | A | Customer Service | American Family | |

| #7 | 25% | A++ | Low Premiums | Geico | |

| #8 | 8% | A++ | Wide Coverage | Travelers | |

| #9 | 10% | A++ | Military Benefits | USAA | |

| #10 | 25% | A | Customizable Options | Liberty Mutual |

Finding the best Toyota Tacoma car insurance doesn’t have to be a challenge. Enter your ZIP code above into our free comparison tool to find the lowest prices in your area.

- Safeco offers the best Toyota Tacoma car insurance with comprehensive coverage

- AAA and Farmers also provide competitive rates and valuable discounts

- Safeco leads with rates around $95 per month for Toyota Tacoma owners

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Safeco: Top Overall Pick

Pros

- Comprehensive Coverage: Safeco offers extensive coverage options for Toyota Tacoma insurance.

- Multi-Vehicle Discount: Enjoy a 25% discount for insuring multiple Toyota Tacoma vehicles. Gain deeper understanding through our article entitled “Safeco Car Insurance Review.”

- High A.M. Best Rating: Rated A for financial strength, ensuring reliable Toyota Tacoma insurance.

Cons

- Limited Discounts for New Drivers: Fewer discounts are available for new Toyota Tacoma owners.

- Higher Premiums in Certain Areas: Rates may be higher for Toyota Tacoma insurance in some regions.

#2 – AAA: Best for Member Discounts

Pros

- Member Discounts: Receive a 25% discount for AAA members on Toyota Tacoma insurance. Find out more by reading our article titled “AAA Car Insurance Review.”

- High A.M. Best Rating: Rated A for financial stability in providing Toyota Tacoma insurance.

- Roadside Assistance: Comprehensive roadside assistance is included for Toyota Tacoma owners.

Cons

- Limited Availability: Coverage might not be available in all states for Toyota Tacoma insurance.

- Higher Initial Costs: Premiums may be higher initially for Toyota Tacoma insurance compared to other providers.

#3 – Farmers: Best for Competitive Rates

Pros

- Competitive Rates: Farmers provide competitive rates for Toyota Tacoma insurance. Broaden your knowledge with our article named “Farmers Car Insurance Review.”

- Multi-Vehicle Discount: Save 20% on Toyota Tacoma insurance with a multi-vehicle policy.

- Good Customer Service: Known for responsive customer service for Toyota Tacoma insurance.

Cons

- Average Discount for Safe Driving: Lower discounts for safe driving compared to some Toyota Tacoma insurance competitors.

- Varied Coverage Options: Coverage options may not be as extensive as other Toyota Tacoma insurance providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Flexible Policies

Pros

- Flexible Policies: Progressive offers a variety of policy options for Toyota Tacoma insurance.

- Competitive Discounts: Includes a 12% multi-vehicle discount on Toyota Tacoma insurance.

- High A.M. Best Rating: Rated A+ for financial strength in Toyota Tacoma insurance. Explore further with our article entitled “Progressive Car Insurance Discounts.”

Cons

- Complex Policy Options: The range of Toyota Tacoma insurance options can be overwhelming for some customers.

- Mixed Customer Reviews: Some customers report inconsistent service experiences with Toyota Tacoma insurance.

#5 – Allstate: Best for Strong Support

Pros

- Strong Support: Allstate provides robust support and resources for Toyota Tacoma insurance.

- High A.M. Best Rating: Rated A+ for financial stability in Toyota Tacoma insurance. Gain insights by reading our article titled “Allstate Car Insurance Review.”

- 25% Multi-Vehicle Discount: Significant savings on Toyota Tacoma insurance for multiple vehicles.

Cons

- Higher Rates for High-Risk Drivers: Rates can be higher for Toyota Tacoma insurance drivers with a history of violations.

- Limited Discounts for Safety Features: Fewer discounts for advanced safety features on Toyota Tacoma insurance compared to competitors.

#6 – American Family: Best for Customer Service

Pros

- Excellent Customer Service: Known for superior customer service for Toyota Tacoma owners.

- 20% Multi-Vehicle Discount: Save on Toyota Tacoma insurance by insuring multiple vehicles.

- High A.M. Best Rating: Rated A for financial strength in Toyota Tacoma insurance. Deepen your understanding with our article called “American Family Car Insurance Review.”

Cons

- Limited Discount for Young Drivers: Fewer discounts are available for young Toyota Tacoma owners.

- Higher Premiums in Certain States: Rates may vary significantly for Toyota Tacoma insurance based on location.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Low Premiums

Pros

- Low Premiums: Geico offers some of the lowest premiums for Toyota Tacoma insurance. For further details, consult our article named “Geico Car Insurance Review.”

- 25% Multi-Vehicle Discount: Significant savings on Toyota Tacoma insurance with multiple vehicles.

- Excellent A.M. Best Rating: Rated A++ for financial strength in Toyota Tacoma insurance.

Cons

- Limited Local Agents: Fewer local agents are available for personalized Toyota Tacoma insurance service.

- Less Comprehensive Coverage Options: There may be fewer coverage options for Toyota Tacoma insurance compared to other insurers.

#8 – Travelers: Best for Wide Coverage

Pros

- Wide Coverage Options: Extensive coverage options for Toyota Tacoma insurance. Discover more by delving into our article entitled “Travelers Car Insurance Review.”

- 8% Multi-Vehicle Discount: Save on Toyota Tacoma insurance with multiple vehicles.

- High A.M. Best Rating: Rated A++ for financial reliability in Toyota Tacoma insurance.

Cons

- Lower Discount for Safe Driving: Less emphasis on discounts for safe driving for Toyota Tacoma insurance.

- Higher Rates in Some Areas: Rates may be higher for Toyota Tacoma insurance in certain regions.

#9 – USAA: Best for Military Benefits

Pros

- Military Benefits: Special benefits for military members and their families on Toyota Tacoma insurance.

- 10% Multi-Vehicle Discount: Save on Toyota Tacoma insurance with a multi-vehicle policy. Get a better grasp by reading our article titled “USAA Car Insurance Review.”

- Top A.M. Best Rating: Rated A++ for exceptional financial strength in Toyota Tacoma insurance.

Cons

- Eligibility Restrictions: Only available to military members and their families for Toyota Tacoma insurance.

- Limited Coverage Options for Non-Military: Coverage options might not be as extensive for non-military Toyota Tacoma owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Options

Pros

- Customizable Options: Offers customizable Toyota Tacoma insurance options for owners.

- 25% Multi-Vehicle Discount: Significant savings on Toyota Tacoma insurance with multiple vehicles.

- High A.M. Best Rating: Rated A for financial stability in Toyota Tacoma insurance. Uncover additional insights in our article called “Liberty Mutual Car Insurance Review.”

Cons

- Higher Premiums for New Drivers: Rates can be higher for new Toyota Tacoma owners.

- Limited Discounts for Safety Features: Fewer discounts are available for advanced safety features in Toyota Tacoma insurance.

Toyota Tacoma Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $115 | $290 |

| Allstate | $120 | $300 |

| American Family | $125 | $310 |

| Farmers | $130 | $310 |

| Geico | $105 | $270 |

| Liberty Mutual | $125 | $305 |

| Progressive | $100 | $260 |

| Safeco | $110 | $275 |

| Travelers | $130 | $320 |

| USAA | $95 | $250 |

Geico and Progressive offer the most affordable rates for minimum coverage, while USAA provides the best value for full coverage at $250 per month. Safeco also remains competitive with full coverage rates of $275 per month.

By comparing these rates, Toyota Tacoma owners can find the best insurance options to fit their budget and coverage needs. Broaden your knowledge with our article named “Best Toyota RAV4 Hybrid Car Insurance.”

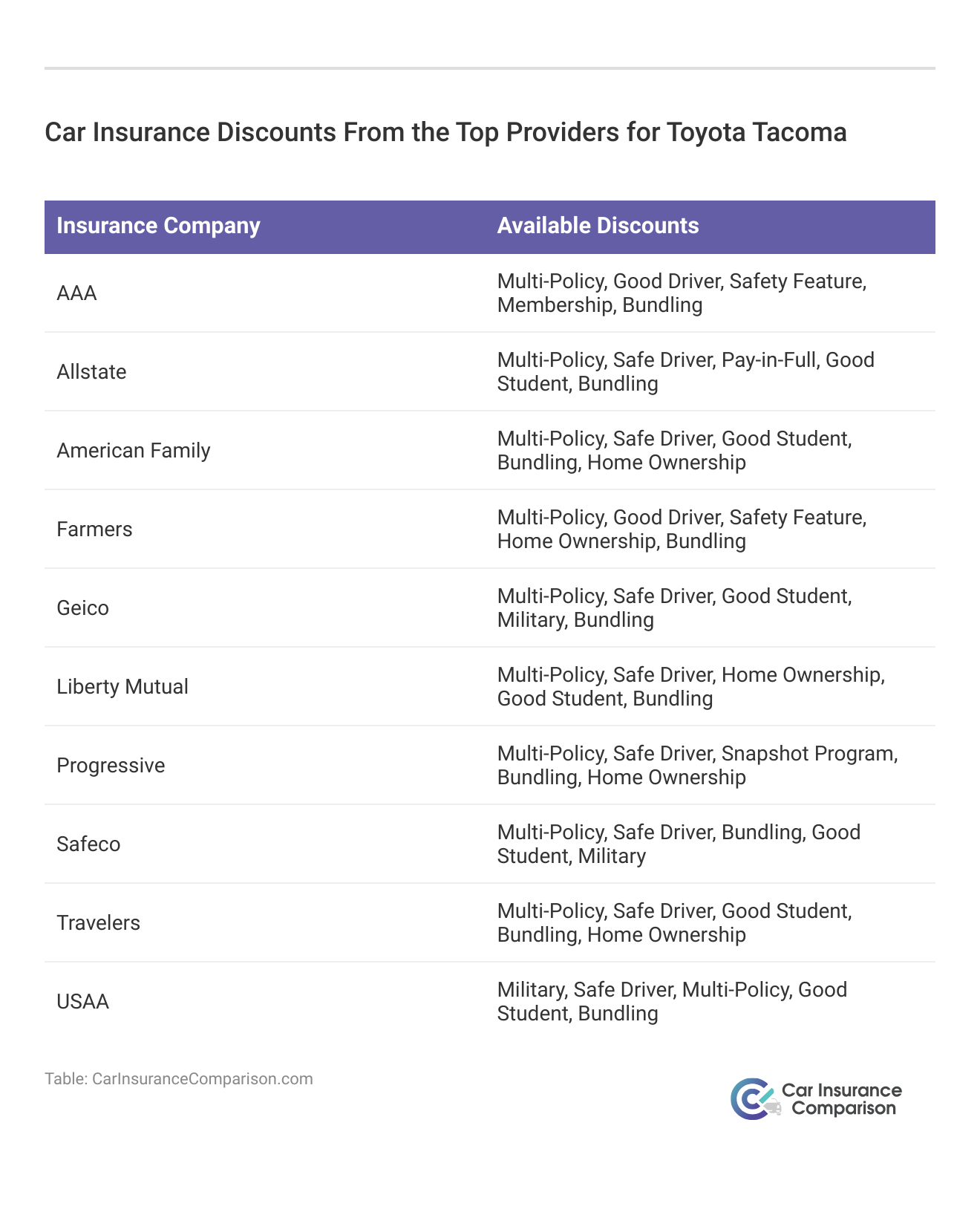

For example, AAA and Safeco provide discounts for safety features and military service, while Geico and Progressive offer savings for good students and military members. These options can help you find the best insurance for a Toyota Tacoma. Whether you’re looking for insurance on a Toyota Tacoma or comparing rates, these discounts can make a significant difference.

Leveraging these opportunities allows you to find the most cost-effective coverage for your Toyota Tacoma. Explore further with our article entitled “Best Toyota RAV4 Car Insurance.”

Frequently Asked Questions

How much is insurance for a Toyota Tacoma?

The cost of insurance for a Toyota Tacoma varies by provider, but Safeco offers coverage starting at $95 per month. Rates for full coverage can reach around $275 per month with Safeco, and different insurers offer varying rates based on coverage and discounts. Explore further details on the best Toyota 4Runner car insurance.

Why is Toyota Tacoma insurance so expensive?

Insurance for a Toyota Tacoma can be costly due to factors such as repair costs, the likelihood of accidents, and the vehicle’s value. Additionally, insurance rates can vary based on individual driving records, location, and coverage choices.

How much is insurance on a 2009 Toyota Tacoma?

The insurance cost for a 2009 Toyota Tacoma is influenced by factors such as the vehicle’s condition, your driving history, and the insurer. For specific rates, comparing quotes from different insurance companies is recommended.

Which brand of car has the cheapest insurance?

Generally, brands like Geico and Progressive offer some of the most affordable insurance rates, especially for minimum coverage. However, exact rates vary based on individual circumstances and location.

What car has the most expensive insurance?

Luxury and high-performance vehicles, such as certain models from brands like Ferrari or Lamborghini, typically have the most expensive insurance due to their high repair costs and higher risk of accidents. Dive deeper into the best Toyota Tundra car insurance for a comprehensive understanding.

What is the cheapest category for car insurance?

The cheapest category for car insurance is usually minimum coverage. This basic level of insurance meets the legal requirements but offers limited protection compared to full coverage options.

What is the difference between TPL and comprehensive insurance?

Third-Party Liability (TPL) insurance covers damages and injuries you cause to others in an accident. Comprehensive insurance, on the other hand, covers a wider range of risks, including theft, vandalism, and natural disasters, in addition to collision damage.

Why is insurance so cheap in Hawaii?

Insurance rates in Hawaii can be lower due to the state’s lower accident rates, fewer uninsured drivers, and regulations that help keep costs down. The state’s relatively mild weather also contributes to reduced risk.

Is Geico insurance good in Hawaii?

Geico is known for offering competitive rates and good service in many states, including Hawaii. However, the quality of insurance can vary based on personal needs and local market conditions. Delve into the depths of the best Toyota Tundra car insurance for additional insights.

What type of cover is the cheapest for car insurance?

The cheapest type of cover is typically minimum liability insurance, which meets basic legal requirements but offers limited protection compared to more comprehensive options.

Which type of vehicle insurance is best?

The best type of vehicle insurance depends on individual needs. Full coverage, which includes liability, comprehensive, and collision insurance, provides the most extensive protection and is often recommended for new or valuable vehicles.

Who has the lowest insurance rates?

Insurers like Geico and Progressive often have some of the lowest insurance rates, particularly for minimum coverage. Rates can vary based on personal factors and location, so it’s essential to compare quotes from multiple providers.

Which category of car insurance is best?

For comprehensive protection, full coverage insurance, which includes liability, comprehensive, and collision coverage, is considered the best. It provides coverage for a wide range of risks and damages. Uncover more about the best Toyota Prius car insurance by reading further.

What is the best car insurance coverage to have?

The best car insurance coverage depends on individual needs, but generally, full coverage insurance is recommended for the most protection. This includes liability, comprehensive, and collision coverage.

What is the cheapest car insurance group?

The cheapest car insurance group usually includes vehicles with lower repair costs, fewer accidents, and lower theft rates. Generally, economy and compact cars fall into these cheaper insurance groups.

What is fully comprehensive car insurance?

Fully comprehensive car insurance, or simply comprehensive insurance, covers damages to your vehicle from various risks, including theft, vandalism, natural disasters, and collision, in addition to third-party damages. It provides extensive coverage beyond basic liability. Discover a wealth of knowledge from the best Toyota Prius Prime car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.